Key Takeaways

- Hiring the right crypto exchange developers determines your platform’s security, performance, and long-term success, making thorough vetting essential before any engagement.

- Ask crypto exchange experts about their specific experience with centralized, decentralized, and white-label exchanges to ensure alignment with your project requirements.

- Security questions should cover wallet architecture, encryption standards, penetration testing, and the team’s track record with blockchain exchange specialists protecting user assets.

- Evaluate the cryptocurrency exchange team’s matching engine capabilities, ensuring they can deliver high TPS performance and handle heavy trading volumes during market volatility.

- Understanding crypto exchange services scope, including spot, margin, derivatives, and advanced trading features, prevents scope creep and budget overruns during the project.

- A reliable crypto exchange solution provider offers transparent pricing, clear milestones, and regular communication throughout the project lifecycle.

- Post-launch support from exchange software experts is critical for ongoing security updates, performance optimization, and feature enhancements as your platform scales.

- Choosing digital asset exchange professionals with proven track records and enterprise experience significantly reduces project risks and increases success probability.

Selecting the right team to build your cryptocurrency exchange represents one of the most consequential decisions in your project’s lifecycle. The difference between a secure, scalable platform and a vulnerable, underperforming one often comes down to asking the right questions before signing any contract. This guide provides the essential questions every exchange founder should ask when evaluating potential partners.

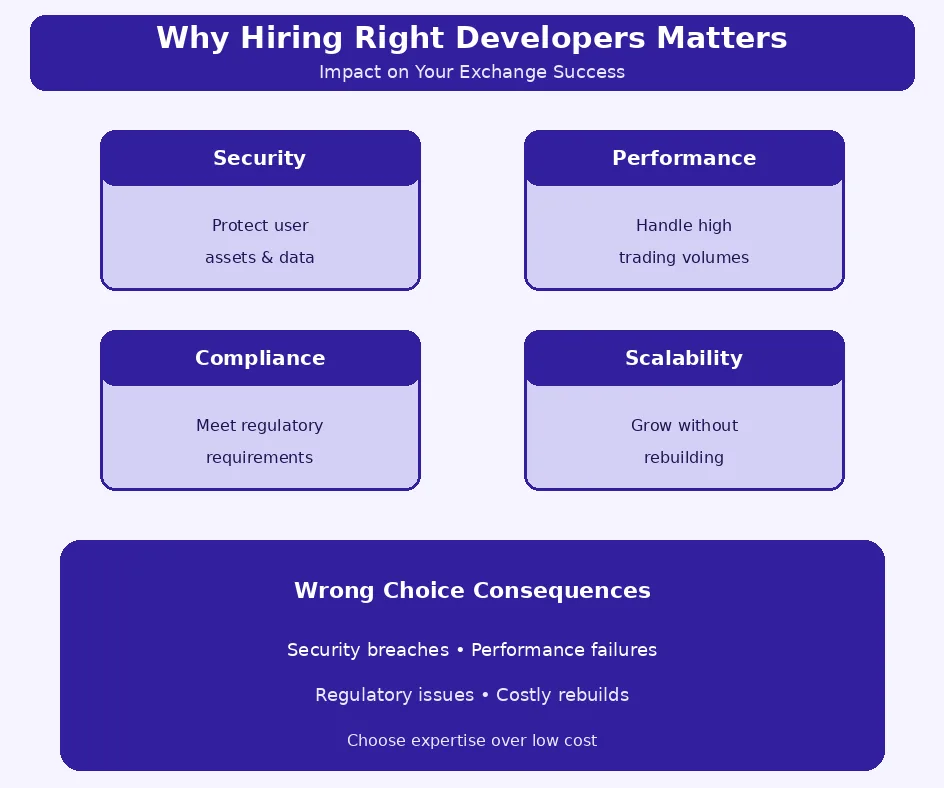

Why Hiring the Right Crypto Exchange Developers Matters

The decision to hire crypto exchange developers shapes every aspect of your platform’s future. From security architecture to user experience, from regulatory compliance to scalability, your chosen team’s expertise directly determines outcomes. Poor choices at this stage have caused numerous exchange failures, while strategic selections have built industry-leading platforms.

Role of Crypto Exchange Experts in Secure Trading Platforms

Crypto exchange experts bring specialized knowledge that general software teams simply cannot match. They understand the unique security requirements of handling digital assets, the performance demands of real-time trading, and the regulatory landscape that governs cryptocurrency platforms. Working with specialized exchange teams ensures your platform benefits from accumulated industry experience.

Their expertise spans technical implementation and business understanding. They know what features traders expect, what security measures regulators require, and what architecture choices enable future growth. This comprehensive perspective prevents costly mistakes that plague exchanges built by teams lacking specific crypto experience.

How the Right Exchange Team Impacts Performance and Scalability

Performance and scalability requirements for cryptocurrency exchanges exceed typical software applications. Trading platforms must handle thousands of transactions per second, maintain sub-millisecond latency, and scale dynamically during market volatility. Only teams with specific exchange experience understand these demands and can architect solutions accordingly.

The right cryptocurrency exchange team builds with growth in mind, implementing architectures that scale horizontally and optimize continuously. Their experience prevents the common scenario where exchanges succeed initially but fail when trading volumes increase, unable to handle success because infrastructure was not designed for scale.

Selection Principle: The cheapest option is rarely the best choice for crypto exchange creation. Security breaches, performance failures, and regulatory issues cost far more than the initial savings from budget providers. Invest in expertise to protect your long-term success.

Questions to Ask About Crypto Exchange Experience

Experience questions reveal whether potential partners truly understand cryptocurrency exchange creation or are generalizing from unrelated software projects. Specific, detailed responses indicate genuine expertise, while vague answers suggest limited actual experience.

What Type of Crypto Exchanges Have You Worked On?

This question establishes baseline experience and specialization areas. Different exchange types require distinct expertise, and teams strong in one area may lack proficiency in others. Understanding their specific experience helps assess fit for your project requirements.

Centralized and Decentralized Exchange Expertise

Centralized exchange (CEX) expertise involves traditional order book systems, custodial wallet management, and regulatory compliance infrastructure. Decentralized exchange (DEX) expertise requires smart contract proficiency, AMM mechanisms, and blockchain-native security approaches. Some projects require hybrid approaches combining elements of both.

Ask for specific examples of each type they have built, including trading volumes handled, security records, and any regulatory approvals obtained. Reviewing comprehensive platform guides helps you understand what questions to probe deeper.

Experience With White Label Crypto Exchange Solutions

White label experience indicates efficiency in delivering proven solutions quickly. Teams offering white label options have refined their platforms through multiple deployments, identifying and resolving issues that custom builds might encounter. This experience accelerates your time-to-market while reducing risk.

Do You Have a Dedicated Cryptocurrency Exchange Team?

Dedicated teams focus exclusively on exchange projects, developing deep expertise through concentrated experience. Shared teams dividing attention across different project types may lack the specialized knowledge that exchange creation demands.

Blockchain Exchange Specialists vs General Software Experts

Blockchain exchange specialists understand cryptocurrency-specific challenges including consensus mechanisms, wallet security, gas optimization, and DeFi integrations. General software experts may build functional systems but miss critical nuances that affect security, performance, and user experience in crypto contexts.

Ask about team composition, individual backgrounds, and how long members have focused specifically on exchange projects. Teams with stable, experienced membership deliver better results than those with high turnover or recent pivots into crypto.

Specialist vs Generalist Team Comparison

| Factor | Exchange Specialists | General Software Teams |

|---|---|---|

| Security Knowledge | Deep crypto-specific expertise | General security practices |

| Compliance Understanding | KYC/AML implementation experience | Learning curve required |

| Performance Optimization | Trading-specific optimizations | Generic performance tuning |

| Risk Awareness | Knows exchange-specific risks | May miss critical vulnerabilities |

| Time to Market | Faster with proven patterns | Longer learning period |

Questions Related to Crypto Exchange Security

Security questions are non-negotiable when evaluating crypto trading platform experts. Exchanges handle real financial assets, making security architecture the most critical evaluation area. Inadequate security has destroyed numerous exchanges and caused massive user losses.

How Do You Ensure Crypto Exchange Security?

Listen for comprehensive answers covering multiple security layers. Strong teams describe defense-in-depth strategies rather than single solutions. They should articulate specific measures for wallet security, API protection, database encryption, and infrastructure hardening.

Secure Crypto Trading Platform Architecture

Secure architecture includes air-gapped cold storage, multi-signature requirements, hardware security modules (HSMs), and comprehensive access controls. Ask how they separate hot and cold wallet systems, what percentage of assets remain in cold storage, and how signing authority is distributed to prevent single points of compromise.

Exchange Risk Management Practices

Risk management practices should include penetration testing schedules, bug bounty programs, incident response plans, and security audit procedures. Ask about their track record with security incidents, how they have responded to vulnerabilities, and what third-party auditors they work with regularly.

What Is Your Approach to KYC AML for Crypto Exchange?

Regulatory compliance questions reveal whether teams understand the evolving legal landscape. Building crypto exchanges requires compliance infrastructure that satisfies requirements across target jurisdictions while maintaining user experience.

Crypto Exchange Compliance Standards

Compliance standards include identity verification integrations, transaction monitoring systems, suspicious activity reporting, and record-keeping requirements. Ask about their experience with specific compliance providers, their approach to tiered verification levels, and how they handle compliance updates when regulations change.

Regulatory Readiness for Global Markets

Global market readiness requires understanding different jurisdictional requirements. Teams should demonstrate familiarity with regulations in your target markets and ability to implement geo-specific compliance measures. This expertise ensures your exchange can operate legally where you intend to serve users.

Questions About Technology and Exchange Architecture

Technology questions assess whether teams can deliver the performance your exchange requires. Trading platforms demand exceptional technical capabilities that separate exchange software experts from general application creators.

What Matching Engine for Crypto Exchange Do You Use?

The matching engine forms the core of any trading platform. Ask whether they use proprietary engines, licensed solutions, or build custom implementations. Understand their experience with different engine architectures and performance characteristics under various load conditions.

High TPS Crypto Exchange Capabilities

Transactions per second (TPS) capabilities determine how your exchange handles peak trading periods. Ask for specific metrics from previous projects, including maximum tested TPS, average latency, and performance during market volatility events. Exchanges that cannot scale during high-volume periods lose users and revenue.

Performance Optimization for Heavy Trading Volume

Performance optimization involves caching strategies, database tuning, load balancing, and code efficiency. Ask how they approach performance testing, what optimization techniques they employ, and how they have handled situations where exchanges they built experienced unexpected traffic spikes.

How Do You Handle Crypto Exchange Liquidity Solutions?

Liquidity determines user experience on trading platforms. Exchanges without sufficient liquidity suffer from poor fills, wide spreads, and user abandonment. Understanding how teams approach liquidity challenges reveals their comprehensive platform thinking.

Liquidity Management for New Exchanges

New exchange liquidity management includes market maker integrations, liquidity pool connections, and bootstrap strategies. Ask about their experience launching exchanges from zero liquidity, what partnerships they can facilitate, and how they have helped previous clients achieve trading activity sufficient for user retention.

Integration With External Liquidity Providers

External liquidity provider integration connects your exchange to broader market liquidity. Ask about their experience with specific providers, aggregation approaches, and how they handle the technical complexity of real-time liquidity connections while maintaining platform performance.

Exchange Creation Evaluation Lifecycle

| Phase | Stage | Key Questions | Red Flags |

|---|---|---|---|

| 1 | Initial Screening | Portfolio, experience, team size | No verifiable projects |

| 2 | Technical Assessment | Architecture, security, performance | Vague technical answers |

| 3 | Reference Checks | Client satisfaction, support quality | No references available |

| 4 | Proposal Review | Scope, pricing, timeline | Unrealistic promises |

| 5 | Contract Negotiation | Terms, IP rights, support | Resistance to clear terms |

| 6 | Pilot/POC | Working relationship, quality | Poor communication |

Questions on Features and Trading Capabilities

Feature questions ensure your exchange includes capabilities that match market expectations and competitive requirements. Crypto exchange services scope determines what traders can do on your platform and how it compares to alternatives.

What Crypto Exchange Services Are Included?

Service scope varies significantly between providers. Some offer basic spot trading only, while others include comprehensive suites covering multiple trading types, wallet services, and ancillary features. Clarify exactly what is included to avoid surprise gaps or additional costs.

Spot, Margin, and Derivatives Trading Support

Different trading types require distinct technical implementations. Spot trading is foundational, margin trading adds lending and liquidation systems, and derivatives require sophisticated risk engines. Ask about experience with each type and how they approach the additional complexity of leveraged products.

Can You Support Advanced Trading Features?

Advanced features differentiate competitive exchanges from basic platforms. Understanding what advanced capabilities teams can deliver helps ensure your exchange can serve sophisticated traders and institutional participants.

Automated Trading and Order Management

Automated trading support includes API access for algorithmic traders, webhook integrations, and order types beyond basic market and limit orders. Ask about their experience implementing stop-loss, take-profit, OCO (one-cancels-other), and other advanced order types that professional traders expect.

Secure Wallet and Digital Asset Handling

Wallet expertise spans multiple blockchain networks, secure key management, and asset reconciliation. Digital asset exchange professionals understand the nuances of different blockchain architectures and can implement wallets that balance security with operational efficiency.

Questions About Cost, Timeline, and Transparency

Cost and timeline questions establish realistic expectations and protect against budget overruns. Transparency in these areas indicates professional operations and reduces project risks.

How Is Crypto Exchange Cost Estimation Done?

Cost estimation approaches reveal how thoroughly teams understand project scope. Detailed estimates based on feature breakdowns indicate experience, while round-number quotes without justification suggest guesswork that leads to scope creep and additional charges.

Feature-Based Pricing Structure

Feature-based pricing clarifies what each component costs, enabling informed decisions about prioritization and phasing. Ask for itemized quotes that show individual feature costs, allowing you to make trade-offs based on budget constraints and launch priorities.

Scalability and Future Expansion Costs

Future expansion costs matter as much as initial builds. Ask how their architecture affects scaling costs, what adding new features typically costs, and whether there are lock-in factors that increase future expenses. Planning for growth from the start prevents expensive rearchitecture later.

What Level of Transparency Can We Expect?

Transparency expectations establish working relationship norms. Understanding communication frequency, progress visibility, and issue escalation processes before engagement prevents frustration during project execution.

Communication With Crypto Exchange Experts

Communication practices should include regular status updates, accessible project managers, and clear escalation paths. Ask about their communication tools, update frequency, and how they handle questions or concerns that arise during the project.

Project Milestones and Delivery Planning

Milestone-based delivery provides visibility into progress and enables course correction if needed. Ask how they structure milestones, what deliverables mark each phase, and how they handle situations where milestones are at risk of being missed.

Critical Warning: Unrealistically low quotes or extremely fast timelines often indicate teams that will cut corners on security, skip proper testing, or demand significant additional payments mid-project. Quality exchange creation requires adequate investment in time and resources.

Questions About Post-Launch Exchange Support

Post-launch support separates professional partners from one-time project vendors. Exchanges require ongoing attention for security, performance, and feature evolution. Teams without strong support capabilities leave you vulnerable after launch.

Do You Offer Post-Launch Exchange Support?

Support offerings should include clear SLAs defining response times, coverage hours, and escalation procedures. Ask about their support team structure, whether dedicated personnel handle your account, and how they prioritize issues affecting live trading.

Performance Monitoring and Security Updates

Proactive monitoring catches issues before they affect users. Ask about their monitoring tools, alerting thresholds, and response procedures for performance degradation or security alerts. Security updates should be continuous, not reactive to incidents.

Platform Optimization and Feature Enhancements

Ongoing optimization improves platform performance as usage patterns emerge. Feature enhancement capabilities enable competitive evolution without changing vendors. Ask about their typical engagement model for post-launch enhancements and how they structure ongoing improvement projects.

Partner Selection Criteria

When evaluating crypto exchange creators, prioritize these factors:

- Verifiable Experience: Launched exchanges you can reference

- Security Track Record: No major breaches, regular audits

- Technical Depth: Specific, detailed technical responses

- Compliance Knowledge: Understanding of regulatory requirements

- Communication Quality: Responsive, clear, professional

- Support Commitment: Strong post-launch support offerings

How to Identify a Trusted Crypto Exchange Company

Identifying trustworthy partners requires looking beyond marketing claims to verify actual capabilities. Trusted crypto exchange solution providers demonstrate their expertise through verifiable achievements rather than just promises.

Hire Expert Crypto Exchange Developers | Secure Trading Platform

As a trusted crypto exchange company, we help you choose the right exchange developers by asking the most important questions for security and scalability.

Launch Your Exchange Now

What Makes a Reliable Crypto Exchange Solution Provider?

Reliability indicators include consistent delivery history, transparent operations, stable team composition, and willingness to provide references. Reliable providers do not oversell capabilities or underestimate challenges, instead offering realistic assessments that build trust.

Proven Track Record and Client Success

Track record verification includes speaking with previous clients, examining launched exchanges, and researching any public information about their work. Success means not just project completion but ongoing platform operation without major incidents.

Enterprise Crypto Exchange Solutions Expertise

Enterprise expertise indicates ability to handle complex requirements, scale challenges, and professional expectations. Teams with enterprise experience understand the rigorous standards that serious exchange projects demand. Working with experienced exchange professionals provides access to this level of expertise.

Engagement Model Comparison

| Factor | Established Provider | Freelancer/Small Team |

|---|---|---|

| Accountability | Company reputation at stake | Individual accountability only |

| Team Depth | Multiple specialists available | Limited expertise coverage |

| Continuity Risk | Low, business continues | High if person leaves |

| Support Capability | Structured support systems | Ad-hoc availability |

| Initial Cost | Higher upfront investment | Lower initial quotes |

Final Checklist

Before finalizing your decision to hire crypto exchange developers, ensure you have satisfactory answers to these essential questions. Building crypto exchanges requires careful partner selection that this checklist helps ensure.

Essential Questions Checklist

- ✓ Have they built exchanges similar to what you need?

- ✓ Can they provide verifiable references from past clients?

- ✓ Is their security approach comprehensive and audited?

- ✓ Do they understand your target market regulations?

- ✓ Can their matching engine handle your performance requirements?

- ✓ Is the pricing transparent with itemized breakdowns?

- ✓ Do they offer robust post-launch support?

- ✓ Is their communication responsive and professional?

- ✓ Can they scale with your growth plans?

- ✓ Do you feel confident in their long-term viability?

Thorough vetting using these questions significantly increases your probability of successful partnership. The investment in proper evaluation prevents far greater costs from failed projects, security incidents, or inadequate platforms that require replacement.

Frequently Asked Questions

When hiring crypto exchange developers, look for proven experience with both centralized and decentralized exchanges, strong security expertise, understanding of regulatory compliance (KYC/AML), and a portfolio of successfully launched platforms. Technical capabilities should include matching engine expertise, wallet integration experience, and scalable architecture knowledge. Communication skills and post-launch support offerings are equally important.

Crypto exchange creation costs vary significantly based on features, security requirements, and team expertise. Basic exchanges may cost $50,000-$150,000, while enterprise-grade platforms with advanced features can exceed $300,000-$500,000. Factors affecting cost include exchange type (CEX vs DEX), trading features (spot, margin, derivatives), security infrastructure, and compliance requirements for target markets.

Key security questions include their approach to hot/cold wallet architecture, multi-signature implementations, encryption standards, DDoS protection, penetration testing practices, and security audit processes. Ask about their experience handling security incidents, their approach to key management, and whether they follow industry security standards. Understanding their track record with zero security breaches is crucial.

Building a crypto exchange typically takes 4-18 months depending on complexity. White-label solutions can launch in 2-4 months, while custom exchanges require 8-18 months for full creation. Timeline depends on features, security requirements, compliance integration, and testing depth. Rush timelines often compromise security, so realistic scheduling is essential for quality platforms.

For crypto exchanges, dedicated teams from established companies offer significant advantages over freelancers including coordinated expertise, accountability, security protocols, and long-term support. Freelancers may seem cost-effective initially but often lack the comprehensive skills, security practices, and reliability needed for financial platforms. The risk of security vulnerabilities and project abandonment is higher with freelancers

Ideal crypto exchange developers should have experience building at least 3-5 exchange platforms, deep blockchain expertise across multiple networks, security architecture background, understanding of financial trading systems, and compliance implementation experience. Look for teams with experience in your target exchange type (CEX, DEX, or hybrid) and familiarity with regulations in your target markets.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.