Key Takeaways

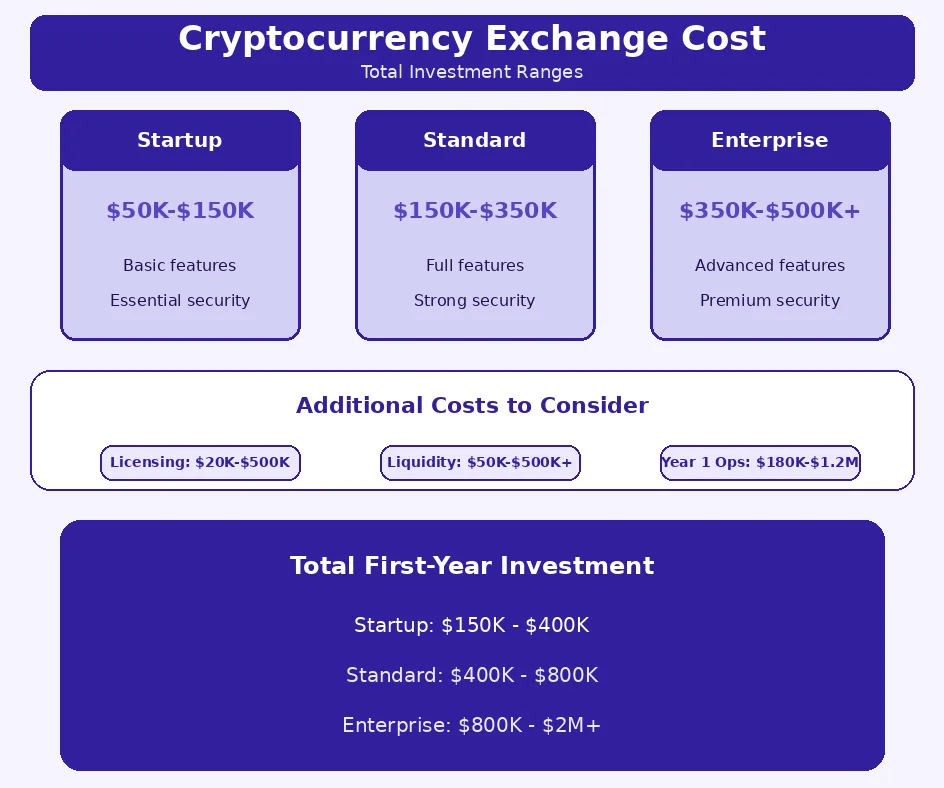

- The cryptocurrency exchange cost ranges from $50,000 for basic white-label solutions to $500,000+ for fully custom platforms with advanced features and comprehensive compliance.

- The cost to build a cryptocurrency exchange includes initial setup, security infrastructure, compliance systems, and operational expenses that continue throughout platform operation.

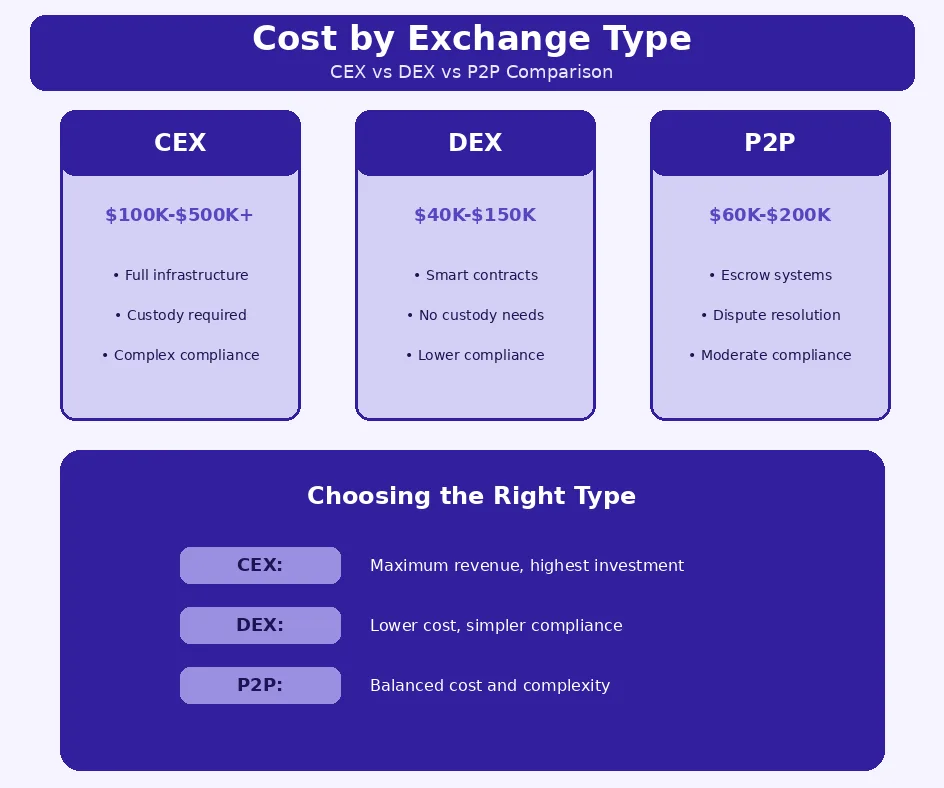

- Crypto exchange platform cost varies significantly by type: centralized exchange cost ($100,000-$500,000), decentralized exchange cost ($40,000-$150,000), and P2P crypto exchange cost ($60,000-$200,000).

- Cryptocurrency exchange pricing must account for matching engine cost ($25,000-$200,000), wallet integration cost ($15,000-$75,000), and KYC AML cost ($15,000-$75,000 initial plus ongoing).

- The crypto exchange security cost represents a critical investment ranging $30,000-$150,000 initially, with ongoing monitoring costs of $5,000-$20,000 monthly.

- Licensing and regulatory compliance add $50,000-$500,000+ to cryptocurrency exchange setup cost depending on jurisdiction and market scope.

- The maintenance cost of crypto exchange operations ranges from $15,000-$100,000+ monthly covering hosting, security, support, and liquidity provision.

- Strategic cost optimization involves choosing appropriate exchange types, prioritizing essential features, and selecting jurisdictions that balance regulatory credibility with reasonable compliance costs.

Understanding the true cost to build a cryptocurrency exchange requires examining multiple interconnected expense categories that span initial creation through ongoing operations. Whether you are an entrepreneur exploring the crypto space or an established business expanding into digital asset trading, accurate cost estimation enables realistic planning and sustainable business model creation.

Cryptocurrency Exchange Cost – Complete Overview

The cryptocurrency exchange cost encompasses far more than simple platform construction. Comprehensive cost analysis must include technology infrastructure, security systems, regulatory compliance, operational expenses, and the ongoing investments required to maintain competitive, secure trading platforms.

How Much Does a Cryptocurrency Exchange Platform Cost?

A cryptocurrency exchange platform costs between $50,000 and $500,000+ for initial creation, with the wide range reflecting different approaches and complexity levels. White-label solutions offer the most economical entry point at $50,000-$150,000, while custom-built platforms requiring unique features and proprietary systems reach $300,000-$500,000 or more.

These figures represent starting points rather than complete investment requirements. Full operational readiness requires additional investment in licensing, compliance systems, security infrastructure, and initial liquidity that can double or triple the base platform cost. Working with experienced exchange specialists helps optimize cost allocation across these essential categories.

Factors That Influence Overall Crypto Exchange Cost

Multiple factors influence overall crypto exchange cost including exchange type (centralized, decentralized, P2P), feature scope, security requirements, target jurisdictions, and operational scale. Custom versus white-label approaches create the largest cost differential, while compliance requirements vary dramatically based on regulatory ambitions.

Team composition also affects total investment. In-house construction requires larger upfront commitments but provides more control. Outsourced approaches offer cost efficiency but require careful partner selection. Building crypto exchanges successfully requires balancing these trade-offs against business objectives and available resources.

Cost Planning Principle: Successful exchange projects budget for the complete journey, not just initial construction. Undercapitalized exchanges often compromise security or compliance to extend runway, creating risks that ultimately cost far more than adequate initial funding would have required.

Cost to Build a Cryptocurrency Exchange – Pricing Breakdown

The crypto exchange cost breakdown reveals how investment distributes across essential components. Understanding this distribution enables informed prioritization and ensures critical elements receive adequate funding while optimizing overall project economics.

Cryptocurrency Exchange Setup Cost Explained

The cryptocurrency exchange setup cost covers all expenses required to create a functional trading platform ready for launch. This includes technology construction, integration of essential services, security implementation, and preparation for regulatory compliance. Setup costs typically represent 40-60% of total first-year investment.

Initial Platform Setup and Configuration Cost

Initial platform setup and configuration cost ranges from $30,000 for basic white-label deployment to $200,000+ for custom platform construction. This includes core trading functionality, user interfaces, admin panels, and basic integrations. Configuration involves customizing the platform for specific business requirements and branding.

Crypto Exchange Launch Cost for New Businesses

The crypto exchange launch cost for new businesses extends beyond platform creation to include market preparation, initial user acquisition, and operational readiness. Launch budgets should allocate funds for marketing, initial liquidity, customer support setup, and contingency reserves for unexpected challenges.

One-Time vs Recurring Crypto Exchange Expenses

Understanding one-time versus recurring expenses enables accurate long-term financial planning. One-time costs include platform construction, initial licensing, and security infrastructure setup. Recurring expenses encompass hosting, compliance monitoring, security operations, customer support, and ongoing compliance maintenance. Sustainable business models ensure recurring revenue exceeds recurring costs.

Cost Breakdown by Component

| Component | Low Estimate | High Estimate | Cost Type |

|---|---|---|---|

| Platform Build | $50,000 | $300,000 | One-time |

| Security Infrastructure | $30,000 | $150,000 | One-time |

| KYC/AML Setup | $15,000 | $75,000 | One-time |

| Licensing | $20,000 | $500,000 | One-time + Annual |

| Monthly Operations | $15,000/mo | $100,000/mo | Recurring |

| Liquidity (Initial) | $50,000 | $500,000+ | Working Capital |

Crypto Exchange Platform Cost Based on Exchange Type

The crypto exchange platform cost varies significantly based on exchange type, with each model presenting distinct cost structures, technical requirements, and operational considerations. Selecting the right exchange type requires balancing business objectives against available capital and risk tolerance.

Centralized Exchange Cost Structure

The centralized exchange cost structure reflects the comprehensive infrastructure required for custody, compliance, and high-performance trading. CEX platforms represent the highest cost category but also offer the greatest revenue potential and mainstream user appeal. Total investment typically ranges from $100,000 to $500,000+ for initial launch readiness.

Infrastructure, Security, and Liquidity Cost

Infrastructure, security, and liquidity cost for centralized exchanges includes enterprise-grade hosting ($5,000-$25,000/month), comprehensive security systems ($50,000-$150,000 initial), and liquidity provision ($100,000-$1,000,000+ in working capital). These requirements create significant barriers to entry but also competitive advantages once established.

Decentralized Exchange Cost Considerations

The decentralized exchange cost typically runs lower than centralized alternatives, ranging from $40,000 to $150,000 for platform creation. DEX models eliminate many infrastructure requirements by leveraging blockchain networks and smart contracts, though they introduce different cost considerations around contract security and liquidity bootstrapping.

Smart Contract, Liquidity Pool, and Audit Cost

Smart contract creation and audit costs for DEX platforms range from $25,000 to $100,000, with security audits representing a critical non-negotiable expense. Liquidity pool incentive programs require additional capital allocation ($50,000-$500,000) to attract initial liquidity providers. Understanding platform building strategies helps optimize these investments.

P2P Crypto Exchange Cost Overview

The P2P crypto exchange cost falls between CEX and DEX models, typically ranging $60,000 to $200,000. P2P platforms require escrow systems, dispute resolution mechanisms, and payment method integrations that create unique cost structures focused on trust and safety rather than high-speed trading infrastructure.

Escrow, Dispute Management, and Operational Cost

Escrow system creation costs $20,000-$50,000, while dispute management systems add $15,000-$40,000. Operational costs for P2P exchanges emphasize customer support ($10,000-$30,000/month) and fraud prevention systems ($5,000-$15,000/month) rather than the high-frequency trading infrastructure that drives CEX operational expenses.

Feature-Based Cryptocurrency Exchange Pricing

Feature-based cryptocurrency exchange pricing helps businesses understand how specific capabilities affect total investment requirements. Each feature adds both initial construction costs and ongoing operational expenses that must be factored into sustainable business models.

Crypto Exchange Security Cost

The crypto exchange security cost represents one of the most critical investment categories, ranging from $30,000 to $150,000 for initial implementation plus $5,000-$20,000 monthly for ongoing operations. Security compromises can destroy exchanges overnight, making this investment non-negotiable for serious platforms.

Wallet Protection, Data Encryption, and Risk Management Cost

Wallet protection systems cost $20,000-$75,000 including hot/cold wallet infrastructure and multi-signature implementations. Data encryption and access control systems add $10,000-$30,000. Risk management systems including monitoring, alerting, and incident response capabilities require $15,000-$50,000 initial investment plus ongoing operational costs.

KYC AML Cost for Cryptocurrency Exchanges

The KYC AML cost for cryptocurrency exchanges includes both system implementation and per-user verification expenses. Initial setup ranges $15,000-$75,000 depending on verification levels required, with ongoing costs of $0.50-$5.00 per user verification plus monthly platform fees and compliance personnel costs.

User Verification, Compliance, and Monitoring Cost

User verification systems cost $10,000-$40,000 for implementation plus per-verification fees. Transaction monitoring and suspicious activity detection add $15,000-$50,000 annually. Compliance personnel and reporting systems require $30,000-$100,000 annually depending on regulatory requirements and trading volumes.

Matching Engine Cost for Crypto Trading Platforms

The matching engine cost represents a major component of crypto trading platform cost, ranging from $25,000 to $200,000 depending on performance requirements. This core component determines trading speed, supported order types, and overall platform capability, making it a critical investment decision.

High-Frequency Trading and Performance Cost

High-frequency trading capable engines require $100,000-$200,000+ investment to achieve microsecond latency and millions of orders per second capacity. Standard engines supporting typical trading patterns cost $25,000-$75,000. Performance requirements should align with target user expectations and competitive positioning.

Cost Accumulation Timeline

| Phase | Duration | Cost Range | Cumulative |

|---|---|---|---|

| 1 | Planning (1-2 mo) | $10,000-$30,000 | $10,000-$30,000 |

| 2 | Build (3-12 mo) | $50,000-$300,000 | $60,000-$330,000 |

| 3 | Compliance (2-6 mo) | $30,000-$200,000 | $90,000-$530,000 |

| 4 | Launch Prep (1-2 mo) | $20,000-$100,000 | $110,000-$630,000 |

| 5 | Year 1 Operations | $180,000-$1,200,000 | $290,000-$1,830,000 |

Operational and Maintenance Cost of Crypto Exchanges

The maintenance cost of crypto exchange operations represents ongoing investment required to keep platforms functional, secure, and competitive. These recurring expenses must be covered by revenue generation, making accurate projection essential for sustainable business models.

Crypto Exchange Hosting and Infrastructure Cost

Crypto exchange hosting and infrastructure costs range from $3,000-$25,000 monthly depending on traffic, trading volumes, and redundancy requirements. Enterprise-grade infrastructure includes multiple data centers, DDoS protection, and scalable computing resources that adjust to demand fluctuations.

Cloud Servers, Storage, and Network Cost

Cloud server costs range $2,000-$15,000 monthly based on capacity requirements. Storage costs for trading data and user information add $500-$3,000 monthly. Network bandwidth and CDN services for global users require $500-$5,000 monthly. These costs scale with user base and trading activity.

Ongoing Crypto Exchange Operational Cost

Ongoing crypto exchange operational costs encompass all expenses required to maintain daily operations beyond infrastructure. This includes personnel, software subscriptions, third-party services, and continuous improvement investments that maintain competitive positioning.

Platform Updates, Monitoring, and Support Cost

Platform update and maintenance costs $5,000-$25,000 monthly for ongoing improvements and bug fixes. Security monitoring services add $3,000-$15,000 monthly. Customer support operations require $5,000-$30,000 monthly depending on user base and service level commitments.

Cryptocurrency Exchange Licensing and Compliance Cost

Licensing and compliance costs represent significant investment that varies dramatically by jurisdiction and regulatory ambition. These costs create barriers to entry but also establish credibility and enable access to markets that require licensed operators.

Regulatory and Legal Cost for Crypto Exchanges

Regulatory and legal costs for crypto exchanges include license application fees, legal consultation, compliance infrastructure, and ongoing regulatory reporting. Total investment ranges from $30,000 for smaller jurisdictions to $500,000+ for major financial centers with comprehensive regulatory frameworks.

Licensing, Jurisdiction, and Legal Consultation Cost

Licensing fees vary from $10,000 in crypto-friendly jurisdictions to $200,000+ in major financial centers. Legal consultation costs $15,000-$100,000 for license application support. Ongoing legal compliance and regulatory relationship management require $20,000-$100,000 annually depending on operational complexity.

Critical Warning: Operating without proper licensing exposes businesses to regulatory enforcement, asset seizures, and personal liability. While unlicensed operation may seem cost-effective initially, enforcement actions can result in costs far exceeding the savings from avoiding compliance investment.

Crypto Exchange Cost Comparison by Business Size

Crypto exchange cost varies significantly based on business scale and ambition. Startups can enter the market with more modest investments, while enterprise operations require substantial capital to achieve competitive positioning and regulatory compliance in major markets.

Startup Crypto Exchange Cost

Startup crypto exchange cost for minimum viable operations ranges from $75,000 to $200,000 using white-label solutions and targeting crypto-friendly jurisdictions. This budget covers basic platform functionality, essential security, limited compliance, and initial operational runway. Working with specialized partners helps maximize value within constrained budgets.

Minimum Investment and Budget Planning Cost

Minimum viable investment breaks down approximately as: platform ($50,000-$80,000), basic security ($15,000-$30,000), essential compliance ($15,000-$30,000), initial operations ($10,000-$30,000), and reserve capital ($10,000-$30,000). Tight budgets require careful prioritization and acceptance of limited initial feature sets.

Enterprise Crypto Exchange Cost

Enterprise crypto exchange cost for comprehensive platforms targeting major markets ranges from $500,000 to $2,000,000+ for initial launch. This investment covers custom platforms, enterprise security, comprehensive compliance across multiple jurisdictions, and substantial liquidity provisions.

Advanced Features and Scalability Cost

Advanced features including margin trading, derivatives, and institutional services add $100,000-$500,000 to base costs. Scalable infrastructure capable of handling millions of users requires $50,000-$200,000 initial investment plus proportionally higher ongoing costs. These investments enable premium positioning and higher revenue potential.

Cost Optimization Selection Criteria

When planning exchange budgets, consider:

- Target Markets: Compliance costs vary dramatically by jurisdiction

- Exchange Type: CEX, DEX, and P2P have different cost profiles

- Feature Scope: MVP vs full-featured affects initial investment

- Build Approach: White-label vs custom has 3-5x cost difference

- Security Standards: Higher protection costs more but reduces risk

- Growth Plans: Build for scale costs more initially but less long-term

Crypto Exchange Cost by Region

Crypto exchange cost varies by region due to differences in regulatory requirements, operational costs, and market characteristics. Understanding regional cost factors helps businesses select appropriate jurisdictions and plan budgets accurately.

Crypto Exchange Cost in India

Crypto exchange cost in India benefits from lower labor costs for technical work while facing evolving regulatory requirements. Platform creation costs 20-40% less than equivalent work in western markets, though compliance uncertainty adds risk premiums. Total investment ranges from $50,000-$250,000 depending on scope.

Local Compliance and Operational Cost Factors

Local compliance costs in India remain dynamic as regulatory frameworks evolve. Technical talent costs $15,000-$40,000 annually per developer compared to $80,000-$150,000 in major western markets. Infrastructure costs are competitive, while banking relationships present unique challenges requiring careful navigation.

Crypto Exchange Cost Worldwide

Crypto exchange cost worldwide varies based on where work is performed and where the exchange operates. Jurisdictions with established crypto frameworks like Malta, Estonia, and Switzerland offer predictable licensing but higher costs. Emerging jurisdictions may offer cost savings with less regulatory certainty.

Regional Pricing Differences and Infrastructure Cost

Regional pricing differences affect both creation and operation costs. Technical talent in Eastern Europe costs 40-60% less than western equivalents. Asian markets offer competitive infrastructure costs. Licensing in established centers provides credibility at premium prices, while newer jurisdictions trade cost savings for regulatory uncertainty.

Cryptocurrency Exchange Cost Estimate and Pricing Models

Understanding cryptocurrency exchange cost estimate methodologies and pricing models helps businesses evaluate proposals and plan budgets accurately. Different pricing structures suit different business situations and risk preferences.

Crypto Exchange Pricing Model Explained

Crypto exchange pricing models include fixed-price contracts, time-and-materials arrangements, subscription licensing, and revenue-sharing structures. Each model presents different cost predictability, risk allocation, and flexibility trade-offs that suit different business circumstances.

Fixed Cost vs Subscription-Based Pricing

Fixed cost models provide predictable budgets but may limit flexibility. Typical fixed prices range $75,000-$400,000 for complete exchange solutions. Subscription models charge $5,000-$50,000 monthly with lower upfront investment but higher long-term costs. Reviewing comprehensive exchange guides helps evaluate appropriate pricing models.

Pricing Model Comparison

| Pricing Model | Upfront Cost | Ongoing Cost | Best For |

|---|---|---|---|

| Fixed Price | $75,000-$400,000 | Minimal | Clear requirements |

| Subscription | $10,000-$50,000 | $5,000-$50,000/mo | Limited upfront capital |

| Revenue Share | $20,000-$100,000 | 5-20% of revenue | Performance alignment |

| Time & Materials | Variable | Hourly rates | Evolving requirements |

Monthly Cost of Running a Cryptocurrency Exchange

The monthly cost of running a cryptocurrency exchange creates the ongoing financial commitment that must be balanced against revenue generation. Understanding these costs enables accurate break-even analysis and sustainable business model creation.

Ongoing Expenses and Revenue Balance

Ongoing expenses range from $15,000-$100,000+ monthly depending on scale, with major categories including infrastructure ($3,000-$25,000), security ($2,000-$15,000), compliance ($5,000-$30,000), support ($5,000-$25,000), and liquidity costs ($5,000-$50,000+). Revenue must exceed these costs for sustainable operation.

Trading Fees, Liquidity Cost, and Platform Sustainability

The trading fee structure cost analysis must balance competitive pricing against operational requirements. Market-standard fees of 0.1-0.5% per trade create revenue that must cover the liquidity cost for crypto exchange operations plus all other expenses. Sustainable exchanges achieve profitability by scaling volume while managing proportional cost growth.

Plan Your Cryptocurrency Exchange Budget with Experts

Our specialists provide accurate cost insights for centralized, decentralized, and P2P exchanges, helping you make informed investment decisions.

Launch Your Exchange Now

Final Thoughts on Cryptocurrency Exchange Cost

Understanding the true cost of crypto exchange software and operations enables realistic planning for successful market entry. While costs vary dramatically based on scope and approach, informed budgeting prevents the common failure mode of undercapitalization that compromises security, compliance, or operational sustainability.

Choosing the Right Cost Structure for Long-Term Success

Choosing the right cost structure requires aligning investment with business objectives, available capital, and risk tolerance. Startup operations can enter markets with $100,000-$200,000 using white-label solutions, while enterprises seeking competitive differentiation should budget $500,000-$2,000,000+ for comprehensive platforms.

Cost Optimization Without Compromising Security

Cost optimization without compromising security focuses investment on essential capabilities while deferring non-critical features. Security and compliance represent non-negotiable investments where savings create unacceptable risk. Other areas offer legitimate optimization opportunities through phased feature rollout, jurisdiction selection, and build-versus-buy decisions. Working with experienced specialists helps identify optimization opportunities while protecting critical investments.

Frequently Asked Questions

The cost to build a cryptocurrency exchange ranges from $50,000 to $500,000+ depending on the approach and complexity. White-label solutions cost $50,000-$150,000, while custom-built exchanges require $200,000-$500,000 or more. Factors including exchange type, features, security requirements, and compliance needs significantly impact the final cryptocurrency exchange cost.

Main cost components include platform setup ($30,000-$200,000), security infrastructure ($20,000-$100,000), KYC/AML integration ($10,000-$50,000), matching engine ($25,000-$150,000), wallet integration ($15,000-$75,000), and ongoing operational costs. Licensing and compliance can add $50,000-$500,000 depending on jurisdiction and regulatory requirements.

Decentralized exchanges typically cost less initially, ranging from $40,000-$150,000, as they require less infrastructure and compliance overhead. Centralized exchanges cost $100,000-$500,000+ due to complex infrastructure, custody requirements, and regulatory compliance. However, DEX operational models and liquidity acquisition present different ongoing cost challenges.

Monthly operational costs for crypto exchanges range from $15,000-$100,000+ depending on scale and features. This includes hosting ($3,000-$20,000), security monitoring ($2,000-$10,000), compliance maintenance ($5,000-$30,000), customer support ($5,000-$25,000), and liquidity costs. Larger exchanges with higher trading volumes face proportionally higher operational expenses.

Crypto exchange license costs vary dramatically by jurisdiction, ranging from $10,000 to $1,000,000+. Smaller jurisdictions like Estonia charge $10,000-$50,000, while major financial centers require $100,000-$500,000+ including compliance infrastructure. Legal consultation, ongoing compliance, and annual renewal fees add to the total licensing investment.

Matching engine costs range from $25,000 to $200,000 depending on performance requirements and whether it is custom-built or licensed. Basic matching engines supporting standard order types cost $25,000-$50,000. High-frequency trading capable engines with advanced order matching algorithms require $100,000-$200,000+ investment.

Security budgets for crypto exchanges should allocate $30,000-$150,000 initially plus $5,000-$20,000 monthly for ongoing protection. This covers wallet security infrastructure, encryption systems, penetration testing, security audits, monitoring tools, and incident response capabilities. Skimping on security often leads to catastrophic losses far exceeding the initial savings.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.