Key Takeaways

- A custodial NFT marketplace holds your private keys and manages your NFT wallet on your behalf, while a non-custodial crypto wallet gives you full control over your private keys and digital assets without any third-party involvement.

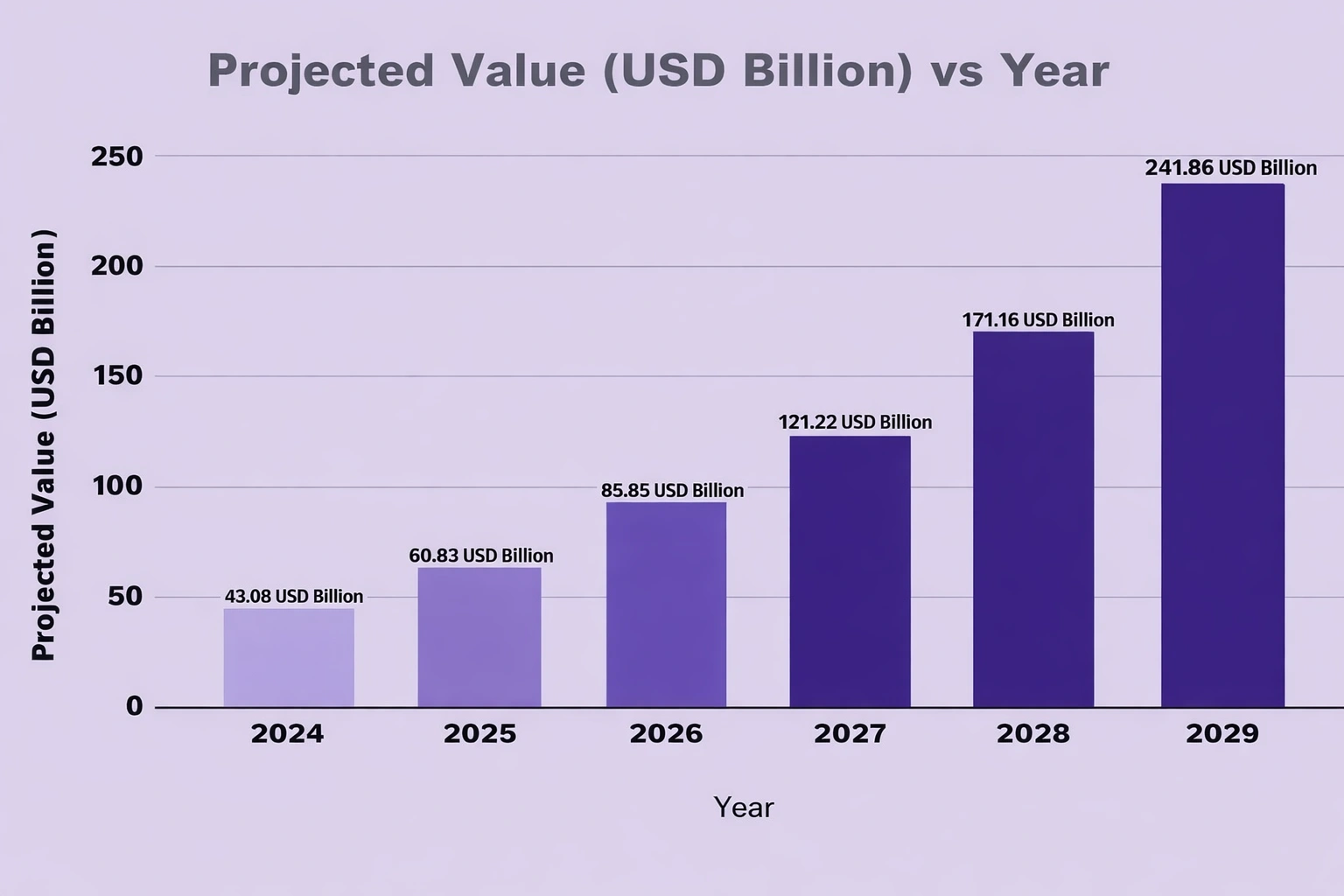

- The global NFT market was valued at around 43 billion dollars in 2025 and is projected to grow to 247 billion dollars by 2029, showing that both custodial and non-custodial NFT marketplaces are part of a fast-growing industry.[1]

- OpenSea, one of the most popular non-custodial NFT marketplace platforms, reclaimed over 40 percent of total NFT trading volume with more than 2.1 million wallets engaging the platform in Q1 2025.[2]

- Ethereum powers about 62 percent of all NFT transactions, making it the most used blockchain for both custodial and non-custodial crypto wallets in the NFT space.[3]

- In 2024, about 2.2 billion dollars were stolen through cryptocurrency hacks, and private key compromises accounted for nearly 70 percent of stolen funds, which highlights the risks involved with both custodial and non-custodial wallet types.[4]

- Custodial NFT platforms like Binance NFT and Nifty Gateway offer password recovery and customer support, which makes them better suited for beginners who are new to NFT wallets and blockchain technology.

- Non-custodial crypto wallets like MetaMask, Trust Wallet, and Ledger give users direct access to DeFi protocols, decentralized exchanges, and multiple blockchain networks without any intermediaries.

If you are getting into NFTs, one of the first things you will need to figure out is where to buy, sell, and store them. That brings you to a big question: should you use a custodial NFT marketplace or a non-custodial one? This choice affects how much control you have over your digital assets, how safe your NFTs are, and what kind of experience you get as a user. The difference between custodial vs non custodial NFT marketplaces comes down to one simple thing: who holds the keys to your NFT wallet. In a custodial setup, a company holds your private keys for you. In a non-custodial setup, you hold those keys yourself. As more platforms introduce advanced NFT marketplace solutions, users now have flexible options that balance ease of use with control. Both options have their own strengths and weaknesses, and the right choice depends on what matters most to you.

This guide breaks down everything you need to know about custodial vs non custodial NFT marketplaces. We will look at how each type works, what kind of nft wallets they use, the security risks involved, real-world examples of both, and how to decide which one is the better fit for your goals. Whether you are a first-time buyer or someone who has been trading NFTs for a while, understanding these differences will help you protect your assets and make smarter choices in the NFT space.

What Is a Custodial NFT Marketplace?

A custodial NFT marketplace is a platform where a third-party company manages your NFT wallet, private keys, and digital assets on your behalf. When you create an account on a custodial NFT marketplace, you usually sign up with an email and password, just like any other website. The platform then creates a custodial crypto wallet for you behind the scenes. You do not see or manage your private keys directly. Instead, the company stores them for you.

Think of it like putting your money in a bank. The bank holds your money, keeps it safe, and lets you access it whenever you need. But technically, the bank is the one in control of your funds while they are stored there. A custodial NFT marketplace works in the same way. You can browse, buy, and sell NFTs through the platform, but the platform is the one that actually holds your crypto assets in its wallets.

1. How Custodial NFT Platforms Handle Your Assets

When you buy an NFT on a custodial platform, the transaction is processed through the platform’s own systems. The NFT sits in the platform’s custodial crypto wallet, and your account records show that you own it. But the private key that proves ownership on the blockchain is held by the company, not by you. If the platform goes down, gets hacked, or decides to freeze your account, you could lose access to your NFTs.

2. Why Some Users Prefer Custodial Platforms

Custodial NFT marketplaces are popular among beginners because they are easy to use. You do not need to understand blockchain technology, gas fees, or private key management. If you forget your password, you can reset it. If you run into a problem, there is a customer support team to help you. For people who are new to crypto and NFT wallets, this kind of hand-holding can be very helpful.

3. Examples of Custodial NFT Marketplaces

Some of the most well-known custodial NFT marketplace platforms include Binance NFT, Nifty Gateway, and Coinbase NFT. Binance NFT benefits from Binance’s massive ecosystem of over 270 million registered users and supports low-cost minting on BNB Chain with a 1 percent platform fee. Nifty Gateway allows users to buy NFTs using credit cards, which removes the need for a separate custodial crypto wallet altogether. These platforms focus on making things simple and accessible for everyday users.

Recommended Reading:

NFT Wallet Use Cases Across Industries and Real World Applications

What Is a Non-Custodial NFT Marketplace?

A non-custodial NFT marketplace is a platform where you keep full control of your private keys, your NFT wallet, and all your digital assets. No company or third party has access to your crypto. You connect your own non-custodial crypto wallet to the marketplace, and all transactions happen directly between you and the blockchain.

This is more like keeping your cash in a personal safe at home. Nobody else has the key. You are fully in charge of your assets. But if you lose that key, nobody can help you get it back. That is the trade-off with non-custodial crypto wallets: full control comes with full responsibility.

1. How Non-Custodial Platforms Process Transactions

On a non-custodial NFT marketplace, when you buy or sell an NFT, the transaction is recorded directly on the blockchain through smart contracts. The NFT moves from one nft wallet to another without the marketplace ever holding your assets. The platform acts as a front-end interface that connects buyers and sellers, but it does not store your funds or your private keys at any point during the process.

2. The Role of Smart Contracts in Non-Custodial Trading

Smart contracts are the backbone of every non-custodial NFT marketplace. These are self-executing pieces of code on the blockchain that automatically handle the transfer of the NFT to the buyer and the payment to the seller once certain conditions are met. This removes the need for a middleman. Creators also benefit because smart contracts can automatically send royalty payments on every secondary sale. Over 80 percent of NFT creators now use royalty-enforcing smart contracts.

3. Examples of Non-Custodial NFT Marketplaces

The biggest non-custodial NFT marketplace is OpenSea, which holds over 40 percent of total NFT trading volume and had more than 2.1 million wallets interact with it in the first three months of 2025. Other popular non-custodial platforms include Blur, Magic Eden, Rarible, and SuperRare. Blur focuses on professional traders with zero platform fees and advanced analytics tools. Magic Eden started on Solana but has expanded to Ethereum, Polygon, and even Bitcoin Ordinals. Rarible lets its community vote on platform decisions through RARI tokens, giving users a real voice in how the marketplace develops.

Custodial vs Non-Custodial Wallet: Understanding the Core Difference

Before we go deeper into how these marketplaces work, it is important to understand the difference between a custodial vs non custodial wallet at a basic level. The wallet is the tool that stores and manages your NFTs and cryptocurrency. The type of wallet you use decides how much control and responsibility you have.

1. What Is a Custodial Crypto Wallet?

A custodial crypto wallet is one where a third party holds your private keys. You access your assets through the company’s app or website using a username and password. If you forget your login details, the company can help you recover access. But because the company controls your keys, they technically have control over your assets. If the company gets hacked, shuts down, or freezes your account, you might lose access to everything stored in that wallet.

2. What Is a Non-Custodial Crypto Wallet?

A non-custodial crypto wallet is one where only you have access to your private keys. When you set up this type of wallet, you receive a seed phrase of 12 to 24 words. This seed phrase is the only way to recover your wallet if you lose access to your device. Popular non-custodial crypto wallets include MetaMask (a browser extension wallet), Trust Wallet (a mobile wallet), Phantom (popular for Solana NFTs), and hardware wallets like Ledger and Trezor. These nft wallets connect directly to blockchain networks without any intermediaries.

3. Custodial vs Non-Custodial Crypto Wallet: The Ownership Question

The well-known phrase in crypto, “not your keys, not your coins,” sums up the custodial vs. non-custodial crypto wallet debate perfectly. When you use a custodial crypto wallet, the platform can restrict what you do with your assets. They can decide which NFTs are listed, which blockchains are supported, and they can even freeze your account if they suspect suspicious activity. With a non custodial crypto wallet, none of that applies. You can send your NFTs anywhere, interact with any decentralized application, and nobody can stop you from accessing your own assets.

Custodial vs Non-Custodial NFT Marketplaces: Feature Comparison

| Feature | Custodial NFT Marketplace | Non Custodial NFT Marketplace |

|---|---|---|

| Private Key Control | Held by the platform | Held by the user |

| Account Recovery | Password reset and customer support available | No recovery if the seed phrase is lost |

| Ease of Use | Very beginner-friendly with a simple sign-up | Requires basic blockchain knowledge |

| KYC Requirements | Usually required for compliance | Not required in most cases |

| DeFi Access | Limited or no access | Full access to DeFi protocols and DApps |

| Transaction Speed | Can be faster due to internal processing | Depends on the blockchain network congestion |

| Content Restrictions | The platform can restrict or censor NFT listings | Open to all types of NFTs without censorship |

| Best For | Beginners and casual NFT buyers | Experienced traders and DeFi users |

Security Risks in Custodial vs. Non-Custodial NFT Marketplaces

Security is one of the biggest concerns when choosing between custodial vs non custodial NFT marketplaces. Both types come with their own risks, and understanding them can save you from losing your assets. According to the TRM Labs 2025 Crypto Crime Report, about 2.2 billion dollars was stolen through cryptocurrency hacks in 2024 alone, which was a 17 percent increase from the previous year. Private key and seed phrase compromises accounted for nearly 70 percent of all stolen funds.

1. Risks of Custodial NFT Marketplaces

The main risk with a custodial NFT marketplace is that you are trusting a company with your assets. If that company is hacked, your NFTs and crypto can be stolen. Since custodial platforms hold the private keys of thousands of users in one place, they become attractive targets for hackers. Exchange hacks have been a common problem in the crypto industry for over a decade. Even large platforms with strong security can be compromised. Beyond hacking, there is also the risk of a company going bankrupt or shutting down. If the custodial NFT marketplace closes, getting your assets back can be extremely difficult.

2. Risks of Non-Custodial NFT Marketplaces

With non-custodial crypto wallets, the biggest risk is user error. If you lose your seed phrase or private key, there is no way to recover your assets. There is no customer support, no password reset button, and no backup. Your assets are gone forever. Phishing attacks are also a major threat. Scammers create fake websites that look exactly like popular non-custodial NFT marketplace platforms. When users connect their nft wallet and approve a transaction, the scammer drains their wallet. According to Check Point’s research, over 68 percent of NFT scams start with a fake announcement on social media platforms like Discord or Telegram.

3. Smart Contract Vulnerabilities

Non-custodial NFT marketplaces rely on smart contracts, and if those contracts have bugs or flaws, hackers can exploit them. In late 2024, a major NFT project had its metadata hosted on a centralized server that was compromised, and attackers changed the image links for over 1,200 NFTs. Owners did not notice until they tried to sell their assets. This shows that even though the blockchain itself is very hard to hack, the surrounding infrastructure can still be vulnerable.

Recommended Reading:

NFT Wallet Types: Which One Works Best for You?

Your choice of nft wallet plays a huge role in your overall experience with NFT marketplaces. Whether you go with a custodial crypto wallet or a non-custodial crypto wallet, each type has specific advantages that matter depending on how you plan to use your NFTs.

1. Software Wallets (Hot Wallets)

Software NFT wallets are applications that you install on your phone, browser, or computer. Most of them are non-custodial crypto wallets. MetaMask is the most popular browser extension wallet for Ethereum-based NFTs. Trust Wallet is widely used on mobile devices and supports multiple blockchains. Phantom is the go-to wallet for Solana NFTs. These wallets are convenient because they are always connected to the internet, making it easy to trade on non-custodial NFT marketplace platforms. But being connected to the internet also makes them more vulnerable to hacking and phishing.

2. Hardware Wallets (Cold Wallets)

Hardware nft wallets like Ledger and Trezor are physical devices that store your private keys offline. These are considered the safest option for long-term NFT storage because hackers cannot access them remotely. Every transaction must be physically confirmed on the device. The downside is that they are less convenient for frequent trading, and they cost money to purchase. For people who hold high-value NFTs and want the strongest possible protection, a hardware wallet combined with a non-custodial crypto wallet setup is the best approach.

3. Exchange Wallets (Custodial Wallets)

Exchange nft wallets are the custodial crypto wallets built into platforms like Binance, Coinbase, and Nifty Gateway. You access them through your exchange account. They are the simplest option because there is nothing extra to set up. But as we covered earlier, the exchange holds your keys, which means you are depending on that company to keep your assets safe. The global crypto wallet market was valued at 12.59 billion dollars in 2024 and is expected to reach 100.77 billion dollars by 2033, which shows how rapidly both custodial and non custodial wallet adoption is growing.

The NFT Marketplace Landscape in 2025

The NFT marketplace landscape has changed a lot over the past few years. As of 2025, there are about 112 active NFT marketplaces globally, and competition between custodial and non-custodial platforms is stronger than ever. The global NFT market was valued at around 43 billion dollars in 2025 and is projected to grow to 247 billion by 2029.

1. OpenSea’s Dominance as a Non-Custodial Platform

OpenSea remains the most used non-custodial NFT marketplace. It holds over 40 percent of total NFT trading volume and supports 19 different blockchain networks. After announcing its native token SEA in February 2025, OpenSea’s daily trading volume jumped from around 3.47 million dollars to an average of 17.4 million dollars. The platform also launched OS2, a redesigned version with full token trading across multiple chains.

2. Blur’s Impact on Professional NFT Trading

Blur is a non-custodial NFT marketplace that targets professional traders. It offers zero marketplace fees, bulk listing tools, and advanced analytics. At one point, Blur captured over 50 percent of the Ethereum NFT market share before settling back down. Its approach shows that non-custodial platforms can compete aggressively on features and pricing without needing to hold user assets.

3. Binance NFT as a Custodial Competitor

Binance NFT is one of the strongest custodial NFT marketplace options. It benefits from Binance’s global ecosystem of over 270 million registered users. The platform charges just a 1 percent platform fee and supports low-cost minting on BNB Chain. Users can buy, sell, and manage NFTs directly from their Binance account, with no need to set up a separate nft wallet. This makes it extremely accessible for people who are already part of the Binance ecosystem.

4. Magic Eden’s Multi-Chain Expansion

Magic Eden started as a Solana focused non custodial NFT marketplace but has expanded to support Ethereum, Polygon, and Bitcoin Ordinals. It is now the third-largest NFT marketplace by trading volume. Its launchpad attracts new creators, and its multi-chain support gives users access to a wider range of NFT collections. In May 2025, Magic Eden recorded about 50 million dollars in monthly trading volume and captured 21 percent of the total market share.

Top NFT Marketplaces by Type and Trading Activity in 2025

| NFT Marketplace | Type | Key Highlights |

|---|---|---|

| OpenSea | Non Custodial | Over 40% market share, supports 19 blockchains, 2.1M+ wallets in Q1 2025 |

| Blur | Non Custodial | Zero fees, bulk listing, analytics tools, targets professional traders |

| Magic Eden | Non Custodial | Multi-chain (Solana, Ethereum, Polygon, Bitcoin), 21% market share in May 2025 |

| Binance NFT | Custodial | 270M+ users, 1% fee, BNB Chain integration, no separate wallet needed |

| Nifty Gateway | Custodial | Credit card purchases, curated drops, Gemini-owned, beginner-focused |

| Rarible | Non Custodial | Community governance via RARI token, custom royalties, multi-chain minting |

| SuperRare | Non Custodial | Curated high-end digital art, one-of-one artwork, and known artists |

Blockchain Networks Behind NFT Marketplaces

The blockchain network a marketplace uses plays a major role in transaction costs, speed, and the type of nft wallet you need. Whether you are on a custodial or non custodial NFT marketplace, the underlying blockchain affects your entire experience.

1. Ethereum

Ethereum is the most dominant blockchain for NFTs, powering about 62 percent of all NFT transactions. Most major non-custodial NFT marketplaces like OpenSea, Blur, and SuperRare are built primarily on Ethereum. The network uses token standards like ERC 721 and ERC 1155 for NFTs. The downside is higher gas fees, especially during busy periods on the network.

2. Solana

Solana handles about 18 percent of NFT transactions and is known for its speed and very low fees. Magic Eden and Phantom wallet are the most popular tools in the Solana NFT ecosystem. For users who want a non-custodial crypto wallet experience without high gas costs, Solana is a strong option.

3. Polygon

Polygon is an Ethereum Layer 2 solution that offers much lower fees while still connecting to the Ethereum network. It hosts about 11 percent of total NFT minting activities and is used by major brands like Nike and Starbucks for their NFT programs. Both custodial and non-custodial platforms support Polygon.

4. BNB Chain

BNB Chain holds about 6 percent of the NFT market share and is closely tied to the Binance ecosystem. It is the primary chain used by Binance NFT, the custodial NFT marketplace. Its low transaction fees make it attractive for high-volume minting and trading.

Recommended Reading:

When Should You Choose a Custodial NFT Marketplace?

A custodial NFT marketplace makes sense in specific situations. Not everyone needs full control over their private keys, and for many users, the convenience of a managed platform is worth the trade-off.

1. You Are New to NFTs and Crypto

If you have never used a non-custodial crypto wallet before and do not understand concepts like gas fees, seed phrases, or smart contract approvals, a custodial platform is the easier starting point. You can learn about NFTs without the risk of accidentally losing your assets due to a wallet mistake.

2. You Want Credit Card or Fiat Payment Options

Custodial NFT marketplaces like Nifty Gateway allow users to buy NFTs directly with credit or debit cards. This removes the need to purchase cryptocurrency first. For users who just want to buy an NFT as a collectible or gift without dealing with crypto exchanges, custodial platforms simplify the process.

3. You Need Customer Support

If something goes wrong on a custodial NFT marketplace, you can contact customer support. Locked out of your account? They can help. Bought the wrong NFT? They might be able to assist. This safety net does not exist on non-custodial platforms.

When Should You Choose a Non-Custodial NFT Marketplace?

A non-custodial NFT marketplace is the better option for users who want maximum control and access to the broader blockchain ecosystem.

1. You Want Full Ownership of Your Assets

If owning your private keys and having complete control over your nft wallet is important to you, then a non-custodial setup is the way to go. Nobody can freeze, restrict, or seize your assets without your permission.

2. You Use DeFi Protocols

Non-custodial crypto wallets give you direct access to decentralized finance protocols, including NFT lending platforms, yield farming, and liquidity pools. NFT lending and fractional ownership alone are projected to reach a 2.3 billion dollar market in 2025. Custodial wallets typically do not support these advanced features.

3. You Trade Across Multiple Blockchains

If you buy NFTs on Ethereum, Solana, Polygon, and other chains, a non custodial nft wallet gives you the flexibility to switch between networks. Custodial platforms usually limit you to the blockchains they support. Over 3 million NFTs were bridged cross chain in 2025, showing how important multi-chain access has become.

4. You Value Privacy

Non-custodial NFT marketplaces do not require KYC verification. You can connect your wallet and start trading without sharing personal information. For users who prioritize privacy, this is a major advantage over custodial platforms that require identity verification to comply with regulations.

NFT Categories Driving Marketplace Growth

Understanding what types of NFTs are being traded helps you decide which kind of marketplace and NFT wallet to use. Different NFT categories often lean toward either custodial or non-custodial platforms based on their user base.

1. Gaming NFTs

Gaming NFTs account for 38 percent of total NFT transaction volume, making them the largest category. Most gaming NFT platforms use non custodial nft wallets so that players can truly own their in-game items and trade them freely. Axie Infinity and Immutable X are examples of gaming-focused platforms that rely on non-custodial wallet connections.

2. Digital Art

Digital art represents about 21 percent of the NFT market with a median sale value of around 1,200 dollars. High-end platforms like SuperRare operate as non-custodial NFT marketplaces, while some curated art drops happen on custodial platforms like Nifty Gateway. The choice often depends on whether the artist and collector prefer control or convenience.

3. Music NFTs

Music NFTs generated over 520 million dollars in revenue in 2025. These tokens allow artists to sell albums, tracks, or exclusive content directly to fans. Most music NFT platforms operate on a non-custodial model, giving artists full control over their royalties and distribution.

4. Event Ticketing NFTs

Event ticketing NFTs now make up 5.3 percent of ticket sales across major US venues. These NFTs help prevent ticket fraud and counterfeiting. Both custodial and non-custodial approaches are used in ticketing, depending on the event organizer’s preference for user experience versus decentralization.

NFT Marketplace Implementations Built With Real-World Blockchain Development

The following projects show how NFT marketplace concepts discussed in this article are being applied in practice. Each implementation uses blockchain-based trading, smart contracts, community governance, or token-integrated economies that connect directly to the custodial vs non-custodial principles covered above.

🎨

LooksRare: Community First NFT Marketplace

Built a community centered non custodial NFT marketplace that rewards traders, collectors, and creators for active engagement. The platform redistributes 100 percent of protocol fees back to the community, features zero royalty enforcement with user choice, supports bulk buying and listing tools, and processes all payments in ETH on the Ethereum blockchain.

Build Your Own Custodial or Non-Custodial NFT Marketplace:

We bring 8+ years of blockchain expertise to NFT marketplace development. Our team handles everything from smart contract creation to multi-chain integration, NFT wallet development, and platform security. Whether you need a custodial NFT marketplace with managed wallets or a fully decentralized non-custodial platform, we build solutions designed for growth and long term performance.

Conclusion

The debate between custodial vs non custodial NFT marketplaces is not about which one is “better” in general. It is about which one is better for your specific situation. Custodial NFT marketplaces offer simplicity, customer support, and easy onboarding for people who are new to the NFT space. They manage your nft wallet, handle your private keys, and make buying and selling NFTs as easy as shopping on any regular website. But that convenience comes at a cost: you give up control of your assets to a third party, and you depend on that company to keep your NFTs safe.

Non-custodial NFT marketplaces put you in the driver’s seat. You hold your own private keys in your own non-custodial crypto wallet, you interact directly with the blockchain through smart contracts, and no company can restrict what you do with your digital assets. But with that freedom comes the responsibility of keeping your seed phrase safe, understanding how blockchain transactions work, and protecting yourself from phishing scams and smart contract exploits.

As the NFT market continues to grow toward the projected 247 billion dollars by 2029, the development of both custodial and non-custodial platforms will keep evolving. We are already seeing custodial platforms add more decentralized features, and non-custodial platforms improve their user interfaces to attract mainstream users. The custodial vs non custodial wallet choice is becoming less of an either-or decision and more of a spectrum, with hybrid solutions emerging that try to combine the best of both approaches. Whatever path you choose, make sure you understand how your nft wallet works, where your private keys are stored, and what risks you are accepting. That knowledge is the foundation of smart participation in the NFT ecosystem.

Frequently Asked Questions

The main difference is who holds your private keys. On a custodial NFT marketplace, the platform holds your keys and manages your NFT wallet for you. On a non-custodial marketplace, you keep full control of your own private keys and connect your own non-custodial crypto wallet to trade.

Both have risks. A custodial crypto wallet can be hacked at the platform level, and you lose control if the company shuts down. A non-custodial crypto wallet is safer from third-party breaches, but can be permanently lost if you lose your seed phrase. Hardware NFT wallets offer the strongest protection for non-custodial users.

Yes, most custodial NFT marketplace platforms allow you to withdraw your NFTs to an external non-custodial crypto wallet. You will need the wallet address of your non custodial nft wallet and may need to pay a small withdrawal or gas fee to complete the transfer.

Popular non custodial nft wallets include MetaMask, Trust Wallet, Phantom, Ledger, and Trezor. MetaMask is widely used for Ethereum NFTs, Phantom is popular for Solana, and Ledger and Trezor are hardware wallets that store your keys offline for added protection.

No, most non-custodial NFT marketplaces do not require KYC or identity verification. You connect your non-custodial crypto wallet and start trading without sharing personal information. Custodial platforms, on the other hand, usually require identity verification to meet regulatory compliance standards.

OpenSea is a non-custodial NFT marketplace. You connect your own nft wallet, such as MetaMask or Phantom, and trade directly on the blockchain. OpenSea never holds your private keys or stores your assets. You always remain in full control of your non-custodial crypto wallet when using the platform.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.