Imagine this: you see the headline, “Bitcoin hits new all-time high in 2025”, and you think, “Now’s my chance.” But then you pause. Because along with the upside comes risk, confusion, and scams. If you’re going to step into the world of Bitcoin, you don’t just want to buy; you want to buy safely. This article walks you through exactly how to do that: from choosing the right platform, verifying your identity, securing your holdings, managing risk, and staying compliant with regulations.

Establish your foundation: what “safe” means

Reputable sources emphasize that safety in crypto isn’t optional. For example, one guide says: “The first step is to choose a secure and reputable platform… their levels of security can vary significantly.”

Another highlight of storage: once your Bitcoin is purchased, “security is everything.”

Keeping these three pillars in mind will guide the rest of the process.

Understand why you’re buying and how much to risk

Before even pressing “Buy,” ask: What is my goal? Long-term store of value? Short-term speculation? Diversification?

Resources like the article by NerdWallet emphasize: “Be sure to take the time to consider whether you have the stomach for such a volatile asset.”

In other words: only invest what you can afford to lose. Set an amount you’re comfortable with, and resist the pressure to throw in more just because of FOMO.

Choose the right platform to buy Bitcoin

There are multiple routes, but not all are equal in terms of safety, usability, and regulation.

a. Centralized Exchanges (CEX)

These are user-friendly, provide liquidity, and often support fiat→crypto routes.

For instance, on Kraken, the steps are: sign up, choose payment method, click “Buy Crypto”, choose Bitcoin, enter amount, complete order.

Another guide notes that in 2025, there are dozens of exchanges of varying quality: “The most common way to buy Bitcoin… especially for beginners” is via an exchange.

Safety markers:

- Strong reputation & longevity.

- Good security features (2-factor auth, cold storage, insurance).

- Transparent fee structure & regulatory compliance.

- Good reviews & customer service (check user complaints).

b. Decentralized Exchanges (DEX) / Peer-to-Peer / Non-KYC options

These offer more privacy, but also greater risk and complexity.

For example, one “safe buying” article lists DEXs and P2P as options, but warns they have trade-offs: “KYC is unnecessary … but increased potential of frauds.”

If you go this route, you must be more self-reliant: you’re managing your own keys, verifying counterparties, and accepting elevated responsibility.

c. Payment/deposit methods

How you fund your purchase matters. Credit/debit cards are fast; bank transfers are slower. One source says: “Your first step … is to choose a form of payment… credit cards, mobile apps, bank transfers, or even cash at physical Bitcoin ATMs.”

Higher fees or limited protection may apply depending on the method; make sure you understand them.

d. Platform selection checklist

- Is the exchange/wallet regulated in your region (India)?

- What is their KYC / AML policy?

- Where is the company based? What happens if they go bust?

- Is there clear transparency (audits, public statements)?

- What are the deposit/withdrawal fees and limits?

- How is your data protected?

Good lists of “secure platforms for 2025” include Coinbase, Kraken, etc.

Tip for India: Choose platforms that are legally compliant in India (and accept INR deposit or have a reliable forex route).

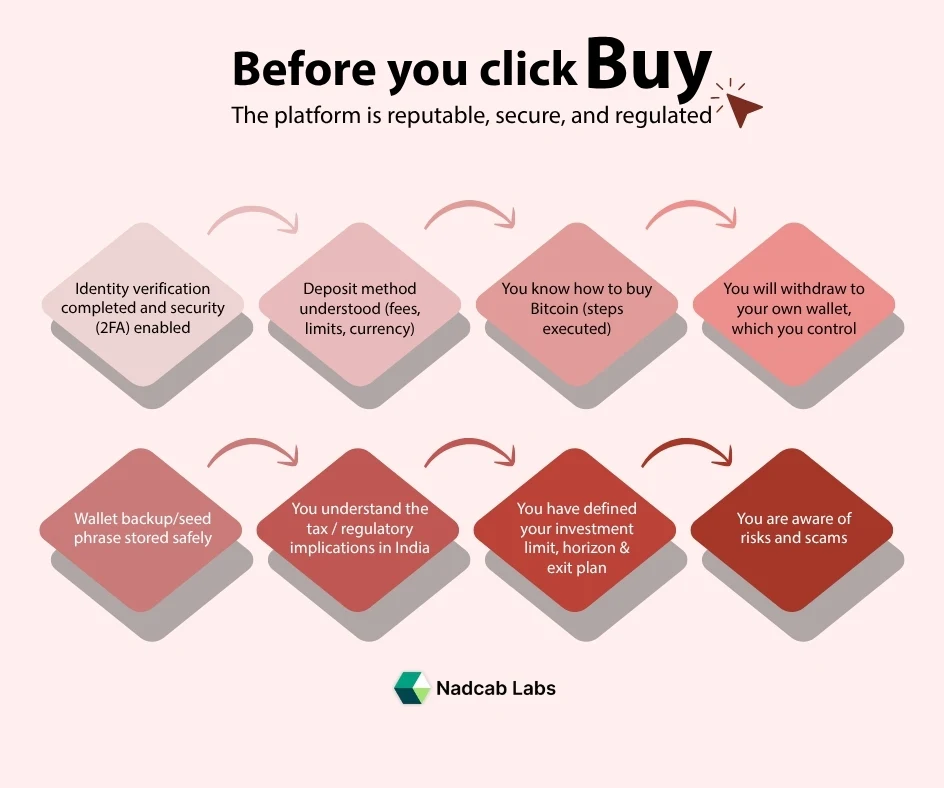

Walk-through: Step-by-step to buy Bitcoin safely

Here’s a more concrete sequence you can follow:

- Verify your identity (on a regulated exchange) and enable security features (2FA, strong password).

- Deposit fiat currency (INR or USD via bank transfer) or use a reliable payment method.

- Select Bitcoin (BTC) from the asset list, decide the amount to invest, review fees & order details.

- Execute the purchase, confirm the order, and check what you are receiving vs the fee. (See Kraken: Steps 1-6)

- Withdraw to your own wallet (strongly recommended). This means moving from the exchange to a wallet where you control the private keys.

- Secure your wallet: if a hardware wallet, it is safe in a physical place; if a software wallet, ensure you have backups, PIN/passphrase stored safely and offline.

- Monitor & follow best practices: keep software updated, never share private keys or seed phrase, verify website URLs to avoid phishing.

Buy Bitcoin the Smart & Secure Way with Expert Guidance from Nadcab Labs

Step confidently into the world of Bitcoin. Our experts guide you through every step, from choosing the right exchange to setting up a secure wallet and managing your investment safely

Storage & security: You bought it, now protect it

Buying is half the job; keeping it safe is the other half.

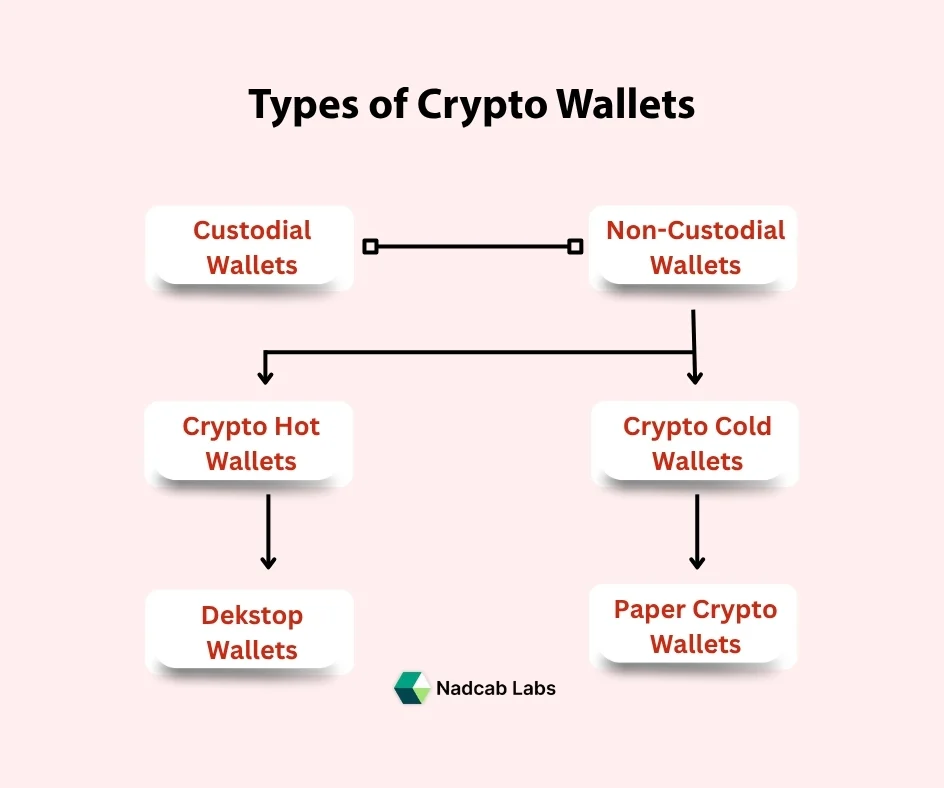

- Hot wallet (online) vs. Cold wallet (offline): Cold wallets are safer for long-term storage. One older but valid guide: “A cold wallet isn’t connected to the Internet and is less likely to be compromised.”

- Backup your seed phrase/keys in multiple safe locations; consider using a fire-safe or bank vault.

- Use hardware wallets (e.g., Ledger, Trezor) if holding a significant amount.

- Enable multi-factor authentication on all Exchange accounts; prefer passkeys where available.

- Beware of phishing, fake apps, and impersonation. Scams around Bitcoin and crypto are increasing sharply in 2025.

- Keep your investment portfolio diversified, don’t put all your savings in Bitcoin.

Regulation, taxation & local context (India view)

Since you are in Lucknow, Uttar Pradesh, India, you should take note of the Indian regulatory and tax environment:

- India’s tax rules for crypto: ensure you document your purchases, record dates & amounts, and understand that crypto gains may be taxed.

- Ensure you use a platform that is compliant with Indian laws (KYC, AML).

- Understand that crypto regulation is still evolving globally; safe zones today may shift tomorrow.

- Consider currency conversion risk if using USD-based platforms.

Because regulation influences safety, e.g., a regulated exchange failing is less risky than an obscure non-licensed one.

Complete KYC Verification (Only on Trusted Platforms)

In 2025, almost every regulated cryptocurrency exchange requires KYC (Know Your Customer) verification to comply with global AML and security laws. KYC protects users from fraud, unauthorized access, and financial crime by confirming your identity through personal details, government-issued ID, and a live selfie check.

For maximum safety, complete KYC only on reputable crypto exchanges that use strong encryption, transparent privacy policies, and secure data storage. Never upload your documents through unknown links, DMs, or social media, as these are common phishing traps in the crypto space.

Risk management & exit strategy

Don’t buy without thinking about how you’ll exit or how much risk you’re willing to hold.

- Set an investment limit (e.g., 1-5 % of your total portfolio).

- Decide your time-horizon: is this a 5-year hold, or short term?

- Use dollar-cost averaging (DCA) rather than a lump sum if you’re unsure. One article notes this as a strategy: “look at exchanges that have an auto-investment feature… set up regular deposits.”

- Be prepared for volatility. The NerdWallet piece: “Bitcoin has traded … be sure to take the time to consider whether you have the stomach for such a volatile asset.”

- Have an exit plan: when will you sell (profit target, stop-loss)?

- Stay updated on regulatory or platform risks that might force you to act.

Avoiding common mistakes & scams

Some common pitfalls to avoid:

- Leaving Bitcoin on an exchange long-term (risk if the exchange collapses).

- Using weak passwords or not enabling 2FA.

- Falling for “too good to be true” offers (guaranteed returns, celebrity endorsements). With scams rising, especially via social media.

- Not verifying website URLs, phishing sites mimic popular exchanges.

- Ignoring fees (which can eat into small buys). For example, the NerdWallet breakdown shows fees vary widely by method.

- Not keeping clear records (for tax, audit, or future reference).

Final thoughts

Buying Bitcoin in 2025 can offer opportunities, whether as a store of value, hedge, or diversification. However, the environment is more mature, more regulated, and more competitive, which means safety matters even more. By following the steps above, you’re aligning with best practices: using credible platforms, controlling your keys, managing risk, and staying informed.

As one recent guide summarised: “The world of cryptocurrency is becoming more advanced… this article will detail the safest and easiest ways to purchase cryptocurrency in 2025.”

In other words: safe buying isn’t passive; it’s deliberate, informed, and proactive.

Frequently Asked Questions

Avoid scams by ignoring offers that promise guaranteed returns, double-checking URLs before logging in, and never sharing your private keys or seed phrase. Stick to verified apps, avoid social media giveaways, and always research the platform before transferring funds.

The safest way to buy Bitcoin in 2025 is through a regulated and reputable exchange that offers strong security features, such as two-factor authentication and cold storage. Always complete KYC verification, use secure payment methods, and withdraw your Bitcoin to a personal wallet where you control the private keys.

Beginners in India can buy Bitcoin safely by using legally compliant crypto exchanges that support INR deposits. Platforms like CoinDCX, WazirX, and Kraken are popular choices. Ensure you verify your identity, enable 2FA, and follow RBI and tax regulations when recording transactions.

Only invest what you can afford to lose. Bitcoin is highly volatile, so most experts recommend starting small, around 1–5% of your total portfolio. Use dollar-cost averaging (DCA) to spread out purchases over time instead of buying in a single lump sum.

It’s best to store your Bitcoin in a private wallet, not on an exchange. While exchanges are convenient for trading, they’re also targets for hackers. Use a hardware wallet (cold storage) for long-term holdings and keep your seed phrase backed up securely offline.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.