Key Takeaways

- Order matching in decentralized exchanges forms the core mechanism that enables trustless trading by pairing buy and sell orders efficiently without central authority oversight.

- The DEX order matching system directly impacts trade execution quality, determining whether users receive fair prices with minimal slippage.

- On-chain order matching provides maximum transparency while off-chain order matching offers faster execution speeds with on-chain settlement.

- Order matching efficiency in DEX depends on algorithm quality, system architecture, and available liquidity across trading pairs.

- The matching engine in decentralized exchanges must balance speed, security, fairness, and decentralization to serve all users effectively.

- Liquidity impact on order matching determines execution quality, with higher liquidity enabling better price accuracy and lower slippage.

- Secure order matching in decentralized exchanges protects users from manipulation while maintaining transparent and verifiable trade execution.

- Future improvements in order matching technology will focus on reducing latency, enhancing scalability, and minimizing slippage through better matching algorithms.

The success of any trading platform hinges on its ability to connect buyers with sellers efficiently and fairly. In decentralized exchanges, this critical function falls to order matching systems that must operate without the centralized infrastructure of traditional exchanges. Understanding how order matching works in decentralized exchanges is essential for traders seeking optimal execution and for projects building the next generation of DeFi infrastructure. This comprehensive guide explores every aspect of DEX order matching, from fundamental concepts to advanced optimization strategies.

What Is Order Matching in Decentralized Exchanges

Order matching in decentralized exchanges refers to the automated process of pairing compatible buy and sell orders to execute trades. When a trader submits an order to purchase tokens at a specific price, the DEX order matching system searches for corresponding sell orders that meet the criteria. This fundamental mechanism enables decentralized trading by eliminating the need for a trusted intermediary while ensuring both parties receive fair execution.

The decentralized exchange order matching process differs significantly from centralized alternatives. Rather than relying on private servers controlled by a single entity, DEX matching systems operate through smart contracts and distributed algorithms. This approach ensures transparency in DEX order matching while maintaining the trustless nature that defines decentralized finance. Every matching decision can be verified on-chain, providing unprecedented accountability in trade execution.

Why DEX Order Matching Is Critical

The importance of order matching in DEX cannot be overstated as it directly determines the quality of trade execution for every user on the platform. Inefficient matching leads to poor price execution, excessive slippage, and failed trades that frustrate users and damage platform reputation. Conversely, fast order matching in DEX creates competitive advantages that attract more traders and liquidity.

Role of Order Matching in Trade Execution

Order execution in decentralized exchanges depends entirely on the matching system’s ability to find compatible counterparties quickly and accurately. The trade matching in DEX process must consider multiple factors including price, quantity, timing, and available liquidity to ensure optimal execution. A well-designed matching system maximizes the likelihood of successful trades while minimizing the time between order submission and execution.

Order Matching Efficiency in DEX

Order matching efficiency in DEX measures how effectively the system pairs orders and executes trades with minimal resources and time. High efficiency means traders experience fast execution, low slippage, and consistent performance even during high-volume periods. Achieving this efficiency requires sophisticated algorithms, optimized infrastructure, and careful system design that balances multiple competing requirements.

Industry Principle: The quality of order matching directly correlates with platform success. Exchanges with superior matching systems consistently outperform competitors in user acquisition and retention because traders prioritize execution quality when choosing where to trade. Investing in matching infrastructure yields compounding returns through improved liquidity and trading volume.

How Order Matching Works in Decentralized Exchanges

Understanding how order matching works in decentralized exchanges requires examining the complete flow from order submission through execution. The process involves multiple stages that work together to ensure trades execute correctly while maintaining the trustless nature of decentralized systems.

Order Matching Process in DEX

The order matching process in DEX follows a structured workflow that ensures consistent and fair execution. When a trader submits an order, the system first validates the order parameters and confirms sufficient balance or authorization. The order then enters the matching queue where algorithms compare it against existing orders to identify potential matches based on price compatibility and quantity requirements.

Order Matching Lifecycle in DEX

| Stage | Process | Key Actions | Outcome |

|---|---|---|---|

| 1. Submission | Order received from trader | Validate parameters, check balance | Order accepted |

| 2. Queuing | Order enters matching queue | Sort by price and time priority | Order positioned |

| 3. Matching | Algorithm finds matches | Compare price, quantity criteria | Match identified |

| 4. Verification | Confirm match validity | Check balances, conditions | Match verified |

| 5. Execution | Trade executed on-chain | Transfer tokens, update state | Trade completed |

| 6. Settlement | Finalize and record | Confirm on blockchain | Trade finalized |

Market Order Matching in DEX

Market order matching in DEX prioritizes execution speed over price specificity. When a trader submits a market order, the system immediately matches it against the best available prices in the order book, consuming liquidity from multiple price levels if necessary. This approach ensures rapid execution but may result in price impact for larger orders, especially in lower-liquidity markets.

Limit Order Matching in DEX

Limit order matching in DEX only executes trades when the specified price condition is met or exceeded. If a buyer sets a limit price of 100 USDC for a token, the order will only match with sell orders at 100 USDC or lower. This mechanism gives traders precise control over execution prices but may result in orders remaining unfilled if market prices never reach the specified level.

Trade Matching in DEX Explained

Trade matching in DEX encompasses the complete process of connecting compatible orders and executing the resulting trades. The matching algorithm typically uses price-time priority, meaning orders at better prices match first, and among equal prices, earlier orders take precedence. This fair ordering principle ensures predictable behavior that traders can rely on when formulating their strategies.

Decentralized Exchange Order Matching Mechanism

Order Matching Mechanism in DEX

The order matching mechanism in DEX defines the rules and algorithms that govern how orders are paired and executed. Most DEX platforms implement variations of the continuous double auction mechanism where buy and sell orders continuously compete for execution. The specific implementation varies between platforms, with some using traditional order book models and others employing automated market maker approaches.

Matching Engine in Decentralized Exchanges

The matching engine in decentralized exchanges serves as the core component responsible for order pairing and execution decisions. Unlike centralized exchanges where matching engines run on private servers, DEX matching engines operate through smart contracts or distributed systems. This architecture ensures that matching logic remains transparent and verifiable while potentially sacrificing some speed compared to centralized alternatives.

Order Execution in Decentralized Exchanges

Order execution in decentralized exchanges occurs when matched orders trigger the actual transfer of assets between parties. Smart contracts handle this atomic swap process, ensuring that either both sides of the trade complete or neither does. This trustless execution model protects traders from counterparty risk while maintaining the immutable record of all trades on the blockchain.

On-Chain vs Off-Chain Order Matching

The choice between on-chain and off-chain order matching represents one of the most significant architectural decisions for DEX platforms. Each approach offers distinct advantages and trade-offs that affect everything from execution speed to decentralization level.

| Feature | On-Chain Matching | Off-Chain Matching |

|---|---|---|

| Execution Speed | Slower (block time dependent) | Faster (milliseconds) |

| Transparency | Full on-chain visibility | Limited to settlement |

| Gas Costs | Higher per operation | Lower (batched settlement) |

| Decentralization | Maximum | Partial (centralized relay) |

| Throughput | Limited by blockchain | High scalability |

On-Chain Order Matching in Decentralized Exchanges

On-chain order matching processes all matching logic directly through smart contracts on the blockchain. Every order submission, matching decision, and execution occurs as blockchain transactions, creating a complete and immutable record of all trading activity. This approach maximizes transparency and decentralization but faces inherent limitations from blockchain throughput and latency constraints.

Transparency in DEX Order Matching

Transparency in DEX order matching ensures that all participants can verify the fairness of trade execution. On-chain matching provides the highest level of transparency as every order and match can be inspected on the blockchain. This visibility protects traders from hidden manipulation while enabling researchers and regulators to analyze market behavior accurately.

Off-Chain Order Matching for Decentralized Exchanges

Off-chain order matching handles the computationally intensive matching process on external servers while relying on the blockchain only for final settlement. This hybrid approach enables fast order matching in DEX by avoiding the latency and cost constraints of on-chain processing. Orders are collected and matched off-chain, with only the resulting trades submitted for on-chain execution.

Fast Order Matching in DEX

Fast order matching in DEX typically requires off-chain processing to achieve execution speeds comparable to centralized exchanges. By handling matching logic off-chain, platforms can process orders in milliseconds rather than waiting for block confirmations. This speed advantage attracts professional traders and market makers who require rapid execution for their strategies.

Order Book and Order Matching Relationship

Order Book vs Order Matching in DEX

Order book vs order matching represents two complementary components of DEX infrastructure. The order book serves as the data structure that stores all pending buy and sell orders organized by price level. Order matching is the active process that queries this order book to identify compatible orders for execution. Together they form the foundation for efficient price discovery and trade execution on order book-based DEX platforms.

How Order Book Data Supports Order Matching

How order book data supports order matching involves providing real-time information about available liquidity at each price level. When the matching engine processes a new order, it queries the order book to find potential counterparties. The order book structure enables efficient lookup of the best available prices and calculation of how much liquidity exists at each level, essential for both market and limit order matching.

Price Accuracy Through Order Matching

Price accuracy through order matching results from the continuous process of matching buy and sell orders at equilibrium prices. As matching occurs, the executed prices reflect the true market supply and demand at that moment. High-quality matching systems maintain accurate pricing by efficiently processing orders and updating the order book state to reflect current market conditions.

Liquidity Impact on Order Matching in DEX

Liquidity and Order Matching Efficiency in DEX

Liquidity impact on order matching fundamentally determines execution quality across the platform. Deep liquidity enables orders to match quickly at favorable prices, while shallow liquidity results in larger price impacts and potentially unfilled orders. Order matching efficiency in DEX directly correlates with available liquidity, making liquidity provision a critical factor for platform success. For insights on launching tokens that can enhance your trading ecosystem, explore our guide on decentralized exchange launchpad platforms.

Slippage and Order Matching in DEX

Slippage and order matching in DEX are intrinsically linked through liquidity availability. Slippage occurs when order execution prices differ from expected prices due to insufficient liquidity at desired price levels. Larger orders experience more slippage as they consume liquidity across multiple price levels. Effective matching systems implement slippage protection mechanisms that prevent trades from executing at prices significantly worse than expected.

Order Matching for Large Trade Volumes

Order matching for decentralized exchanges handling large trade volumes requires specialized approaches to minimize market impact. Techniques include order splitting to distribute execution across time, iceberg orders that hide total size, and algorithmic execution strategies. These mechanisms help large traders achieve better average prices while reducing the visible footprint of their orders in the market.

Risk Consideration: Large orders in low-liquidity markets can experience significant slippage that substantially affects execution quality. Always check available liquidity depth before placing large orders, and consider using limit orders with appropriate price boundaries to protect against unfavorable execution. Understanding liquidity conditions is essential for effective trading.

Security and Transparency in DEX Order Matching

Secure Order Matching in Decentralized Exchanges

Secure order matching in decentralized exchanges relies on cryptographic principles and smart contract logic to protect users from manipulation and fraud. Unlike centralized systems where users must trust the exchange operator, DEX matching systems operate according to immutable code that anyone can audit. This security model ensures that matching decisions cannot be manipulated by any single party.

Trustless Order Execution in DEX

Trustless order execution in DEX eliminates counterparty risk through atomic swap mechanisms that ensure trades either complete fully or not at all. Smart contracts hold assets in escrow and release them only when matching conditions are satisfied. This approach protects traders from partial fills with stuck orders and ensures that both parties receive their expected assets upon successful execution.

Transparency in Order Matching Process

Transparency in the order matching process enables users to verify that execution follows stated rules without favoritism or manipulation. All order matching logic in well-designed DEX platforms can be inspected and audited. This transparency creates accountability and trust that attracts users who value verifiable fairness over opaque centralized alternatives.

Common Challenges in DEX Order Matching

Scalability Issues in Order Matching System

Scalability challenges affect DEX order matching systems that struggle to handle increasing transaction volumes efficiently. On-chain matching faces inherent limitations from blockchain throughput, while off-chain systems require robust infrastructure to maintain performance under load. Addressing scalability requires careful architectural decisions and often involves trade-offs between decentralization and performance.

Delays in Order Execution

Delays in order execution can result from network congestion, complex matching logic, or insufficient system resources. These delays frustrate traders and can lead to missed opportunities or unfavorable execution prices. Minimizing execution delays requires optimized matching algorithms, efficient infrastructure, and sometimes architectural changes that prioritize speed while maintaining security.

Maintaining Order Matching Accuracy

Maintaining order matching accuracy requires careful handling of edge cases, race conditions, and system failures. Accurate matching ensures that orders execute at correct prices with proper quantities while preventing double-spending or orphaned orders. Rigorous testing, formal verification, and continuous monitoring help maintain matching accuracy even under adverse conditions.

Order Matching Architecture Selection Criteria

Speed Requirements

Target latency, throughput needs, user expectations

Decentralization Level

Full on-chain vs hybrid approaches, trust assumptions

Security Priority

MEV protection, front-running resistance, audit status

Cost Efficiency

Gas optimization, operational costs, user fees

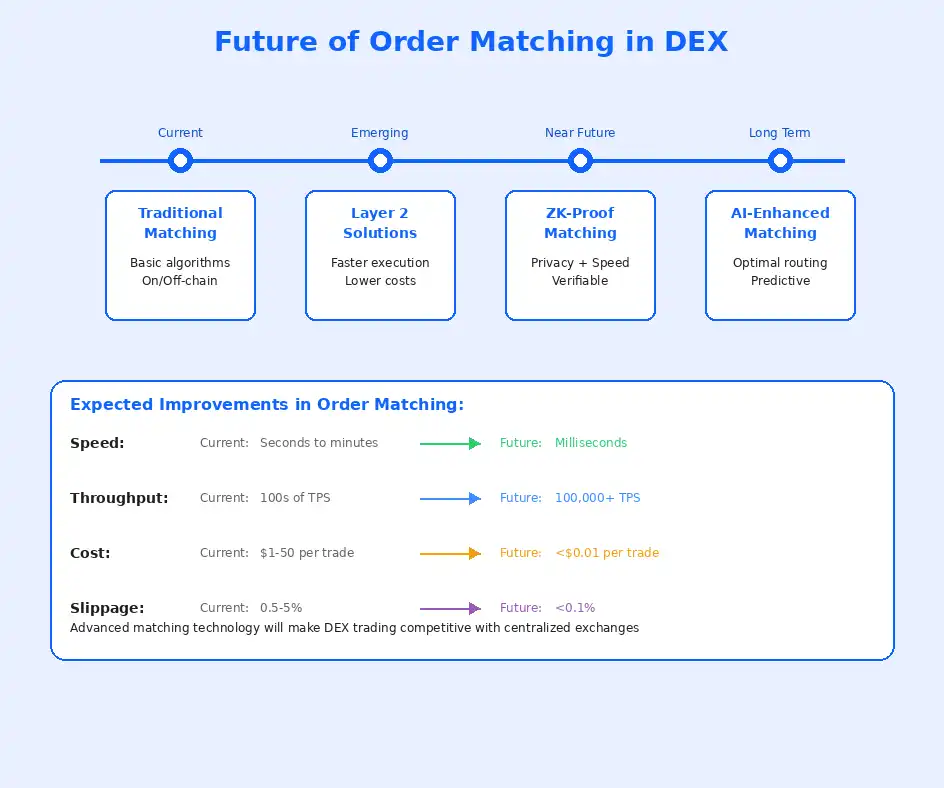

Future of Order Matching in Decentralized Exchanges

Improvements in Order Matching Mechanism

Future improvements in order matching mechanisms will focus on achieving centralized exchange performance while maintaining decentralized principles. Advances in layer 2 scaling, zero-knowledge proofs, and novel consensus mechanisms enable faster and more efficient matching without sacrificing transparency. These technological developments will transform what is possible for DEX order matching systems.

Enhancing Order Matching Efficiency in DEX

Enhancing order matching efficiency in DEX requires continued innovation in algorithm design, infrastructure optimization, and architectural improvements. Machine learning techniques may optimize matching decisions, while specialized hardware could accelerate computation. For projects seeking to build advanced trading infrastructure, our expertise in decentralized exchange solutions provides comprehensive capabilities.

Reducing Slippage Through Better Order Matching

Reducing slippage through better order matching involves improved liquidity aggregation, smarter order routing, and enhanced price discovery mechanisms. Future systems may leverage cross-platform liquidity pools, predictive analytics, and dynamic fee structures to minimize price impact for traders. These innovations will make DEX trading increasingly competitive with centralized alternatives.

Ready to build a high-performance crypto exchange with optimized order matching

Our expert team delivers secure, scalable solutions tailored to your requirements

Launch Your Exchange Now

Conclusion

Order matching in decentralized exchanges represents the critical infrastructure that enables trustless trading in the DeFi ecosystem. From the fundamental DEX order matching process to advanced concepts like on-chain and off-chain matching, understanding these mechanisms is essential for traders, developers, and platform operators alike. The quality of order matching directly impacts trade execution, price accuracy, and overall user experience.

The choice between different order matching approaches involves carefully weighing trade-offs between speed, decentralization, security, and cost. On-chain matching maximizes transparency while off-chain solutions enable faster execution. Liquidity impact on order matching underscores the importance of deep markets for efficient execution, while security considerations demand robust smart contract design and thorough auditing.

As the DeFi ecosystem continues to mature, order matching technology will evolve to deliver increasingly competitive performance while maintaining the trustless principles that define decentralized trading. Future improvements in scalability, efficiency, and slippage reduction will expand what is possible for DEX platforms, ultimately benefiting all participants in the decentralized finance ecosystem. Understanding these fundamentals positions traders and builders to capitalize on opportunities as the technology advances.

Frequently Asked Questions

Order matching in decentralized exchanges is the process of pairing buy and sell orders based on price and quantity criteria to execute trades. The DEX order matching system uses algorithms to find compatible orders and facilitate trades between users without requiring a central authority. This mechanism ensures that traders receive fair prices while maintaining the trustless nature of decentralized trading.

How order matching works in decentralized exchanges involves collecting orders from traders, organizing them by price and time priority, and then matching compatible buy and sell orders. The order matching process in DEX can occur either on-chain through smart contracts or off-chain with on-chain settlement. The matching engine in decentralized exchanges continuously scans for matching opportunities to execute trades efficiently.

On-chain order matching processes all matching logic directly on the blockchain, providing maximum transparency but with higher latency and gas costs. Off-chain order matching handles the matching process on external servers for faster execution, with only final settlements recorded on-chain. Each approach offers different trade-offs between speed, cost, transparency, and decentralization that platforms choose based on their priorities.

The importance of order matching in DEX lies in its direct impact on trade execution quality, price accuracy, and user experience. Effective decentralized exchange order matching ensures traders receive fair prices without excessive slippage while maintaining platform liquidity. Poor order matching can lead to failed trades, unfavorable prices, and ultimately drive users away from the platform.

Market order matching in DEX executes trades immediately at the best available price, prioritizing speed over price specificity. Limit order matching in DEX only executes when the specified price condition is met, giving traders control over their entry or exit prices. Both order types serve different trading strategies and require different handling by the order matching mechanism in DEX.

Liquidity impact on order matching determines how efficiently orders can be filled and at what prices. Higher liquidity enables faster order matching with minimal slippage, while low liquidity can cause significant price impact for larger orders. Order matching efficiency in DEX depends heavily on maintaining adequate liquidity across trading pairs to ensure smooth trade execution.

Slippage and order matching in DEX are directly related, with slippage occurring when the executed price differs from the expected price due to market movement or insufficient liquidity. Large orders or low-liquidity pools experience more slippage as they consume multiple price levels to fill completely. Advanced order matching systems implement slippage protection mechanisms to limit unfavorable price execution.

Secure order matching in decentralized exchanges relies on smart contract logic that executes trades without requiring trust in any central party. The transparent nature of blockchain ensures all matching logic is verifiable and auditable by anyone. Trustless order execution in DEX protects users from manipulation while maintaining the integrity of the matching process through cryptographic verification.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.