Key Takeaways

- To buy cryptocurrency, start by choosing a reputable crypto trading platform, completing identity verification, depositing fiat funds, and placing your first market or limit order.

- The safest way to buy and sell crypto is through a regulated exchange with two-factor authentication, cold storage for funds, and encrypted data protocols.

- Beginner crypto trading should focus on understanding order types (market vs limit), managing risk with stop-losses, and starting with small, manageable positions.

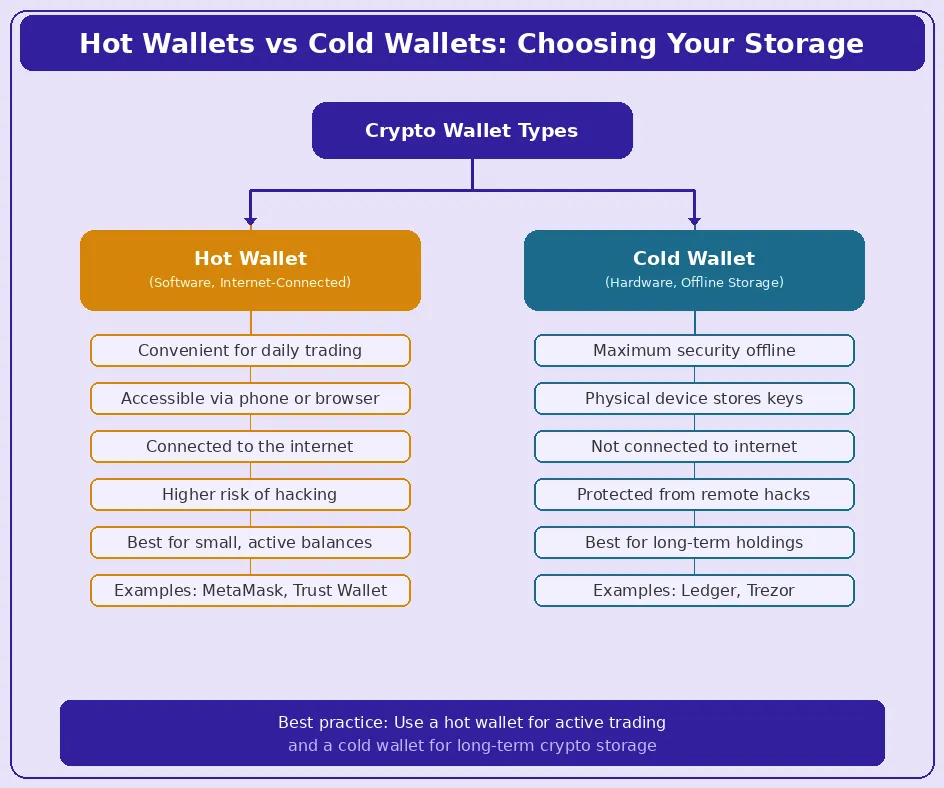

- Hot wallets are convenient for frequent trading, while cold wallets (hardware devices) are essential for securing long-term crypto holdings offline.

- Before you trade cryptocurrency, learn the difference between spot trading, margin trading, and futures trading to match your risk tolerance and experience level.

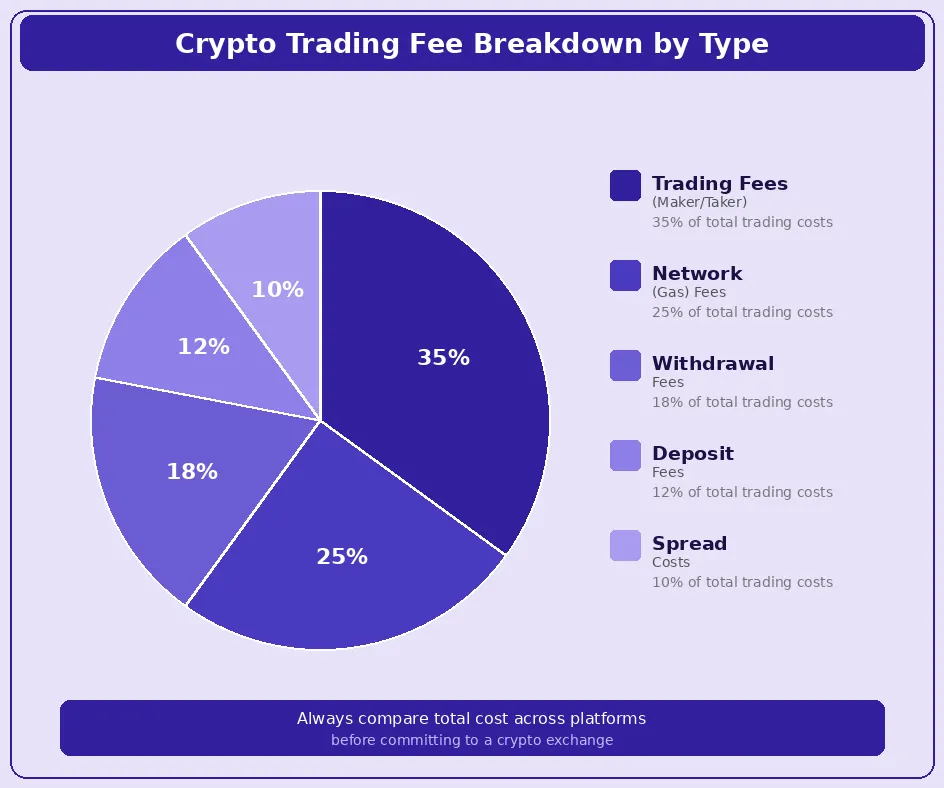

- Cryptocurrency trading fees, including maker-taker fees, withdrawal charges, and network gas fees, vary widely across platforms and directly impact profitability.

- Selling cryptocurrency involves placing a sell order on your exchange, converting to fiat currency, and withdrawing to your linked bank account, typically within one to three business days.

- Risk management techniques like stop-loss orders, portfolio diversification, and position sizing are critical tools for anyone entering cryptocurrency trading.

Getting into crypto does not have to be overwhelming. Whether you want to buy cryptocurrency for the first time, sell cryptocurrency at the right moment, or trade cryptocurrency with a clear strategy, this step-by-step guide walks you through every stage of the process. From choosing the right cryptocurrency exchange to securing your wallet and placing your first order, every detail is covered so you can move forward with clarity and confidence.

What Is Cryptocurrency Trading?

Cryptocurrency trading is the act of speculating on the price movements of digital assets through a cryptocurrency exchange, or buying and selling the underlying coins themselves. Unlike traditional stock markets, crypto markets operate 24 hours a day, seven days a week, which means opportunities (and risks) are always present. Whether you are looking to how to buy crypto for investment purposes or how to trade crypto actively for short-term gains, understanding the fundamental mechanics is the first step.

At its core, cryptocurrency trading involves two parties: a buyer and a seller. The exchange acts as a marketplace where these parties connect. Prices are determined by supply and demand. When more people want to buy cryptocurrency than sell it, the price goes up. When selling pressure outpaces buying interest, the price drops. This dynamic plays out across thousands of digital assets around the clock.

Understanding Cryptocurrency Investment Basics

Before diving into active trading, it helps to understand the investment landscape. Cryptocurrencies like Bitcoin and Ethereum serve as both stores of value and utility tokens within their respective ecosystems. Investing in crypto can mean simply buying and holding (often called “HODLing”), or it can involve active trading strategies designed to profit from price fluctuations.

The investment thesis varies depending on the asset. Bitcoin is often compared to digital gold due to its fixed supply of 21 million coins. Ethereum, on the other hand, powers a vast ecosystem of decentralized applications and smart contracts, giving it a fundamentally different value proposition. Understanding the core mechanics behind digital currencies is essential before committing capital to any position.

How Cryptocurrency Exchanges Work

A cryptocurrency exchange is a digital marketplace where you can buy cryptocurrency, sell cryptocurrency, and trade cryptocurrency against other digital assets or fiat currencies. Exchanges maintain order books that match buy and sell orders, provide wallet services for storing assets, and handle the execution of trades. They are the primary gateway for most people entering the crypto space.

The quality of a cryptocurrency exchange matters enormously. Factors like security infrastructure, trading volume, fee structure, supported assets, and regulatory compliance all determine whether your experience will be smooth or problematic. This is why platforms that are engineered with institutional-grade trading architecture tend to offer better execution, deeper liquidity, and stronger trust from users.

Centralized vs Decentralized Crypto Exchanges

Centralized exchanges (CEXs) are operated by companies that manage the platform, hold user funds, and facilitate trades. They offer high speed, deep liquidity, fiat on-ramps, and customer support. Examples include platforms similar to Coinbase, Binance, and Kraken. Decentralized exchanges (DEXs) operate through smart contracts on a blockchain, allowing peer-to-peer trading without a central intermediary. They prioritize user custody and privacy but often have higher slippage and fewer trading pairs.

For most beginners, centralized exchanges provide the most accessible entry point. They handle the complexity of matching engines, order routing, and custody behind a simple interface. As you gain experience, exploring decentralized platforms can offer additional flexibility and control over your assets.

Things to Know Before You Buy Cryptocurrency

Before you buy cryptocurrency, preparation is everything. Rushing in without understanding the landscape can lead to avoidable mistakes, from choosing the wrong platform to losing funds through poor security practices. This section covers the essential groundwork every new participant should complete before placing their first order.

Choosing the Right Cryptocurrency Exchange

Selecting the right crypto trading platform is the most important decision you will make early on. The exchange you choose determines your trading experience, your fee structure, the security of your funds, and the range of assets available to you. Look for platforms that are licensed or regulated in your jurisdiction, offer robust security features, and maintain high trading volumes for the pairs you are interested in.

Pay attention to user reviews, the platform’s track record on security incidents, and whether they offer responsive customer support. A well-chosen cryptocurrency exchange should feel like a reliable partner in your trading journey, not a source of anxiety.

Security Features of a Crypto Trading Platform

Security is non-negotiable. The safest way to buy and sell crypto starts with choosing a platform that implements multi-layered protection. Essential security features include two-factor authentication (2FA), cold storage for the majority of user funds, encrypted data transmission, withdrawal whitelisting, and anti-phishing codes. Some platforms also offer insurance on custodial assets, adding an additional layer of protection.

Beyond platform security, your personal security habits matter just as much. Use unique, complex passwords, never share your seed phrase, and be cautious of phishing attempts disguised as official communications from your exchange.

Fees and Liquidity in Crypto Exchanges

Every trade you make on a cryptocurrency exchange comes with a cost. Trading fees are typically charged as a percentage of the transaction value, usually following a maker-taker model. Makers (who add liquidity by placing limit orders) generally pay lower fees than takers (who remove liquidity by placing market orders). Deposit fees, withdrawal fees, and blockchain network fees also apply and can vary significantly between platforms.

Liquidity is equally important. A platform with high liquidity ensures that your orders are filled quickly and at prices close to what you expect. Low liquidity leads to slippage, where the execution price differs from the quoted price. For anyone serious about cryptocurrency trading, choosing a platform with competitive fees and deep liquidity is a foundational step.

Setting Up a Secure Crypto Wallet

A crypto wallet stores the cryptographic keys that give you access to your digital assets. While exchanges offer built-in wallets for convenience, transferring your holdings to a personal wallet gives you complete control and significantly reduces the risk of losing funds to an exchange hack or insolvency event.

Hot Wallets vs Cold Wallets

Hot wallets are software-based wallets connected to the internet. They are convenient for active trading and quick transactions but are more vulnerable to hacking attempts. Cold wallets are hardware devices that store your keys offline, making them the most secure option for long-term storage. Many experienced traders use a combination: a hot wallet for day-to-day trading and a cold wallet for the bulk of their holdings.

Centralized vs Decentralized Exchange Comparison

| Feature | Centralized Exchange (CEX) | Decentralized Exchange (DEX) |

|---|---|---|

| Custody of Funds | Exchange holds user funds | User retains full custody |

| Speed | Very fast execution | Depends on network congestion |

| Liquidity | High (market makers, deep books) | Variable (pool-dependent) |

| Fiat Support | Yes (bank transfers, cards) | No (crypto-to-crypto only) |

| KYC Required | Yes | Usually No |

| Privacy | Limited (identity verified) | High (wallet-based access) |

| Best For | Beginners, fiat trading | Advanced users, DeFi traders |

Step-by-Step Guide to Buy Cryptocurrency

This step by step guide to buy cryptocurrency breaks the process into manageable stages. Follow these in order and you will go from zero to your first crypto purchase with full confidence.

Creating and Verifying Your Crypto Exchange Account

Start by selecting a trusted cryptocurrency exchange. Visit the platform’s website or download their official app. Register with your email address and create a strong, unique password. Most regulated exchanges require Know Your Customer (KYC) verification, which involves submitting a government-issued ID and proof of address. This process typically takes a few minutes to a few hours, depending on the platform.

Once verified, enable two-factor authentication immediately. This single step dramatically reduces the risk of unauthorized access to your account. Some platforms also let you set up withdrawal whitelists and anti-phishing codes for additional security.

Adding Funds to Buy Cryptocurrency

After your account is verified, you need to deposit funds before you can buy cryptocurrency. Most major exchanges support multiple deposit methods, giving you flexibility based on your region and preference.

Buying Crypto Using Fiat Currency

Fiat deposits are the most common method for first-time buyers. You can transfer funds from your bank account via wire transfer, ACH, or SEPA (depending on your region), or use a debit/credit card for instant deposits. Bank transfers typically have lower fees but take longer, while card payments are instant but carry higher processing charges. Once your fiat balance is available, you are ready to place your first order.

Buying Crypto Using Stablecoins

If you already hold stablecoins like USDT or USDC, you can deposit them directly to your exchange wallet and use them to buy cryptocurrency. Stablecoin pairs are available for virtually every major crypto asset, and trading against stablecoins often comes with lower fees than fiat pairs. This method is especially popular among experienced traders who keep a portion of their portfolio in stablecoins to take advantage of market dips quickly.

Placing Your First Crypto Buy Order

With funds in your account, navigate to the trading section, select the crypto asset you want to purchase, and choose your order type. For most beginners, a simple market order is the easiest way to get started. If you want more control over pricing, a limit order lets you set the exact price at which you want to buy.

Market Orders vs Limit Orders

A market order buys or sells immediately at the current best available price. It guarantees execution but not a specific price, which can result in minor slippage on volatile assets. A limit order allows you to specify the exact price you are willing to pay. The trade only executes if the market reaches your target price. Limit orders are preferred by traders who want precision, while market orders are ideal when speed is the priority.

Cryptocurrency Buying Lifecycle: From Account to First Trade

| Stage | Action | Key Consideration | Time Required |

|---|---|---|---|

| 1. Research | Compare exchanges and assets | Fees, security, supported regions | 1-2 hours |

| 2. Register | Create account, set strong password | Use a unique email for crypto | 5-10 minutes |

| 3. Verify (KYC) | Submit ID and proof of address | Required for fiat trading | 10 mins – 24 hours |

| 4. Secure Account | Enable 2FA, set withdrawal limits | Non-negotiable step | 5 minutes |

| 5. Deposit Funds | Bank transfer, card, or stablecoin | Compare deposit fees per method | Instant – 3 business days |

| 6. Place Order | Market order or limit order | Start small, learn the interface | Under 1 minute |

| 7. Secure Holdings | Transfer to personal wallet if holding long-term | Cold wallet for large amounts | 5-15 minutes |

How to Sell Cryptocurrency Safely

Knowing how to sell cryptocurrency is just as important as knowing how to buy. Selling at the right time, on the right platform, and with proper security measures can make the difference between locking in profits and losing value to fees, slippage, or poor timing.

When Is the Right Time to Sell Cryptocurrency?

Timing a sale perfectly is nearly impossible, but you can use strategies to make more informed decisions. Many traders sell when a pre-set price target is reached, when they need to rebalance their portfolio, or when market indicators suggest a downturn. Others use a dollar-cost averaging (DCA) approach in reverse, selling fixed amounts at regular intervals to gradually exit a position without trying to time the peak.

The key principle is to have a plan before you need to sell. Emotional selling, driven by fear during a dip or greed during a spike, is the most common mistake in cryptocurrency trading. Set your targets in advance and stick to them.

Step-by-Step Process to Sell Crypto on Exchanges

To sell cryptocurrency on an exchange, follow these steps: navigate to the trading section, select the asset you want to sell, choose the trading pair (e.g., BTC/USD or ETH/USDT), set your order type (market or limit), enter the amount, and confirm the sale. The proceeds will appear in your exchange wallet as fiat or stablecoin, depending on the pair you traded against.

Converting Cryptocurrency to Fiat

Once you have sold your crypto for fiat on the exchange, the funds sit in your fiat balance. From there, you can either use them to purchase other assets or withdraw to your bank account. The conversion process itself is straightforward: select a fiat pair, place the sell order, and the fiat equivalent is credited to your account balance after the trade executes.

Withdrawing Funds Securely

When withdrawing fiat from your exchange, double-check that your linked bank details are correct. Most platforms process withdrawals within one to three business days, though some offer same-day options for verified accounts. Always use withdrawal whitelisting if available, and be cautious of any unexpected withdrawal confirmation emails, as these could be phishing attempts.

How to Trade Cryptocurrency Like a Beginner

Learning how to trade cryptocurrency for beginners does not require an MBA in finance. It starts with understanding the basic types of trading, the tools available, and the discipline to manage risk. Beginner crypto trading is about building a foundation, not chasing quick profits.

Types of Cryptocurrency Trading

There are several ways to trade cryptocurrency, each with its own risk profile and complexity level. The three primary categories are spot trading, margin trading, and futures trading. Beginners should start with spot trading and only explore leveraged products after gaining significant experience.

Spot Trading in Crypto Markets

Spot trading is the simplest form of cryptocurrency trading. You buy an asset at the current market price and own it outright. You can hold it, sell it later, or transfer it to your wallet. There is no leverage involved, which means your risk is limited to the amount you invest. For anyone following this cryptocurrency trading guide as a beginner, spot trading is where you should spend your first several months.

Margin and Futures Trading Basics

Margin trading allows you to borrow funds to trade larger positions than your account balance would normally allow. Futures trading involves contracts that bet on the future price of an asset, without necessarily owning the underlying token. Both offer higher potential returns but come with significantly higher risk, including the possibility of losing more than your initial investment. These instruments are best left to experienced traders who understand liquidation mechanics and margin calls.

Understanding Crypto Market Trends

Successful cryptocurrency trading requires an understanding of market trends. Crypto markets move in cycles influenced by macroeconomic factors, regulatory news, technological milestones, and broader market sentiment. Learning to read these trends, whether through charts or fundamental research, gives you an edge in timing your entries and exits.

Technical Analysis vs Fundamental Analysis

Technical analysis (TA) uses historical price data and chart patterns to predict future price movements. Tools like moving averages, RSI, MACD, and support/resistance levels are staples of technical trading. Fundamental analysis (FA) evaluates the intrinsic value of a cryptocurrency based on its technology, team, adoption, tokenomics, and competitive positioning. Most successful traders use a combination of both.

Crypto Trading Types Comparison

| Criteria | Spot Trading | Margin Trading | Futures Trading |

|---|---|---|---|

| Risk Level | Low to Moderate | High | Very High |

| Leverage | None (1:1) | 2x to 10x typical | Up to 125x on some platforms |

| Ownership | You own the asset | Borrowed funds used | Contract-based (no ownership) |

| Liquidation Risk | None | Yes (if margin falls below threshold) | Yes (forced closure possible) |

| Best For | Beginners, long-term holders | Intermediate traders | Advanced/professional traders |

| Capital Requirement | Low (start with $10+) | Moderate (collateral needed) | Variable (margin deposit required) |

Common Crypto Trading Strategies for Beginners

Having a strategy is what separates informed trading from gambling. For beginners, the best approach is to start simple, manage risk aggressively, and scale complexity as your understanding deepens. A reliable cryptocurrency trading guide will always emphasize strategy and discipline over chasing trends.

Long-Term vs Short-Term Crypto Trading

Long-term trading (often called position trading or investing) involves buying and holding assets for weeks, months, or years, based on the belief that their value will increase over time. Short-term trading includes day trading, swing trading, and scalping, all of which require more active management and a deeper understanding of technical analysis.

For most people new to beginner crypto trading, a long-term approach combined with dollar-cost averaging is the least stressful and most forgiving strategy. It removes the pressure of timing the market perfectly and allows you to benefit from the overall growth trajectory of the crypto market.

Risk Management in Cryptocurrency Trading

Risk management is the single most important skill in cryptocurrency trading. Without it, even the best trade ideas can result in devastating losses. The goal is not to avoid risk entirely, but to manage it so that no single trade or event can significantly damage your portfolio.

Setting Stop-Loss and Take-Profit Levels

A stop-loss order automatically sells your position if the price drops to a level you define, limiting your downside. A take-profit order locks in gains by selling when the price reaches your target. Using both on every trade is a discipline that protects your capital and removes emotional decision-making from the process. Most experienced traders risk no more than 1-2% of their total portfolio on any single trade.

Crypto Trading Platform Selection Criteria

Choosing the best crypto trading platform depends on your experience level, trading goals, and geographic location. Here is a framework to evaluate your options systematically.

| Selection Criteria | Beginner Priority | Advanced Trader Priority |

|---|---|---|

| User Interface | Simple, clean, guided experience | Advanced charting, customizable layout |

| Security Features | 2FA, cold storage, insurance | 2FA, API security, withdrawal controls |

| Fee Structure | Transparent, low flat fees | Competitive maker-taker model |

| Asset Range | Major coins (BTC, ETH, SOL) | Hundreds of pairs, DeFi tokens |

| Trading Tools | Market/limit orders, basic charts | Margin, futures, API, bots |

| Regulatory Compliance | Licensed in user’s jurisdiction | Licensed with global reach |

Risks Involved in Buying, Selling, and Trading Crypto

Every form of investing carries risk, and cryptocurrency is no exception. In fact, the crypto market’s unique characteristics, including 24/7 trading, extreme volatility, and evolving regulatory frameworks, make risk awareness even more critical. Being informed about these risks is not about being fearful; it is about being prepared.

Crypto Market Volatility Explained

Cryptocurrency prices can swing by double-digit percentages within a single day, sometimes within hours. This volatility is driven by factors including market sentiment, regulatory announcements, macroeconomic shifts, whale activity (large holders moving funds), and liquidity gaps. While volatility creates opportunities for traders, it also means that the value of your holdings can decrease rapidly.

For anyone learning how to trade cryptocurrency for beginners, understanding that volatility is a constant feature of this market, not a temporary bug, is essential. Position sizing and stop-losses are your primary defenses against unexpected moves.

Security Risks in Crypto Trading

Security risks in crypto range from exchange hacks and phishing attacks to SIM-swap fraud and malware targeting wallet software. Unlike traditional banking, crypto transactions are irreversible. If your funds are stolen, recovery is extremely unlikely. This makes proactive security the single most important habit you can build as a crypto participant.

Avoiding Scams and Fraud in Crypto Exchanges

Scams in crypto take many forms: fake exchanges, Ponzi schemes disguised as yield platforms, impersonation scams on social media, and fraudulent token launches. The golden rule is to never invest in anything you do not fully understand, and never send funds to an address or platform you have not independently verified. Using established, regulated exchanges is the first line of defense against fraud. When in doubt, resources like a trusted platform evaluation guide can help you vet options properly.

Best Practices for Safe Crypto Buying and Selling

The safest way to buy and sell crypto is a combination of choosing the right platform, implementing strong personal security, and maintaining disciplined trading habits. Here are the practices that form the foundation of safe participation in crypto markets.

Using Secure Crypto Trading Platforms

Always verify that a platform is licensed in your region, has a transparent security track record, and offers features like cold storage, 2FA, and encrypted communications. Read third-party security audits when available, and check whether the platform has an insurance fund to protect against losses from breaches. The effort you invest in selecting a secure cryptocurrency exchange pays dividends in peace of mind and asset protection.

Protecting Your Crypto Wallet and Private Keys

Your private keys are the only thing standing between your assets and a thief. Never store them digitally in plain text, never share them with anyone, and never enter them on a website you did not navigate to yourself. Use hardware wallets for long-term holdings, keep recovery seed phrases in a secure physical location (not on your phone or cloud), and consider using a passphrase for additional protection.

Building a crypto exchange that earns user trust requires a deep commitment to security architecture, regulatory compliance, and seamless trading infrastructure from the ground up.

Getting Started with Cryptocurrency Trading

If you have read this far, you have the knowledge foundation you need to begin. The next step is action. Start small, stay disciplined, and treat every trade as a learning experience. The crypto market rewards patience, preparation, and consistency more than it rewards bravado or speculation.

Tips to Start Crypto Trading with Confidence

Begin with a clear goal: are you investing for the long term, or do you want to trade actively? Choose one or two assets to start with, preferably large-cap tokens like Bitcoin or Ethereum that have deep liquidity and abundant market analysis available. Set a budget you are comfortable potentially losing. Use a step by step guide to buy cryptocurrency like this one to walk through each stage methodically, and resist the urge to make impulsive decisions based on social media hype or fear.

Education is ongoing. Follow reputable sources, subscribe to market analysis newsletters, and consider paper trading (simulated trading without real funds) to test strategies before putting real money on the line. Practical resources for secure Bitcoin purchasing practices can also reinforce your confidence as you take your first steps.

Build a Secure & Scalable Crypto Exchange Platform

Launch your crypto exchange with a secure, scalable, and high-performance trading platform built to grow with your business.

Launch Your Exchange Now

Choosing the Best Crypto Trading Platform

Your choice of platform sets the tone for your entire trading experience. Revisit the selection criteria table above and evaluate at least three platforms before committing. Look for a crypto trading platform that matches your current experience level while offering room to grow. A platform that is excellent for beginner crypto trading should offer simple buy/sell flows, educational content, and responsive support, while also providing advanced tools you can graduate to as your skills improve.

The best platforms balance accessibility with depth. They make it easy to how to buy crypto with a few clicks, but also offer professional-grade charting, API access, and sophisticated order types for when you are ready. Security, liquidity, regulatory standing, and fee transparency should always be your top-line evaluation criteria when selecting where to trade cryptocurrency.

Frequently Asked Questions

The easiest way to buy cryptocurrency as a beginner is to sign up on a reputable cryptocurrency exchange, complete your identity verification, and deposit fiat currency using a bank transfer or debit card. Once funded, you can place a simple market order to purchase Bitcoin, Ethereum, or any other supported token instantly. Choosing a platform with a clean interface and strong security features makes the entire process smooth and stress-free.

To sell cryptocurrency and withdraw to your bank, navigate to the trading section of your exchange, select the crypto you want to sell, and place a sell order against your preferred fiat pair. Once the sale is executed, the fiat funds appear in your exchange balance. You can then initiate a bank withdrawal, which typically takes one to three business days depending on your region and the exchange’s processing speed.

A centralized exchange is operated by a company that manages the order book, holds user funds, and handles transactions on behalf of users. A decentralized exchange runs on smart contracts and allows peer-to-peer trading without a central intermediary, giving users full custody of their assets. Centralized exchanges typically offer faster speeds and more trading pairs, while decentralized exchanges prioritize privacy and user control.

Trading cryptocurrency online is safe when you use a regulated, reputable crypto trading platform with strong security protocols like two-factor authentication, cold storage, and encryption. The risks increase when users neglect basic practices like securing private keys, using weak passwords, or trading on unverified platforms. Staying with well-known exchanges and enabling every available security layer is the safest approach to crypto trading.

Common fees include trading fees (a percentage of each transaction), deposit and withdrawal fees, and network fees charged by the blockchain itself. Maker-taker fee models are standard on most platforms, where makers (who add liquidity) pay lower fees than takers (who remove liquidity). Comparing fee structures across exchanges before committing is essential, as these costs directly affect your overall returns.

A market order executes immediately at the best available price, making it ideal when you want to buy or sell cryptocurrency quickly. A limit order lets you set a specific price at which you want to buy or sell, and the order only executes if the market reaches that price. Limit orders give you more control over pricing but may not fill immediately, while market orders guarantee execution but not the exact price.

You can start trading cryptocurrency with as little as $10 to $50 on most major exchanges. There is no minimum portfolio size required, and many platforms allow fractional purchases of high-value tokens like Bitcoin. Starting small is actually recommended for beginners, as it lets you learn the mechanics of trading without exposing yourself to significant financial risk.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.