Key Takeaways

- Synthetic minting in DEX enables creation of blockchain tokens that track real-world assets like stocks, commodities, and currencies without requiring actual ownership of underlying assets.

- Collateralized synthetic assets require depositing cryptocurrency collateral at ratios typically between 150-500% to mint synthetic tokens through smart contracts.

- Synthetix platform synthetic minting leads the space, allowing users to stake SNX tokens to mint sUSD and trade various Synths representing diverse asset classes.

- DEX trading synthetic assets provides 24/7 market access, eliminates geographic restrictions, and enables portfolio diversification beyond traditional crypto holdings.

- Understanding how to mint synthetic assets involves preparing collateral, executing the minting transaction, and actively managing positions to avoid liquidation.

- Liquidation risks remain the primary concern for synthetic minters, requiring constant monitoring and maintenance of healthy collateralization ratios.

- Advanced strategies include using synthetic tokens for arbitrage opportunities, hedging existing positions, and integrating synthetics into broader DeFi portfolio strategies.

- Cross-chain synthetic asset minting represents the future, enabling synthetic creation and trading across multiple blockchain networks for enhanced liquidity and accessibility.

Synthetic minting has emerged as one of the most transformative innovations in decentralized finance, enabling traders to access virtually any asset class through blockchain-based tokens. This comprehensive decentralized exchange guide explores the complete process of creating, managing, and trading synthetic assets on DEX platforms. Whether you seek exposure to traditional markets, want to hedge existing positions, or aim to explore new trading strategies, understanding synthetic minting opens doors to unprecedented financial flexibility.

Introduction to Synthetic Minting in DEX

Synthetic minting in DEX represents a paradigm shift in how traders access financial markets through blockchain technology. By creating token representations of real-world assets, synthetic protocols eliminate traditional barriers including geographic restrictions, minimum investment requirements, and intermediary dependencies. This innovation democratizes access to global markets while maintaining the trustless, permissionless nature that defines decentralized finance.

Building crypto exchanges that support synthetic assets requires sophisticated infrastructure combining oracle systems, collateral management, and liquidation engines. The complexity of these systems reflects the ambitious goal of bringing traditional financial assets into the decentralized ecosystem while maintaining security and reliability.

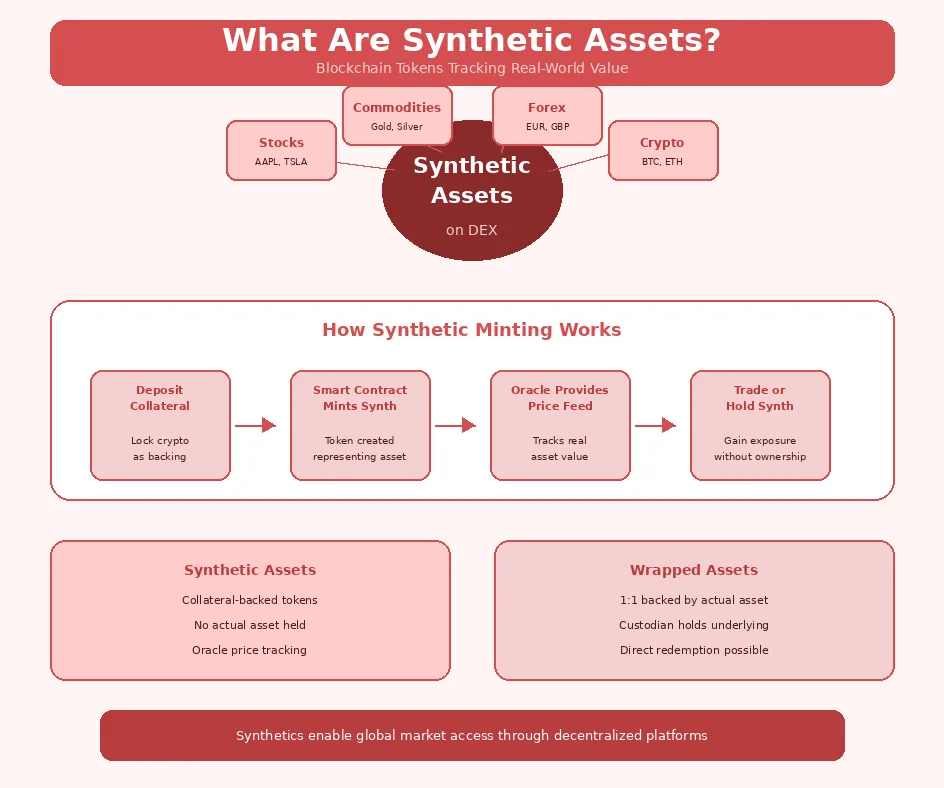

What Are Synthetic Assets in Decentralized Exchanges

Synthetic assets in decentralized exchanges are blockchain tokens that mirror the price movements of other assets without requiring direct ownership of those assets. Unlike wrapped tokens backed by actual holdings, synthetics derive their value from collateral pools and oracle price feeds. A synthetic gold token, for example, tracks gold’s price without any physical gold backing it; instead, cryptocurrency collateral secures its value.

The mechanism enables remarkable flexibility in what assets can be tokenized. Any asset with reliable price data can potentially become a synthetic, from major stock indices to foreign currencies to cryptocurrency pairs. This universality transforms DEX platforms into gateways for accessing virtually any market, all from a single blockchain interface. Understanding how decentralized exchanges process different trading mechanisms provides context for synthetic asset integration.

Importance of Synthetic Minting for DEX Traders

The importance of synthetic minting for DEX traders extends beyond simple market access to fundamental changes in trading capabilities. Traders gain exposure to assets that would otherwise require traditional brokerage accounts, regulatory compliance across jurisdictions, and significant capital commitments. A single wallet can now access stocks, commodities, forex, and crypto markets simultaneously.

For active traders, synthetic assets enable strategies previously impossible in crypto-only portfolios. Hedging crypto positions with inverse synthetics, diversifying into uncorrelated traditional assets, and implementing sophisticated multi-asset strategies become accessible through unified DeFi interfaces. This capability expansion represents a significant evolution in what decentralized trading can offer.

Market Insight: Synthetic assets have grown from experimental DeFi primitives to essential trading instruments with billions in total value locked. Their importance continues expanding as protocols improve and new synthetic types emerge.

Understanding the Synthetic Minting Process

Understanding the synthetic minting process requires examining both the technical mechanics and economic incentives that make synthetic creation function. The process involves multiple components working together: collateral deposits, smart contract interactions, oracle price feeds, and liquidation systems. Each element plays a crucial role in maintaining synthetic asset integrity and value stability.

How to Mint Synthetic Tokens on DEX Platforms

Learning how to mint synthetic tokens on DEX platforms begins with selecting an appropriate protocol and understanding its specific requirements. Most platforms follow similar general processes: connect wallet, deposit collateral, specify synthetic type and amount, and execute the minting transaction. However, details vary significantly between protocols regarding accepted collateral, ratio requirements, and synthetic options available.

The technical process involves smart contract interactions that lock your collateral and create corresponding synthetic tokens in your wallet. These tokens represent debt positions that must eventually be repaid to retrieve collateral. The newly minted synthetics can be traded, held for exposure, or used in other DeFi protocols, providing flexibility in how you utilize your synthetic positions.

Collateralized Synthetic Assets Explained

Collateralized synthetic assets derive their backing and value security from cryptocurrency deposits that exceed the value of minted synthetics. This overcollateralization creates safety buffers that protect the system when collateral values fluctuate. If a user deposits $5,000 in collateral to mint $1,000 in synthetic assets (500% ratio), significant collateral decline can occur before the synthetic becomes undercollateralized.

The collateralization model differs from traditional asset backing where 1:1 reserves secure token value. Instead, synthetic systems use dynamic collateral pools that can absorb volatility while maintaining synthetic stability. This approach enables synthetic creation without holding actual underlying assets, though it introduces liquidation risks that require active management.

Platforms Supporting Synthetic Minting (e.g., Synthetix)

Synthetix platform synthetic minting pioneered the synthetic asset space and remains the largest protocol by total value locked. The platform enables SNX token holders to stake and mint sUSD, which can be exchanged for various Synths including synthetic stocks, commodities, and cryptocurrencies. Synthetix operates on Ethereum and Optimism, with Layer 2 deployment offering reduced transaction costs.

Other platforms have emerged with different approaches to synthetic minting. Mirror Protocol on Terra (before its collapse) offered synthetic stocks with different mechanics. UMA Protocol provides customizable synthetic creation tools. Each platform presents unique features, collateral options, and synthetic asset selections that cater to different user needs and preferences.

Synthetic Minting Platform Comparison

| Platform | Collateral | Min Ratio | Synthetic Types |

|---|---|---|---|

| Synthetix | SNX, ETH | 400% | Crypto, Forex, Stocks, Commodities |

| UMA Protocol | Various ERC-20 | 120-150% | Custom synthetics |

| GMX | GLP tokens | N/A (pool-based) | Perpetual synthetics |

| Kwenta | sUSD | Via Synthetix | Perpetual futures |

Benefits of Synthetic Minting in Decentralized Exchanges

The benefits of synthetic minting in decentralized exchanges span accessibility, efficiency, and strategic dimensions that collectively transform trading possibilities. These advantages explain the rapid adoption of synthetic protocols despite their complexity, as the value proposition for traders significantly outweighs the learning curve required for participation.

Increased Trading Flexibility with Synthetic Assets

Increased trading flexibility through synthetic assets enables portfolio strategies that transcend traditional crypto limitations. Traders can simultaneously hold long Bitcoin exposure, short stock index exposure, and gold allocation all within the same DeFi wallet. This flexibility was previously impossible without multiple brokerage accounts across different asset classes and jurisdictions.

The 24/7 nature of synthetic markets removes timing constraints that affect traditional asset trading. Synthetic stocks trade around the clock, unlike their underlying markets with limited hours. This continuous access enables reaction to global events regardless of when they occur, providing responsive trading capabilities that traditional markets cannot match.

Cost Efficiency and Liquidity Advantages

Cost efficiency in synthetic trading manifests through elimination of traditional brokerage fees, reduced settlement times, and absence of custody costs associated with holding actual assets. While blockchain gas costs apply, they often compare favorably to traditional trading expenses, particularly for smaller positions that would face minimum fee structures elsewhere.

Liquidity advantages emerge from synthetic pools that enable trading without traditional counterparty matching. The debt pool model used by protocols like Synthetix means trades execute against the pool rather than requiring a buyer for every seller. This mechanism enables large trades with minimal slippage that might significantly move prices on traditional order book exchanges. Learning about yield opportunities in decentralized exchanges complements synthetic minting strategies.

Risk Management Using Collateral-Backed Tokens

Risk management using collateral-backed tokens enables hedging strategies that protect crypto portfolios against adverse movements. A trader holding significant ETH can mint synthetic short ETH exposure to neutralize price risk during uncertain periods. This hedging capability provides downside protection without requiring liquidation of core holdings.

The transparency of on-chain collateral creates verifiable backing that differs from trust-based systems. Anyone can audit the collateralization levels of synthetic protocols in real-time, providing assurance about system health. This transparency enables informed risk assessment that traditional financial products often cannot match.

Step-by-Step Guide to Mint Synthetic Assets

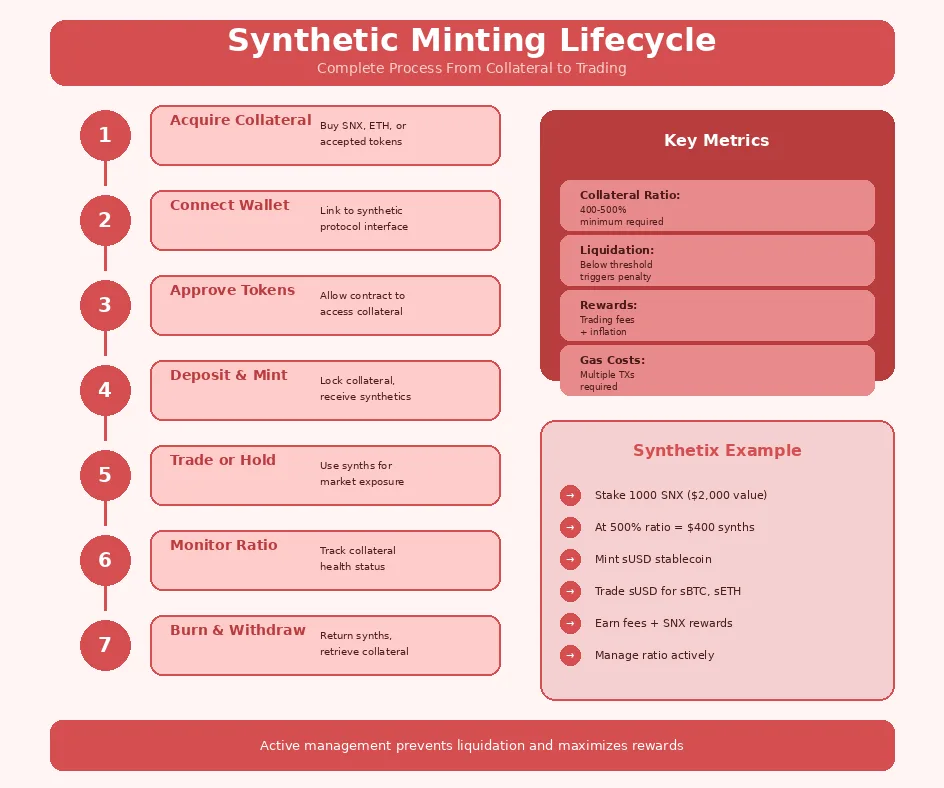

This step-by-step guide to mint synthetic assets walks through the complete process from initial preparation to ongoing management. Following these steps carefully ensures successful minting while minimizing risks associated with improper position setup or inadequate monitoring.

Preparing Collateral for Synthetic Minting

Preparing collateral for synthetic minting begins with acquiring the required collateral tokens accepted by your chosen platform. For Synthetix, this means obtaining SNX tokens through exchanges or swaps. Ensure you have sufficient collateral to maintain ratios well above minimum requirements, providing safety buffer against market volatility that might otherwise trigger liquidation.

Calculate the collateral amount needed based on desired synthetic exposure and target collateralization ratio. If you want $1,000 in synthetic exposure with a 500% ratio (well above Synthetix minimum), you need $5,000 in collateral value. Factor in potential collateral price decline to ensure your ratio remains safe even during significant market drops.

Executing the Minting Process on DEX

Executing the minting process on DEX involves connecting your wallet to the synthetic protocol interface, navigating to the minting section, and completing the required transactions. Most protocols require first approving the contract to access your collateral tokens, then executing the actual minting transaction that locks collateral and creates synthetics.

Review all transaction details before confirmation, including gas costs, collateral amounts, and resulting synthetic quantities. High gas periods can make minting expensive, so consider timing transactions during lower-cost windows. After successful minting, synthetic tokens appear in your wallet and can be used for trading or other DeFi activities.

Monitoring and Managing Synthetic Tokens

Monitoring and managing synthetic tokens requires ongoing attention to collateralization ratios that change with market movements. Both collateral value changes and synthetic value changes affect your ratio. Set up alerts or regularly check positions to ensure ratios remain healthy. Many protocols provide dashboard interfaces showing current ratios and recommended actions.

Management actions include adding collateral when ratios decline, burning synthetics to improve ratios, or claiming rewards earned through staking. Proactive management prevents liquidation while optimizing position economics. Regular monitoring becomes especially important during volatile market periods when ratios can change rapidly.

Synthetic Minting Lifecycle

| Stage | Action | Requirements | Outcome |

|---|---|---|---|

| 1 | Acquire Collateral | Exchange access, capital | Collateral tokens in wallet |

| 2 | Connect to Protocol | Web3 wallet | Interface access |

| 3 | Approve Collateral | Gas for approval TX | Contract can access tokens |

| 4 | Deposit & Mint | Gas for minting TX | Synthetics in wallet |

| 5 | Trade or Hold | Market access | Position exposure |

| 6 | Monitor Ratio | Regular checking | Position health awareness |

| 7 | Burn & Withdraw | Synthetic tokens to burn | Collateral returned |

Advanced Strategies for DEX Trading with Synthetic Assets

Advanced strategies for DEX trading with synthetic assets unlock sophisticated approaches that leverage unique synthetic characteristics. These strategies require deeper understanding of synthetic mechanics but offer potential returns and risk management capabilities unavailable through simple position taking.

Leveraging Synthetic Assets for Arbitrage

Leveraging synthetic assets for arbitrage exploits price discrepancies between synthetic tokens and their underlying assets or between different synthetic venues. When synthetic gold trades at a premium to actual gold prices, arbitrageurs can profit by shorting the synthetic while going long on gold elsewhere. These opportunities arise from market inefficiencies and help maintain price accuracy across platforms.

Cross-platform arbitrage between different synthetic protocols offers additional opportunities when the same asset trades at different prices. However, transaction costs, execution timing, and capital requirements must be carefully considered, as narrow margins can quickly turn profitable opportunities into losses. Exploring how decentralized exchanges facilitate advanced trading provides deeper understanding of execution mechanics.

Using Synthetic Tokens for Hedging

Using synthetic tokens for hedging protects existing positions against adverse price movements without requiring position liquidation. A trader with substantial Bitcoin holdings can mint synthetic short BTC exposure to neutralize directional risk during uncertain periods. This hedge maintains long-term positions while providing short-term protection.

Portfolio-level hedging uses synthetics representing inversely correlated assets to reduce overall volatility. Adding synthetic gold or forex exposure to crypto-heavy portfolios can smooth returns across different market conditions. The key is sizing hedges appropriately relative to the positions they protect while managing the costs and complexity of maintaining additional positions.

Integrating Synthetic Assets into DeFi Portfolios

Integrating synthetic assets into DeFi portfolios creates diversified exposures that reduce correlation with pure crypto holdings. A portfolio combining crypto, synthetic stocks, and synthetic commodities behaves differently than crypto-only allocations, potentially improving risk-adjusted returns. This diversification was previously impossible without traditional financial accounts.

Yield strategies using synthetics include providing liquidity for synthetic pairs, staking minted positions for protocol rewards, and using synthetics as collateral in lending protocols. These layered approaches compound returns while maintaining desired exposures, though they also compound risks that require careful management.

Synthetic Protocol Selection Criteria

When choosing a synthetic minting platform, evaluate these factors:

- Collateral Requirements: Assess minimum ratios, accepted collateral types, and liquidation thresholds

- Synthetic Selection: Verify desired assets are available with adequate liquidity

- Oracle Quality: Evaluate price feed reliability and decentralization

- Fee Structure: Compare minting fees, trading fees, and gas costs

- Security Track Record: Review audit history and incident response

- Reward Mechanisms: Consider staking rewards and fee distributions

Challenges and Considerations in Synthetic Minting

Challenges and considerations in synthetic minting require careful attention to protect capital and optimize outcomes. Understanding these challenges enables informed participation that manages risks while capturing synthetic benefits.

Collateral Requirements and Liquidation Risks

Collateral requirements present the most significant operational challenge for synthetic minters. High ratios (400%+ for Synthetix) mean substantial capital lockup relative to synthetic exposure obtained. This capital efficiency tradeoff balances safety against opportunity cost of locked funds that cannot be deployed elsewhere.

Liquidation risks emerge when collateral ratios fall below minimum thresholds due to market movements. Liquidation results in collateral loss including penalty fees, making ratio management essential. Strategies to mitigate liquidation include maintaining ratios well above minimums, setting up monitoring alerts, and keeping additional collateral ready for emergency deposits.

Platform Fees and Gas Costs

Platform fees and gas costs impact synthetic economics, particularly for smaller positions where costs represent larger percentages of total value. Minting transactions, trading synthetic pairs, and position adjustments all incur fees that accumulate over active management periods. Layer 2 deployments significantly reduce gas costs, making synthetic participation more accessible.

Fee analysis should consider all cost components: initial minting gas, ongoing management transactions, trading fees, and eventual position closure costs. These total costs determine minimum position sizes where synthetic participation remains economically viable. Understanding how exchange platforms optimize transaction efficiency illuminates approaches to cost management.

Regulatory and Security Considerations

Regulatory considerations vary by jurisdiction, with some regions treating synthetic assets similarly to derivatives subject to trading restrictions. Users should understand applicable regulations in their jurisdictions, as synthetic stock exposure may face different treatment than crypto-native synthetics. Regulatory uncertainty creates risks that could affect protocol operations or user access.

Security considerations include smart contract risks, oracle manipulation vulnerabilities, and protocol governance attacks. Despite audits and security measures, DeFi protocols have experienced exploits resulting in user losses. Participating with risk-appropriate position sizes and diversifying across protocols helps manage security-related exposure.

Risk Warning: Synthetic minting involves significant risks including liquidation, smart contract vulnerabilities, and regulatory uncertainty. Never mint synthetics with capital you cannot afford to lose. Maintain conservative collateralization ratios and monitor positions regularly.

Synthetic Minting Risk Assessment

| Risk Type | Description | Mitigation Strategy |

|---|---|---|

| Liquidation | Ratio falls below minimum | Maintain high ratios, set alerts |

| Smart Contract | Code vulnerabilities exploited | Use audited protocols, limit exposure |

| Oracle Failure | Incorrect price feeds | Choose protocols with robust oracles |

| Debt Pool | Shared exposure to all synths | Understand pool dynamics, hedge |

| Regulatory | Access restrictions, compliance | Monitor regulatory developments |

Future of Synthetic Minting in Decentralized Exchanges

The future of synthetic minting in decentralized exchanges promises expanded capabilities, improved efficiency, and broader adoption as protocols mature and infrastructure advances. Innovation continues across multiple dimensions that will shape how synthetic assets integrate into the broader financial ecosystem.

Innovations in Synthetic Assets

Innovations in synthetic assets include new collateral types, improved capital efficiency mechanisms, and novel synthetic categories beyond traditional asset classes. Protocols are exploring multi-collateral systems that accept diverse assets, reducing dependence on single tokens while improving stability. Real-world asset tokenization may eventually integrate with synthetic systems, blurring lines between synthetic and backed assets.

Perpetual synthetics that track assets without expiration dates represent significant innovation enabling long-term exposure without rollover requirements. Leveraged synthetics providing multiplied exposure expand trading possibilities while introducing additional risks requiring careful management.

Cross-Chain Synthetic Asset Minting

Cross-chain synthetic asset minting enables synthetic creation and trading across multiple blockchain networks, dramatically expanding liquidity and accessibility. Users could mint synthetics on one chain using collateral from another, accessing the best features of different ecosystems. This interoperability vision requires robust bridging infrastructure and cross-chain oracle systems currently under active development.

The multi-chain future of synthetics promises reduced fragmentation where assets flow freely across ecosystems. Traders would access unified liquidity pools spanning multiple chains, improving execution while reducing costs associated with single-chain limitations.

Build Your Own DEX with Synthetic Asset Support

Partner with our DEX development company to launch a secure, scalable, and feature-rich decentralized exchange with synthetic asset trading capabilities.

Evolving DEX Platforms and Synthetic Token Use

Evolving DEX platforms increasingly integrate synthetic capabilities as standard features rather than specialized functions. Major exchanges are incorporating synthetic trading alongside spot and derivatives offerings, creating comprehensive platforms serving diverse trading needs. This integration brings synthetics to mainstream users who might not engage with standalone synthetic protocols.

Synthetic token use cases continue expanding beyond trading to include synthetic collateral in lending protocols, synthetic LP positions for automated strategies, and synthetic governance tokens enabling cross-protocol participation. These evolving applications suggest synthetics becoming fundamental DeFi infrastructure rather than niche instruments.

Future Outlook: Synthetic minting represents a foundational capability that will continue expanding as DeFi matures. From traditional asset access to novel financial instruments, synthetics enable possibilities that transcend current market structures. Participants who understand these mechanics position themselves advantageously for evolving opportunities.

Synthetic minting on decentralized exchanges unlocks transformative trading capabilities that bridge blockchain and traditional financial markets. From basic minting mechanics to advanced strategies, understanding synthetics empowers traders with tools previously unavailable in decentralized environments. As protocols mature and cross-chain capabilities emerge, synthetic assets will increasingly become essential components of sophisticated DeFi portfolios.

Success in synthetic trading requires balancing opportunities against risks through careful platform selection, conservative ratio management, and ongoing position monitoring. The complexity involved rewards informed participants while creating hazards for unprepared newcomers. Approaching synthetic minting with appropriate education and risk awareness enables capturing benefits while managing downside exposure effectively.

Frequently Asked Questions

Synthetic minting in DEX is the process of creating blockchain-based tokens that track the value of real-world or digital assets without requiring ownership of those underlying assets. Users deposit collateral into smart contracts, which then mint synthetic tokens representing assets like stocks, commodities, or cryptocurrencies. This enables traders to gain exposure to diverse markets through decentralized platforms without actually purchasing the original assets.

To mint synthetic tokens on a DEX, you first connect your wallet to a synthetic asset platform like Synthetix, then deposit accepted collateral (typically native tokens) into the protocol’s smart contracts. Once your collateral meets the required ratio, you can mint synthetic assets proportional to your collateral value. The process involves approving token spending, locking collateral, and selecting which synthetic asset to create based on available options.

Collateral requirements vary by platform but typically include native protocol tokens, stablecoins, or major cryptocurrencies like ETH. Synthetix platform synthetic minting requires SNX tokens as collateral with a minimum collateralization ratio of 400-500%. Other platforms may accept different assets with varying ratio requirements. The collateral backs the value of minted synthetics and can be liquidated if ratios fall below maintenance thresholds.

Synthetic assets in decentralized exchanges offer benefits including 24/7 trading access to traditional markets, no geographic restrictions, elimination of intermediaries, and ability to gain exposure to assets otherwise inaccessible to crypto users. DEX trading synthetic assets also provides portfolio diversification, hedging capabilities, and potential yield opportunities through staking minted positions. The permissionless nature enables global participation regardless of traditional financial access.

The collateralization ratio represents the percentage of collateral value relative to minted synthetic asset value. Most protocols require ratios between 150% and 500%, meaning you must lock significantly more collateral than the synthetics you mint. Higher ratios provide greater safety margins against liquidation during market volatility. Users must actively manage their ratios, adding collateral or burning synthetics when ratios approach dangerous levels.

Synthetic minting risks include liquidation if collateral ratios fall below requirements, smart contract vulnerabilities, oracle manipulation affecting price feeds, and market volatility impacting both collateral and synthetic values. Additional risks involve platform-specific factors like debt pool dynamics where minters share collective exposure to all synthetic positions. Understanding these risks is essential before participating in synthetic asset protocols.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.