Key Takeaways

- Decentralized exchange platforms enable trustless peer-to-peer trading through smart contracts without requiring users to deposit funds with intermediaries.

- DEX architecture consists of smart contracts, liquidity pools, and user interfaces working together to facilitate non-custodial trading operations.

- Automated market maker (AMM) in DEX uses mathematical formulas and liquidity pools to determine prices and execute trades instantly without order books.

- DEX liquidity directly impacts trade execution quality, with higher liquidity resulting in lower slippage and better price accuracy for traders.

- Security measures in DEX platforms include smart contract audits, transparent on-chain operations, and user-controlled private keys for fund protection.

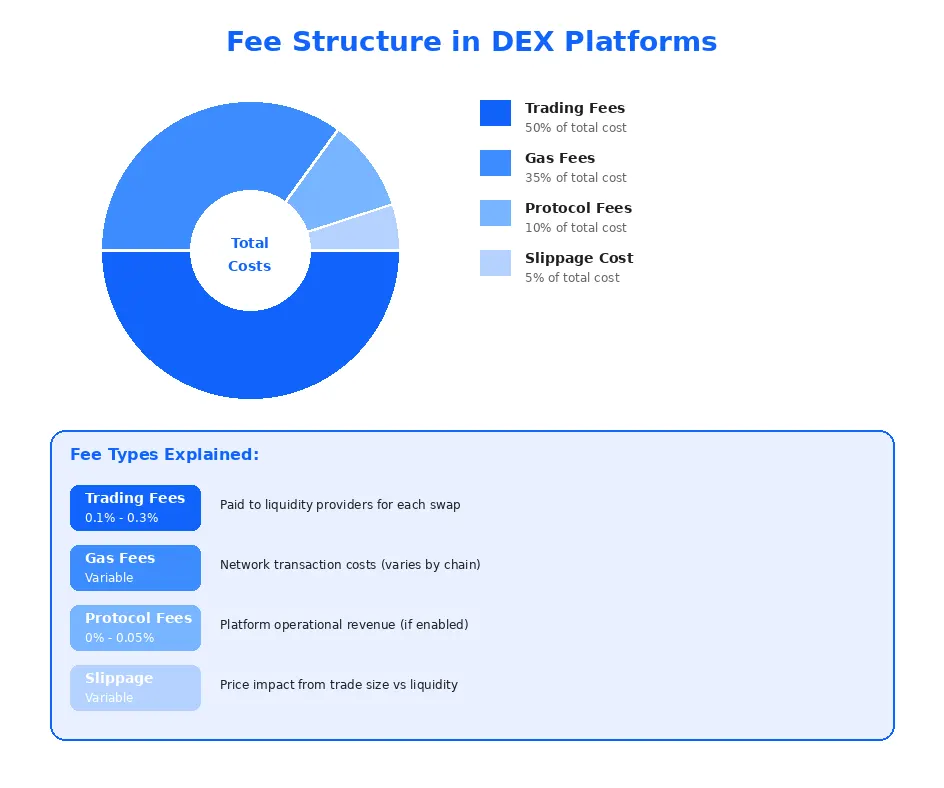

- The fee structure in decentralized exchanges includes trading fees (0.1-0.3%), network gas fees, and liquidity provider incentives that vary by platform.

- Transaction speed in DEX depends on the underlying blockchain, with layer 2 solutions offering near-instant execution at reduced costs.

- Future advancements focus on improving DEX architecture, enhancing liquidity mechanisms, and reducing costs while maintaining security and decentralization.

The rise of decentralized finance has fundamentally transformed how cryptocurrency trading operates. Decentralized exchange platforms represent the backbone of this revolution, enabling millions of users to trade digital assets without relying on centralized intermediaries. Understanding how decentralized exchanges work is essential for traders, investors, and anyone participating in the crypto ecosystem. This comprehensive guide explores every aspect of DEX platforms, from their underlying architecture to the intricacies of liquidity, security, and fee structures.

What Are Decentralized Exchange Platforms

Decentralized exchange platforms are blockchain-based trading systems that allow users to swap cryptocurrencies directly with each other without centralized intermediaries holding their funds. Unlike traditional exchanges that operate as custodians, DEX platforms execute trades through smart contracts that automatically match and settle transactions on-chain. This fundamental difference creates a trustless environment where users maintain complete control over their assets throughout the trading process.

How Decentralized Exchanges Work

How decentralized exchanges work involves a seamless interaction between user wallets, smart contracts, and liquidity mechanisms. When a user initiates a trade, their wallet connects directly to the DEX smart contract, which processes the transaction according to predefined rules. The DEX functioning relies on either automated market makers that use liquidity pools or order book systems that match buyers with sellers algorithmically.

The decentralized exchange workflow begins when users connect their cryptocurrency wallets to the platform interface. They then select the tokens they wish to trade, specify amounts, and approve the transaction. Smart contracts handle the actual swap, transferring tokens between parties atomically, meaning both sides of the trade complete simultaneously or not at all. This atomic execution eliminates counterparty risk inherent in traditional trading.

Importance of Decentralized Exchange Platforms in Crypto

Decentralized exchange platforms serve as critical infrastructure for the entire cryptocurrency ecosystem. They provide censorship-resistant trading access, allowing anyone with an internet connection to participate regardless of geographic location or identity requirements. DEX platforms also enable permissionless token listings, supporting innovation by allowing new projects to gain liquidity without gatekeepers.

Industry Principle: The non-custodial nature of DEX platforms fundamentally shifts the security paradigm from trusting institutions to trusting code. Users who maintain control of their private keys eliminate the risks associated with exchange hacks, insider theft, or platform insolvency that have historically plagued centralized exchanges.

Architecture of Decentralized Exchange Platforms

Understanding DEX Architecture

DEX architecture represents the technical foundation that enables trustless trading through distributed systems. DEX architecture explained at its core involves smart contracts deployed on blockchain networks that handle all trading logic, fund transfers, and state management. The DEX platform structure typically separates concerns between on-chain components for security-critical operations and off-chain elements for user interface and enhanced performance.

Core Components of a Decentralized Exchange

Understanding the core components helps appreciate how decentralized exchange operations function cohesively. Each element plays a specific role in enabling efficient, secure, and transparent trading experiences for users.

Order Matching Engine in DEX

Order matching in DEX platforms that use order book models requires sophisticated algorithms to pair buy and sell orders efficiently. Unlike centralized exchanges with proprietary matching engines, DEX order matching operates through transparent smart contract logic that anyone can verify. The trading mechanism in DEX order books follows price-time priority, matching orders at the best available prices while maintaining fairness through deterministic execution.

Automated Market Makers (AMM) in Decentralized Exchanges

Automated market maker (AMM) in DEX revolutionized decentralized trading by eliminating the need for order books entirely. AMMs use mathematical formulas like the constant product formula (x * y = k) to determine token prices based on pool ratios. When traders swap tokens, they interact directly with liquidity pools, and the algorithm automatically adjusts prices to maintain balance. This innovation enables instant trades without waiting for counterparty orders.

Role of Liquidity Pools in DEX Architecture

Liquidity pools in decentralized exchanges serve as the foundation for AMM-based trading. These pools contain token pairs deposited by liquidity providers who earn fees from trades executed against their deposited assets. The pool depth directly determines the trading experience quality, with deeper pools enabling larger trades with minimal price impact. This mechanism democratizes market making, allowing anyone to participate and earn returns.

How Decentralized Exchange Platform Workflow Operates

DEX Trading Workflow Lifecycle

| Stage | Process | Component | Outcome |

|---|---|---|---|

| 1. Connection | User connects wallet | Web3 Interface | Wallet authenticated |

| 2. Selection | Choose trading pair | User Interface | Trade parameters set |

| 3. Quote | Price calculation | AMM/Order Book | Expected output shown |

| 4. Approval | Token authorization | Smart Contract | Spending permitted |

| 5. Execution | Swap processed | Smart Contract | Tokens exchanged |

| 6. Settlement | On-chain confirmation | Blockchain | Trade finalized |

Liquidity in Decentralized Exchange Platforms

What Is DEX Liquidity and Why It Matters

DEX liquidity represents the total value of assets available for trading within a platform’s pools or order books. Liquidity in decentralized exchanges determines how easily trades can execute without significantly affecting market prices. Higher liquidity enables larger trades with minimal price impact, creating more efficient markets that attract additional traders and liquidity providers in a positive feedback loop.

Factors Affecting Liquidity in Decentralized Exchanges

Trade Volume and Its Impact on DEX Liquidity

Trading volume directly correlates with DEX liquidity as higher activity attracts more liquidity providers seeking fee income. Active trading pairs generate substantial returns for liquidity providers, incentivizing deeper pool deposits. This relationship creates a flywheel effect where increased volume leads to better liquidity, which enables better execution, attracting more traders and volume.

How Liquidity Providers Boost Decentralized Exchange Platforms

Liquidity providers form the backbone of DEX platforms by depositing token pairs into pools that traders use for swaps. In return, they earn a share of trading fees proportional to their pool contribution. This democratized market-making model allows anyone to participate in providing liquidity and earning returns, fundamentally different from traditional finance where market making is reserved for specialized institutions.

Slippage and Price Accuracy in DEX Liquidity

Slippage in DEX liquidity occurs when actual execution prices differ from quoted prices due to pool size limitations relative to trade size. Larger trades relative to pool depth experience more slippage as they significantly shift the token ratio. Understanding and managing slippage is crucial for traders, with most DEX platforms offering slippage tolerance settings to protect against unfavorable execution.

How Liquidity Affects Trading Efficiency on DEX

Adequate liquidity directly enhances trading efficiency by enabling faster execution, better prices, and lower overall trading costs. Deep liquidity pools allow traders to execute larger positions without fragmenting orders or waiting for counterparties. For projects seeking to launch tokens with strong liquidity foundations, exploring decentralized exchange launchpad provides valuable pathways to market.

Security in Decentralized Exchange Platforms

Importance of Security in Decentralized Exchanges

DEX security represents the foundational requirement for user trust and platform viability. Unlike centralized exchanges where security depends on institutional practices, security measures in DEX platforms rely on code quality, cryptographic proofs, and transparent operations. The immutable nature of blockchain means security vulnerabilities can have irreversible consequences, making robust security protocols essential.

Security Measures Implemented in DEX Platforms

Smart Contract Audits in Decentralized Exchanges

Smart contract audits represent the primary security validation for DEX platforms, involving thorough review of code by independent security firms. These audits identify vulnerabilities, logic errors, and potential exploit vectors before code deployment. Reputable DEX platforms undergo multiple audits from different firms and maintain ongoing bug bounty programs to incentivize continuous security review.

Transaction Validation and Transparency in DEX

Security protocols in DEX benefit from the inherent transparency of blockchain transactions. Every trade, liquidity action, and contract interaction is recorded on-chain and verifiable by anyone. This transparency enables real-time monitoring, community oversight, and immediate detection of anomalous activities that might indicate security issues or attempted exploits.

User Wallet and Key Security in DEX Platforms

User wallet and key security in DEX platforms shifts responsibility to individual users who maintain control of their private keys. This non-custodial model eliminates centralized attack targets but requires users to implement proper key management practices. Hardware wallets, secure backup procedures, and careful transaction approval habits become essential for protecting funds in DEX trading.

Common Security Challenges for Decentralized Exchanges

Despite robust security measures, DEX platforms face ongoing challenges including smart contract vulnerabilities, flash loan attacks, oracle manipulation, and front-running by MEV bots. These threats require continuous security evolution and innovative countermeasures. The open-source nature of most DEX code means vulnerabilities can be discovered by malicious actors, necessitating rapid response capabilities.

Security Warning: While DEX platforms eliminate centralized custodial risks, they introduce smart contract risks that users must understand. Always verify you are interacting with official contracts, use reputable platforms with multiple audits, and never approve unlimited token spending. Start with small amounts when using new platforms.

Fees and Cost Structure of Decentralized Exchange Platforms

Understanding Trading Fees in Decentralized Exchanges

Trading fees in DEX platforms fund liquidity provider incentives and protocol operations. The fee structure in decentralized exchanges typically ranges from 0.1% to 0.3% per swap, significantly lower than many centralized alternatives. Understanding the decentralized exchange cost breakdown helps traders optimize their strategies and compare platforms effectively.

Types of Fees on DEX Platforms

| Fee Type | Typical Range | Recipient | Purpose |

|---|---|---|---|

| Trading Fee | 0.1% – 0.3% | Liquidity Providers | LP incentive |

| Protocol Fee | 0% – 0.05% | Protocol Treasury | Platform operations |

| Gas Fee | Variable | Network Validators | Transaction processing |

| Slippage Cost | Variable | Arbitrageurs | Market efficiency |

Transaction Fees in Decentralized Exchange Platforms

Decentralized exchange fees for trading typically consist of a percentage deducted from each swap transaction. These fees accumulate in the liquidity pool and are distributed to providers when they withdraw their positions. The fee percentage varies by platform and sometimes by pool, with stablecoin pairs often featuring lower fees due to reduced impermanent loss risk.

Liquidity Provider Fees in DEX

Liquidity provider fees in DEX represent the primary revenue stream for those supplying capital to trading pools. These fees compensate providers for the risks they assume, including impermanent loss from price divergence. Higher trading volume and strategic pool selection can significantly enhance LP returns, making fee analysis crucial for liquidity provision strategies.

Network Costs and Gas Fees in DEX Platforms

Network costs and gas fees in DEX platforms vary dramatically based on the underlying blockchain and current network congestion. Ethereum mainnet transactions can cost $5-50+ during peak times, while Layer 2 solutions and alternative chains offer transactions for fractions of a cent. Understanding transaction speed in DEX relative to costs helps traders choose optimal networks for their needs.

How Fees Impact Liquidity and Trading on Decentralized Exchanges

The relationship between fees and liquidity creates important dynamics for DEX platforms. Higher fees attract more liquidity providers but may deter traders, while lower fees increase trading volume but reduce LP incentives. Finding the optimal balance is crucial for platform success, with most successful DEX platforms converging around the 0.3% fee standard for volatile pairs.

DEX Platform Selection Criteria

Liquidity Depth

Pool TVL, slippage levels, trading pairs availability

Security Track Record

Audit history, time in operation, incident response

Fee Structure

Trading fees, gas costs, LP incentives balance

Network Choice

Transaction speed, costs, asset availability

Future of Decentralized Exchange Platforms

Advancements in DEX Architecture

Future DEX architecture will incorporate concentrated liquidity, which allows providers to focus capital within specific price ranges for enhanced efficiency. Cross-chain protocols will enable seamless trading across different blockchain networks. For projects building advanced trading infrastructure, comprehensive decentralized exchange solutions offer the expertise needed for next-generation platforms.

Innovations in Liquidity Management for Decentralized Exchanges

Innovations in liquidity management include dynamic fee mechanisms that adjust based on volatility, automated position management for liquidity providers, and cross-protocol liquidity aggregation. These advancements will improve capital efficiency, reduce impermanent loss, and create better returns for liquidity providers while enhancing execution quality for traders.

Enhancing Security Protocols in DEX Platforms

Future security enhancements will leverage formal verification, improved oracle designs, and MEV protection mechanisms to create more robust DEX platforms. Real-time monitoring systems with automated response capabilities will detect and mitigate threats faster. Insurance protocols and safety modules will provide additional protection layers for users and liquidity providers.

Reducing Costs and Fees for Users on Decentralized Exchanges

Cost reduction efforts focus on layer 2 scaling solutions that dramatically decrease gas fees while maintaining security. Batch processing, optimistic rollups, and zero-knowledge proofs enable more transactions per block at lower costs. These improvements will make DEX trading accessible to users who currently face prohibitive transaction costs on congested networks.

Ready to build a high-performance crypto exchange with optimized architecture and liquidity

Our expert team delivers secure, scalable solutions tailored to your vision

Launch Your Exchange Now

Conclusion

Decentralized exchange platforms represent a fundamental evolution in how cryptocurrency trading operates, offering trustless, transparent, and accessible alternatives to centralized systems. Understanding how decentralized exchanges work across the dimensions of architecture, liquidity, security, and fees empowers users to make informed decisions and optimize their trading strategies.

The DEX architecture combining smart contracts, AMMs, and liquidity pools creates efficient trading environments that anyone can access and participate in. DEX liquidity dynamics determine execution quality, making pool depth and trading volume crucial factors for traders to consider. Security measures in DEX platforms provide robust protection through code audits, transparency, and non-custodial design, though users must understand their role in maintaining wallet security.

The fee structure in decentralized exchanges balances incentives between traders and liquidity providers while covering network costs. As the technology continues advancing, DEX platforms will become increasingly efficient, secure, and cost-effective. Those who understand these mechanisms today position themselves to capitalize on opportunities as decentralized trading becomes the dominant paradigm for cryptocurrency exchange.

Frequently Asked Questions

Decentralized exchange platforms work by enabling peer-to-peer cryptocurrency trading without intermediaries through smart contracts on blockchain networks. How decentralized exchanges work involves users connecting their wallets directly to the platform, where trades execute automatically via smart contracts. The DEX functioning relies on either order book matching or automated market maker (AMM) systems that use liquidity pools to facilitate trades instantly.

DEX architecture refers to the technical framework that powers decentralized exchanges, including smart contracts, liquidity pools, and user interfaces. The DEX platform structure typically consists of on-chain components for trade execution and settlement, combined with off-chain elements for order management and user experience. DEX architecture explained simply involves the interaction between user wallets, smart contracts, and liquidity mechanisms that enable trustless trading.

DEX liquidity represents the availability of assets in trading pools that enables smooth trade execution without significant price impact. Liquidity in decentralized exchanges matters because it directly affects trade execution speed, slippage levels, and overall trading costs. Higher liquidity pools in decentralized exchanges result in better prices, tighter spreads, and more efficient trading experiences for all users.

Automated market maker (AMM) in DEX uses mathematical formulas to determine token prices based on the ratio of assets in liquidity pools rather than traditional order books. When traders swap tokens, the AMM algorithm automatically adjusts prices to maintain balance in the pool. This trading mechanism in DEX eliminates the need for counterparties and enables instant trades at any time with available liquidity.

Security measures in DEX platforms include smart contract audits, formal verification, multi-signature controls, and transparent on-chain operations. DEX security relies on the immutability of blockchain and cryptographic proofs rather than trusting centralized entities. Security protocols in DEX also involve time-locks on critical functions, bug bounty programs, and community governance for protocol upgrades.

Decentralized exchange fees typically include trading fees (usually 0.1-0.3% per swap), network gas fees for blockchain transactions, and sometimes protocol fees. The fee structure in decentralized exchanges varies by platform, with trading fees in DEX going primarily to liquidity providers as incentives. Understanding the decentralized exchange cost structure helps traders optimize their strategies and minimize overall expenses.

Slippage in DEX liquidity occurs when the executed trade price differs from the expected price due to insufficient liquidity or large order sizes relative to pool depth. Low liquidity pools experience higher slippage as trades significantly impact the token ratio and price calculation. Traders can minimize slippage by trading in high-liquidity pools, splitting large orders, and setting appropriate slippage tolerance limits.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.