Key Takeaways

- Synthetic futures enable traders to gain exposure to diverse assets including stocks, commodities, and crypto through decentralized exchange platforms without owning underlying assets.

- Smart contract trading eliminates intermediaries, providing transparent, trustless execution of DeFi derivatives with full user custody throughout the trading process.

- The impact of synthetic futures on DEX liquidity has been transformative, attracting substantial trading volume and creating deeper, more efficient markets.

- Synthetic assets in DEX platforms offer efficient capital usage through leverage while enabling access to global markets from a single decentralized interface.

- On-chain derivatives provide 24/7 trading access, permissionless participation, and elimination of counterparty risk from centralized exchange failures.

- Futures trading on blockchain requires understanding smart contract risks, oracle dependencies, and liquidation mechanics to trade safely and effectively.

- Trading innovations in DeFi continue expanding synthetic futures capabilities, with new products and improved infrastructure emerging across major blockchain networks.

- Decentralized finance trading through synthetic futures is reshaping how traders in USA, UK, UAE, and Canada access global markets and manage portfolio exposure.

The convergence of blockchain technology and derivatives trading has created one of the most significant innovations in modern finance: synthetic futures on decentralized exchanges. This transformation is reshaping how traders across global markets access leveraged exposure to diverse assets while maintaining complete control over their funds. For participants in financial centers like New York, London, Dubai, and Toronto, synthetic futures represent a paradigm shift from traditional derivatives markets toward transparent, permissionless alternatives.

Introduction to Synthetic Futures and DEXs

The introduction of synthetic futures to decentralized exchanges marks a pivotal moment in the evolution of DeFi derivatives. These instruments combine the leverage and hedging capabilities of traditional futures with the transparency and accessibility of blockchain technology. Understanding how synthetic futures function within DEX ecosystems reveals why this innovation is attracting substantial attention from both retail and institutional participants worldwide.

Building crypto exchanges that support synthetic futures requires sophisticated infrastructure combining oracle systems, collateral management, and risk engines. The technical complexity involved explains why capable platforms have achieved significant competitive advantages in attracting derivatives trading volume.

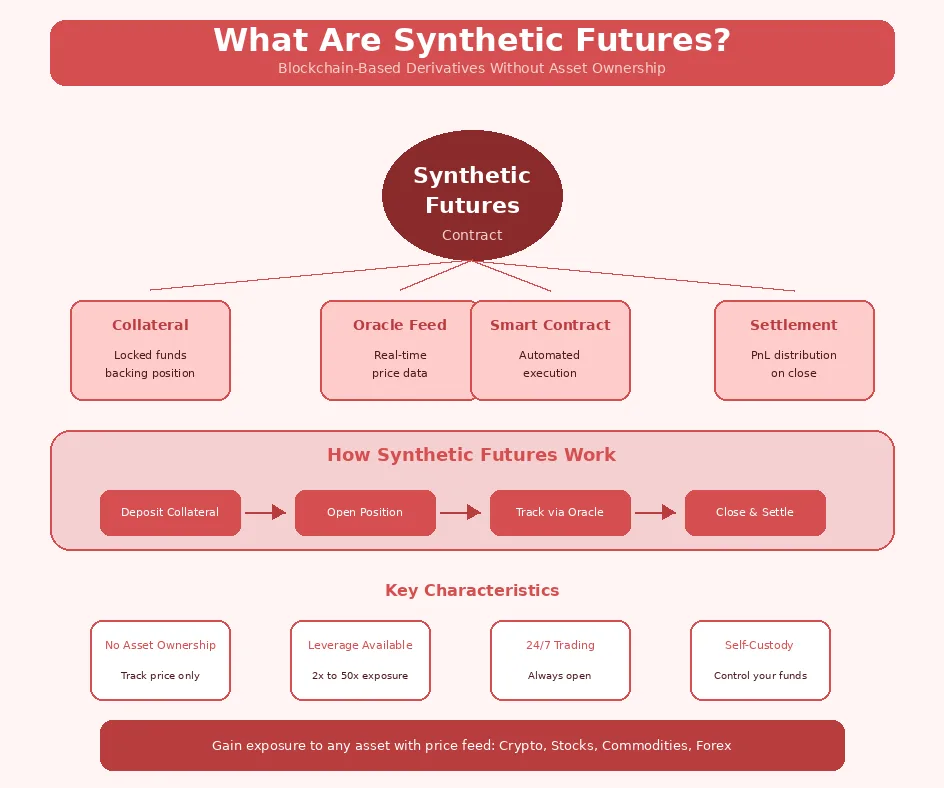

What Are Synthetic Futures?

Synthetic futures are derivative instruments created through smart contracts that track the price of underlying assets without requiring physical delivery or direct ownership. Unlike traditional futures that may involve actual asset exchange at expiration, synthetic futures settle entirely in cryptocurrency based on price feed data. This design enables exposure to virtually any asset class with reliable pricing data, from Bitcoin to gold to stock indices.

The mechanics involve collateral deposits that back synthetic positions, with smart contracts managing margin requirements automatically. When a trader opens a long synthetic future, they deposit collateral and gain exposure to price increases in the underlying asset. Short positions profit from price decreases. The synthetic nature means no actual asset changes hands; rather, collateral flows between counterparties based on price movements reported by oracles.

This approach democratizes access to markets previously requiring specialized accounts and significant capital. Traders in the UK, USA, Canada, and UAE can access identical synthetic futures markets without the jurisdictional restrictions that limit traditional derivatives access. Understanding how modern trading platforms enable permissionless market access illuminates the transformative potential of these instruments.

Overview of Decentralized Exchanges (DEXs)

Decentralized exchanges operate through smart contracts on blockchain networks, enabling peer-to-peer trading without centralized intermediaries. DEX trading has evolved from simple token swaps to sophisticated platforms supporting spot trading, lending, and increasingly, derivatives. The non-custodial nature means users maintain control of their assets throughout the trading process, eliminating counterparty risk from exchange operators.

Modern DEXs utilize various mechanisms for price discovery and liquidity provision. Automated market makers use algorithmic pricing based on liquidity pool composition, while order book DEXs match buyers and sellers directly. For derivatives trading, specialized designs handle the additional complexity of margin, leverage, and funding rates. These diverse approaches create a rich ecosystem serving different trading needs and preferences.

Importance of Synthetic Assets in DeFi

Synthetic assets in DEX platforms bridge blockchain ecosystems with traditional financial markets, creating on-chain representations of off-chain value. This bridging function enables DeFi participants to diversify portfolios, hedge positions, and speculate on price movements across asset classes that would otherwise require traditional brokerage accounts. The importance extends beyond trading convenience to fundamental portfolio management capabilities.

For decentralized finance trading ecosystems, synthetic assets expand the total addressable market dramatically. Rather than competing solely for crypto-native trading volume, platforms offering synthetics attract users seeking exposure to stocks, commodities, and forex. This expansion drives DEX liquidity growth while creating network effects that strengthen the broader DeFi ecosystem.

Market Insight: Synthetic assets have grown from experimental DeFi primitives to essential infrastructure supporting billions in trading volume. Their importance in modern DEX ecosystems continues expanding as new assets and improved mechanisms attract broader participation.

The Role of Synthetic Futures in Decentralized Trading

Synthetic futures play a central role in expanding DEX capabilities beyond spot trading into sophisticated derivatives markets. The role encompasses providing leverage access, enabling hedging strategies, and creating arbitrage opportunities that improve overall market efficiency. For platforms seeking to serve serious traders, synthetic futures capabilities have become essential competitive requirements.

How Synthetic Futures Work on DEX Platforms

Synthetic futures on DEX platforms operate through integrated systems combining collateral management, position tracking, oracle feeds, and liquidation engines. When traders open positions, smart contracts lock their collateral and record position parameters including size, direction, entry price, and leverage. The contracts continuously monitor positions against current prices to manage margin requirements and trigger liquidations when necessary.

Funding rates balance long and short interest, with periodic payments flowing from the dominant side to the minority side. This mechanism keeps synthetic prices aligned with underlying spot markets while compensating traders who take the less popular position. The entire process executes automatically through smart contract trading logic without human intervention or counterparty credit risk.

Advantages of Synthetic Futures in DEX Trading

The advantages of synthetic futures in DEX trading span accessibility, efficiency, and security dimensions. These benefits collectively explain the rapid adoption of synthetic derivatives across the DeFi ecosystem and their growing importance to traders worldwide.

Enhanced Liquidity

Enhanced liquidity emerges from synthetic futures attracting diverse participant categories including speculators, hedgers, and arbitrageurs. The collateral locked in synthetic positions creates substantial value pools that deepen market liquidity for all participants. Trading volume in synthetic markets often exceeds spot equivalents, reflecting strong demand for leveraged exposure that these instruments satisfy.

DEX liquidity benefits extend beyond the synthetic markets themselves. Arbitrageurs connecting synthetic and spot markets improve pricing efficiency across both venues. The capital efficiency of leveraged positions means more trading activity per dollar deposited, amplifying liquidity effects throughout integrated platforms.

Access to Diverse Assets

Access to diverse assets through synthetic tokens enables portfolio strategies previously impossible within DeFi. Traders can gain exposure to gold, oil, foreign currencies, stock indices, and individual equities alongside native crypto assets from a single interface. This diversity supports sophisticated allocation strategies and comprehensive hedging without requiring multiple accounts across different platforms and jurisdictions.

For traders in markets like Dubai, Toronto, London, and New York, synthetic asset access removes barriers that traditionally limited international market participation. Time zone restrictions, account requirements, and capital minimums that constrain traditional derivatives access simply do not apply to permissionless synthetic markets.

Efficient Capital Usage

Efficient capital usage through leverage enables traders to control larger positions with smaller capital outlays. A trader depositing $10,000 in collateral can control $50,000 or more in synthetic exposure, amplifying returns on successful trades. This efficiency attracts participants seeking to maximize capital productivity while managing risk through position sizing rather than capital commitment.

The capital efficiency extends to hedging applications where traders protect existing positions without liquidating them. Hedging with synthetic futures requires only the collateral for the hedge position rather than selling actual holdings, preserving long-term positions while managing short-term risk exposure.

Synthetic Futures Advantages Comparison

| Feature | Traditional Futures | Synthetic Futures on DEX |

|---|---|---|

| Market Access | Broker account required | Permissionless, wallet only |

| Trading Hours | Exchange hours, weekdays | 24/7/365 continuous |

| Custody | Broker holds funds | Self-custody via smart contract |

| Counterparty Risk | Clearinghouse backed | Smart contract secured |

| Asset Range | Exchange listed only | Any asset with oracle feed |

| Minimum Capital | Often $5,000-25,000 | As low as $10-100 |

Risks and Considerations

While synthetic futures offer compelling advantages, they also present specific risks that traders must understand and manage. Informed participation requires recognizing these risks and implementing appropriate safeguards to protect capital while pursuing trading opportunities.

Smart Contract Risks

Smart contract risks arise from potential bugs, vulnerabilities, or exploits in the code governing synthetic futures protocols. Despite audits and formal verification, complex financial contracts may contain subtle flaws that attackers could exploit to drain funds. The immutable nature of blockchain means exploited contracts cannot easily be patched, potentially resulting in permanent losses for affected users.

Risk mitigation involves using established protocols with extensive audit coverage, limiting exposure relative to total portfolio, and staying informed about security developments. The history of DeFi includes notable exploits that remind participants of smart contract risks requiring ongoing vigilance.

Market Volatility

Market volatility poses particular risks for leveraged synthetic positions that face liquidation during rapid price movements. Volatile markets can trigger cascading liquidations that accelerate price movements and catch even well-margined positions. Traders must size positions appropriately for expected volatility and maintain sufficient margin buffers to survive adverse movements.

The 24/7 nature of crypto markets means volatility can occur at any hour, potentially liquidating positions while traders sleep. Understanding liquidation mechanics and using appropriate position sizes protects against unexpected losses during volatile periods.

Regulatory Challenges

Regulatory challenges vary significantly across jurisdictions, with authorities in USA, UK, UAE, and Canada taking different approaches to DeFi derivatives. Some jurisdictions have restricted access to leveraged crypto products while others maintain more permissive frameworks. Traders must understand applicable regulations in their jurisdictions and consider potential future regulatory changes that could affect access or taxation.

The evolving regulatory landscape creates uncertainty for both traders and platforms. Responsible participation includes staying informed about regulatory developments and maintaining compliance with applicable requirements while recognizing that permissionless protocols operate independently of jurisdictional rules.

Risk Warning: Synthetic futures involve substantial risk of loss due to leverage, volatility, and smart contract vulnerabilities. Trade only with capital you can afford to lose and ensure thorough understanding of mechanisms before participating. Past performance does not guarantee future results.

Impact of Synthetic Futures on DEX Performance

The impact of synthetic futures on DEX ecosystems has been profoundly positive across multiple performance dimensions. Platforms offering synthetic derivatives have experienced accelerated growth in users, volume, and total value locked compared to spot-only alternatives. Understanding these impacts reveals why synthetic futures have become essential components of competitive DEX offerings.

Influence on Liquidity Pools and Trading Volume

Influence on liquidity pools from synthetic futures trading manifests through substantial capital inflows that deepen available liquidity. Traders providing collateral for synthetic positions contribute to protocol liquidity even when not actively trading. The leverage inherent in synthetic futures means each dollar of collateral supports multiple dollars of trading volume, amplifying liquidity effects throughout the platform.

Trading volume on synthetic futures often exceeds spot equivalents by significant multiples. This volume concentration attracts market makers and arbitrageurs whose activity further improves liquidity and pricing efficiency. The virtuous cycle of volume attracting liquidity attracting more volume has propelled leading synthetic platforms to dominant positions within DeFi derivatives.

Effect on Trading Strategies and User Behavior

Effect on trading strategies extends beyond simple speculation to sophisticated approaches previously impossible in DeFi. Synthetic futures enable delta-neutral strategies, basis trades, and cross-market arbitrage that require derivatives for execution. Professional traders bring these strategies to DEX platforms, improving market quality while generating consistent volume.

User behavior has evolved to incorporate hedging as standard practice rather than exceptional activity. DeFi participants increasingly use synthetic futures to protect existing positions against adverse movements without liquidating core holdings. This behavioral shift toward risk management indicates market maturation that benefits all participants. Exploring how advanced trading platforms support sophisticated strategies reveals the infrastructure enabling these approaches.

Innovation in DeFi Derivatives

Innovation in DeFi derivatives accelerates as synthetic futures success demonstrates viable models for on-chain derivatives. New products including options, structured products, and exotic derivatives build on synthetic infrastructure to expand available trading instruments. The composability of DeFi enables combinations impossible in traditional finance, creating novel products serving specific risk and return objectives.

Trading innovations in DeFi continue pushing boundaries of what decentralized markets can offer. From prediction markets to volatility products to yield derivatives, the synthetic futures foundation supports increasingly sophisticated instruments. This innovation trajectory suggests substantial further evolution in coming years as developers explore new possibilities.

Synthetic Futures Trade Lifecycle

| Stage | Action | Smart Contract Function | User Requirement |

|---|---|---|---|

| 1 | Connect Wallet | Read wallet state | Web3 wallet |

| 2 | Deposit Collateral | Lock funds in contract | Approved collateral tokens |

| 3 | Open Position | Mint synthetic exposure | Specify size, direction, leverage |

| 4 | Position Monitoring | Track PnL via oracle | Monitor margin ratio |

| 5 | Funding Payment | Periodic rate settlement | Automatic (affects margin) |

| 6 | Close Position | Burn synthetic, settle PnL | Confirm transaction |

| 7 | Withdraw Collateral | Release funds to wallet | Request withdrawal |

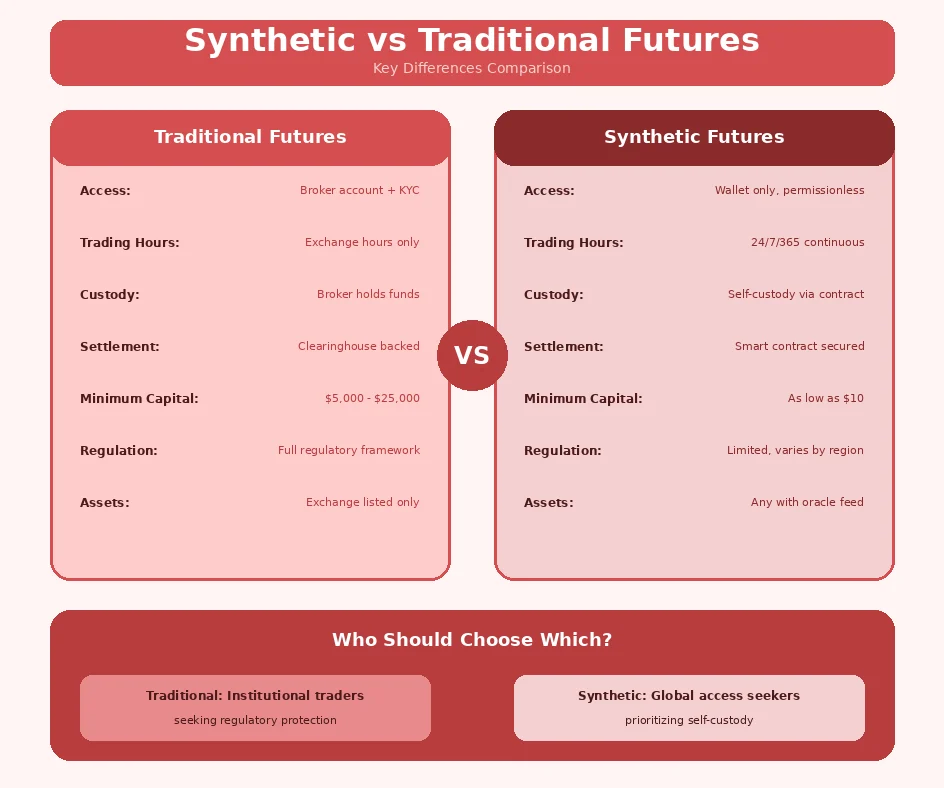

Synthetic Futures vs Traditional Futures

Comparing synthetic futures to traditional futures reveals fundamental differences in structure, access, and risk profiles. Both instruments serve similar economic functions but through dramatically different mechanisms. Understanding these differences helps traders select appropriate venues based on their specific requirements and constraints.

On-Chain vs Off-Chain Futures

On-chain derivatives execute entirely through blockchain smart contracts with all positions, collateral, and settlements recorded immutably on public ledgers. This transparency enables independent verification of platform solvency and individual position status. Off-chain futures rely on centralized exchange databases where users must trust operators to maintain accurate records and execute trades fairly.

The on-chain model eliminates certain risks while introducing others. Exchange insolvency cannot affect on-chain positions since funds remain in smart contract custody. However, smart contract vulnerabilities create risks absent in traditional systems with legal recourse and insurance protections. The choice between models depends on which risk profile better aligns with individual preferences and circumstances.

Benefits of Blockchain-Based Synthetic Assets

Benefits of blockchain-based synthetic assets include composability with other DeFi protocols, enabling automated strategies combining lending, trading, and yield generation. Synthetic positions can serve as collateral elsewhere, improving capital efficiency across the DeFi ecosystem. This interoperability creates possibilities impossible in siloed traditional markets where positions remain locked within single platforms.

Programmability enables customized risk management unavailable in traditional futures. Smart contracts can implement sophisticated conditional orders, automatic de-leveraging, and portfolio rebalancing that execute without manual intervention. This programmable finance approach represents genuine innovation beyond simply replicating traditional instruments on blockchain.

Comparative Analysis: Risk, Cost, and Accessibility

Comparative analysis across risk, cost, and accessibility dimensions reveals distinct advantages for each model. Traditional futures benefit from regulatory protections, established legal frameworks, and institutional liquidity. Synthetic futures offer lower barriers, continuous access, and elimination of intermediary risks. The optimal choice depends on individual circumstances including jurisdiction, capital size, and trading objectives.

Cost structures differ significantly between models. Traditional futures involve broker commissions, exchange fees, and regulatory costs that create minimum viable trade sizes. Synthetic futures primarily incur blockchain gas costs and protocol fees that can be lower for smaller positions but higher during network congestion. Understanding how fee structures impact trading economics informs platform selection decisions.

Risk, Cost, and Accessibility Comparison

| Factor | Traditional Futures | Synthetic Futures | Winner |

|---|---|---|---|

| Counterparty Risk | Clearinghouse protected | Smart contract secured | Depends on preference |

| Regulatory Protection | Strong legal framework | Limited recourse | Traditional |

| Access Barriers | High (accounts, minimums) | Low (wallet only) | Synthetic |

| Trading Hours | Limited | Continuous | Synthetic |

| Liquidity Depth | Very deep for majors | Growing but variable | Traditional |

| Cost for Small Trades | High relative cost | Lower barriers | Synthetic |

Platform Selection Criteria for Synthetic Futures

When selecting a synthetic futures platform, evaluate these key factors:

- Security Track Record: Review audit history, insurance coverage, and incident response

- Liquidity Depth: Assess available depth for intended position sizes and assets

- Oracle Quality: Verify oracle decentralization, data sources, and update frequency

- Fee Structure: Compare trading fees, funding rates, and gas costs

- Leverage Options: Confirm available leverage matches trading requirements

- Asset Coverage: Ensure desired synthetic assets are supported with adequate liquidity

Future of DEXs with Synthetic Futures

The future of DEXs increasingly intertwines with synthetic futures as these instruments become essential infrastructure for competitive platforms. Evolution in this space will likely accelerate as technical capabilities improve and user adoption grows. Anticipating future developments helps participants position for opportunities while preparing for challenges ahead.

Emerging Trends in Synthetic Asset Trading

Emerging trends in synthetic asset trading include expansion to new asset classes, improved capital efficiency through cross-margining, and integration with traditional finance rails. Real-world asset tokenization increasingly connects with synthetic markets, potentially enabling compliant exposure to securities through DeFi interfaces. These trends suggest substantial growth opportunities for platforms positioned to capture emerging demand.

Layer 2 scaling solutions are transforming synthetic trading economics by reducing gas costs dramatically. Platforms deploying on Arbitrum, Optimism, and other L2 networks offer dramatically improved user experiences with faster transactions and lower fees. This infrastructure evolution removes friction that previously limited synthetic futures adoption.

Potential for New Trading Products and Derivatives

Potential for new trading products extends beyond perpetual futures to structured products, options, and exotic derivatives currently absent from DeFi. Volatility products tracking implied or realized volatility could enable sophisticated hedging strategies. Power perpetuals and everlasting options represent innovations possible only through programmable synthetic infrastructure.

Composability enables combinations creating entirely new financial products. Synthetic futures integrated with automated market makers could create dynamic hedging products. Integration with lending protocols enables leveraged yield strategies. The design space for DeFi derivatives remains largely unexplored, suggesting substantial innovation ahead. Exploring how next-generation platforms enable derivative innovation reveals emerging possibilities.

How DeFi Innovation is Shaping the Market

DeFi innovation shapes markets by demonstrating that financial infrastructure can operate transparently, permissionlessly, and efficiently without traditional intermediaries. Synthetic futures exemplify this transformation, providing derivatives access that previously required institutional relationships and substantial capital. The demonstration effect influences traditional finance innovation while expanding DeFi’s addressable market.

Market structure evolution driven by DeFi innovation benefits participants globally. Traders in USA, UK, Canada, and UAE access identical markets without jurisdictional fragmentation that characterizes traditional derivatives. This global liquidity aggregation improves market quality while reducing costs for all participants regardless of location.

Build Your Synthetic Futures DEX Platform

Launch a powerful DEX with synthetic futures trading capabilities. We deliver smart contract infrastructure and liquidity solutions. Get free consultation.

Conclusion

Synthetic futures have fundamentally transformed decentralized exchanges from spot trading venues into comprehensive derivatives platforms serving sophisticated trading needs. The impact of synthetic futures extends across liquidity, user behavior, and innovation dimensions, establishing these instruments as essential DeFi infrastructure. For traders seeking leveraged exposure, hedging capabilities, and diverse asset access, synthetic futures on DEXs provide compelling alternatives to traditional derivatives markets.

The advantages of synthetic futures including permissionless access, continuous trading, and self-custody come balanced against risks from smart contracts, volatility, and regulatory uncertainty. Informed participation requires understanding these tradeoffs and implementing appropriate risk management. Platforms continue improving security, liquidity, and user experience, addressing historical limitations while expanding capabilities.

Looking forward, synthetic futures will likely play increasingly central roles in both DeFi ecosystems and broader financial markets. Innovation in products, infrastructure, and accessibility continues accelerating, suggesting substantial evolution ahead. For participants in global markets from London to New York to Dubai to Toronto, synthetic futures represent not merely alternative trading venues but potentially transformative financial infrastructure reshaping how derivatives markets function.

Frequently Asked Questions

Synthetic futures are blockchain-based financial instruments that mirror the price movements of underlying assets without requiring actual ownership of those assets. These derivatives use smart contracts to create exposure to commodities, stocks, currencies, or crypto assets through collateralized positions on decentralized platforms. Traders in markets like the USA, UK, and UAE can gain leveraged exposure to diverse assets while maintaining full custody of their collateral through DeFi protocols.

Synthetic futures on DEXs work through smart contracts that lock collateral and mint synthetic tokens representing future price exposure. Oracles feed real-time price data to determine position values and liquidation thresholds. When traders open positions, they deposit collateral that backs the synthetic asset, with the smart contract automatically managing margin requirements, funding rates, and settlement without intermediaries.

Traditional futures trade on centralized exchanges with clearinghouses managing counterparty risk, while synthetic futures operate entirely on blockchain through smart contracts. Traditional futures require broker accounts and face regulatory restrictions by jurisdiction, whereas synthetic futures offer permissionless access globally. The key distinction is custody: traditional futures involve trusted intermediaries, while synthetic futures enable self-custody throughout the trading process.

Synthetic futures carry specific risks including smart contract vulnerabilities, oracle manipulation, and liquidation during volatile markets. However, established protocols with audited contracts and robust oracle systems provide reasonable security for informed traders. Safety depends on choosing reputable platforms, understanding collateralization requirements, and managing position sizes appropriately relative to market volatility and personal risk tolerance.

Synthetic futures can represent virtually any asset with reliable price feeds including cryptocurrencies, traditional stocks, commodities like gold and oil, forex pairs, and market indices. This flexibility allows traders to access global markets from a single DeFi interface without geographic restrictions. Popular synthetic assets include BTC, ETH, major stock indices, precious metals, and foreign currencies that appeal to traders in Canada, UK, USA, and Dubai.

Synthetic futures significantly enhance DEX liquidity by attracting derivatives traders who bring substantial volume and capital to platforms. The collateral locked in synthetic positions creates deep liquidity pools that benefit all platform users. Additionally, arbitrageurs help maintain price efficiency between synthetic and spot markets, further improving overall market quality and reducing spreads for traders.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.