Token smart contracts represent the foundational infrastructure powering digital assets on blockchain networks, enabling automated token creation, management, and transfers without intermediaries. As blockchain token adoption accelerates across industries, understanding token smart contract architecture and functionality becomes essential for developers, businesses, and investors. This comprehensive guide explores what token smart contracts are, their core components, implementation processes, and how they enable the growing crypto market size through programmable digital assets.

Key Takeaways

- Definition: Token smart contracts are self-executing programs on blockchains that maintain ledgers for digital assets with embedded logic ensuring integrity and automated operations.

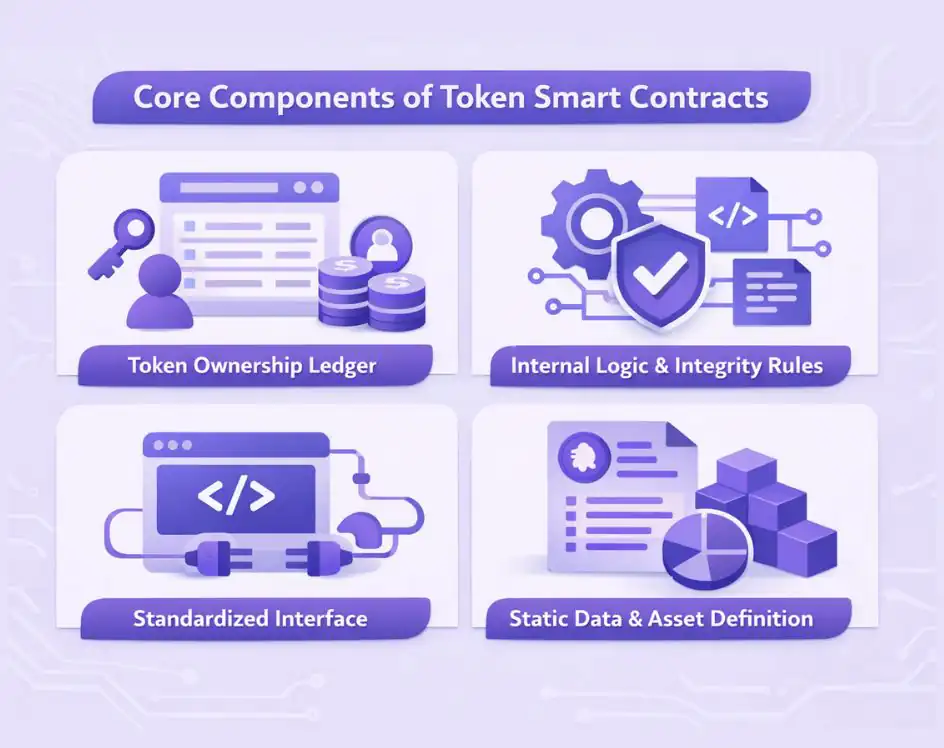

- Core Components: Every token smart contract includes four elements—ownership ledger, internal logic, interface, and static data defining asset characteristics.

- Trust-Minimized: Execution occurs in decentralized environments rather than centralized servers, eliminating single points of control and enhancing security.

- Standardization: Token standards like ERC-20, ERC-721, and ERC-1155 enable interoperability across wallets, exchanges, and DeFi protocols.

- Token Types: Smart contracts support fungible tokens, non-fungible tokens (NFTs), utility tokens, security tokens, and governance tokens with customized logic.

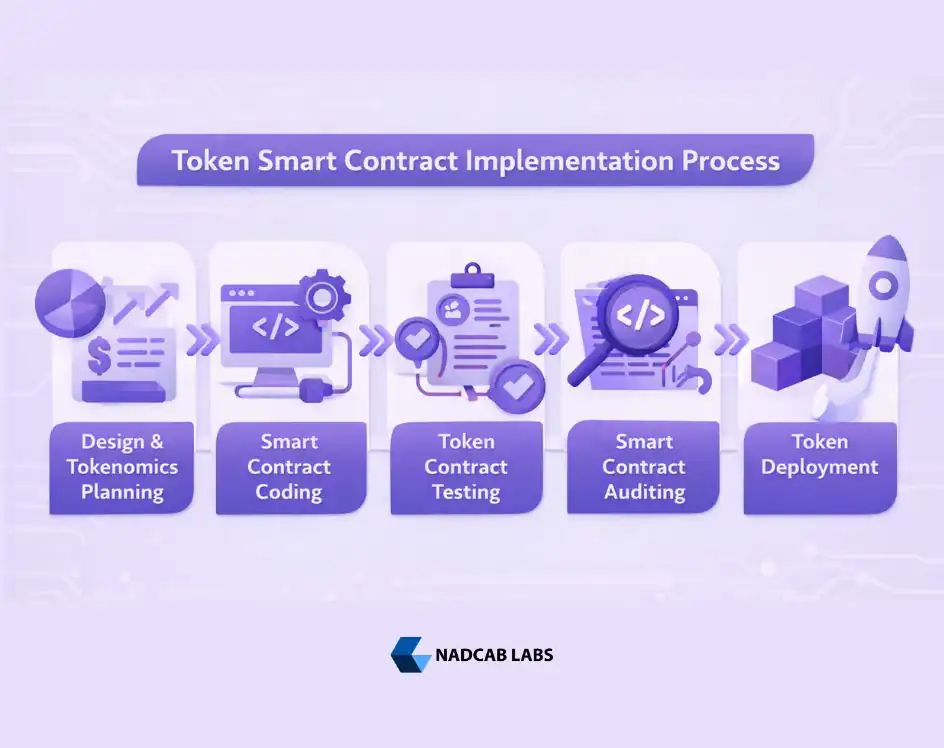

- Development Process: Creating token smart contracts involves design, coding, testing, auditing, and deployment with specialized blockchain expertise.

- Automation: Token minting and burning, transfer management, balance tracking, and approval mechanisms execute automatically through coded rules.

- Versatility: Token smart contracts enable ICOs, IDOs, DAOs, staking, asset tokenization, and diverse blockchain applications across industries.

Understanding Token Smart Contracts

A token smart contract is a self-executing program running in a shared, trust-minimized blockchain environment that maintains a ledger for particular assets or asset categories. Unlike traditional databases controlled by single entities, token smart contracts operate on decentralized networks where code execution is verified by distributed nodes, ensuring transparency and eliminating central authority.[1]

Creating token smart contracts combines software engineering with blockchain technology to build programmable digital assets. These contracts define rules governing token creation on blockchain, ownership tracking, transfer mechanisms, and lifecycle management through code rather than manual intervention. When deployed to public blockchains like Ethereum, token smart contracts become immutable programs accessible to anyone while remaining resistant to unauthorized modifications.

The fundamental distinction between token smart contracts and traditional systems lies in their execution environment. Banks’ core systems guarantee money integrity through centralized servers, while blockchain tokens achieve integrity through decentralized consensus. This architectural difference enables trust-minimized operations where participants don’t need to trust any single entity—they trust the publicly verifiable code and cryptographic security.

Core Components of Token Smart Contracts

Token smart contract architecture comprises four essential components working together to enable secure, automated digital asset management.

Token Ownership Ledger

The ledger represents the central element of any token smart contract, tracking asset ownership and balances. For fungible tokens, the ledger associates user identifiers (typically hash of public keys) with token quantities, maintaining current account balances. The identifier system provides pseudonymous identification while enabling transparent verification.

While public blockchains maintain complete transaction histories, token smart contracts manage specific ledger sections dedicated to particular assets. Transaction history remains accessible by examining the blockchain’s record of the contract’s previous states. Different token types implement varied data structures—NFTs associate owners with unique asset identifiers, while multi-class tokens may link owners to specific sub-category units.

Internal Logic and Integrity Rules

Token smart contract functions include internal logic ensuring digital asset integrity through automated rule enforcement. Transfer rules prevent asset duplication—each transfer triggers logic applying controls before updating the ledger. This automated validation eliminates manual oversight while maintaining accuracy.

Token minting and burning functions provide controlled supply management. Minting logic defines when and how new tokens enter circulation, while burning permanently removes tokens from supply. These mechanisms enable flexible tokenomics including deflationary models, reward systems, and dynamic supply adjustments based on programmed conditions.

Governance rules embedded in token management smart contracts determine upgrade mechanisms and parameter changes. Issuance rules provide participants guarantees about token supply and creation processes. These governance functions prove particularly important for security tokens and governance tokens where decision-making transparency is critical.

Standardized Interface

The interface defines operations external programs use to interact with token smart contracts, enabling interoperability across wallets, exchanges, and decentralized applications. Primary functions include reading ledger data (querying balances), executing transfers, and managing approvals allowing third parties to spend tokens on behalf of owners.

Standardization reduces integration costs dramatically. Token standards like ERC-20 for Ethereum token development define fundamental functions for fungible tokens, enabling any compliant wallet or protocol to interact seamlessly. ERC-721 NFT development and ERC-1155 token standard serve specialized needs for non-fungible and multi-token contracts respectively.

Each blockchain ecosystem establishes its own standards—BRC-20 token development for Bitcoin Ordinals, Jetton token standard for TON token development, and others. This diversity accommodates varied requirements while maintaining core functionality consistency within each ecosystem.

Static Data and Asset Definition

Token smart contracts embed static data defining asset characteristics that remain constant over time. This includes basic identification like token name, symbol, and decimal precision for display purposes. For security tokens, static data often references legal documentation establishing regulatory compliance. NFTs link to metadata and images defining unique asset properties.

The contract’s blockchain address serves as its unique identifier, enabling reference in legal documents and establishing verifiable connections between smart contracts and traditional legal frameworks. This bridging proves essential for real-world asset tokens requiring regulatory clarity.

Types of Blockchain Tokens Enabled by Smart Contracts

Smart contract token implementation supports diverse token categories serving different purposes and implementing varied logic.

Fungible Tokens

Fungible tokens represent interchangeable units where each token equals any other token of the same type. Cryptocurrencies, stablecoins, and utility tokens typically implement fungible logic through standards like ERC-20. These tokens power payment systems, DeFi protocols, and reward mechanisms across blockchain ecosystems.

Non-Fungible Tokens (NFTs)

Non-fungible tokens (NFTs) represent unique assets where each token has distinct characteristics and cannot be directly exchanged one-for-one. NFT smart contracts associate unique identifiers with ownership records, enabling digital art, collectibles, gaming assets, and tokenized real estate. Standards like ERC-721 define interfaces for managing these unique digital items.

Utility Tokens

Utility tokens provide access to specific services or features within blockchain platforms. These tokens implement logic controlling usage rights, consumption mechanics, and potentially burning mechanisms when services are utilized. Utility tokens drive platform ecosystems by aligning incentives between developers and users.

Security Tokens

Security tokens represent ownership in traditional financial assets like equity, debt, or investment funds. These contracts implement additional compliance logic including investor verification, transfer restrictions, and regulatory reporting. Security token smart contracts bridge traditional finance with blockchain technology while maintaining legal compliance.[2]

Governance Tokens

Governance tokens enable decentralized decision-making by granting voting rights proportional to token holdings. Smart contracts track voting power, proposal submissions, and execution of approved changes. These tokens form the backbone of DAOs (Decentralized Autonomous Organizations) enabling community-driven project governance.

Asset-Backed Tokens

Asset-backed tokens represent claims on physical or financial assets held in reserve. Smart contracts for these tokens often include verification mechanisms, redemption logic, and proof-of-reserve functions connecting on-chain tokens to off-chain assets. Real-world asset tokens like tokenized commodities, real estate, or traditional securities fall into this category.

Token Smart Contract Implementation Process

Creating robust token smart contracts requires systematic implementation following industry best practices to ensure security, functionality, and compliance.

Design and Tokenomics Planning

The process begins with defining token economics and functionality. This includes determining total supply, distribution mechanisms, transfer restrictions, and governance parameters. Tokenomics planning shapes how tokens create value and incentivize desired behaviors within the ecosystem.

Design decisions affect every aspect of token lifecycle management—from initial distribution through ongoing operations to potential deprecation. Teams must consider regulatory implications, particularly for security tokens or tokens with investment characteristics. Working with a cryptocurrency development company ensures professional design aligned with project goals.

Smart Contract Coding

Smart contract coding implements designed functionality using blockchain-specific programming languages. Ethereum typically uses Solidity, while other chains employ languages like Rust, Move, or FunC. Developers implement token standards (ERC-20, ERC-721, etc.) while adding custom logic for unique requirements.

Code quality proves critical as deployed smart contracts become immutable. Developers follow security best practices including access controls, overflow protection, reentrancy guards, and secure randomness generation. Modular code design facilitates testing and potential upgrades through proxy patterns when needed.

Token Contract Testing

Comprehensive token contract testing validates functionality and identifies vulnerabilities before deployment. Unit tests verify individual functions behave correctly, while integration tests ensure components work together properly. Test networks (testnets) allow developers to deploy contracts in blockchain-like environments without risking real funds.

Testing should cover normal operations, edge cases, and potential attack vectors. Token transfer management, balance tracking, approval and allowance mechanisms, and minting/burning functions all require thorough validation. Automated testing frameworks enable regression testing as code evolves.

Smart Contract Auditing

Professional smart contract auditing by third-party security firms provides independent verification of code security and correctness. Auditors examine code for common vulnerabilities, logic errors, gas optimization opportunities, and compliance with best practices. Audit reports detail findings and recommended fixes.

For high-value token deployments, multiple audits from different firms provide additional security assurance. Bug bounty programs complement audits by incentivizing ongoing security research after deployment. These measures protect users and maintain project credibility.[3]

Token Deployment

Token deployment publishes the smart contract to the blockchain, making it permanently accessible. Deployment requires paying transaction fees (gas) and careful verification of deployment parameters. Once deployed, the contract address becomes the permanent identifier for the token.

Post-deployment verification includes publishing source code on blockchain explorers, initializing token distribution, and configuring any administrative functions. Teams should document deployment details and provide transparency about contract capabilities and limitations.

Token Standards Across Blockchain Ecosystems

Different blockchain networks have established token standards defining interfaces and functionality for interoperability.

Ethereum Token Standards

ERC-20 created the template for fungible tokens with functions like transfer, balanceOf, approve, and allowance. This standard powers thousands of tokens including stablecoins, DeFi tokens, and utility tokens. ERC-721 introduced non-fungible tokens with unique identifiers and ownership tracking. ERC-1155 enables multi-token contracts managing both fungible and non-fungible assets efficiently.

Bitcoin and Ordinals

BRC-20 and Ordinals bring token functionality to Bitcoin through inscriptions on individual satoshis. While more limited than Ethereum’s smart contract capabilities, these standards enable fungible and non-fungible assets on Bitcoin’s secure network.

TON Blockchain

The Jetton token standard defines TON tokens with features optimized for the network’s architecture. TON’s approach emphasizes scalability and integration with Telegram’s massive user base, enabling token-based applications for hundreds of millions of potential users.

Use Cases for Token Smart Contracts

Token smart contracts enable diverse applications across industries and use cases.

Fundraising: ICO and IDO Tokens

ICOs and IDOs leverage smart contracts for decentralized fundraising. Contracts manage token sales, vesting schedules, and distribution automatically based on programmed rules. This reduces intermediaries while increasing transparency for investors.

Decentralized Governance: DAO Tokens

DAO tokens enable community-driven organizations where token holders vote on proposals and treasury management. Smart contracts execute approved decisions automatically, creating transparent, democratic governance systems.

Staking and Rewards

Staking smart contracts allow users to lock tokens for rewards, validator participation, or liquidity provision. Contracts calculate rewards, manage lock periods, and distribute earnings automatically based on coded formulas.

Asset Tokenization Services

Asset tokenization services use smart contracts to represent real-world assets on blockchains. This includes real estate, commodities, art, and securities. Token smart contracts enable fractional ownership, automated compliance, and global trading of traditionally illiquid assets.[4]

Benefits of Professional Token Contract Implementation

Working with experienced blockchain developers ensures token smart contracts meet security, functionality, and regulatory requirements.

Professional Crypto Token Development Company teams bring specialized expertise in token standards, security best practices, and blockchain-specific optimization. They implement comprehensive testing, arrange professional audits, and ensure compliance with relevant regulations.

Custom token implementation addresses unique business requirements while maintaining interoperability with existing blockchain infrastructure. This includes specialized logic for governance, compliance, or integration with external systems. Professional work reduces deployment risks and creates sustainable token ecosystems.

Conclusion

Token smart contracts form the fundamental infrastructure enabling blockchain’s programmable economy, automating asset management through self-executing code in trust-minimized environments. Understanding token smart contract architecture—from ownership ledgers and internal logic to standardized interfaces and static data—empowers informed participation in blockchain ecosystems.

The implementation process requires careful design, professional coding, comprehensive testing, and security auditing to create robust digital assets. Standards like ERC-20, ERC-721, and emerging protocols across different blockchains enable interoperability while supporting diverse token types from fungible currencies to unique NFTs and complex governance systems.

As crypto token adoption continues evolving, token smart contracts enable increasingly sophisticated applications including DeFi protocols, DAOs, asset tokenization, and real-world asset integration. For businesses and developers looking to create crypto token projects, partnering with experienced teams ensures security, compliance, and successful deployment.

The future of token smart contracts points toward enhanced scalability, improved security standards, and broader adoption across industries. Whether launching utility tokens, creating NFT collections, or tokenizing real-world assets, understanding token smart contract fundamentals provides the foundation for successful blockchain innovation in the expanding digital economy.

Frequently Asked Questions

Token smart contract development is creating self-executing blockchain programs that maintain digital asset ledgers with automated logic for transfers, minting, burning, and governance. These contracts run on decentralized networks ensuring trust-minimized operations.

Token smart contracts specifically manage asset ownership ledgers and implement standardized interfaces for token operations. While sharing general smart contract principles, they focus on maintaining balances, enabling transfers, and defining asset characteristics rather than general-purpose logic.

Ethereum offers the most established ecosystem with extensive tooling and standards. However, Binance Smart Chain, Polygon, Solana, and TON provide alternatives with lower fees or specific features. Choice depends on project requirements, target users, and development expertise.

ERC-20 for fungible tokens, ERC-721 for NFTs, and ERC-1155 for multi-token contracts dominate Ethereum. BRC-20 and Ordinals serve Bitcoin, while each blockchain has ecosystem-specific standards like Jetton for TON or SPL for Solana.

Costs range from $5,000 for simple ERC-20 tokens to $50,000+ for complex contracts with custom logic. Factors include token type, custom features, audit requirements, and blockchain selection. Professional development ensures security justifying the investment.

Standard contracts are immutable once deployed. However, upgradeable proxy patterns enable updates by separating logic from data storage. This adds complexity but allows fixing bugs or adding features. Teams should carefully consider upgrade mechanisms during design.

Essential security includes professional audits, comprehensive testing, access controls, overflow protection, reentrancy guards, and following established standards. Multiple audits, bug bounties, and gradual deployment reduce risks for high-value tokens.

Simple tokens following standards can be developed in 2-4 weeks. Complex tokens with custom logic, governance, or compliance features require 2-3 months. Timelines include design, development, testing, auditing, and deployment phases.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.