Key Takeaways

- Essential for Interoperability: Token standards like ERC‑20, ERC‑721, and ERC‑1400 ensure seamless interaction across wallets, exchanges, and dApps

- Enables Fractional Ownership: Fungible tokens such as ERC‑20, SPL, and BEP‑20 allow high-value properties to be divided into smaller, tradeable shares

- Supports Regulatory Compliance: Security token standards like ERC‑1400 and ERC‑3643 embed KYC/AML, transfer restrictions, and accredited investor rules on-chain

- Protects Investor Rights: Standards define ownership, transferability, and voting rights, ensuring transparency and minimizing disputes

- Enhances Liquidity: Tokenized real estate can be traded on secondary markets, improving access and capital efficiency

- Flexible Asset Representation: Non-fungible and multi-token standards such as ERC‑721, ERC‑1155, and FA2 support unique properties or hybrid portfolios

- Global Adoption and Market Potential: Countries like the U.S., Switzerland, Singapore, and the UAE are adopting tokenization, signaling growth in digital real estate

Token standards for real estate tokenization are transforming the way properties are bought, sold, and managed. By defining how digital property assets are represented, transferred, and regulated on the blockchain, these standards enable fractional ownership, ensure compliance, and enhance liquidity. Nadcab Labs leverages these standards to create secure, efficient, and globally accessible real estate investment solutions, making property investment simpler and more inclusive than ever before.

Why Token Standards Matter for Property Investment

Token standards are the backbone of real estate tokenization, determining how digital property assets are represented, traded, and managed on the blockchain. Choosing the right standard is crucial because it directly impacts liquidity, compliance, interoperability, and investor trust.

1. Ensures Interoperability

Token standards for real estate tokenization like ERC-20, ERC-721, and ERC-1400 follow predefined rules, ensuring that tokens work seamlessly across wallets, exchanges, and decentralized applications (dApps). Without standardized protocols, property tokens could face compatibility issues, limiting investor access and reducing market efficiency.[1]

2. Enables Fractional Ownership

Fungible token standards such as ERC-20 allow a property to be divided into smaller units, making high-value real estate accessible to more investors. Standardized tokens ensure that each unit is identical and tradeable, creating liquidity in a traditionally illiquid market.

3. Supports Regulatory Compliance

Security token standards like ERC-1400 embed legal rules directly into the token, such as investor eligibility, transfer restrictions, and reporting requirements. This ensures that property investments meet local regulations, providing confidence to institutional and retail investors alike.

4. Protects Investor Rights

Token standards for real estate tokenization define ownership, transferability, and voting rights on-chain. For real estate, this ensures that investors have a clear, verifiable claim on the property or its income, minimizing disputes and increasing transparency.

5. Facilitates Market Growth

By using widely recognized token standards for real estate tokenization, can attract global investors, enable secondary market trading, and integrate with other DeFi protocols. This adoption accelerates property market liquidity and democratizes real estate investment.

In short: Token standards for real estate tokenization are not just technical specifications, they are essential enablers for secure, compliant, and scalable property investment in the digital age. Choosing the right standard determines how easily a property can be fractionalized, traded, and adopted in global markets.

Key Features of Real Estate Token Standards

Real estate token standards define how property assets are represented, traded, and managed on the blockchain. Understanding their key features is essential for investors and platforms to ensure secure, compliant, and liquid real estate investments.

1. Fungibility vs Non-Fungibility

- Fungible Tokens (ERC‑20):

Fungible tokens are identical and interchangeable, meaning each token represents the same value. For real estate, ERC‑20 tokens are commonly used to fractionalize property ownership, allowing multiple investors to hold shares of a single property. This creates liquidity and makes high-value properties more accessible to smaller investors. - Non-Fungible Tokens (ERC‑721, ERC‑1155):

Non-fungible tokens are unique and indivisible, representing distinct properties or units. ERC‑721 is widely used for tokenizing individual properties or digital deeds, preserving uniqueness while enabling secure transfer and ownership verification. This is crucial for legal clarity and property-specific rights.[2]

Why it matters: Choosing between fungible and non-fungible tokens depends on whether you want fractional investment or unique property representation.

2. Compliance and Regulatory Features

Token standards for real estate tokenization such as ERC‑1400 are designed to embed regulatory compliance directly into the token standards for real estate tokenization. Key features include:

- Whitelisting of approved investors

- Transfer restrictions based on jurisdiction or investor type

- Audit trails for legal and tax reporting

These features ensure that tokenized real estate investments adhere to local and international securities laws, reducing legal risk and attracting institutional investors.

Why it matters: Compliance features build trust and legitimacy in tokenized property markets, which is crucial for mainstream adoption.

3. Transferability and Liquidity

- Standardized tokens enable easy transfer between wallets, exchanges, or marketplaces, which is not possible in traditional real estate markets.

- Fungible tokens like ERC‑20 offer high liquidity, allowing investors to buy, sell, or trade fractional ownership quickly.

- Even non-fungible tokens (ERC‑721) can benefit from marketplaces that support NFT trading, making it easier to exchange individual property tokens without lengthy legal processes.

Why it matters: Transferability and liquidity transform real estate from a traditionally illiquid asset into a tradeable, investable digital asset, attracting a wider investor base and improving capital efficiency.

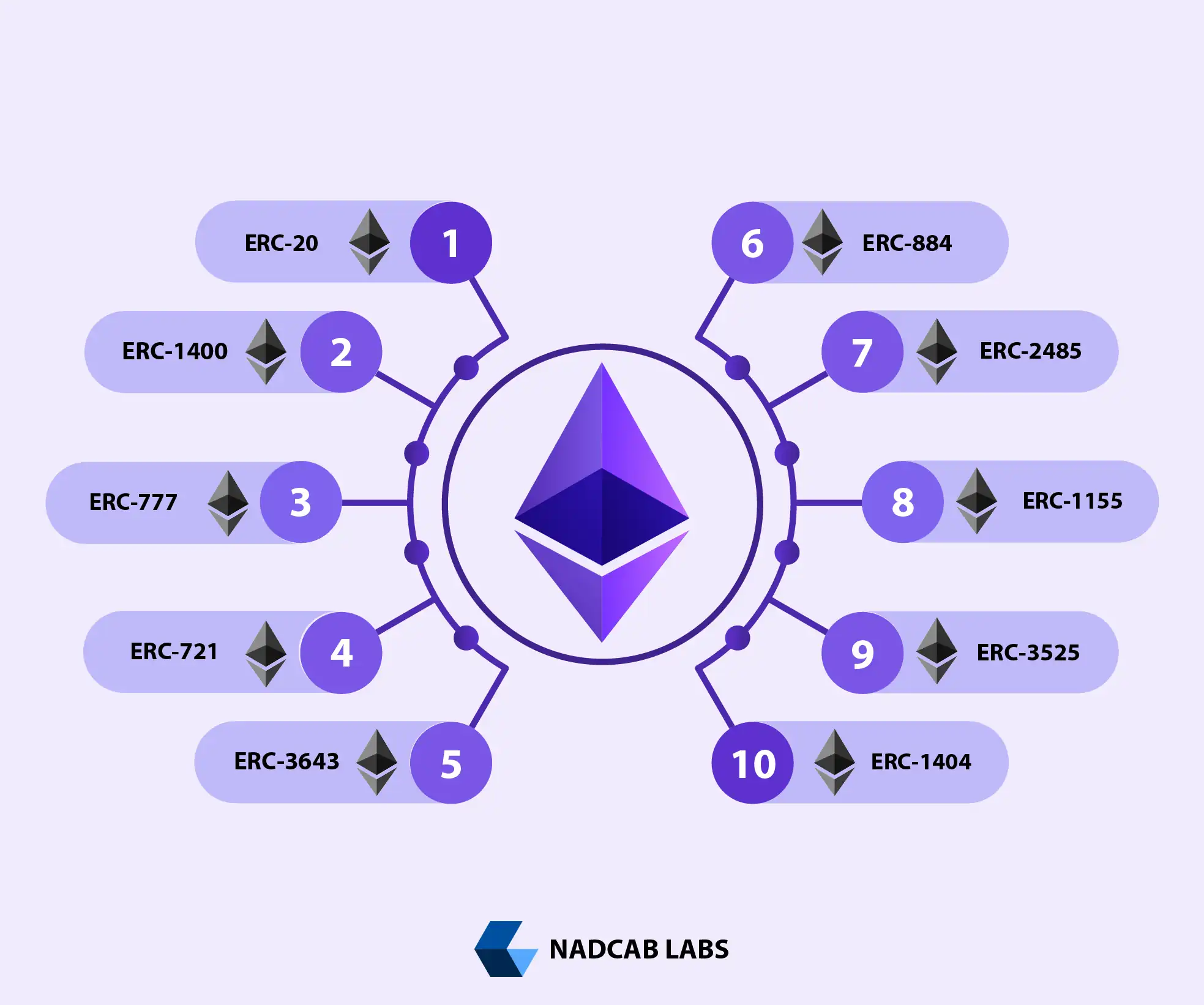

Most Commonly Used Token Standards for Real Estate Tokenization Every Investor Should Know

Token standards define how digital property assets are represented, transferred, and traded on the blockchain. Choosing the right token standard is crucial for investors and platforms to ensure liquidity, compliance, and efficiency. Here’s a detailed look at the most commonly used Token standards for real estate tokenization, including emerging ones:

1. ERC-20

- Type: Fungible Token

- Use Case: Fractional ownership of properties

- Why it matters: Allows investors to own divisible shares of a property, making high-value real estate accessible to smaller investors.

- User benefit: Easy to trade and highly liquid, ideal for global investors seeking fractional investments.

2. ERC-721

- Type: Non-Fungible Token (NFT)

- Use Case: Unique property representation

- Why it matters: Each token represents a single property or deed, preserving uniqueness and ownership rights.

- User benefit: Provides clear legal proof of property ownership on-chain, minimizing disputes.[4]

3. ERC-1155

- Type: Multi-Token (Fungible & Non-Fungible)

- Use Case: Mixed property portfolios

- Why it matters: Supports both fractionalized shares and unique property units within a single smart contract.

- User benefit: Reduces transaction costs and simplifies management of diverse property assets.

4. ERC-1400

- Type: Security Token Standard

- Use Case: Regulatory-compliant property tokens

- Why it matters: Built-in compliance features like investor whitelisting and transfer restrictions ensure legal adherence.

- User benefit: Institutional investors can safely participate, knowing all regulatory requirements are met.

5. ERC-3643 (T-REX)

- Type: Security Token for Regulated Assets

- Use Case: Fractionalized, compliant real estate

- Why it matters: Combines ERC-1400 features with advanced compliance tools for global property markets.

- User benefit: Enables legally safe and internationally accessible property investments.

6. ERC-3525

- Type: Semi-Fungible Token

- Use Case: Hybrid ownership models

- Why it matters: Supports property shares with unique attributes, combining fungible and non-fungible traits.

- User benefit: Perfect for complex investment structures where each investor holds distinct rights.

7. SPL Token (Solana)

- Type: Fungible Token

- Use Case: High-speed, low-cost property tokenization

- Why it matters: Solana’s blockchain allows fast transactions with low fees, suitable for high-volume trading.

- User benefit: Investors can quickly buy, sell, or trade property shares with minimal cost.

8. BEP-20 (Binance Smart Chain)

- Type: Fungible Token

- Use Case: Global fractional property investment

- Why it matters: BEP-20 tokens allow real estate projects to leverage Binance Smart Chain’s low fees and wide ecosystem.

- User benefit: Affordable and accessible property investment for users worldwide.

9. TRC-20 (Tron)

- Type: Fungible Token

- Use Case: Efficient property token trading

- Why it matters: Tron blockchain enables high throughput and low transaction fees, making property token trading faster.

- User benefit: Provides a smooth, cost-effective experience for retail and institutional investors.

10. FA2 (Tezos)

- Type: Multi-Asset Token (Fungible & Non-Fungible)

- Use Case: Tokenizing portfolios of properties

- Why it matters: FA2 standard allows both fungible shares and unique property tokens, suitable for real estate investment funds.

- User benefit: Flexible and secure token standard for both individual and collective property ownership.

11. ERC-777

- Type: Fungible Token

- Use Case: Advanced programmable property tokens

- Why it matters: Offers improved gas efficiency and additional smart contract features over ERC-20.

- User benefit: Enables more complex property token behaviors and faster transaction execution.

12. ERC-884

- Type: Fungible Token for Corporate Shares

- Use Case: Tokenizing property-owning entities

- Why it matters: Designed to represent shares in companies that hold real estate.

- User benefit: Legal clarity for investors buying company shares tied to real estate assets.

13. ERC-1404

- Type: Security Token Standard

- Use Case: Restricted transfer property tokens

- Why it matters: Simple compliance rules for limited transferability and regulatory adherence.

- User benefit: Minimizes legal risk for fractional property investors.

14. ERC-2485

- Type: Dividend-Paying Security Token

- Use Case: Property income distribution

- Why it matters: Supports on-chain dividend or rent payouts directly to token holders.

- User benefit: Provides automated income streams to fractional investors.

15. Polygon (MATIC) Tokens

- Type: ERC-Compatible Fungible/Non-Fungible Tokens

- Use Case: Low-fee property tokenization

- Why it matters: Polygon’s Layer-2 scaling reduces costs and transaction time.

- User benefit: Cheaper and faster property investment transactions.

16. Algorand ASA

- Type: Fungible & Non-Fungible Tokens

- Use Case: Real estate portfolios and fractionalized ownership

- Why it matters: High-speed transactions with secure and scalable blockchain architecture.

- User benefit: Reliable tokenized property investments for institutional and retail investors.

17. Cardano Native Tokens

- Type: Multi-Asset Tokens

- Use Case: Tokenized property investments

- Why it matters: Multi-asset support allows efficient handling of diverse property portfolios.

- User benefit: Flexible and energy-efficient blockchain for sustainable property investments.

18. Waves Token (WRC-20)

- Type: Fungible Token

- Use Case: Digital property projects

- Why it matters: Fast and scalable token issuance on the Waves blockchain.

- User benefit: Enables smooth trading of property-backed tokens.

19. Stellar Tokens (SRT)

- Type: Fungible Token

- Use Case: Fractionalized property ownership

- Why it matters: Stellar’s blockchain provides fast settlement and cross-border payments.

- User benefit: Efficient for global property investment and secondary market trading.

20. NEO NEP-5 / NEP-11

- Type: Fungible (NEP-5) & Non-Fungible (NEP-11) Tokens

- Use Case: Tokenized property and digital deeds

- Why it matters: Offers both fungible shares and unique property representation on NEO blockchain.

- User benefit: Supports diverse real estate investment models, including hybrid fractional ownership.

Choosing the Right Token Standard for Your Property

Selecting the right token standards for real estate tokenization is a critical decision for real estate tokenization. The chosen standard dictates how your property will be represented, traded, and regulated on the blockchain. It also affects investor trust, liquidity, and compliance with legal frameworks.

Factors to Consider

1. Fungibility

- Fungible tokens ERC-20 represent divisible shares of a property, allowing multiple investors to own fractional portions.

- Non-fungible tokens ERC-721 represent unique properties or individual units with distinct characteristics.

- Choosing the right type depends on whether you want fractional ownership or unique property representation.

2. Compliance

- Real estate often falls under securities regulations, especially when fractionalized.

- Security token standards for real estate tokenization like ERC-1400 and emerging frameworks (ERC-3643, ERC-6065) allow on-chain compliance, including transfer restrictions, whitelisting, and reporting obligations.

- Platforms must select a standard that aligns with local and international regulatory requirements to avoid legal risks.

3. Liquidity

- ERC-20 tokens are highly liquid and can be traded on secondary markets easily, which is essential for fractional real estate investments.

- Non-fungible standards (ERC-721) offer uniqueness but are less liquid, as each token standards for real estate tokenization represents a single property or unit.

- ERC-1155 can provide flexibility, handling both fungible and non-fungible assets efficiently, which may improve liquidity in mixed portfolios.

4. Platform Compatibility

- Ensure your token standards for real estate tokenization is supported by wallets, exchanges, and DeFi protocols you intend to integrate.

- Using widely adopted standards like ERC-20, ERC-721, or ERC-1400 ensures broad interoperability, reducing integration complexity.

Platforms Using Different Token Standards

| Platform / Company | Token Standard | Use Case | Key Feature |

|---|---|---|---|

| Red Swan | ERC-1400 | Institutional real estate | Security token compliance and fractional ownership |

| Slice | ERC-20 | Fractionalized high-value properties | High liquidity and easy transferability |

| Reido | ERC-721 | Unique residential/commercial units | Non-fungible, representing individual property titles |

| Propy | ERC-721 + ERC-20 | Global property sales | Combines unique title representation with fractional investment options |

| RealT | ERC-20 | US-based rental properties | Simplified fractional ownership and secondary market trading |

| Harbor | ERC-1400 | Commercial real estate | Compliance-focused security tokens for institutional investors |

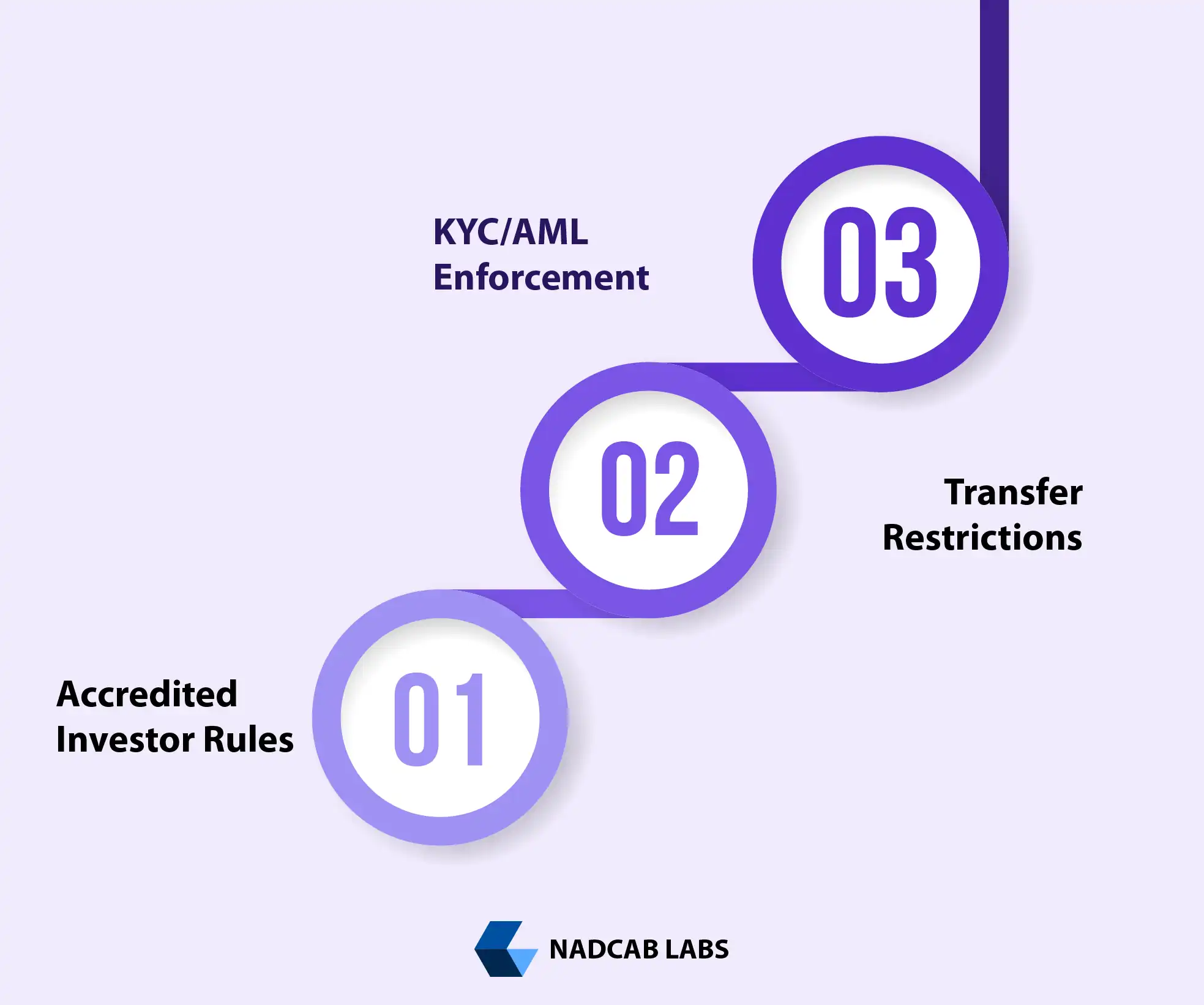

Regulatory Compliance Embedded in Token Standards

When it comes to token standards for real estate tokenization, regulatory compliance is a crucial factor. Unlike traditional real estate transactions, tokenized properties are digital assets tokenization that must adhere to legal frameworks to protect investors and maintain market integrity. Modern token standards for real estate tokenization, especially security token standards like ERC‑1400, are designed with built-in compliance features to ensure that all regulatory requirements are automatically enforced on-chain.

KYC/AML Enforcement

Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures are essential for real estate tokenization. Token standards for real estate tokenization can embed automated KYC/AML checks directly into smart contracts. This ensures that only verified investors can participate in tokenized property offerings, preventing fraudulent or illicit transactions. For example, an ERC‑1400 token can restrict transfers to crypto wallets that have passed KYC verification.

Transfer Restrictions

Another key compliance feature is transfer restrictions. Real estate regulations often dictate who can buy or sell property shares, and token standards for real estate tokenization can enforce these rules programmatically. Tokens can be coded to allow transfers only between authorized investors or during specific trading windows, ensuring compliance with local securities laws. This reduces legal risk for both the issuer and the investor.

Accredited Investor Rules

Many tokenized real estate offerings are classified as securities, which means only accredited or qualified investors can participate. Token standards like ERC‑1400 allow smart contracts to automatically check investor eligibility before enabling token transfers. This ensures that all participants meet legal requirements, protecting both the platform and investors while maintaining market integrity.

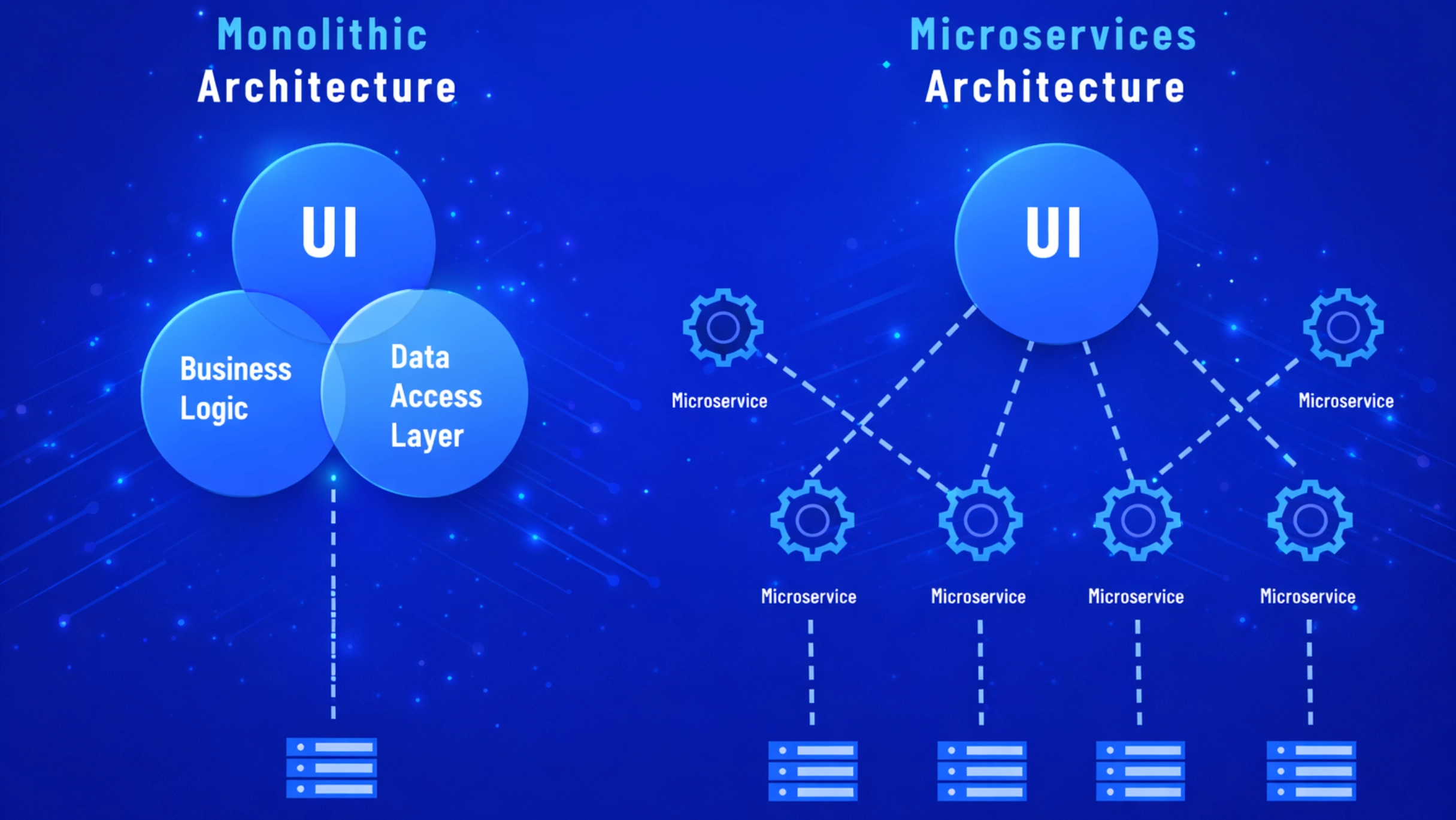

Technical Architecture Behind Real Estate Tokens

The backbone of token standards for real estate tokenization lies in their technical architecture, which ensures security, compliance, and interoperability. Understanding how these tokens are structured helps investors and platforms implement efficient and legally compliant tokenized property solutions.

1. Blockchain Layer

Token standards for real estate tokenization are built on top of blockchain networks such as Ethereum, Binance Smart Chain, or Solana. The blockchain layer provides:

- Decentralization: No single entity controls the token ledger.

- Transparency: All transactions are publicly verifiable.

- Immutability: Ownership records cannot be tampered with.

ERC‑20, ERC‑721, ERC‑1400, and other token standards for real estate tokenization are smart contracts deployed on these blockchains, defining the rules and behavior of each token.

2. Smart Contract Layer

Smart contracts define how real estate tokens operate. Key functionalities include:

- Token issuance and minting: Creating fractional ownership or unique property tokens.

- Transfer rules: Enforcing transfer restrictions for compliance (e.g., accredited investor rules).

- Dividend and revenue distribution: Automatically distributing rent or property income to token holders.

- Burning or redemption: Removing tokens when an investment is liquidated or property is sold.

Security token standards for real estate tokenization like ERC‑1400 embed KYC/AML checks and regulatory compliance directly into smart contracts, making them critical for institutional-grade real estate offerings.

3. Metadata and Off-Chain Data

Tokenized real estate often requires additional data stored off-chain to keep blockchain storage efficient. Examples include:

- Property details: Location, size, and legal documents.

- Ownership agreements: Contracts and compliance documents.

- Valuation data: Appraisals, market rates, and investment performance.

Off-chain data is often linked to the token via hashes or URIs, ensuring integrity and easy verification by investors and regulators.

4. Integration Layer (Wallets and Marketplaces)

Tokens interact with:

- Digital wallets: For holding, sending, and receiving tokens.

- Exchanges or secondary markets: Where tokens can be traded, rented, or sold.

- DeFi platforms: For lending, staking, or liquidity provision, expanding the usability of token standards for real estate tokenization.

Proper architecture ensures interoperability across wallets, exchanges, and regulatory platforms.

5. Security and Compliance Layer

Token standards enforce:

- Access control: Only authorized wallets can hold or transfer tokens.

- Audit trails: Every transaction is logged and verifiable.

- Regulatory compliance: Embedded KYC/AML, transfer restrictions, and accredited investor checks ensure the tokenized real estate remains legally compliant.

Complete Token Lifecycle in Real Estate from Minting to Trading and Burning

Understanding the token lifecycle is essential when exploring token standards for real estate tokenization, as it defines how property tokens are created, used, and eventually retired. The lifecycle ensures transparency, security, and compliance throughout the investment process.

1. Minting – Creating Property Tokens

Minting is the process of creating new tokens that represent a real estate asset. Depending on the chosen token standards for real estate tokenization:

- ERC‑20 tokens can represent fractional ownership of a property, allowing multiple investors to hold divisible shares.

- ERC‑721 tokens can represent unique property units or digital deeds, each token corresponding to a distinct asset.

- ERC‑1400 tokens enable compliance-aware token issuance, embedding KYC/AML checks and transfer restrictions from the moment tokens are created.

Minting is executed through smart contracts, which automatically define the token’s properties, ownership rules, and compliance features. This step is critical to ensuring that tokens accurately reflect legal property ownership.

2. Trading – Secondary Market Functionality

Once minted, real estate tokens can be traded on secondary markets, providing liquidity that traditional real estate lacks. Key points include:

- ERC‑20 tokens are ideal for high-liquidity trading of fractional shares.

- ERC‑721 tokens are traded individually, representing full ownership of a unique property unit.

- ERC‑1400 tokens enforce transfer restrictions, ensuring only compliant investors can participate.

Secondary trading allows investors to buy, sell, or exchange tokens efficiently, creating a dynamic real estate investment ecosystem and expanding access to global investors.[14]

3. Burning – Retiring Tokens After Property Sale

Burning is the process of retiring tokens once the underlying property is sold or the investment is liquidated. Key aspects include:

- Ensures the total token supply accurately reflects the current ownership structure.

- Prevents fraudulent or duplicate claims on sold properties.

- Can trigger automated smart contract actions, such as distributing sale proceeds to token holders.

By integrating burning into the token lifecycle, platforms maintain trust, transparency, and regulatory compliance across the investment journey.

| Stage | Description | Token Standards Used | Key Features / Benefits |

|---|---|---|---|

| Minting | Creating new tokens that represent a real estate asset | ERC‑20, ERC‑721, ERC‑1400 | – ERC‑20 – Fractional ownership – ERC‑721 – Unique property units – ERC‑1400 – Compliance-aware issuance – Digital contracts define ownership, rules, and compliance |

| Trading | Secondary market functionality for buying, selling, or exchanging tokens | ERC‑20, ERC‑721, ERC‑1400 | – ERC‑20 – High-liquidity fractional shares – ERC‑721 – Individual unique property trading – ERC‑1400 – Transfer restrictions for compliant investors – Provides liquidity and access to global investors |

| Burning | Retiring tokens after property sale or investment liquidation | ERC‑20, ERC‑721, ERC‑1400 | – Ensures accurate token supply – Prevents duplicate claims – Automates distribution of sale proceeds – Maintains transparency and regulatory compliance |

Emerging Market Trends and Investment Potential in Real Estate Tokenization

The adoption of token standards for real estate tokenization is reshaping how investors access and participate in the property market. Over the past few years, tokenization has gained traction globally, driven by blockchain tech ability to fractionalize property ownership, enhance liquidity, and provide transparency.

Launch a Compliant Real Estate Tokenization Platform!

Build a compliant real estate tokenization platform with expert guidance. Talk to our blockchain specialists today.

Growing Market Adoption

Real estate tokenization is no longer experimental. Platforms around the world are embracing ERC‑20, ERC‑721, and ERC‑1400 standards to create tokenized property funds, individual property tokens, and security tokens. According to a FasterCapital report [15] the tokenized real estate market is projected to reach billions in value by 2026, signaling strong investor interest and growing institutional adoption.

Investor Accessibility and Fractional Ownership

Token standards for real estate tokenization such as ERC‑20 allow properties to be divided into fractional shares, enabling investors to participate with smaller capital. This democratizes access to high-value real estate, attracting retail investors who were previously excluded from commercial property investments. At the same time, ERC‑721 and ERC‑1400 support unique property tokens and compliant security tokens, appealing to institutional investors seeking regulated and verifiable ownership.

Liquidity and Secondary Market Growth

One of the most significant advantages of tokenized real estate is enhanced liquidity. Traditional real estate investments are typically illiquid, requiring months to sell or transfer. Token standards for real estate tokenization enable secondary market trading of real estate tokens on compliant exchanges, allowing investors to buy, sell, or trade property shares quickly and efficiently. This creates a more dynamic investment ecosystem and encourages participation from both small and large investors.

Global Trends and Emerging Markets

Markets in the U.S., Europe, and Asia are seeing early adoption, with countries like Switzerland, Singapore, and the UAE introducing favorable regulations for security tokens. Emerging markets are also exploring tokenization to attract international capital and increase transparency in property ownership. This global interest indicates a strong upward trend in tokenized real estate investments.

The Impact of Token Standards for Real Estate Tokenization on Investor Confidence

As real estate embraces the blockchain revolution, token standards for real estate tokenization play a critical role in ensuring security, compliance, and investor confidence. Platforms like Nadcab Labs are at the forefront, offering tokenized solutions that unlock liquidity, broaden access, and facilitate seamless trading. By choosing the right token standards, investors can confidently participate in a dynamic and regulated digital property market.

People Also Ask

Token standards for real estate tokenization like ERC‑20 and ERC‑1400 define transferability rules and fractional ownership, enabling secondary market trading. This significantly increases liquidity, allowing investors to buy, sell, or exchange property tokens faster than traditional real estate methods.

Yes. ERC‑20 tokens can be integrated with smart contracts that distribute rental income or dividends automatically to token holders, ensuring real-time revenue sharing without manual intervention, enhancing transparency and efficiency for investors.

ERC‑1400 embeds KYC/AML checks, transfer restrictions, and accredited investor rules into smart contracts. This ensures tokenized property offerings comply with local and international securities regulations, protecting issuers and investors from legal risks in cross-border transactions.

ERC‑721 tokens represent unique properties, but managing large portfolios individually can be complex. Combining ERC‑721 with ERC‑20 or using multi-token standards like ERC‑1155 allows hybrid portfolios, simplifying asset management while preserving uniqueness.

Security token standards for real estate tokenization enforce smart contract rules that restrict transfers to whitelisted wallets or approved investors. This prevents unauthorized trading, ensures regulatory compliance, and maintains the integrity of the tokenized real estate ecosystem.

Yes. Fungible and compliant tokens (ERC‑20, ERC‑1400) can be integrated into DeFi platforms, enabling investors to use property tokens as collateral for loans, unlocking liquidity while retaining ownership of the underlying asset.

ERC‑3525 allows hybrid ownership models with distinct attributes per investor, ideal for joint ventures or fractional ownership with customized rights. This flexibility simplifies governance and revenue distribution while maintaining compliance and transparency.

Property details, legal documents, and appraisals are stored off-chain for efficiency. Tokens link to this data via URIs or hashes, ensuring verifiable ownership, compliance, and easy access for investors, auditors, and regulators without bloating the blockchain.

ERC‑3643 enhances ERC‑1400 with advanced compliance tools and flexible transfer rules, enabling international investors to safely participate in tokenized property offerings while adhering to jurisdiction-specific regulations, making global real estate investment more accessible.

Standards dictate transferability, fractionalization, and legal compliance. ERC‑20 tokens facilitate high-liquidity secondary trading, while ERC‑721 supports unique property sales. Properly designed standards allow seamless global trading while maintaining investor protection and regulatory adherence.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.