Key Takeaways

- Bitcoin multisig wallets require multiple private keys to authorize transactions, providing enhanced security against single-point failures and aligning with cryptocurrency wallet regulation standards.

- Multisig technology is the preferred security model for institutions, DAOs, and high-value BTC holders, especially under evolving cryptocurrency wallet regulation frameworks.

- Modern multisig setups combine Bitcoin Script, hardware wallets, and policy-based governance to meet cryptocurrency wallet regulation compliance requirements.

- By 2026, multisig wallets are critical for risk management, institutional custody, and adherence to cryptocurrency wallet regulation standards worldwide.

The evolution of Bitcoin custody has undergone a dramatic transformation over the past decade, moving from simple single-key wallets to sophisticated multisignature security systems. As someone with over 8 years of experience in blockchain security and digital asset management, I’ve witnessed firsthand how cryptocurrency wallet regulation has shaped the industry’s approach to secure custody solutions. The journey from individual key management to institutional-grade multisig architectures reflects not just technological advancement, but a fundamental shift in how we think about digital asset security and regulatory compliance.

In 2026, the landscape of Bitcoin security is defined by rising threats that include wallet hacks, key loss incidents, insider risk, and increasing regulatory pressure. Exchange breaches have resulted in billions of dollars in losses, while countless individuals have lost access to their Bitcoin holdings due to misplaced or compromised private keys. These challenges have made it clear that traditional single-key wallets are no longer sufficient for serious Bitcoin holders. The bitcoin multisig wallet has emerged as the gold standard for secure cryptocurrency storage, especially for those navigating the complex world of cryptocurrency wallet regulation.

Throughout our years working with financial institutions, hedge funds, and crypto-native organizations, we’ve helped implement multisig solutions that not only enhance security but also ensure compliance with evolving cryptocurrency wallet regulation standards. This comprehensive guide draws on that extensive experience to explain how bitcoin multisig wallets work, why they’re essential, and how they fit into the broader regulatory framework governing digital assets today.

What Is a Bitcoin Multisig Wallet?

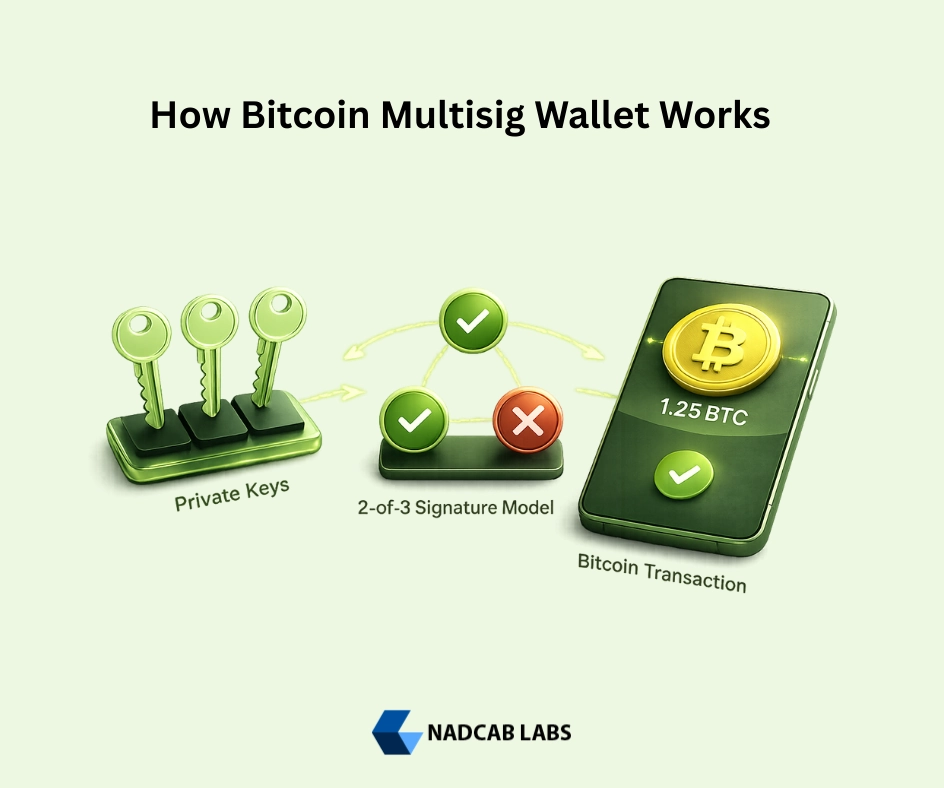

A bitcoin multisig wallet is a cryptocurrency wallet that requires multiple private keys to authorize and execute transactions. Unlike traditional single-signature wallets where one private key controls all funds, multisig wallets distribute control across multiple keys, creating a more secure and robust custody solution. This fundamental design aligns perfectly with cryptocurrency wallet regulation requirements that mandate separation of duties and enhanced security controls for institutional holders.

The difference between single-signature and multi-signature Bitcoin wallets is straightforward yet profound. In a single-signature wallet, possession of one private key grants complete access to all funds. If that key is lost, stolen, or compromised, the entire balance is at risk. A multisig wallet, however, requires a predetermined number of keys from a larger set to approve any transaction. For example, in a 2-of-3 multisig setup, any two out of three designated keys must sign a transaction before it can be broadcast to the Bitcoin network.

Bitcoin introduced multisig capability through its native script support, a programmable feature built into the protocol from its early days. This wasn’t an afterthought or external addition; multisig functionality is embedded directly into Bitcoin’s core architecture. The Bitcoin Script language allows users to define complex spending conditions, with multisignature schemes being one of the most powerful and widely adopted applications. As cryptocurrency wallet regulation has matured, regulators have increasingly recognized multisig as a best practice for institutional custody, making it not just a security enhancement but often a compliance requirement.

How Bitcoin Multisig Wallets Work

Understanding how bitcoin multisig wallets work requires grasping three fundamental concepts: public keys, private keys, and signature validation. In Bitcoin’s cryptographic system, each private key has a corresponding public key. When you want to spend Bitcoin, you create a transaction and sign it with your private key. The network then validates this signature using your public key. In a multisig configuration, multiple public keys are combined into a single multisig address, and spending from that address requires signatures from multiple corresponding private keys.

The M-of-N signature model is the cornerstone of multisig functionality. “M” represents the minimum number of signatures required, while “N” represents the total number of possible signers. Common configurations include 2-of-3 (two signatures required from three possible keys), 3-of-5 (three signatures from five keys), and even more complex arrangements like 5-of-7 or 7-of-10 for large organizations. These flexible configurations allow organizations to design security policies that match their operational needs while satisfying crypto wallet regulation requirements for appropriate controls and redundancy.

The transaction approval flow in a bitcoin multisig wallet follows a specific sequence. First, one keyholder initiates a transaction by creating and signing it with their private key. This partially signed transaction is then passed to other keyholders. Each additional keyholder reviews the transaction details and, if approved, adds their signature. Once the minimum required number of signatures (M) is collected, the fully signed transaction can be broadcast to the Bitcoin network for confirmation. This multi-step process creates natural checkpoints and audit trails, essential features for cryptocurrency wallet regulation compliance.

Bitcoin Multisig Wallet Architecture (Technical Foundation)

The technical foundation of multisig wallets rests on Bitcoin Script and Pay-to-Script-Hash (P2SH) or its SegWit variant, Pay-to-Witness-Script-Hash (P2WSH). Bitcoin Script is a stack-based programming language that defines the conditions under which Bitcoin can be spent. P2SH allows complex spending conditions to be encoded in a standardized address format, making multisig wallets compatible with all Bitcoin wallets and exchanges. This technical architecture is particularly important for entities subject to cryptocurrency wallet regulation, as it provides transparency and auditability.

Key generation and address creation in a multisig setup involve several steps. Each participant generates their own private/public key pair, typically using hardware wallets for enhanced security. These public keys are then combined using a specific script that defines the M-of-N requirement. The resulting script is hashed to create the multisig address, which looks like a standard Bitcoin address but contains the embedded multisig logic. Throughout our 8 years of implementing these systems, we’ve seen how proper key generation procedures, when documented and audited, significantly aid in cryptocurrency wallet regulation compliance.

Offline signing and transaction broadcasting represent critical security features of multisig systems. Keyholders can review and sign transactions on air-gapped devices that never connect to the internet, dramatically reducing exposure to malware and remote attacks. The partially signed transactions are transferred via QR codes or USB drives to online devices only for broadcasting after all required signatures are collected. This offline signing capability is often mandated by cryptocurrency wallet regulation standards for high-value custody operations.

Types of Bitcoin Multisig Wallet Configurations

Different use cases demand different multisig configurations, and understanding these options is crucial for both security and cryptocurrency wallet regulation compliance. Personal multisig wallets typically employ 2-of-3 configurations, where an individual might hold two keys (perhaps on different hardware devices) and a trusted third party or backup service holds the third. This setup protects against device failure while maintaining personal control, and it aligns with cryptocurrency wallet regulation principles of redundancy and recovery.

| Configuration Type | Typical M-of-N Setup | Primary Use Case | Regulation Compliance Level |

|---|---|---|---|

| Personal Multisig | 2-of-3 | Individual self-custody with backup | Basic security standards |

| Business Multisig | 3-of-5 | Corporate treasury management | Moderate cryptocurrency wallet regulation |

| Enterprise Multisig | 5-of-7 or 7-of-10 | Institutional custody and exchanges | Strict cryptocurrency wallet regulation |

| DAO Treasury | 4-of-7 | Decentralized governance | Emerging cryptocurrency wallet regulation |

| Escrow Multisig | 2-of-3 | Transaction mediation and disputes | Contract-specific regulations |

Business and enterprise multisig setups typically require more complex configurations. A 3-of-5 arrangement might distribute keys among the CEO, CFO, CTO, and two board members, ensuring no single executive can unilaterally move funds. Large institutions subject to strict cryptocurrency wallet regulation often implement 5-of-7 or even 7-of-10 configurations, distributing keys across departments, geographic locations, and hierarchical levels. These sophisticated setups demonstrate to regulators that proper controls are in place and that no insider can act alone.

DAO and treasury-controlled multisig wallets represent a unique category where governance token holders collectively manage funds through on-chain voting. These systems often use 4-of-7 or similar configurations where elected signers must implement decisions made by the broader community. Escrow-based multisig arrangements use 2-of-3 setups where buyer and seller each hold one key, and a neutral arbitrator holds the third, only signing in case of disputes. Each configuration must balance operational efficiency with security and cryptocurrency wallet regulation requirements.

Why Bitcoin Multisig Wallets Are More Secure Than Single-Key Wallets

The elimination of single-point failure represents the most fundamental security advantage of bitcoin multisig wallets. In our extensive experience implementing custody solutions, we’ve seen numerous cases where single-key wallets led to catastrophic losses. One compromised device, one phishing attack, one moment of carelessness—and millions of dollars vanish permanently. Multisig eliminates this vulnerability by distributing trust across multiple keys. An attacker would need to compromise multiple independent keys simultaneously, a feat exponentially more difficult than attacking a single target. This redundancy is a core principle in cryptocurrency wallet regulation frameworks worldwide.

Protection against device compromise and phishing becomes dramatically more effective with multisig. Even if an attacker successfully installs malware on one keyholder’s computer or tricks them into revealing their private key, the attacker still cannot move funds without additional signatures. We’ve witnessed real-world scenarios where phishing attacks successfully compromised one key in a 3-of-5 multisig setup, but the remaining honest keyholders quickly identified the threat and secured the funds by moving them to a new multisig address. This resilience is increasingly recognized in cryptocurrency wallet regulation guidance as a necessary control for professional custody operations.

Defense against insider threats is particularly crucial for organizations holding significant Bitcoin treasuries. A disgruntled employee, a compromised executive, or collusion between insiders poses real risks that single-key systems cannot adequately address. Multisig forces any malicious insider to recruit multiple co-conspirators, significantly raising the difficulty and risk of detection. Many cryptocurrency wallet regulation standards now explicitly require multisig or equivalent controls for institutional custody specifically to mitigate insider risk, recognizing that operational security is as important as technical security.

Safer recovery mechanisms represent another critical advantage. With single-key wallets, losing your seed phrase means permanent loss of access. Multisig provides graceful degradation: in a 2-of-3 setup, losing one key is inconvenient but not catastrophic. The funds can be moved to a new address using the remaining two keys. This recovery capability aligns with cryptocurrency wallet regulation requirements for business continuity and disaster recovery planning, ensuring that technical failures or human errors don’t result in permanent asset loss.

Bitcoin Multisig Wallet vs Traditional Bitcoin Wallets

The choice between multisig and traditional single-key wallets involves careful consideration of security, usability, cost, and operational complexity. While multisig offers superior security and better alignment with cryptocurrency wallet regulation requirements, it does introduce additional complexity that may not be necessary for all use cases. Understanding these trade-offs helps determine when multisig is essential versus when it might be overkill.

| Factor | Single-Key Wallet | Multisig Wallet | Cryptocurrency Wallet Regulation Impact |

|---|---|---|---|

| Security Level | Single point of failure | Distributed trust, no single point of failure | Multisig preferred for regulated entities |

| Setup Complexity | Simple, 5-10 minutes | Complex, 30-60 minutes | Documentation required for compliance |

| Transaction Speed | Immediate signing | Requires coordination among keyholders | Delay acceptable for cryptocurrency wallet regulation |

| Insider Risk | High vulnerability | Requires collusion among multiple parties | Critical control for institutional custody |

| Recovery Options | Lose key = lose funds | Graceful degradation with remaining keys | Disaster recovery mandated by regulations |

| Audit Trail | Limited, single signer | Comprehensive, multiple approvals | Essential for cryptocurrency wallet regulation |

| Operational Cost | Low, minimal overhead | Higher, requires coordination | Justified for regulated operations |

From a security comparison perspective, multisig clearly dominates. However, usability trade-offs exist. Single-key wallets allow instant transactions with no coordination, making them suitable for frequent trading or spending. Multisig requires synchronizing multiple keyholders, which can slow down operations. For most institutional settings subject to cryptocurrency wallet regulation, this trade-off is acceptable because security and compliance outweigh the convenience of instant execution.

Cost and operational complexity must also be considered. Setting up and maintaining a multisig wallet requires more initial effort and ongoing coordination. Multiple hardware wallets must be purchased, keys must be distributed securely, and procedures must be documented and followed. These costs, while real, pale in comparison to the potential losses from a security breach. In our 8 years of consulting on these systems, we’ve found that organizations subject to cryptocurrency wallet regulation quickly recognize that the investment in multisig infrastructure pays for itself through reduced insurance premiums, enhanced regulatory standing, and peace of mind.

Determining when multisig is necessary versus overkill depends on several factors. For small amounts (under $10,000) and personal use, a well-secured single-key wallet may suffice. For amounts above $50,000, business treasuries, or any situation involving cryptocurrency wallet regulation oversight, multisig becomes strongly advisable. For institutional custody, regulated exchanges, or amounts exceeding $1 million, multisig is not just recommended but often legally required under cryptocurrency wallet regulation frameworks in most jurisdictions.

Real-World Use Cases of Bitcoin Multisig Wallets

Crypto exchanges and custodial platforms were among the early adopters of multisig technology, driven both by security concerns and cryptocurrency wallet regulation requirements. Major exchanges like Coinbase, Kraken, and Gemini utilize complex multisig setups for their cold storage systems, often employing 5-of-7 or even more complex configurations. These arrangements distribute keys across different geographic locations, departments, and security tiers. For exchanges operating in multiple jurisdictions, multisig provides a unified security model that satisfies diverse cryptocurrency wallet regulation standards across different countries.

Institutional investors and hedge funds managing client funds face stringent fiduciary duties and cryptocurrency wallet regulation obligations. A typical institutional multisig setup might involve 3-of-5 keys distributed among the portfolio manager, chief compliance officer, an external auditor, and two board members. This configuration ensures that no single person can misappropriate funds while allowing legitimate operations to proceed with reasonable efficiency. We’ve implemented such systems for numerous hedge funds, and the combination of enhanced security and regulatory compliance has become a competitive advantage in attracting institutional capital.

DAO treasuries and governance wallets represent one of the most innovative applications of multisig technology. Decentralized Autonomous Organizations often hold millions or even hundreds of millions of dollars in cryptocurrency, managed by multisig wallets where keys are distributed among elected community representatives. Projects like Uniswap, Aave, and Compound use multisig configurations where 4-of-7 or 6-of-9 signers must approve treasury transactions. As DAOs increasingly interact with traditional finance and face evolving cryptocurrency wallet regulation, having robust multisig governance becomes essential for legitimacy and compliance.

Family offices and long-term BTC storage scenarios benefit immensely from multisig’s recovery features and multi-generational planning capabilities. A family office might use a 2-of-3 multisig where parents hold two keys and a trusted attorney or family member holds the third. This setup protects against key loss while ensuring inheritance planning works smoothly. The attorney can assist heirs in accessing funds if something happens to the parents, all while maintaining security and adhering to cryptocurrency wallet regulation requirements for high-net-worth family offices.

How to Set Up a Bitcoin Multisig Wallet (Step-by-Step Overview)

Setting up a bitcoin multisig wallet requires careful planning and execution, especially when cryptocurrency wallet regulation compliance is a consideration. Based on our 8 years of implementation experience, the process begins with choosing the right multisig policy that balances security, operational efficiency, and regulatory requirements. For personal use, 2-of-3 provides an excellent balance. For small businesses, 3-of-5 offers appropriate redundancy. Larger organizations subject to strict cryptocurrency wallet regulation typically require 5-of-7 or more complex configurations.

Selecting hardware wallets and signing devices represents a critical security decision. We strongly recommend hardware wallets like Ledger, Trezor, or Coldcard for all keys in a multisig setup. These devices keep private keys isolated from internet-connected computers, protecting against malware and remote attacks. For enterprise deployments under cryptocurrency wallet regulation scrutiny, using different hardware wallet brands for different keys can further reduce supply chain risks and vendor-specific vulnerabilities. Each keyholder should have their device properly initialized in a secure environment.

Key distribution and backup best practices are where many organizations falter. Keys should never be generated or stored together. Each keyholder should generate their key independently, ideally in a secure location with no cameras or network connectivity. Backup seed phrases must be written down (never photographed or stored digitally) and stored in different physical locations, preferably in safes or safety deposit boxes. For organizations subject to cryptocurrency wallet regulation, documenting the key generation and storage procedures provides essential evidence of proper controls during audits.

Transaction testing before production use cannot be overstated. Before transferring significant value to a new multisig wallet, conduct multiple test transactions with small amounts. Verify that all keyholders can successfully sign, that partially signed transactions can be properly shared, and that the transaction broadcasting process works as expected. Test the recovery procedure by simulating the loss of one key and ensuring the remaining keys can still access funds. This testing phase, while time-consuming, prevents catastrophic errors and demonstrates due diligence for cryptocurrency wallet regulation purposes.

Advanced Security Practices for Bitcoin Multisig Wallets

Geographic key separation represents an advanced security technique that protects against physical threats and local disasters. In our consulting work with regulated institutions, we typically recommend distributing keys across at least three different geographic locations, ideally in different cities or even countries. This approach protects against natural disasters, civil unrest, or targeted physical attacks. For organizations operating under cryptocurrency wallet regulation in multiple jurisdictions, geographic distribution also helps satisfy requirements about operational resilience and disaster recovery capabilities.

Hardware wallet isolation means not just using hardware wallets, but ensuring they remain permanently offline except for signing operations. Keys should never be generated on or transferred to internet-connected devices. Some advanced users employ air-gapped computers dedicated solely to Bitcoin operations, with hardware wallets only connected to these isolated machines. For the highest security environments subject to strict cryptocurrency wallet regulation, such as exchange cold storage or institutional custody, this level of isolation is standard practice.

Time-locked recovery mechanisms add another layer of sophistication to multisig security. Bitcoin’s scripting language allows for time-based conditions where, for example, a 3-of-5 multisig might fall back to a 2-of-5 requirement after 12 months, or allow a designated backup key to sign after 24 months. These mechanisms prevent funds from being permanently lost if keyholders become unavailable, while still maintaining security during normal operations. Implementing such features requires careful legal and technical planning, particularly for entities navigating cryptocurrency wallet regulation frameworks.

Multi-party operational policies define not just which keys are needed, but when, how, and under what circumstances transactions can occur. A comprehensive policy might specify that transactions above a certain threshold require additional approvals, that certain keyholders must be present for specific transaction types, or that certain time windows are off-limits for moving funds. These policies, when properly documented and enforced, provide strong evidence of robust internal controls for cryptocurrency wallet regulation compliance and can significantly reduce operational risk.

Bitcoin Multisig Wallets and Regulatory Compliance

Cryptocurrency wallet regulation has evolved significantly over the past several years, with regulators worldwide increasingly focusing on custody standards and operational controls. Multisig wallets inherently support auditability and transparency because every transaction requires multiple approvals, creating a clear record of who authorized what and when. This transparency is precisely what regulators seek when evaluating whether an organization has adequate controls over digital assets. The transaction history, combined with documentation of the multisig policy and keyholder identities, provides regulators with confidence that funds cannot be misappropriated.

| Cryptocurrency Wallet Regulation Requirement | How Multisig Addresses It | Implementation Example |

|---|---|---|

| Separation of Duties | Multiple parties must approve transactions | 3-of-5 with keys across departments |

| Audit Trail | All signatures recorded on blockchain | Transaction logs with keyholder identification |

| Insider Threat Prevention | No single person can move funds | Keys distributed across management levels |

| Business Continuity | Redundancy prevents single point of failure | Geographic key distribution with backup procedures |

| Access Controls | Predetermined authorization requirements | M-of-N policy enforced cryptographically |

| Operational Transparency | Public blockchain verification | Multisig addresses can be monitored by regulators |

Internal controls for regulated entities go beyond just implementing multisig; they encompass the entire operational framework around the wallet. This includes documented procedures for key generation, storage, and backup; defined roles and responsibilities for keyholders; approval workflows for different transaction types and amounts; regular audits and reconciliations; and incident response procedures. In our experience helping organizations meet cryptocurrency wallet regulation standards, the combination of multisig technology and comprehensive operational procedures creates a robust control environment that satisfies even the most demanding regulators.

Multisig’s role in institutional custody frameworks cannot be overstated. Regulatory frameworks like MiCA in Europe, the proposed Digital Asset framework in the United States, and similar cryptocurrency wallet regulation initiatives worldwide increasingly expect or require multisig for qualified custodians. The technology demonstrates that custodians have implemented industry best practices for safeguarding client assets. Insurance companies providing custody insurance also increasingly require multisig as a precondition for coverage, recognizing its effectiveness in reducing risk.

Common Risks and Mistakes in Bitcoin Multisig Wallets

Poor key management strategies undermine even the most sophisticated multisig configurations. We’ve seen organizations store multiple keys in the same physical location, defeating the purpose of distribution. Others have stored keys with related seed phrases in the same safe, meaning a single theft compromises multiple keys. Some have failed to properly label or document which key is which, leading to confusion during critical operations. From a cryptocurrency wallet regulation perspective, such failures demonstrate inadequate controls and can result in regulatory sanctions or loss of licenses.

Incomplete recovery planning is another common mistake. Organizations set up multisig wallets without fully considering what happens if keyholders become unavailable due to death, incapacitation, or departure from the organization. Without proper succession planning and documented recovery procedures, funds can become inaccessible even though the system is working exactly as designed. Comprehensive recovery planning should address every possible failure scenario and be tested regularly. For entities subject to cryptocurrency wallet regulation, regulators often require detailed recovery and business continuity plans as part of licensing requirements.

Over-complex signature policies can make operations unnecessarily difficult or create vulnerabilities. While a 7-of-10 configuration might seem more secure than 5-of-7, it also means more keyholders must coordinate for every transaction, increasing operational friction and the risk of human error. The optimal configuration balances security with operational reality. In our consulting practice, we’ve helped organizations simplify overly complex setups that were causing operational paralysis. For cryptocurrency wallet regulation purposes, demonstrating that your security model is both effective and operationally sustainable is more valuable than implementing the most complex possible scheme.

Human error in operational workflows remains a persistent challenge. Keyholders might sign transactions without properly verifying details, partially signed transactions might be lost or miscommunicated, or procedural steps might be skipped under time pressure. Implementing proper checks and balances, maintaining clear documentation, providing regular training, and using software tools that guide users through the process all help mitigate human error. Organizations subject to cryptocurrency wallet regulation should maintain detailed logs of all operations and conduct regular reviews to identify and address procedural weaknesses.

Bitcoin Multisig Wallets vs MPC Wallets (2026 Comparison)

Multi-Party Computation (MPC) wallets represent an alternative approach to distributed custody that has gained attention in recent years. Unlike multisig, where multiple complete private keys exist and must be combined through signatures, MPC distributes key material across multiple parties such that no single party ever possesses a complete private key. The key is mathematically reconstructed during signing through a cryptographic protocol. Both approaches aim to eliminate single-point failures, but they differ significantly in implementation and implications for cryptocurrency wallet regulation.

| Aspect | Bitcoin Multisig Wallets | MPC Wallets | Cryptocurrency Wallet Regulation Preference |

|---|---|---|---|

| Key Ownership | Each party holds complete key | Key shares distributed, no complete keys | Multisig clearer for auditing |

| Transparency | Fully transparent on blockchain | Appears as single-sig transaction | Multisig provides public auditability |

| Protocol Maturity | Native Bitcoin feature since 2012 | Newer technology, still evolving | Multisig proven track record |

| Implementation Complexity | Straightforward, well-documented | Complex cryptographic protocols | Simpler solutions preferred for compliance |

| Transaction Fees | Slightly higher due to larger size | Standard single-sig fees | Cost difference negligible for institutions |

| Regulatory Acceptance | Widely recognized and understood | Growing acceptance but less established | Cryptocurrency wallet regulation favors proven tech |

The key ownership versus distributed computation distinction has important implications. With multisig, each keyholder has a complete, functional private key. This provides clarity about who controls what and makes recovery straightforward. With MPC, no one has a complete key, which provides theoretical security advantages but can complicate recovery and auditability. From a cryptocurrency wallet regulation perspective, regulators often prefer the transparency and clarity of multisig, where responsibility and control are explicitly defined and verifiable.

Transparency versus abstraction represents another key difference. Multisig transactions are clearly identifiable on the blockchain, allowing anyone to verify that proper controls are in place. MPC transactions appear identical to single-signature transactions, hiding the security model. While this privacy might appeal to some users, it creates challenges for cryptocurrency wallet regulation compliance. Regulators and auditors cannot independently verify that proper custody controls are being used by examining blockchain data alone; they must rely on the custodian’s representations and internal audits.

Use cases where multisig outperforms MPC include scenarios requiring maximum transparency, simplicity, and regulatory acceptance. Exchanges, institutional custodians, and organizations operating under strict cryptocurrency wallet regulation typically prefer multisig because its security model is easier to explain to regulators, auditors, and clients. Multisig also benefits from over a decade of production use and battle-testing, while MPC implementations are newer and have less operational history.

Hybrid custody models are emerging that combine elements of both approaches. Some organizations use multisig for their primary security layer while employing MPC techniques for specific operational conveniences, such as enabling certain automated transactions without compromising overall security. As cryptocurrency wallet regulation continues to evolve, we expect regulators to develop more sophisticated frameworks that can accommodate various technical approaches while maintaining the core principles of distributed control and operational transparency.

Future of Bitcoin Multisig Wallets

Wallet user experience improvements represent a critical frontier for multisig adoption. While multisig offers superior security and better cryptocurrency wallet regulation compliance, its complexity has hindered mainstream adoption. The next generation of multisig wallets focuses on abstracting complexity while maintaining security. We’re seeing innovations like guided setup wizards, automated key backup procedures, mobile-friendly coordination tools, and intelligent transaction routing that make multisig accessible to users without technical expertise. These improvements will be essential as cryptocurrency wallet regulation extends beyond institutions to encompass retail custody providers.

Integration with account abstraction-like layers represents an exciting technical development. While Bitcoin doesn’t have native account abstraction like some newer blockchains, second-layer solutions and sidechain technologies are enabling more sophisticated wallet logic. Future multisig implementations might incorporate features like automated rebalancing, scheduled payments, conditional transactions, and programmable access controls, all while maintaining the core security benefits of multisig. These capabilities could help organizations build more sophisticated treasury management systems that satisfy evolving cryptocurrency wallet regulation requirements.

Enterprise adoption trends show accelerating momentum. Our client base has grown from primarily crypto-native companies in 2018 to include traditional financial institutions, publicly traded companies, government entities, and family offices today. Each new entrant brings higher expectations for security, compliance, and operational sophistication. We expect this trend to continue as more traditional institutions allocate to Bitcoin and face cryptocurrency wallet regulation requirements. By 2030, multisig will likely be the default standard for any organization holding more than nominal amounts of Bitcoin.

Multisig as a Bitcoin security standard is increasingly codified in industry best practices, insurance requirements, and regulatory frameworks. Organizations like the Blockchain Association, the Chamber of Digital Commerce, and various industry working groups are developing standardized multisig implementation guidelines. Insurance companies are formalizing their multisig requirements for custody coverage. Most importantly, cryptocurrency wallet regulation frameworks being developed worldwide are converging on multisig or equivalent distributed custody models as minimum standards for qualified custodians. This regulatory endorsement virtually guarantees multisig’s role as the foundation of institutional Bitcoin custody.

Final Thoughts: Is a Bitcoin Multisig Wallet Right for You?

Determining whether a bitcoin multisig wallet is right for you depends on several factors: the value of assets being secured, your risk tolerance, regulatory obligations, and operational capabilities. Drawing on our 8 years of experience implementing custody solutions across diverse contexts, we can provide a framework for making this decision that accounts for both security needs and cryptocurrency wallet regulation considerations.

| User Type | Asset Value Range | Recommended Solution | Cryptocurrency Wallet Regulation Impact |

|---|---|---|---|

| Individual Holder | Under $10,000 | Hardware wallet (single-key acceptable) | Minimal regulatory concern |

| Serious Individual | $10,000 – $100,000 | 2-of-3 multisig strongly recommended | Best practice for significant holdings |

| High Net Worth | $100,000 – $1 million | 2-of-3 or 3-of-5 multisig essential | Estate planning considerations |

| Small Business | $50,000+ | 3-of-5 multisig required | Corporate governance mandates multisig |

| Institution/Exchange | $1 million+ | 5-of-7 or more complex multisig mandatory | Cryptocurrency wallet regulation requires multisig |

| Regulated Custodian | Any amount | Complex multisig with comprehensive policies | Legal requirement under cryptocurrency wallet regulation |

When to adopt multisig is often clearer than people realize. For individuals, the threshold is typically when holdings exceed your annual income or represent wealth you cannot afford to lose. For businesses, multisig should be adopted from day one if Bitcoin comprises any significant portion of treasury holdings. For organizations operating under cryptocurrency wallet regulation oversight, multi-chain is non-negotiable regardless of amount. The peace of mind and risk reduction provided by multisig far outweigh the modest additional complexity and cost.

The long-term security outlook for Bitcoin holders increasingly points toward multisig as the standard. As Bitcoin matures and integrates further into the traditional financial system, custody standards will continue rising. Cryptocurrency wallet regulation will become more sophisticated and comprehensive, with multisig or equivalent distributed custody models becoming baseline requirements. Early adopters of robust multisig practices position themselves not just for better security today, but for seamless compliance with future regulatory regimes. The question is no longer whether institutions need multisig, but how quickly they can implement it properly.

Throughout this comprehensive guide, we’ve drawn on over 8 years of hands-on experience implementing multisig solutions across diverse contexts—from individual holders to billion-dollar custodians. The consistent lesson is that bitcoin multisig wallets represent far more than a technical curiosity; they are essential infrastructure for serious Bitcoin ownership in 2026 and beyond. By eliminating single points of failure, providing graceful recovery mechanisms, enabling transparent audit trails, and aligning with cryptocurrency wallet regulation requirements, multisig addresses the most critical challenges facing Bitcoin custody.

As the Bitcoin ecosystem continues to mature and cryptocurrency wallet regulation frameworks become more comprehensive, the organizations and individuals who have invested in proper multisig infrastructure will find themselves better positioned for long-term success. Whether you’re an individual protecting generational wealth, a business managing corporate treasury, or an institution providing custody services, the time to implement robust multisig solutions is now. The combination of battle-tested technology, growing regulatory recognition, and proven effectiveness makes bitcoin multisig wallets not just a security best practice but an essential foundation for responsible Bitcoin ownership in 2026 and the years ahead.

Ready to Secure Your Bitcoin with Multisig?

With 8+ years of expertise in blockchain security and cryptocurrency wallet regulation compliance, our team can help you implement a multisig solution that meets your security needs and regulatory requirements. Don’t leave your Bitcoin vulnerable to single-point failures.

Trusted by institutions worldwide for secure Bitcoin custody solutions

Frequently Asked Questions

A Bitcoin multisig wallet is a type of wallet that requires multiple private keys to approve a transaction instead of just one, providing higher security for Bitcoin storage and transfers.

A bitcoin multisig wallet works by using a predefined signature rule (such as 2-of-3), where a transaction is executed only when the required number of keys approve it.

Unlike single-key wallets, a bitcoin multisig wallet removes single points of failure, protecting funds from hacks, lost keys, and unauthorized access.

In a 2-of-3 bitcoin multisig wallet, three private keys exist, and at least two must sign a transaction for it to be successfully broadcast to the Bitcoin network.

Bitcoin multisig wallets are ideal for businesses, exchanges, DAOs, institutional investors, and individuals holding large amounts of Bitcoin who need advanced security.

Yes, most bitcoin multisig wallet setups allow recovery as long as the minimum required number of keys remains accessible.

While a bitcoin multisig wallet offers superior security, it may be complex for beginners and is best used by users with basic Bitcoin knowledge or professional guidance.

Risks include poor key management, overly complex signature setups, and permanent loss of funds if recovery rules are not properly planned.

A bitcoin multisig wallet uses multiple on-chain signatures, while MPC wallets split a private key across parties off-chain, offering different security and transparency trade-offs.

Yes, bitcoin multisig wallets are expected to remain a core security standard in 2026 due to increasing institutional adoption and regulatory compliance needs.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.