Key Takeaways

- Liquidity pool analysis is essential for evaluating DEX pool performance, helping investors identify profitable opportunities while minimizing exposure to risks like impermanent loss.

- Core liquidity pool analysis metrics including TVL, trading volume, APR, and fees provide comprehensive insights into pool health, activity levels, and potential returns.

- Understanding liquidity pool analysis slippage and price impact helps traders execute better transactions and liquidity providers select optimal pools for their capital.

- Impermanent loss assessment should be central to any liquidity pool analysis strategy, as price divergence between token pairs can significantly erode returns.

- Token pair selection dramatically affects risk profiles, with stable pairs offering lower volatility but reduced returns compared to volatile trading pairs.

- Liquidity pool analysis tools like DeFiLlama, DEX Screener, and Dune Analytics streamline data collection but should be combined with manual verification for accuracy.

- Building a sustainable liquidity pool analysis strategy requires balancing short-term yield optimization with long-term risk management and portfolio diversification.

- Regular monitoring and performance tracking over time enables liquidity providers to adjust positions proactively and maximize overall portfolio returns.

The decentralized finance ecosystem has transformed how individuals interact with financial markets, and liquidity pools stand at the heart of this revolution. For anyone seeking to provide liquidity or trade efficiently on decentralized exchanges, mastering liquidity pool analysis is not optional but essential.

What Is Liquidity Pool Analysis and Why It Matters

Understanding the fundamentals of liquidity pool analysis sets the foundation for successful participation in decentralized finance. This section establishes the core concepts and demonstrates why thorough analysis separates profitable liquidity providers from those who consistently underperform or lose capital.

Definition of Liquidity Pool Analysis

Liquidity pool analysis refers to the systematic examination of decentralized exchange pools to evaluate their performance characteristics, risk factors, and potential returns. This analytical process involves assessing multiple data points including Total Value Locked, trading volumes, fee generation, impermanent loss exposure, and token pair dynamics. The goal is to make data-driven decisions about where to allocate capital for liquidity provision or how to optimize trading strategies.

Unlike traditional market analysis, DEX liquidity pool analysis requires understanding unique mechanisms like automated market makers (AMMs), constant product formulas, and the interplay between liquidity depth and price stability. These factors create a distinct analytical framework that differs fundamentally from centralized exchange evaluation methods.

How Liquidity Pools Function on DEXs

Liquidity pools operate through smart contracts that hold reserves of two or more tokens, enabling decentralized trading without traditional order books. When users deposit tokens into these pools, they receive liquidity provider (LP) tokens representing their share of the pool. Traders interact with these pools by swapping one token for another, paying fees that get distributed proportionally to liquidity providers.

The most common mechanism uses the constant product formula (x * y = k), where the product of token quantities must remain constant after each trade. This mathematical relationship determines prices algorithmically and creates the foundation for understanding slippage, price impact, and other critical liquidity pool analysis metrics. For those interested in building their own trading infrastructure, our guide on building a decentralized exchange provides comprehensive technical insights.

Role of Liquidity Pool Analysis in Informed Decision-Making

Informed decision-making in DeFi requires moving beyond surface-level APR numbers to understand the complete picture of pool dynamics. Liquidity pool analysis enables investors to identify pools with sustainable yield generation, assess risk-adjusted returns, and avoid common pitfalls like rug pulls or unsustainable tokenomics. This analytical approach transforms speculation into strategic capital allocation.

Industry Insight: Based on our extensive experience developing DeFi protocols, we have observed that investors who conduct thorough liquidity pool analysis consistently outperform those who chase high APR numbers without understanding underlying risks. The difference often amounts to preserving capital versus losing significant portions to impermanent loss or protocol failures.

How to Analyze Liquidity Pools on a DEX

Moving from theory to practice requires a structured approach to analyze liquidity pools effectively. This section provides actionable frameworks that you can apply immediately to evaluate any DEX pool.

Step-by-Step Process to Analyze Liquidity Pools

A systematic approach to DEX liquidity pool analysis ensures consistency and thoroughness. Begin by identifying pools that match your investment criteria, then proceed through data collection, metric evaluation, and risk assessment before making any capital allocation decisions.

Liquidity Pool Analysis Lifecycle

| Stage | Activities | Key Outputs | Tools Used |

|---|---|---|---|

| 1. Discovery | Identify potential pools, filter by chain and protocol | Shortlist of candidate pools | DeFiLlama, DEX Screener |

| 2. Data Collection | Gather TVL, volume, APR, fee data | Comprehensive metrics dataset | Protocol dashboards, APIs |

| 3. Risk Assessment | Evaluate IL exposure, smart contract risks | Risk score and profile | IL calculators, audit reports |

| 4. Comparison | Compare pools against benchmarks | Ranked pool selection | Custom spreadsheets, Dune |

| 5. Execution | Deposit liquidity, set position parameters | Active LP position | DEX interface, wallet |

| 6. Monitoring | Track performance, adjust positions | Ongoing optimization | Portfolio trackers, alerts |

Key Data Points Involved in DEX Liquidity Pool Analysis

Effective DEX liquidity pool analysis requires tracking multiple interconnected data points. Primary metrics include TVL for pool depth assessment, 24-hour and 7-day trading volumes for activity measurement, and APR calculations for return estimation. Secondary metrics encompass fee generation rates, historical impermanent loss, slippage percentages at various trade sizes, and price impact curves.

Beyond numerical data, qualitative factors matter significantly. These include smart contract audit status, protocol governance structure, team reputation, and community sentiment. Combining quantitative metrics with qualitative assessment creates a holistic view that supports better investment decisions.

Importance of Choosing the Right Token Pair for Analysis

Token pair selection fundamentally shapes your liquidity provision experience. The liquidity pool analysis token pair evaluation should consider correlation between assets, historical volatility patterns, and trading demand. Pairs with highly correlated assets minimize impermanent loss but may offer lower returns, while uncorrelated pairs present higher risk with potentially greater rewards.

Core Liquidity Pool Analysis Metrics You Must Track

Overview of Liquidity Pool Analysis Metrics

Liquidity pool analysis metrics form the quantitative backbone of informed decision-making. These measurements provide objective benchmarks for comparing pools, tracking performance over time, and identifying optimal entry and exit points. Understanding what each metric reveals and how they interact enables sophisticated analysis that goes beyond surface-level evaluation.

Why Metrics Define Pool Performance and Sustainability

Metrics translate complex pool dynamics into actionable intelligence. A pool might display attractive APR figures, but without understanding the underlying TVL trends, volume consistency, and fee sustainability, that number lacks context. Comprehensive metric tracking reveals whether returns are sustainable or artificially inflated, whether liquidity is growing or declining, and whether the pool ecosystem supports long-term value creation.

| Metric | What It Measures | Ideal Range | Warning Signs |

|---|---|---|---|

| TVL | Pool depth and stability | $1M+ for major pairs | Declining TVL trend |

| 24h Volume | Trading activity level | 10-50% of TVL daily | Volume/TVL ratio below 5% |

| APR | Annualized returns | 5-50% sustainable | APR above 100% unsustained |

| Fee Rate | Transaction cost structure | 0.05% to 1% | Fees misaligned with volatility |

| Price Impact | Trade size effect on price | Below 1% for standard trades | High impact on small trades |

Liquidity Pool Analysis TVL

What TVL Indicates About Pool Stability

Liquidity pool analysis TVL serves as the foundational metric for understanding pool health. Total Value Locked represents the combined dollar value of all assets deposited in a pool, indicating the capital commitment from liquidity providers. Higher TVL generally correlates with greater pool maturity, reduced manipulation risk, and improved trading conditions for all participants.

TVL trends over time reveal crucial information about market confidence. Consistently growing TVL suggests increasing trust and utility, while declining TVL may indicate shifting sentiment or emerging concerns about the pool or protocol. Analyzing TVL alongside other metrics provides context for interpreting these movements accurately.

How TVL Impacts Liquidity Depth and Confidence

Liquidity depth directly determines trading efficiency and price stability within a pool. Deep liquidity allows larger trades to execute with minimal slippage and price impact, attracting institutional traders and high-volume participants. This creates a virtuous cycle where better trading conditions attract more volume, generating more fees, which attracts more liquidity providers.

Liquidity Pool Analysis Volume

Relationship Between Trading Volume and Pool Activity

Liquidity pool analysis volume metrics reveal the actual usage and demand for a particular trading pair. High volume indicates active markets with consistent trading interest, which translates directly into fee generation for liquidity providers. The volume-to-TVL ratio helps normalize this metric across pools of different sizes, enabling meaningful comparisons.

Volume as an Indicator of Real Usage

Sustained trading volume validates genuine market demand rather than artificial inflation through wash trading or incentive programs. Analyzing volume patterns across different timeframes helps distinguish organic activity from temporary spikes. Consistent volume generation indicates a healthy pool with real utility, making it a more reliable choice for liquidity provision.

Liquidity Pool Analysis APR and Fees

Understanding Liquidity Pool Analysis APR

Liquidity pool analysis APR represents the projected annual return for providing liquidity, typically calculated from recent fee generation extrapolated over a year. This metric serves as the primary attraction for many liquidity providers, but understanding its composition and sustainability is crucial. APR can come from trading fees, protocol incentives, or a combination of both sources.

Distinguishing between fee-based APR and incentive-based APR matters significantly for long-term planning. Fee-based returns depend on sustainable trading activity, while incentive-based returns rely on continued protocol subsidies that may decrease over time. A pool showing 100% APR primarily from temporary incentives presents very different prospects than one earning 30% purely from trading fees.

How Fees Contribute to Liquidity Provider Returns

Liquidity pool analysis fees directly determine the income stream for providers. Fee structures vary across DEX protocols, typically ranging from 0.01% to 1% per transaction. Higher fee tiers generally suit volatile pairs where traders accept increased costs for the liquidity access, while lower fees work better for stable pairs competing on execution efficiency.

Evaluating Risk Through Liquidity Pool Analysis

Why Risk Assessment Is Critical in Liquidity Pool Analysis

Liquidity pool analysis risk evaluation prevents capital losses that can easily exceed any earned returns. DeFi environments present unique risk vectors including smart contract vulnerabilities, economic exploits, oracle manipulation, and sudden liquidity withdrawals. Comprehensive risk assessment should be non-negotiable before any significant capital deployment.

Risk Warning: Never invest more than you can afford to lose in liquidity pools. Smart contract risks, impermanent loss, and market volatility can result in significant capital losses. Always verify contract audits, start with smaller positions, and diversify across multiple pools and protocols to manage risk effectively.

Common Risk Factors Across DEX Pools

Smart contract risk remains the most fundamental concern, as bugs or vulnerabilities can lead to complete fund loss. Protocol governance risks involve potential changes to fee structures or tokenomics that disadvantage existing providers. Market risks include sudden volatility spikes that accelerate impermanent loss, while liquidity concentration risk emerges when few large providers dominate a pool.

Liquidity Pool Analysis Impermanent Loss

What Impermanent Loss Means in Practical Terms

Liquidity pool analysis impermanent loss quantifies the opportunity cost of providing liquidity versus simply holding tokens. When token prices diverge from their ratio at deposit time, the AMM algorithm automatically rebalances your position, resulting in more of the depreciating token and less of the appreciating one. This mechanical rebalancing creates losses relative to a hold-only strategy.

The term impermanent reflects that losses only become permanent upon withdrawal. If prices return to the original ratio, the loss disappears. However, in practice, prices rarely return exactly, making some degree of permanent loss common for volatile pairs. Understanding and modeling this risk is essential for profitable liquidity provision.

How Token Price Movement Affects Pool Balance

Price movements trigger automatic portfolio rebalancing through the AMM mechanism. As one token appreciates, arbitrageurs purchase it from the pool at below-market rates, reducing your holdings of the winning asset. Conversely, you accumulate more of the depreciating token. This constant rebalancing means liquidity providers always hold a position that underperforms the better-performing asset.

Liquidity Pool Analysis Slippage and Price Impact

How Slippage Affects Trade Execution

Liquidity pool analysis slippage measures the deviation between expected and executed trade prices. In decentralized environments, slippage arises from two sources: price movement during transaction confirmation and the inherent price impact of trading against an AMM curve. Higher slippage tolerance settings allow trades to execute despite price movement but can result in significantly worse execution prices.

Price Impact and Its Connection to Pool Depth

Liquidity pool analysis price impact reveals how individual trade sizes affect pool prices. Deeper pools with higher TVL absorb trades with minimal impact, while shallow pools experience dramatic price shifts from modest trades. For traders, this determines execution quality. For liquidity providers, understanding price impact helps predict trading activity patterns and fee generation potential.

| Pool TVL | $1K Trade Impact | $10K Trade Impact | $100K Trade Impact |

|---|---|---|---|

| $100K Pool | ~1% | ~10% | Not feasible |

| $1M Pool | ~0.1% | ~1% | ~10% |

| $10M Pool | ~0.01% | ~0.1% | ~1% |

Liquidity Pool Analysis Strategy for Smarter Decisions

Building a Sustainable Liquidity Pool Analysis Strategy

A robust liquidity pool analysis strategy combines systematic metric evaluation with adaptive positioning based on market conditions. Rather than chasing the highest APR, sustainable strategies prioritize risk-adjusted returns, diversification across pool types, and continuous monitoring. This approach may sacrifice some short-term gains but protects capital and generates consistent returns over time.

Short-term vs Long-term Analysis Perspectives

Short-term analysis focuses on immediate opportunities like new pool launches, temporary incentive programs, or volatility events that create enhanced fee generation. Long-term analysis emphasizes fundamental pool health, sustainable tokenomics, and protocol development trajectories. Balancing both perspectives enables tactical positioning within a strategic framework.

Aligning Strategy with Risk Tolerance

Individual risk tolerance should drive pool selection and position sizing. Conservative investors might favor stable pairs on established protocols, accepting lower returns for reduced volatility exposure. Aggressive participants might pursue higher-yielding volatile pairs while understanding and accepting potential impermanent loss. Honest self-assessment prevents emotional decision-making during market stress.

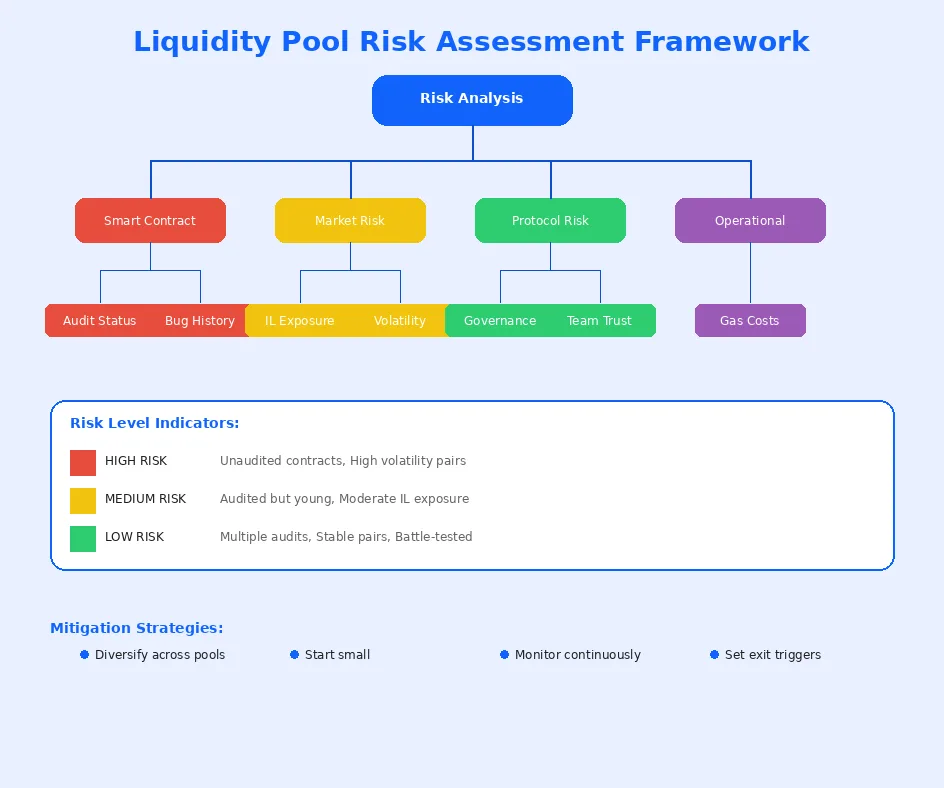

Pool Selection Criteria Framework

Security Score

Audit status, bug bounty, track record, insurance coverage

Return Potential

Fee APR, incentive sustainability, volume trends, TVL growth

Risk Profile

IL exposure, token volatility, concentration risk, protocol risk

Operational Factors

Gas costs, withdrawal flexibility, monitoring complexity

Using Liquidity Pool Analysis Tools

Overview of Commonly Used Liquidity Pool Analysis Tools

Liquidity pool analysis tools streamline data collection and visualization across multiple protocols and chains. DeFiLlama provides comprehensive TVL tracking and protocol comparisons. DEX Screener offers real-time pool data with charting capabilities. Dune Analytics enables custom queries for deeper analysis. Protocol-specific dashboards like Uniswap Analytics or Curve’s pools page provide native insights for their respective ecosystems.

For comprehensive understanding of liquidity dynamics, exploring our resource on understanding liquidity on decentralized exchanges provides valuable foundational knowledge that complements tool-based analysis.

How Tools Simplify Metric Tracking and Comparison

Modern analytics platforms aggregate data from blockchain networks, calculate derived metrics automatically, and present information in accessible formats. This automation saves countless hours compared to manual data extraction and calculation. Cross-protocol comparisons become straightforward, enabling rapid evaluation of opportunities across the entire DeFi landscape.

Limitations of Relying Only on Tools

While liquidity pool analysis tools provide invaluable assistance, over-reliance creates blind spots. Tools may have data delays, calculation errors, or coverage gaps for newer protocols. They cannot assess qualitative factors like team reputation, governance dynamics, or emerging risks. Successful analysis combines tool efficiency with manual verification and critical thinking.

Comparing Token Pairs in Liquidity Pool Analysis

Why Token Pair Selection Matters

Token pair characteristics fundamentally determine pool behavior, risk profile, and return potential. Correlated pairs minimize divergence and impermanent loss but may offer limited volume. Uncorrelated pairs provide higher fee potential but expose providers to significant rebalancing losses. Understanding these dynamics enables informed pair selection aligned with investment objectives.

Stable vs Volatile Token Pairs

Stable pairs like USDC/USDT maintain near-constant price ratios, virtually eliminating impermanent loss concerns. These pools attract high-volume stablecoin swaps but typically offer modest APRs due to low volatility and intense competition. Volatile pairs combining assets with independent price movements generate higher fees during active markets but accumulate impermanent loss during price divergence periods.

Token Pair Behavior Under Different Market Conditions

Market conditions dramatically affect pair performance. Bull markets often see correlated appreciation that limits impermanent loss while driving volume. Bear markets can trigger divergence as risk assets decline while stablecoins hold value. Sideways markets favor fee accumulation without significant rebalancing. Understanding these dynamics helps time entries, exits, and pair rotations strategically.

Best Practices for DEX Liquidity Pool Analysis

Practical Tips for Consistent Liquidity Pool Analysis

Establish regular analysis routines rather than ad-hoc evaluations. Create standardized checklists covering all critical metrics and risk factors. Document your analysis and decisions to learn from outcomes over time. Maintain updated watchlists of pools meeting your criteria for rapid deployment when conditions align.

Build a High-Performance DEX with Advanced Liquidity Pool Insights

As an experienced DEX development company, we design secure and scalable decentralized exchanges with optimized liquidity pools, smart analytics, and seamless trading experiences tailored to your business goals.

Launch Your Exchange Now

Avoiding Common Mistakes During Analysis

Common analytical errors include overweighting APR without considering sustainability, ignoring impermanent loss potential, failing to verify smart contract security, and concentrating too heavily in single pools or protocols. Avoid analysis paralysis by setting clear decision criteria before beginning evaluation. Accept that perfect information is impossible and make decisions with appropriate uncertainty acknowledgment.

Monitoring Performance Over Time

Post-deployment monitoring enables continuous optimization. Track actual returns against projections, monitor changing pool conditions, and establish trigger points for position adjustments. Regular reviews identify underperforming positions early, allowing reallocation to better opportunities. This active management approach maximizes risk-adjusted returns across your liquidity portfolio.

Professional Insight: With eight years of experience building DeFi infrastructure, our team has observed that successful liquidity providers treat analysis as an ongoing discipline rather than a one-time activity. Markets evolve, protocols upgrade, and opportunities shift constantly. Continuous learning and adaptation separate consistent performers from those who experience occasional wins followed by significant losses.

Looking to build your own decentralized exchange with advanced liquidity analytics? Our experienced development team can create custom DEX solutions tailored to your vision.

Conclusion

Mastering liquidity pool analysis transforms participation in decentralized exchanges from speculation into strategic investment. The metrics, tools, and frameworks outlined in this guide provide a comprehensive foundation for evaluating any DEX pool with confidence. From understanding TVL dynamics to calculating impermanent loss exposure, from leveraging analytics tools to building personalized strategies, each component contributes to informed decision-making.

The DeFi landscape continues evolving rapidly, introducing new pool mechanisms, fee structures, and risk profiles. Successful liquidity providers embrace continuous learning, adapting their analysis frameworks as the ecosystem matures. By combining the technical knowledge presented here with disciplined execution and ongoing education, you position yourself to capture opportunities while managing the inherent risks of decentralized finance.

Remember that liquidity pool analysis serves risk management equally as much as return optimization. The best analysis identifies pools to avoid just as effectively as it highlights attractive opportunities. This defensive application of analytical skills protects capital through market cycles, enabling sustainable participation in the DeFi ecosystem for years to come.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.