Key Takeaways

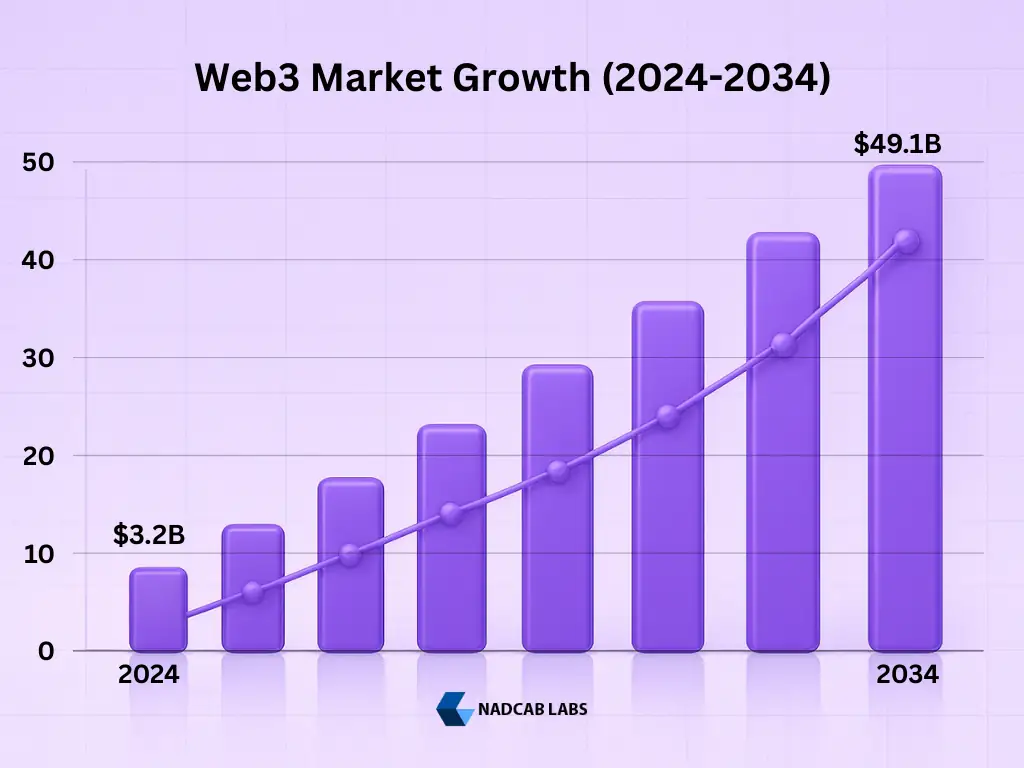

- Web3 is moving beyond hype and becoming a core pillar of the global digital economy, with market projections reaching USD 49.1 billion by 2034 at a 31.8% CAGR.

- Global Web3 adoption is accelerating, with 560+ million users in 2025 and daily active dApp wallets reaching 24.6 million, signaling real utility-driven growth.

- At a 43.6% CAGR, the US Web3 market is expected to rise from USD 4.0 billion in 2025 to about USD 5.74 billion in 2026, highlighting strong annual growth and enterprise adoption.

- In 2024, the Web3 market was led by cryptocurrency and payments, holding over 65% share, while DeFi and BFSI were major end users. In 2025, BFSI becomes the largest sector, cryptocurrency applications remain dominant, and retail and e-commerce emerges as the fastest-growing segment.

- DePINs are bridging Web3 with real-world infrastructure, enabling decentralized wireless, energy, and sensor networks worth nearly USD 30 billion by early 2025.

- Payments, blockchain infrastructure, gaming, and DeFi are the strongest growth drivers, with Web3 payments alone projected to hit USD 44.98 billion by 2027.

Over the past few years, the idea of Web3, a decentralized, blockchain-powered evolution of the internet, has shifted from niche crypto circles to mainstream business forecasts. Several industry reports now project that Web3 markets could hit 49.1 billions of dollars globally by 2034 , depending on what you include payments, blockchain infrastructure, gaming.

As adoption grows, Web3 is shifting from a speculative concept to a key pillar of emerging digital economies. Businesses are using decentralized applications to boost transparency and reduce reliance on intermediaries, while users increasingly value digital ownership and self-custody. Rapid growth in DeFi, NFTs, decentralized storage, and digital identity highlights Web3’s expanding role. With enterprise interest and improved regulations, Web3 is moving toward a more open, user-controlled internet.

Web3 Market Size – Current Valuations and Projections

Here’s some of the major projections for Web3 market, crypto users, and blockchain markets.

- According to a Web3 market report, the overall Web3 market size is expected to grow USD 49.1 billion by 2034., registering a CAGR of 31.8%.[1]

- Additionally, the Web3 payments segment alone is projected to reach USD 44.98 billion by 2027, reflecting rapid growth in blockchain-based transactions and digital payment rails.

- For the Web3 blockchain market, one recent analysis shows it generated USD 4.43 billion in 2024 and is forecast to rise from USD 6.57 billion in 2025 to nearly USD 226.4 billion by 2034, reflecting strong long-term expansion ahead.[2]

- The Web3 gaming market is projected to surge rapidly over the coming years, reaching $88.57 billion by 2029 with a strong compound annual growth rate (CAGR) of 22.3%.

- On the adoption front – As per a popular article, there is a projection that the number of global crypto (or Web3) users could reach 1 billion by 2027, a roughly fivefold increase from then-estimated ~200 – 300 million users.[3]

Taken together, these numbers sketch a landscape where Web3 evolves from early adopters and niche companies into a global industry with significant economic heft.

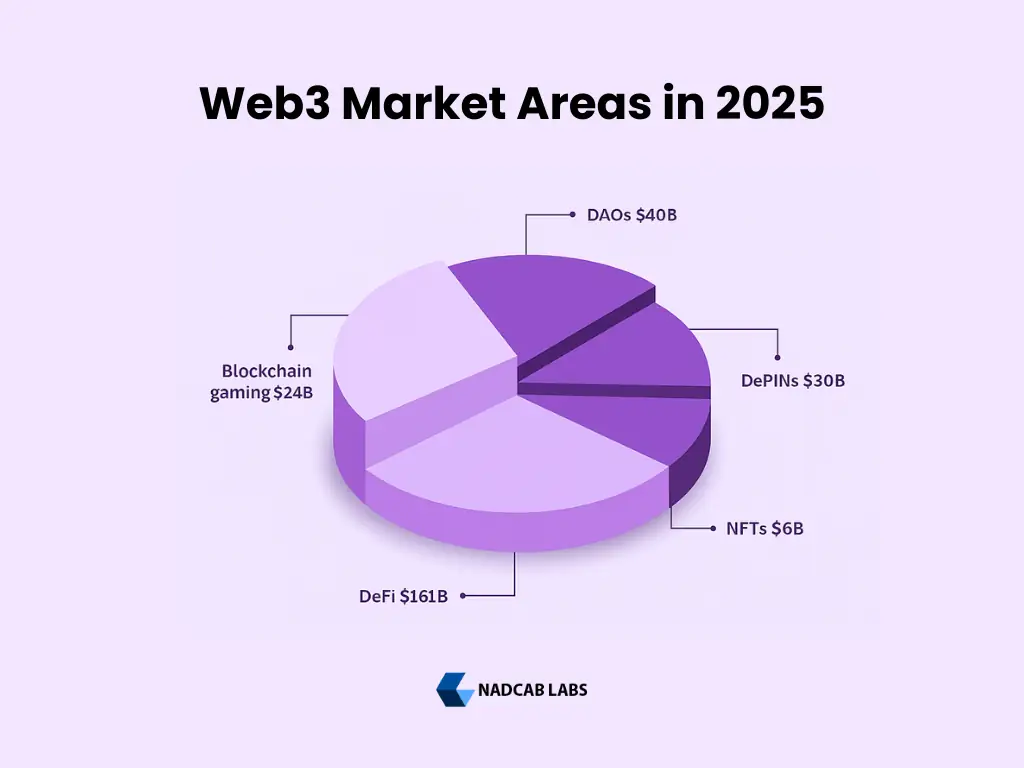

A Simple Overview of Web3 Market Areas

1. Decentralized Finance (DeFi)

Decentralized Finance is a new way of using money without depending on banks. People can save, borrow, and earn interest using blockchain technology. In late 2024, DeFi was very successful, but in early 2025 the total value in DeFi systems went down to around $156 billion.

Later, by mid-2025, it grew again to nearly $161 billion. Ethereum is still the most popular platform, though many newer blockchains are also becoming important. About 60% of financial institutions around the world are now studying or using DeFi. This shows that decentralized finance is slowly becoming a trusted and accepted system.

2. Blockchain Gaming

According to IMARC Group, the global blockchain gaming market is expected to reach USD 24.4 billion in 2025. The firm further projects that the market will surge to USD 1,172.8 billion by 2033, registering an impressive CAGR of 62.59% from 2025 to 2033. In 2024, the Asia Pacific region leads the market with a 28.7% share, reflecting strong regional adoption.

3. Decentralized Physical Infrastructure Networks (DePINs)

DePINs are one of the fastest-growing parts of Web3, using blockchain to power real-world systems like wireless networks, sensors, and energy devices. Instead of relying on big companies, they allow everyday people to help build infrastructure and earn rewards. By early 2025, the sector was worth nearly $30 billion with over 1,500 active projects. DePINs matter because they bring Web3 into practical, real-life services, helping communities create and manage systems in a more open, fair, and decentralized way.

4. Decentralized Autonomous Organizations (DAOs)

DAOs are online groups where people make decisions together as a community. Their rules and votes are recorded on a blockchain, making everything transparent and fair. By early 2025, there were over 13,000 DAOs managing more than $40 billion in treasury funds. DAOs matter because they shift power from a single leader to the entire community. Many companies are now testing DAO-like models to involve users in decisions. As people understand them better, DAOs may become a common way for online organizations to work.

5. Non-Fungible Tokens (NFTs)

As per MRFR analysis, the Gaming NFT Market Size was valued at USD 4.316 billion in 2024 and is expected to reach USD 5.694 billion in 2025, eventually growing to USD 90.89 billion by 2035 at a CAGR of 31.92%. This growth parallels the expanding Web3 market, driven by increasing blockchain adoption across gaming platforms. Rising interest in digital ownership, NFT-based assets, and decentralized gaming ecosystems is fueling demand, supporting the long-term growth of both the Gaming NFT sector and the broader Web3 economy.

Web3 Market Growth In Different Regions

North America

North America accounted for 39.6% of the total revenue in 2024, driven by strong venture funding, a large pool of skilled experts, and ongoing enterprise blockchain initiatives. Coinbase’s USD 2.03 billion in institutional revenue reflects the region’s high liquidity and market concentration.

Since the United States is the largest contributor within North America, it’s essential to look at its individual market trends.

Dimension Market Research stated that the US Web3 Market size is projected to reach USD 4.0 billion in 2025, growing at a 43.6% CAGR. The country acts as a global hub for Web3 innovation, supported by top blockchain developers, crypto startups, strong venture capital activity, and advanced digital infrastructure.

Asia

The Asia-Pacific region is the fastest-growing Web3 market, expected to expand at a 47.3% CAGR. Singapore is attracting numerous blockchain companies due to its simplified licensing rules and investment-friendly policies, establishing itself as a hub for innovation.

Dimension Market Research stated that the Japan Web 3.0 Market size is projected to reach USD 600 million in 2025, growing at a 50.5% CAGR. Supportive policies, tax incentives, and a national Web3 plan have encouraged companies like Sony to invest USD 3.5 million in Startale Labs. India and Indonesia are also leading in crypto adoption, ranking first and third globally, showing a large user base ready for new Web3 applications.

Europe

The Europe Web3 market size is projected to reach USD 2.4 billion in 2025, with a 42.9% CAGR. Europe plays a key role in shaping Web 3.0 through strong regulations, digital rights protections, and ethical technology standards. Frameworks like GDPR and MiCA support a secure and transparent digital environment. Governments are investing in blockchain research, DeFi, and national adoption strategies, driving innovation in identity, supply chains, and digital currencies. Although slower in venture funding, Europe’s thoughtful approach keeps it influential globally.

Inside the Web 3.0 Market

Reasons Behind the Rise of Web 3.0

Several technological, economic, and social factors are driving the rapid growth of Web 3.0. From increasing concerns around privacy to advancements in blockchain infrastructure, users and businesses alike are seeking alternatives to centralized digital models. Below are the key reasons accelerating the adoption of Web 3.0 worldwide.

1. Increasing Focus on Personal Data Ownership

As concerns over data misuse rise, users want platforms where they control their own information. Web 3.0 supports this shift by using decentralized systems that let individuals manage how their data is stored, shared, and monetized. This growing need for privacy-friendly ecosystems is pushing companies to build more transparent, user-owned platforms. With trust in major tech companies declining, demand for self-sovereign, user-first digital solutions is quickly increasing.

2. Advancements in Blockchain & Smart Contracts

The Web 3.0 ecosystem is growing stronger with major upgrades in blockchain speed, security, and developer tools. Faster blockchains, advanced Layer-2 networks, and better consensus methods now support cheaper, smoother, and more scalable dApps. These improvements remove old barriers like high fees and slow transactions, making development easier. Open-source communities and ready-to-use Web3 toolkits are also boosting innovation across finance, gaming, digital identity, and enterprise solutions.

3. Growth of IoT and Connected Smart Devices

The rising number of IoT devices is contributing to Web 3.0 adoption. Smart devices generate valuable real-time data that becomes more secure and interoperable when tied to blockchain networks. Decentralized data verification, automated smart contracts, and secure machine-to-machine communication enable smarter and more efficient environments from homes and factories to smart cities.

Problems Web 3.0 Still Faces

Although Web 3.0 promises a more open and decentralized internet, it still faces critical obstacles that limit mass adoption. Challenges such as usability gaps, limited awareness, and regulatory uncertainty must be resolved to enable broader trust, scalability, and long-term growth.

1. Lack of Awareness and Complicated Setup

Despite rapid growth, Web 3.0 adoption still struggles due to low general awareness and complex user journeys. Many people are unfamiliar with concepts like private keys, wallets, or decentralized identities. Tasks such as setting up a wallet, interacting with dApps, or managing digital assets can feel overwhelming, especially for non-technical users. The lack of intuitive user interfaces and simplified education resources restricts mainstream usage, keeping Web 3.0 adoption mostly within tech-savvy communities.

2. Regulatory Uncertainty and Inconsistency Across Regions

Web 3.0 continues to face an unclear and rapidly changing regulatory climate globally. Governments are still defining rules related to crypto assets, token classifications, data privacy, taxation, and anti-money laundering requirements. The absence of unified standards creates hesitation for enterprises and investors, slowing large-scale deployment. Sudden changes in policy, restrictions in certain countries, and evolving legal interpretations add compliance risks. These uncertainties make scaling Web 3.0 solutions across borders more challenging.

How Web 3.0 Can Grow ?

A combination of technological innovation, economic shifts, and changing user expectations is accelerating Web 3.0’s growth. As demand for transparency, user control, and decentralized systems rises, improved blockchain capabilities are encouraging individuals and enterprises to move beyond centralized digital platforms.

1. Expanding Digital Access in Developing Regions

Web 3.0 can greatly improve access to finance, identity services, and digital tools in underserved regions. With just a smartphone, people can join global digital markets, access credit, verify documents, and use decentralized services without depending on traditional institutions. This creates huge opportunities for Web3 builders to provide low-cost, secure, and borderless solutions. In areas with low trust in central authorities, blockchain’s transparency can also reduce fraud and improve public services.

2. The Rise of dApps and the Creative Economy

Decentralized applications are transforming how creators, developers, and communities earn and collaborate. Web 3.0 removes middlemen, allowing creators to monetize their work directly through tokens, NFTs, and transparent micro-payments. Tokenized communities let users take part in governance, share rewards, and co-own platforms. As developer tools become easier to use, Web 3.0 apps across areas like entertainment and education will expand, opening new earning opportunities for creators worldwide.

3. Web 3.0 Adoption in Traditional Industries

Enterprises are increasingly exploring blockchain for supply chain transparency, secure data sharing, identity management, IoT infrastructure, and interoperability between platforms. Web 3.0 technologies such as tokenization, cross-chain protocols, decentralized storage, and secure data marketplaces are enabling innovative business models. Organizations integrating these tools can unlock new efficiencies while building more trustworthy and user-centric digital systems.

The Role of Artificial Intelligence in Web 3.0 Growth

Web 3.0 is the next stage of the internet, designed to give users more control, privacy, and freedom online. A key factor driving this evolution is artificial intelligence which makes online experiences smarter, faster, and more personalized. By combining AI with blockchain, Web 3.0 platforms can understand user preferences, offer better content recommendations, and create more intuitive interactions between humans and machines.

AI is transforming Web 3.0 applications beyond content delivery. It enhances security, powers intelligent NFTs, improves decentralized apps (dApps), and supports safer, faster transactions in decentralized finance (DeFi).

The integration of AI in Web 3.0 is also driving market growth. Businesses can develop smarter solutions, boost user engagement, and unlock new revenue opportunities. As AI adoption increases, the Web3 market size is expected to expand rapidly, creating a more user-friendly, secure, and innovative digital ecosystem.

Bring Your Web3 Idea to Life!

Turn imagination into innovation with customized web3 solutions ready for users, investors, and global markets.

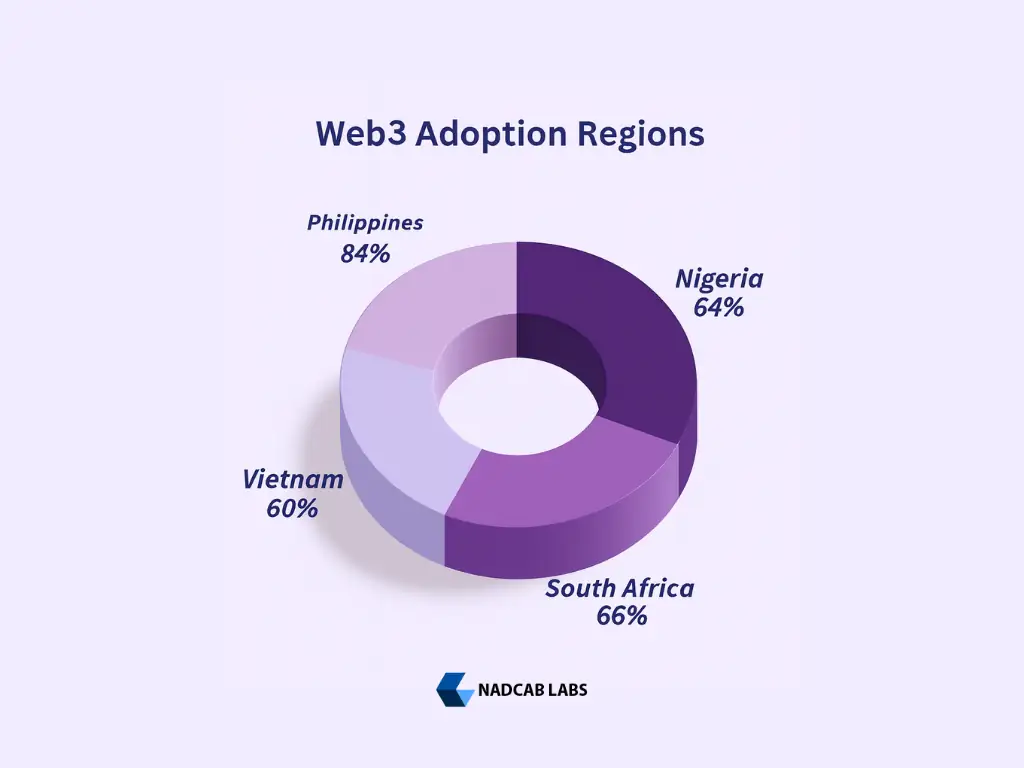

Global Crypto and Web3 Adoption in 2025

The crypto and Web3 ecosystem is growing faster than ever in early 2025. Today, more than 560 million people around the world use cryptocurrencies or Web3 applications – about 6.8% of the global population. At this pace, the number of crypto users could cross 1.5 billion by 2030, showing strong mainstream adoption.

Leading Regions

Emerging economies are driving this growth. In 2024, countries like Nigeria (84%), South Africa (66%), Vietnam (60%), and the Philippines (54%) recorded the highest adoption levels. Strong mobile penetration, digital payments, and financial inclusion have helped these markets embrace Web3 faster.

Wallet Growth

Blockchain usage is also rising steadily, with nearly 1.68 billion wallets created across various networks. Although many wallets may be inactive, the demand for non-custodial wallets is expected to grow by 20–30% in the second half of 2025, as more users choose self-managed digital assets.

Active dApp users

Daily activity in decentralized applications continues to increase. In Q1 2025, Daily Unique Active Wallets (dUAW) reached 24.6 million, powered by strong engagement in Web3 gaming, DeFi platforms, and social applications. This shows that practical, utility-driven use cases are now supporting long-term Web3 adoption.

A Balanced Take- Optimism With Caution

Yes, the projections for Web3 hitting USD 49.1 B by 2034 are not just hype. They are grounded in credible reports, growth trends, and macroeconomic shifts. The expected surge in users (potentially up to 1 billion), rising enterprise interest, DeFi adoption, tokenization, and evolving infrastructure all point toward a once-in-a-generation opportunity.

Yet, the same projections often rest on assumptions: smooth regulatory roadmaps, robust security, seamless UX, global macroeconomic stability, and mainstream adoption. Any disruption, regulatory backlash, major hack, prolonged bear market, or technology stagnation could derail or delay these forecasts.

For builders, developers, marketers, and auditors, this means – be ready, but stay grounded. Build real value, prioritize security and compliance, educate users, and stay adaptive.

Frequently Asked Questions

Investors view the Web3 market as a high-growth frontier, drawing venture capital, institutional funding, and strategic partnerships, with strong focus on blockchain infrastructure, decentralized finance (DeFi), NFT platforms, and AI-powered decentralized applications (dApps).

Gaming plays a key role in Web3 adoption, with blockchain games and metaverse platforms offering play-to-earn models, NFT-based assets, and immersive experiences that engage users, driving mainstream interest and broader participation in decentralized ecosystems.

Many traditional internet companies are exploring Web3 through NFTs, digital assets, and tokenized ecosystems. Adoption is expected to be gradual, embracing a hybrid approach that blends the stability of Web2 with the innovation of Web3 technologies.

Yes. Companies in finance, supply chain, logistics, entertainment, real estate, and healthcare are exploring blockchain for tokenization, identity verification, process automation, and secure data sharing. This enterprise shift contributes significantly to market projections.

North America holds the largest share of the global Web3 market, leading in both revenue and adoption. The global Web3 market size was valued at around USD 6.1 billion in 2024, and the region accounted for over 41% of this total. North America is expected to maintain its dominance in 2025 .

Web3 introduces decentralization, allowing users to control their data, assets, and digital identity. It shifts power away from centralized platforms toward blockchain-based ecosystems, enabling trustless transactions and transparent digital ownership.

The growth is being fueled by a surge in demand for digital ownership, the rapid adoption of decentralized finance (DeFi), and the expansion of blockchain-based gaming and virtual economies. Additionally, more enterprises are exploring tokenization and smart contracts to enhance efficiency, transparency, and innovation.

Sectors like finance (DeFi, payments, remittances), gaming (Web3 gaming & NFTs), digital identity, supply-chain, real estate tokenization, and decentralized storage are expected to see significant value creation as blockchain adoption increases.

By 2030, the Web3 payments sector is anticipated to reach USD 15-20 billion, driven by growing adoption of blockchain-based transactions, stablecoins, and decentralized payment protocols underscoring the expanding global shift toward decentralized, efficient, low-cost digital payments.

Web3 can transform digital advertising and data privacy by giving users control over their personal data, reducing reliance on centralized platforms, enabling permissioned data sharing, and allowing advertisers to reach audiences transparently, ethically, and efficiently.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.