The decentralized finance ecosystem thrives on liquidity, and the ability to efficiently move that liquidity between platforms has become increasingly crucial for maximizing returns. Liquidity migration in DEX represents one of the most strategic activities that liquidity providers undertake, allowing them to optimize their positions, respond to market incentives, and adapt to the constantly evolving DeFi landscape. Understanding how liquidity migration works in DEX environments is essential for anyone looking to actively participate in decentralized exchanges and liquidity provision.

As the DeFi space matures, liquidity migration crypto strategies have evolved from simple manual processes to sophisticated automated systems. Whether you’re a seasoned liquidity provider or exploring opportunities in decentralized finance, grasping the mechanics, motivations, and risks associated with DEX liquidity migration will empower you to make informed decisions about your liquidity deployment strategies. This comprehensive guide explores every aspect of decentralized exchange liquidity migration, from basic concepts to advanced techniques.

Key Takeaways

- Liquidity migration in DEX involves withdrawing assets from one liquidity pool and redepositing them into another pool or platform to optimize returns, access better incentives, or respond to protocol changes.

- The migration process requires multiple blockchain transactions including liquidity removal, token approvals, and liquidity addition, each incurring gas fees that must be weighed against potential benefits.

- Liquidity providers migrate primarily for higher yield opportunities, improved fee structures, protocol upgrades, new token launches, and diversification across multiple platforms to manage risk.

- Manual migration offers complete control but requires technical knowledge and exposes assets to price volatility during the transition, while automated tools reduce execution time and human error but introduce smart contract dependencies.

- Impermanent loss during migration can be significant if token prices diverge substantially between pool exit and entry, making timing and market conditions critical factors in migration decisions.

- Smart contract risks, including potential vulnerabilities in migration tools and approval transactions, require careful due diligence on contract audits and platform reputation before executing migrations.

- Liquidity migration differs fundamentally from liquidity bootstrapping: migration moves existing liquidity between established pools, while bootstrapping initiates new pools with fresh capital.

- The impact of liquidity migration on DEX ecosystems affects trading depth, volume consistency, user experience, and market stability, particularly during large-scale migration events.

- Cross-chain liquidity migration introduces additional complexity through bridge protocols, requiring longer execution times, higher fees, and increased security considerations compared to same-chain migrations.

- Future trends point toward increasingly automated and intelligent migration systems that can optimize timing, minimize costs, and dynamically respond to market opportunities across the DeFi landscape.

What Is Liquidity Migration in DEX?

Liquidity migration in DEX represents a strategic repositioning of capital within the decentralized finance ecosystem. At its core, this process involves liquidity providers deliberately moving their deposited assets from one liquidity pool or decentralized exchange to another. Unlike traditional finance where liquidity is managed by institutional market makers, decentralized exchanges rely on permissionless liquidity pools where individual providers can enter and exit positions freely. This flexibility enables providers to actively manage their capital allocation in response to changing market conditions and incentive structures.

The significance of DEX liquidity migration extends beyond individual provider decisions. Large-scale migrations can reshape the competitive landscape of decentralized exchanges, influence token prices through supply and demand dynamics, and signal market sentiment about different protocols. Understanding liquidity migration in DEX contexts requires recognizing both the technical mechanisms that enable these movements and the economic motivations that drive them. As the DeFi sector grows more sophisticated, migration strategies have evolved from reactive responses to proactive capital management.

Meaning of Liquidity Migration in Decentralized Exchanges

Within decentralized exchanges, liquidity migration crypto activities encompass the complete cycle of withdrawing assets from an existing pool, managing those assets during the transition period, and redepositing them into a new destination pool. This process differs fundamentally from simple trading or swapping because it involves the actual movement of liquidity provider positions rather than individual trades. When you provide liquidity to an AMM-based DEX, you receive LP tokens representing your share of the pool. Migration requires burning these LP tokens to reclaim underlying assets, then using those assets to mint new LP tokens in a different pool.

The meaning extends to the strategic implications of these movements. Liquidity migration serves as a market mechanism that rewards platforms offering superior value propositions while pressuring underperforming protocols to improve. This competitive dynamic drives innovation across the DeFi space, as platforms continuously develop better incentive structures, improved user experiences, and enhanced capital efficiency to attract and retain liquidity. For providers, understanding this broader context helps inform migration timing and platform selection. Those looking to establish DEX platforms must design compelling value propositions that attract and retain liquidity.

How DEX Liquidity Migration Differs From CEX Liquidity

The mechanics of liquidity migration in decentralized exchanges contrast sharply with liquidity management in centralized exchanges. On centralized platforms, liquidity is typically provided by professional market makers under contractual agreements with the exchange. These market makers cannot simply migrate their operations without negotiations, contract modifications, and coordination with exchange management. The liquidity exists in custodial wallets controlled by the centralized entity, creating friction in any movement attempts.

Decentralized exchange liquidity migration operates on fundamentally different principles. Liquidity providers maintain custody of their assets through non-custodial wallet interactions with smart contracts. They can withdraw liquidity at any time without permission, approval, or coordination with any central authority. This permissionless nature enables rapid response to market opportunities but also introduces unique challenges. Gas fees, smart contract interactions, and blockchain confirmation times create friction that doesn’t exist in centralized systems. Additionally, DEX migrations expose providers to price volatility and impermanent loss risks during the transition period, considerations absent in traditional market-making arrangements.

Liquidity migration in decentralized systems empowers individual providers but requires comprehensive understanding of technical processes and associated risks.

How Does Liquidity Migration Work in DEX?

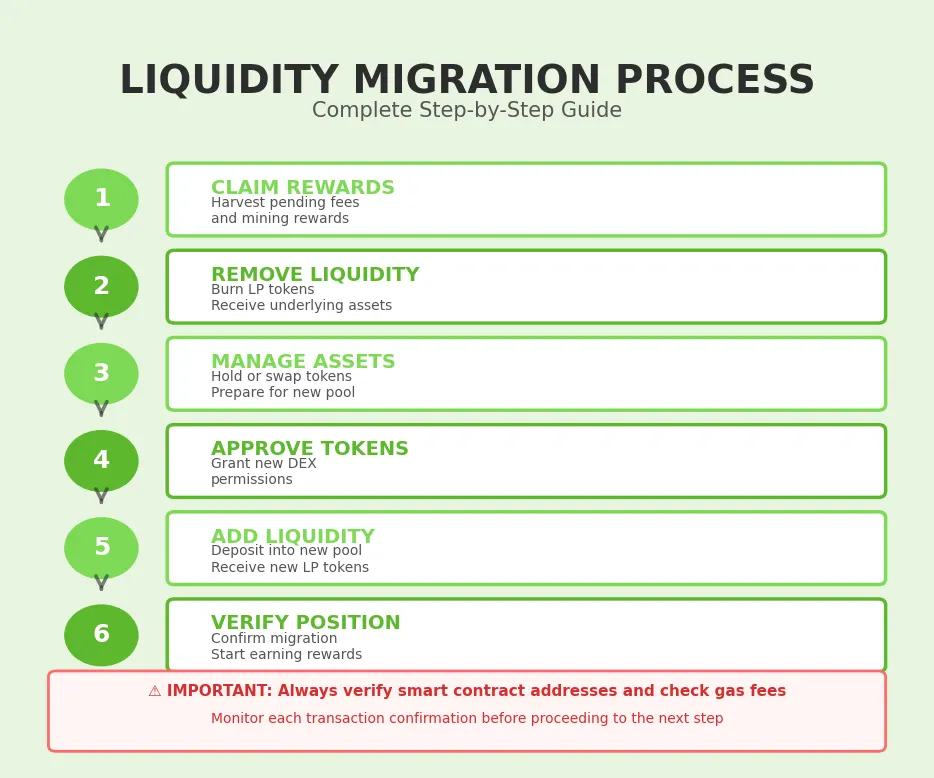

The operational mechanics of how liquidity migration works in DEX environments involve a multi-step process coordinated through smart contract interactions. Understanding each phase of this process is crucial for executing successful migrations while minimizing risks and costs. The journey begins with the decision to migrate, followed by careful preparation, execution of withdrawal transactions, asset management during transition, and finally the redeposition into the target pool. Each step presents specific considerations and potential pitfalls that providers must navigate.

Modern liquidity migration can occur through manual processes where providers execute each step individually, or through automated migration tools that bundle multiple operations into streamlined transactions. Both approaches have merits depending on the provider’s technical sophistication, migration complexity, and risk tolerance. The fundamental steps remain consistent regardless of methodology: removing liquidity from the source, managing assets during transition, and adding liquidity to the destination. However, the execution details, transaction bundling, and optimization strategies can vary significantly.

Liquidity Pool Migration Process Explained

The liquidity pool migration process follows a logical sequence designed to safely transfer value while maintaining control throughout the transition. Before initiating any migration, successful liquidity providers conduct thorough research on the destination platform, verify smart contract addresses, understand the target pool’s requirements, and calculate expected costs including gas fees and potential slippage. This preparation phase prevents costly mistakes and ensures the migration aligns with overall portfolio strategy.

Once prepared, the migration progresses through distinct phases. First, providers must claim any pending rewards from the source pool to avoid forfeiting earned incentives. Next comes the actual liquidity removal, followed by potential token swaps if the destination pool requires different ratios or tokens. Token approvals grant the new platform permission to interact with your assets. Finally, the actual deposit into the new pool completes the migration. Each phase requires confirming transaction success before proceeding, as failures at any stage can result in locked funds or incomplete migrations requiring additional troubleshooting.

Removing Liquidity From an Existing DEX Pool

Removing liquidity from an existing pool initiates the migration process and represents the point where your capital exits the safety of the original pool. This step involves burning your LP tokens in exchange for the underlying assets proportional to your pool share. The smart contract calculates your position value based on current pool ratios and returns the corresponding amounts of both tokens. Importantly, the amounts returned may differ from your initial deposit due to price changes and accumulated trading fees, reflecting both impermanent loss and fee earnings.

Before executing removal, providers should verify current pool balances, check for any lockup periods or withdrawal restrictions, and assess market conditions to avoid migrating during extreme volatility. Some pools implement withdrawal fees or require waiting periods after staking, which must be factored into migration timing. The removal transaction itself is typically straightforward through the platform’s interface, but providers should double-check slippage settings and gas prices. Once confirmed, the underlying tokens return to your wallet, ready for the next migration phase.

Transferring Assets to a New DEX Protocol

The asset transfer phase represents the vulnerable period where your capital sits outside any liquidity pool, exposed to market price movements without earning yield. This intermediate state should be minimized through efficient execution and proper preparation. If migrating to a pool on the same blockchain, the transfer is simply managing tokens in your wallet. However, cross-chain migrations require using bridge protocols to move assets between different blockchain networks, adding complexity, time, and additional risks to the process.

During this phase, providers may need to perform token swaps to match the requirements of the destination pool. For example, if you’re migrating from an ETH/USDC pool to a different token pair, you’ll need to swap some or all of your assets. These swaps incur their own fees and slippage, which must be calculated into the migration’s total cost. Time sensitivity becomes crucial here, as prolonged exposure to price volatility can erode migration benefits. Experienced providers often execute migrations during periods of lower volatility or use limit orders to control swap prices.

Adding Liquidity to a New Liquidity Pool

Adding liquidity to the destination pool completes the migration cycle and returns your capital to a productive state. This final step requires approving the new protocol’s smart contracts to access your tokens, then executing the deposit transaction that mints new LP tokens representing your position in the target pool. The approval step is often overlooked but critical, as it grants the smart contract permission to move your tokens. Providers should be extremely cautious about approvals, verifying contract addresses and understanding the permissions being granted.

When depositing into the new pool, you must provide tokens in the correct ratio required by that pool’s current composition. Most DEX interfaces show required ratios and calculate amounts automatically, but providers should understand these calculations. If your token amounts don’t perfectly match the required ratio, you may need to swap additional tokens or deposit slightly less liquidity to maintain balance. Once the deposit transaction confirms, you receive new LP tokens and begin earning fees and rewards from the destination pool. Successful providers immediately verify their position appears correctly and that reward accrual has started.

Why Liquidity Migration Happens in DEX Platforms

The motivations driving liquidity migration DeFi DEX activities stem from the competitive and dynamic nature of decentralized finance. Unlike traditional financial markets where liquidity providers typically maintain long-term relationships with specific venues, DeFi’s permissionless architecture enables and encourages capital fluidity. Providers constantly evaluate opportunities across the ecosystem, comparing yield rates, reward programs, risk profiles, and platform features. This ongoing optimization process drives liquidity toward protocols offering the best value propositions at any given moment.

Beyond individual optimization, systemic factors trigger large-scale migration events that reshape the DeFi landscape. Protocol launches, major upgrades, token listing decisions, and changes in governance parameters can all catalyze significant liquidity movements. Understanding these motivations helps providers anticipate migration opportunities and make strategic decisions about their own liquidity deployment. It also provides insights into the competitive dynamics driving innovation across decentralized exchanges and the factors that determine long-term protocol success.

Liquidity Provider Incentives and Rewards

Incentive structures represent the primary driver of liquidity migration decisions. DEX platforms compete for liquidity by offering various reward mechanisms including trading fee distributions, liquidity mining programs that distribute governance tokens, bonus multipliers for early providers, and special incentives for specific pools. When a new platform launches an attractive liquidity mining program, rational providers calculate whether the additional rewards justify migration costs and risks. These yield farming opportunities can offer substantially higher returns than established pools, creating powerful migration incentives.

However, incentive evaluation requires sophisticated analysis beyond simple APY comparison. Providers must consider reward token price volatility, vesting schedules that lock earned tokens, the sustainability of high yields, and tax implications of frequent migrations. Some platforms offer stable, predictable returns through consistent trading volume, while others provide explosive but temporary yields through promotional campaigns. Experienced liquidity providers balance these factors, often maintaining positions across multiple platforms to capture different opportunity types while managing overall portfolio risk. Exploring comprehensive liquidity strategies helps providers optimize their approach.

Better Yield Opportunities and Fee Structures

Fee structures vary significantly across decentralized exchanges, creating migration opportunities for providers seeking optimal returns. Traditional AMM protocols charge fixed fees (often 0.3%) that get distributed proportionally to liquidity providers. However, newer platforms experiment with dynamic fee models that adjust based on market volatility, tiered structures that reward larger positions, and concentrated liquidity approaches that allow providers to earn fees on specific price ranges. These innovations can dramatically improve capital efficiency and fee earnings for strategic providers.

Trading volume directly impacts fee generation, making pool selection crucial. A pool with lower percentage fees but significantly higher volume may generate more absolute returns than a high-fee, low-volume alternative. Providers analyze 24-hour volumes, historical volume trends, and pool depth to project potential earnings. Additionally, some protocols implement revenue sharing mechanisms where a portion of platform fees gets redistributed to token holders or stakers, creating additional yield layers beyond basic LP returns. Understanding these nuanced fee structures enables providers to identify genuinely superior opportunities rather than chasing superficial APY figures.

Protocol Upgrades and New DEX Launches

Major protocol upgrades often trigger substantial liquidity migration as platforms introduce improved features that enhance provider returns or user experience. The transition from Uniswap V2 to V3, for example, introduced concentrated liquidity mechanics that fundamentally changed how providers could deploy capital. These upgrades typically include migration incentives, with platforms offering bonus rewards to early movers who help establish liquidity in new contracts. The combination of improved features and migration bonuses creates compelling reasons for providers to undertake the migration effort and costs.

New DEX launches represent another major migration catalyst, particularly when backed by significant capital, experienced teams, or innovative approaches. These launches often feature aggressive liquidity mining programs designed to bootstrap initial liquidity and compete with established platforms. Early participation in successful protocol launches can generate outsized returns, though it carries increased risk from unproven smart contracts and uncertain market reception. Providers must balance the potential for early-mover advantages against the risks of untested protocols, often starting with smaller positions to test new platforms before committing significant capital.

Migration decisions should balance yield optimization with risk management, considering both immediate returns and long-term protocol sustainability.

Role of Liquidity Providers in DEX Liquidity Migration

Liquidity providers serve as the critical actors in the DEX ecosystem, and their migration decisions collectively shape the competitive landscape of decentralized finance. Individual providers range from retail participants managing modest positions to institutional liquidity providers deploying millions in capital across multiple protocols. Regardless of scale, each provider makes strategic decisions about where to deploy capital based on risk tolerance, return expectations, and investment horizon. The aggregate of these individual decisions creates the liquidity flows that determine which protocols thrive and which struggle.

The role extends beyond passive capital provision. Active liquidity providers monitor market conditions, track incentive programs, analyze protocol developments, and execute strategic rebalancing across platforms. This active management approach treats liquidity provision as a dynamic investment strategy rather than a static deposit. Sophisticated providers employ various tools and metrics to optimize their positions, from APY calculators and impermanent loss estimators to portfolio trackers that aggregate positions across multiple chains and protocols.

| Provider Type | Typical Migration Frequency | Primary Motivation | Migration Approach |

|---|---|---|---|

| Retail Providers | Quarterly to annually | Yield optimization, new opportunities | Manual, platform interfaces |

| Active Traders | Monthly to quarterly | High APY chasing, farming | Mix of manual and automated |

| Professional LPs | Weekly to monthly | Capital efficiency, risk management | Automated tools, custom strategies |

| Institutional Providers | As needed, strategic | Protocol partnerships, volume | Custom solutions, direct integration |

| Yield Farmers | Daily to weekly | Maximum short-term returns | Heavily automated, bots |

| Long-term Holders | Rarely, major events only | Stability, established platforms | Manual, conservative timing |

How LPs Migrate Liquidity Between DEXs

Liquidity providers employ various strategies when migrating between DEX platforms, ranging from simple full migrations to complex partial rebalancing approaches. Full migration involves completely withdrawing from one platform and redepositing entire positions into another. This straightforward approach works well when providers have clear convictions about superior opportunities elsewhere or when consolidating positions for simplified management. However, it exposes the entire position to migration risks and eliminates diversification benefits.

Partial migration strategies offer more nuanced approaches. Providers might migrate a portion of liquidity to test new platforms before committing fully, maintain positions across multiple DEXs for diversification, or gradually shift liquidity as new opportunities prove themselves. This incremental approach reduces risk but increases complexity and transaction costs through multiple migrations. Some sophisticated providers implement dollar-cost averaging into new positions, spreading migration over time to reduce exposure to any single market condition. Understanding these different approaches helps providers select strategies aligned with their risk tolerance and objectives.

Manual Liquidity Provider Migration

Manual migration processes give providers complete control over every step, allowing careful verification and deliberate decision-making at each phase. This approach involves directly interacting with each DEX’s interface to remove liquidity, managing tokens in your wallet, and adding liquidity to the destination pool through separate transactions. Manual migration suits providers who value transparency, want to minimize trust in third-party tools, or need to execute complex migrations involving multiple token swaps or cross-chain transfers.

The manual approach requires technical knowledge about transaction parameters, gas optimization, and smart contract interactions. Providers must understand concepts like slippage tolerance, gas price settings, and transaction confirmation monitoring. While more time-consuming than automated alternatives, manual migration offers flexibility to pause between steps, adjust strategy based on market movements, and troubleshoot issues as they arise. Many experienced providers prefer manual migration for large positions where the additional attention justifies the time investment and reduces risks associated with automated processes.

Automated Liquidity Migration Mechanisms

Automated migration tools streamline the process by bundling multiple operations into single transactions or coordinated sequences that minimize manual intervention and execution time. These tools, offered by aggregators, migration services, or protocol-specific utilities, handle the technical complexity of removing liquidity, swapping tokens as needed, managing approvals, and depositing into destination pools. The automation reduces the vulnerable period where assets sit outside pools and minimizes user error from incorrect transaction parameters or missed steps.

However, automated migration introduces dependencies on third-party smart contracts that must be carefully evaluated. Providers should verify that migration tools have undergone professional security audits, maintain good reputations within the community, and clearly document their processes. Some automated systems charge service fees, while others operate transparently without additional costs beyond standard gas fees. The choice between manual and automated approaches often depends on position size, migration frequency, and provider technical sophistication. Learning about DEX infrastructure fundamentals enhances understanding of these migration mechanisms.

Liquidity Migration Mechanism in AMM-Based DEXs

Automated Market Maker protocols form the foundation of most decentralized exchanges, and understanding how liquidity migration works in DEX systems built on AMM models is crucial for effective liquidity management. AMM mechanisms use mathematical formulas to price assets and facilitate trades without traditional order books. The most common formula, implemented by Uniswap and many forks, is the constant product formula (x * y = k) where x and y represent token reserves and k remains constant. This formula determines how much of each token liquidity providers receive when they withdraw and what ratios they must maintain when depositing.

Migration between AMM-based protocols requires understanding how different implementations affect the migration process. While the basic steps remain consistent across platforms, variations in fee structures, pool types, and smart contract implementations create nuances that impact migration strategies. Concentrated liquidity models like Uniswap V3 require providers to specify price ranges when depositing, adding complexity compared to full-range liquidity in earlier AMM versions. These technical differences influence both the migration process itself and the ongoing management requirements after migration completes.

Liquidity Migration in AMM DEX Models

The AMM model’s mathematical foundations directly impact liquidity migration mechanics. When you remove liquidity from an AMM pool, the protocol calculates your share based on the percentage of total LP tokens you hold. This calculation uses current pool reserves, not your original deposit amounts, meaning you receive tokens proportional to the current pool composition. If token prices have shifted significantly since your initial deposit, the returned amounts will differ from what you deposited, reflecting both impermanent loss and accumulated trading fees.

Different AMM variants introduce migration considerations. Constant product AMMs (x * y = k) dominate the ecosystem but stable swap AMMs optimized for stablecoin trading use different formulas that minimize slippage for similar-priced assets. Weighted pools allow arbitrary ratios rather than strict 50/50 splits, giving providers more flexibility but requiring careful attention to rebalancing during migration. Understanding these AMM variations helps providers select appropriate destination pools and anticipate migration outcomes. Those interested in specific pool types should explore detailed pool mechanics to optimize their strategies.

Liquidity Pool Migration Using Smart Contracts

Smart contracts orchestrate every aspect of liquidity migration in decentralized systems, from initial withdrawal through final deposit. These self-executing code contracts enforce the rules and calculations that govern liquidity pools without requiring human intervention or trust in centralized parties. When you initiate a migration, you’re interacting with multiple smart contracts: the source pool’s contract to burn LP tokens and receive underlying assets, potentially swap contracts for token exchanges, approval contracts that grant permissions, and finally the destination pool’s contract to mint new LP tokens.

The reliability and security of these smart contracts fundamentally determine migration safety. Well-audited contracts from established protocols have proven track records of secure operation, while new or unaudited contracts carry risks of bugs, vulnerabilities, or malicious code. Migration tools that bundle operations use their own smart contracts to coordinate multiple steps, adding another layer that requires security evaluation. Providers should verify contract addresses carefully, understand what permissions they’re granting through approval transactions, and never rush through security verification regardless of potential opportunity costs.

Risks and Challenges of Liquidity Migration in DEX

Every liquidity migration carries inherent risks that providers must carefully evaluate before executing moves between platforms. These risks range from technical failures and smart contract vulnerabilities to market-driven losses from price volatility and impermanent loss. Understanding the complete risk landscape enables providers to make informed decisions about whether migration benefits justify potential downsides. Risk management in liquidity migration requires assessing both the probability of adverse events and their potential magnitude, then implementing strategies to mitigate these risks.

The challenge extends beyond individual risk factors to their interactions. High gas fees might be acceptable if reward advantages are substantial, but combined with significant impermanent loss risk and uncertain reward token value, the overall risk profile may be unattractive. Sophisticated providers develop frameworks for holistic risk assessment that consider multiple factors simultaneously rather than evaluating risks in isolation. This comprehensive approach prevents situations where providers successfully avoid one risk only to encounter unexpected problems from factors they underweighted.

| Risk Category | Risk Level | Potential Impact | Mitigation Strategy |

|---|---|---|---|

| Impermanent Loss | Medium to High | Position value decrease vs holding | Choose correlated pairs, migrate in low volatility |

| Smart Contract Bugs | Low to Medium | Complete loss of funds | Use audited contracts, established platforms |

| Transaction Failure | Low | Lost gas fees, incomplete migration | Proper gas settings, test transactions |

| Price Slippage | Medium | Unfavorable execution prices | Set appropriate slippage tolerance, limit orders |

| Gas Fee Spikes | Medium | Migration becomes uneconomical | Monitor gas prices, migrate off-peak |

| Destination Risk | Variable | New platform underperforms | Research thoroughly, start with test amounts |

Liquidity Migration Risks for Liquidity Providers

Liquidity providers face a spectrum of risks during migration that can impact returns or, in worst cases, result in significant losses. Market risk manifests through price volatility during the migration window when assets sit outside pools unprotected. A sudden market movement can dramatically affect position value between withdrawal and redeposit, potentially eroding the anticipated benefits of migration. This risk intensifies during volatile market conditions or when migrating large positions that require multiple transactions to complete.

Operational risks stem from human error or technical failures during migration execution. Sending tokens to incorrect addresses, setting wrong slippage parameters, underestimating gas fees leading to stuck transactions, or failing to complete all migration steps creates various failure scenarios. These operational risks particularly affect less experienced providers who may not fully understand transaction parameters or smart contract interactions. Educational resources and careful verification at each step reduce these risks, though they can never be completely eliminated.

Impermanent Loss During Liquidity Migration

Impermanent loss represents one of the most significant risks facing liquidity providers, and migration can crystallize or exacerbate this phenomenon. When you provide liquidity to an AMM pool, your position’s value fluctuates relative to simply holding the underlying tokens. If token prices diverge significantly, you experience impermanent loss, the difference between your pool position value and what you would have by holding tokens separately. During migration, this loss becomes realized as you withdraw liquidity and receive tokens at current ratios.

Migration timing critically affects impermanent loss impact. Migrating when token prices have returned near their initial deposit ratios minimizes realized impermanent loss. Conversely, migrating during extreme price divergence locks in maximum loss. The time between pool exit and entry to the new pool creates additional exposure, as prices can move further during migration. Sophisticated providers calculate expected impermanent loss under various scenarios and only migrate when the destination pool’s superior returns justify accepting realized losses. Understanding impermanent loss mechanics is essential for any liquidity provider considering migration.

Smart Contract and Execution Risks

Smart contract risks permeate every aspect of DeFi, and liquidity migration multiplies these concerns by requiring interaction with multiple contracts across different platforms. Every smart contract contains potential vulnerabilities, from minor bugs that cause transaction failures to critical exploits that enable fund theft. Even thoroughly audited contracts can contain undiscovered vulnerabilities, and migration tools add another layer of smart contract interaction that must be trusted. Providers must evaluate contract security through audits, battle-testing duration, and protocol reputation.

Execution risks involve transaction failures from various causes including insufficient gas, network congestion, or unfavorable market conditions. A failed transaction consumes gas fees without accomplishing migration objectives, requiring diagnosis and retry with adjusted parameters. Partial migrations where some steps succeed but others fail create particularly challenging scenarios requiring careful recovery. Setting appropriate gas limits, slippage tolerance, and deadline parameters helps mitigate execution risks, though cannot eliminate them entirely. Providers should always monitor transactions through completion and have contingency plans for common failure scenarios.

Risk awareness and proactive mitigation strategies separate successful long-term liquidity providers from those who experience preventable losses.

Liquidity Migration vs Liquidity Bootstrapping in DEX

Understanding the distinction between liquidity migration and liquidity bootstrapping clarifies important concepts in decentralized exchange operations. While both involve capital deployment into DEX pools, they serve fundamentally different purposes and occur under distinct circumstances. Liquidity migration moves existing capital between established pools or platforms, representing reallocation decisions by existing liquidity providers. Bootstrapping involves the initial establishment of liquidity for new trading pairs or platforms, typically requiring fresh capital and occurring during protocol launches or new pool creation.

The mechanics and incentive structures differ substantially between these processes. Migration involves straightforward withdrawal and redeposit workflows between functioning pools with established prices. Bootstrapping requires solving the cold-start problem of establishing initial liquidity without existing price discovery mechanisms. Protocols employ various bootstrapping strategies including token auctions, liquidity mining programs, and partnerships with initial liquidity providers. Understanding when each process applies and how they interact helps providers identify opportunities and understand market dynamics driving DEX ecosystem evolution.

Key Differences Between Liquidity Migration and Bootstrapping

Liquidity migration operates within established market contexts where prices, volumes, and liquidity depths already exist. Providers migrating between pools can evaluate historical performance, assess current yield rates, and make informed comparisons between alternatives. The migration decision optimizes existing positions rather than creating new market infrastructure. Migration timing flexibility allows providers to wait for favorable conditions, though opportunity costs from delayed moves must be considered.

Bootstrapping confronts the challenge of establishing markets from scratch without historical data to guide decisions. Initial liquidity providers accept higher risks in exchange for potentially outsized early rewards. Price discovery during bootstrapping periods can be volatile and inefficient, creating both risks and opportunities. Bootstrapping incentives typically front-load rewards to compensate for these elevated risks, while migration focuses on steady optimization of established positions. The skill sets required differ significantly: migration demands analytical comparison and timing optimization, while bootstrapping requires risk assessment and conviction in untested protocols. Exploring specialized farming strategies reveals how providers approach both scenarios.

When DEX Protocols Use Liquidity Migration

DEX protocols strategically employ migration mechanisms during several key scenarios that advance platform objectives. Protocol upgrades requiring new smart contracts necessitate migration from legacy systems to updated versions. Platforms typically offer migration tools and incentives to facilitate smooth transitions, recognizing that liquidity fragmentation between old and new versions harms user experience. These coordinated migration events represent critical moments in protocol evolution, often accompanied by extensive communication campaigns to ensure providers understand the process and benefits.

Competitive positioning drives another category of migration initiatives. When protocols launch attractive liquidity mining programs or superior features, they explicitly target liquidity from competing platforms. These competitive migrations reshape the DEX landscape, with liquidity flowing toward platforms offering the best combination of returns, features, and trustworthiness. Some protocols employ aggressive incentive campaigns specifically designed to trigger mass migrations from competitors, though sustainability of such approaches varies. Understanding these protocol-level strategies helps providers anticipate migration trends and position themselves advantageously.

Impact of Liquidity Migration on DEX Ecosystem

Liquidity migration events ripple through the DEX ecosystem with effects that extend far beyond individual provider returns. These movements influence trading conditions for all platform users, affect protocol competitiveness, and drive innovation across the sector. Large-scale migrations can dramatically alter platform dynamics, shifting a protocol from vibrant activity to relative dormancy or vice versa within days. Understanding these systemic impacts provides perspective on how individual migration decisions aggregate into market-wide phenomena that shape DeFi’s evolution.

The feedback loops created by liquidity migration create interesting market dynamics. Successful platforms attract more liquidity, which improves trading conditions, which attracts more traders, which generates more fees, which attracts more liquidity providers. This virtuous cycle explains why liquidity tends to concentrate on leading platforms rather than distributing evenly. Conversely, liquidity exits can trigger negative spirals where declining depth reduces trader satisfaction, lowering volumes and fees, motivating more providers to exit. These dynamics make liquidity migration decisions partially self-fulfilling, as collective behavior determines outcomes.

Effects on DEX Trading Volume and Depth

Trading volume responds directly to liquidity availability, creating immediate impacts from migration events. Deep liquidity pools offer lower slippage and better prices, attracting traders who prefer optimal execution. When substantial liquidity migrates into a platform, trading conditions improve, volumes typically increase, and the platform becomes more attractive to both traders and additional liquidity providers. This positive reinforcement can rapidly transform a platform’s competitive position, particularly if migration originates from a competing platform whose conditions simultaneously deteriorate.

Market depth, the total liquidity available at various price levels, determines how large orders can execute without excessive price impact. Migration that reduces pool depth on one platform while increasing it on another shifts where sophisticated traders execute large orders. This trader migration follows liquidity migration, creating cascading effects. Platforms experiencing liquidity outflows often implement emergency measures like enhanced incentives or protocol adjustments to stem the tide, while platforms receiving inflows work to retain and build upon their improving position. These competitive dynamics keep the DEX ecosystem dynamic and continuously evolving.

User Experience and Market Stability Impact

User experience across decentralized exchanges depends heavily on liquidity depth and stability. Traders on platforms with consistent, deep liquidity enjoy predictable execution, tight spreads, and minimal slippage. Migration events that suddenly drain liquidity create frustrating experiences with unexpectedly poor execution and higher costs. These negative experiences can permanently drive traders to alternative platforms, extending migration impacts beyond the immediate liquidity movement. Protocols must carefully manage migration incentives to avoid destabilizing existing liquidity while attracting new capital.

Market stability benefits from steady, predictable liquidity rather than volatile flows responding to temporary incentive spikes. Excessive migration activity driven by short-term yield chasing creates instability as liquidity rapidly shifts between platforms chasing marginal returns. This behavior, while rational at individual levels, can degrade overall ecosystem health through fragmented liquidity and inconsistent trading conditions. The most successful protocols balance attractive incentives with sustainable yield sources and strong community alignment that encourages stable, long-term liquidity provision. Understanding advanced fee mechanisms shows how protocols address these challenges.

Future of Liquidity Migration in Decentralized Exchanges

The evolution of liquidity migration mechanisms represents a frontier in DeFi innovation, with emerging trends pointing toward increasingly sophisticated and automated systems. Future migration tools will likely employ artificial intelligence to optimize timing, route finding across multiple chains, and risk management. Cross-chain migration will become more seamless as bridge technology improves and interoperability standards mature. These advancements will reduce migration friction, enabling more dynamic capital allocation and intensifying competition between protocols for liquidity.

The conceptual framework around liquidity provision itself continues evolving. Concentrated liquidity models require more active management than traditional full-range positions, blurring lines between passive liquidity provision and active trading. Migration automation will enable sophisticated strategies where positions automatically rebalance across platforms and price ranges based on programmed criteria. This professionalization of liquidity provision may challenge retail participants but will improve overall market efficiency. The future likely involves a spectrum from fully passive set-and-forget positions to highly active, algorithmically managed strategies.

Automated Liquidity Migration Trends

Automation trends in liquidity migration are accelerating rapidly, driven by demand for more efficient capital management and technological capabilities enabling sophisticated automation. Current automation tools handle basic migration tasks like bundling transactions and optimizing gas usage. Next-generation systems will incorporate predictive analytics to forecast optimal migration timing, portfolio optimization algorithms that balance returns across multiple positions, and autonomous execution that responds to market conditions without manual intervention. These tools will democratize sophisticated strategies previously available only to professional liquidity providers.

However, increased automation introduces new considerations around strategy transparency, tool trustworthiness, and systemic risks from correlated automated behavior. If many providers use similar automation strategies, their coordinated actions could create liquidity surges and withdrawals that destabilize markets. Protocol designers and automation developers must consider these systemic implications while building tools that optimize individual outcomes. Regulation may eventually address automated liquidity management, particularly as these tools handle increasing capital amounts and potentially affect market stability.

Build a DEX With Seamless Liquidity Migration

Launch a high-performance DEX with secure liquidity migration mechanisms, smart contract automation, and LP-friendly incentives designed for long-term growth.

Launch Your Exchange Now

Evolution of DEX Liquidity Migration Mechanisms

The mechanisms underlying liquidity migration continue evolving as protocols experiment with innovations that reduce friction and improve efficiency. Layer-2 scaling solutions dramatically reduce gas costs, making migration more economical even for smaller positions. Cross-chain messaging protocols enable coordinated actions across different blockchains, facilitating seamless multi-chain migration strategies. Intent-based architectures may eventually allow providers to express desired outcomes while specialized solvers determine optimal execution paths, abstracting away technical complexity.

Protocol-level innovations will continue reshaping migration dynamics. Mechanisms like veTokenomics that reward long-term commitment may reduce migration frequency by aligning incentives toward stability. Conversely, improved capital efficiency through concentrated liquidity and other innovations may encourage more active position management. The balance between these competing forces will determine whether DeFi liquidity becomes more stable and concentrated or increasingly fluid and distributed. Regardless of direction, liquidity migration will remain a crucial mechanism through which markets allocate capital to its most productive uses.

Frequently Asked Questions

Liquidity migration in DEX refers to the process where liquidity providers move their deposited assets from one decentralized exchange or liquidity pool to another. This typically involves withdrawing liquidity from an existing pool, which returns the underlying tokens to the provider, and then redepositing those assets into a different DEX protocol or pool that offers better incentives, yields, or features. The migration can be motivated by seeking higher trading fees, better reward programs, or improved token utility.

The duration of DEX liquidity migration depends on several factors including blockchain network congestion, gas fees, and whether the migration is manual or automated. Manual migrations typically take anywhere from 15 minutes to several hours, involving separate transactions for removing liquidity, approving tokens, and adding them to a new pool. Automated migration tools can reduce this time to minutes by bundling multiple operations into single transactions. However, during periods of high network activity, confirmation times may extend significantly, and providers should account for potential delays.

Yes, liquidity migration carries several risks that can result in financial losses. Impermanent loss can occur if token prices change significantly between removing liquidity from one pool and adding it to another. Transaction failures due to slippage, insufficient gas fees, or smart contract issues can result in locked funds or incomplete migrations. Additionally, price volatility during the migration window can affect the value of withdrawn assets. Liquidity providers should carefully calculate potential risks, use appropriate slippage settings, and consider migrating during periods of lower volatility to minimize potential losses.

Liquidity providers migrate between DEX platforms primarily to maximize their returns and optimize capital efficiency. Common motivations include chasing higher APY rates offered through liquidity mining programs, accessing better fee structures on alternative platforms, participating in new token launches with attractive incentives, and responding to protocol upgrades that offer improved features. Providers also migrate to reduce exposure to specific risks, diversify across multiple platforms, or take advantage of temporary promotional campaigns. The competitive DeFi landscape constantly evolves, creating opportunities for strategic liquidity repositioning.

DEX liquidity migration involves multiple fee layers that providers must consider. Primary costs include blockchain gas fees for executing withdrawal and deposit transactions, which vary based on network congestion and complexity of smart contract interactions. Some platforms charge withdrawal fees when removing liquidity, typically ranging from 0% to 1% of the pool value. Token approval transactions also require gas fees. Additionally, there may be slippage costs if the migration involves swapping tokens to match the requirements of the new pool. Automated migration tools may charge service fees, though they can offset this by optimizing gas usage across bundled transactions.

Automated liquidity migration offers certain safety advantages but introduces different risks compared to manual migration. Automated systems reduce human error, minimize the time assets spend outside pools (reducing price exposure), and can implement sophisticated risk management strategies. However, they require trusting third-party smart contracts, which introduce potential vulnerabilities if not properly audited. Manual migration provides complete control and transparency at each step but exposes providers to longer execution times and potential mistakes in transaction parameters. The safer choice depends on the provider’s technical expertise, the automation tool’s reputation and audit status, and the specific migration scenario.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.