Key Takeaways

- Crypto liquidity measures how easily a digital asset can be bought or sold at a stable market price without causing significant price movement.

- High liquidity in crypto markets leads to tighter bid-ask spreads, faster execution, and reduced slippage, making trading more efficient and predictable.

- Bitcoin consistently maintains the highest liquidity among all cryptocurrencies due to its large market cap, institutional adoption, and global exchange presence.

- Low-cap altcoins and new tokens often suffer from liquidity risk, which can lead to increased volatility, price manipulation, and difficulty exiting positions.

- DeFi liquidity pools and automated market makers have introduced a new model for providing and managing liquidity outside of centralized exchanges.

- Key metrics for measuring cryptocurrency liquidity include 24-hour trading volume, order book depth, bid-ask spread, and on-chain transaction activity.

- Market makers, incentive programs, and yield farming strategies all play a role in improving and sustaining liquidity across crypto ecosystems.

- Understanding the importance of liquidity in crypto is essential for managing risk, optimizing entry and exit points, and making informed investment decisions.

Understanding the mechanics behind crypto liquidity is one of the most practical steps any trader or investor can take to navigate digital asset markets with confidence. Whether you are analyzing Bitcoin, exploring altcoins, or participating in DeFi protocols, liquidity shapes every trade you make and every price you see. This guide breaks down what liquidity in crypto markets truly means, why it matters, and how it influences everything from price stability to your ability to enter or exit a position.

What Is Liquidity in Crypto?

At its core, what is liquidity in crypto comes down to is a simple concept: how quickly and easily can you convert a cryptocurrency into cash, or into another digital asset, without affecting its market price? This is the foundation of every functioning financial market, and in the crypto space, it carries even more weight because of the fragmented nature of exchanges and the wide spectrum of digital tokens available.

When a market has strong liquidity, transactions happen smoothly. Buyers find sellers almost instantly, prices remain stable, and traders feel confident entering and exiting positions. When liquidity is thin, the experience changes entirely. Orders take longer to fill, prices become unpredictable, and even modest trades can push prices up or down dramatically.

Meaning of Liquidity in Cryptocurrency Markets

Liquidity in cryptocurrency markets refers to the degree to which a digital asset can be traded at its current fair market value. It is a measure of market health and efficiency. A liquid market is one where there are enough participants (both buyers and sellers), sufficient order book depth, and consistent trading volume to support seamless transactions.

Think of it this way: if you hold $50,000 worth of Ethereum and need to sell it immediately, liquidity determines whether you get a price close to the current market value or whether you have to accept a much lower price just to find a buyer. In mature financial markets, liquidity is often taken for granted, but in cryptocurrency, it varies wildly from one asset to another and from one exchange to another.

Simple Explanation of Cryptocurrency Liquidity for Beginners

If you are new to crypto, here is the simplest way to understand cryptocurrency liquidity: imagine trying to sell a popular item versus a rare collectible at a flea market. A popular item (like Bitcoin) will have dozens of interested buyers, so you can sell it quickly at a fair price. A rare collectible (like a tiny altcoin) may attract very few buyers, so you might have to lower your price significantly just to make a sale. That gap between what you want and what you get is influenced by liquidity.

In crypto terms, a token traded on multiple exchanges with thousands of daily transactions has high liquidity. A token listed on one small exchange with a handful of trades per day has low liquidity. Beginners should pay close attention to liquidity before investing, because it determines not just if you can buy, but whether you can sell at a reasonable price when the time comes.

How Liquidity Works in Crypto Trading

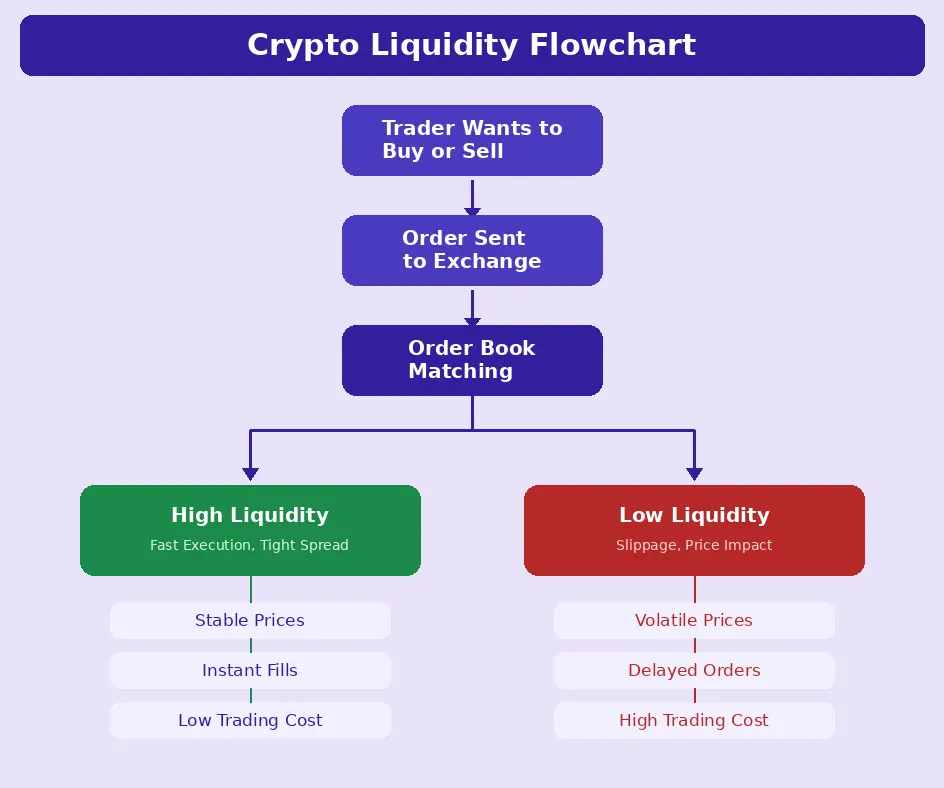

Liquidity in crypto trading operates through the interaction of order books, market participants, and exchange infrastructure. When a trader places a buy order, the exchange matches it against existing sell orders. If there are plenty of sell orders at or near the current price, the trade executes instantly at a good price. If the sell side is thin, the order might be filled at progressively higher prices, resulting in slippage.

This is where crypto exchanges that are built with robust trading architecture make a meaningful difference. Exchanges designed with matching engines capable of handling high throughput and deep order books naturally support healthier liquidity conditions, benefiting every user on the platform.

Role of Buyers, Sellers, and Trading Volume

Liquidity does not appear on its own. It is created by the collective activity of market participants. Buyers place bids, sellers place asks, and when these orders overlap or come close enough in price, trades happen. Trading volume, which measures the total value of assets exchanged over a given time period, is one of the most widely used indicators of liquidity. High volume means high liquidity, and vice versa.

Institutional traders, retail investors, bots, and market makers all contribute to this ecosystem. Each participant adds depth to the order book and increases the probability that any given trade can be executed quickly and fairly. Without this diversity of participants, markets become fragile and prone to sharp, sudden price movements.

Why Liquidity Matters in Crypto Markets

The importance of liquidity in crypto cannot be overstated. It is the silent engine behind market efficiency, price discovery, and investor confidence. Whether you are a day trader executing dozens of positions or a long-term holder looking to accumulate, liquidity affects the quality and cost of every interaction you have with the market.

Importance of Liquidity in Crypto Trading

For active traders, the importance of liquidity in crypto is felt on every trade. It determines your execution price, the speed at which your order fills, and how much slippage you experience. In a liquid market, you can enter and exit positions confidently, knowing that the price you see is the price you get. In an illiquid market, every trade carries hidden costs.

Liquidity also affects strategy viability. Scalping, arbitrage, and other high-frequency strategies simply cannot function in low-liquidity environments because the price impact of each trade would wipe out any potential profit. Even swing traders and position traders benefit from liquid markets because they can manage risk more effectively with precise entries and exits.

How Liquidity Impacts Price Stability

Price stability in crypto markets is directly proportional to liquidity. When there is deep liquidity on both the buy and sell sides of an order book, even large trades are absorbed without dramatic price changes. This creates a stable trading environment that attracts more participants, which in turn adds even more liquidity, creating a positive cycle.

Conversely, thin liquidity creates a fragile market. A single large order can trigger a cascade of price movement, activating stop-losses and liquidations that amplify the initial move. This is why flash crashes are far more common in low-liquidity assets and during off-peak trading hours when market participation is lower.

Effects of High vs Low Liquidity in Crypto

The contrast between high liquidity vs low liquidity crypto environments is stark, and understanding it is critical for any market participant. High-liquidity markets reward discipline, while low-liquidity markets punish carelessness.

Price Volatility and Market Manipulation Risks

In low-liquidity markets, a relatively small amount of capital can move prices significantly. This creates an environment ripe for manipulation. Practices like wash trading, spoofing, and pump-and-dump schemes are far more effective when there is not enough genuine trading activity to counterbalance artificial orders.

For retail traders, this means that investing in low-liquidity tokens carries an additional layer of risk beyond the typical volatility of crypto. You might see a token’s price surge on low volume, only to find that the exit is nearly impossible because there are not enough buyers to absorb your sell order at a reasonable price.

High Liquidity vs Low Liquidity: A Side-by-Side Comparison

| Factor | High Liquidity | Low Liquidity |

|---|---|---|

| Bid-Ask Spread | Narrow (tight spreads) | Wide (large spreads) |

| Trade Execution Speed | Near-instant | Delayed, partial fills |

| Price Stability | Stable, predictable | Volatile, unpredictable |

| Slippage | Minimal | Significant |

| Manipulation Risk | Low | High |

| Institutional Participation | Encouraged | Discouraged |

| Example Assets | Bitcoin, Ethereum | Micro-cap tokens |

Crypto Market Liquidity Explained

When we say crypto market liquidity, we are talking about the overall ease of trading across the entire ecosystem, not just a single asset. This includes exchange-level liquidity, cross-platform order flow, and the infrastructure that connects buyers and sellers globally. A healthy crypto market has deep liquidity pools spread across multiple exchanges, supporting efficient price discovery and protecting traders from extreme volatility.

Factors That Influence Crypto Market Liquidity

Multiple factors come together to determine the liquidity of any given cryptocurrency or market. These range from macroeconomic conditions and regulatory clarity to exchange infrastructure and the activity of market makers. Crypto liquidity explained in the simplest terms is a product of supply, demand, and the mechanisms that connect them.

Trading Volume, Market Depth, and Order Books

Trading volume is the most visible indicator of crypto market liquidity. It represents the total amount of an asset that changes hands within a specific period. High volume suggests active participation and a liquid market. Market depth measures the cumulative size of buy and sell orders at different price levels. A deep order book, with substantial orders stacked close to the current price, indicates robust liquidity.

Order books themselves are the backbone of centralized exchange liquidity. They display all open buy and sell orders, giving traders transparency into the available supply and demand at every price point. Exchanges that invest in exchange platform engineering best practices typically deliver deeper order books and better liquidity outcomes for their users.

How Liquidity Affects Crypto Prices

The relationship between liquidity and price is direct and powerful. In a liquid market, the price of an asset reflects genuine consensus between a large number of participants. In an illiquid market, prices can be distorted by a few large orders, giving a misleading picture of the asset’s true value.

Understanding Slippage and Bid-Ask Spread

Slippage is the difference between the expected execution price and the actual execution price of a trade. It is most pronounced in low-liquidity environments. The bid-ask spread is the gap between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept. A tight spread signals high liquidity, while a wide spread indicates that the market is thin.

For example, if Bitcoin is trading at $62,000 and the bid-ask spread is just $2, you can be confident that the market is highly liquid. If a micro-cap altcoin is trading at $0.15 but the spread is $0.03, that 20% gap represents significant friction for any trader entering or exiting the position.

Liquidity in Bitcoin and Altcoins

Understanding liquidity in bitcoin and altcoins is essential for portfolio construction and risk management. Not all cryptocurrencies are created equal, and liquidity is one of the most important differentiators between established tokens and speculative assets.

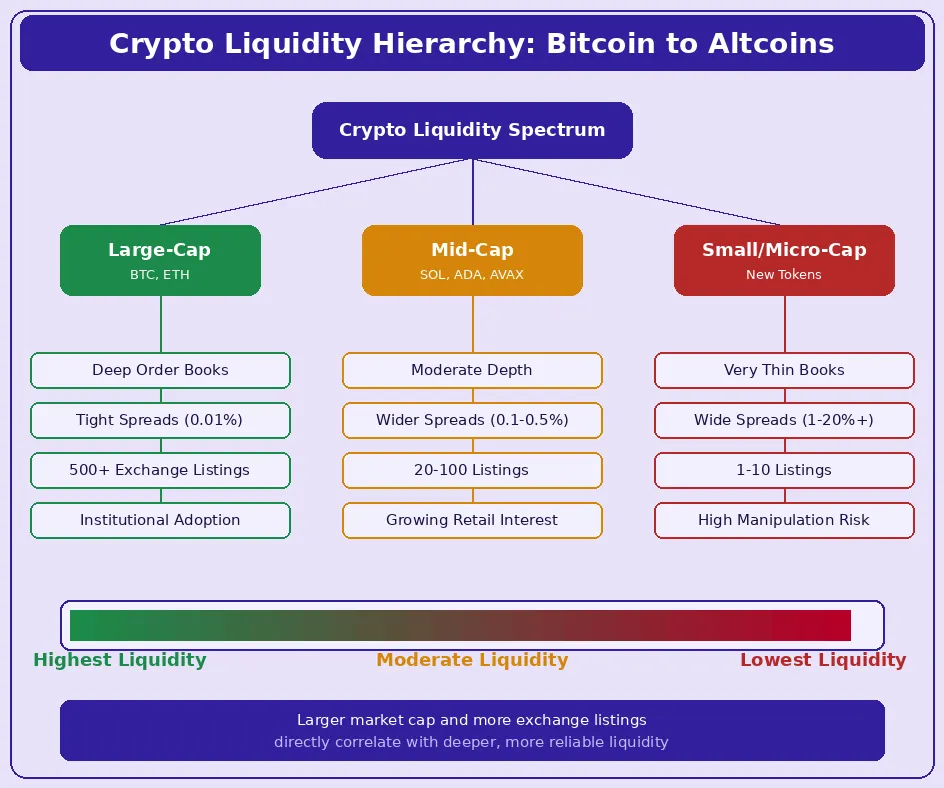

Bitcoin Liquidity Compared to Altcoins

Bitcoin sits at the top of the crypto liquidity hierarchy. It is listed on virtually every exchange, traded in pairs against dozens of fiat currencies and stablecoins, and supported by deep institutional infrastructure. On any given day, billions of dollars worth of Bitcoin change hands globally, making it the most liquid cryptocurrency by a significant margin.

Ethereum follows as the second most liquid digital asset, supported by its role as the primary platform for DeFi, NFTs, and smart contract applications. Beyond these two, liquidity drops off rapidly. Mid-cap altcoins like Solana or Cardano have reasonable liquidity on major exchanges, but their depth is a fraction of what Bitcoin and Ethereum offer.

Why Large-Cap Cryptocurrencies Have Higher Liquidity

Large-cap cryptocurrencies enjoy higher liquidity for several interconnected reasons. Their larger market capitalizations attract more institutional investors, who demand liquid markets. They are listed on more exchanges, which increases the number of trading venues where orders can be filled. They also have longer track records, which builds trust and encourages more retail participation.

This creates a self-reinforcing cycle: more liquidity attracts more participants, who generate more volume, which deepens liquidity further. For investors, this means that allocating a significant portion of a portfolio to large-cap assets is inherently less risky from a liquidity standpoint.

Liquidity Risk in Low-Cap Cryptocurrencies

Low-cap cryptocurrencies present unique challenges when it comes to liquidity. These tokens often trade on only a few exchanges, have small order books, and attract limited market-making activity. This makes them highly susceptible to dramatic price swings and creates real difficulties for anyone trying to trade meaningful positions.

Challenges Faced by New and Emerging Tokens

New tokens face a chicken-and-egg problem with liquidity. They need trading volume to attract market makers and exchanges, but they need market makers and exchange listings to generate volume. This early-stage liquidity gap is one of the biggest hurdles for emerging crypto projects.

Many projects attempt to solve this by offering liquidity mining incentives, listing on decentralized exchanges first to bootstrap initial trading activity, or partnering with market-making firms. However, without organic demand and a strong community, these artificial liquidity measures often prove temporary.

Bitcoin vs Altcoin Liquidity Comparison

| Metric | Bitcoin (BTC) | Mid-Cap Altcoins | Low-Cap Altcoins |

|---|---|---|---|

| Daily Volume | $15B – $40B+ | $200M – $2B | Under $10M |

| Bid-Ask Spread | 0.01% – 0.05% | 0.1% – 0.5% | 1% – 20%+ |

| Order Book Depth | Very Deep | Moderate | Very Thin |

| Exchange Listings | 500+ | 20 – 100 | 1 – 10 |

| Manipulation Risk | Very Low | Moderate | Very High |

| Slippage Impact | Negligible | Noticeable on large orders | Severe |

Liquidity in DeFi and Decentralized Exchanges

The rise of decentralized finance has fundamentally changed how crypto liquidity is created, managed, and distributed. Unlike centralized exchanges that rely on order books and market makers, DeFi platforms use liquidity pools and algorithmic pricing to enable permissionless trading around the clock.

Liquidity Pools in Crypto Ecosystems

Liquidity pools are smart contract-based reserves of token pairs that enable trading on decentralized exchanges (DEXs) like Uniswap, PancakeSwap, and Curve. Instead of matching individual buy and sell orders, traders swap tokens against these pools, with prices determined algorithmically based on the ratio of assets in the pool.

These pools are funded by individual users who deposit equal values of two tokens. In return, they receive liquidity provider (LP) tokens that represent their share of the pool and entitle them to a portion of the trading fees generated by the pool.

How Automated Market Makers Manage Liquidity

Automated market makers (AMMs) are the algorithms that power liquidity pools. The most common model is the constant product formula (x * y = k), where x and y represent the quantities of two tokens in a pool and k is a constant. As one token is bought, its quantity in the pool decreases and its price increases, maintaining the balance.

More advanced AMMs, like those used by Curve Finance or Balancer, use different formulas optimized for specific use cases. Curve, for example, uses a stableswap algorithm designed to minimize slippage when trading between assets of similar value, like stablecoins. These innovations have significantly improved liquidity in cryptocurrency within the DeFi space.

Role of Liquidity Providers in DeFi

Liquidity providers are the backbone of the DeFi ecosystem. Without them, decentralized exchanges would have no assets to facilitate trades. Providers take on risk by locking their tokens in smart contracts and are compensated through trading fees and, in many cases, additional token incentives.

Incentives, Rewards, and Risks for Providers

The primary incentive for liquidity providers is earning a share of the trading fees generated by the pool. On Uniswap, for example, each swap incurs a 0.3% fee that is distributed proportionally to all providers in the pool. Many protocols also offer token rewards through liquidity mining programs to attract additional capital.

However, providing liquidity is not without risks. The most significant is impermanent loss, which occurs when the price ratio of the two tokens in a pool changes relative to when they were deposited. If one token appreciates significantly against the other, a provider may end up with less total value than if they had simply held both tokens. Understanding this risk is essential before participating as a provider. Teams managing exchange-level liquidity strategies account for these dynamics when structuring market solutions.

How to Measure Liquidity in Crypto Markets

Measuring crypto liquidity requires looking at several metrics in combination, rather than relying on any single indicator. A holistic view of volume, spread, depth, and on-chain activity provides the most accurate picture of how liquid a market truly is.

Key Metrics Used to Measure Crypto Liquidity

The most commonly used metrics for assessing liquidity in crypto markets include daily trading volume, bid-ask spread, order book depth (measured as the total value of orders within a certain percentage of the mid-price), and the number of active trading pairs. Each of these metrics tells a different part of the liquidity story.

Trading Volume, Market Depth, and Slippage

Trading volume shows activity levels, market depth shows the capacity to absorb orders, and slippage shows the real-world cost of executing trades. Together, they give a comprehensive view of market health. A token might have high volume but shallow depth if most trading is concentrated at a narrow price range, making it vulnerable to sudden moves if a large order hits.

Tools and Indicators for Analyzing Liquidity

Several tools are available for analyzing crypto liquidity across both centralized and decentralized venues. Data aggregators like CoinGecko and CoinMarketCap provide trading volume and exchange-specific data. More advanced platforms like Kaiko, CryptoQuant, and Nansen offer institutional-grade liquidity analytics including real-time order book snapshots, volume-weighted metrics, and historical liquidity trends.

On-Chain and Exchange-Based Liquidity Metrics

On-chain metrics like the total value locked (TVL) in DeFi protocols, token transfer volume, and active wallet addresses provide insights into liquidity that go beyond exchange order books. Exchange-based metrics, including aggregated order book depth and historical bid-ask spreads, round out the picture. The most sophisticated analysts combine both data sets to identify liquidity trends and spot potential risks before they materialize.

Crypto Liquidity Assessment Lifecycle

| Stage | Action | Key Metrics to Review | Outcome |

|---|---|---|---|

| 1. Initial Screening | Check 24-hour volume and market cap ratio | Volume-to-market-cap ratio | Filter out extremely illiquid assets |

| 2. Spread Analysis | Review bid-ask spreads across exchanges | Bid-ask spread percentage | Estimate trading costs |

| 3. Depth Assessment | Examine order book depth at 1% and 2% levels | Order book depth in USD | Determine capacity for your trade size |

| 4. Slippage Testing | Simulate trade execution at various sizes | Expected slippage percentage | Quantify real cost of entering/exiting |

| 5. Historical Review | Analyze volume and spread trends over 30/90 days | Trend direction and consistency | Identify liquidity trends or deterioration |

| 6. On-Chain Verification | Cross-reference with on-chain data and DeFi TVL | TVL, active addresses, transfer volume | Validate exchange data with blockchain activity |

| 7. Final Decision | Compile findings and assess overall liquidity grade | Composite liquidity score | Proceed with trade or adjust strategy |

Risks of Low Liquidity in Cryptocurrency Markets

Low liquidity is not just an inconvenience; it is a genuine source of financial risk for traders and investors. Markets with thin liquidity are inherently more dangerous because they amplify losses, limit your options, and attract predatory behaviour.

Liquidity Risk and Its Impact on Traders

Liquidity risk is the possibility that you will not be able to execute a trade at your desired price, or at all. For traders, this can mean being stuck in a losing position with no way to exit, or being forced to accept a much worse price than expected. This risk is especially acute during market downturns, when liquidity tends to evaporate precisely when it is needed most.

Difficulty in Entering and Exiting Positions

In a low-liquidity environment, entering a position can be just as challenging as exiting one. A large buy order can push the price up significantly before the order is fully filled, meaning you end up paying a much higher average price than you intended. On the sell side, a large order can crash the price, resulting in substantial losses from slippage alone.

This is why professional traders and fund managers always assess liquidity before taking a position. The ability to enter and exit smoothly is just as important as the quality of the trade idea itself.

How Low Liquidity Affects Crypto Investors

For longer-term investors, low liquidity presents different but equally serious risks. It can mean that the market value displayed on a portfolio tracker does not reflect the actual value you would receive if you tried to sell. It can also lead to situations where external events cause panic selling, and the thin order book leads to cascading liquidations and extreme price drops.

Increased Volatility and Execution Delays

Volatility and liquidity have an inverse relationship. The less liquid a market is, the more volatile it tends to be. Each trade has a proportionally larger impact on price, so prices bounce around erratically. Execution delays compound this problem. If your order takes minutes (or hours) to fill in a fast-moving market, the price can move significantly against you before your trade is complete.

Improving Liquidity in Crypto Projects

Building and maintaining healthy liquidity is a deliberate effort that requires infrastructure, partnerships, and strategic incentives. Whether you are running a centralized exchange or managing a DeFi protocol, liquidity does not sustain itself without ongoing investment.

How Crypto Exchanges Maintain Market Liquidity

Centralized crypto exchanges maintain liquidity through a combination of market-maker partnerships, fee structures that incentivize high-volume trading, and technology investments that attract professional trading firms. Leading exchanges actively recruit institutional market makers by offering rebates and preferred access, ensuring that their order books remain deep and spreads stay tight.

Market Makers and Incentive Mechanisms

Market makers are firms or individuals that commit to placing both buy and sell orders at quoted prices, earning the spread as profit. On centralized exchanges, they are often given reduced fees, API priority, or direct rebates in exchange for maintaining minimum order book depth. This symbiotic relationship benefits everyone: the exchange gets better liquidity, traders get tighter spreads, and market makers earn consistent revenue.

For projects launching a new token, partnering with professional market makers can be the difference between a healthy trading environment and a dead market. This is one reason why teams that specialize in crypto exchange solutions emphasize liquidity integration as a core platform component.

Liquidity Model Selection Criteria for Crypto Projects

Choosing the right liquidity model depends on the nature of the project, its target audience, and its stage of growth. Below is a framework for evaluating the most appropriate approach.

| Criteria | Order Book Model (CEX) | AMM Model (DEX) | Hybrid Model |

|---|---|---|---|

| Best Suited For | Established tokens with institutional interest | Early-stage tokens, DeFi-native projects | Mid-stage projects seeking broad coverage |

| Liquidity Depth | High (with market maker partnerships) | Variable (depends on pool size) | Moderate to High |

| Capital Efficiency | High (concentrated at active price levels) | Low to Moderate (full-range distribution) | Moderate |

| Cost to Maintain | Market maker fees and rebates | Token incentives and smart contract risks | Both fee structures apply |

| User Experience | Familiar, fast, precise | Simple swaps, higher slippage risk | Best of both worlds |

| Regulatory Consideration | Compliance-friendly | Regulatory uncertainty | Depends on implementation |

Liquidity Solutions in DeFi Ecosystems

DeFi ecosystems have pioneered several innovative approaches to liquidity provision. Concentrated liquidity (introduced by Uniswap V3) allows providers to allocate capital within specific price ranges, dramatically improving capital efficiency. Protocols like Tokemak act as liquidity reactors, directing liquidity to where it is most needed across the ecosystem.

Yield Farming and Liquidity Incentives

Yield farming is the practice of moving assets between different DeFi protocols to maximize returns. In the context of liquidity, yield farming programs incentivize users to deposit tokens into liquidity pools by offering additional token rewards on top of trading fees. These programs have been instrumental in bootstrapping liquidity for new protocols.

However, yield farming liquidity can be mercenary, meaning it flows to wherever the highest returns are and leaves quickly when incentives decline. Sustainable liquidity requires a combination of competitive incentives, strong protocol fundamentals, and genuine user demand for the trading pairs being offered.

Building a crypto exchange that attracts consistent liquidity requires thoughtful engineering, robust matching engines, and integrated market-making infrastructure from day one.

Final Thoughts on Liquidity in Crypto

Liquidity is not just a technical metric. It is the lifeblood of crypto markets, determining everything from the fairness of prices to the accessibility of assets. A market without sufficient liquidity is a market where traders face hidden costs, investors take on unnecessary risk, and prices fail to reflect genuine supply and demand.

Build a High-Liquidity Crypto Exchange That Scales

Launch a secure crypto exchange designed for high liquidity and better trading performance.

Launch Your Exchange Now

Why Understanding Liquidity Is Essential for Crypto Traders and Investors

Whether you are placing your first trade or managing a diversified portfolio, understanding liquidity in crypto trading gives you a critical edge. It helps you avoid assets that look attractive on paper but are impossible to trade efficiently. It guides your choice of exchanges and trading pairs. And it helps you set realistic expectations for execution quality and cost.

For traders, liquidity means better prices, faster execution, and lower risk of manipulation. For investors, it means confidence that the value displayed on your screen is close to the value you would actually receive. For project builders and exchange operators, it means credibility, user trust, and a sustainable platform. Regardless of your role in the crypto ecosystem, liquidity is the foundation everything else is built on.

The crypto market continues to mature, and with that maturation comes deeper liquidity, better infrastructure, and more sophisticated tools for measuring and managing market health. By taking the time to understand what is liquidity in crypto and applying that knowledge to your trading and investment decisions, you position yourself to navigate this evolving landscape with greater confidence and better outcomes.

Frequently Asked Questions

Liquidity in crypto refers to how quickly and easily a digital asset can be bought or sold on the open market without causing a significant change in its price. A cryptocurrency with high liquidity has a large number of active buyers and sellers, which means trades can be executed almost instantly at fair market prices. Low liquidity, on the other hand, can result in delays, price slippage, and difficulty closing positions.

Liquidity is important because it directly affects how stable a cryptocurrency’s price remains during trading activity. When a market is highly liquid, large orders can be filled without dramatically moving the price, which protects traders from unexpected losses. Without sufficient liquidity, even moderate trade sizes can cause wild price swings, making it risky for both retail and institutional participants.

High liquidity means there is a deep pool of buy and sell orders, tight bid-ask spreads, and fast execution times for trades. Low liquidity indicates fewer market participants, wider spreads, and the possibility that a single trade can dramatically shift the asset’s price. Traders generally prefer high-liquidity markets because they offer better pricing and lower risk of manipulation.

Bitcoin’s price stability is closely tied to its liquidity levels across exchanges worldwide. When Bitcoin has deep liquidity, large institutional purchases or sales are absorbed by the market without causing dramatic price changes. During periods of reduced liquidity, such as weekends or macroeconomic uncertainty, even Bitcoin can experience sharper-than-usual price swings.

Low liquidity can be caused by several factors, including low trading volume, a small number of active participants, limited exchange listings, and market uncertainty or fear. Newer tokens with small market capitalizations are especially prone to low liquidity because they attract fewer traders and market makers. Regulatory crackdowns or negative sentiment can also drive participants away from certain markets.

A liquidity pool is a collection of cryptocurrency tokens locked in a smart contract that facilitates trading on decentralized exchanges. Instead of relying on a traditional order book, these pools allow users to trade directly against pooled assets using automated market maker algorithms. Liquidity providers earn transaction fees as a reward for depositing their tokens into the pool.

Crypto liquidity is typically measured using trading volume, bid-ask spread, market depth, and order book thickness. High trading volume indicates strong market activity, while a narrow bid-ask spread shows that buyers and sellers agree on pricing. Market depth reveals how many orders sit at various price levels, giving a picture of how well the market can absorb large trades.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.