Key Takeaways

- APY in decentralized exchanges represents the annual yield earned through liquidity provision, yield farming, and staking, including the effects of compound interest in DeFi.

- The difference between APY and APR in crypto is compounding: APY includes reinvested earnings while APR represents simple interest without compounding effects.

- APY calculation in DeFi factors in trading fees, token incentives, compounding frequency, and pool parameters to determine expected annual returns.

- Why APY is high in DEX platforms relates to token emission incentives, lack of intermediaries, and competitive dynamics between DeFi protocols seeking liquidity.

- APY risks in decentralized exchanges include impermanent loss, smart contract vulnerabilities, token price volatility, and unsustainable yield models.

- Liquidity pool APY varies based on trading volume, total liquidity, reward emissions, and market conditions, making returns inherently variable.

- Best APY strategies in DeFi involve diversification, choosing audited protocols, understanding tokenomics, and balancing yield against risk exposure.

- Sustainable APY in DeFi protocols typically comes from real revenue generation through trading fees rather than solely from inflationary token rewards.

The decentralized finance revolution has introduced new opportunities for earning passive income on cryptocurrency holdings. At the center of these opportunities lies APY, a metric that determines how much you can earn by participating in various DeFi activities. Understanding what is APY in DEX platforms is essential for anyone looking to maximize returns while managing risks effectively. This comprehensive guide explores everything you need to know about APY in the context of decentralized exchanges, from basic concepts to advanced strategies for optimizing your DeFi earnings.

What is APY in DEX?

Understanding APY in decentralized exchanges forms the foundation for successful DeFi participation. This fundamental metric tells you how much your assets can grow over a year when you provide liquidity, stake tokens, or engage in yield farming activities on decentralized platforms.

APY Meaning in Crypto & DeFi

The DEX APY meaning refers to Annual Percentage Yield, a standardized metric that expresses the rate of return on an investment over one year, accounting for compound interest in DeFi. Unlike simple interest that only calculates returns on your initial principal, APY includes the effect of earning interest on previously earned interest. This compounding mechanism can significantly boost your effective returns over time.

In traditional finance, APY typically ranges from 0.01% to 2% for savings accounts. However, APY in DeFi can reach substantially higher levels, sometimes exceeding 100% or even 1000% for certain opportunities. These elevated rates reflect the nascent nature of DeFi, competitive dynamics between protocols, and the risks associated with participating in decentralized systems.

The decentralized exchange APY differs fundamentally from centralized alternatives because it comes from protocol-level activities rather than institutional lending. When you provide liquidity to a DEX, your tokens facilitate trades for other users, and you earn a share of trading fees proportional to your pool contribution. Additional token incentives may further boost your returns.

How APY Works in DEX Platforms

Understanding how APY works in DEX requires grasping the underlying mechanics of liquidity provision and reward distribution. When you deposit tokens into a liquidity pool, you receive LP (Liquidity Provider) tokens representing your share of the pool. As traders execute swaps against the pool, they pay fees that accumulate to all LP token holders proportionally.

The compounding mechanism in DeFi works through automatic reinvestment of earnings. Many protocols compound rewards continuously or at regular intervals, meaning your earned fees and tokens begin generating additional returns immediately. Some platforms offer auto-compounding vaults that automatically reinvest rewards, maximizing the compound interest in DeFi effect without requiring manual intervention.

Industry Insight: The power of compounding in DeFi cannot be overstated. A 50% APY with daily compounding actually yields approximately 64.9% annually, while the same rate with annual compounding yields exactly 50%. This difference demonstrates why understanding compounding frequency is crucial for accurately evaluating DeFi opportunities.

APY vs APR in DeFi

Difference Between APY and APR in Crypto

The difference between APY and APR in crypto fundamentally comes down to compounding. APR (Annual Percentage Rate) represents the simple interest rate without accounting for compounding effects. APY (Annual Percentage Yield) includes compound interest, showing what you would actually earn if rewards are reinvested throughout the year.

APY vs APR in DeFi matters significantly because DeFi protocols often compound rewards frequently, sometimes with every block. This means the stated APR can translate to a substantially higher effective APY. For example, a 100% APR with daily compounding equals approximately 171.5% APY, demonstrating the substantial impact of compounding on returns.

| Feature | APR | APY |

|---|---|---|

| Definition | Simple interest rate | Compound interest rate |

| Compounding | Not included | Included |

| Same Base Rate | Lower effective return | Higher effective return |

| Best For | Comparing base rates | Understanding actual returns |

| 100% Rate Example | 100% annual return | ~171.5% with daily compounding |

Which Is Better for DEX Users – APY or APR?

When APY in DeFi is more beneficial depends on your strategy and time horizon. For understanding your actual expected returns, APY provides a more accurate picture because it reflects what you will actually earn with typical compounding. However, APR is useful for comparing base rates between protocols before compounding effects are applied.

Use cases for APR vs APY vary based on context. When evaluating borrowing costs, APR gives a clearer picture of the interest burden. When assessing earning potential on deposits, APY better represents actual returns. Sophisticated DeFi users often look at both metrics and understand the compounding frequency to make informed decisions.

How APY Is Calculated in Decentralized Exchanges

APY Calculation in DeFi Protocols

APY calculation in DeFi follows the standard compound interest formula adapted for the specific compounding frequency of each protocol. The formula is: APY = (1 + r/n)^n – 1, where r is the periodic interest rate and n is the number of compounding periods per year. For daily compounding, n equals 365; for per-block compounding on Ethereum, n could exceed 2 million.

Daily, weekly, and auto-compounding strategies each produce different effective APY from the same base rate. Auto-compounding vaults that reinvest rewards with each block achieve the highest theoretical APY, though gas costs can offset gains for smaller positions. Understanding your specific protocol’s compounding mechanism is essential for accurate return projections.

APY Earning Lifecycle in DEX

| Stage | Action | APY Impact | Timing |

|---|---|---|---|

| 1. Deposit | Add tokens to pool | APY begins accruing | Immediate |

| 2. Fee Accumulation | Trading fees collected | Base yield generated | Continuous |

| 3. Reward Distribution | Token incentives distributed | APY boosted by incentives | Per block/daily |

| 4. Compounding | Rewards reinvested | Compound effect applied | Auto or manual |

| 5. Monitoring | Track performance | Adjust for APY changes | Ongoing |

| 6. Withdrawal | Remove tokens + earnings | Realized returns | User-initiated |

Factors Affecting APY in DEX

Multiple factors influence APY fluctuation in liquidity pools. Trading volume directly impacts fee generation, with higher volume producing more fees distributed to liquidity providers. Liquidity pool size affects individual returns inversely: as more capital enters a pool, each provider’s share of fees decreases, reducing APY.

Token incentives and emissions play a crucial role in boosting DeFi APY rates beyond what trading fees alone would provide. Protocols allocate governance or reward tokens to liquidity providers as additional incentives. These emissions typically follow predetermined schedules that decrease over time, explaining why newer pools often show higher APY that gradually declines.

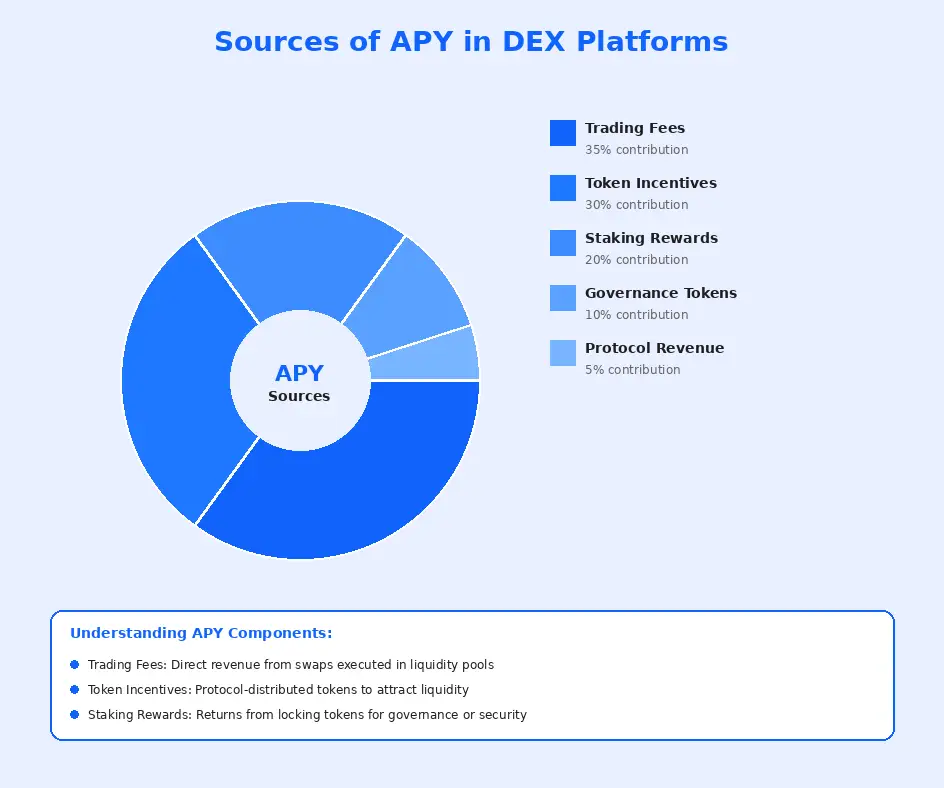

Sources of APY in DEX Platforms

Liquidity Pool APY Explained

Liquidity pool APY represents the returns earned by providing token pairs to automated market maker (AMM) pools on decentralized exchanges. Liquidity provider rewards APY comes from two primary sources: trading fees collected from swaps executed against the pool and additional token incentives distributed by the protocol.

How LP fees contribute to APY depends on the pool’s fee structure and trading activity. Most DEXs charge between 0.1% and 1% per swap, with these fees distributed proportionally among all liquidity providers. High-volume pools generate substantial fee revenue, while lower-activity pools may rely more heavily on token incentives to offer competitive APY.

Yield Farming APY in DEX

DEX yield farming APY overview encompasses strategies that maximize returns by actively moving capital between opportunities and stacking multiple reward sources. Yield farmers may provide liquidity to earn LP tokens, then stake those LP tokens in farming contracts to earn additional governance tokens, creating layered returns.

Incentive tokens and reward distribution mechanisms vary across protocols. Some distribute rewards continuously based on stake proportion, while others use epoch-based systems with periodic distributions. Understanding these mechanisms helps farmers optimize their strategies for maximum DEX passive income APY.

APY in Crypto Staking on DEX

APY in crypto staking within DEX ecosystems offers an alternative to liquidity provision with different risk-reward characteristics. The difference between staking and liquidity APY lies primarily in impermanent loss exposure: staking typically involves single assets without the price divergence risk inherent to LP positions.

Staking rewards inside DeFi ecosystems often come from protocol revenue sharing, governance incentives, or validator rewards for proof-of-stake mechanisms. For those interested in launching their own token through established platforms, our guide on decentralized exchange launchpad platforms provides valuable insights into token distribution mechanisms.

Why APY Is High in Decentralized Exchanges

Reasons Behind High APY in DeFi

Why APY is high in DEX platforms stems from the fundamental differences between decentralized and traditional finance. No intermediaries extract value from the system, meaning more fees flow directly to liquidity providers. Token rewards and early adoption incentives further boost returns as protocols compete aggressively for liquidity and users.

New protocols often launch with extremely high APY DEX platforms rates to bootstrap liquidity quickly. These elevated rates attract capital that enables the protocol to function effectively, creating a flywheel effect where liquidity attracts traders, generating fees that sustain returns even as token emissions decline.

Is High APY Sustainable in DEX?

Real vs advertised APY in DeFi often diverges significantly over time. Extremely high APY rates are typically unsustainable because they depend on token emissions that dilute value or on temporary promotional periods. Sustainable APY in DeFi protocols generally comes from actual trading fee revenue rather than inflationary rewards.

Long-term vs short-term returns differ dramatically in DeFi. A pool showing 1000% APY might drop to 20% within months as more capital enters and emissions decrease. Sophisticated investors focus on sustainable yield models and understand that chasing the highest advertised rates often leads to disappointing outcomes.

Risk Warning: Extremely high APY rates often indicate elevated risk levels. APY above 100% typically relies on inflationary token rewards that may lose value, new protocol risk with unproven security, or unsustainable economic models. Always research thoroughly before committing capital to high-yield opportunities.

Risks Associated With APY in DEX

Impermanent Loss and APY

Impermanent loss and APY have a critical relationship that all liquidity providers must understand. When token prices diverge from their ratio at deposit time, LPs experience impermanent loss that can partially or completely offset APY earnings. For a position to be profitable, earned APY must exceed the impermanent loss incurred.

How LPs can reduce losses involves strategic pool selection. Stable pair pools with highly correlated assets experience minimal impermanent loss. Concentrated liquidity positions allow tighter ranges that capture more fees but amplify impermanent loss if prices move outside the range. Understanding these trade-offs is essential for profitable liquidity provision.

Smart Contract & Market Risks

Smart contract risks in high APY DEX platforms represent perhaps the most significant danger to capital. Bugs, exploits, or vulnerabilities in protocol code can result in complete loss of deposited funds. Even audited protocols have experienced exploits, making smart contract risk an inherent part of DeFi participation.

Token price volatility impact on APY can dramatically affect actual returns. Even high APY becomes meaningless if reward tokens lose significant value. Market-wide downturns can simultaneously reduce trading volume (lowering fee APY) and crash token prices (reducing incentive value), creating compounding negative effects on returns.

How to Earn APY on DEX Safely

Best APY Strategies in DeFi

Best APY strategies in DeFi prioritize risk-adjusted returns over headline rates. Diversifying liquidity pools across multiple protocols and token pairs spreads risk while maintaining exposure to yield opportunities. Choosing stable pairs for a portion of your portfolio provides consistent returns with minimal impermanent loss.

How to earn APY on DEX safely requires ongoing education and monitoring. Understand the source of yields before depositing: sustainable APY in DeFi protocols comes from real economic activity like trading fees, while unsustainable yields often rely solely on token emissions. Regular portfolio review helps identify when to exit declining opportunities.

How to Choose High APY DEX Platforms

Security audits represent the minimum requirement for any platform consideration. High APY DEX platforms should have multiple independent audits from reputable firms, active bug bounty programs, and transparent security practices. Platforms without audits carry unacceptable risk regardless of advertised returns.

Transparent APY calculations allow users to verify advertised rates and understand their composition. Trusted DeFi protocols clearly explain how APY is calculated, what portion comes from fees versus incentives, and how rates may change over time. Opacity about yield sources often indicates potential issues.

DEX Platform Selection Criteria for APY

Security

Multiple audits, bug bounties, track record, insurance options

Yield Source

Fee vs emission ratio, sustainability, tokenomics health

Transparency

Clear APY calculation, open-source code, governance docs

Track Record

Time in operation, TVL stability, community trust

Examples of APY in Popular DEX Platforms

Real-World APY Examples in DeFi

DEX passive income APY scenarios vary widely across platforms and pool types. Established stablecoin pools on major DEXs typically offer 5-20% APY from trading fees alone, representing sustainable yield. Newer token pairs with incentive programs may show 100-500% APY, though these rates typically decline rapidly as more liquidity enters.

Variable vs fixed APY models represent different approaches to yield. Most DeFi APY is variable, changing constantly based on market conditions. Some protocols offer fixed-rate products that lock in yields for specified periods, trading flexibility for predictability. Understanding which model suits your needs helps optimize your DeFi strategy.

| Pool Type | Typical APY Range | Risk Level | IL Exposure |

|---|---|---|---|

| Stablecoin Pairs | 5-20% | Low | Minimal |

| Blue Chip Pairs | 10-50% | Medium | Moderate |

| Incentivized Pools | 50-500% | High | Variable |

| New Token Launches | 100-1000%+ | Very High | Extreme |

Future of APY in Decentralized Exchanges

Trends Shaping DeFi APY Rates

Sustainable yield models are becoming increasingly important as the DeFi ecosystem matures. Protocols are shifting toward revenue-sharing mechanisms where APY comes from actual protocol earnings rather than inflationary token emissions. This transition creates more realistic and sustainable DeFi APY rates.

Reduced inflationary rewards represent the natural evolution of DeFi economics. As protocols mature, token emission schedules decrease, bringing APY rates closer to sustainable levels based on real economic activity. This trend benefits long-term participants who focus on fundamental value rather than short-term yield farming.

Role of Advanced DEX Infrastructure

Smarter liquidity mechanisms are emerging that optimize capital efficiency and improve APY for providers. Concentrated liquidity allows LPs to focus their capital within specific price ranges, earning more fees per dollar deployed. These innovations increase DEX liquidity providing returns while requiring more active management.

Efficient reward distribution systems are being refined to ensure APY reaches intended recipients while minimizing exploitation. For projects looking to build their own exchange infrastructure, our expertise in decentralized exchange solutions encompasses these advanced mechanisms.

How Nadcab Labs Helps Build High-APY DEX Platforms

DEX Services for Sustainable APY

Nadcab Labs specializes in creating custom DEX solutions that implement sustainable yield mechanisms. Our approach focuses on designing tokenomics and reward structures that offer attractive APY while maintaining long-term protocol health. Liquidity pool smart contract implementation ensures efficient fee distribution and secure reward mechanisms.

Secure & Scalable DeFi Exchange Solutions

Our DeFi exchange expertise encompasses comprehensive security practices and optimized yield models. We coordinate thorough security audits, implement battle-tested contract patterns, and design APY mechanisms that balance user attraction with protocol sustainability. Every solution prioritizes both security and capital efficiency.

Ready to build a high-performance crypto exchange with optimized APY mechanisms

Our expert team delivers secure, scalable solutions tailored to your vision

Launch Your Exchange Now

Conclusion

Understanding APY in decentralized exchanges is fundamental for anyone participating in the DeFi ecosystem. From the basic DEX APY meaning to advanced yield farming strategies, this comprehensive understanding enables informed decision-making about where and how to deploy capital. The difference between APY and APR in crypto, the mechanics of APY calculation in DeFi, and the factors driving APY fluctuation in liquidity pools all contribute to successfully navigating this complex landscape.

While high APY DEX platforms can offer attractive returns, understanding the associated risks is equally important. Impermanent loss and APY relationships, smart contract risks in high APY DEX environments, and the distinction between real vs advertised APY in DeFi all demand attention. By applying best APY strategies in DeFi and choosing platforms carefully based on security, transparency, and sustainability, participants can pursue attractive yields while managing risks appropriately.

The future of DeFi APY rates points toward more sustainable models based on genuine economic activity rather than inflationary incentives. As the ecosystem matures, those who understand the fundamentals of how to earn APY on DEX safely will be best positioned to benefit from this evolution. Whether providing liquidity, yield farming, or staking, the principles of diversification, due diligence, and risk management remain essential for long-term success in decentralized finance.

Frequently Asked Questions

APY in decentralized exchanges refers to the Annual Percentage Yield that liquidity providers and yield farmers earn by participating in DeFi protocols. Unlike simple interest, APY in DeFi includes the effect of compound interest, meaning your earnings are reinvested to generate additional returns over time. The decentralized exchange APY can come from trading fees, token rewards, or a combination of both incentive mechanisms.

APY calculation in DeFi uses the formula: APY = (1 + r/n)^n – 1, where r is the periodic interest rate and n is the number of compounding periods per year. For DEX platforms, this calculation factors in trading fees earned, token incentives distributed, and the frequency of compounding. Most platforms compound rewards daily or with each block, significantly boosting effective returns compared to simple interest calculations.

The difference between APY and APR in crypto lies in compounding. APR (Annual Percentage Rate) represents simple interest without compounding, while APY (Annual Percentage Yield) includes compound interest effects. For the same base rate, APY will always be higher than APR when compounding occurs more than once per year. In DeFi, APY vs APR in DeFi matters significantly because frequent compounding can substantially increase your actual returns.

Why APY is high in DEX platforms stems from several factors including the absence of traditional intermediaries, aggressive token emission schedules to attract liquidity, and competition between protocols for users. Early-stage DeFi projects often offer exceptionally high APY DEX platforms rates to bootstrap liquidity, though these rates typically decrease over time as the protocol matures and token emissions reduce.

Is APY fixed or variable in DeFi depends on the specific protocol, but most DEX APY rates are variable. Liquidity pool APY fluctuates based on trading volume, total liquidity in the pool, token prices, and reward emission rates. APY fluctuation in liquidity pools can be significant, sometimes changing dramatically within hours based on market conditions and user activity on the platform.

APY risks in decentralized exchanges include impermanent loss, smart contract vulnerabilities, token price volatility, and unsustainable yield models. Smart contract risks in high APY DEX platforms are particularly concerning as bugs or exploits can result in total loss of funds. Additionally, high APY often comes from inflationary token rewards that may decrease in value, reducing real returns significantly below advertised rates.

Impermanent loss and APY have an inverse relationship where significant price divergence between paired tokens can erode or completely offset APY earnings. When token prices move substantially from their ratio at deposit time, liquidity providers may end up with less value than if they simply held the tokens. The liquidity pool APY must exceed impermanent loss for the position to be profitable overall.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.