ERC-20 tokens have become the backbone of the Ethereum ecosystem, powering thousands of cryptocurrency projects, DeFi protocols, and blockchain applications. As the most widely adopted token standard, ERC-20 provides a unified framework enabling seamless interaction between tokens, wallets, and decentralized applications. This comprehensive guide explains what ERC-20 tokens are, how they work, their benefits and risks, and why this standard revolutionized token development on Ethereum.

Key Takeaways

- Standard Definition: ERC-20 is the technical standard for fungible tokens created on the Ethereum blockchain, ensuring interoperability across applications.

- Universal Compatibility: All ERC-20 tokens work with any Ethereum wallet, exchange, or dApp without specialized conversion requirements.

- Six Core Functions: The standard defines total Supply, balance Of, transfer, transfer From, approve, and allowance functions for token operations.

- ICO Catalyst: ERC-20 enabled the 2017-2018 ICO boom by simplifying token creation and ensuring ecosystem compatibility.

- Popular Examples: USDT, USDC, LINK, UNI, and SHIB are among the most recognized ERC-20 tokens by market capitalization.

- DeFi Foundation: ERC-20 tokens power decentralized finance including stablecoins, governance tokens, and liquidity pool tokens.

- Smart Contract Based: Each ERC-20 token operates through smart contracts defining its rules, supply, and transfer mechanisms.

What is ERC-20?

ERC-20 stands for “Ethereum Request for Comment 20,” representing the technical standard governing fungible tokens built on the Ethereum blockchain. Proposed by developer Fabian Vogelsteller in 2015 and implemented in 2017, ERC-20 established standardized rules that all Ethereum-based fungible tokens should follow, enabling universal compatibility across the ecosystem.[1]

Before ERC-20, token development on Ethereum lacked standardization, meaning tokens weren’t always compatible with all decentralized applications. Users faced complicated conversion processes between different tokens and applications. The ERC-20 standard solved these challenges by creating a unified framework that simplified token creation and ensured interoperability.

Today, ERC-20 tokens on Ethereum include popular cryptocurrencies like Tether (USDT), USD Coin (USDC), Chainlink (LINK), and Uniswap (UNI). These tokens can be traded on any Ethereum-compatible exchange, stored in any supporting wallet, and used across virtually all dApps built on Ethereum without specialized integration requirements.

How ERC-20 Tokens Work

ERC-20 tokens operate through smart contracts deployed on the Ethereum blockchain. These smart contracts contain code defining the token’s behavior, including how tokens are created, transferred, and managed. Understanding ERC-20 token functions is essential for anyone looking to create crypto token projects on Ethereum.

Core ERC-20 Token Functions

The ERC-20 standard defines six mandatory functions that every compliant token must implement:

Total Supply: Returns the total number of tokens in circulation. This function allows anyone to query how many tokens exist, providing transparency about the token’s supply dynamics and potential token emission patterns.

balance Of: Returns the token balance of a specific address. Wallets and applications use this function to display how many tokens a user holds.

transfer: Enables direct token transfers from one address to another. This fundamental function executes when users send tokens to other wallets or smart contracts.

transfer From: Allows approved third parties to transfer tokens on behalf of token owners. This function is essential for smart contract interactions where contracts need to move tokens.

approve: Grants permission for another address to withdraw tokens up to a specified amount. Users must approve smart contracts before those contracts can access their tokens.

allowance: Returns the remaining number of tokens that an approved spender can withdraw from an owner’s account.

ERC-20 Token Events

Beyond functions, ERC-20 tokens must emit two events that enable transaction tracking and transparency:

Transfer: Triggered whenever tokens move between addresses, creating a permanent record on the blockchain.

Approval: Logged when an owner approves a spender, documenting permission grants for future reference.

Benefits of ERC-20 Tokens

The ERC-20 standard delivers significant advantages driving its widespread adoption across the Ethereum ecosystem and beyond.

Simplified Token Development

ERC-20 streamlines token creation by providing a standardized template. Developers don’t need to build token functionality from scratch or worry about compatibility issues. This simplification was a significant catalyst for the ICO boom, enabling rapid token development and deployment for blockchain projects worldwide.

Professional token development solutions leverage ERC-20’s framework to create compliant tokens efficiently. By following established standards, development teams ensure their tokens integrate seamlessly with existing infrastructure including wallets, exchanges, and DeFi protocols.

Universal Interoperability

Perhaps the most significant benefit of ERC-20 tokens is their universal compatibility. Any ERC-20 compliant token works with any Ethereum wallet, exchange, or decentralized application without specialized conversion or integration. This interoperability reduces friction for users and developers alike, boosting ecosystem liquidity and participation.[2]

Enhanced Liquidity

Before ERC-20, trading between different tokens required complicated conversion processes. The standard removed these barriers, enabling seamless trading across decentralized exchanges. This liquidity enhancement benefits token holders through better price discovery and easier portfolio management.

Transparency and Predictability

Because all ERC-20 tokens follow identical standards, users can predict how any compliant token will function. This predictability helps users make informed decisions and encourages developer innovation within a stable, well-understood framework.

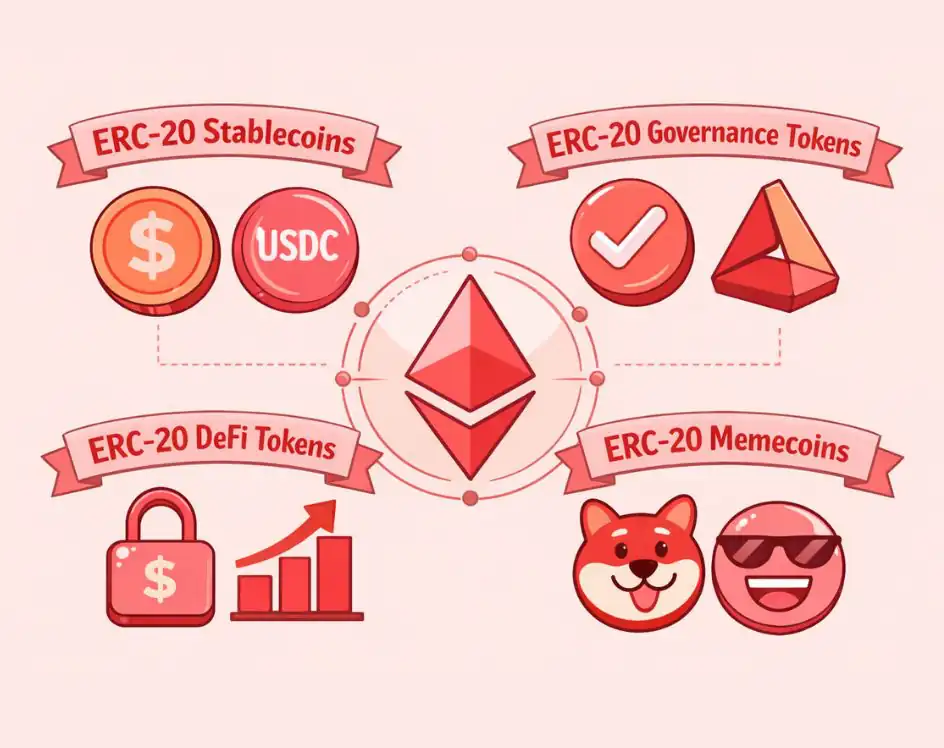

Popular ERC-20 Token Examples

Thousands of ERC-20 tokens exist across various categories, demonstrating the standard’s versatility for different use cases.

ERC-20 Stablecoins

Tether (USDT) and USD Coin (USDC) are leading ERC-20 stablecoins pegged to the US dollar. These tokens provide price stability essential for trading, payments, and DeFi applications. Stablecoin development on ERC-20 has enabled billions in daily transaction volume across Ethereum.

ERC-20 Governance Tokens

Uniswap (UNI), Aave (AAVE), and Compound (COMP) represent governance tokens giving holders voting power over protocol decisions. These ERC-20 tokens enable decentralized decision-making, allowing communities to shape platform development and policy changes.

ERC-20 DeFi Tokens

Chainlink (LINK) powers decentralized oracle networks, while tokens like Wrapped Bitcoin (WBTC) bring Bitcoin liquidity to Ethereum DeFi. These utility tokens demonstrate ERC-20’s flexibility for diverse decentralized finance applications requiring token development expertise.

ERC-20 Memecoins

Shiba Inu (SHIB) exemplifies how ERC-20 enables community-driven token projects. While memecoins carry significant risks, they demonstrate the low barrier to entry for token creation—a double-edged characteristic of the ERC-20 standard.

ERC-20 vs Other Token Standards

Understanding how ERC-20 compares to other standards helps clarify its specific role within Ethereum token standards and broader blockchain ecosystems.

ERC-20 vs ERC-721

While ERC-20 governs fungible tokens where each unit is identical and interchangeable, ERC-721 defines non-fungible tokens (NFTs) representing unique assets. ERC-20 tokens work like currency—one USDT equals any other USDT. ERC-721 NFTs are unique—each token represents a distinct digital asset with individual properties.

ERC-20 vs ERC-1155

The ERC-1155 standard combines fungible and non-fungible capabilities in a single contract, offering gas efficiency improvements for applications managing multiple token types. Gaming platforms particularly benefit from ERC-1155’s flexibility in development scenarios requiring both fungible currencies and unique items.

ERC-20 vs BEP-20

BEP-20 is Binance Smart Chain’s equivalent standard, designed for compatibility with ERC-20 while operating on Binance’s network. Many tokens exist as both ERC-20 and BEP-20 versions, enabling cross-chain functionality. Developers often create tokens on both standards to maximize accessibility.

Creating an ERC-20 Token

Creating an ERC-20 token requires implementing the standard’s required functions within a smart contract. While the process has become more accessible, successful token development demands careful planning and technical expertise.

Development Process Overview

Token development begins with defining token parameters including name, symbol, decimal places, and total supply. Developers then write smart contract code implementing all required ERC-20 functions. Testing on Ethereum testnets validates functionality before mainnet deployment.[3]

Working with experienced crypto token solution providers ensures proper implementation, security auditing, and deployment. Professional development teams understand ERC-20 compliance requirements and can customize tokens for specific use cases while maintaining standard compatibility.

Optional Token Features

Beyond mandatory functions, ERC-20 allows optional features enhancing token utility. Token name and symbol provide human-readable identification, while decimal specification (typically 18) determines divisibility. Advanced features like minting, burning, and pausing can be added during development based on project requirements.

Risks and Challenges of ERC-20 Tokens

Despite their benefits, ERC-20 tokens carry risks that users and developers must understand.

Low Barrier to Entry

The ease of creating ERC-20 tokens enables both legitimate projects and scams. Bad actors can quickly deploy tokens for pump-and-dump schemes, rug pulls, or fraudulent ICOs. Users must conduct thorough due diligence before investing in any ERC-20 token, regardless of marketing claims.

Smart Contract Vulnerabilities

Poorly written smart contracts can contain bugs or security vulnerabilities enabling exploits. Professional crypto development company teams conduct thorough audits to identify and address potential vulnerabilities before deployment, but risks remain for tokens lacking proper security review.

Gas Fee Dependency

All ERC-20 token transactions require ETH for gas fees. During network congestion, fees can become prohibitively expensive for small transactions. This dependency on Ethereum’s base layer creates cost unpredictability affecting token usability.

Regulatory Uncertainty

Many ERC-20 tokens face regulatory scrutiny regarding securities classification. Depending on token characteristics and distribution methods, some tokens may be considered securities subject to strict regulatory requirements. Development teams must consider compliance implications during token design.[4]

The Importance of ERC-20 for Ethereum

ERC-20 has been instrumental in Ethereum’s growth into the second-largest blockchain by market capitalization. The standard enabled explosive ecosystem development by removing technical barriers to token creation and ensuring universal compatibility.

The DeFi revolution built largely on ERC-20 tokens, with stablecoins, governance tokens, and liquidity pool tokens all leveraging the standard. Without ERC-20’s interoperability guarantees, the composable “money legos” characterizing DeFi would be impossible.

Looking forward, ERC-20 will continue serving as the foundation for fungible token development on Ethereum. While newer standards like ERC-1155 offer enhanced capabilities for specific use cases, ERC-20 remains the default choice for straightforward fungible token implementations requiring maximum ecosystem compatibility.

Conclusion

ERC-20 tokens represent one of blockchain’s most significant innovations, establishing the standard framework powering Ethereum’s vast token ecosystem. By defining universal rules for fungible token creation, ERC-20 enabled seamless interoperability driving DeFi growth, ICO proliferation, and widespread crypto token adoption.

Understanding ERC-20—from its core functions and benefits to associated risks—is essential for anyone participating in the Ethereum ecosystem. Whether trading stablecoins, participating in governance, or exploring token development solutions for new projects, ERC-20 knowledge provides foundational understanding of how Ethereum tokens function.

For businesses and developers considering token development, ERC-20 offers a proven, widely-supported standard ensuring maximum compatibility and liquidity. Working with experienced Crypto Token Development Company teams ensures proper implementation, security, and compliance. As Ethereum continues evolving, ERC-20 will remain the foundational standard for fungible tokens, supporting continued ecosystem innovation and growth in decentralized finance and beyond.

Frequently Asked Questions

ERC-20 tokens are fungible digital tokens built on Ethereum following standardized rules ensuring compatibility with wallets, exchanges, and decentralized applications across the ecosystem.

ETH is Ethereum’s native cryptocurrency used for gas fees and network operations. ERC-20 tokens are created through smart contracts on Ethereum and require ETH for transaction fees.

ERC-20 compliance requires implementing six mandatory functions (totalSupply, balanceOf, transfer, transferFrom, approve, allowance) and two events (Transfer, Approval) within the erc-20 token smart contract.

Yes, anyone with basic development knowledge can create ERC-20 tokens using available templates and tools. However, professional cryptocurrency development company expertise ensures proper security, compliance, and functionality.

Uses include stablecoins, governance voting, DeFi protocol participation, loyalty rewards, gaming currencies, fundraising, and representing real-world assets on blockchain.

Safety varies significantly between tokens. While the ERC-20 standard itself is secure, individual tokens may have smart contract vulnerabilities, poor tokenomics, or fraudulent intentions. Thorough research is essential.

Deployment costs depend on Ethereum gas prices and contract complexity. Basic deployments may cost $50-$500 in gas, while professional development services including auditing range from $5,000-$50,000+ depending on requirements.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.