Key Takeaways – Non-Custodial Wallet Security Model

- Risk Transfer: The Non-Custodial Wallet Security Model does not eliminate risk; it transfers security responsibility from institutions to individual users through exclusive cryptographic authority.

- Endpoint Security: Blockchain protocols guarantee transaction validity, not user intent or safety, making endpoint security and user behavior the dominant risk factors.

- Real-World Failures: Most failures occur outside the blockchain, driven by phishing, malware, social engineering, or deceptive transaction approvals rather than cryptographic flaws.

- Structural Protections: Non-custodial wallets protect against custodial insolvency, censorship, and third-party fund control, while remaining vulnerable to private key compromise and user-side errors.

- Operational Security: True security requires combining cryptographic literacy, secure key management, and disciplined operational practices rather than relying solely on software safeguards.

In the world of Web3, controlling your crypto assets comes with both freedom and responsibility. The Non-Custodial Wallet Security Model is a framework that gives users complete authority over their funds, eliminating intermediaries and custodial controls. While this approach maximizes autonomy and trust minimization, it also places full security responsibility on the user. Understanding its assumptions, inherent risks and operational limits is essential for anyone managing digital assets, because most wallet failures occur not from blockchain flaws but from user-side compromises. This article dives deep into the Non-Custodial Wallet Security Model, exploring its architecture, threat vectors, and practical safeguards to help users navigate the decentralized landscape safely.

What Is the Non-Custodial Wallet Security Model?

The Non-Custodial Wallet Security Model is a security framework in which cryptographic authority and transaction control are held entirely by the user, without intermediaries, recovery desks, or protocol-level safeguards. Security depends on private key control, software integrity, and endpoint security rather than institutional protection.

Non-custodial cryptocurrency wallets are widely regarded as the most secure and trust-minimized way to interact with blockchain networks. The phrase “own your keys” has become synonymous with autonomy, control and security in Web3. While this is partially correct, it is not the complete picture. The Non-Custodial Wallet Security Model does not eliminate risk, it fundamentally shifts it from institutions to individuals and changes the ways failures manifest.

In a non-custodial wallet, the user takes full responsibility for security. There are no recovery desks, administrators or transaction reversal mechanisms embedded in the blockchain protocol. Any compromise, mistake or unintended action is treated as valid by the system.

This article provides an in-depth exploration of the Non-Custodial Wallet Security Model, focusing on architectural and threat-model perspectives. We explain the key assumptions these wallets rely on, their inherent limitations and why most failures occur outside the blockchain itself.

Why “Non-Custodial” Is a Security Philosophy, Not a Feature

Absence of Intermediaries as a Design Choice

The Non-Custodial Wallet Security Model deliberately removes intermediaries in the transaction process. Unlike banks or custodial platforms, there is no third-party reviewing, approving or delaying transactions. Every transaction is executed solely through cryptographic signatures generated by the user’s private key.

This absence of intermediaries is not merely functional, it defines the security philosophy. By removing third-party control, the system achieves censorship resistance and trust minimization. Policy research from institutions like the Wilson Center explains that non-custodial wallets intentionally eliminate intermediaries to maximize sovereignty, while explicitly shifting security responsibility to individual users.[1] However, it also removes safeguards that traditional systems rely on, such as fraud detection, transaction reversals and account freezes. Once a transaction is signed and confirmed on-chain, it becomes irreversible. In essence, autonomy is absolute and so is finality.

Consider sending crypto to the wrong address by accident. In a custodial system, you might be able to contact support and recover funds. In a non-custodial wallet, the system treats the transaction as valid and there is no undo button. This design highlights why understanding risk is essential for all users.

Authority Concentration at the User Boundary

In non-custodial wallets, all security authority collapses into the user’s environment. This environment includes the device, operating system, wallet software, browser and the user’s own decision-making processes. There are no external validation layers. If any of these components is compromised, the Non-Custodial Wallet Security Model fails immediately.

From the blockchain’s perspective, a valid signature represents legitimate authority, regardless of how it was produced. This concentration of authority simplifies trust assumptions but significantly increases the consequences of failure. Even a single compromised device or mistaken approval can result in complete loss of funds.

This highlights the dual nature of non-custodial systems, the same independence that protects against third-party failure also makes the user’s environment the single point of failure.

Why Non-Custodial Does Not Mean Risk-Free

Non-custodial wallets eliminate certain institutional risks, such as custodial fraud, insolvency, and mismanagement, but they do not eliminate risk itself. Instead, risk is transferred from centralized platforms to individuals. Real-world data shows that the majority of losses in non-custodial wallets result from phishing attacks, malware, exposed seed phrases, and deceptive transaction approvals. Industry-level analysis further confirms that these failures overwhelmingly originate from user-side security breakdowns rather than weaknesses in blockchain protocols. [2] Cryptography works as intended, the loss occurs because the user’s authority was misused.

Blockchains guarantee correctness and validity, not intent or safety. Treating non-custodial wallets as inherently safe ignores this fundamental distinction and can be dangerous for unprepared users.

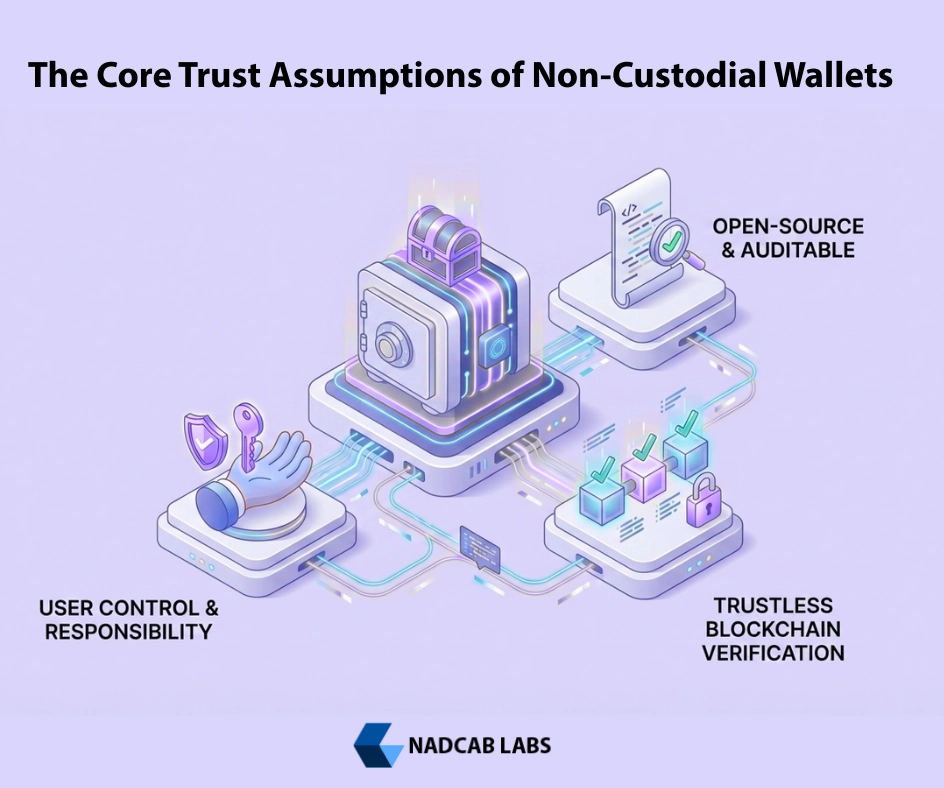

The Core Trust Assumptions of Non-Custodial Wallets

User-Exclusive Control over Cryptographic Authority

The Non-Custodial Wallet Security Model assumes that users maintain exclusive control of cryptographic authority. Private keys and seed phrases must remain secret, secure and accessible only to the user. This assumption is fragile. If keys are copied, exposed or stored insecurely, the model collapses immediately.

The blockchain cannot differentiate between rightful ownership and theft. Whoever holds the key has authority. There is no protocol-level identity verification or recovery mechanism to resolve disputes. This highlights the importance of secure key management and redundancy planning for users.

Software Honesty and Execution Integrity Assumptions

Non-custodial wallets also rely on software integrity. Wallet applications are assumed to behave exactly as intended when generating keys, constructing transactions and signing them. Users implicitly trust wallet code, third-party dependencies, updates and distribution channels.

If wallet software is malicious or compromised, even perfect cryptography becomes ineffective. A malicious wallet can generate valid signatures to transfer funds to an attacker. From the blockchain’s perspective, everything is legitimate. This demonstrates that software trust is a critical component of the Non-Custodial Wallet Security Model.

Environmental Trust Dependencies Outside the Protocol

While blockchains secure consensus and transaction validity, they do not secure endpoints. Non-custodial wallets depend on external systems that the blockchain cannot verify, including operating systems, browsers, hardware security modules, firmware and physical device security. Malware or system-level compromise can completely undermine cryptographic guarantees without violating protocol rules. Endpoint security is therefore the most critical and vulnerable component of the Non-Custodial Wallet Security Model.

Threat Models in the Non-Custodial Wallet Security Model

User-Side Compromise as the Dominant Failure Mode

The most common failure mode in non-custodial systems is user-side compromise. Infected devices, leaked seed phrases and coerced approvals account for the majority of losses. From the blockchain’s perspective, these are valid transactions executed by authorized keys. The protocol operates correctly, while the user experiences irreversible loss. This gap between protocol correctness and user safety defines the real-world risk in the Non-Custodial Wallet Security Model.

Malware, Phishing and Social Engineering Vectors

Non-custodial wallets are particularly vulnerable to phishing and social engineering because authority is transferred via signatures , not passwords. Attackers exploit UI familiarity, urgency, and trust. Fake dApp, malicious prompts, clipboard-hijacking malware and wallet-draining contracts succeed by manipulating human behavior rather than breaking cryptography. These attacks operate entirely within the system’s rules, demonstrating that human behavior is the weakest link in the Non-Custodial Wallet Security Model.

Why Protocol Security Cannot Compensate for Endpoint Failure

Protocol security ensures only valid signatures can modify blockchain state. It does not evaluate intent, context or legitimacy. Once a private key signs a transaction, the blockchain must accept it. This guarantees decentralization and censorship resistance but also means that endpoint security failures cannot be corrected. Even the strongest cryptography cannot prevent compromised authority from being exploited.

These threat models define not only how non-custodial wallets fail in practice, but also the clear boundaries of what the Non-Custodial Wallet Security Model can and cannot protect against.

What Non-Custodial Wallets Can Realistically Protect Against

The Non-Custodial Wallet Security Model structurally prevents third parties from controlling user funds. Exchanges, custodial platforms or other intermediaries cannot freeze balances or restrict withdrawals. Because authority is not pooled, failures are localized to the individual wallet. Unlike custodial systems, where a single breach can impact millions of users, non-custodial wallets contain failures to the affected wallet only.

Furthermore, non-custodial wallets eliminate exposure to institutional insolvency, balance-sheet failures or rehypothecation. Funds cannot disappear due to platform collapse. They can only move through cryptographic authorization, highlighting how the Non-Custodial Wallet Security Model combines autonomy with structural financial safety.

Non-Custodial Wallet Security Model, Protections vs Real-World Limits

| Security Aspect | What the Non-Custodial Wallet Security Model Protects | What It Does Not Protect |

|---|---|---|

| Custodial control | Prevents exchanges or intermediaries from freezing, rehypothecating, or restricting funds. | Cannot stop user-authorized transfers. |

| Blockchain integrity | Ensures only valid cryptographic signatures can modify on-chain state. | Does not assess transaction intent or legitimacy. |

| Institutional failure | Eliminates risks from platform insolvency or custodial mismanagement. | Cannot compensate for individual user mistakes. |

| Transaction finality | Guarantees irreversible settlement once transactions are confirmed. | Offers no rollback for accidental or malicious approvals. |

| Authority isolation | Localizes failure to individual wallets instead of pooled accounts. | Cannot protect against compromised private keys. |

| Protocol-level enforcement | Enforces consensus rules and cryptographic signature validity. | Does not secure devices, browsers, or wallet interfaces. |

Security Limits of the Non-Custodial Wallet Security Model

Despite their protections, non-custodial wallets cannot prevent private key theft, silent compromise or malware-infected devices. If keys or seed phrases are exfiltrated, attackers can monitor and drain funds silently. User errors, such as sending funds to the wrong address or approving malicious contracts, are irreversible.

The blockchain does not evaluate intent, transactions executed with valid signatures are final. Social engineering remains one of the most effective attack vectors. Users must understand that ultimate control brings ultimate responsibility under the Non-Custodial Wallet Security Model.

Software-Level Safeguards and Their Hard Limits

Wallets may implement spending limits, warning systems or transaction simulations. However, these safeguards operate only at the application layer. Once a transaction is signed, protocol rules override local policies. Confirmation dialogs reduce accidental mistakes but cannot prevent targeted manipulation. Over-reliance on interface safeguards may create false assurance, encouraging users to underestimate risk. The Non-Custodial Wallet Security Model relies on users’ judgment and operational security above all.

Recovery, Support and the Absence of Failsafe

Losses in non-custodial wallets cannot be remediated at the protocol layer. Without cryptographic authority, access cannot be restored. Social recovery mechanisms introduce redundancy but add trust and coordination risks. While they mitigate some failure scenarios, they do not replace secure key management. True autonomy requires accepting irreversible consequences and decentralized systems provide no emergency brake.

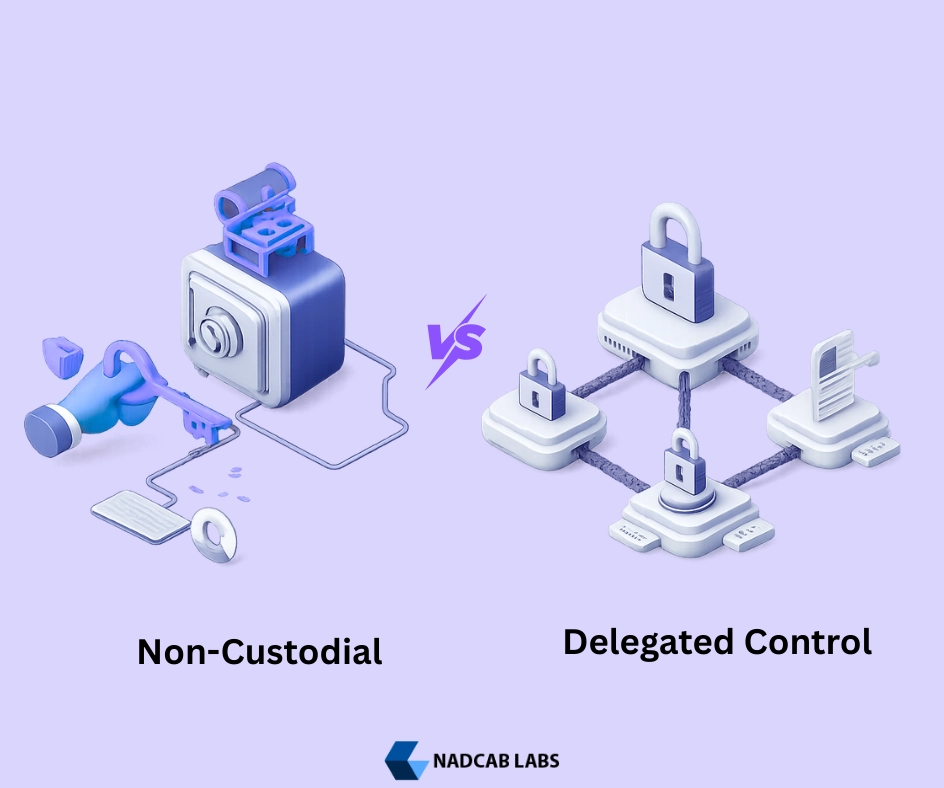

Comparative Risk Non-Custodial Vs Delegated Control

Non-custodial wallets shift risk from institutions to users rather than eliminate it. Security outcomes depend on the user’s competence and practices. Two users with identical wallets can experience completely different outcomes. Architecture defines the possibilities, but behavior determines results. Users must combine operational discipline with cryptographic knowledge to navigate the Non-Custodial Wallet Security Model safely.

Architectural Consequences for Wallet Designers

Wallet designers must accept that some failures cannot be prevented without compromising decentralization. Security boundaries are absolute, valid cryptographic authority cannot be overridden. Interfaces should communicate risk, finality and consequences clearly, avoiding false reassurance. Realistic wallet design assumes compromise will happen. The goal is containment, clarity and informed recovery not perfection.

Security Realities of Non-Custodial Wallets

The Non-Custodial Wallet Security Model empowers users with complete autonomy and control while eliminating custodial risks. However, it also places full security responsibility on the user. Understanding its assumptions, threat vectors and limits is essential for safely managing non-custodial wallets in Web3. Users must combine cryptographic literacy with strong operational practices to fully benefit from decentralized control.

Frequently Asked Questions

It is a security framework where users retain full cryptographic authority over their assets, without intermediaries, recovery desks or protocol-level safeguards. It maximizes autonomy but places full responsibility on the user.

In a custodial wallet, a third party holds your private keys and can assist with recovery. In a non-custodial wallet, only the user controls the keys, which grants autonomy but full responsibility for security.

Primary risks include theft or loss of private keys, phishing, malware attacks, social engineering, and user mistakes like sending funds to the wrong address or approving malicious transactions.

No. Once private keys or seed phrases are lost or stolen, access cannot be restored. Blockchain treats any valid signature as legitimate, and there is no central recovery mechanism.

They provide maximum control and security but require users to understand key management and safe operational practices. Beginners should carefully learn about backups, phishing prevention, and endpoint security.

Non-custodial wallets eliminate institutional risks like custodial fraud but transfer all security responsibility to users. Most losses occur due to user-side compromise, not blockchain failure.

Typically no. Non-custodial wallets focus on self-custody and privacy, so they do not require identity verification or personal data like custodial exchanges do.

Hardware wallets are generally safer because private keys are stored offline, reducing exposure to malware. Software wallets are more convenient but more vulnerable to endpoint attacks.

Best practices include backing up seed phrases offline, using hardware wallets, keeping devices secure, avoiding phishing links and carefully reviewing every transaction before signing.

Once a transaction is signed, the blockchain treats it as valid. There is no rollback, so unauthorized approvals or mistakes can lead to irreversible loss of funds.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.