Key Takeaways

- Farming pools enable crypto holders to generate passive income in crypto by contributing liquidity to decentralized exchanges and earning rewards from trading fees plus token incentives.

- Yield farming combines multiple reward streams including swap fees, governance token distributions, and staking rewards to maximize DeFi earnings potential.

- Liquidity mining programs on DEX platforms distribute platform tokens to liquidity providers, creating additional incentives that can significantly boost overall returns.

- Understanding impermanent loss is crucial for yield farmers, as price divergence between paired tokens can reduce returns even when farming rewards appear attractive.

- Effective crypto investment strategies combine careful platform selection, diversification across multiple pools, and regular yield optimization to maximize risk-adjusted returns.

- Liquidity provision supports the broader DEX ecosystem by enabling efficient trading, reducing slippage, and contributing to price stability across markets.

- Smart contract risks require thorough due diligence including reviewing audit reports, checking protocol track records, and starting with established platforms before exploring newer opportunities.

- Successful farming requires ongoing monitoring of DeFi earnings, market conditions, and reward token performance to adapt strategies as circumstances change.

The decentralized finance revolution has fundamentally transformed how cryptocurrency holders can put their assets to work. Rather than letting tokens sit idle in wallets, innovative farming pools on DEX platforms now enable participants to earn substantial crypto rewards while supporting the infrastructure that powers decentralized trading. This comprehensive guide explores how yield farming works, the strategies that maximize returns, and the essential considerations for anyone looking to boost their earnings through liquidity provision and token incentives.

Introduction to Farming Pools on DEX Platforms

The emergence of farming pools represents one of the most significant innovations in cryptocurrency finance, creating mechanisms that align individual profit motives with ecosystem health. These sophisticated smart contract systems enable anyone with crypto holdings to participate in market making activities that were previously restricted to institutional players with substantial capital and technical infrastructure. The democratization of these opportunities has opened new pathways for passive income in crypto that continue to attract participants worldwide.

Understanding how farming pools operate within the broader context of decentralized exchanges provides essential foundation for anyone considering participation. The relationship between liquidity providers, traders, and platform mechanics creates a dynamic ecosystem where each participant’s actions affect overall market quality and reward distribution. This interconnected nature means that successful farming requires more than simply depositing tokens; it demands appreciation for the systems that generate and distribute value.

What are Farming Pools and Yield Farming

Farming pools are smart contract-based liquidity repositories where users deposit cryptocurrency pairs to enable trading on decentralized exchanges. When you contribute to a farming pool, your tokens join a collective reserve that the platform’s automated market maker uses to execute trades for other users. In exchange for providing this essential service, you receive a proportional share of the trading fees generated by your pool, plus potentially additional token incentives that platforms distribute to attract and retain liquidity.

Yield farming extends this concept by describing the active pursuit of maximizing returns through strategic deployment of capital across various pools and platforms. Sophisticated yield farmers continuously evaluate opportunities, moving assets between protocols to capture the highest available yields while managing associated risks. This active approach to crypto farming can generate returns significantly exceeding traditional finance alternatives, though it requires greater engagement and risk management compared to simple buy-and-hold strategies.

Overview of Decentralized Exchanges (DEX)

Decentralized exchanges represent a paradigm shift from traditional trading venues by eliminating centralized intermediaries and enabling peer-to-peer token swaps through automated smart contracts. Unlike centralized exchanges where a company holds user funds and matches orders, DEX platforms use algorithmic market makers that price assets based on the ratio of tokens held in liquidity pools. This architecture creates markets that operate continuously without downtime, censorship, or counterparty risk from exchange operators.

The DEX platforms ecosystem has evolved rapidly, with different protocols offering unique features, fee structures, and reward mechanisms. Major platforms like Uniswap pioneered the constant product market maker model, while others like Curve optimized for stable asset pairs and Balancer introduced flexible pool compositions. Understanding the distinctions between platforms helps farmers identify opportunities that match their investment goals and risk tolerance. Building effective automated trading infrastructure requires deep expertise in these mechanics.

Importance of Liquidity Provision in Crypto Trading

Liquidity provision serves as the foundational mechanism that enables decentralized exchanges to function effectively. Without sufficient liquidity in pools, trades would suffer from excessive slippage where executed prices deviate significantly from quoted prices, making the platform unusable for practical trading. Liquidity providers essentially perform market making functions that in traditional finance require specialized firms with substantial resources and expertise.

The importance of healthy liquidity extends beyond individual trade execution to affect overall market quality and price discovery. Deep liquidity pools create tighter spreads, more accurate pricing, and greater resilience against manipulation attempts. This is why platforms invest heavily in liquidity mining programs and token incentives to attract and maintain sufficient reserves. Exploring how capital flows enable seamless trading reveals the critical role providers play in ecosystem health.

| Pool Type | Typical APY Range | Risk Level | Best For |

|---|---|---|---|

| Stablecoin Pairs | 3% – 15% | Low | Conservative yield seekers |

| Blue Chip Token Pairs | 10% – 40% | Medium | Balanced risk/reward preference |

| New Token Pairs | 50% – 500%+ | High | Risk-tolerant speculators |

| Incentivized Pools | 20% – 200% | Medium-High | Active yield optimizers |

Industry Insight: The most successful yield farmers typically allocate 60-70% of their farming capital to stable, established pools while reserving 30-40% for higher-yield opportunities that may carry greater risk but offer enhanced return potential.

How Yield Farming Works in DEX Platforms

The mechanics of yield farming on DEX platforms involve a series of interconnected processes that convert deposited assets into earning positions. Understanding this complete flow from initial deposit through reward accumulation to eventual withdrawal enables farmers to optimize their strategies and make informed decisions. The technical infrastructure supporting these operations relies on smart contracts that execute transparently and predictably, though the economic outcomes depend heavily on market conditions and strategic choices.

Modern yield farming has evolved beyond simple liquidity provision to encompass multi-layered strategies that stack different reward mechanisms. Sophisticated farmers leverage composability between protocols, using LP tokens from one platform as collateral or deposits in another, effectively multiplying their earning potential. This layered approach characterizes DeFi earnings optimization but requires careful attention to the compounding risks that accompany compounding returns.

Depositing Tokens into Farming Pools

The process of depositing tokens into farming pools begins with selecting a pool that matches your available assets and risk preferences. Most pools require you to deposit two tokens in equal value proportions, such as 50% ETH and 50% USDC for an ETH-USDC pool. Upon deposit, the smart contract mints LP tokens representing your proportional ownership of the pool, which you hold in your wallet as proof of your liquidity position.

Your deposited tokens immediately begin working within the automated market maker system, available for traders executing swaps against the pool. Each trade that touches your pool generates fees that accumulate to your position proportionally. Understanding the relationship between your deposit size, total pool liquidity, and trading volume helps estimate expected returns and compare opportunities across different pools and platforms.

Role of Crypto Staking

Crypto staking complements farming pool participation in many DeFi strategies, offering an additional avenue for generating staking rewards from held assets. While traditional staking involves locking tokens to support proof-of-stake blockchain security, DeFi staking often means depositing LP tokens or platform tokens into additional contracts that distribute extra rewards. This stacking of yield sources represents a core tactic in yield optimization strategies.

Many DEX platforms implement staking mechanisms that encourage long-term liquidity commitment by offering boosted rewards for users who lock their LP tokens for extended periods. These time-locked positions typically earn higher APY than flexible alternatives, creating incentives that help stabilize platform liquidity. Evaluating the tradeoff between enhanced rewards and reduced flexibility represents an important decision for each farmer’s individual circumstances.

Token Incentives and Crypto Rewards

Token incentives represent the additional crypto rewards that platforms distribute to liquidity providers beyond the base trading fees. These incentives typically come in the form of the platform’s native governance or utility token, distributed according to predetermined emission schedules and allocation formulas. The addition of token incentives can dramatically increase headline APY figures, sometimes making otherwise uncompetitive pools highly attractive.

Evaluating token incentives requires assessing not just the quantity of tokens received but their expected value over time. High emission rates can lead to token price depreciation as recipients sell their rewards, potentially eroding real returns even as nominal APY remains high. Sustainable incentive programs typically balance emission rates against token utility, demand drivers, and buyback mechanisms that support long-term value.

Understanding Liquidity Mining

Liquidity mining describes the specific process of earning platform tokens by providing liquidity, distinguishing it from broader yield farming that encompasses all earning strategies. This mechanism emerged as a powerful tool for bootstrapping new protocols, allowing projects to distribute governance tokens widely while simultaneously building the liquidity depth necessary for functional markets. The alignment of incentives between platform growth and provider rewards creates powerful network effects.

The mechanics of liquidity mining vary across platforms but generally involve tracking each provider’s contribution to targeted pools and distributing tokens proportionally during regular epochs. Some programs weight rewards based on time commitment, rewarding early or long-term participants more heavily than recent depositors. Understanding the specific rules governing each liquidity mining program helps optimize participation timing and pool selection.

How Liquidity Mining Contributes to Passive Income in Crypto

Liquidity mining creates passive income in crypto through automatic reward accumulation that requires no active management once positions are established. Your LP tokens continuously earn their share of distributed platform tokens based on your proportional contribution to the mining program. This passive accrual allows farmers to benefit from their positions without constant attention, though periodic claiming and compounding can optimize total returns.

The passive nature of liquidity mining income makes it particularly attractive for investors seeking yield without the time demands of active trading. Once you understand the mechanics and have made informed decisions about which pools to join, the earning process largely runs itself. However, truly passive income requires accepting the returns generated by initial positioning rather than continuously optimizing for maximum yields.

Examples of DEX Platforms Offering Farming Rewards

Major DEX platforms offering farming rewards include Uniswap with its UNI token distributions, SushiSwap featuring SUSHI rewards and additional platform incentives, PancakeSwap on Binance Smart Chain with CAKE emissions, and Curve Finance specializing in stable asset pools with CRV rewards. Each platform has distinct characteristics including supported blockchains, pool types, fee structures, and reward mechanisms that suit different farming strategies.

Emerging platforms frequently launch with aggressive liquidity mining programs to attract initial liquidity, creating opportunities for early farmers to earn elevated rewards. However, newer platforms carry higher risks including unproven smart contracts, uncertain token value trajectories, and potential for protocol failures. Balancing the appeal of high yields against these risks requires careful due diligence and appropriate position sizing. The mechanics behind how reserve pools enable trading remain consistent across platforms despite these variations.

Yield Farming Lifecycle: From Deposit to Earnings

| Stage | Action | What Happens | Outcome |

|---|---|---|---|

| 1 | Select Pool | Research and choose target farming pool | Identified opportunity matching goals |

| 2 | Prepare Tokens | Acquire equal value of both pool tokens | Ready assets for deposit |

| 3 | Add Liquidity | Deposit token pair into pool contract | Receive LP tokens as proof |

| 4 | Stake LP Tokens | Deposit LP tokens in farming contract | Begin earning bonus rewards |

| 5 | Accumulate Rewards | Earn fees plus token incentives over time | Growing claimable rewards |

| 6 | Harvest and Compound | Claim rewards, reinvest for growth | Optimized compounding returns |

Calculating Earnings from Farming Pools

Calculating earnings from farming pools requires understanding multiple revenue streams and their respective contributions to total returns. Base trading fees represent the most predictable component, calculated as your proportional share of the fee percentage applied to all swaps in your pool. Token incentives add variable rewards that depend on emission schedules and your share of staked liquidity. Together, these components determine gross yield before accounting for costs and risks.

Accurate earnings calculation must also factor in impermanent loss effects that can reduce or even eliminate profits despite attractive headline APY figures. Gas costs for entering, claiming, and exiting positions eat into net returns, particularly for smaller depositors or during network congestion. Sophisticated farmers track all these elements to understand true profitability and compare opportunities on an apples-to-apples basis.

Yield Optimization Strategies

Yield optimization strategies range from simple approaches like regular reward compounding to complex multi-protocol strategies that leverage composability across the DeFi ecosystem. Auto-compounding vaults offered by protocols like Yearn Finance and Beefy automate the harvest and reinvestment process, capturing compound interest effects without manual intervention. These convenience services charge fees but often generate net-positive returns through gas efficiency and optimal compounding frequency.

More advanced yield optimization involves actively moving capital between opportunities as relative attractiveness changes. This might mean shifting from one pool to another as incentive programs evolve, or leveraging new protocol launches that offer elevated initial rewards. Active optimization can significantly boost returns but requires constant monitoring, quick decision-making, and acceptance of increased transaction costs and risks.

Factors Affecting DeFi Earnings

Multiple factors affect DeFi earnings from farming pools, with trading volume representing the primary driver of fee-based returns. Pools with higher trading activity generate more fees to distribute among liquidity providers. However, popular pools also attract more liquidity, diluting individual shares. Finding pools with favorable volume-to-liquidity ratios represents a key skill in yield farming.

Token incentive sustainability significantly impacts long-term earnings as emission rates typically decline according to predetermined schedules. The value of reward tokens relative to deposit assets creates another variable, as farming rewards priced in volatile tokens may appreciate or depreciate substantially. Market conditions affecting the tokens you hold in pools introduce impermanent loss dynamics that can dramatically impact actual returns. Understanding these interconnected factors enables realistic expectations and informed strategy development.

Benefits of Participating in Farming Pools

Participating in farming pools offers benefits that extend beyond direct financial returns to include portfolio diversification, exposure to emerging protocols, and contribution to the decentralized finance ecosystem. These advantages make yield farming attractive not just as an income strategy but as a way to engage actively with cryptocurrency markets while potentially earning returns exceeding traditional investment alternatives.

The accessibility of farming pools democratizes opportunities previously available only to sophisticated financial institutions. Anyone with cryptocurrency and an internet connection can participate in market making activities, earning their share of transaction fees alongside the largest DeFi whales. This permissionless access represents a fundamental value proposition of decentralized finance.

Maximizing Passive Income

Maximizing passive income through farming pools involves strategic decisions at multiple levels from platform selection to pool choice to reward management. The most effective passive income strategies prioritize sustainable yields over flashy APY figures, recognizing that consistent moderate returns compound more effectively than volatile high returns that may evaporate. Building positions in established protocols with proven track records provides foundation for reliable income streams.

Diversification across multiple pools and platforms reduces concentration risk while maintaining aggregate yield targets. Rather than chasing the single highest APY available, spreading capital across several solid opportunities creates more stable overall returns. This approach also provides exposure to different reward tokens, potentially benefiting from price appreciation across multiple assets.

How Crypto Investment Strategies Leverage Farming Pools

Sophisticated crypto investment strategies leverage farming pools as yield-generating components within broader portfolio constructions. Rather than treating farming as standalone activity, integrated strategies might use farming yields to fund other investment activities, hedge core positions, or accelerate portfolio growth. This strategic integration maximizes the utility of farming income beyond simple accumulation.

Some strategies involve using farming rewards to dollar-cost average into target assets, converting platform tokens into desired holdings through regular harvests. Others reinvest rewards into expanding farming positions, compounding both liquidity provision and future reward earning capacity. The flexibility of farming income enables customized approaches matching individual investment goals and risk preferences.

Real-Life Examples of Staking Rewards

Real-world staking rewards examples illustrate the practical potential of farming pool participation. A user providing $10,000 liquidity to a stablecoin pool earning 10% APY would generate approximately $1,000 annually in trading fees and token rewards, with minimal impermanent loss risk. The same capital in a higher-risk new token pool might generate 100%+ APY initially, though sustainability and impermanent loss would require careful monitoring.

Larger positions benefit from economies of scale where gas costs represent smaller proportions of total value, enabling more frequent compounding and strategy adjustments. A $100,000 farming position earning 20% APY generates $20,000 annually, justifying more active management and optimization efforts. These concrete examples help frame expectations and planning for farmers at different scale levels.

Farming Pool Selection Criteria

When evaluating farming pool opportunities, apply these essential criteria:

- Protocol Security: Verified audits from reputable firms, established track record, and no history of exploits

- Total Value Locked: Sufficient liquidity indicating community trust and reduced manipulation risk

- Yield Sustainability: Reasonable APY supported by actual trading volume, not just temporary emissions

- Token Pair Risk: Volatility profile and correlation between paired assets affecting impermanent loss

- Reward Token Value: Utility, demand drivers, and realistic price expectations for incentive tokens

- Lock Requirements: Flexibility to exit positions without excessive penalties or waiting periods

Supporting DEX Ecosystem and Liquidity

Beyond personal profit, farming pool participation supports the broader DEX ecosystem by providing the liquidity that enables efficient, decentralized trading. Your deposited tokens become part of the infrastructure allowing others to swap assets without centralized intermediaries. This contribution to liquidity provision creates positive externalities that benefit all ecosystem participants, from casual traders to sophisticated arbitrageurs.

Healthy liquidity levels create virtuous cycles where better trading conditions attract more users, generating more fees that attract more liquidity. Participating in this ecosystem growth means your rewards partially reflect the value you help create for the broader community. This alignment between individual incentives and collective benefit represents a core achievement of well-designed DeFi mechanisms.

Contribution to Liquidity Provision

Every dollar of liquidity you provide expands the capacity of DEX platforms to handle trades without excessive price impact. Your contribution joins with others to create deep pools where large orders can execute efficiently, benefiting traders who may never directly interact with your specific tokens. This collective provision model democratizes market making in ways impossible in traditional finance.

The marginal impact of your liquidity depends on pool size and existing depth. Contributing to smaller pools can have proportionally greater effect on market quality, though it may also expose you to more volatile conditions. Understanding where your liquidity creates most value helps optimize both personal returns and ecosystem contribution.

How This Improves Trading Efficiency and Price Stability

Deep liquidity pools improve trading efficiency by reducing slippage, the difference between expected and executed trade prices. With more tokens available in pools, even large trades cause minimal price movement, enabling traders to execute with confidence about final outcomes. This efficiency attracts more trading volume, generating more fees for liquidity providers in a positive feedback loop.

Price stability benefits from liquidity depth as well, since deeper pools resist manipulation attempts and provide more accurate price discovery. Arbitrageurs keeping DEX prices aligned with broader markets rely on sufficient liquidity to execute their balancing trades profitably. Your liquidity provision indirectly supports the price accuracy that all market participants depend upon.

| Platform Feature | Uniswap | PancakeSwap | Curve Finance |

|---|---|---|---|

| Primary Chain | Ethereum, L2s | BNB Chain | Multi-chain |

| Reward Token | UNI | CAKE | CRV |

| Pool Specialty | General purpose | General purpose | Stable assets |

| Fee Tier Options | 0.01% – 1% | 0.25% | 0.04% – 0.4% |

| Best For | ETH ecosystem farmers | Low-cost farming | Stablecoin yields |

Risks and Considerations in Yield Farming

Yield farming, despite its attractive return potential, carries significant risks that every participant must understand and manage. The decentralized, permissionless nature of DeFi means no regulatory safety nets or deposit insurance protect against losses. Informed risk assessment and appropriate position sizing represent essential skills for sustainable farming participation.

Risk categories span technical vulnerabilities in smart contracts, economic risks from market movements, and operational risks from user error or platform issues. Comprehensive risk management addresses all these categories, recognizing that any single failure point could result in partial or total loss of deposited capital. The following sections examine the primary risk categories in detail.

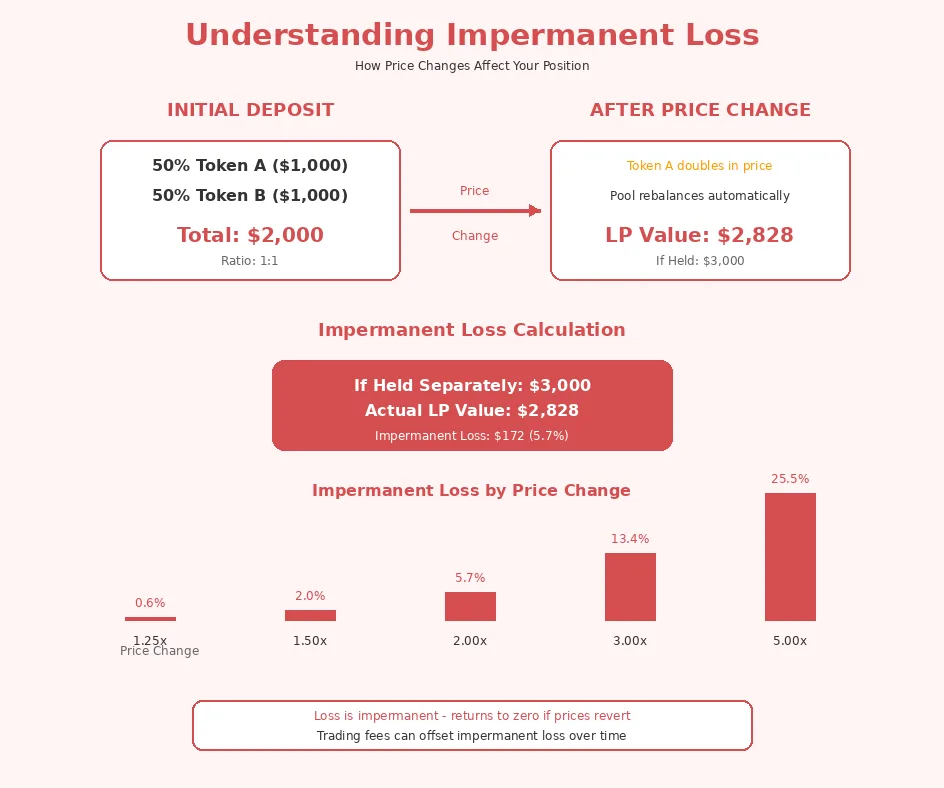

Impermanent Loss and Volatility

Impermanent loss represents the most distinctive risk of liquidity provision, occurring when price ratios between pool tokens change from your deposit time. The automated market maker constantly rebalances your position, selling tokens that increase in price and buying those that decrease. This rebalancing means your holdings diverge from what you would have by simply holding the original tokens, creating a loss relative to that benchmark.

Volatility amplifies impermanent loss risk since larger price movements create larger divergences between pool positions and held equivalents. Farming pairs with highly correlated or stable assets minimizes this risk, while farming volatile uncorrelated pairs maximizes it. Understanding this tradeoff helps select pools matching your risk tolerance and market outlook.

Understanding Potential Losses in Crypto Farming

Potential losses in crypto farming can exceed the impermanent loss component when factoring in reward token depreciation, smart contract failures, or platform insolvency. A pool earning 50% APY in a governance token that loses 80% of its value delivers negative real returns despite nominal reward accumulation. This scenario has played out numerous times across DeFi history, particularly with newer protocols offering unsustainably high yields.

Total loss scenarios, though rare with established protocols, remain possible through smart contract exploits, governance attacks, or catastrophic market events. Sizing positions appropriately for your risk tolerance and diversifying across platforms helps limit exposure to any single failure. Never farm with capital you cannot afford to lose completely.

Risk Warning: Yield farming involves substantial risk of capital loss. Smart contract vulnerabilities, impermanent loss, token devaluation, and platform failures can result in partial or complete loss of deposited funds. Only participate with capital you can afford to lose and always conduct thorough due diligence before depositing.

Smart Contract Risks

Smart contract risks encompass vulnerabilities in the code that governs farming pool operations, from logic errors that enable exploits to upgrade mechanisms that could be abused by malicious actors. Even audited contracts have been exploited, as audits cannot guarantee security and new attack vectors continuously emerge. The immutable nature of deployed contracts means bugs cannot simply be patched once discovered.

Mitigating smart contract risk involves favoring protocols with multiple reputable audits, long track records without incidents, bug bounty programs incentivizing white-hat disclosure, and appropriate upgrade mechanisms with time locks and governance oversight. No protocol is completely risk-free, but these factors meaningfully reduce probability of catastrophic failures.

Security Concerns in DeFi Platforms

Security concerns in DeFi platforms extend beyond smart contract code to include oracle manipulation, governance attacks, admin key compromises, and economic exploits that abuse intended functionality in unintended ways. The composability that makes DeFi powerful also creates complex interaction surfaces where vulnerabilities can emerge from combinations of individually secure components.

Monitoring protocol communications, understanding governance mechanisms, and staying informed about ecosystem security developments helps identify emerging risks before they materialize as losses. Active community participation and following security researchers provides early warning of potential issues. This vigilance represents necessary overhead for serious farming participation. Understanding how decentralized trading platforms handle security informs better risk assessment.

Tips to Boost Earnings on DEX Platforms

Optimizing earnings from DEX farming pools requires combining strategic platform selection, intelligent pool choices, and ongoing management practices that adapt to changing conditions. The difference between mediocre and excellent farming returns often comes down to attention to these optimization details rather than simply chasing headline APY figures. Building effective crypto exchanges requires mastering these same yield dynamics.

The following tips synthesize best practices from successful yield farmers, providing actionable guidance for maximizing risk-adjusted returns. These principles apply across platforms and market conditions, forming a foundation for sustainable farming strategies that can evolve as the DeFi landscape continues developing.

Choosing the Right DEX Platform

Choosing the right DEX platform involves evaluating security track record, total value locked indicating community trust, available pool options matching your holdings, and transaction costs on the underlying blockchain. Established platforms like Uniswap and Curve offer greater security confidence but may have lower yields than newer protocols offering aggressive incentives to bootstrap liquidity.

Consider blockchain selection as part of platform choice, since gas costs significantly impact net returns especially for smaller positions. Ethereum mainnet offers the deepest liquidity but highest transaction costs, while Layer 2 solutions and alternative chains provide cost efficiency with varying liquidity and security tradeoffs. Matching platform choice to position size and trading frequency optimizes overall outcomes.

Combining Yield Farming with Token Incentives

Combining yield farming with token incentives means strategically selecting pools that offer both organic trading fee income and supplementary token rewards. Incentivized pools often provide meaningfully higher total yields, though evaluating the sustainability and value trajectory of reward tokens is essential. Temporary incentive programs may justify short-term positioning that would be adjusted when rewards end.

Advanced strategies stack incentives by depositing LP tokens into additional farming contracts, earning on multiple layers simultaneously. This approach multiplies yield potential but also multiplies smart contract exposure and complexity. Understanding the complete flow of tokens through various contracts helps assess total risk alongside total reward.

Monitoring DeFi Earnings and Optimizing Strategies

Monitoring DeFi earnings requires tracking actual returns against expectations, accounting for all components including trading fees, token rewards, impermanent loss, and transaction costs. Portfolio tracking tools like Zapper, DeBank, and platform-specific dashboards provide visibility into performance across positions. Regular review enables identifying underperforming allocations and opportunities for improvement.

Optimizing strategies means willingness to reallocate capital as conditions change, whether from shifting APY rankings, ending incentive programs, or changing market dynamics affecting impermanent loss profiles. Balance optimization frequency against transaction costs, since excessive repositioning can erode gains through fees. Establishing clear criteria for when to make changes brings discipline to the optimization process.

Build a High-Performance Yield Farming Exchange

We develop custom crypto exchanges with advanced farming, staking, and liquidity mining features to maximize platform profitability.

Conclusion

Farming pools represent one of the most accessible and potentially rewarding opportunities in decentralized finance, enabling cryptocurrency holders to generate passive income while contributing essential liquidity to the trading ecosystem. The mechanics of yield farming combine trading fee distributions, token incentives through liquidity mining, and staking rewards to create multiple income streams that can significantly exceed traditional investment returns.

Success in yield farming requires balancing opportunity pursuit against careful risk management. Understanding impermanent loss, smart contract vulnerabilities, and reward token sustainability enables informed decision-making about pool selection and position sizing. The most successful farmers combine strategic planning with ongoing monitoring, adapting their approaches as market conditions and opportunities evolve.

The democratization of market making through farming pools represents a fundamental shift in how financial infrastructure operates. Participating thoughtfully in this ecosystem not only generates personal returns but contributes to the growth of decentralized finance alternatives to traditional financial systems. With appropriate knowledge and risk awareness, farming pools offer a compelling pathway to boost crypto earnings while supporting the evolution of open, permissionless markets.

Frequently Asked Questions

Farming pools are smart contract-based mechanisms on decentralized exchanges where users deposit their cryptocurrency tokens to provide liquidity and earn rewards in return. By contributing assets to these pools, participants enable trading activity on the platform while receiving a share of transaction fees and additional token incentives. This process creates a mutually beneficial ecosystem where the platform gains liquidity depth and users generate passive income from their idle crypto holdings.

Yield farming on DEX platforms works by allowing users to deposit token pairs into liquidity pools, which are then used to facilitate trades between other users. In exchange for providing this liquidity, farmers receive LP tokens representing their share of the pool, plus they earn a portion of trading fees generated by swap activity. Many platforms also distribute governance or utility tokens as additional rewards, creating multiple income streams that can significantly boost overall returns.

Yield farming involves providing liquidity to trading pools by depositing token pairs and earning rewards from trading fees plus token incentives, while staking typically means locking a single token to support network security or governance functions. Yield farming generally offers higher potential returns but carries more risk including impermanent loss from price fluctuations between paired tokens. Staking tends to be simpler and more predictable but usually provides lower yields compared to active liquidity provision strategies.

Earnings from crypto farming pools vary widely depending on factors including the specific platform, token pairs chosen, total liquidity in the pool, trading volume, and additional token incentives offered. Annual percentage yields can range from 5% for stable, established pools to over 100% for newer or incentivized farming opportunities. However, high APY figures should be evaluated carefully as they often involve higher risks, volatile reward tokens, or unsustainable emission schedules that may not persist long-term.

Impermanent loss occurs when the price ratio between tokens in a liquidity pool changes from when you deposited, causing your holdings to be worth less than if you had simply held the tokens separately. This happens because the automated market maker algorithm constantly rebalances your position, selling the appreciating token and buying the depreciating one to maintain the pool ratio. The loss becomes permanent only when you withdraw; if prices return to the original ratio, the loss disappears, which is why it is called impermanent.

Leading DEX platforms offering competitive farming rewards include Uniswap, SushiSwap, PancakeSwap, Curve Finance, and Balancer, each with unique features and reward structures. The best platform depends on your specific needs including the blockchain you prefer, tokens you want to farm, risk tolerance, and whether you prioritize stable returns or higher-risk opportunities. Evaluating factors like protocol security, audit history, total value locked, and reward token sustainability helps identify platforms that match your investment goals.

Yield farming carries inherent risks that beginners should thoroughly understand before participating, including smart contract vulnerabilities, impermanent loss, volatile reward token values, and potential rug pulls on less established platforms. Starting with well-audited protocols, conservative token pairs like stablecoin pools, and smaller amounts allows beginners to learn the mechanics while limiting potential losses. Education about the specific risks and mechanics of each platform is essential before committing significant capital to farming strategies.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.