Key Takeaways

- ROI in crypto MLM combines traditional commission structures with blockchain rewards, creating faster payouts and greater transparency compared to conventional MLM models.

- Blockchain technology provides verifiable transaction records and real-time tracking, reducing the risk of hidden fees and ensuring accurate profit distribution.

- Token economics directly impact earnings potential. Understanding supply, demand, and utility is crucial for assessing long-term profitability.

- Smart contracts eliminate human error and delays in payouts, improving overall ROI efficiency and building user trust through automated systems.

- Gas fees and network selection can significantly reduce net profits. Choosing low-fee blockchains is a practical strategy for maximizing returns.

- Market volatility remains a primary risk factor. Sustainable reward mechanisms and real product utility are essential for consistent ROI.

- Regulatory compliance strengthens platform stability and investor confidence, directly supporting long-term profitability and user retention.

Introduction to ROI and Profitability in Crypto MLM

Return on investment, or ROI, represents the percentage gain or loss an investor receives relative to their initial investment. In the context of crypto-based multi-level marketing systems, ROI takes on a unique significance. Unlike traditional business models where returns are measured in conventional currency, crypto MLM platforms offer rewards through token distributions, commission structures, and network bonuses that fluctuate with market conditions.

The emergence of cryptocurrency has fundamentally changed how MLM platforms operate. Instead of relying solely on banking infrastructure and payment processors, crypto MLM systems leverage blockchain technology to create decentralized reward mechanisms. This shift brings both opportunities and challenges. For investors, understanding how ROI works in this space is not merely about tracking earnings. It requires knowledge of token economics, market behavior, regulatory landscapes, and sustainable business models.

Profitability analysis matters for two distinct groups. First, individual users need to evaluate whether their time and capital investment will generate meaningful returns. Second, companies must demonstrate that their platforms can deliver consistent profits to participants without relying on an endless stream of new recruits. This distinction separates legitimate operations from unsustainable structures. When both parties understand and align around profitability metrics, trust builds, and the entire ecosystem becomes more stable.

Also Read: What is MLM? Meaning, Types, Earnings, and Global Legality

What ROI Means in Crypto MLM Businesses

In crypto MLM operations, ROI encompasses several distinct income streams that work together to create overall returns. The first component is the initial investment. Users typically purchase a starter package or minimum token allocation to participate in the platform. This serves as their entry cost and the baseline against which all gains are measured.

Rewards form the second component. These are earnings generated through platform participation, which might include staking rewards, trading commissions, or holding bonuses. Many platforms distribute tokens directly to users based on activity levels or asset holdings. The value of these rewards depends entirely on the token’s market price and real-world utility.

Commission structures represent the third element. When users recruit others into the network, they earn a percentage of those recruits’ investments or activities. This creates the classic MLM incentive structure. In crypto versions, commissions are often paid instantly through smart contracts rather than waiting for monthly or quarterly processing cycles.

Long-term returns depend on whether the platform generates genuine value or relies primarily on recruitment. Legitimate crypto MLM operations create products, services, or utility tokens that have intrinsic value. Users earn money from real economic activity, not just from recruiting others. The distinction is critical. When ROI comes purely from new user investments, the system becomes unsustainable and eventually collapses.

How Crypto MLM Differs from Traditional MLM in ROI

Traditional MLM platforms have operated for decades using conventional financial infrastructure. Payments flow through banking systems, and payout processing typically takes days or weeks. Transparency remains limited because only company administrators can verify commission calculations and fund distributions.

Crypto MLM systems operate differently on three fundamental levels. The first difference involves payout speed. When smart contracts automate reward distribution, payments happen in minutes or seconds rather than weeks. Users experience instant gratification and can reinvest earnings faster, potentially compounding returns. This speed advantage attracts many participants but also introduces volatility since market prices can shift rapidly between investment and receipt.

Transparency represents the second major distinction. Blockchain records every transaction permanently and immutably. Participants can independently verify that promised payments occurred and that calculations were accurate. This eliminates the need to trust company claims about fund distribution. On the other hand, traditional MLM requires trusting corporate accounting departments, which historically has led to numerous fraud cases and hidden fee structures.

The third difference concerns earning potential visibility. In crypto systems, everyone can see the total token supply, current price, and trading volume. This data helps participants estimate whether continued price appreciation is realistic or if the token is approaching a valuation ceiling. Traditional MLM offers no such transparency about the true value proposition of offered products.

Practical Example: A traditional MLM distributor receives a commission check after 30 days. A crypto MLM participant receives tokens instantly to their wallet. They can immediately see their new balance on the blockchain. However, if they need to convert tokens to currency, they depend on market liquidity. If many users sell simultaneously during market decline, they might receive significantly less value than the token price promised to them during recruitment.

Role of Blockchain in Improving ROI Transparency

Blockchain technology functions as a permanent, transparent ledger of all transactions. This foundational characteristic directly improves ROI transparency in several critical ways. When a platform operates on a public blockchain like Ethereum or Binance Smart Chain, every transaction is visible to anyone who checks the blockchain explorer. This creates an unprecedented level of accountability.

Verifiable transactions mean users can independently confirm that promised payments actually occurred. They do not need to accept the platform’s word. They can look at the blockchain and see the exact amount transferred, the timestamp, the sender address, and the recipient address. This eliminates the traditional MLM problem where administrators control all financial reporting.

Real-time tracking allows users to monitor their earnings as they accumulate. Instead of waiting for a monthly statement, participants see their balance update in real-time as rewards are distributed. This constant visibility builds confidence in the platform, assuming the data matches user expectations. If discrepancies appear, users notice them immediately rather than discovering problems months later.

Trust in profit distribution improves dramatically when transparency mechanisms are genuine. However, we must acknowledge that transparency cuts both ways. Users can see when platform administrators move funds to personal wallets. They can track whether newly issued tokens are being distributed fairly or concentrated in executive addresses. This visibility sometimes exposes problems that traditional MLM operations could hide. Legitimate platforms embrace this transparency because it proves their integrity.

It is important to note that blockchain transparency has limitations. The technology verifies that transactions occurred but does not evaluate whether they are fair, legal, or wise. A platform could be completely transparent while still operating as a pyramid scheme. Transparency is necessary but not sufficient for determining whether an MLM is legitimate.

Profitability Models Used in Crypto MLM Platforms

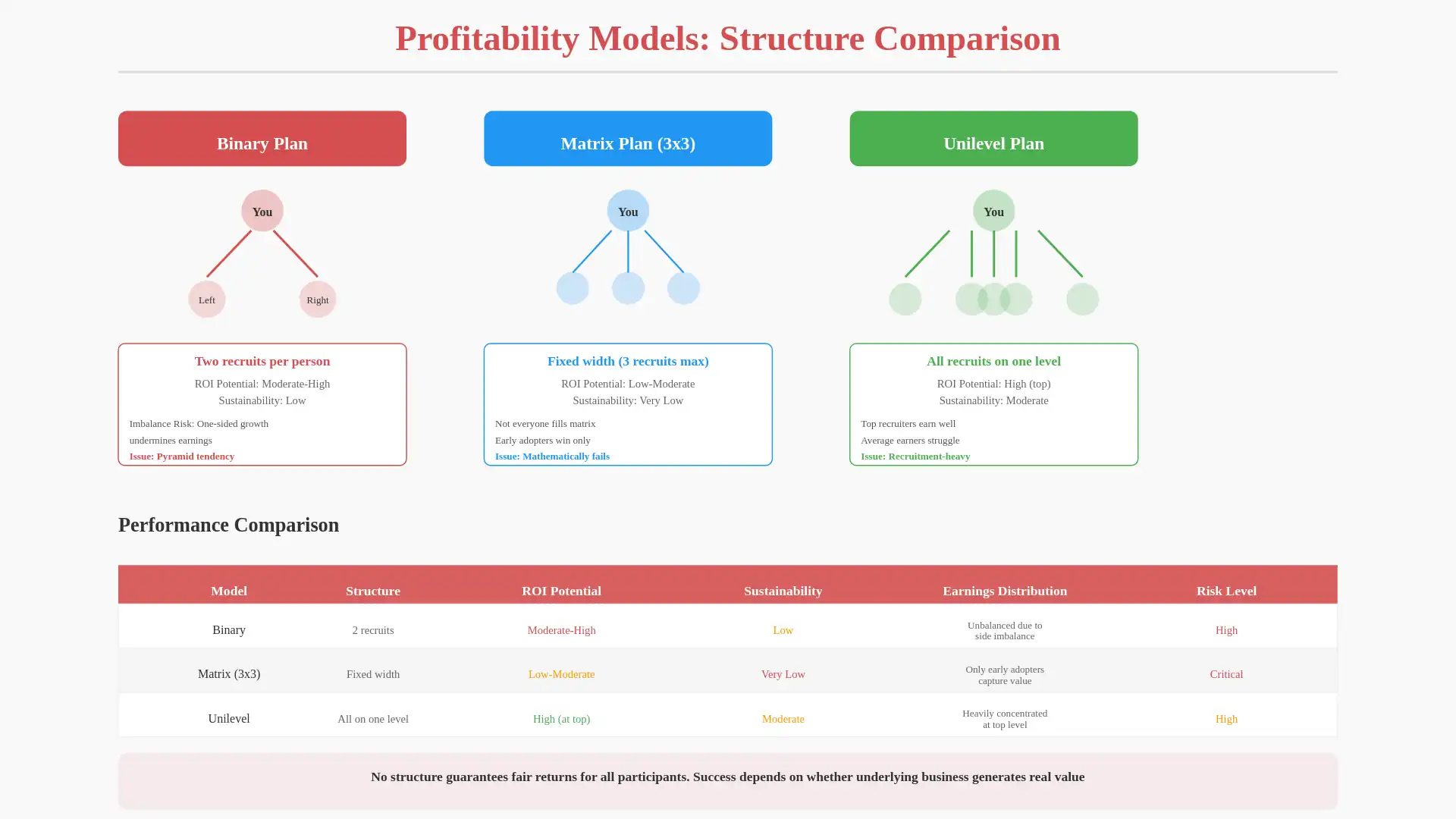

Crypto MLM platforms employ different structural models for calculating and distributing profits. Each model has distinct characteristics that impact participant ROI. Understanding these models helps users assess whether a platform’s earning potential aligns with their expectations.

Binary Plans structure the network as a tree with each participant having two direct recruits below them. Participants earn commissions from both sides. The strength of binary plans lies in their simplicity. However, they create incentive problems because participants might recruit heavily on one side, leaving the other side empty. Earnings potential becomes unbalanced, and some participants struggle to generate meaningful returns despite active recruitment efforts.

Matrix Plans establish a fixed width structure, such as a three-wide matrix where each participant recruits exactly three people. Everyone cannot achieve the maximum downline size simultaneously, so the structure forces some participants toward the bottom where earnings potential is limited. This design creates clear winners and losers, with early adopters capturing most available earnings.

Unilevel Structures place all directly recruited members on a single level. Participants earn commissions from everyone they recruit directly, plus additional commissions from those recruits’ networks to varying depths. Unilevel plans reward active recruiters generously but create diminishing returns for average participants. The model concentrates wealth among the most successful networkers.

Hybrid Models combine elements from multiple structures. For example, a platform might use a unilevel base structure for direct commissions but add binary bonuses for balanced recruitment on two key branches. Hybrid models attempt to balance earning opportunities across different participant types, though they become complex to manage and explain to users.

| Model Type | Structure | ROI Potential | Sustainability |

|---|---|---|---|

| Binary | Two recruits per person | Moderate to High | Low (pyramid tendency) |

| Matrix | Fixed width (3×3, 5×5) | Low to Moderate | Very Low (mathematically unsustainable) |

| Unilevel | All recruits on one level | High (for top recruiters) | Moderate (recruitment dependent) |

| Hybrid | Combined model | Moderate to High | Moderate (model dependent) |

From a profitability standpoint, no single model guarantees fair returns for all participants. Each structure inherently favors early adopters and successful networkers while limiting opportunities for average participants. The most sustainable models are those that combine recruitment commissions with genuine product sales or platform utility, ensuring income streams exist even when network growth slows.

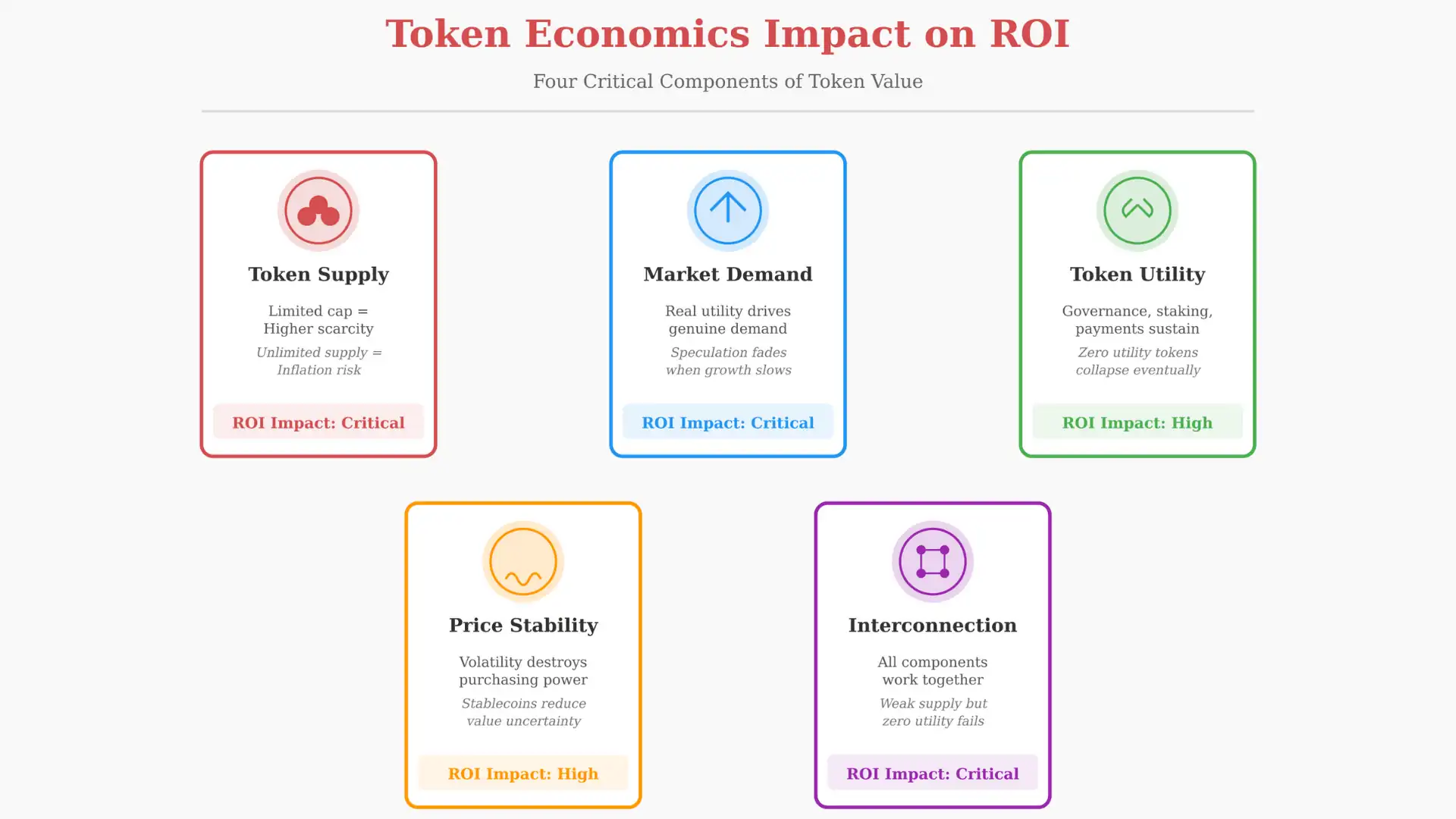

Impact of Token Economics on ROI

Token economics, often called tokenomics, describes the rules governing how a cryptocurrency token functions within its ecosystem. These rules directly determine whether user earnings will have real value or become worthless. Understanding tokenomics is essential for evaluating realistic ROI projections.

Token supply represents the first critical variable. If a platform distributes unlimited tokens to all participants as rewards, inflation spirals out of control. Early recipients receive tokens worth significant value, but later recipients receive tokens that have been diluted through massive oversupply. This creates a situation where nominal earnings increase but actual purchasing power decreases. Legitimate platforms cap total token supply and demonstrate a clear, limited distribution schedule.

Demand for tokens drives price appreciation. If thousands of people desperately want to purchase a token because they believe it provides genuine utility or investment returns, prices naturally rise. However, if participants only want tokens because they hope to sell them to the next wave of recruits, demand becomes artificial. When growth slows, no one wants to buy anymore, and token values collapse. Real demand comes from people using tokens for actual purposes beyond speculation.

Token utility describes what the token can actually do. Does it provide voting rights in platform governance? Can it be used to purchase goods or services? Does it generate passive income through staking mechanisms? Tokens with genuine utility retain value even if the platform’s growth slows because people continue using them. Tokens with no purpose beyond being traded inevitably lose value once recruitment momentum stops.

Price stability affects real-world purchasing power. If a token’s value fluctuates wildly, users cannot reliably estimate their earnings in terms anyone outside the crypto ecosystem cares about. A user might be told they earned one thousand tokens per month, but if the token value swings from five dollars to fifty cents over several months, the actual return becomes unpredictable. Platforms that use stablecoins or implement mechanisms to reduce volatility create more trustworthy earning environments.

The relationship between all these factors determines whether token-based ROI is real. A token might have unlimited supply, zero utility, high volatility, and rely entirely on recruitment for any demand. In such cases, everyone who invests thinking they will earn returns through token appreciation are essentially making speculative bets. They are not investing in a business with underlying value.

Smart Contracts and Automated Payouts

Smart contracts are self-executing programs stored on blockchains that automatically perform actions when predefined conditions are met. In crypto MLM systems, smart contracts manage nearly every financial transaction, from reward distribution to commission payouts. This automation creates several advantages for ROI efficiency.

Reduced human error represents the first major benefit. Traditional MLM systems rely on administrative staff to calculate commissions, process payments, and manage accounts. Humans make mistakes. They might miscalculate commission percentages, apply bonus structures incorrectly, or miss payments entirely. Smart contracts perform the same calculations identically every single time, without fatigue or oversight. This consistency means participants receive exactly what they are owed according to the platform’s rules.

Elimination of delays is the second advantage. In traditional systems, someone must manually verify eligibility, approve payments, and initiate transfers. This process takes time. In smart contracts, the moment conditions are satisfied, payments execute automatically. A user qualifies for a bonus at block number 16,000,000, and they receive it at block number 16,000,001. There is no waiting period, no approval queue, and no opportunity for funds to be held or diverted.

Improved ROI efficiency follows logically from automation. When payouts happen faster, users can reinvest earnings more quickly. This acceleration of capital cycles can amplify returns through compounding effects. Users who receive commissions weekly rather than monthly might reinvest those funds and receive additional rewards on the reinvested amount. Over time, this compounding effect becomes significant. However, it is important to note that this benefit only materializes if the underlying investment actually generates returns. Fast payouts of zero-value tokens add no real value.

Trust through transparency emerges as smart contracts operate on transparent blockchains. Users can independently verify that smart contract code matches the platform’s claims. They can see exactly what the code does and confirm it distributes rewards fairly. This transparency builds confidence in the platform’s payment mechanisms, though again, we must note that fast, transparent payments of worthless tokens are ultimately still worthless payments.

Transaction Costs and Their Effect on Profits

Every blockchain transaction requires a fee, commonly called gas fees or network fees. These costs are paid to miners or validators who process transactions. In MLM systems where users make frequent transactions, these fees accumulate and significantly reduce net profits. Understanding and managing transaction costs is a practical strategy for maximizing real returns.

Ethereum, one of the most popular blockchains for crypto applications, frequently charges gas fees between five and one hundred dollars per transaction depending on network congestion. If a platform distributes rewards to ten thousand users weekly, the platform must pay between fifty thousand and one million dollars in gas fees alone. These costs must come from somewhere, typically from a percentage of user rewards. Users who think they earned ten tokens might only receive nine after gas fees are deducted.

Network selection dramatically impacts fee structures. Ethereum prioritizes security and decentralization but sacrifices cheap transaction costs. Binance Smart Chain offers much lower fees, typically between a dollar and ten dollars per transaction. Other blockchains like Polygon or Solana offer even lower costs, sometimes under a dollar per transaction. A platform operating on Solana can offer higher net rewards to users simply because transaction costs are lower.

The relationship between transaction costs and profit margins works like this. A platform collects one hundred thousand dollars from users and promises to distribute ninety percent as rewards. If network fees consume ten percent, the platform retains the original ten percent fee plus another ten percent that was supposed to go to users but got consumed by transaction costs. The platform’s actual margins improve while user returns decline. This dynamic creates perverse incentives for platforms to use blockchain networks and transaction structures that maximize fee absorption.

Savvy users should calculate the true net effect of gas fees on their projected returns. If a platform promises one hundred dollars in monthly rewards but operates on an expensive blockchain, actual net receipts might be seventy or eighty dollars after fees. This represents a real reduction in ROI that must be factored into investment decisions. Platforms that operate on low-cost networks and minimize unnecessary transactions are more likely to deliver promised returns.

Influence of Market Volatility on Crypto MLM Returns

Cryptocurrency markets experience extreme price fluctuations. Bitcoin has swung from twenty thousand dollars to three thousand dollars and back to fifty thousand dollars within single year periods. These swings affect crypto MLM returns because platform tokens inevitably inherit cryptocurrency market volatility. Users might receive their promised rewards only to watch them decline in value as market sentiment shifts.

Price fluctuations occur due to several drivers. First, cryptocurrency adoption rates are still uncertain. Large institutions entering the market can create buying pressure and price appreciation. Regulatory crackdowns can create selling pressure and declines. Second, crypto markets remain relatively small compared to traditional financial markets, meaning individual large trades can move prices significantly. Third, sentiment and speculation drive prices more than fundamentals do. Users’ beliefs about future adoption and value matter more than current utility metrics.

Platforms implement several strategies to manage volatility risks. Some use stablecoin rewards, paying users in tokens that are always worth exactly one dollar. This removes price volatility but shifts the problem elsewhere, as users then worry whether the stablecoin itself will maintain its peg. Other platforms implement gradual vesting schedules where earned tokens unlock over time rather than all at once. This strategy reduces sudden market impact if many users try to sell simultaneously. Third, some platforms create buyback mechanisms where they purchase their own tokens from the market to support prices. However, such buybacks only work if the platform has sufficient revenue to sustain them.

From a user perspective, market volatility creates both opportunity and risk. Participants who receive tokens when market prices are depressed benefit from subsequent appreciation. Those who receive tokens before market crashes lose real value. This randomness is unavoidable in crypto MLM systems. Users should view token value fluctuations as a source of uncertainty that adds to their overall investment risk. Promised percentage returns become meaningless if the underlying asset’s value is unpredictable.

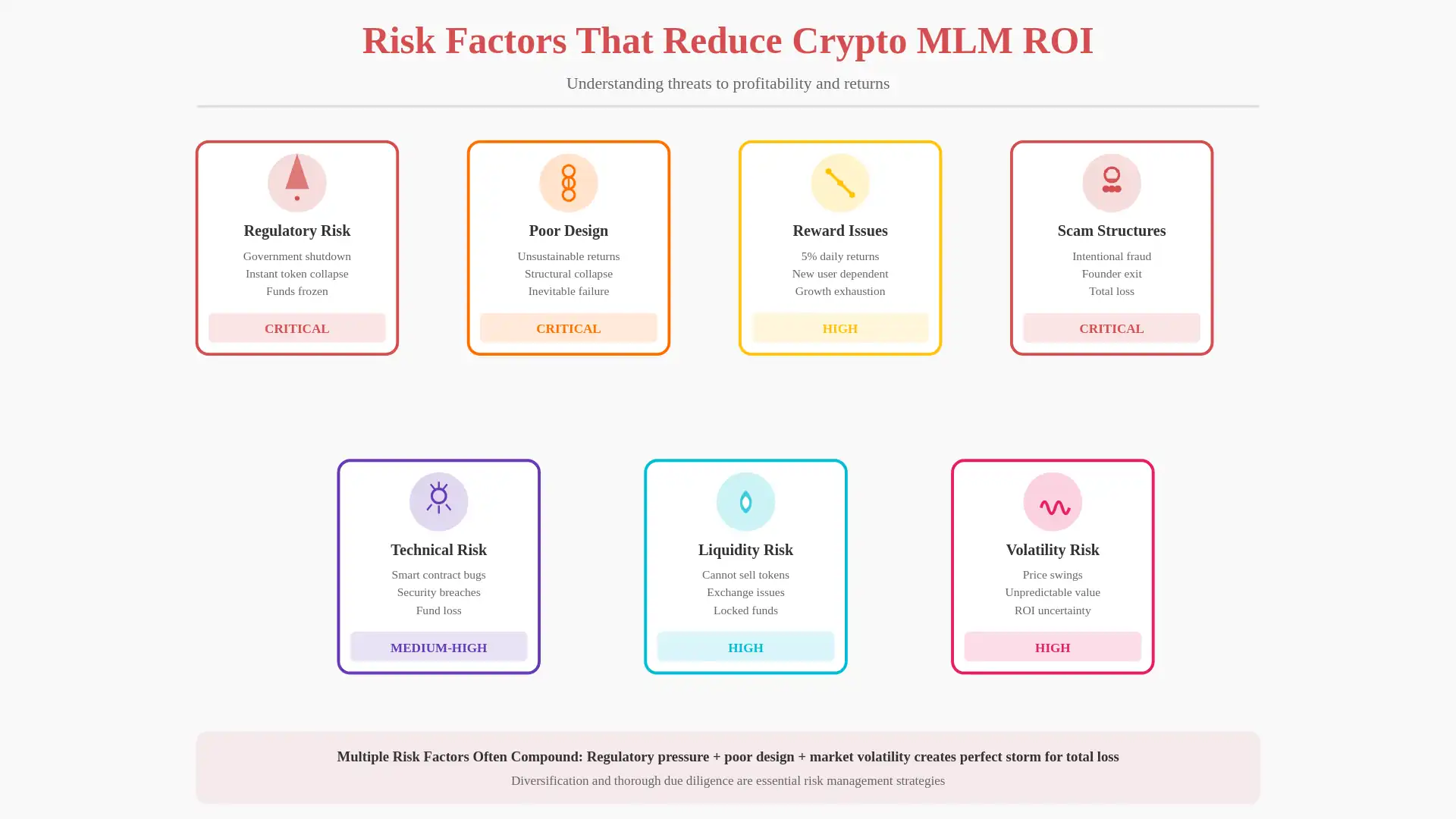

Risk Factors That Can Reduce ROI in Crypto MLM

Multiple risk categories threaten ROI in crypto MLM systems. Understanding these risks helps users and regulators identify platforms that are unlikely to deliver promised returns. The risks range from technical issues to fundamental design flaws that make success mathematically impossible.

Regulatory Risks present perhaps the most significant threat to platform stability. Governments worldwide are developing cryptocurrency regulations. Some jurisdictions may determine that certain crypto MLM structures violate securities laws or money transmission rules. If a platform receives a cease-and-desist order, it must shut down immediately, leaving user funds at risk. Regulatory action can also affect token value directly. A token might decline fifty percent in a single day if regulators announce skepticism about its legal status.

Poor Project Design creates structural problems that prevent success. A platform might promise returns exceeding one hundred percent annually while spending most capital on administrative overhead. Such designs are unsustainable from inception. They can function temporarily while user recruitment accelerates, but they collapse once growth slows. The mathematical reality catches up and the promised returns become impossible.

Unsustainable Reward Models represent a specific subset of poor design. Some platforms promise five percent daily returns. This yields one hundred fifty percent annually, which far exceeds returns from traditional investments and implies exceptional business performance. When promised returns dramatically exceed what comparable businesses generate, the math suggests the business is not actually earning that much. Instead, it is using new user capital to pay earlier users. This arrangement cannot persist indefinitely.

Scam Structures involve deliberate deception. Founders know the business model is unsustainable but present it as legitimate to attract investment. Once sufficient capital is collected, founders disappear with funds and leave users with worthless tokens. These outright scams are distinguishable from bad projects because they involve intentional fraud rather than honest miscalculation. However, from a user perspective, the financial loss is equally severe whether the problem stems from fraud or mere incompetence.

Other risk factors include smart contract code bugs that cause fund loss, compromised security where hackers steal tokens, exchange liquidity problems where users cannot sell accumulated tokens at reasonable prices, and team abandonment where developers stop supporting the platform.

Sustainability and Long-Term Profitability

A profitable MLM system must sustain itself indefinitely. Many platforms function admirably for one to three years while recruitment accelerates, but they inevitably collapse as growth slows. Sustainability requires fundamental business models that generate real value independent of new participant recruitment.

Sustainable reward mechanisms distribute earnings from actual business operations rather than from recruitment-funded pools. For example, if a platform operates a cryptocurrency exchange and charges trading fees, those fees represent genuine business income. The platform can distribute a portion of fee revenue to participants without risking system collapse. By contrast, if a platform’s only income is new user investments, it cannot sustain distributions once recruitment plateaus.

Real utility ensures that tokens maintain value even when new user recruitment stops. If a token provides governance rights, dividend payments, or access to valuable services, rational actors will continue holding and using it regardless of whether new people join the system. Tokens with zero utility outside of speculative trading inevitably lose value once speculation sentiment shifts.

The mathematics of sustainable systems work like this. Suppose a platform generates fifty thousand dollars weekly in transaction fees. It can sustainably distribute twenty-five thousand dollars to participants as rewards. This sustainable payout level remains constant whether the platform has one thousand users or one million users. Early adopters benefit from smaller payouts split among fewer people, but the payout mechanism does not collapse as user numbers increase.

Contrast this with an unsustainable system. A platform promises that participants will earn five thousand dollars monthly through recruitment commissions. When there are one hundred users, this is possible because each user recruits a few others and everyone earns as promised. But when the platform reaches one hundred thousand users, recruiting continues but the number of people available to recruit becomes finite. Eventually, there are no more people to recruit. At this point, the promised five thousand dollar monthly returns cannot be delivered to everyone, and the system fails. Users who joined toward the end receive nothing while early participants captured all available value.

Compliance and Legal Considerations Affecting Profitability

Regulatory compliance creates direct impacts on platform profitability and user returns. While some view compliance as a burden that reduces profits, the opposite is often true. Compliant platforms enjoy better long-term stability and user confidence, both of which support returns.

When a platform operates without compliance effort, it faces risk of government shutdown. The moment regulators decide the platform violates relevant laws, operations cease. Users lose access to funds at critical moments. Even if funds are not directly lost, the legal uncertainty creates selling pressure as risk-averse participants exit. Token prices decline from regulatory fear alone, destroying user returns regardless of whether funds were actually stolen.

Compliant platforms enjoy legitimate banking relationships. They can use traditional financial infrastructure to move money between platforms and users. This eliminates the conversion barriers and liquidity limitations that plague unregulated platforms. Users who can easily convert tokens to stable currency have more confidence in their assets’ real value. This confidence attracts more users and increases platform growth, benefiting all participants.

Investor confidence grows when platforms demonstrate compliance commitment. Sophisticated investors avoid platforms with regulatory uncertainty. This leaves compliant platforms to attract a higher quality user base. Early participants in compliant platforms benefit from higher quality recruitment, as more serious business-minded people join. This improves network effects and creates stronger communities.

The specific legal structure varies by jurisdiction. Some countries view crypto MLM platforms as securities, meaning they must register with financial regulators and follow strict rules. Others view them as currency operations requiring money transmitter licenses. Still others remain unclear. Platforms that proactively engage with regulators and adapt their structures to comply with evolving rules create durable businesses. Those that ignore compliance face increasing pressure until they cease operations.

How Users Can Maximize ROI in Crypto MLM

Users seeking to maximize returns in crypto MLM systems should follow practical strategies grounded in basic investment principles. These strategies do not guarantee success but reduce avoidable losses and improve chances of positive outcomes.

Choose Reliable Platforms by conducting due diligence before investing. Research the platform’s history, leadership team, and track record. Does the team have previous experience building successful companies? Do they have skin in the game through significant personal investment? Are they transparent about who they are, or do they hide behind pseudonyms? Platforms with transparent leadership and proven track records in other business ventures are statistically more likely to deliver promised returns.

Understand Compensation Plans thoroughly before participating. Read the entire plan documentation, not just the marketing highlights. Calculate what average participants are likely to earn, not just top performers. If the plan requires recruiting to earn meaningful money, understand how many recruits are needed and how realistic recruitment targets are. If the only way to earn significant returns is by recruiting, recognize that this creates pyramid characteristics regardless of whether the platform offers token appreciation.

Manage Crypto Assets Wisely by not converting all earned tokens to currency immediately. Token price volatility creates opportunities. Users who hold tokens during periods of rising prices capture appreciation gains. Those who immediately sell capture current prices and miss subsequent increases. However, holding also carries the opposite risk that prices might decline. A balanced approach involves dollar-cost averaging, selling portions of earned tokens gradually rather than all at once. This strategy provides some upside capture if prices rise while ensuring some profits are locked in if prices decline.

Diversify Across Platforms rather than investing all capital with a single MLM. If one platform encounters problems, users with diversified investments suffer smaller losses. If one platform performs exceptionally well, users still benefit from participation. Diversification is a foundational risk management principle in all investing.

Avoid Recruitment Pressure and resist psychological pressure to recruit aggressively. The most sustainable earnings come from platform rewards and transaction participation, not from endless recruitment. Users who focus on genuine platform participation rather than pressuring friends and family to join tend to build more authentic networks and avoid reputational damage.

Maximize ROI and Profitability in Crypto MLM

Take your MLM business to the next level. Leverage our 8+ years of blockchain and MLM expertise to create a secure, transparent, and scalable token-based platform.

Key Metrics to Evaluate Crypto MLM Profitability

Several quantitative metrics help assess whether a crypto MLM platform is genuinely profitable or heading toward failure. These metrics are publicly available for blockchain-based platforms and can be monitored over time.

User Growth should accelerate initially then stabilize as the platform matures. Extremely rapid user growth (doubling every month) suggests aggressive recruitment-driven expansion. This often precedes crashes when growth inevitably slows. Stable or slightly declining user growth rates, even if smaller in absolute number, suggest a platform moving beyond recruitment dependency toward sustainable operations.

Transaction Volume represents the total value of transactions processed through the platform. Growing transaction volume suggests genuine economic activity beyond speculation. Users conducting real transactions indicate the platform serves actual needs. Platforms where transaction volume grows separately from user growth are maturing healthily.

Payout Ratio measures what percentage of platform revenue is returned to users versus retained by the company. High payout ratios (above eighty percent) leave limited resources for development, marketing, and operational expenses. Extremely high ratios often indicate unsustainable reward structures. Moderate ratios around fifty to seventy percent suggest the platform is balancing user rewards with business sustainability.

Retention Rate tracks what percentage of users remain active over time. Platforms with high retention rates indicate users are satisfied with returns and platform experience. High churn rates where fifty percent or more of users leave annually suggest fundamental problems with returns, user experience, or token value.

Token Price Trend reveals market confidence over time. Tokens should trend upward during early growth phases then stabilize as platforms mature. Consistent declining token price despite growing user numbers suggests the market perceives overvaluation. A token price collapse following regulatory news indicates the platform’s viability depends on avoiding legal scrutiny.

Developer Activity on the platform’s smart contracts and code repositories indicates whether the team is actively improving the platform. Platforms with no code updates for months often indicate abandoned projects approaching failure.

Future Outlook of ROI in Crypto MLM Ecosystems

Several emerging trends will shape how crypto MLM platforms function and what ROI looks like in coming years. Understanding these trends helps participants anticipate changes and position themselves strategically.

DeFi Integration represents one significant trend. Decentralized finance protocols allow platforms to offer sophisticated financial instruments like yield farming, liquidity pools, and derivatives. Rather than simply distributing tokens to users, platforms can allow users to deposit tokens into earning mechanisms that generate yields. This moves crypto MLM toward being more akin to traditional financial platforms and less like pure recruitment schemes. Users earn returns from capital deployment rather than from recruiting others.

Stablecoin Adoption is accelerating. More platforms will shift from volatile native tokens toward rewards in stablecoins pegged to the dollar or other major currencies. This eliminates price volatility concerns and makes ROI calculations straightforward. Users will know exactly what their earnings are worth in real currency. However, this also eliminates speculative appreciation opportunities where early users could benefit from token price rises.

AI-Driven Reward Optimization will emerge as platforms deploy machine learning to personalize reward structures and optimize participant engagement. Algorithms will determine which users are most likely to remain active and receive enhanced incentives. This represents a shift from static compensation plans toward dynamic systems that adjust based on individual behavior and value contribution.

Regulatory Clarity will continue developing as governments finalize cryptocurrency rules. Rather than operating in regulatory gray areas, successful platforms will adopt proactive compliance. This creates legitimacy advantages for compliant platforms competing against unregulated alternatives.

Platform Consolidation will likely occur as smaller platforms fail and successful ones acquire user bases and technology. The crypto MLM landscape will shift from hundreds of competing platforms toward a smaller number of established players. This consolidation improves stability and reduces risk for participants by lowering the probability that their chosen platform becomes abandoned.

For learning more about blockchain fundamentals and cryptocurrency economics: Visit Wikipedia’s cryptocurrency section[1] for comprehensive introductions to blockchain technology, cryptocurrency history, and how various consensus mechanisms work. The articles maintain high editorial standards and are regularly updated by subject matter experts.

Final Thoughts on ROI and Profitability in Crypto MLM

ROI in crypto MLM systems differs fundamentally from ROI in traditional businesses or investments. The combination of blockchain technology, rapid market volatility, and recruitment-dependent reward structures creates unique opportunities and risks. Participants who approach crypto MLM with realistic expectations and disciplined analysis are more likely to achieve positive returns.

Smart planning involves evaluating platforms based on fundamental business characteristics rather than testimonials from successful early users. How does the platform generate revenue independent of new user recruitment? What genuine utility does the token provide? Do token economics support long-term price stability or do they invite unsustainable inflation? Are founders and team members transparent about identity and track record? These fundamental questions matter more than promised percentage returns.

Transparency remains essential but insufficient. A platform can be completely transparent about unsustainable reward structures. Blockchain technology cannot prevent mathematical realities. Users must critically evaluate whether promised returns are actually possible given the platform’s revenue sources and cost structures. If promised returns exceed what comparable businesses generate, skepticism is warranted.

Technology-driven growth creates opportunities that did not exist in traditional MLM. Smart contracts provide instant, verifiable payments. Blockchain enables transparent transaction tracking. Crypto rewards offer borderless transfers without banking infrastructure. However, technology cannot fix fundamental business model problems. Automation merely makes unsustainable systems collapse faster with greater transparency about how the collapse occurred.

The future of crypto MLM profitability belongs to platforms that genuinely create value. Those combining real economic activity with distributed reward structures will thrive. Those relying primarily on recruitment and speculation will eventually fail. As regulatory frameworks solidify and user sophistication increases, platforms will face increasing pressure to demonstrate legitimate value creation. Users who invest in platforms during this transition toward legitimacy position themselves to benefit from increasing stability and acceptance.

Frequently Asked Questions

ROI in a Crypto MLM business refers to the returns earned from your initial crypto investment through commissions, bonuses, and token rewards. It includes both direct earnings and network-based income. Since blockchain records every transaction, ROI calculation is transparent and real-time, helping users clearly track profits without relying on manual reports.

Profitability in Crypto MLM platforms is calculated by subtracting total investment costs from earned rewards, commissions, and token value growth. Factors such as smart contract payouts, transaction fees, token price stability, and long-term sustainability play a major role. A profitable model ensures earnings come from real utility, not just recruitment.

Crypto MLM can be more profitable than traditional MLM due to lower operating costs, automated payouts, and global accessibility. Blockchain removes intermediaries, allowing higher commission distribution. However, actual profitability depends on platform design, compliance, reward sustainability, and market conditions rather than technology alone.

Smart contracts improve ROI by automating reward distribution instantly and securely. They eliminate delays, human errors, and payment manipulation. Since payouts occur automatically when conditions are met, users receive earnings faster, operational costs are reduced, and overall trust in the MLM system increases significantly.

Yes, cryptocurrency volatility can directly affect Crypto MLM profits. If rewards are paid in volatile tokens, earnings may rise or fall with market prices. Many platforms reduce this risk by using stablecoins or hybrid payout systems, ensuring more predictable ROI and protecting users from extreme market fluctuations.

Long-term profitability depends on token utility, sustainable reward models, user growth, platform compliance, and transparent governance. Projects focused only on high short-term payouts often fail. Platforms with real blockchain use cases and balanced compensation plans offer more stable and consistent returns over time.

Yes, transaction fees play an important role in ROI calculation. High gas fees can reduce net profits, especially for frequent transactions. Crypto MLM platforms built on low-fee blockchains help maximize earnings by minimizing costs, making the overall profitability more attractive for users and network participants.

Blockchain transparency allows investors to verify payouts, track transactions, and monitor fund flow in real time. This removes hidden charges and false claims. With clear data available on-chain, users can accurately measure ROI and profitability without depending on centralized reports or third-party confirmations.

Yes, Crypto MLM profitability can be sustainable if the platform focuses on real-world utility, balanced rewards, and regulatory compliance. Sustainable models limit excessive payouts and encourage genuine participation. Long-term success depends on strong technology, responsible tokenomics, and consistent value creation beyond recruitment.

Users can maximize ROI by choosing transparent platforms, understanding compensation plans, managing crypto assets wisely, and reinvesting strategically. Monitoring market trends and selecting systems with stable payout mechanisms also helps. Avoiding unrealistic promises and focusing on long-term value improves profitability and reduces risk.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.