Mobile Wallet Application, Complete Guide to Features, Types, Architecture and Creation

A practical, end-to-end guide for founders, product teams, and enterprises written in simple English with examples, tables, comparisons and a build lifecycle you can actually follow.

Key Takeaways

- A mobile wallet application enables users to store money digitally, make payments, and manage transactions directly from their smartphones.

- Mobile wallets are replacing cash and physical cards by offering faster, more convenient, and secure payment experiences.

- Different wallet types closed, semi-closed, open and digital asset wallets serve different user and business needs.

- Defining a clear purpose before creation helps align features, user experience, compliance, and long-term scalability.

- Core functions like authentication, balance tracking, money transfers, notifications, and security controls are essential for trust.

- A simple and intuitive experience is a major adoption driver for any financial product.

- Modern systems use layered design: frontend, backend, payment processing, security, compliance, admin monitoring, and integrations.

- Security must be treated as the foundation encryption, fraud controls, access rules, and continuous monitoring are non-negotiable.

- Compliance with financial and data regulations improves credibility and reduces legal and operational risk.

- The future of wallets is faster payments, advanced identity/security, and deeper integration into daily digital services.

Building a mobile wallet application has become one of the most valuable opportunities in the digital finance world. As users move away from cash and physical cards, Cryptocurrency wallets are becoming the primary way to store value, make payments, and manage everyday transactions using a Mobile wallet application. From scanning QR codes at a grocery store to sending money to a friend instantly, wallet products now sit at the center of daily finance.

This guide walks you through the complete creation journey from beginner-friendly fundamentals to advanced execution topics like security layers, compliance thinking, testing strategy, scaling, and monetization. You’ll also get tables, comparison frameworks, a build lifecycle, and real-life examples so your product planning feels practical instead of theoretical for a Mobile wallet application.

Agency statement: Our team has 8+ years of experience delivering fintech and payment-grade systems covering wallet platforms, payment integrations, security hardening, transaction monitoring, and production scaling. That experience shows up in this article as execution-first checklists, practical pitfalls, and build decisions that reduce rework in mobile wallet application.

Understanding the Basics Of Mobile Wallet Application

At the simplest level, a wallet app is a digital version of a physical wallet. Instead of carrying cash, cards, vouchers, and receipts, users store value and payment capability inside an app. When they open the app, they can check balance, pay merchants, send money, receive funds, and review transaction history without repeatedly entering bank details.[1]

Real-life example: A user scans a QR code at a coffee shop. The app validates the user, checks balance, calculates fees (if any), confirms the payee identity, and then completes the transfer. The user experiences it as “scan → confirm → done,” while multiple systems quietly work in the background.

How It Works in Real Life

- User installs the app and registers with phone/email.

- Identity is verified (basic OTP or full KYC depending on model).

- User adds money via bank/card or receives funds.

- User initiates payment (QR / contact / bank transfer / online checkout).

- System validates request, checks limits, applies risk rules.

- Payment is processed and confirmed; user gets notification.

Why Users Prefer Wallets

- Speed: payments in seconds with fewer steps

- Convenience: no physical card required

- Security: device + identity controls

- Visibility: clear history, receipts, alerts

- Features: rewards, bills, subscriptions, more

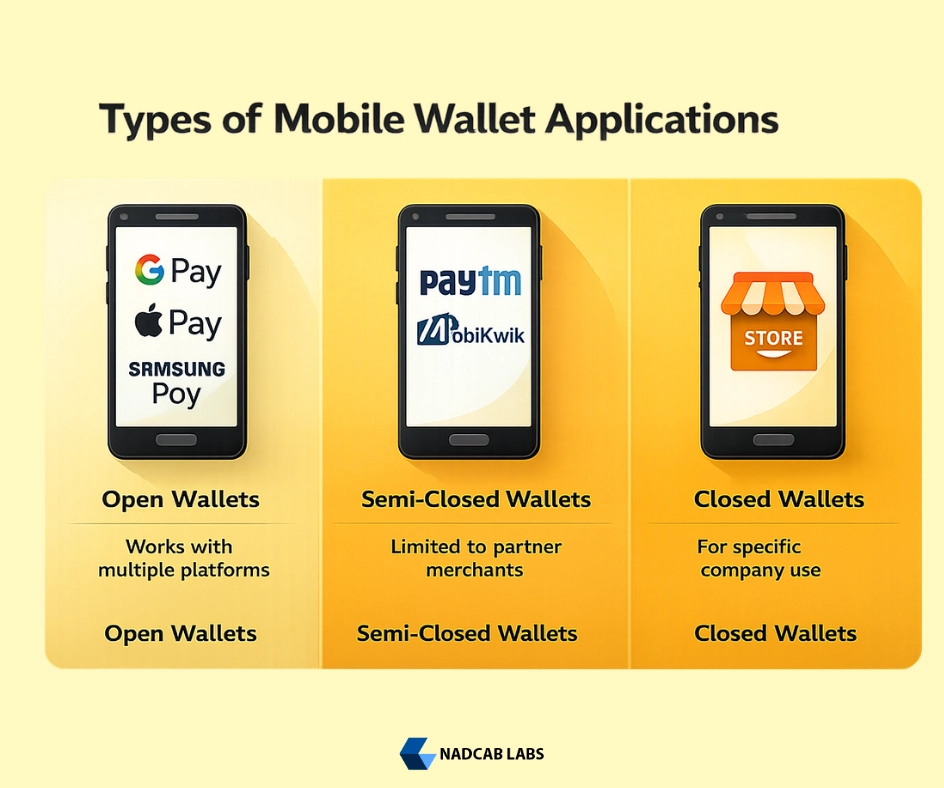

Types of Mobile Wallet Application

Not all wallet products behave the same. The type you choose affects compliance requirements, payment integrations, features, and even how you’ll earn revenue in mobile wallet application . Below are the most common types and where they fit.[2]

| Type | What It Means | Best For | Example Scenario |

|---|---|---|---|

| Closed | Funds can be used only within one brand/platform; usually no bank withdrawal. | Marketplaces, food delivery, ride-hailing loyalty ecosystems | Users add balance and spend only inside the mobile wallet application on orders. |

| Semi-closed | Payments to multiple partner merchants; cash withdrawal often restricted. | City networks, retail groups, franchise chains | A wallet works at connected stores/restaurants in a region. |

| Open | Connected to banks and payment rails; supports add, pay, and withdraw. | Fintechs, banking-grade wallets, remittance products | Users add funds, pay merchants, and transfer back to bank anytime. |

| Digital asset wallet | Manages tokens/coins, on-chain transfers, and Web3 interactions. | Crypto products, token platforms, Web3 services | Users store tokens and interact with decentralized apps securely. |

Practical tip: start by picking one primary type and one primary user flow (like “QR pay at merchant” or “P2P transfer”). You can expand later without making the first launch too heavy.

Define the Purpose Before You Build

Many products fail not because the code is bad, but because the purpose is unclear. A Crypto wallet built for “everyone” often becomes complicated, expensive to maintain, and difficult to market as a Mobile wallet application . A wallet built for a focused purpose ships faster and earns trust sooner.

Purpose Examples

- Local payments: QR payments, merchant onboarding, fast confirmations

- Cross-border: FX conversion, compliance, payout partners, transparent fees

- Business payouts: bulk transfers, approval workflow, audit logs

- Marketplace wallet: refunds, store credits, loyalty, in-app checkout

Validation Questions (Fast)

- Who is the first user group, and what pain do they feel daily?

- What is the “one main action” they must complete in under 30 seconds?

- What stops them from using current apps—fees, UX, trust, limits, speed?

- What proof can we collect early—pilot merchants, waitlist, partner LOIs?

Market research becomes easier when your purpose is fixed. Read user reviews, study competitor flows, and map friction points. If users complain about confusing steps or unclear charges, your competitive advantage for your Mobile wallet application could simply be clarity and transparency.

Core Features Checklist (Trust + Execution)

Below is a practical “must-have vs good-to-have” feature set. This is useful for scoping MVP, estimating cost, and planning a phased roadmap for a Mobile wallet application .

| Feature Area | Must-Have (MVP) | Good-to-Have (Phase 2) | Why It Matters |

|---|---|---|---|

| Onboarding | Phone/email sign-up, OTP, basic profile | Guided onboarding, referral, smart prompts | Fewer steps = higher completion |

| Wallet & Ledger | Balance, transaction history, receipts | Advanced statements, export, tags | Trust comes from accurate records |

| P2P Transfer | Send/receive, contacts, confirmation | Scheduled transfers, split bills | Most-used daily flow for retention |

| Merchant Payments | QR scan/pay, merchant ID validation | Tips, cashback, loyalty rules | Drives real-world usage |

| Notifications | Payment alerts, OTP, status updates | Smart reminders, insights, nudges | Reduces support tickets |

| Security Controls | Device binding, session rules, PIN/biometric | Risk scoring, anomaly detection, step-up auth | Protects users + platform reputation |

Execution tip from 8+ years of delivery: Build the ledger and transaction states early. If your ledger is correct, features can be added safely. If the ledger is weak, every new feature increases bugs, disputes, and support load.

User Experience Design: Why Simplicity Wins

Users treat financial apps differently than social apps. If something feels confusing, slow, or “hidden,” trust drops instantly. That’s why successful wallets focus heavily on clarity—especially around balances, fees, and payment confirmation.

High-Trust UX Principles

- Show available balance clearly (avoid confusing terms)

- Confirm payee identity before sending money

- Display fees before confirmation, not after

- Use clear status: Pending → Success → Failed → Reversed

- Provide receipts with reference IDs for support

Example: A “Good” Send Flow

- Select contact or scan QR

- Enter amount

- See fees + final payable amount

- Confirm recipient name + last 4 digits of ID

- Authenticate (PIN/biometric)

- Instant result + receipt + share option

When you design for simplicity, you also reduce fraud (users notice wrong payees), reduce disputes (fees are transparent), and reduce support load (receipts contain strong references).

Build My Crypto wallet Now!

Turn your dream into reality with a powerful, secure crypto wallet built just for you. Start building now and watch your idea come alive!

Technology Stack Behind a scalable Mobile wallet application Product

A wallet platform is not just a mobile UI. It’s a coordinated system that includes apps, backend services, databases, integration layers, observability, and security controls. The exact stack depends on your region, payment partners, and compliance model, but the building blocks remain similar.

Common Components

- Mobile app: iOS/Android UI, local encryption, biometrics

- Backend services: user, wallet, ledger, transfers, limits

- Database: transactional store + audit trails

- Payments integration: gateways, bank rails, settlement

- Notifications: push, SMS, email

- Analytics & monitoring: dashboards, alerts, logs

Non-Negotiables for Scale

- Idempotency: prevents double charging on retries

- Queueing: handles peaks without crashes

- Rate limits: blocks abuse and bot attacks

- Strong observability: trace every transaction end-to-end

- Dispute-ready logs: you can explain every ledger change

Practical note: Don’t select tools based only on popularity. Select based on (1) payment partner requirements, (2) compliance constraints, (3) transaction throughput targets, and (4) your team’s ability to maintain it for years.

Architecture Explained in Simple Terms

Think of the system like a well-organized office. Each department has a role, and the payment only succeeds when departments coordinate correctly. Here’s a simple layered view that helps both technical and non-technical teams align.

Frontend Layer

Screens for login, balance, pay, history, and alerts. Goal: fast, clear, responsive UX across devices.

Backend Services

Business logic: users, balances, transaction state management, limits, and activity tracking.

Payment Processing Layer

Connects to banks/gateways, handles transfers, confirmations, retries, and settlement.

Security & Encryption Layer

Protects credentials, secures data in transit/at rest, and applies access controls.

Compliance & Verification Layer

Identity checks, transaction monitoring, and rules enforcement to reduce legal and fraud risk.

Admin & Monitoring Layer

Support dashboards, reconciliation views, alerts, dispute tools, and operational controls.

Third-Party Integrations

SMS/push providers, analytics, fraud tools, reporting, customer support systems.

Example: If a payment is “pending” too long, it might be caused by payment partner delays, retry rules, or reconciliation mismatch. A layered view helps teams locate the exact layer responsible and reduce resolution time.

Security Architecture: Protect Users, Funds, and Reputation

Security is not a “feature toggle.” In wallets, a single security incident can destroy years of trust. Strong security means layered controls: prevention, detection, and response. It also means building safe defaults so users don’t accidentally take risky actions.

Core Security Practices

- Secure authentication: PIN + biometric + step-up checks

- Device binding: reduce account takeover from unknown devices

- Encryption: in transit and at rest for sensitive data

- Fraud controls: velocity limits, anomaly detection, blacklists

- Session rules: timeout, refresh tokens, suspicious logout

- Audit logs: immutable trails for disputes and investigations

Example: Step-Up Verification

If a user logs in from a new device or tries to send a large amount, the system can request additional verification. This reduces fraud without making every user action slow.

Trigger → New device login

Action → OTP + biometric confirmation

Result → Access granted + device added to trusted list

Operational reality: Security also includes customer support tools like freezing suspicious accounts, reversing eligible transactions, and documenting disputes clearly. Build those controls early to reduce damage during incidents.

Compliance and Legal Considerations (Plan Early)

As soon as you handle payments through a Mobile wallet application , identity, or stored value, you enter a regulated space. Compliance is not only about avoiding penalties—it helps you build partnerships, unlock higher limits, and improve user trust.

| Compliance Area | What You Typically Need | Why It Matters |

|---|---|---|

| KYC | Identity verification, document checks, user risk tiering | Reduces fraud, meets financial regulations |

| AML | Transaction monitoring, alerts, suspicious activity workflows | Prevents illegal flows; protects partnerships |

| Data privacy | Consent, retention policy, secure storage, access controls | Avoids data misuse and improves credibility |

| Consumer protection | Transparent fees, dispute handling, receipts, refund logic | Reduces chargebacks, disputes, and reputation risk |

Compliance requirements vary by region and business model. The safest execution becomes real for a Mobile wallet application approach is: define your wallet type → define rails/partners → define user limits → then finalize compliance scope and workflows.

Development Lifecycle (From Idea to Scale)

Below is a practical execution lifecycle used by experienced teams to reduce failure, prevent rework, and ship in phases. This is where “development and execution” becomes real.

Lifecycle Stages

Execution “Definition of Done” (Quick Checklist)

- Transaction states are consistent (pending/success/failed/reversed) with receipts.

- Ledger entries are auditable and explainable for every balance change.

- Retry behavior is safe (idempotency prevents double debit/credit).

- Support team can track and resolve disputes using admin tools.

- Monitoring and alerts exist for latency spikes, failures, and fraud patterns.

Comparison Tables (Helpful for Planning)

Use these comparisons to decide product direction and prioritize what to build first.

Wallet vs Banking App (Simple Comparison)

| Factor | Wallet Product | Banking App |

|---|---|---|

| Main focus | Payments, transfers, daily transactions | Full banking services (accounts, loans, deposits) |

| Speed | Designed for fast actions and simplified flows | Often broader flows with more steps |

| User intent | “Pay now” and “send money” | “Manage finances” and “banking operations” |

| Typical add-ons | Rewards, bills, merchant offers, QR payments | Investments, credit, statements, account services |

Closed vs Semi-Closed vs Open (Decision Table)

| Aspect | Closed | Semi-closed | Open |

|---|---|---|---|

| Spend scope | Single brand ecosystem | Partner merchant network | Wider rails + merchants |

| Withdrawal | Often not supported | Often restricted | Usually supported |

| Complexity | Low to medium | Medium | High |

| Best starting point | When you already have captive users | When you can onboard merchants fast | When you have strong compliance/partners |

Monetization Models (Transparent Wins)

A wallet can generate revenue in multiple ways, but trust always comes first. If users feel charges are hidden, churn increases. A clear pricing strategy keeps growth sustainable.

Common Revenue Options

- Transaction fees: small fee on certain transfers

- Merchant services: onboarding, settlement, reporting, subscriptions

- Premium features: higher limits, advanced statements, business tools

- Value-added: bill payments, subscriptions, rewards, offers

Pricing Example

Keep “everyday actions” cheap or free, and charge for premium or high-risk actions.

Free: wallet-to-wallet transfers up to a limit

Low fee: instant bank payout

Subscription: business dashboard + bulk payouts

Challenges in Building Advanced Wallet Platforms

As the product grows, the difficulties shift from “building screens” to “managing risk, reliability, and scale.” Below are the most common problems teams face—and what experienced teams do differently.

| Challenge | What It Looks Like | Execution Fix |

|---|---|---|

| Fraud & account takeover | Suspicious logins, fast repeated transfers, chargeback spikes | Step-up auth, device binding, velocity rules, risk scoring |

| Ledger mismatches | User sees wrong balance or missing transaction | Strong transaction states, reconciliation jobs, audit trails |

| Performance under load | Slow confirmation, spikes during campaigns or salary days | Queueing, caching, autoscaling, stress testing |

| Support overload | Users report “pending” or “money deducted” issues | Admin dashboards, clear receipts, standardized dispute workflows |

Reality check: Wallet products require ongoing tuning after launch fraud rules, payment retries, and monitoring thresholds evolve with user behavior. Plan resources for continuous improvement, not just one-time development.

Future of Wallet Products

The next generation of wallets will feel less like “apps” and more like “embedded finance.” Users will expect faster payments, stronger identity, less friction, and smarter security that works quietly in the background.

Trends to Watch

-

- Biometric-first auth: faster onboarding and secure approvals

- AI risk detection: smarter fraud prevention with fewer false blocks

- Instant settlement: faster confirmation + fewer “pending” disputes

- Deeper integrations: subscriptions, commerce, loyalty, identity

What This Means for Builders

- Build flexible systems that can add new payment rails easily

- Invest in observability so issues are found before users complain

- Design UX for trust: fees, receipts, and identity confirmation

- Plan compliance early so you can grow limits safely

Conclusion

Building a wallet product is a journey from simple user flows to a full financial platform that demands reliability, security, and compliance. The teams that win usually do three things well they keep the first version focused, they treat security and ledger accuracy as foundational, and they build operational tools that make support and monitoring easy.

When created with clarity, simplicity, and long-term execution planning, a wallet becomes more than a payment tool it becomes a trusted financial companion users rely on every day through a Mobile wallet application. users rely on every day.

Frequently Asked Questions

It is a digital platform that allows users to store money, make payments, send or receive funds, and manage financial transactions securely using a smartphone. It replaces physical cash and cards with a convenient digital alternative.

It works by linking a user’s account to a bank account, card, or stored balance. When a payment is made, the app securely processes the transaction through backend systems and payment networks, completing the transfer within seconds.

Yes, It is safe when built with strong security measures such as encryption, secure authentication, transaction monitoring, and fraud detection. Most modern wallet apps also use additional verification steps to protect user funds and data.

Common features of a mobile wallet application include user registration, balance display, money transfer, bill payments, transaction history, notifications, and security controls. Advanced wallets may also support QR payments, digital assets, and analytics.

There are three main types of mobile wallet applications, closed wallets, semi-closed wallets, and open wallets. Each type differs in how users can add, spend, or withdraw money and how the wallet connects to banks or merchants.

Yes, It supports cross-border payments. These wallets handle currency conversion, compliance checks, and international transfers, making them useful for global transactions and remittances.

It focuses mainly on payments, transfers, and everyday transactions, while a banking app provides full banking services such as loans, savings accounts, and financial management. Wallet apps are usually faster and simpler for daily use.

It uses a combination of frontend interfaces, backend servers, APIs, payment gateways, and encryption technologies. These components work together to process transactions securely and maintain real-time balances.

The time required to create a mobile wallet application depends on its features and complexity. A basic wallet can be completed faster, while advanced wallets with security, compliance, and scalability features take longer to build and test.

The future of the mobile wallet application includes faster payments, stronger security, biometric authentication, artificial intelligence, and deeper integration with everyday digital services. Wallets are expected to become central financial tools for users worldwide.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.