Key Takeaways

- Decentralized exchange launchpads provide trustless token launch systems through smart contract automation, eliminating the need for intermediary trust and reducing counterparty risks.

- The benefits of decentralized exchange launchpad include transparent token sales, fair token distribution, and automatic liquidity generation that ensures immediate trading availability.

- DEX launchpad platforms offer significantly lower costs compared to centralized alternatives, making them ideal low-cost token launch platforms for startups with limited budgets.

- Global access crypto launchpad functionality removes geographical barriers, enabling projects to reach international investors and communities without regulatory restrictions of centralized platforms.

- Community driven token launch mechanisms and governance features give platform users direct influence over project selection and platform development decisions.

- Investor protection in DEX launchpad environments comes through transparent on-chain verification, audited smart contracts, and community vetting processes.

- Cross-chain DEX launchpad solutions enable multi-network token launches, expanding reach and reducing single-chain dependency risks.

- Smart contract based launchpad automation reduces human error, ensures consistent rule application, and provides 24/7 operational capability without manual intervention.

The cryptocurrency landscape has witnessed remarkable evolution in how new projects raise funds and distribute tokens to early supporters. Decentralized exchange launchpads have emerged as a transformative solution that addresses many limitations of traditional fundraising methods.

What is a Decentralized Exchange Launchpad?

A decentralized exchange launchpad represents a fundamental shift in how cryptocurrency projects conduct initial token offerings and connect with early investors. These platforms combine the fundraising capabilities of traditional launchpads with the trustless, transparent nature of decentralized exchanges, creating a powerful ecosystem for both project teams and investors seeking promising opportunities.

Understanding the Concept of a Launchpad on a Decentralized Exchange

A launchpad on decentralized exchange operates through smart contracts that automate the entire token sale process without requiring central authority oversight. When a project launches through such a platform, the smart contract handles fund collection, token distribution, and liquidity provision according to predetermined rules that cannot be altered once deployed. This decentralized token launch mechanism ensures that all participants receive fair treatment based on transparent, verifiable criteria.

The DEX token launch platform integrates seamlessly with existing decentralized exchange infrastructure, enabling immediate trading once the token sale concludes. This integration distinguishes DEX launchpads from standalone platforms that require additional steps for token liquidity. The result is a streamlined experience where investors can participate in sales and begin trading within the same ecosystem.

Difference Between Centralized and Decentralized Launchpads

Understanding the fundamental differences between centralized and decentralized launchpads helps investors and projects make informed decisions about their preferred approach. Each model offers distinct advantages and trade-offs that suit different requirements and risk tolerances.

| Feature | Centralized Launchpad | DEX Launchpad |

|---|---|---|

| Fund Custody | Platform controlled | Smart contract controlled |

| KYC Requirements | Mandatory verification | Often permissionless |

| Transparency | Limited visibility | Full on-chain transparency |

| Global Access | Geographic restrictions | Borderless participation |

| Costs | Higher platform fees | Lower smart contract costs |

| Liquidity Integration | Separate listing process | Automatic DEX integration |

Key Components of a DEX Launchpad

A comprehensive DEX based launchpad solution comprises several interconnected components that work together to facilitate secure token launch on DEX platforms. The smart contract layer handles all financial logic, including fund collection, allocation calculations, and token distribution. The frontend interface provides user-friendly access for both projects and investors to interact with underlying contracts.

Additional components include governance modules for community voting, staking mechanisms for allocation tiers, and liquidity management systems that interface with DEX protocols. Together, these elements create a robust DEX launchpad ecosystem that supports the entire token launch lifecycle from initial configuration through post-sale trading.

Industry Insight: Based on our experience developing launchpad solutions, we have observed that successful platforms prioritize smart contract security above all other features. The most effective DEX launchpads invest heavily in multiple security audits and implement time-tested contract patterns to protect both projects and investors.

Advantages of Using a Decentralized Exchange Launchpad

The DEX launchpad benefits extend across multiple dimensions, offering compelling value propositions for all ecosystem participants. Understanding these advantages helps stakeholders appreciate why decentralized launchpads have gained significant traction in the cryptocurrency space.

Security and Trustless Token Launches

The trustless token launch system represents perhaps the most significant advantage of decentralized launchpads. Smart contracts execute all operations according to immutable code, eliminating the need to trust any central party with fund management. Investors can verify contract logic before participating, ensuring that the rules governing their investment cannot be arbitrarily changed.

This automated token launch process reduces human error and eliminates opportunities for manipulation that exist in centralized systems. The smart contract based launchpad approach means that once parameters are set, the system operates exactly as programmed, providing predictable outcomes for all participants. For detailed insights on maintaining liquidity in decentralized environments, explore our guide on understanding liquidity dynamics on decentralized exchanges.

Transparency in Token Sales and Distribution

The transparent token sale platform nature of DEX launchpads allows anyone to audit the entire process. All contributions, allocations, and distributions occur on-chain, creating an immutable record that verifies fair treatment of all participants. This transparency builds confidence among investors who can independently verify that fair token distribution mechanisms are being applied correctly.

Lower Costs and Efficient Fundraising

Operating as a low-cost token launch platform, DEX launchpads significantly reduce the financial burden on launching projects. By eliminating intermediaries and automating processes through smart contracts, these platforms can offer competitive fee structures that preserve more capital for project development. The decentralized fundraising model passes these savings to both projects and investors.

The decentralized fundraising platform approach also eliminates hidden costs associated with centralized platforms, such as listing fees, marketing requirements, and ongoing maintenance charges. Projects can allocate more resources to actual development rather than platform overhead.

Global Accessibility for Projects and Investors

The global access crypto launchpad functionality removes geographical barriers that limit participation in centralized platforms. Anyone with an internet connection and cryptocurrency wallet can participate in token sales, regardless of their location. This permissionless token listing approach democratizes access to early-stage investment opportunities previously reserved for well-connected investors.

Community Participation and Governance Benefits

The community driven token launch model empowers platform users to influence project selection and platform development. Through governance tokens and voting mechanisms, participants help curate quality projects and shape the launchpad’s evolution. This collective intelligence approach often results in better project vetting than centralized decision-making processes.

How Startups and Investors Benefit from DEX Launchpads

Benefits for Startups

Startups leveraging DEX launchpads gain access to a streamlined decentralized project onboarding process that simplifies fundraising complexity. The reduced barrier to entry allows innovative projects to raise capital without extensive connections or substantial upfront investments in platform fees. Additionally, automatic liquidity generation through DEX launchpad ensures tokens become immediately tradeable, building market credibility from day one.

Benefits for Investors

Investor protection in DEX launchpad environments comes through multiple mechanisms. Transparent smart contracts allow verification of allocation rules, vesting schedules, and fund usage before committing capital. The crypto launchpad decentralized model ensures that investors maintain control of their assets until the moment of swap, reducing counterparty risk significantly.

| Benefit Category | For Startups | For Investors |

|---|---|---|

| Cost Efficiency | Lower platform fees, no intermediaries | Reduced transaction costs |

| Access | Global investor reach | Early-stage opportunities |

| Control | Full tokenomics control | Asset custody until swap |

| Liquidity | Automatic DEX listing | Immediate trading access |

Key Features of a DEX Launchpad

Smart Contract Automation for Token Launches

The smart contract based launchpad architecture automates every aspect of the token launch process. From contribution acceptance to allocation calculation and token distribution, all operations execute according to predefined logic without human intervention. This automated token launch process ensures consistency, reduces errors, and provides 24/7 operational capability that manual processes cannot match.

Liquidity Generation Through Launchpad Platforms

Liquidity generation through DEX launchpad platforms solves the critical bootstrapping problem that new tokens face. By automatically allocating portions of raised funds to liquidity pools, these platforms ensure tokens have sufficient market depth for trading immediately upon launch. This integration eliminates the common scenario where tokens launch without adequate liquidity, leading to extreme volatility and poor investor experiences.

Token Listing and Fair Distribution

The permissionless token listing capability of DEX launchpads democratizes access for projects that might not meet stringent centralized platform requirements. Combined with fair token distribution mechanisms enforced by smart contracts, these platforms create equitable opportunities for diverse participants. Allocation systems typically prevent whale dominance through caps, tiered systems, or lottery mechanisms.

Governance and Community Voting Mechanisms

Community governance mechanisms allow token holders to participate in platform decisions, from project selection to parameter adjustments. This decentralized decision-making process leverages collective intelligence while giving participants direct influence over platform evolution. Voting systems typically weight influence by token holdings or staking amounts, aligning incentives with platform success.

DEX Launchpad Token Sale Lifecycle

| Phase | Activities | Duration | Key Outputs |

|---|---|---|---|

| 1. Project Onboarding | Application, vetting, contract deployment | 1-2 weeks | Approved listing |

| 2. Whitelist Period | User registration, KYC if required | 3-7 days | Participant list |

| 3. Token Sale | Contribution collection, allocation | 24-72 hours | Funds raised |

| 4. Distribution | Token allocation, vesting setup | Immediate | Tokens distributed |

| 5. Liquidity Creation | Pool creation, liquidity lock | Immediate | Trading enabled |

| 6. Post-Launch | Vesting releases, community building | Ongoing | Project growth |

Challenges and Considerations

Technical Complexity and Development Needs

Building and operating a DEX launchpad requires significant technical expertise in smart contract development, security practices, and blockchain infrastructure. Projects considering launching their own platforms must invest in experienced development teams or partner with specialized agencies. The complexity extends beyond initial development to ongoing maintenance, upgrades, and security monitoring.

Risk Warning: Smart contract vulnerabilities can lead to significant fund losses. Always verify that launchpad contracts have undergone multiple professional security audits before participating. Never invest more than you can afford to lose, and thoroughly research all projects regardless of the platform hosting their launch.

Security Risks and Mitigation Strategies

While DEX launchpads eliminate certain centralization risks, they introduce smart contract security concerns that require careful attention. Common vulnerabilities include reentrancy attacks, integer overflow issues, and access control weaknesses. Mitigation strategies include multiple independent audits, bug bounty programs, formal verification where feasible, and gradual rollouts with limited initial caps.

Regulatory Compliance and Legal Considerations

The regulatory landscape for token launches remains complex and evolving across jurisdictions. While decentralization offers certain advantages, projects must still consider securities laws, investor protection regulations, and anti-money laundering requirements in relevant markets. Engaging legal counsel familiar with cryptocurrency regulations is essential for projects seeking broad market access.

Launchpad Selection Criteria for Projects

Security Standards

Audit history, bug bounties, track record, insurance coverage

Community Reach

Active users, social following, investor network size

Technical Features

Multi-chain support, liquidity tools, vesting options

Cost Structure

Platform fees, token requirements, hidden costs

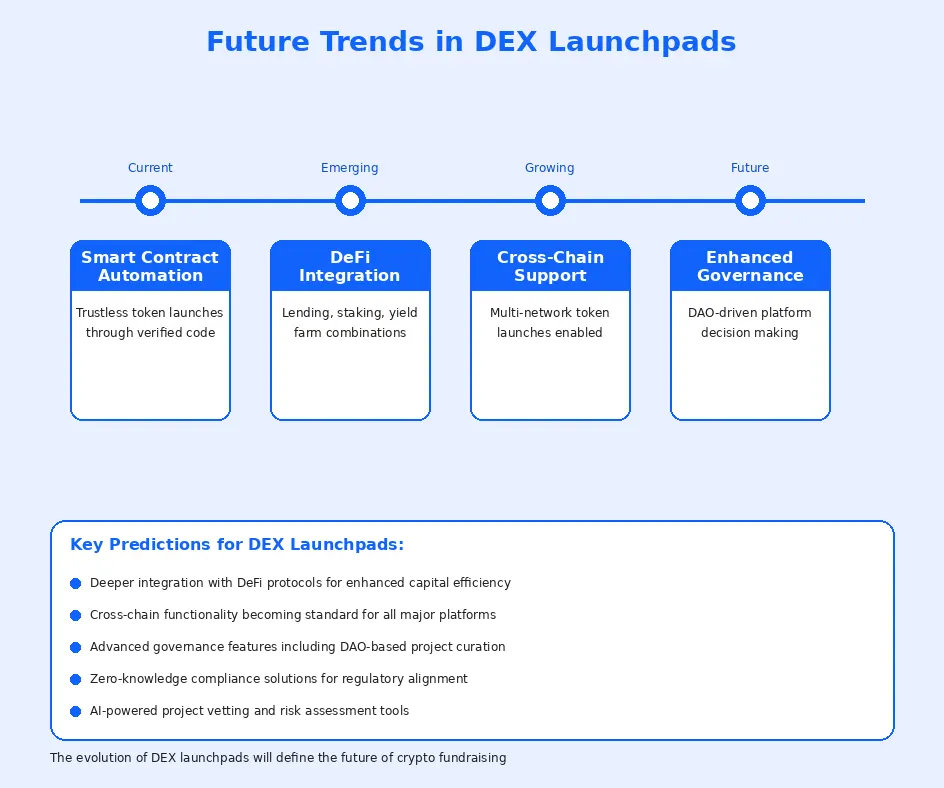

Future Trends in Decentralized Exchange Launchpads

Integration with DeFi Protocols

The convergence of DEX launchpads with broader DeFi ecosystems creates powerful synergies. Integration with lending protocols enables leveraged participation, while yield aggregator connections provide additional utility for launchpad tokens. These integrations enhance capital efficiency and create more comprehensive financial services around token launch activities.

Cross-Chain Launchpad Platforms

Cross-chain DEX launchpad solutions represent the next evolution in platform capability. By enabling token launches across multiple blockchain networks, these platforms maximize investor reach while reducing single-chain dependency. Bridge integrations and cross-chain messaging protocols enable seamless participation regardless of which network investors prefer to use.

Enhanced Security and Governance Features

Future developments in formal verification, zero-knowledge proofs for privacy-preserving compliance, and advanced governance mechanisms will further strengthen DEX launchpad security and functionality. These technological advances will enable platforms to offer stronger guarantees while maintaining the permissionless, transparent nature that defines decentralized systems.

Nadcab Labs’ Role in DEX Launchpad

Custom Launchpad Solutions for Projects

Nadcab Labs specializes in creating tailored DEX launchpad solutions that address specific project requirements and market needs. Our custom development approach ensures that each platform incorporates the exact features, tokenomics, and governance structures that align with client objectives. From simple token sale platforms to comprehensive ecosystems with advanced DeFi integrations, we build solutions scaled to project ambitions.

End-to-End Development and Deployment Services

Our comprehensive service offering covers the entire launchpad development lifecycle from initial concept through deployment and beyond. This includes requirement analysis, architecture design, smart contract development, frontend implementation, testing, audit coordination, and mainnet deployment. We work closely with clients throughout the process to ensure alignment with evolving requirements and market conditions. For projects seeking to build their own exchange infrastructure, our expertise in building decentralized exchange platform provides the foundation for comprehensive trading platforms.

Security, Audits, and Ongoing Support

Security remains our highest priority throughout all engagements. We coordinate with leading audit firms, implement comprehensive testing frameworks, and establish ongoing monitoring systems to protect client platforms and their users. Post-deployment support includes incident response capabilities, upgrade management, and continuous security assessment to address emerging threats.

Ready to build a custom crypto exchange or launchpad platform

Our experienced development team delivers secure, scalable solutions tailored to your vision.

Launch Your Exchange Now

Conclusion

The benefits of decentralized exchange launchpad extend across the entire cryptocurrency ecosystem, offering compelling advantages for projects, investors, and the broader community. From trustless token launches and transparent distribution mechanisms to lower costs and global accessibility, DEX launchpads address fundamental limitations of traditional fundraising approaches while introducing new possibilities enabled by blockchain technology.

As the technology matures and regulatory clarity improves, we anticipate continued growth in DEX launchpad adoption and sophistication. Cross-chain capabilities, deeper DeFi integrations, and enhanced governance features will further strengthen the value proposition for all participants. The community driven token launch model aligns incentives between platforms, projects, and investors in ways that centralized alternatives cannot replicate.

For projects considering token launches, DEX launchpads offer a compelling combination of efficiency, transparency, and accessibility. For investors, these platforms provide opportunities to participate in early-stage projects with greater confidence in fair treatment and transparent processes. As the decentralized fundraising platform landscape evolves, those who understand and leverage these tools effectively will be best positioned to capitalize on the opportunities ahead.

Frequently Asked Questions

A decentralized exchange launchpad is a platform built on blockchain technology that enables new crypto projects to raise funds and launch their tokens directly through a DEX without intermediaries. Unlike centralized launchpads, these platforms operate through smart contracts, ensuring trustless token launches and transparent token sales. The decentralized launchpad platform provides fair token distribution mechanisms while giving early investors access to promising projects.

DEX launchpads operate without central authority control, using smart contract based launchpad mechanisms for automated and transparent token distribution. Centralized launchpads require users to trust a third party with their funds and personal information, while decentralized alternatives offer permissionless token listing and trustless token launch systems. The key differences include custody of funds, transparency levels, and accessibility for global participants.

The benefits of decentralized exchange launchpad include enhanced security through smart contracts, transparent token sale processes, lower operational costs, and global access for both projects and investors. Additional advantages include community driven token launch mechanisms, fair token distribution without favoritism, and automatic liquidity generation through DEX launchpad integration. These platforms also provide investor protection in DEX launchpad environments through transparent on-chain verification.

DEX launchpads ensure fair token distribution through automated smart contract mechanisms that apply the same rules to all participants regardless of their status or connections. These platforms typically implement lottery systems, tiered allocation based on staking, or first-come-first-served models with caps to prevent whale dominance. The transparent token sale platform records all transactions on-chain, allowing anyone to verify the fairness of the distribution process.

Decentralized launchpads offer enhanced safety through transparent smart contracts, on-chain fund management, and elimination of centralized points of failure. However, investors should still conduct thorough due diligence on projects launching through these platforms. Investor protection in DEX launchpad environments relies on verified smart contracts, project vetting processes, and community governance mechanisms that help identify legitimate opportunities from potential scams

Liquidity generation through DEX launchpad platforms works by automatically allocating a portion of raised funds to create trading pairs on the underlying decentralized exchange. This automated token launch process ensures immediate tradability after the token sale concludes, preventing liquidity crises that plagued early crypto launches. The smart contracts lock liquidity for predetermined periods, providing stability and investor confidence in the new token market.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.