The stablecoin market has crossed the $300 billion mark as we step into 2026, and it shows no signs of slowing down. More people, businesses, and institutions now rely on stablecoins for payments, savings, and trading than ever before. But with dozens of options out there, picking the right stablecoin can feel a bit overwhelming.

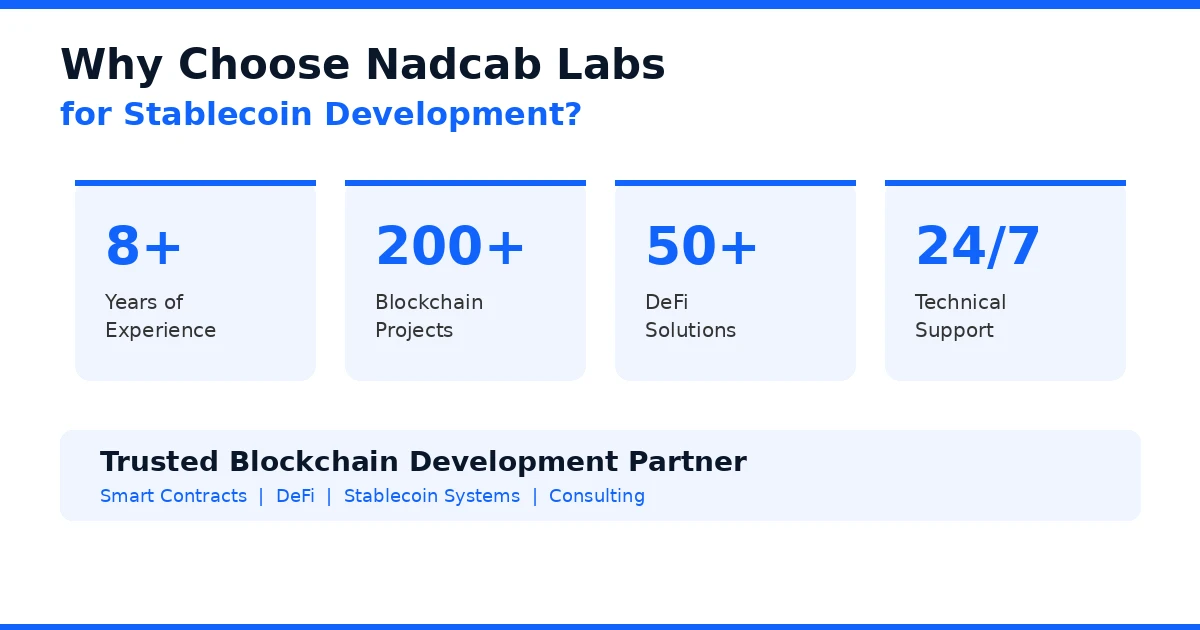

This guide breaks down the top 7 stablecoins you should know about in 2026. Whether you are a trader looking for liquidity, an investor seeking safety, or a business exploring cross-border payments, this article covers what each stablecoin brings to the table. We also look at the different types, how they work, and what factors should drive your decision. With over 8 years of hands-on experience in blockchain development and consulting, Nadcab Labs has helped hundreds of businesses navigate the stablecoin space, and this guide draws from that real-world expertise.

Key Takeaways

- Stablecoins are digital currencies pegged to stable assets like the US dollar or gold, designed to reduce price volatility common in traditional cryptocurrencies.

- USDT and USDC remain the two largest stablecoins by market cap in 2026, with USDT leading in liquidity and USDC leading in regulatory compliance.

- Newer players like USDe (Ethena) and FDUSD (First Digital) are gaining traction with innovative mechanisms and multi-chain deployments.

- There are four main types of stablecoins: fiat-backed, crypto-backed, commodity-backed, and synthetic (algorithmic).

- DAI continues to be the top choice for users who value decentralization and censorship resistance in DeFi applications.

- PAXG offers exposure to physical gold through tokenization, making it a strong hedge against inflation and market uncertainty.

- Regulatory frameworks like the US GENIUS Act and the EU MiCA regulation are shaping the stablecoin landscape in 2026, making compliance a key factor when selecting a stablecoin.

- Nadcab Labs, with 8+ years of blockchain expertise, provides end-to-end stablecoin development and consulting services to businesses and startups.

What Are Stablecoins and Why Do They Matter in 2026?

If you have spent any time in the crypto world, you know that prices can swing wildly within hours. Bitcoin might drop 10% in a day. Ethereum can shoot up 15% overnight. That kind of volatility is great for some traders, but it creates problems for people who want to use crypto for everyday transactions, savings, or business operations.

That is where stablecoins come in. A stablecoin is a type of cryptocurrency designed to hold a steady value. Most stablecoins are pegged to the US dollar, meaning one token is supposed to be worth exactly $1 at all times. Some are pegged to other assets like gold or the euro, but dollar-pegged stablecoins dominate the market.

Think of stablecoins as the digital version of keeping cash in your wallet. You get all the benefits of blockchain technology, including fast transfers, low fees, and global accessibility, without the wild price swings. In 2026, the total stablecoin market cap sits above $300 billion, and monthly transaction volumes are closing in on numbers that rival traditional payment networks like Visa and Mastercard.

Stablecoins matter more now because regulatory clarity has finally arrived. The US passed the GENIUS Act, and the EU rolled out MiCA regulations, both of which provide clear rules for stablecoin issuers. This has opened the door for wider institutional adoption and boosted confidence among everyday users. At Nadcab Labs, we have seen a significant uptick in clients asking for stablecoin integration into their platforms, payment systems, and DeFi protocols over the past year. Understanding blockchain adoption challenges is the first step toward making informed decisions about which stablecoin works best for your specific use case.

Types of Stablecoins in Blockchain

Not all stablecoins are built the same way. The method used to keep a stablecoin’s value stable is what defines its type. Here is a breakdown of the four main categories you will encounter in 2026.

Fiat-Collateralized Stablecoins are the most straightforward type. For every stablecoin token in circulation, there is a corresponding dollar (or equivalent asset) held in reserve by the issuing company. USDT, USDC, TUSD, and FDUSD all fall into this category. The reserves typically consist of cash, US Treasury bills, and other low-risk financial instruments. The biggest advantage here is simplicity. The biggest risk is that you have to trust the issuer to actually hold those reserves. Regular audits and attestations help, but the level of transparency varies from issuer to issuer.

Crypto-Collateralized Stablecoins take a different approach. Instead of holding dollars in a bank, these stablecoins are backed by other cryptocurrencies locked in smart contracts. DAI is the most well-known example. Because crypto prices are volatile, these stablecoins are usually over-collateralized, meaning there is more crypto locked up than the value of stablecoins issued. If you deposit $150 worth of Ethereum, you might only be able to mint $100 worth of DAI. This buffer protects the system if ETH prices drop.

Commodity-Collateralized Stablecoins are backed by physical assets like gold or silver. PAXG (Paxos Gold) is the leading example. Each PAXG token represents one troy ounce of gold stored in secure vaults. The value of these stablecoins moves with the price of the underlying commodity, so they are not pegged to $1. Instead, they offer a way to hold real-world assets on the blockchain.

Synthetic Stablecoins use financial engineering rather than traditional reserves. USDe from Ethena Labs is the most prominent example in 2026. It maintains its dollar peg through delta-neutral hedging, which involves holding crypto collateral while simultaneously taking short positions in perpetual futures contracts. The profits from this strategy help keep the peg stable and also generate yield for holders. These stablecoins are complex, but they represent an important innovation in the space.

| Type | Backing Mechanism | Examples | Risk Level |

|---|---|---|---|

| Fiat-Collateralized | Cash, Treasury bills in reserves | USDT, USDC, TUSD, FDUSD | Low to Moderate |

| Crypto-Collateralized | Over-collateralized crypto in smart contracts | DAI | Moderate |

| Commodity-Collateralized | Physical gold/silver in vaults | PAXG | Low |

| Synthetic | Delta-neutral hedging strategies | USDe | Moderate to High |

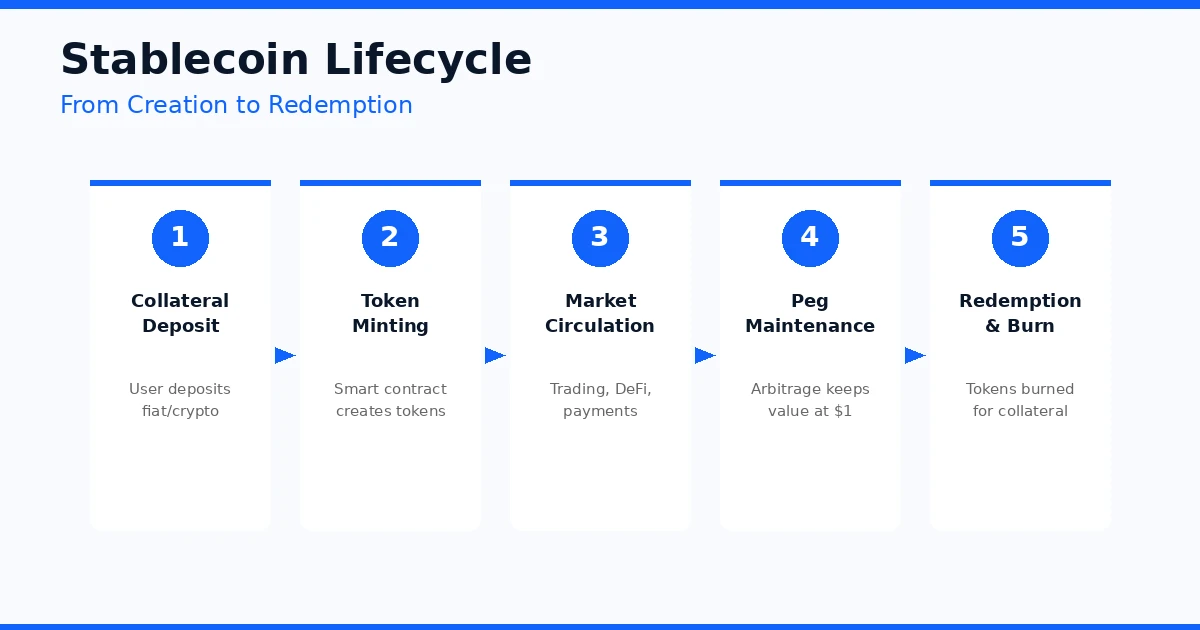

How the Stablecoin Lifecycle Works

Understanding how stablecoins move from creation to redemption helps you see why some are more reliable than others. Here is how the process typically works, step by step.

It starts with collateral deposit. A user or institution deposits the required backing asset with the stablecoin issuer. For fiat-backed stablecoins, this means sending US dollars to the issuer’s bank account. For crypto-backed stablecoins like DAI, it means locking cryptocurrency into a smart contract. For commodity-backed tokens like PAXG, it means purchasing allocated gold.

Next comes token minting. Once the collateral is verified and secured, the issuer’s smart contract creates new stablecoin tokens. These tokens are then sent to the depositor’s wallet. The minting process is often automated through smart contracts, especially for decentralized stablecoins. If you are interested in how blockchains handle complex processes like this, reading about atomicity in blockchain gives you a good foundation.

The tokens then enter market circulation. Stablecoins are traded on exchanges, used in DeFi protocols for lending and borrowing, sent as payments, and held as savings. During this phase, the stablecoin functions like digital cash, moving between wallets and platforms.

Peg maintenance happens continuously behind the scenes. If a stablecoin trades slightly above $1, arbitrageurs buy the cheaper collateral and mint new tokens, pushing the price back down. If it drops below $1, they buy the discounted tokens and redeem them for the full $1 worth of collateral, pushing the price back up. This natural market mechanism, combined with the issuer’s reserve management, keeps the peg intact. The role of state channels in blockchain and other scaling solutions also helps stablecoins process transactions faster, which supports smoother peg stability.

Finally, redemption and burning closes the loop. When a holder wants to cash out, they send their stablecoin tokens back to the issuer. The smart contract destroys (burns) those tokens, and the corresponding collateral is released back to the holder. This process reduces the circulating supply and keeps the stablecoin fully backed at all times.

Top 7 Stablecoins to Use on Blockchain in 2026

Now let us get into the main list. These seven stablecoins have been selected based on their market capitalization, liquidity, transparency, use cases, and overall reputation heading into 2026. Each one serves a different purpose, so the best choice depends on what you need.

1. USDT (Tether)

USDT is the largest stablecoin in the world by market capitalization, sitting well above $145 billion as of early 2026. It was launched back in 2014 by Tether Limited, a subsidiary of Hong Kong-based iFinex, and has maintained its position at the top ever since. USDT is pegged to the US dollar and backed by a combination of cash, commercial paper, US Treasury bills, and other assets.

What makes USDT stand out is its sheer liquidity. It is available on virtually every cryptocurrency exchange and supported across more than 15 different blockchains, including Ethereum, Tron, Solana, and Avalanche. For traders, this means you can enter and exit positions quickly with minimal slippage. For businesses handling cross-border payments, USDT provides fast settlement at low cost.

The main criticism of USDT has always been around transparency. Unlike some competitors, Tether does not publish full independent audits but rather provides quarterly attestations. That said, the company has improved its disclosure practices over the years, and in early 2026, Tether even launched a new US-regulated stablecoin called USA₮ under the GENIUS Act framework. For many users, USDT’s liquidity advantage outweighs transparency concerns. If you are building a platform on the Avalanche blockchain, USDT is one of the first tokens you will want to integrate.

2. USDC (USD Coin)

USDC is issued by Circle and has positioned itself as the gold standard for regulatory compliance in the stablecoin market. With a market cap exceeding $75 billion in early 2026, it is the second largest stablecoin globally. Every USDC token is backed 1:1 by cash and short-term US Treasury bills, held at top-tier custodians including BlackRock and BNY Mellon.

What really sets USDC apart is its transparency. Circle publishes monthly audit reports conducted by Deloitte, a level of disclosure that no other major stablecoin issuer matches. The company went public on the NYSE in 2025, adding another layer of accountability and oversight.

USDC has become the preferred stablecoin for institutional investors, traditional financial companies, and payment processors like Visa and Mastercard. It is deployed across 15 blockchains, including Ethereum, Solana, Base, and Avalanche. If your priority is safety and compliance, USDC is hard to beat. Realistic yields of 4 to 6% APY are available through Circle’s own programs and DeFi protocols like Aave and Compound.

The trade-off is that USDC enforces strict compliance rules. Addresses tied to sanctioned entities or ongoing investigations can be frozen, which some users see as a negative from a decentralization perspective.

3. DAI

DAI stands apart from every other stablecoin on this list because it is fully decentralized. There is no single company behind DAI. Instead, it is governed by MakerDAO, a community of token holders who vote on protocol changes and risk parameters. DAI is minted when users deposit crypto assets like ETH or wrapped Bitcoin as collateral into smart contracts called Vaults.

The system is designed to be over-collateralized. If you want to mint $100 worth of DAI, you typically need to lock up $150 or more in crypto assets. This buffer protects the system from price swings in the underlying collateral. If prices drop too far, the smart contract automatically liquidates the collateral to keep DAI stable.

In 2026, DAI remains the go-to stablecoin for DeFi power users. It is widely used in lending, borrowing, yield farming, and DAO treasury management across protocols like Aave, Compound, and Curve. Its market cap hovers around $5 billion, which is much smaller than USDT or USDC, but its importance within the DeFi ecosystem is outsized. Understanding how decentralized consensus mechanisms like DPoS in blockchain work can give you a deeper appreciation for how DAI’s governance model functions.

DAI’s biggest strength is also its biggest limitation. Because it relies on crypto collateral, it can experience small deviations from its $1 peg during extreme market events. These depegs are usually minor and temporary, but they do happen.

4. PAXG (Paxos Gold)

PAXG is not your typical stablecoin. Instead of being pegged to $1, each PAXG token represents one fine troy ounce of physical gold stored in London Bullion Market Association (LBMA) approved vaults. As of early February 2026, PAXG trades around $4,900 to $5,000 per token, tracking the spot price of gold.

Paxos Trust Company, the issuer behind PAXG, is regulated by the New York Department of Financial Services (NYDFS). The company provides monthly attestation reports verifying that the gold reserves match the token supply. Holders of PAXG actually own the underlying gold and can even redeem their tokens for physical gold bars if they hold enough.

PAXG is an excellent choice for investors looking to hedge against inflation and market uncertainty. Gold has been on a strong uptrend, and holding it on the blockchain eliminates the hassle of physical storage, insurance, and shipping. You can buy fractional amounts, trade it 24/7 on crypto exchanges, and even use it as collateral in DeFi protocols. The current market cap sits around $2.2 billion with a circulating supply of approximately 455,000 tokens.

For businesses that deal with commodities or want to diversify their treasury, PAXG offers a bridge between traditional assets and blockchain technology. At Nadcab Labs, we have built several platforms that integrate commodity-backed tokens like PAXG for portfolio management and trading applications.

5. USDe (Ethena)

USDe from Ethena Labs is one of the most innovative stablecoins to emerge in recent years. Launched in early 2024, it quickly climbed to become the third-largest stablecoin by market cap, surpassing $6 billion. USDe is a synthetic stablecoin, meaning it does not hold fiat dollars in a bank. Instead, it uses a delta-neutral hedging strategy to maintain its $1 peg.

Here is how it works in simple terms. Ethena accepts crypto assets like staked Ethereum as collateral. It then takes short positions in perpetual futures contracts that match the value of that collateral. If ETH goes up, the short positions lose value but the collateral gains value, and vice versa. The two cancel each other out, keeping the overall position stable at $1. The funding rates from these futures positions generate yield for USDe holders, often between 10 to 20% APY.

This yield is what attracts so many users, but it also comes with risks. The system depends on perpetual funding rates remaining positive. If market conditions shift and funding rates turn negative for an extended period, it could put pressure on the peg. USDe has also experienced minor depegs during sharp Ethereum drawdowns, though it has recovered each time.

USDe is backed by BlackRock’s BUIDL fund and has recently partnered with Anchorage Digital for US custody, positioning itself for GENIUS Act compliance. For DeFi-focused users willing to accept higher complexity in exchange for higher yield, USDe is worth serious consideration. Grasping the role of Plasma in blockchain can help you understand the Layer 2 scaling approaches that support some of USDe’s underlying infrastructure.

6. FDUSD (First Digital USD)

FDUSD is issued by First Digital Labs, a Hong Kong-based company, and has established itself as a solid fiat-backed stablecoin option, especially within the Binance ecosystem. Each FDUSD token is backed 1:1 by US dollars and cash equivalents, with reserves held in segregated, bankruptcy-remote accounts. The company publishes monthly audit reports following ISAE 3000 standards.

What makes FDUSD notable is its multi-chain architecture. As of 2026, it is deployed on Ethereum, BNB Chain, TON, Solana, Arbitrum, and Sui, giving users broad access across different blockchain ecosystems. The integration with TON is particularly interesting because it opens up stablecoin functionality within Telegram’s massive user base.

FDUSD gained a lot of traction during 2024 and 2025 thanks to its strong presence on Binance, where it was commonly used for zero-fee trading pairs. While Binance has since delisted some FDUSD margin pairs, the stablecoin still maintains healthy liquidity and adoption. Its current market cap is around $500 million, which is smaller than the top players, but its technical foundation and compliance posture make it a reliable choice for users in the Asia-Pacific region and beyond.

If your project involves building on multiple blockchains or requires a stablecoin with strong compliance documentation, FDUSD is a practical option. Ensuring smooth performance across chains requires understanding concepts like node synchronization in blockchain, which Nadcab Labs specializes in for multi-chain deployments.

7. TUSD (TrueUSD)

TrueUSD is a fiat-collateralized stablecoin that emphasizes transparency through real-time, on-chain reserve verification. Each TUSD token is backed 1:1 by US dollars held in reserve, and the project uses third-party attestation services to provide live proof of reserves. This approach goes beyond the periodic reports that most stablecoin issuers provide.

TUSD was one of the earlier regulated stablecoins to enter the market, and it has maintained a steady presence since then. It is available on major exchanges and supports transactions on Ethereum, BNB Chain, and several other networks.

While TUSD’s market cap has declined compared to its peak levels, it still serves a purpose for users who prioritize verifiable reserve backing in real time. It is a straightforward, no-surprises stablecoin that does exactly what it promises. For investors and businesses that want a simple, compliant option without the complexity of synthetic mechanisms, TUSD remains a solid choice.

Comparing the Top 7 Stablecoins: Side by Side

To make your decision easier, here is a comparison table that puts all seven stablecoins next to each other based on the factors that matter most.

| Stablecoin | Peg | Type | Market Cap (2026) | Transparency | Best For |

|---|---|---|---|---|---|

| USDT | USD | Fiat-Backed | $145B+ | Quarterly Attestations | Trading, Liquidity |

| USDC | USD | Fiat-Backed | $75B+ | Monthly Audits (Deloitte) | Institutions, Compliance |

| DAI | USD | Crypto-Backed | $5B+ | Fully On-Chain | DeFi, Decentralization |

| PAXG | Gold | Commodity-Backed | $2.2B+ | Monthly Attestations | Inflation Hedge, Gold Exposure |

| USDe | USD | Synthetic | $6B+ | On-Chain Verification | High Yield, DeFi |

| FDUSD | USD | Fiat-Backed | $500M+ | Monthly ISAE 3000 Audits | Asia-Pacific, Multi-Chain |

| TUSD | USD | Fiat-Backed | $500M+ | Real-Time On-Chain | Verifiable Reserves |

This table should give you a quick snapshot of where each stablecoin fits. But numbers alone do not tell the whole story. The right stablecoin depends on your goals, your risk tolerance, and the blockchain ecosystem you operate in.

How to Choose the Right Stablecoin for Your Needs

With seven strong options on the table, how do you actually pick one? The answer depends on what you are trying to accomplish. Here are some practical scenarios to guide your thinking.

If you are a trader who needs maximum liquidity, USDT is the clear winner. Its massive trading volume and presence on every major exchange means you can move in and out of positions without worrying about slippage or availability.

If you are an institution or business that needs regulatory compliance, USDC should be your first choice. Its audits, NYSE-listed issuer, and integration with traditional payment networks make it the safest bet from a compliance standpoint.

If you are a DeFi user who values decentralization, DAI offers something no other major stablecoin can: true community governance and censorship resistance. No single entity can freeze your DAI tokens or block your transactions.

If you want to hedge against inflation with gold exposure, PAXG lets you hold physical gold on the blockchain without the logistical headaches of traditional gold ownership.

If you are looking for high yield and are comfortable with complexity, USDe’s synthetic approach offers returns that far exceed what you can get with traditional fiat-backed stablecoins.

If you are building on multiple blockchains in the Asia-Pacific region, FDUSD’s multi-chain deployment and compliance documentation make it a practical choice.

And if you simply want a straightforward, transparent stablecoin with real-time proof of reserves, TUSD delivers on that promise without any bells and whistles.

At Nadcab Labs, we often help clients evaluate these options based on their specific technical requirements, regulatory environment, and business objectives. Choosing the right stablecoin is not just about the token itself. It is about how it integrates with your existing systems, what blockchain networks you are targeting, and how your users will interact with it. You can also read about how sidechain pegs in blockchain work, as they play a role in how some stablecoins maintain cross-chain compatibility.

Build Your Stablecoin Strategy with Experts

Need help choosing, integrating, or building stablecoin solutions? Nadcab Labs brings 8+ years of blockchain expertise to help you move with confidence.

The Regulatory Landscape for Stablecoins in 2026

Regulation has been a hot topic for stablecoins for years. In 2026, the picture is much clearer than it was even two years ago. Two major regulatory frameworks have reshaped how stablecoins operate globally.

The GENIUS Act in the United States provides federal guidelines for stablecoin issuers. It defines what qualifies as a compliant stablecoin, sets reserve requirements, and establishes oversight mechanisms. Tether’s launch of its new USA₮ stablecoin under this framework is a direct result of this legislation. USDC was already positioned well for compliance, and the GENIUS Act further solidified its standing.

In Europe, the Markets in Crypto-Assets (MiCA) regulation has introduced standardized licensing and transparency requirements for stablecoin issuers operating in EU markets. This has created a more level playing field and has encouraged new entrants who can meet the higher compliance bar.

These regulations are good news for the stablecoin market overall. They increase trust, attract institutional capital, and protect consumers. However, they also raise the bar for smaller issuers and make it harder for unregulated tokens to compete. For businesses building stablecoin-related products, working with an experienced blockchain development company like Nadcab Labs ensures that your solutions are compliant from day one.

| Regulation | Region | Key Requirements | Impact on Stablecoins |

|---|---|---|---|

| GENIUS Act | United States | Federal licensing, reserve standards, oversight | Legitimizes compliant stablecoins; raises compliance bar |

| MiCA | European Union | Licensing, transparency, consumer protection | Creates standardized rules; encourages institutional adoption |

Real-World Use Cases of Stablecoins in 2026

Stablecoins are no longer just a crypto trading tool. Their real-world applications have expanded significantly. Here are some practical examples of how people and businesses are using stablecoins right now.

Cross-border payments are one of the biggest use cases. Sending money internationally through traditional banks is slow, expensive, and often takes multiple business days. With stablecoins like USDT or USDC, the same transfer can be completed in minutes for a fraction of the cost. This is especially valuable for migrant workers sending remittances home and for businesses paying international suppliers.

DeFi lending and borrowing relies heavily on stablecoins. Protocols like Aave and Compound let you deposit stablecoins to earn interest, or use them as collateral to borrow other assets. DAI and USDe are particularly popular in this space. According to industry data, stablecoins account for roughly 70% of all DeFi transaction volume.

Treasury management is another growing area. Companies that hold crypto on their balance sheets use stablecoins to reduce volatility exposure during bearish periods. PAXG adds another dimension by allowing businesses to hold gold-backed assets alongside dollar-pegged stablecoins. Exploring how tools like Bitcoin blockchain explorers work can help you monitor on-chain treasury movements in real time.

E-commerce and merchant payments have also started adopting stablecoins. Some online platforms now accept USDC and USDT as payment, offering customers a fast and borderless payment option. As more payment processors integrate stablecoins, this trend will accelerate. Projects that explore new blockchain platforms for payments may also benefit from understanding how to create tokens on the Sui blockchain or similar emerging networks.

Why Nadcab Labs Is the Right Partner for Stablecoin Projects

Building, integrating, or managing stablecoin solutions requires deep blockchain expertise and a practical understanding of the regulatory environment. Nadcab Labs has been in the blockchain development and consulting space for over 8 years, and during that time, we have helped businesses across multiple industries design and deploy stablecoin-related solutions.

Our team has worked on everything from custom smart contract development for stablecoin minting and redemption to full-stack DeFi platform builds that integrate multiple stablecoins. We understand the technical challenges of maintaining peg stability, building secure smart contracts, and ensuring compliance with evolving regulations.

What sets Nadcab Labs apart is that we do not just write code. We work with you to understand your business objectives, assess which stablecoin architecture fits your needs, and guide you through the entire development lifecycle. Whether you need to build a stablecoin from scratch, integrate existing stablecoins into your platform, or audit your current smart contracts for security vulnerabilities, our team has the experience and track record to deliver. Learning about approaches like PoET for permissioned blockchain and decentralized identifiers can give you a sense of the breadth of blockchain technologies we work with across our projects.

We have also published detailed resources on topics like orphan blocks in blockchain to help our community better understand how blockchain networks operate at a fundamental level.

Final Thoughts

The stablecoin market in 2026 is more mature, more regulated, and more diverse than it has ever been. Whether you choose USDT for its liquidity, USDC for its compliance, DAI for its decentralization, PAXG for its gold backing, USDe for its yield, FDUSD for its multi-chain reach, or TUSD for its real-time transparency, there is a stablecoin that fits your specific needs.

The key is to understand what each option offers, what risks come with it, and how it aligns with your goals. Stablecoins are not just another crypto trend. They are becoming a fundamental part of the global financial system, and the decisions you make now about which ones to use will shape your experience in the years ahead.

If you need expert guidance on stablecoin integration, development, or consulting, Nadcab Labs is here to help. With over 8 years of experience and hundreds of successful blockchain projects, we bring the technical depth and business understanding that your project needs.

Frequently Asked Questions

USDC is generally considered the safest stablecoin to hold in 2026 because of its monthly audits by Deloitte, full backing by cash and US Treasury bills, and Circle’s public listing on the NYSE. It also meets requirements under both the US GENIUS Act and EU MiCA regulations, making it the most compliance-friendly option. However, safety also depends on your use case. For gold exposure, PAXG offers physical gold backing regulated by the NYDFS.

Fiat-backed stablecoins like USDT and USDC maintain their peg by holding equivalent dollar reserves for every token issued. Crypto-backed stablecoins like DAI use over-collateralization and smart contract automation to keep the price steady. Synthetic stablecoins like USDe use delta-neutral hedging strategies. In all cases, market arbitrageurs play a role by buying tokens below $1 and redeeming them for full value, which naturally pushes the price back to the target peg.

Yes, there are several ways to earn yield on stablecoins in 2026. DeFi protocols like Aave and Compound let you lend your USDC or DAI for interest. USDe from Ethena Labs offers built-in yield through its delta-neutral hedging strategy, often between 10 to 20% APY. Circle also offers yield programs for USDC holders. The returns vary depending on the platform, the stablecoin, and current market conditions, so always assess the risks before depositing funds.

Both USDT and USDC are fiat-backed stablecoins pegged to the US dollar, but they differ in transparency and governance. USDC is issued by Circle, publicly listed on the NYSE, and undergoes monthly audits by Deloitte. USDT is issued by Tether Limited and provides quarterly attestations instead of full audits. USDT has higher liquidity and trading volume, making it preferred by traders. USDC is favored by institutions and businesses that need strong regulatory compliance and transparency.

PAXG is technically classified as a commodity-backed stablecoin, but it behaves differently from dollar-pegged stablecoins. Each PAXG token represents one troy ounce of physical gold stored in LBMA approved vaults in London. Its price tracks the spot price of gold, which means it fluctuates with the gold market rather than staying fixed at $1. PAXG is regulated by the New York Department of Financial Services and is issued by Paxos Trust Company. It is ideal for blockchain users who want gold exposure without physical storage.

Nadcab Labs offers end-to-end blockchain development and consulting services for stablecoin projects. With over 8 years of experience, we help businesses design stablecoin architectures, build secure smart contracts for minting and redemption, integrate stablecoins into DeFi platforms, and ensure compliance with regulations like the GENIUS Act and MiCA. We also provide ongoing support for maintaining peg stability and optimizing system performance across multiple blockchain networks.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.