Decentralized exchanges have transformed cryptocurrency trading by enabling direct peer-to-peer transactions without centralized intermediaries. While DEXs offer privacy, security, and complete fund control, high gas fees remain a significant challenge for traders. Gas tokens in crypto provide an innovative solution for managing and reducing transaction costs on blockchain networks. This comprehensive guide explains what gas tokens are, how they work, and why they matter for anyone trading on decentralized exchanges.

Key Takeaways

- Gas Fee Basics: Every blockchain transaction requires gas fees paid to validators for processing and verification.

- Gas Token Function: Gas tokens allow users to lock in lower gas costs during off-peak times for later use during high-fee periods.

- Cost Savings: Strategic gas token usage significantly reduces overall trading costs for active DEX traders.

- Price Protection: Gas tokens shield users from sudden fee spikes during network congestion or major market events.

- DeFi Optimization: Gas fee management improves user experience and increases decentralized exchange adoption.

- Strategic Timing: Minting gas tokens during low-fee periods maximizes their effectiveness and value.

- Complementary Solution: Gas tokens work alongside native cryptocurrencies rather than replacing them.

Understanding Blockchain Gas Fees

Before exploring gas tokens, understanding gas fees provides essential context. Every action on a blockchain network requires computational resources. Sending cryptocurrency, swapping tokens, or interacting with smart contracts all demand processing power from network validators. Gas fees compensate these validators for their work in verifying and processing transactions.

Gas fees are not fixed amounts. They fluctuate based on several factors including network traffic levels, demand for block space, overall market activity, and special events like token launches or NFT drops. When many users compete for limited block space simultaneously, gas fees increase dramatically through auction-style pricing mechanisms.

For DEX traders, these variable costs create unpredictable expenses. A simple token swap might cost a few dollars during quiet periods but surge to tens or even hundreds of dollars during peak congestion. This volatility makes trading planning difficult and can make smaller trades economically unfeasible.

What is a Gas Token?

A gas token is a specialized cryptocurrency designed to help users manage and reduce blockchain transaction costs. Rather than accepting whatever gas price the network demands at transaction time, gas tokens allow users to benefit from periods when network fees are lower.

The concept works by allowing users to lock value into smart contracts when gas prices are low, receiving gas tokens in return. Later, when network congestion drives fees higher, these tokens can be utilized to reduce the effective gas cost of transactions. This mechanism enables users to average their gas expenses over time rather than being subject to peak pricing.

Gas tokens do not replace native cryptocurrencies like ETH. Instead, they work alongside them as a complementary tool for cost optimization. This approach to gas fee reduction on DEX platforms has made gas tokens valuable for frequent traders seeking predictable transaction expenses.

How Gas Tokens Work

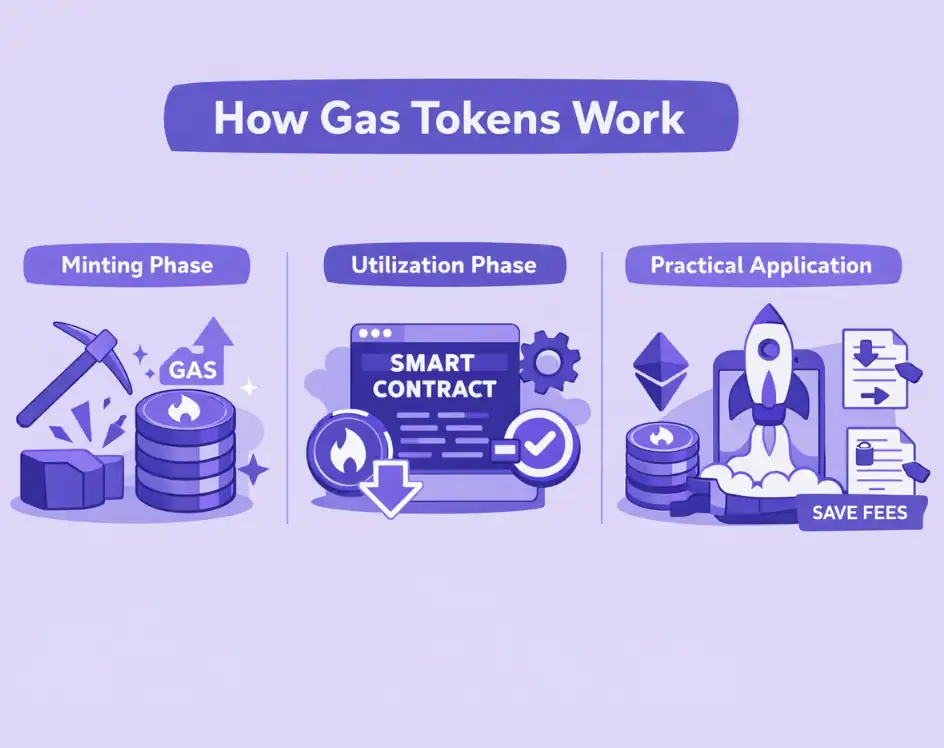

Gas tokens operate on the principle of gas optimization through strategic timing. The process involves two primary phases: minting during low-fee periods and utilizing during high-fee periods.

Minting Phase

When blockchain networks experience low activity and gas fees are minimal, users can mint gas tokens. Minting involves interacting with a smart contract that stores data on the blockchain. This data storage creates value that can be recovered later. The minting transaction itself requires gas, but the low fees during quiet periods make this investment worthwhile.

Utilization Phase

When users need to execute transactions during high-fee periods, gas tokens provide savings through smart contract gas refunds. The blockchain offers refunds for freeing up storage space. By destroying previously minted gas tokens during expensive transactions, users receive partial refunds that offset the high gas costs. This mechanism effectively transfers the lower gas prices from minting time to utilization time.

Practical Application

Consider a trader who mints gas tokens on a Sunday morning when Ethereum gas prices are 20 gwei. Later that week, a major token launch causes congestion pushing prices to 200 gwei. By utilizing their gas tokens during this peak period, the trader pays effectively less than traders who did not prepare. This gas token strategy for active traders provides meaningful cost advantages over time.

Gas Fee Factors on Different Networks

Understanding what drives gas fees helps users optimize their gas token strategies. The following table compares gas fee characteristics across major blockchain networks supporting DEX trading.

| Average Gas Cost | High (variable) | Low to Medium | Very Low | Minimal |

| Fee Volatility | Very High | Moderate | Low | Low |

| Peak Period Impact | Severe (10x+ increases) | Noticeable (2-3x) | Minimal | Minimal |

| Gas Token Benefit | High | Moderate | Limited | Limited |

| DeFi Ecosystem Size | Largest | Large | Growing | Growing |

| Smart Contract Complexity | High cost impact | Moderate cost impact | Low cost impact | Different model |

Gas tokens provide the most significant benefits on networks with high fee volatility, particularly Ethereum. Networks with consistently low fees offer less opportunity for gas optimization through token mechanisms.

Key Benefits of Gas Tokens on DEXs

Gas tokens offer multiple advantages for decentralized exchange users seeking to optimize their trading costs.

Lower Transaction Costs

The primary benefit of gas tokens is direct cost savings. By minting during low-fee periods and utilizing during high-fee periods, traders reduce their average transaction costs significantly. For users executing multiple trades daily, these savings accumulate into substantial amounts over weeks and months of active trading.

Protection from Price Fluctuations

Gas prices can spike unexpectedly due to market events, popular NFT mints, or DeFi protocol launches. Gas tokens provide protection against these sudden increases by locking in costs in advance. This predictability helps traders budget more effectively and avoid situations where high fees make planned trades uneconomical.

Improved Trading Experience

High gas fees often cause hesitation in trading decisions. Users may avoid smaller trades or delay transactions waiting for fees to decrease. Gas tokens remove this friction by making fees more manageable and predictable. The improved DeFi user experience encourages more active participation and experimentation with different protocols.

Greater Control Over Expenses

Gas tokens give users agency over their transaction costs rather than being passive victims of network congestion. Users can decide when to mint tokens, how many to hold, and when to utilize them based on their trading patterns and market conditions. This flexibility supports personalized cost management strategies.

Increased DEX Adoption

Lower effective trading costs attract more users to decentralized exchanges. When gas fee management tools make DEX trading more affordable, the platforms become competitive with centralized alternatives. This accessibility supports broader adoption of decentralized finance and contributes to ecosystem development.

Gas Token Use Cases

Different user types benefit from gas tokens in various ways based on their trading patterns and needs.

Active Traders

Frequent DEX traders executing multiple transactions daily benefit most from gas tokens. The cumulative savings from optimized gas usage can represent significant percentages of overall trading costs. Active traders often develop sophisticated strategies for timing their minting and utilization activities.

DeFi Power Users

Users engaging with multiple DeFi protocols for yield farming, liquidity provision, and governance participation generate numerous transactions. Smart contract gas fees for complex DeFi interactions can be substantial, making gas optimization particularly valuable for these power users.

Developers and Businesses

Teams building decentralized applications incur significant gas costs during development and testing. Additionally, platforms operating DEXs or other DeFi services can integrate gas token functionality to reduce costs for their users. Professional token development teams often incorporate gas optimization features into their solutions.

Arbitrage Traders

Arbitrage opportunities often exist for brief windows and require rapid execution. High gas fees can eliminate profit margins on arbitrage trades. Gas tokens help arbitrage traders maintain profitability by reducing their execution costs, enabling them to capture opportunities that would otherwise be uneconomical.

Strategies for Effective Gas Token Usage

Maximizing gas token benefits requires strategic approaches to timing and management.

Monitor Gas Prices Regularly

Gas prices follow patterns based on time of day, day of week, and market conditions. Using gas tracking tools helps identify optimal minting windows. Generally, weekends and early morning hours in major time zones offer lower fees. Consistent monitoring enables better timing decisions.

Mint During Confirmed Low Periods

Only mint gas tokens when fees are genuinely low compared to historical averages. Minting during moderate fee periods provides limited benefit and may not justify the effort. Patience in waiting for truly low-fee windows maximizes the value captured in each gas token.

Plan Transactions in Advance

Anticipating upcoming trading activity allows proactive gas token preparation. If you expect to interact with multiple DeFi protocols or execute numerous trades, minting gas tokens beforehand ensures cost savings when those transactions occur. Planning ahead is essential for effective gas fee management in blockchain environments.

Use Automated Tools

Several platforms and wallets offer automated gas tracking and optimization features. These tools monitor prices continuously and can automate minting when conditions are favorable. Automation removes the burden of constant monitoring while ensuring optimal timing.

Challenges and Limitations

While gas tokens offer significant benefits, users should understand their limitations.

Complexity for New Users

Gas token concepts can confuse newcomers to cryptocurrency. Understanding when to mint, how storage and refunds work, and optimal utilization timing requires blockchain knowledge. Educational resources and user-friendly interfaces help address this barrier, but some learning curve remains.

Network Changes Impact Effectiveness

Blockchain upgrades can affect gas token mechanisms. Ethereum’s EIP-3529 update, for example, reduced the gas refunds available for storage clearing, diminishing gas token effectiveness on that network. Users must stay informed about network development changes that could impact their gas optimization strategies.

Platform Support Varies

Not all DEX platforms and wallets support gas token integration. Users may need to choose platforms carefully or use separate tools to benefit from gas tokens. This fragmentation adds complexity to the user experience.

Timing Risk

Minting gas tokens when prices are not actually low wastes resources. Poor timing decisions reduce or eliminate the cost advantages gas tokens should provide. Accurate market assessment and patience are necessary for successful gas token usage.

Building Gas-Optimized DEX Solutions?

Professional development teams create efficient decentralized exchange platforms with integrated gas optimization features for improved user experience.

Gas Tokens and DeFi Scalability

Gas tokens represent one component of broader efforts to make DeFi more accessible and affordable. They work alongside other solutions including Layer 2 networks, rollups, and smart contract optimization to address blockchain scalability challenges.

As decentralized finance continues growing, gas fee management remains critical for mainstream adoption. High transaction costs create barriers that prevent casual users from participating in DeFi opportunities. Gas tokens and other optimization techniques help lower these barriers, supporting broader ecosystem development and accessibility.

For projects looking to create a cryptocurrency or build DEX platforms, incorporating gas optimization features improves competitiveness. Working with experienced crypto development company teams ensures these features are implemented securely and effectively.

Conclusion

Gas tokens provide a practical solution for managing transaction costs on decentralized exchanges. By enabling users to capture value during low-fee periods and utilize it during expensive times, gas tokens make DEX trading more affordable and predictable for active participants.

Understanding how gas tokens work, their benefits, and their limitations helps users make informed decisions about incorporating them into their trading strategies. While they require some learning and strategic planning, the potential cost savings justify the effort for frequent traders and DeFi users.

As blockchain technology and Crypto Token Development continue evolving, gas optimization will remain important for mainstream DeFi adoption. Gas tokens, alongside Layer 2 solutions and other innovations, contribute to making decentralized finance accessible to broader audiences. For traders seeking to reduce DEX trading fees and for platforms building user-friendly experiences, gas tokens represent valuable tools in the ongoing effort to improve blockchain efficiency and accessibility.

Frequently Ask Question

A gas token is a cryptocurrency that helps users reduce blockchain transaction costs by allowing them to lock in lower gas prices during off-peak periods for use during high-fee times.

Gas tokens are minted when network fees are low, storing value in smart contracts. Later, when fees are high, utilizing these tokens triggers refunds that offset the elevated costs.

DEX transactions involve complex smart contract interactions requiring significant computational resources. When network demand exceeds capacity, users bid higher fees for transaction priority, driving costs up.

Gas fees are typically lowest during weekends and off-peak hours when fewer users are active. Monitoring gas tracking tools helps identify optimal minting windows.

Gas tokens are most effective on networks with high fee volatility like Et

Are there risks associated with gas tokens?

Risks include poor timing reducing effectiveness, network upgrades changing gas refund mechanisms, and smart contract vulnerabilities. Understanding these risks helps users make informed decisions.

By reducing effective trading costs, gas tokens make decentralized exchanges more accessible and competitive with centralized alternatives. Lower costs attract more users and support broader DeFi adoption.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.