Key Takeaways

- The timeline to build a crypto exchange ranges from 3-18 months, with white-label solutions offering the fastest path at 2-4 months and custom builds requiring 12-18 months.

- Cryptocurrency exchange build time depends on five key phases: planning, design, core setup, security and compliance, and testing plus launch preparations.

- The crypto exchange timeline is significantly impacted by feature complexity, with basic spot trading requiring less time than advanced derivatives or margin trading capabilities.

- Time to launch a crypto exchange includes parallel workstreams for technical build and regulatory licensing, with compliance often determining the critical path.

- Cryptocurrency exchange setup time can be optimized by using pre-built frameworks, prioritizing MVP features, and planning security and compliance requirements from day one.

- Building a crypto exchange platform requires dedicated phases for the trading engine, wallet integration, liquidity solutions, and comprehensive security infrastructure.

- The cryptocurrency exchange creation time for centralized exchanges typically exceeds DEX timelines due to more complex infrastructure and compliance requirements.

- Reducing exchange launch timelines requires experienced teams, clear scope definition, parallel development tracks, and early engagement with regulatory requirements.

Launching a cryptocurrency exchange represents one of the most complex undertakings in the fintech space, requiring careful orchestration of technology, security, compliance, and user experience. Understanding the realistic timeline to build a crypto exchange helps entrepreneurs plan resources effectively, set appropriate expectations, and avoid costly delays that can derail promising projects.

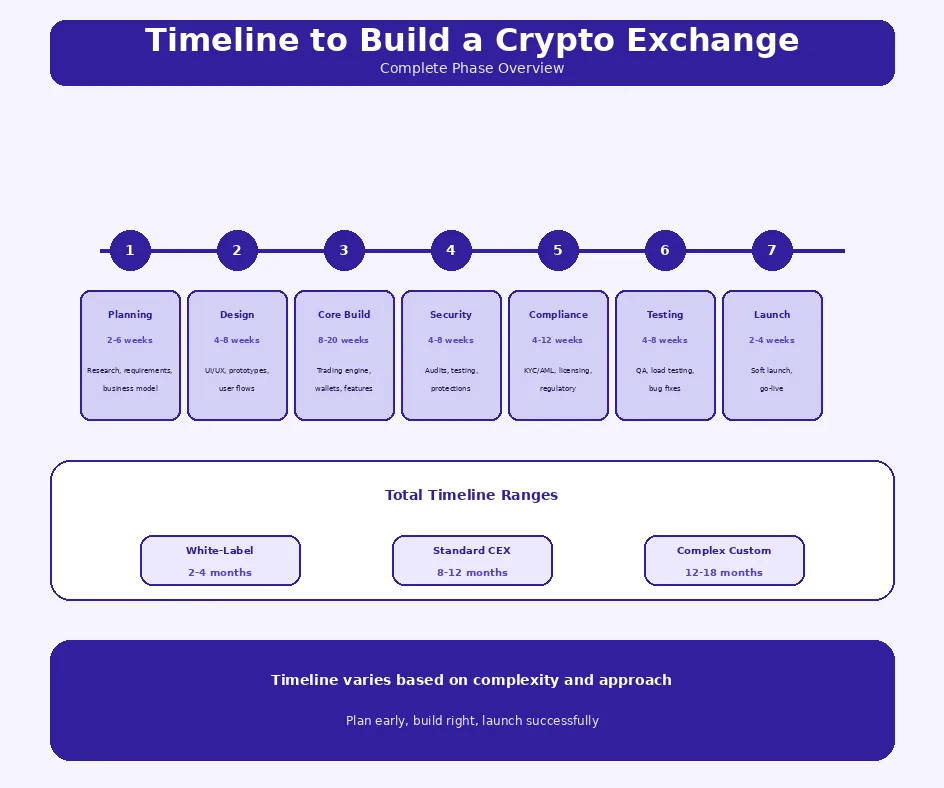

Timeline to Build a Crypto Exchange – Complete Overview

The timeline to build a crypto exchange encompasses multiple interdependent phases that must be carefully sequenced and managed. While some activities can proceed in parallel, others have dependencies that create critical path constraints. A realistic understanding of these timelines prevents the common mistake of underestimating project duration, which leads to rushed work, security compromises, and ultimately, failed launches.

Why Understanding the Crypto Exchange Timeline Matters

Understanding the crypto exchange timeline matters because cryptocurrency platforms involve significant financial and technical investments. Accurate timeline estimation enables proper budgeting, resource allocation, and stakeholder communication. Projects that underestimate timelines often face funding shortfalls mid-project, forcing compromises on security or features that can prove fatal to long-term success.

Market timing also makes timeline accuracy crucial. Cryptocurrency markets evolve rapidly, and opportunities can shift during extended build periods. Having realistic expectations allows businesses to plan market entry strategies, competitive positioning, and initial user acquisition campaigns appropriately.

How Long Does It Take to Build a Crypto Exchange Platform

The time to launch a crypto exchange varies dramatically based on approach and complexity. White-label solutions enable launches in 2-4 months, offering pre-built infrastructure that requires mainly configuration and branding. Custom exchanges with unique features and proprietary trading engines require 12-18 months for comprehensive implementation. Most projects fall somewhere between these extremes.

Factors determining cryptocurrency exchange build time include the exchange type (CEX, DEX, P2P), feature scope, security requirements, regulatory compliance needs, and team expertise. Projects partnering with experienced exchange specialists often achieve faster timelines while maintaining quality standards.

Project Planning Principle: The most successful crypto exchange projects invest heavily in the planning phase. Every week spent on thorough planning typically saves 2-3 weeks during implementation by preventing rework, scope changes, and integration issues that cause delays.

Key Phases in the Timeline to Build a Crypto Exchange

Key phases in building a crypto exchange follow a logical sequence from initial planning through launch. While some activities can overlap, understanding phase dependencies helps create realistic schedules and identify opportunities for parallel development that can compress overall timelines.

Planning Phase in the Crypto Exchange Build Timeline

The planning phase in the crypto exchange build timeline typically spans 2-6 weeks depending on project complexity. This phase establishes the foundation for all subsequent work, defining business requirements, technical architecture, and regulatory strategy. Comprehensive planning reduces downstream changes that cause costly delays.

Market Research and Business Model Finalization

Market research and business model finalization require 2-4 weeks to complete thoroughly. This phase identifies target markets, competitive positioning, revenue models, and initial feature priorities. Understanding market requirements before building prevents expensive pivots after significant work has been completed.

Business model decisions significantly impact the technical roadmap. Fee structures, supported assets, trading options, and target user segments all influence architecture choices. These decisions should be finalized before beginning technical work to avoid scope changes during implementation.

Choosing the Right Crypto Exchange Type (CEX, DEX, P2P)

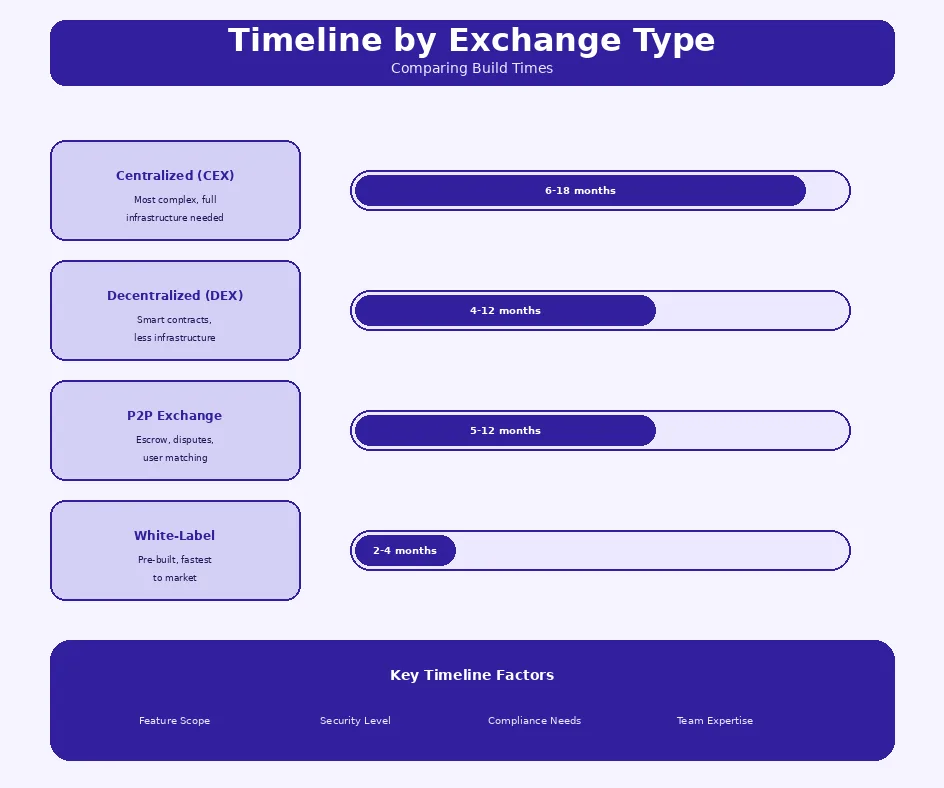

Choosing between centralized (CEX), decentralized (DEX), or peer-to-peer (P2P) exchange types dramatically affects the timeline to build a crypto exchange. CEX platforms require more infrastructure but offer greater control and typically higher revenue potential. DEX platforms involve smart contract work but less ongoing operational complexity. P2P models require escrow systems and dispute resolution mechanisms.

Each model has distinct technical requirements, regulatory implications, and market positioning considerations. The choice should align with business strategy, available resources, and target market preferences. Reviewing comprehensive platform building guides helps inform this critical decision.

Design Phase and User Experience Timeline

The design phase typically requires 4-8 weeks to complete, encompassing user interface design, user experience flows, and visual branding. Quality design directly impacts user adoption and platform success, making this phase worth appropriate investment despite schedule pressures.

Interface Design and User Flow Planning

Interface design and user flow planning require 3-5 weeks for comprehensive execution. This includes designing all user-facing screens, creating responsive layouts for multiple devices, and mapping complete user journeys from registration through trading activities. Building crypto exchanges with intuitive interfaces significantly improves user retention.

Admin Panel and Trader Dashboard Structure

Admin panel and trader dashboard structure design adds 2-4 weeks to the design timeline. These interfaces serve different user needs and require distinct design approaches. Admin panels need comprehensive management capabilities, while trader dashboards prioritize real-time data visualization and efficient trade execution.

Timeline by Exchange Type

| Exchange Type | Minimum Time | Typical Time | Complex Build |

|---|---|---|---|

| Centralized (CEX) | 4-6 months | 8-12 months | 12-18 months |

| Decentralized (DEX) | 3-4 months | 5-8 months | 8-12 months |

| P2P Exchange | 3-5 months | 6-9 months | 9-14 months |

| White-Label | 2-3 months | 3-4 months | 4-6 months |

Core Platform Setup and Feature Integration Timeline

Core platform setup represents the most substantial portion of cryptocurrency exchange build time, typically spanning 8-20 weeks depending on feature scope. This phase transforms designs into functional systems, implementing the trading infrastructure that will power all exchange operations.

Essential Features That Impact Crypto Exchange Build Time

Essential features form the core functionality without which an exchange cannot operate. These components require careful implementation as they handle financial transactions and must perform reliably under varying conditions. The quality of these implementations directly impacts platform success.

Trading Engine and Order Matching System

The trading engine and order matching system require 6-12 weeks to implement properly, representing the heart of any crypto exchange. This component must handle thousands of orders per second, maintain order book integrity, and execute matches fairly and efficiently. Performance requirements drive architectural decisions that impact the entire build.

Custom trading engines take longer but offer competitive advantages in speed and functionality. Pre-built engines can reduce cryptocurrency exchange creation time significantly but may limit differentiation. The choice depends on competitive strategy and available resources.

Wallet Integration and Asset Management

Wallet integration and asset management typically require 4-8 weeks depending on the number of supported cryptocurrencies. Hot and cold wallet architectures must be designed for security while enabling efficient deposit and withdrawal processing. Multi-signature schemes and key management add complexity but provide essential protection.

Liquidity Integration and Price Feeds

Liquidity integration and price feeds add 3-6 weeks to the timeline. New exchanges need external liquidity sources to provide adequate trading depth from launch. Integrating with market makers, aggregators, or other exchanges requires API work and ongoing management. Real-time price feeds must be reliable and resistant to manipulation.

Advanced Features and Their Effect on Exchange Timeline

Advanced features significantly extend the time to launch a crypto exchange but may be essential for competitive positioning. These capabilities differentiate platforms and attract sophisticated traders, but they also add complexity and risk that must be managed carefully.

Margin, Futures, and Derivatives Trading Setup

Margin, futures, and derivatives trading features add 8-16 weeks to the cryptocurrency exchange setup time. These capabilities require complex risk management systems, liquidation engines, and funding rate calculations. The regulatory implications are also more significant, potentially requiring additional licenses and compliance measures.

API Integration for Third-Party Services

API integration for third-party services typically requires 2-6 weeks depending on the number and complexity of integrations. Payment processors, KYC providers, analytics tools, and market data services all need proper integration. Well-designed APIs also enable users and institutional clients to build automated trading systems.

Exchange Build Phase Timeline

| Phase | Stage | Duration | Key Deliverables |

|---|---|---|---|

| 1 | Planning | 2-6 weeks | Business model, requirements, architecture |

| 2 | Design | 4-8 weeks | UI/UX designs, user flows, prototypes |

| 3 | Core Build | 8-20 weeks | Trading engine, wallets, core features |

| 4 | Security | 4-8 weeks | Security infrastructure, audits, testing |

| 5 | Compliance | 4-12 weeks | KYC/AML, licensing, regulatory setup |

| 6 | Testing | 4-8 weeks | QA, load testing, bug fixes |

| 7 | Launch | 2-4 weeks | Soft launch, monitoring, go-live |

Security, Compliance, and Testing Timeline

Security, compliance, and testing represent non-negotiable phases that cannot be compressed without risking platform integrity. These activities protect user assets, ensure regulatory compliance, and validate platform reliability before exposing real users to potential issues.

Security Measures in the Crypto Exchange Setup Process

Security measures in the crypto exchange setup process require 4-10 weeks depending on platform complexity. This phase implements protective mechanisms across all system layers, from network security to application-level protections. Security architecture should be designed from the beginning, not added as an afterthought.

Data Protection and Asset Safety Mechanisms

Data protection and asset safety mechanisms include encryption systems, secure key management, cold storage solutions, and access control frameworks. Implementation requires 3-6 weeks, with additional time for documentation and operational procedure establishment. These mechanisms must be robust enough to withstand sophisticated attacks.

Penetration Testing and Risk Assessment

Penetration testing and risk assessment add 3-6 weeks to the timeline, including time for remediation of discovered vulnerabilities. External security audits provide independent validation that internal teams may miss. Multiple testing rounds are often necessary as fixes can introduce new vulnerabilities.

Legal and Compliance Timeline for Crypto Exchange Launch

Legal and compliance timelines often represent the longest and least predictable components of cryptocurrency exchange setup time. Regulatory requirements vary significantly by jurisdiction and can change during project implementation. Early engagement with legal counsel helps avoid surprises that delay launches.

KYC and AML Integration Time

KYC and AML integration typically requires 2-4 weeks for technical implementation plus ongoing configuration and optimization. Selecting providers, negotiating contracts, and completing integration testing all contribute to this timeline. The quality of KYC implementation affects both compliance and user experience.

Regulatory Requirements and Regional Compliance

Regulatory requirements and regional compliance can add 3-18 months depending on jurisdictions targeted. Some regions require licenses before operations can begin, while others allow launches with subsequent registration. Understanding regulatory timelines is essential for realistic project planning.

Critical Warning: Rushing security implementation or compliance processes to meet aggressive timelines creates significant risk. Security breaches can destroy exchanges overnight, while regulatory violations can result in shutdowns, fines, and personal liability. These phases should never be compressed beyond reasonable limits.

Final Testing and Launch Timeline of a Crypto Exchange

Final testing and launch represent the culmination of all previous work, validating that the platform operates correctly under realistic conditions. This phase identifies issues that only emerge under load or with real-world usage patterns, providing the last opportunity to fix problems before they affect users.

Quality Testing and Performance Optimization Phase

Quality testing and performance optimization require 4-8 weeks for thorough execution. This phase includes functional testing, regression testing, and user acceptance testing to ensure all features work as specified. Performance optimization addresses bottlenecks discovered during testing.

Load Testing and Trading Performance Checks

Load testing and trading performance checks simulate real-world usage patterns at scale, identifying how the platform behaves under stress. This testing reveals performance limits and potential failure points before users encounter them. Adequate load testing typically requires 2-4 weeks including time for optimization based on results.

Crypto Exchange Launch Process and Go-Live Timeline

The crypto exchange launch process typically spans 2-4 weeks from final testing completion to full public availability. This period includes soft launch activities, initial user onboarding, and close monitoring for issues that escaped testing. Graduated rollout reduces risk compared to immediate full launch.

Soft Launch, Monitoring, and User Onboarding

Soft launch, monitoring, and user onboarding create controlled environments for validating production readiness. Initial users provide feedback that informs final adjustments. Monitoring during this phase catches issues that load testing might have missed. Progressive scaling allows teams to address problems before they affect large user populations.

Factors That Influence the Timeline to Build a Crypto Exchange

Multiple factors influence the timeline to build a crypto exchange, and understanding these helps set realistic expectations. Project managers must account for both technical and non-technical factors that can accelerate or delay completion.

Custom Features vs Ready-Made Exchange Solutions

The choice between custom features and ready-made exchange solutions represents the most significant timeline determinant. Custom builds require 12-18 months but offer unlimited flexibility. White-label solutions launch in 2-4 months but limit differentiation. Hybrid approaches using pre-built cores with custom extensions offer middle-ground options.

Team Expertise and Technology Stack

Team expertise and technology stack selection significantly impact cryptocurrency exchange build time. Experienced teams familiar with exchange-specific challenges complete work faster with fewer errors. Technology stack choices affect not just build time but also long-term scalability and maintenance requirements.

Security, Compliance, and Feature Complexity

Security requirements, compliance scope, and feature complexity all extend timelines in proportion to their ambition. Platforms targeting multiple jurisdictions face more complex compliance requirements. Advanced trading features require sophisticated implementation. Higher security standards require more testing and validation.

Approach Selection Criteria

When deciding between custom and white-label approaches, consider:

- Timeline Urgency: How critical is speed to market?

- Budget Constraints: What resources are available?

- Differentiation Needs: Must you be unique or will standard features suffice?

- Long-term Vision: Will limitations become problematic later?

- Team Capabilities: Can you maintain custom systems?

- Competitive Landscape: What do competitors offer?

Estimated Time to Launch Different Types of Crypto Exchanges

Estimated time to launch varies significantly across exchange types, each with distinct technical requirements and complexity profiles. Understanding these differences helps align expectations with business objectives and available resources.

Timeline for Centralized Cryptocurrency Exchange

The timeline for centralized cryptocurrency exchange builds typically ranges from 6-18 months. CEX platforms require extensive infrastructure including trading engines, order matching systems, custody solutions, and comprehensive compliance frameworks. The additional complexity extends timelines but enables the most comprehensive trading experiences.

Timeline for Decentralized Exchange Platform

The timeline for decentralized exchange platforms typically ranges from 4-12 months. DEX builds focus on smart contract implementation, liquidity pool mechanisms, and frontend interfaces. While some infrastructure complexity reduces, smart contract security becomes critical, requiring thorough audits that add to timelines.

P2P Crypto Exchange Setup Time

P2P crypto exchange setup time typically spans 5-12 months. These platforms require escrow systems, dispute resolution mechanisms, user reputation systems, and payment method integration. The complexity lies in managing user-to-user interactions safely rather than high-frequency trading systems.

White Label Crypto Exchange Launch Time

White label crypto exchange launch time compresses to 2-6 months using pre-built platforms. This approach suits businesses prioritizing speed over uniqueness. Configuration, branding, and compliance setup still require time, but the bulk of technical work comes pre-completed. Working with specialized crypto exchange providers ensures quality implementation.

Custom vs White-Label Timeline Comparison

| Factor | Custom Build | White-Label |

|---|---|---|

| Total Timeline | 12-18 months | 2-4 months |

| Customization | Unlimited | Limited |

| Initial Cost | Higher | Lower |

| Ownership | Full IP ownership | Licensed use |

| Best For | Long-term differentiation | Fast market entry |

How to Reduce the Timeline to Build a Crypto Exchange

Reducing the timeline to build a crypto exchange requires strategic decisions that optimize for speed without sacrificing essential quality. Several proven approaches can significantly compress schedules while maintaining platform integrity.

Using Pre-Built Exchange Frameworks

Using pre-built exchange frameworks eliminates months of core engineering. These frameworks provide tested trading engines, wallet infrastructure, and security foundations. Customization focuses on differentiation rather than rebuilding solved problems. This approach offers the fastest path to market for most business models.

Prioritizing Must-Have Features First

Prioritizing must-have features enables MVP launches that capture market position while additional features develop. Spot trading, basic order types, and essential security form the minimum viable product. Advanced features like margin trading, derivatives, or social trading can launch in subsequent phases.

Planning Compliance and Security Early

Planning compliance and security from project initiation prevents delays caused by late-stage discoveries. Regulatory requirements and security architectures inform technical decisions throughout construction. Late changes to accommodate overlooked requirements cause the most significant timeline extensions.

Also Read: Full guide on how to hire Crypto App Developers

Final Thoughts on the Timeline to Build a Crypto Exchange

The timeline to build a crypto exchange varies dramatically based on approach, scope, and resources. Realistic planning accounts for the full spectrum of activities from initial concept through stable operation. Projects that underestimate timelines face funding pressures, quality compromises, and launch delays that can prove fatal to business success.

Success requires balancing speed with thoroughness. While faster launches capture market opportunities, rushing essential phases creates risks that can destroy exchanges entirely. Security breaches and compliance failures have ended many promising projects that prioritized speed over substance.

Launch Your Crypto Exchange Faster with Experts

Get expert guidance and complete support to launch a secure, fully-featured crypto exchange quickly.

Launch Your Exchange Now

Choosing the Right Approach for Faster and Secure Exchange Launch

Choosing the right approach for faster and secure exchange launch depends on your specific business context. White-label solutions suit businesses prioritizing speed and cost efficiency. Custom builds serve those requiring unique capabilities and long-term differentiation. Understanding comprehensive exchange building strategies helps inform this critical decision.

Regardless of approach, certain principles apply universally. Security and compliance cannot be compromised. User experience determines adoption success. Infrastructure must scale with growth. Applying these principles while optimizing for timeline creates the best outcomes for sustainable exchange businesses.

Frequently Asked Questions

The timeline to build a crypto exchange typically ranges from 3 to 18 months depending on complexity and approach. A white-label solution can launch in 2-4 months, while custom-built exchanges require 12-18 months. Factors like feature complexity, security requirements, regulatory compliance, and team expertise significantly impact the final cryptocurrency exchange build time.

Building a crypto exchange involves several key phases: planning and research (2-4 weeks), design and UX (4-6 weeks), core platform setup (8-16 weeks), security implementation (4-8 weeks), compliance integration (4-12 weeks), testing (4-8 weeks), and launch preparation (2-4 weeks). Each phase has specific deliverables that must be completed before proceeding to the next stage.

Cryptocurrency exchange setup time depends on several factors including the type of exchange (CEX, DEX, P2P), feature complexity, security requirements, regulatory compliance needs, technology stack selection, team expertise, and whether you choose custom or white-label solutions. Third-party integrations for KYC, payment gateways, and liquidity also add to the timeline.

Obtaining crypto exchange licenses can take 3-18 months depending on jurisdiction. Some regions like Estonia or Lithuania process applications in 3-6 months, while major financial centers may take 12-18 months. The licensing timeline runs parallel to technical work but must be planned early as it often determines the overall time to launch a crypto exchange.

Yes, white-label crypto exchange solutions significantly reduce launch time to 2-4 months compared to 12-18 months for custom builds. These pre-built platforms include core features, security infrastructure, and compliance tools. However, they offer less customization flexibility. The trade-off between speed and uniqueness should align with your business strategy.

The minimum time to build a crypto exchange platform with essential features using white-label solutions is approximately 8-12 weeks. This includes basic trading functionality, wallet integration, user management, and standard security features. However, rushing the process compromises security and user experience, so realistic timelines should prioritize quality over speed.

Security testing for crypto exchanges typically requires 4-8 weeks for comprehensive assessment. This includes penetration testing, code audits, vulnerability assessments, and security architecture review. Multiple testing rounds may be needed to address identified issues. Security should never be rushed as vulnerabilities can result in catastrophic losses and reputation damage.

The most time-consuming features in crypto exchange creation include the trading engine and order matching system (6-10 weeks), advanced trading options like margin and futures (8-12 weeks), and comprehensive security infrastructure (4-8 weeks). Multi-currency wallet integration and liquidity solutions also require significant implementation time depending on scope.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.