Key Takeaways

- Web3 banking uses blockchain technology and smart contracts to provide financial services without traditional intermediaries like banks

- Decentralized banking enables permissionless access to financial services for anyone with an internet connection, regardless of location or status

- The future of banking with Web3 includes instant global transactions, programmable money, and user-controlled assets rather than bank-held deposits

- Web3 finance explained: smart contracts automate financial operations that traditionally required human intermediaries, reducing costs and errors

- Blockchain banking offers transparency through public ledgers where anyone can verify transactions and protocol operations

- Web3 in banking addresses inefficiencies like multi-day settlement times, high cross-border fees, and limited access hours

- Blockchain transaction fee management continues improving through Layer 2 solutions and more efficient consensus mechanisms [1]

- Challenges include regulatory uncertainty, smart contract security risks, and the learning curve for users accustomed to traditional banking

What Is Web3 Banking?

The financial world is witnessing a fundamental shift in how banking services are conceived, delivered, and experienced. Web3 banking represents this transformation, bringing the principles of decentralization, transparency, and user empowerment to financial services. For those accustomed to traditional banking, understanding this new paradigm is essential as it reshapes the future of money and finance.

Web3 banking definition

Web3 banking refers to financial services built on decentralized blockchain infrastructure rather than centralized institutional systems. Instead of banks holding customer deposits and controlling account access, Web3 banking uses smart contracts and distributed networks where users maintain direct custody of their assets. This fundamental shift changes the relationship between individuals and their money.

In practical terms, Web3 banking means you can send money globally in minutes rather than days, earn interest through automated protocols rather than bank discretion, and access financial services without opening accounts or proving eligibility. The bank’s role as gatekeeper and intermediary is replaced by transparent code that executes consistently for everyone.

Core concepts of Web3 finance

Web3 finance explained at its core involves several key concepts: self-custody (users control their own assets through private keys), smart contracts (automated programs that execute financial logic), and composability (protocols that can connect and build upon each other). Together, these create a financial system that operates like programmable money rather than institutional services.

The technology enables what traditional banking cannot: 24/7 operation without human intervention, instant settlement without waiting periods, and transparent rules that apply equally to all participants. These aren’t incremental improvements but fundamental changes to how financial systems function.

How Web3 differs from traditional banking

Traditional banking requires trust in institutions: you trust the bank to safeguard your money, process transactions honestly, and remain solvent. Web3 banking requires trust in code: you trust that smart contracts will execute as written, verified by thousands of independent computers. This “trustless” model doesn’t mean no trust is required, but that trust shifts from institutions to mathematics and transparent systems.

The practical differences are significant. Traditional banks operate during business hours with multi-day settlement for many transactions. Web3 operates continuously with near-instant finality. Traditional banks can freeze accounts, deny services, or impose arbitrary limits. Web3 protocols treat all users equally according to their coded rules.

How Traditional Banking Works Today?

To appreciate what Web3 banking offers, we must first understand the current banking system’s structure and limitations. Traditional banking evolved over centuries to address specific challenges, but it also created inefficiencies and restrictions that technology now makes unnecessary. Understanding these limitations clarifies why Web3 represents such a significant opportunity.

Role of intermediaries in banking

Traditional banking relies on layers of intermediaries. When you transfer money internationally, it might pass through your bank, a correspondent bank, a clearing network, another correspondent bank, and finally the recipient’s bank. Each intermediary adds time, cost, and potential points of failure. This system developed when instant verification wasn’t possible, but technology has since made it obsolete.

Banks serve as trusted third parties because historically there was no other way to ensure transaction integrity. Someone had to verify you had funds, authorize the transfer, and update records. Web3 replaces this human-dependent process with cryptographic proofs and distributed consensus that achieve the same outcomes automatically.

Limitations of centralized banking systems

Centralized systems create single points of failure and control. Banks can fail, freeze accounts, or change terms unilaterally. Access depends on meeting bank criteria, which excludes billions of people globally from formal financial services. Operating hours, geographic restrictions, and bureaucratic processes create friction that wouldn’t exist in a purely digital system.

The cost structure of traditional banking reflects its inefficiencies. International wire transfers cost $25-50 and take 3-5 days. Currency conversion includes hidden spreads. Account maintenance, overdraft fees, and minimum balances extract value from customers. These costs fund the infrastructure of intermediaries that Web3 makes unnecessary.

Trust and transparency challenges

Traditional banking operates largely as a black box. Customers don’t see how their deposits are used, what risks banks take, or how decisions are made. The 2008 financial crisis revealed how opacity can hide systemic risks until catastrophic failure. Even routine operations lack transparency that would be standard in an open system.

How Web3 Is Transforming the Banking Sector?

The transformation from traditional to Web3 banking isn’t a sudden replacement but a gradual evolution driven by clear advantages. Understanding how Web3 technology applies to banking functions reveals why this transformation is accelerating and what it means for the future of banking with Web3.

Decentralization in financial services

Decentralized banking distributes control across many participants rather than concentrating it in institutions. No single entity can unilaterally change rules, freeze funds, or deny service. This distribution makes the system more resilient (no single point of failure) and more fair (consistent rules for everyone). It also removes the need to trust specific institutions with your financial future.

In practice, decentralization means a lending protocol on Ethereum operates the same way for a user in Singapore, London, or Toronto. The protocol doesn’t care about your nationality, credit history, or relationship with any institution. It cares only whether you meet the collateral requirements coded into its smart contracts.

Smart contracts in banking operations

Smart contracts automate banking operations that traditionally required human judgment and processing. A loan that might take weeks to approve and fund through a bank can execute in seconds through a smart contract. The contract verifies collateral, calculates terms, disburses funds, and manages the entire loan lifecycle automatically.

This automation isn’t just faster; it’s more consistent. Smart contracts execute exactly as written every time, eliminating discretionary decisions that could be biased or inconsistent. Organizations creating professional cryptocurrency trading infrastructure leverage these smart contract capabilities for reliable, automated operations.

Blockchain-based financial infrastructure

Blockchain provides the foundation for Web3 banking: a shared, immutable record of all transactions that anyone can verify. This infrastructure supports everything from simple transfers to complex financial instruments. Unlike traditional infrastructure that’s fragmented across institutions, blockchain banking creates a single source of truth accessible to all participants.

| Feature | Traditional Banking | Web3 Banking |

|---|---|---|

| Operating Hours | Business hours (limited) | 24/7/365 |

| Settlement Time | 1-5 business days | Minutes to seconds |

| Access Requirements | Account approval, KYC | Internet connection only |

| Transaction Visibility | Private (bank sees all) | Transparent (public ledger) |

| Asset Control | Bank custody | Self-custody |

| Cross-Border Fees | $25-50+ per transfer | $0.01-5 typically |

Web3 vs Traditional Banking

Direct comparison between Web3 and traditional banking models illuminates the fundamental differences in approach, capability, and philosophy. Neither system is universally superior; each has strengths suited to different needs. Understanding these differences helps individuals and organizations choose appropriate solutions.

Centralized vs decentralized banking models

Centralized banking concentrates decision-making, risk, and control in institutions regulated by governments. This provides certain protections (deposit insurance, dispute resolution) but also limitations (access restrictions, censorship capability). Decentralized banking distributes these functions across networks, providing different benefits (permissionless access, censorship resistance) and risks (user responsibility, regulatory uncertainty).

The choice between models often depends on individual circumstances. Those well-served by traditional banking may see less immediate value in Web3. Those excluded from or poorly served by traditional banking may find Web3 transformative. Most users will likely use both systems for different purposes.

User ownership and financial control

Web3 banking fundamentally changes who controls assets. In traditional banking, you have a claim on the bank, which holds your money. In Web3, you hold your assets directly through private keys. This self-custody means no one can freeze your funds or deny access, but it also means no one can recover lost keys or reverse mistaken transactions.

Cost efficiency and transaction speed

By eliminating intermediaries and automating operations, Web3 achieves significant cost efficiency for many transaction types. International transfers that cost $50 through banks might cost $1 through Web3 protocols. However, blockchain transaction fee management remains a consideration, particularly on congested networks where gas fees can spike during high demand.

Key Benefits of Web3 Banking

Web3 banking offers concrete advantages that address long-standing limitations of traditional finance. These benefits explain the growing adoption and investment in decentralized financial infrastructure. Understanding these advantages helps evaluate where Web3 banking makes sense for different use cases.

Permissionless access to financial services

Perhaps the most transformative benefit is permissionless access. Web3 banking doesn’t require bank accounts, credit checks, minimum balances, or institutional approval. Anyone with internet access and a small amount of cryptocurrency can participate in sophisticated financial services. This addresses the reality that nearly 2 billion adults globally lack access to traditional banking.

For those in regions with unstable currencies, limited banking infrastructure, or financial exclusion, Web3 banking provides alternatives that simply weren’t possible before. The same protocols that serve sophisticated traders in major financial centers serve first-time users in underbanked regions.

Enhanced transparency and security

Web3 in banking brings radical transparency. Every transaction is recorded on public blockchains where anyone can verify it. Protocol rules are encoded in smart contracts visible to all. This transparency makes it impossible for operators to secretly change rules or misappropriate funds. Teams building comprehensive trading platform solutions leverage this transparency to build user trust.

Reduced reliance on intermediaries

Removing intermediaries means removing their costs, delays, and potential for errors or abuse. Direct peer-to-peer transactions execute faster and cheaper than mediated transactions. This disintermediation is particularly valuable for international transactions where correspondent banking adds multiple days and layers of fees.

Web3 Banking Benefits Summary

- Access: Open to anyone, anywhere, anytime

- Speed: Minutes instead of days for settlements

- Cost: Dramatically lower fees for most transactions

- Control: Users own and control their assets

- Transparency: All operations publicly verifiable

- Innovation: Programmable money enables new services

Web3 Banking Use Cases

Web3 banking isn’t theoretical; it’s actively used for diverse financial activities today. These use cases demonstrate practical applications where Web3 offers clear advantages over traditional alternatives. Understanding these applications reveals where Web3 banking is already delivering value.

Decentralized payments and transfers

Global payments represent Web3’s most immediate banking application. Sending value anywhere in the world takes minutes regardless of borders, currencies, or banking relationships. Remittance corridors that charge 7-10% through traditional channels can use Web3 for a fraction of the cost. Businesses can pay international contractors without complex wire transfers.

Lending and borrowing without banks

DeFi lending protocols enable borrowing and lending without banks. Users supply assets to earn interest; others borrow against collateral. Interest rates are determined algorithmically based on supply and demand, often exceeding traditional savings rates. The entire process is automated, instant, and doesn’t require credit checks or approval processes.

Asset tokenization in banking

Tokenization brings traditional assets onto blockchain, enabling fractional ownership, 24/7 trading, and integration with DeFi protocols. Real estate, securities, and other assets can be represented as tokens that trade globally without traditional settlement delays. This creates liquidity for previously illiquid assets and enables new investment structures.

Challenges and Risks in Web3 Banking

Web3 banking isn’t without challenges and risks that participants must understand and navigate. Honest assessment of these issues helps users make informed decisions and drives continued improvement in the ecosystem. Responsible participation requires understanding what can go wrong.

Regulatory uncertainty

Regulatory frameworks for Web3 banking remain inconsistent and evolving globally. What’s clearly legal in one jurisdiction may be restricted in another. This uncertainty creates risks for both users and service providers. Regulatory clarity is improving but varies significantly by region, creating a complex compliance landscape.

Security and smart contract risks

Smart contracts can contain bugs that attackers exploit to drain funds. Even audited contracts aren’t guaranteed safe, as auditors can miss vulnerabilities. Users bear full responsibility for the protocols they use; there’s no recourse for lost funds due to smart contract failures. This reality demands careful protocol selection and risk management.

Scalability and user adoption issues

Blockchain networks face scalability limitations that can cause congestion and high fees during peak usage. User experience often remains more complex than traditional banking apps. These friction points slow mainstream adoption, though Layer 2 solutions and improved interfaces are addressing both challenges progressively.

| Challenge | Impact | Mitigation |

|---|---|---|

| Regulatory Uncertainty | Service availability varies by region | Stay informed, use compliant platforms |

| Smart Contract Bugs | Potential loss of funds | Use audited, established protocols |

| Network Congestion | High fees during peak times | Use Layer 2 solutions |

| User Complexity | Steep learning curve | Start small, learn gradually |

Role of DeFi in the Future of Banking

DeFi (Decentralized Finance) represents the most mature implementation of Web3 banking principles. Understanding DeFi’s relationship to broader Web3 banking clarifies how decentralized financial services are evolving and where they’re headed.

Relationship between Web3 and DeFi

DeFi is essentially Web3 banking in action: specific protocols implementing banking functions on decentralized infrastructure. While Web3 banking describes the concept, DeFi represents the working implementations. Protocols like Aave, Compound, and Uniswap demonstrate that decentralized banking isn’t theoretical but operational, processing billions in transactions.

DeFi protocols as banking alternatives

DeFi protocols now offer alternatives to most basic banking services: savings (lending protocols), borrowing (collateralized loans), trading (decentralized exchanges), and transfers (stablecoin payments). These alternatives often offer better rates, faster execution, and broader access than traditional equivalents, driving growing adoption among those familiar with the technology.

Open financial ecosystems

DeFi creates open financial ecosystems where protocols interact and build upon each other. This composability enables complex financial strategies impossible in siloed traditional systems. Users can combine multiple protocols in single transactions, creating custom financial products without intermediary approval. Teams creating advanced digital asset platforms integrate with these ecosystems to offer comprehensive services.

Web3 Banking Solutions for Businesses

Businesses face different considerations than individuals when evaluating Web3 banking. Enterprise requirements around compliance, integration, and scale demand tailored solutions. Understanding available options helps businesses navigate this landscape effectively.

Web3 banking platforms

Web3 banking platforms provide infrastructure for businesses to access decentralized financial services. These platforms often bridge the gap between traditional business requirements (compliance, reporting, controls) and Web3 capabilities (efficiency, transparency, automation). Solutions range from self-hosted infrastructure to managed services depending on business needs.

Blockchain solutions for financial institutions

Financial institutions increasingly adopt blockchain for specific functions: cross-border settlements, asset tokenization, and process automation. These implementations often use permissioned blockchains that provide blockchain benefits while maintaining institutional control. Such hybrid approaches let institutions capture Web3 efficiencies within familiar regulatory frameworks.

Web3 finance integration services

Integration services help businesses connect existing systems with Web3 capabilities. This includes wallet infrastructure, payment processing, DeFi protocol integration, and compliance tooling. Professional services teams building complete exchange and trading infrastructure provide these integration capabilities for enterprises entering the space.

| Phase | Stage | Activities | Outcome |

|---|---|---|---|

| 1 | Assessment | Evaluate use cases, regulatory requirements | Strategy defined |

| 2 | Pilot | Test with limited scope and funds | Proof of concept |

| 3 | Integration | Connect Web3 with existing systems | Infrastructure ready |

| 4 | Deployment | Launch services, onboard users | Live operations |

| 5 | Optimization | Monitor, iterate, expand capabilities | Mature implementation |

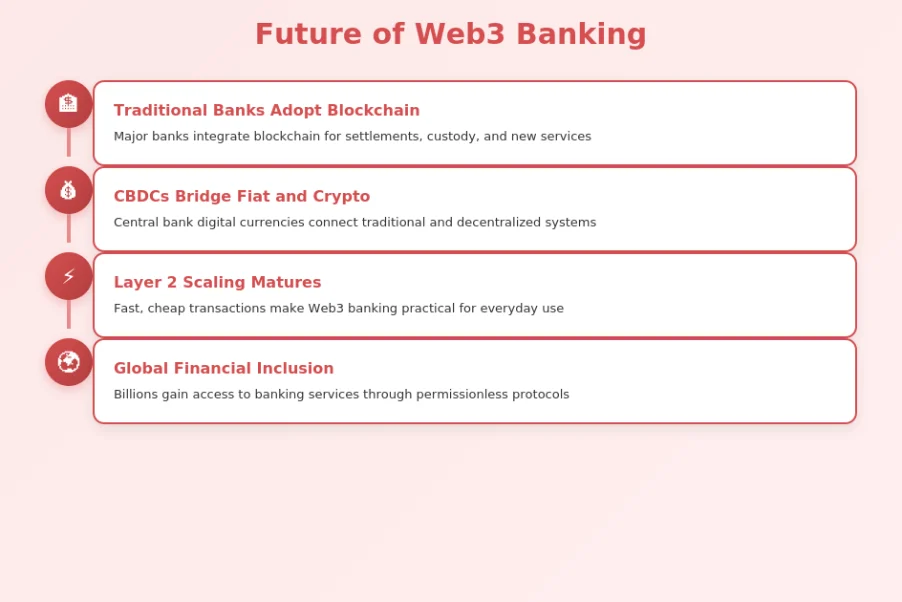

What the Future Holds for Web3 Banking?

The trajectory of Web3 banking points toward continued growth, innovation, and mainstream integration. While predicting specifics is impossible, clear trends indicate where the industry is headed. Understanding these trends helps individuals and businesses position for the evolving financial landscape.

Emerging trends in decentralized banking

Several trends are shaping decentralized banking’s evolution. Real-world asset tokenization is bringing traditional assets onto blockchain. Central bank digital currencies (CBDCs) may bridge fiat and crypto systems. Layer 2 scaling solutions are making transactions faster and cheaper. Improved user interfaces are reducing the learning curve. These developments address current limitations while expanding capabilities.

Adoption outlook for Web3 finance

Adoption continues accelerating across user segments. Individuals are using Web3 for savings, trading, and international transfers. Businesses are exploring treasury management, payment processing, and new financial products. Institutions are building blockchain infrastructure and offering crypto services. Each adoption wave creates infrastructure and familiarity that supports the next.

Long-term impact on global banking systems

The long-term impact will likely be transformation rather than replacement. Traditional banks will incorporate blockchain technology. DeFi protocols will add compliance features. The distinction between Web3 and traditional banking will blur as best practices from both worlds combine. The result will be more efficient, accessible, and innovative financial services globally.

Transform Your Financial Future

Build Web3 banking solutions with expert guidance for seamless blockchain integration.

The future of banking with Web3 isn’t a distant possibility but an unfolding reality. From permissionless global payments to automated lending, from transparent operations to user-controlled assets, Web3 banking is demonstrating that better alternatives exist. As the technology matures and adoption grows, the question isn’t whether Web3 will impact banking but how quickly and comprehensively this transformation will occur.

For individuals, the opportunity is to explore these tools, understand their benefits and risks, and incorporate them where they add value. For businesses, the opportunity is to leverage Web3 efficiencies, serve evolving customer expectations, and position for a financial future that’s more open, efficient, and accessible than ever before.

Frequently Asked Questions

Web3 transforms banking by removing intermediaries, reducing costs, and enabling 24/7 global transactions without institutional approval. Traditional banks act as trusted middlemen who verify, process, and settle transactions over days. Web3 replaces this with automated smart contracts that execute instantly, transparently, and without requiring trust in any single entity.

Web3 is more likely to complement and transform traditional banking than completely replace it. Banks provide services like regulatory compliance, consumer protection, and familiar interfaces that many users value. However, Web3 is capturing growing market share in areas like international transfers, lending, and asset management where it offers clear advantages.

Blockchain brings transparency (all transactions are publicly verifiable), efficiency (24/7 operation with instant settlement), accessibility (no geographic or demographic restrictions), and programmability (complex financial logic automated through smart contracts). These benefits translate to lower costs, faster service, and financial inclusion for underserved populations.

DeFi operates through open protocols on public blockchains, accessible to anyone without permission. Traditional finance requires accounts with regulated institutions that verify identity and can restrict access. DeFi is transparent and programmable; traditional finance is opaque and discretionary. DeFi offers higher yields but less consumer protection; traditional finance offers

Key risks include smart contract bugs that could result in lost funds, regulatory uncertainty that could affect service availability, volatile asset values, and the responsibility users bear for their own security. Unlike traditional banking, there’s no FDIC insurance or customer service to recover lost funds. Users must carefully evaluate protocols and understand they’re accepting these tradeoffs for the benefits.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.