Blockchain networks are growing fast, but they often struggle to keep up with demand. Sidechain peg mechanisms offer a practical solution by moving transactions away from crowded main networks. This guide breaks down how these systems work and why they matter for businesses and developers looking to build faster, cheaper blockchain applications.

Key Takeaways

- Sidechain peg mechanisms allow assets to move between a main blockchain and a secondary chain through a secure locking and unlocking process.

- Two-way pegs enable bidirectional asset transfers, while one-way pegs only allow movement in a single direction.

- Offloading transactions to sidechains reduces congestion on the main network, resulting in faster processing and lower fees.

- Real networks like Liquid Network for Bitcoin and Polygon for Ethereum demonstrate practical scalability improvements through sidechain technology.

- Sidechains differ from Layer 2 solutions and sharding by maintaining their own consensus mechanisms while staying connected to the parent chain.

- Security considerations include validator trust models and the balance between decentralization and transaction speed.

Introduction: The Scalability Challenge in Blockchains

Every blockchain network faces a fundamental problem. As more people use the network, transactions pile up, fees increase, and confirmation times slow down. Bitcoin processes roughly seven transactions per second. Ethereum handles around 15 to 30. Compare that to Visa, which manages thousands of transactions every second, and you can see the gap.

This limitation comes from how blockchains work. Every node in the network must verify and store every transaction. This creates security and decentralization but limits throughput. The more users join, the worse the congestion becomes.

Sidechains and their peg mechanisms provide one answer to this problem. Instead of processing every transaction on the main chain, sidechains handle the overflow. Assets move between chains through peg mechanisms that keep everything secure and synchronized. Understanding how blockchain technology works helps grasp why these solutions matter for long-term adoption.

What Is a Sidechain? (Explained Simply)

A sidechain is a separate blockchain that runs alongside a main blockchain, often called the parent chain or mainchain. Think of it like a highway with multiple lanes. When the main lane gets crowded, traffic can shift to side lanes to keep things moving.

Sidechains operate independently with their own rules and consensus mechanisms. They can process transactions faster or handle specific types of applications without affecting the main network. However, they stay connected to the parent chain through bridges that allow assets to move back and forth.

According to Wikipedia, sidechains were first proposed in 2014 as a way to add new features to Bitcoin without changing its core protocol. The concept has since expanded to other blockchains and become a key part of the scalability toolkit.

Mainchain vs Sidechain Comparison

| Feature | Mainchain | Sidechain |

|---|---|---|

| Primary Purpose | Core network security and settlement | Specialized tasks and overflow processing |

| Consensus Mechanism | Original protocol (PoW, PoS) | Can use different mechanisms |

| Transaction Speed | Limited by network capacity | Often faster due to optimizations |

| Security Model | Highest network security | Dependent on own validators |

| Asset Connection | Native assets | Pegged assets from mainchain |

Understanding Sidechain Pegs

A peg mechanism is the system that connects a sidechain to its parent chain. It controls how assets move between the two networks while maintaining their value and authenticity. Without a proper peg, users could not safely transfer their cryptocurrency or tokens between chains.

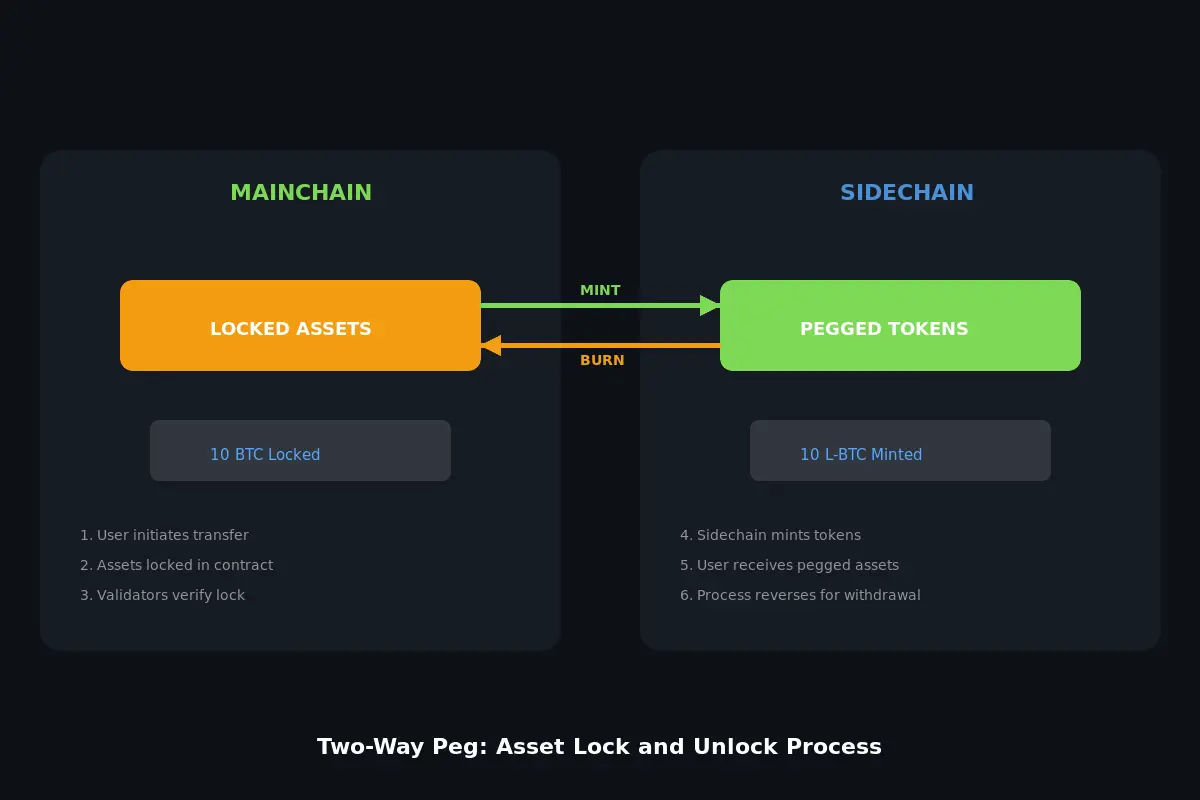

The basic idea works like this: when you want to move Bitcoin from the main network to a sidechain, your Bitcoin gets locked on the mainchain. The sidechain then creates an equivalent amount of pegged Bitcoin that you can use. When you want to return to the mainchain, the process reverses. Your pegged assets get destroyed, and your original Bitcoin unlocks.

Two-Way Peg

A two-way peg allows assets to move freely in both directions. You can send assets from the mainchain to the sidechain and back again without restrictions. This flexibility makes two-way pegs the most common choice for general-purpose sidechains.

The security of a two-way peg depends on how the locking mechanism works. Some systems use a group of trusted validators called a federation. Others rely on cryptographic proofs that let the sidechain verify mainchain transactions automatically.

One-Way Peg

A one-way peg only allows asset transfers in a single direction. Once you move assets to the sidechain, they cannot return to the mainchain in their original form. This approach is simpler to implement but limits flexibility.

One-way pegs sometimes appear in token burning mechanisms or when creating new chains from existing ones. They are less common for scalability solutions because users generally want the option to move their assets back.

The Lock and Unlock Process

Every peg mechanism relies on locking and unlocking assets. This process ensures that the same asset cannot exist on both chains simultaneously, which would create inflation and destroy trust in the system.

Step 1: User initiates transfer from mainchain to sidechain

Step 2: Assets get locked in a special address or smart contract on the mainchain

Step 3: Sidechain validators verify the lock transaction

Step 4: Sidechain mints equivalent pegged assets to the user

Step 5: For return transfers, the process reverses with burning and unlocking

How Sidechain Pegs Improve Scalability

The primary benefit of sidechain pegs is straightforward: they reduce the load on the mainchain. Every transaction that happens on a sidechain is one less transaction competing for space on the parent network.

Offloading Transactions from the Mainchain

When users move their assets to a sidechain, their subsequent transactions happen entirely on that secondary network. A game that processes thousands of in-game purchases per minute can run on its own sidechain without affecting the mainchain at all. Only the initial asset transfers and final settlements need mainchain resources.

This offloading effect multiplies as more applications adopt sidechains. Each specialized sidechain serves its own user base, spreading the total transaction volume across multiple networks instead of concentrating it on one.

Reducing Network Congestion

Mainchain congestion causes two problems: slow confirmations and high fees. When blocks fill up, users must pay more to get their transactions included. During peak demand, Ethereum gas fees have exceeded $100 for simple transfers.

Sidechains break this bottleneck. By handling routine transactions elsewhere, they keep the mainchain available for high-value transfers that truly need its security. This division of labor benefits everyone, even users who stay on the mainchain.

Faster Transaction Processing

Sidechains can process transactions faster than their parent chains for several reasons. They often use quicker consensus mechanisms, have smaller validator sets, or implement optimizations that would not work on a larger network.

Some sidechains achieve block times of just a few seconds compared to 10 minutes for Bitcoin or 12 seconds for Ethereum. For applications requiring near-instant confirmation, this speed difference makes new use cases possible.

Lower Gas and Transaction Fees

Competition for block space drives fees up. Sidechains with more capacity and less competition naturally have lower fees. Some networks charge fractions of a cent per transaction, making micropayments and high-frequency applications economically viable.

At Nadcab Labs, we have spent over 8 years helping businesses implement these solutions. Our experience shows that fee reduction is often the factor that makes or breaks a project’s economics. Applications that seemed impractical on the mainchain become sustainable on properly designed sidechains.

Simple Ways Sidechain Pegs Boost Performance

Beyond the basic scalability improvements, sidechain pegs enable several performance enhancements that compound their benefits.

Asset Transfer Without Mainchain Overload

Once assets move to a sidechain, they can circulate freely without touching the mainchain. Users can trade, stake, lend, and transfer their pegged assets thousands of times. The mainchain only sees the initial deposit and the final withdrawal.

This efficiency mirrors how banks handle transactions. Most daily payments happen within bank networks. Only periodic settlements require movement through central systems. Sidechains bring similar efficiency to blockchain.

Parallel Transaction Processing

Multiple sidechains can operate simultaneously, each processing its own transactions in parallel. This architecture scales horizontally. Adding a new sidechain adds new capacity without changing existing systems.

Compare this to simply making blocks bigger on the mainchain. Bigger blocks require more storage and bandwidth from every node, eventually pushing out smaller participants. Sidechains add capacity while keeping the mainchain requirements manageable.

Specialized Sidechains for Specific Use Cases

Different applications have different needs. A high-frequency trading platform needs speed above all else. A supply chain tracking system needs to store lots of data cheaply. A gaming platform needs to handle many small transactions.

Sidechains can be customized for these specific requirements. A trading sidechain might sacrifice some decentralization for lower latency. A data-heavy sidechain might use compression and pruning techniques unsuitable for a general-purpose chain.

Resource Utilization Comparison

| Metric | Mainchain Only | With Sidechains |

|---|---|---|

| Transaction Throughput | Fixed limit | Expandable with new sidechains |

| Node Requirements | All nodes process everything | Nodes can specialize |

| Customization | One size fits all | Optimized per use case |

| Failure Impact | Affects entire network | Contained to specific sidechain |

Real-World Examples of Sidechain Pegs

Theory matters less than results. Several sidechain implementations demonstrate these scalability benefits in practice.

Bitcoin Sidechains: Liquid Network

The Liquid Network is a federated sidechain for Bitcoin operated by Blockstream. It targets traders and exchanges who need faster transfers between platforms. Liquid uses a federation of about 60 members who collectively manage the peg.

On Liquid, Bitcoin becomes L-BTC (Liquid Bitcoin) through a two-way peg. Transactions confirm in about two minutes instead of Bitcoin’s typical hour for full confirmation. The network also supports confidential transactions that hide transfer amounts from public view.

Exchanges and traders using Liquid can move Bitcoin between platforms without waiting for mainchain confirmations or paying high fees during congestion. This improves capital efficiency and trading speed significantly.

Ethereum Sidechains and Pegged Assets

Polygon (formerly Matic Network) represents one of the most successful Ethereum sidechains. It uses a Proof of Stake consensus mechanism and processes transactions at a fraction of Ethereum’s cost.

Assets move to Polygon through a bridge contract on Ethereum. Users deposit ETH or ERC-20 tokens, which get locked on the mainchain. Polygon then makes equivalent tokens available on its network. The process takes about 10 minutes for deposits and up to an hour for withdrawals back to Ethereum.

Thousands of applications run on Polygon, from DeFi protocols to NFT marketplaces. The sidechain handles millions of transactions daily that would otherwise compete for space on Ethereum.

Performance Improvements Achieved

These implementations show concrete improvements. Polygon reports transaction fees of less than $0.01 compared to several dollars on Ethereum during normal conditions. Block times drop from 12 seconds to around 2 seconds. Throughput increases from roughly 15 transactions per second to hundreds or thousands.

The history of blockchain shows a consistent pattern of scaling solutions evolving to meet growing demand. Sidechains represent one mature response to this ongoing challenge.

Ready to Scale Your Blockchain Project?

Nadcab Labs brings 8+ years of experience in sidechain development and blockchain scalability solutions. Let us help you build faster, cheaper, and more efficient blockchain applications.

Security and Trust Considerations

Sidechains trade some characteristics of the mainchain for their performance benefits. Understanding these tradeoffs helps in choosing the right solution for specific needs.

Risks Associated with Peg Mechanisms

The peg is the critical point in any sidechain system. If the peg fails or gets compromised, users could lose access to their assets. Several attack vectors exist depending on the peg design.

Federated pegs depend on their member organizations behaving honestly. If enough federation members collude, they could steal locked assets. This risk is why federation members typically include established exchanges and companies with reputations to protect.

Smart contract pegs face code vulnerability risks. Bugs in the bridge contract could allow attackers to mint unbacked tokens or drain locked assets. Several bridge hacks have resulted in losses exceeding $100 million.

Validators, Federations, and Trust Models

Different sidechains use different trust models for their peg mechanisms. Each approach balances security, speed, and decentralization differently.

Federated models use a fixed group of known validators. This allows fast consensus but requires trusting the federation members. The Liquid Network uses this approach.

Economic security models use staking to incentivize honest behavior. Validators lock up collateral that they lose if they act maliciously. Polygon and similar chains use variations of this approach.

Cryptographic proofs aim to minimize trust requirements. They use mathematical verification to ensure valid transfers without relying on specific parties. These systems are more complex but potentially more secure long-term.

Balancing Scalability and Decentralization

The blockchain trilemma suggests that networks must choose between scalability, security, and decentralization. Sidechains let projects make different choices for different layers of their architecture.

The mainchain can optimize for maximum security and decentralization. Sidechains can optimize for speed and cost. Users choose where to keep their assets based on their own priorities. Someone holding assets long-term might prefer mainchain security. Someone actively trading might prefer sidechain speed.

Sidechains vs Other Scalability Solutions

Sidechains are not the only approach to blockchain scaling. Understanding how they compare to alternatives helps in selecting the right tool for specific requirements.

Sidechains vs Layer 2 Solutions

Layer 2 solutions like rollups and payment channels inherit security directly from the mainchain. They use the mainchain as a settlement layer and verification system. This gives them stronger security guarantees than sidechains but often with more constraints.

Sidechains have their own security models independent of the mainchain. This independence allows more flexibility in design but means the sidechain must provide its own security. A sidechain failure does not directly affect the mainchain, but the reverse is also true: mainchain security does not protect sidechain users.

Sidechains vs Sharding

Sharding splits the mainchain itself into parallel segments. Each shard processes a portion of the total transactions. All shards share the same core protocol and security model.

Sidechains exist as separate networks with their own protocols. They connect to the mainchain through bridges but operate independently. Sharding increases capacity within one system. Sidechains add capacity through additional systems.

Scalability Solutions Comparison

| Solution Type | Security Model | Flexibility | Best Use Case |

|---|---|---|---|

| Sidechains | Independent validators | High customization | Specialized applications |

| Layer 2 Rollups | Inherited from mainchain | Moderate | General scaling with security |

| Payment Channels | Inherited from mainchain | Limited | Frequent bilateral transfers |

| Sharding | Same as mainchain | Low | Native scaling for entire network |

When Sidechain Pegs Make More Sense

Sidechains work best when applications need specific characteristics that the mainchain cannot provide efficiently. Examples include high transaction volume with lower security requirements, specialized functionality like confidential transactions, or isolated environments for testing and development.

They also make sense when projects want control over their own network parameters. A company building a blockchain gaming platform might prefer running their own sidechain rather than competing for mainchain resources with unrelated applications.

Use Cases Benefiting from Sidechain Pegs

Several categories of applications benefit particularly from sidechain architectures. These use cases share common needs for speed, low costs, or specialized features.

DeFi Platforms

Decentralized finance applications process large numbers of transactions: trades, loans, yield farming operations, and liquidations. Many of these transactions are time-sensitive, where delays cost users money through price slippage or missed opportunities.

DeFi protocols on sidechains can offer faster execution and lower fees. This makes smaller transactions economically viable and improves user experience. Major protocols now deploy across multiple chains to serve users wherever they prefer to operate.

NFT Marketplaces

NFT minting and trading involve many transactions, especially during popular collection launches. Mainchain fees during high demand can exceed the value of lower-priced NFTs, making purchases impractical.

Sidechain marketplaces allow creators to mint collections affordably and buyers to make purchases without excessive fees. Some platforms use sidechains for all trading activity while recording ownership proofs on the mainchain periodically.

Gaming and Metaverse Projects

Blockchain games need to record many actions: item transfers, achievement unlocks, character movements, and economic transactions within game worlds. These actions must happen quickly to feel responsive, and they cannot cost much or players will not engage.

Game-specific sidechains solve these problems. They can process thousands of game transactions per second at negligible cost. Important assets can be bridged to the mainchain for long-term storage or cross-game portability.

Crypto MLM and High-Volume Transaction Systems

Multi-level marketing and similar business models generate many small transactions: commissions, referral bonuses, rank updates, and reward distributions. These transactions are individually small but collectively numerous.

Processing millions of micro-payments on mainchains would be prohibitively expensive. Sidechains handle this volume economically while maintaining the transparency and auditability that blockchain provides. The Nadcab Labs team has implemented such systems across various business models, demonstrating that proper sidechain design makes these applications practical.

Future of Sidechain Pegs in Blockchain Scaling

Sidechain technology continues to evolve as developers address current limitations and explore new possibilities.

Emerging Innovations in Peg Mechanisms

New peg designs aim to reduce trust requirements while maintaining speed. Zero-knowledge proofs allow sidechains to prove transaction validity without revealing details or requiring trust in specific parties. Light client verifications let users check sidechain state without running full nodes.

Cross-chain communication protocols are becoming more standardized. This allows different sidechains to interact with each other, not just with their parent chains. Assets could move between sidechains directly without returning to the mainchain first.

Interoperability and Cross-Chain Ecosystems

The blockchain space is moving toward interconnected networks rather than isolated chains. Sidechain pegs form part of a broader system of bridges connecting different blockchain ecosystems.

Projects like Cosmos and Polkadot create frameworks where multiple chains can communicate natively. Ethereum’s ecosystem includes numerous sidechains and Layer 2 solutions that users can choose between. This diversity offers options but also creates complexity in choosing where to operate.

Long-Term Impact on Blockchain Adoption

Scalability has been a barrier to mainstream blockchain adoption. Applications that work well with dozens of users often fail with millions. Sidechains remove this constraint by allowing capacity to grow with demand.

As sidechain technology matures, we expect to see blockchain applications that match the performance of traditional systems while maintaining the benefits of decentralization and transparency. This combination could finally fulfill the promise of blockchain for everyday use cases.

Sidechain Peg Implementation Lifecycle

Organizations considering sidechain deployment should understand the typical implementation process. Each phase requires specific expertise and careful planning.

Phase 1: Requirements Analysis

Determine transaction volume, speed requirements, security needs, and regulatory considerations. Define how assets will move between chains and who will validate transfers.

Phase 2: Architecture Design

Select consensus mechanism, peg type, and validator structure. Design bridge contracts and communication protocols. Plan for upgrades and emergency procedures.

Phase 3: Development and Testing

Build sidechain infrastructure, bridge contracts, and user interfaces. Conduct security audits and stress testing. Test peg mechanisms under various scenarios.

Phase 4: Deployment and Launch

Deploy contracts, initialize validator network, and open bridges. Start with limited capacity and expand as system proves stable.

Phase 5: Operation and Optimization

Monitor performance, respond to issues, and implement improvements. Adjust parameters based on real-world usage patterns.

With 8+ years of experience in blockchain integration, Nadcab Labs has guided numerous organizations through this lifecycle. Our team understands both the technical challenges and business considerations that determine project success.

Conclusion: Why Sidechain Pegs Matter

Sidechain peg mechanisms represent a practical solution to blockchain scalability challenges. They work by moving transactions off congested mainchains while maintaining connections through secure asset bridges. This approach reduces fees, speeds up processing, and enables use cases that would otherwise be impractical.

The technology has proven itself through implementations like Liquid Network and Polygon, which handle millions of transactions that would otherwise burden their parent chains. These real-world examples demonstrate that sidechains deliver tangible benefits, not just theoretical improvements.

For businesses and developers, sidechains offer a path to building blockchain applications that can actually scale with user growth. Rather than waiting for mainchains to solve their capacity problems, projects can deploy sidechains customized to their specific needs today.

The tradeoffs are real. Sidechains have their own security considerations and require careful design. But for many applications, the benefits of speed and affordability outweigh these concerns, especially when combined with proper architecture and trusted validators.

As blockchain adoption continues growing, sidechain pegs will likely become even more important. They provide a flexible, proven method for expanding network capacity while preserving the core benefits that make blockchains valuable in the first place. Organizations that understand and implement these solutions position themselves ahead of competitors still struggling with mainchain limitations.

Frequently Asked Questions

A sidechain peg mechanism is a system that connects a secondary blockchain to a main blockchain, allowing assets to move between them securely. When you transfer cryptocurrency from the mainchain to a sidechain, your assets get locked on the main network. The sidechain then creates equivalent pegged tokens for you to use. This process works both ways, letting you move assets back by burning pegged tokens and unlocking original assets. Peg mechanisms are essential for blockchain scalability solutions.

Sidechains improve scalability by processing transactions separately from the congested mainchain. When users move assets to a sidechain, their transactions no longer compete for limited mainchain space. This reduces network congestion significantly. With less competition for block space, transaction fees drop from dollars to fractions of a cent. Sidechains can also use faster consensus mechanisms, achieving thousands of transactions per second compared to mainchain limits of 15-30 TPS.

A two-way peg allows assets to move freely in both directions between mainchain and sidechain. You can deposit assets to the sidechain and withdraw them back to the mainchain anytime. This flexibility makes two-way pegs popular for most scalability solutions. A one-way peg only permits transfers in a single direction. Once assets move to the sidechain, they cannot return in original form. One-way pegs are simpler but less practical for everyday blockchain applications and trading.

Sidechain security depends on the peg mechanism design and validator trust model. Federated pegs use trusted organizations to manage asset transfers, relying on their reputation for honesty. Economic security models require validators to stake collateral they lose if they cheat. Smart contract bridges face code vulnerability risks and have suffered major hacks. Users should research specific sidechain security measures, audit history, and validator reputation before transferring significant assets.

Popular sidechain examples include Liquid Network for Bitcoin and Polygon for Ethereum. Liquid Network uses a federated two-way peg managed by exchanges and financial institutions, offering faster Bitcoin transfers with confidential transactions. Polygon connects to Ethereum through bridge contracts, processing millions of daily transactions at minimal fees. Both networks demonstrate practical scalability improvements, reducing costs and confirmation times while maintaining connections to their parent blockchains.

Sidechains operate as independent blockchains with their own consensus mechanisms and security models, connected to the mainchain through bridges. Layer 2 solutions like rollups inherit security directly from the mainchain, using it for final settlement and verification. Sharding splits the mainchain itself into parallel segments sharing the same protocol. Sidechains offer maximum customization flexibility, Layer 2 provides inherited security, and sharding scales the core network without external chains.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.