Token vesting has become a fundamental mechanism in cryptocurrency projects, determining how tokens are distributed to stakeholders over time. Whether you’re a project founder, investor, or team member, understanding vesting crypto concepts is essential for evaluating tokenomics and long-term project viability. This comprehensive guide explains what token vesting is, how it works, different vesting schedules, and why crypto vesting is crucial for sustainable blockchain project development.

Key Takeaways

- Definition: Token vesting is the gradual release of tokens to stakeholders over predetermined schedules rather than all at once.

- Purpose: Vesting aligns stakeholder interests with long-term project success and prevents immediate token dumping.

- Cliff Period: An initial waiting period before any tokens are released, typically 6-12 months for team allocations.

- Vesting Types: Linear, graded, and milestone-based schedules offer different distribution approaches.

- Smart Contract Implementation: Token vesting contracts automate distribution, ensuring transparency and security.

- Market Stability: Controlled token release prevents oversupply and helps maintain price stability.

- Investor Protection: Vesting schedules protect investors from sudden sell-offs by early participants.

What is Token Vesting?

Token vesting refers to the process of locking cryptocurrency tokens for a predetermined period before they can be fully accessed or transferred. Rather than receiving all allocated tokens immediately, stakeholders including team members, advisors, and early investors receive their tokens gradually according to a defined crypto vesting schedule.[1]

The concept originates from traditional finance where employee stock options vest over time to encourage retention. In the crypto world, vesting serves similar purposes by ensuring long-term commitment from key stakeholders while protecting the broader community from sudden token dumps that could crash prices.

When a project implements token vesting, a specific portion of total tokens is locked in smart contracts and released according to the vesting schedule. These locked tokens aren’t available for sale during the vesting period crypto, preventing early participants from immediately selling their allocations and destabilizing the market.

How Token Vesting Works

Understanding how token vesting works is essential for anyone participating in ICO, IDO, or other token distribution events. The process typically involves several key components working together.

Token Vesting Contract

A token vesting contract is a smart contract deployed on blockchain that automatically manages token distribution according to predetermined rules. Once deployed, these contracts execute without human intervention, ensuring transparency and eliminating the need to trust centralized parties. Professional token development teams implement secure vesting contracts that have undergone thorough auditing.

Vesting Cliff

The vesting cliff is an initial waiting period before any tokens are released. For example, a project might implement a 6-month cliff where no tokens are distributed to team members. After the cliff ends, tokens begin releasing according to the schedule. Cliffs prevent stakeholders from receiving tokens and immediately leaving the project.

Vesting Period Crypto

Following the cliff, the vesting period determines how long token distribution continues. A typical setup might include a 1-year cliff followed by 3-year linear vesting. During this period, tokens are released according to the schedule, whether monthly, quarterly, or based on milestones, until all allocated tokens are distributed.

Types of Token Vesting Schedules

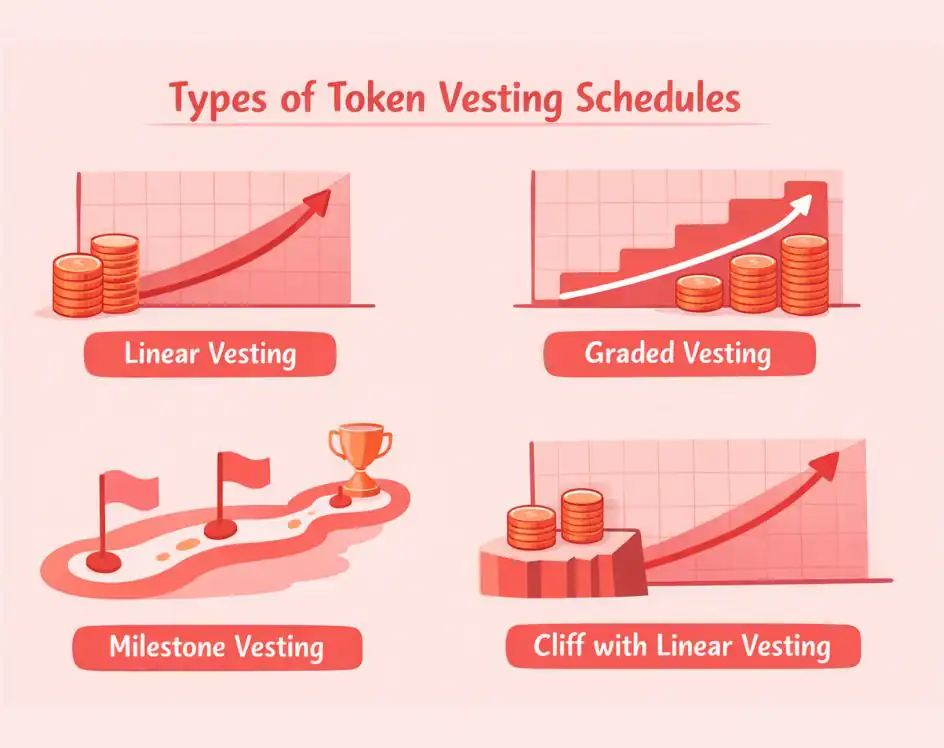

Different crypto vesting schedule types serve various purposes depending on project needs and stakeholder categories.

Linear Vesting

Linear vesting distributes tokens in equal portions over a predetermined timeframe. For instance, if someone has 12,000 tokens vesting linearly over 12 months, they receive 1,000 tokens each month. This straightforward approach provides predictable token release and is commonly used for team and advisor allocations in token development projects.

Graded Vesting

Graded vesting releases different percentages at different intervals. A project might release 10% after year one, 20% after year two, 30% after year three, and 40% after year four. This approach rewards longer commitment with larger releases, incentivizing stakeholders to remain engaged throughout the project’s development lifecycle.

Milestone Vesting

Milestone-based vesting ties token releases to achieving specific project goals rather than time alone. Tokens might unlock when mainnet launches, when user adoption targets are met, or when revenue milestones are achieved. This approach directly links rewards to project progress and successful development outcomes.

Cliff with Linear Vesting

The most common approach combines cliff and linear vesting. Stakeholders wait through a cliff period, typically 6-12 months, after which tokens vest linearly. This hybrid model ensures initial commitment while providing predictable ongoing distribution. It has become a standard pattern for ICO token vesting and IDO token vesting implementations.

Why Token Vesting is Important

Understanding why vesting is important in crypto projects reveals its critical role in sustainable tokenomics and ecosystem health.

Aligns Stakeholder Interests

Token vesting ensures team members, advisors, and early investors have ongoing financial interest in project success. When tokens vest over multiple years, stakeholders are motivated to contribute positively to the project’s growth rather than extracting short-term value. This alignment is fundamental for long-term project development.

Prevents Market Manipulation

Without vesting, large token holders could dump their allocations immediately after listing, crashing prices and harming retail investors. Vesting crypto mechanisms serve as anti-dump protections, preventing coordinated sell-offs that could devastate token ecosystems. This protection is especially important for ERC-20 token projects launching on exchanges.[2]

Maintains Price Stability

Controlled token release through vesting helps maintain market stability by preventing sudden supply increases. Gradual distribution matches token supply growth with ecosystem development and adoption, supporting healthier price discovery and reducing volatility caused by oversupply.

Builds Investor Confidence

Projects with transparent vesting schedules demonstrate commitment to long-term success rather than quick profits. Investors can evaluate how token vesting affects token price and make informed decisions knowing when tokens will enter circulation. This transparency builds trust essential for sustainable community development.

Provides Development Time

Vesting periods give teams time to build products and achieve milestones before facing selling pressure. This runway allows focused development without distraction from token price volatility. Professional crypto development company teams understand this importance when designing tokenomics.

Token Vesting for Different Stakeholders

Different stakeholder groups typically have different vesting arrangements based on their roles and risk profiles.

Founders and Teams

Team allocations usually have the longest vesting periods, often spanning 3-4 years with 1-year cliffs. This ensures founders and core team members remain committed throughout critical development phases. Longer vesting demonstrates confidence in the project and protects against founder departures immediately after fundraising.

Investors

VC token vesting and early investor schedules vary based on investment round. Seed investors might have 2-year vesting with 6-month cliffs, while public sale participants might have shorter or no vesting. Earlier investors typically accept longer vesting in exchange for lower token prices.

Advisors

Advisors typically receive tokens vesting over 1-2 years, ensuring they provide ongoing value rather than collecting tokens for minimal contribution. Milestone-based vesting works particularly well for advisors, tying releases to specific deliverables or introductions.

DeFi Projects and DAOs

Token vesting for DeFi projects and token vesting for DAOs often includes community treasury allocations with governance-controlled release. These mechanisms ensure sustainable ecosystem funding while preventing any single party from controlling excessive token supply.

Token Vesting vs Lockup

While often used interchangeably, token vesting vs lockup represents distinct mechanisms with important differences.

Token Lockup: A fixed period during which tokens cannot be sold or transferred at all. After the lockup ends, all tokens become immediately available. This is a simpler, more rigid approach.

Token Vesting: Gradual release of tokens over time according to a schedule. Vesting offers more flexibility and nuance, with tokens becoming available incrementally rather than all at once.

Vesting is generally considered more strategic as it provides ongoing alignment incentives, while lockups simply delay access. Many projects combine both—implementing initial lockups followed by vesting periods for comprehensive token supply control.

Manual vs Automated Token Vesting

Projects can implement vesting manually or through automated smart contracts, each approach having distinct implications.

Manual Token Vesting Challenges

Manual vesting requires founders to control token wallets and distribute according to schedules. This approach faces several problems: high transaction fees for multiple distributions, time-consuming processes for large participant numbers, transparency concerns since founders control locked tokens, and security risks from centralized custody. These limitations make manual vesting unsuitable for professional token development.

Automated Token Vesting Benefits

Smart contract vesting automates the entire process, eliminating human error and centralization risks. Automated vesting provides verifiable transparency since anyone can audit the contract, reduced costs through batch processing, enhanced security through decentralized custody, and trustless execution without relying on any single party. Most serious projects implement automated vesting using audited smart contracts.[3]

Token Vesting Security Considerations

Token vesting security is paramount given the significant value locked in vesting contracts. Professional Crypto Token Development Company teams implement multiple security measures.

Smart Contract Audits

All vesting contracts should undergo thorough security audits from reputable firms before deployment. Audits identify vulnerabilities that could allow unauthorized token access or manipulation. Multiple audits from different firms provide additional assurance for high-value contracts.

Access Controls

Proper access controls ensure only authorized parties can interact with vesting contracts. Multi-signature requirements for administrative functions prevent single points of failure. Timelock mechanisms provide transparency for any parameter changes.

Transparent Verification

Token holders should be able to verify their vesting schedules and remaining balances on-chain. Transparency tools allowing public verification of locked tokens build community trust and demonstrate project integrity.

How Token Vesting Affects Token Price

Understanding how token vesting affects token price helps investors evaluate projects and anticipate market movements.

When large token unlocks approach, markets often anticipate increased selling pressure. This can cause price declines before actual unlocks as traders front-run expected sales. Projects with well-designed vesting schedules spread unlocks to minimize these impacts.

Conversely, long vesting periods for team and insider tokens signal confidence and reduce circulating supply, potentially supporting prices. Investors analyze vesting schedules alongside token emission rates to understand total supply dynamics.

Projects should communicate vesting schedules clearly and provide advance notice of significant unlocks. Transparent communication helps markets price in unlocks gradually rather than experiencing sudden shocks.

Best Practices for Token Vesting

Implementing effective token vesting requires careful planning aligned with project goals and stakeholder needs.

Design Appropriate Schedules

Match vesting duration to stakeholder roles and project timelines. Longer vesting for insiders demonstrates commitment, while reasonable schedules for investors maintain attractiveness. Consider different schedules for different allocation categories based on their purpose.

Maintain Transparency

Publish complete vesting schedules in documentation and provide on-chain verification. Regular updates about upcoming unlocks help communities prepare for supply changes. Transparency builds trust essential for long-term success.

Use Professional Development

Work with experienced cryptocurrency development company teams to implement secure, audited vesting contracts. Professional development ensures proper security, gas optimization, and compliance with token standards.

Conclusion

Token vesting represents a foundational element of sustainable tokenomics, determining how tokens flow to stakeholders while protecting broader community interests. Through carefully designed crypto vesting schedules, projects align incentives, prevent market manipulation, and build the trust necessary for long-term success.

Understanding vesting mechanisms from cliff periods and linear distribution to milestone-based releases empowers both project teams and investors to make informed decisions. Whether evaluating investment opportunities or designing tokenomics for new projects, vesting analysis provides crucial insights into project commitment and potential price dynamics.

For teams implementing token vesting, working with experienced Crypto Token Development Company professionals ensures secure smart contract development, appropriate schedule design, and transparent implementation. As the crypto ecosystem matures, well-structured vesting continues distinguishing serious projects from short-term schemes, making it essential knowledge for anyone participating in token economies.

Frequently Asked Questions

Token vesting is the gradual release of cryptocurrency tokens to stakeholders over predetermined schedules, preventing immediate selling and aligning interests with long-term project success.

Vesting prevents token dumping, maintains price stability, aligns stakeholder interests with project goals, builds investor confidence, and provides development teams time to build products.

A vesting cliff is an initial waiting period before any tokens are released. After the cliff ends, tokens begin distributing according to the vesting schedule.

Team and founder vesting typically spans 3-4 years with 1-year cliffs. Investor vesting ranges from 6 months to 2 years depending on investment round and terms.

Smart contract vesting is typically immutable once deployed, ensuring stakeholders can trust the schedule. Some contracts include governance mechanisms allowing community-approved changes.

Vesting affects price by controlling token supply entering circulation. Large upcoming unlocks may create selling pressure, while long vesting periods reduce circulating supply, potentially supporting prices.

Projects use platforms like TrustSwap, Team.Finance, and custom smart contracts for vesting implementation. Professional token development solutions ensure secure, audited contract deployment.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.