Key Takeaways

- A bitcoin paper wallet is offline cold storage that holds a public address and private key (often as QR codes).

- Public key = receive BTC; private key = full control. If someone gets the private key, they can spend your Bitcoin.

- Security depends on how you generate it: create keys offline using trusted, open-source tools and strong randomness.

- Paper wallets don’t “store” coins Bitcoin stays on-chain; the wallet stores the key needed to move funds.

- Sweeping is safer than importing: sweep funds to a new wallet and treat the paper wallet as single-use.

- Main risks are physical loss/damage and human error (printing risks, poor backups, compromised generators).

- In 2026, hardware wallets are best for most users, while paper wallets fit niche needs like long-term storage or small BTC gifts.

- Use redundancy: keep multiple secure backups in different locations; never store photos/scans of your private key online.

What Is a Bitcoin Paper Wallet?

A bitcoin paper wallet is a physical document containing a Bitcoin address and its corresponding private key, typically printed as QR codes or alphanumeric strings. Unlike Cryptocurrency wallets stored on computers or smartphones, a paper wallet exists entirely offline, representing one of the purest forms of cold storage in the cryptocurrency ecosystem.

The term “paper” wallet derives from the most common medium used to record this information physical paper. However, the concept extends beyond paper itself. Some users engrave keys on metal plates, etch them into wood, or use other durable materials to create long-lasting offline storage solutions. The critical characteristic isn’t the material but rather the complete disconnection from internet-connected devices.

Understanding Public and Private Keys

To comprehend how a bitcoin paper wallet functions, you must first understand the fundamental cryptographic components of Bitcoin:

Public Key (Bitcoin Address): Think of this as your bank account number. It’s the address you share with others to receive Bitcoin. This 26-35 character string typically begins with “1,” “3,” or “bc1” and can be freely distributed without security concerns. Anyone can send Bitcoin to this address, but they cannot withdraw funds from it.

Private Key: This is equivalent to your account password and PIN combined. It’s a 64-character hexadecimal string (or 51-52 characters in Wallet Import Format) that provides complete control over the Bitcoin associated with the public address. Anyone possessing this key can spend the Bitcoin, making its security absolutely critical.

Ownership on the Bitcoin blockchain operates through mathematical proof rather than traditional account systems. When you create a bitcoin paper wallet, you’re generating a cryptographic key pair. The blockchain doesn’t store your identity or personal information it only recognizes that whoever can produce a valid signature using the private key controls the associated Bitcoin. This principle makes paper wallets particularly appealing for those who prioritize privacy and self-custody.

How a Bitcoin Paper Wallet Works

The operational mechanics of a bitcoin paper wallet involve a carefully orchestrated process of key generation, secure storage, and eventual access when needed. Understanding each phase helps users appreciate both the security benefits and potential vulnerabilities of this storage method.

Generating a Public and Private Key Pair

Key generation relies on cryptographically secure random number generation. The process typically uses your computer’s random number generator combined with mouse movements, keyboard inputs, or other entropy sources to create a truly random private key. From this private key, the corresponding public address is mathematically derived through elliptic curve cryptography—specifically, the secp256k1 curve used by Bitcoin.

The beauty of this system lies in its one-way nature. While generating a public key from a private key is computationally straightforward, deriving a private key from a public address is practically impossible with current technology. This mathematical asymmetry forms the foundation of Bitcoin’s security model and makes paper wallets viable as a storage solution.

Sending Bitcoin to Your Paper Wallet

Once you’ve generated and printed your bitcoin paper wallet, receiving funds is remarkably simple. You share only the public address (never the private key) with the sender or use it in your exchange withdrawal interface. The Bitcoin network processes the transaction, and within minutes to hours, depending on network congestion and transaction fees, the Bitcoin appears at your paper wallet address.

From this moment forward, your Bitcoin exists on the blockchain, secured by your private key. The paper wallet itself doesn’t “contain” the Bitcoin in any physical sense it merely holds the cryptographic key required to access and move those coins recorded on the distributed ledger.

Accessing Funds: Sweeping vs Importing Keys

When the time comes to spend your Bitcoin wallet, you face two primary options:

| Method | How It Works | Security Level | Best For |

|---|---|---|---|

| Sweeping | Transfers all Bitcoin from the paper wallet to a new address in your software wallet in a single transaction | Higher – Paper wallet becomes empty and unusable | One-time access, complete withdrawal |

| Importing | Adds the private key to your wallet software, allowing the address to remain active | Lower – Creates security vulnerabilities if device is compromised | Multiple transactions (not recommended) |

Our experience working with cryptocurrency holders has consistently shown that sweeping is the superior approach. Once a private key has been exposed to an internet-connected device, the security advantages of the paper wallet are permanently compromised. Treating each bitcoin paper wallet as a single-use storage solution maximizes security.

Why No Internet Connection Is Involved

The offline nature of a bitcoin paper wallet represents its primary security advantage. Unlike hot wallets, which maintain constant connectivity and face perpetual exposure to network-based attacks, paper wallets exist completely outside the digital realm until you choose to access them. This air gap makes remote hacking impossible an attacker would need physical access to your paper wallet to steal your Bitcoin.

Why Bitcoin Paper Wallets Were Popular

During Bitcoin’s early years, from 2009 through approximately 2016, paper wallets represented the gold standard for secure cold storage. Understanding this historical context helps explain their continued relevance and the nostalgia many early adopters feel toward this storage method.

Early Bitcoin Storage Challenges

In Bitcoin’s infancy, storage options were severely limited. The original Bitcoin Core crypto wallet required downloading the entire blockchain a process that consumed enormous storage space and bandwidth. Desktop wallets faced constant security threats from malware, and mobile cryptocurrency wallets were primitive at best. Exchange hacks occurred with alarming frequency, making third-party custody extremely risky.

Paper wallets emerged as an elegant solution to these problems. They required no expensive hardware, no technical expertise, and no ongoing maintenance. For early adopters accumulating Bitcoin at sub-$1000 prices, printing a wallet and storing it safely seemed like common sense.

Long-Term Holding (HODL) Use Cases

The bitcoin paper wallet concept aligned perfectly with the “HODL” philosophy that permeated early Bitcoin culture. Long-term holders who didn’t plan to touch their Bitcoin for years, or even decades, appreciated the simplicity of generating a wallet, loading it with Bitcoin, and tucking it away in a safe deposit box. The lack of moving parts, software updates, or battery concerns made paper wallets ideal for set-it-and-forget-it storage strategies.

Trustless and Self-Custodial Nature

Perhaps most importantly, paper wallets embodied Bitcoin’s core principle: “Not your keys, not your coins.” Creating a bitcoin paper wallet meant generating your own keys using open-source software, without trusting any third party manufacturer, company, or service provider. This trustless characteristic resonated deeply with Bitcoin’s cypherpunk roots and attracted users seeking maximum sovereignty over their assets.

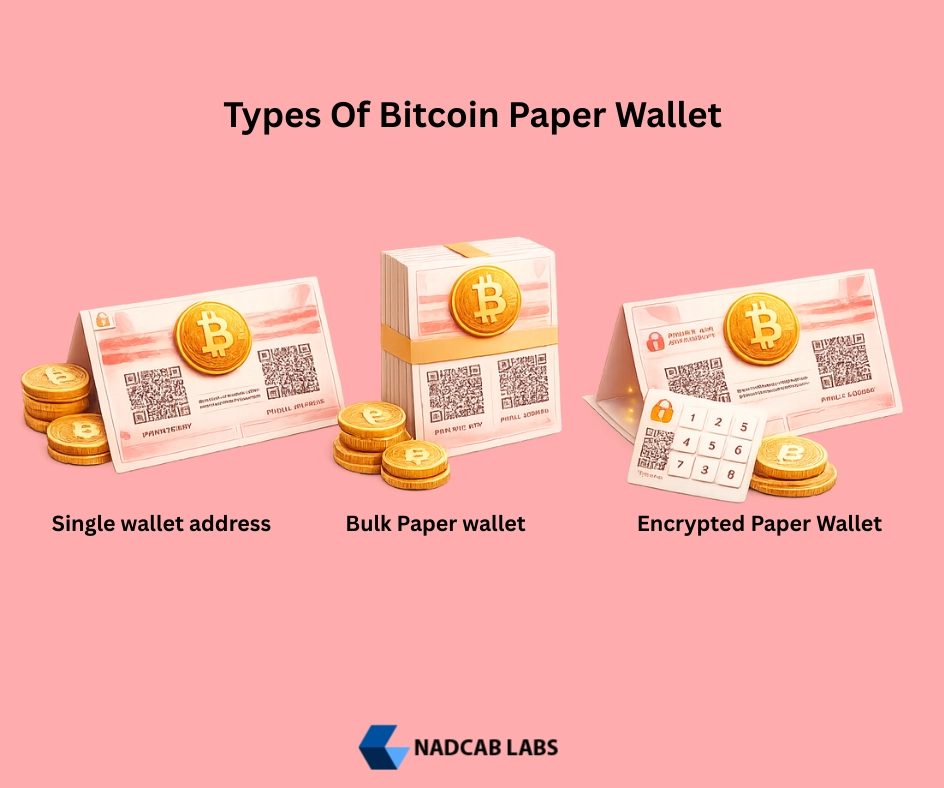

Types of Bitcoin Paper Wallets

Not all paper wallets are created equal. Over the years, various implementations and methodologies have emerged, each with distinct characteristics and use cases.

Single-Address Paper Wallets

The most common wallet type generates one public address and one private key. This straightforward approach works well for basic storage needs but lacks privacy features. Every transaction to and from this address is publicly visible on the blockchain, creating a permanent record of your holdings and transaction history.

QR-Code–Based Paper Wallets

Most modern bitcoin paper wallet generators include QR codes alongside the alphanumeric keys. These square barcodes can be scanned by smartphone cameras, eliminating the error-prone process of manually typing 64-character private keys. This convenience significantly reduces the risk of transcription errors during the critical moment when you’re accessing your funds.

Encrypted vs Unencrypted Paper Wallets

Some advanced implementations allow BIP38 encryption, adding a password layer to the private key. This means even if someone physically obtains your paper wallet, they cannot access the Bitcoin without the password. However, this added security comes with a critical caveat: lose the password, and your Bitcoin becomes permanently inaccessible. During our years of consulting, we’ve seen numerous cases where encryption actually led to loss rather than preventing it.

Brain Wallet vs Paper Wallet

Brain wallets, often confused with paper wallets, operate on a fundamentally different principle. Instead of randomly generating keys, brain wallets derive private keys from user-chosen passphrases. This approach has proven catastrophically insecure, as humans are terrible at creating truly random phrases. Attackers run dictionary attacks against common passphrases, and countless brain wallets have been emptied within seconds of receiving Bitcoin. We strongly advise against brain wallets under any circumstances.

How to Create a Bitcoin Paper Wallet Securely (Step-by-Step)

Creating a secure bitcoin paper wallet requires meticulous attention to detail. After implementing hundreds of secure cryptocurrency storage solutions for clients, we’ve refined this process to minimize every possible vulnerability.

Step 1: Choose a Trusted Paper Wallet Generator

Select open-source, well-audited software such as BitAddress.org or Bitcoinpaperwallet.com. Download the entire website as a local HTML file rather than using it online. Verify the source code on GitHub if you possess technical expertise. Never use closed-source generators or online-only tools, as these present significant security risks.

Step 2: Set Up an Air-Gapped Computer

The most secure approach involves using a computer that has never—and will never—connect to the internet. Options include:

- A new computer purchased specifically for this purpose

- An old laptop with the network card physically removed

- A live USB Linux distribution (like Tails) booted on an offline machine

Step 3: Generate Your Wallet Offline

Disconnect from the internet completely. Open the paper wallet generator HTML file from your saved copy. Move your mouse randomly across the screen and type random characters to generate entropy. The software uses these inputs to create cryptographically secure random keys. Take your time this randomness is crucial for security.

Step 4: Print or Write Keys

If printing, use a printer that’s never been connected to a network. Laser printers are preferable to inkjet models, as laser toner resists fading better than ink. Some security-conscious users prefer writing keys manually to avoid printer memory concerns. Generate multiple copies for redundancy.

Step 5: Verify Address Generation

Before sending significant amounts of Bitcoin, verify your paper wallet by sending a small test transaction (0.001 BTC or less). Confirm the transaction appears on a blockchain explorer. Wait at least one confirmation. Only after successful verification should you proceed with larger amounts. This simple check has prevented countless losses in our client work.

Best Security Practices for Bitcoin Paper Wallets

Even a perfectly generated bitcoin paper wallet can fail without proper security measures. These practices represent insights gained from nearly a decade of cryptocurrency security consulting.

Safe Printing Methods

The printing process introduces numerous vulnerabilities. Modern networked printers often store print jobs in memory, and some even upload data to cloud services. Use dedicated, non-networked printers exclusively. After printing, physically destroy the printer or ensure its memory is completely wiped. For maximum security, manually writing keys eliminates printer risks entirely, though this increases transcription error possibilities.

Using Offline Computers

The air-gapped computer requirement cannot be overstated. Malware specifically designed to compromise cryptocurrency wallets has become increasingly sophisticated. Even briefly connecting a computer to the internet after key generation can expose those keys. Consider the offline machine compromised if it ever touches a network.

Paper Durability and Ink Considerations

Standard paper and ink degrade over time, especially when exposed to light, humidity, or temperature fluctuations. Laser printer toner bonds with paper more permanently than inkjet ink, which can smear or fade. For long-term storage, consider archival-quality paper, lamination (done carefully to avoid creating visible QR code lines), or more durable alternatives like steel plates designed specifically for cryptocurrency backup.

| Storage Material | Durability | Cost | Pros | Cons |

|---|---|---|---|---|

| Standard Paper | 5-10 years | Very Low | Easy, accessible, familiar | Degrades quickly, vulnerable to water/fire |

| Laminated Paper | 10-20 years | Low | Water resistant, more durable | Can still burn, lamination may obscure QR codes |

| Archival Paper | 50+ years | Medium | Acid-free, designed for longevity | Still paper, vulnerable to fire/water |

| Steel Plates | Indefinite | High | Fire/water/corrosion resistant, extremely durable | Expensive, requires engraving tools |

Multiple Backups and Storage Locations

Never rely on a single copy of your bitcoin paper wallet. Create at least three copies and store them in geographically diverse, secure locations. Consider combinations like a home safe, bank safe deposit box, and trusted family member’s secure storage. This redundancy protects against localized disasters like fires, floods, or theft.

Avoiding Common Mistakes

Through our consulting practice, we’ve identified recurring errors that compromise paper wallet security: taking digital photos of private keys, storing scans in cloud services, generating wallets on internet-connected devices, using weak encryption passwords, and forgetting to test wallets before large deposits. Each of these mistakes can result in complete loss of funds.

How to Use a Bitcoin Paper Wallet to Send or Spend BTC

The process of accessing funds from a bitcoin paper wallet represents the moment of greatest vulnerability. Proper technique is essential to maintain security throughout the withdrawal process.

Importing Private Keys into a Software Wallet

Most modern cryptocurrency wallets support private key import functions. Electrum, Mycelium, and Blockchain Wallet all provide straightforward import capabilities. Navigate to the import section, scan the QR code with your device’s camera (or manually enter the private key), and the software wallet incorporates the address. However, remember that this process exposes your key to the internet-connected device permanently.

Why Paper Wallets Should Not Be Reused

This principle is critical: treat every bitcoin paper wallet as single-use storage. Once you’ve exposed the private key to any internet-connected device—even momentarily—the security guarantees of cold storage evaporate. Malware, keyloggers, or compromised software could capture the key. After sweeping funds from a paper wallet, immediately consider those keys compromised and never send Bitcoin back to that address.

Transaction Fee Considerations

When sweeping a paper wallet, you’ll pay network transaction fees. These vary dramatically based on network congestion, ranging from a few dollars during quiet periods to over $50 during peak demand. Modern wallet software typically estimates appropriate fees automatically, but during your sweep transaction, ensure you understand how much Bitcoin will arrive at the destination after fees are deducted.

Risks and Limitations of Bitcoin Paper Wallets

Despite their historical popularity and certain security advantages, paper wallets present significant risks that have become increasingly apparent over time. Honest assessment of these limitations is essential for informed decision-making.

Physical Damage and Loss Risks

Paper wallets are physical objects subject to all the vulnerabilities that implies. House fires, floods, coffee spills, pet damage, and simple misplacement can result in permanent Bitcoin loss. Unlike digital backups, which can be easily replicated across infinite copies, physical media requires deliberate redundancy efforts that many users neglect until it’s too late.

Human Error and Poor Key Generation

The bitcoin paper wallet creation process involves numerous steps where user error can compromise security. Using compromised paper wallet generators, generating keys on internet-connected computers, taking photos of private keys, and inadequate randomness during generation are common mistakes. Unlike hardware wallets, which handle these technical aspects automatically, paper wallets place the entire burden of correct implementation on the user.

Malware Risks During Creation

Sophisticated malware can compromise the key generation process in ways users never detect. Screen capture malware, clipboard hijackers, and keyloggers all pose threats during paper wallet creation. Even seemingly air-gapped systems can be vulnerable if they were previously connected to the internet or if USB devices carrying malware are used to transfer the wallet generator software.

Lack of Recovery Options

Perhaps the most serious limitation: paper wallets offer no recovery mechanism. Lose the paper, and the Bitcoin is gone forever. No seed phrase recovery, no backup service, no customer support. This unforgiving characteristic makes paper wallets inappropriate for users uncomfortable with total personal responsibility for their assets.

UX Limitations for Beginners

The technical knowledge required to safely create, use, and maintain a bitcoin paper wallet exceeds what most newcomers possess. Understanding cryptographic concepts, implementing offline computer setups, and executing secure key sweeping all require expertise that takes time to develop. Modern hardware wallets abstract away this complexity while maintaining high security standards.

Is a Bitcoin Paper Wallet Still Safe in 2026?

The security landscape has evolved dramatically since paper wallets first gained popularity. In 2026, answering whether paper wallets remain safe requires nuanced analysis of current threats, alternatives, and specific use cases.

Security Comparison with Modern Wallets

From a pure cryptographic perspective, a correctly generated bitcoin paper wallet stored securely offers excellent protection against remote attacks. The offline nature prevents network-based threats entirely. However, this theoretical security advantage is often undermined by implementation failures, human error, and physical vulnerabilities that modern alternatives address more effectively.

Impact of Better Hardware Wallets

Hardware wallets like Ledger, Trezor, and ColdCard have matured significantly. They provide cold storage security with dramatically improved user experience. Seed phrase backup systems, PIN protection, and secure element chips address many vulnerabilities inherent to paper wallets. For most users in 2026, quality hardware wallets represent superior solutions.

Threat Model in 2026

Current threats facing cryptocurrency holders include sophisticated malware, supply chain attacks on hardware, SIM-swap attacks (irrelevant for cold storage), and physical theft. Paper wallets protect against digital attacks but remain vulnerable to physical threats and user error. Threat models must consider specific individual circumstances rather than applying one-size-fits-all security recommendations.

Who Should Still Consider Paper Wallets

- Technical experts with deep understanding of proper implementation procedures

- Users concerned about hardware wallet supply chain attacks who want zero third-party dependencies

- Gift givers presenting small amounts of Bitcoin as educational gifts

- Individuals in extreme threat environments where hardware wallet possession could be dangerous

- Long-term cold storage advocates with secure, geographically diverse storage locations and proper redundancy

Who Should Avoid Paper Wallets

- Cryptocurrency beginners without technical background in cryptographic security

- Users requiring frequent access to their Bitcoin holdings

- Individuals uncomfortable with total personal responsibility for asset security

- Those without secure physical storage options available

- Users who prefer convenience over maximum theoretical security

Bitcoin Paper Wallet vs Hardware Wallet (2026 Comparison)

Understanding the practical differences between paper wallets and hardware wallets helps users select the appropriate solution for their specific needs and technical comfort level.

| Feature | Bitcoin Paper Wallet | Hardware Wallet |

|---|---|---|

| Security | Excellent if created correctly; vulnerable to physical damage and user error | Excellent with additional protections like PIN codes and secure elements |

| Ease of Use | Difficult for beginners; complex creation and usage process | Intuitive interfaces designed for mainstream users |

| Recovery Options | None – loss is permanent | Seed phrase recovery allows wallet restoration |

| Cost | Nearly free (paper, printer) | $50-$200+ depending on model |

| Best For | Technical users, long-term cold storage, small gift amounts | Most users, active traders, multi-currency holders |

| Transaction Frequency | Single-use recommended | Unlimited transactions supported |

| Physical Durability | Vulnerable to fire, water, degradation | Robust electronic device; seed phrase still paper-based |

| Supply Chain Risk | None if properly implemented | Minimal with reputable manufacturers |

Bitcoin Paper Wallet vs Software Wallet

Software wallets and paper wallets represent opposite ends of the convenience-security spectrum. Understanding this tradeoff helps users allocate their Bitcoin holdings appropriately across different storage solutions.

Hot Wallet vs Cold Storage

Software wallets maintain constant internet connectivity, enabling convenient transactions but exposing users to network-based attacks. A bitcoin paper wallet eliminates remote attack vectors entirely but sacrifices accessibility. Many sophisticated users employ both: software wallets for spending amounts and paper wallets for long-term savings.

Convenience vs Maximum Security

Software wallets excel at frequent transactions, providing instant access through smartphone apps or browser extensions. Paper wallets require deliberate, time-consuming processes to access funds—a feature, not a bug, for long-term holders who want friction preventing impulsive spending.

Ideal Scenarios for Each

Use software wallets for daily spending amounts you can afford to lose if your device is compromised—similar to the cash in your physical wallet. Reserve paper wallet usage for significant holdings you won’t need to access for months or years, comparable to long-term bank savings accounts.

When a Bitcoin Paper Wallet Makes Sense Today

Despite modern alternatives, specific use cases still justify paper wallet implementation when executed correctly with full understanding of the risks involved.

Long-Term Cold Storage

For Bitcoin intended for storage spanning decades, properly created paper wallets stored in secure, geographically distributed locations remain viable. The lack of electronic components eliminates concerns about hardware degradation, battery life, or technological obsolescence that could affect hardware wallets over extremely long timeframes.

Inheritance Planning

Paper wallets can serve as part of estate planning strategies. Creating clear instructions alongside the wallet allows heirs to access Bitcoin without requiring technical expertise during emotionally difficult times. However, this approach requires careful documentation and should include lawyer consultation to ensure proper integration with broader estate plans.

Gifting Bitcoin Securely

Small-amount paper wallets make excellent educational gifts for those curious about Bitcoin. Loading $50-$100 worth of BTC onto an attractively designed paper wallet creates a tangible introduction to cryptocurrency ownership. Recipients can learn about private keys, addresses, and blockchain transactions through hands-on experience.

Educational or Experimental Use

Creating paper wallets provides valuable learning experiences for those seeking deep understanding of Bitcoin’s underlying mechanics. The process demystifies public-key cryptography and blockchain concepts in ways that using abstracted wallet apps never can.

Build My Crypto wallet Now!

Turn your dream into reality with a powerful, secure crypto wallet built just for you. Start building now and watch your idea come alive!

Modern Alternatives to Bitcoin Paper Wallets

The cryptocurrency security landscape has evolved significantly, offering various solutions that address paper wallet limitations while maintaining robust protection against attacks.

Hardware Wallets

Devices like Ledger Nano X, Trezor Model T, and Cold Card Mk4 combine cold storage security with user-friendly interfaces. They generate and store private keys in secure elements that never expose keys to connected computers, preventing malware from stealing funds even on compromised devices. Recovery seed phrases provide backup capabilities paper wallets lack.

Multi-Signature Wallets

Multi-sig solutions require multiple keys to authorize transactions, distributing security across several devices or people. A 2-of-3 multisig setup, for example, allows you to lose one key without losing access to Bitcoin. Services like Casa and Unchained Capital specialize in collaborative custody models that eliminate single points of failure.

MPC Wallets

Multi-Party Computation wallets represent cutting-edge technology that splits private keys across multiple locations mathematically. No single location ever possesses the complete private key, yet transactions can still be signed through cryptographic protocols. This emerging technology shows promise for institutional-grade security accessible to individual users.

Air-Gapped Mobile Wallets

Specialized applications like Blue Wallet’s air-gapped mode allow smartphone-based cold storage. Old smartphones become dedicated cryptocurrency devices, never connecting to the internet after wallet creation. This approach mirrors paper wallet security principles while providing more sophisticated features and better user experience.

Common Mistakes to Avoid With Bitcoin Paper Wallets

Learning from others’ errors can prevent devastating Bitcoin losses. These mistakes appear repeatedly across years of security consulting work.

Reusing Addresses

Address reuse creates multiple problems. It degrades privacy by linking transactions publicly on the blockchain. More critically, reusing a bitcoin paper wallet after exposing its private key to an online device negates the security benefits entirely. Every sweep should permanently retire that address.

Storing Online Photos

Photographing paper wallets creates digital copies that can be stolen through phone hacks, cloud storage breaches, or automatic photo backup services. Never create digital images of your private keys, regardless of claimed encryption. The convenience of digital backups isn’t worth the security risk.

Using Compromised Generators

Fake or malicious bitcoin paper wallet generators exist specifically to steal funds. These sites generate predictable keys that attackers control, sweeping any deposited Bitcoin immediately. Always download generator code from official GitHub repositories, verify checksums, and use offline after download.

Poor Backup Planning

Single-copy paper wallets represent single points of failure. Natural disasters, theft, or simple misplacement can result in permanent loss. Creating multiple copies and distributing them geographically requires extra effort but dramatically reduces loss risk.

Should You Use a Bitcoin Paper Wallet in 2026?

After eight years of implementing cryptocurrency security solutions, our assessment of paper wallets in 2026 balances historical perspective with current technological realities and individual user needs.

Summary of Pros and Cons

Advantages:

- Complete offline security when properly implemented

- No hardware costs beyond basic printing materials

- Zero third-party trust requirements

- No supply chain attack vectors

- No electronic component degradation concerns

- Educational value for understanding Bitcoin fundamentals

Disadvantages:

- High risk of user error during creation and use

- Vulnerable to physical damage and loss

- No recovery options if lost or destroyed

- Poor user experience, especially for beginners

- Single-use limitation reduces practicality

- Requires significant technical knowledge for safe implementation

Clear Recommendation by User Type

For Beginners: Hardware wallets represent a better choice. The user-friendly interfaces, recovery options, and reduced error potential far outweigh the modest cost. Paper wallets can serve as educational tools with small amounts ($20-50) to understand Bitcoin mechanics, but shouldn’t hold significant savings.

For Intermediate Users: Consider paper wallets only for specific use cases like long-term cold storage of a portion of holdings, gifting Bitcoin, or creating inheritance mechanisms. Combine with hardware wallets for more accessible funds.

For Advanced Users: Paper wallets remain viable options when implemented with rigorous security practices. They work well for ultra-long-term storage, situations requiring zero electronic components, or when specific threat models demand complete independence from hardware manufacturers.

Security-First Conclusion

The bitcoin paper wallet concept remains fundamentally sound from a cryptographic security perspective. However, practical security depends more on implementation than theory. The majority of Bitcoin losses attributed to paper wallets stem from user error rather than inherent technological flaws.

In 2026, paper wallets occupy a niche role rather than serving as the default cold storage recommendation. They excel in specific scenarios but have been surpassed by hardware wallets for most general use cases. The evolution of cryptocurrency security hasn’t made paper wallets obsolete, but it has positioned them as specialized tools rather than universal solutions.

For those choosing to implement paper wallets despite modern alternatives, success requires obsessive attention to security details, redundant backups, secure physical storage, and honest assessment of personal technical capabilities. Paper wallets demand perfection one mistake can result in permanent loss.

Whether you’re considering a bitcoin paper wallet for long-term storage or exploring modern alternatives, remember that the best security solution is the one you’ll implement correctly and consistently. Our eight years of experience has proven that perfect security on paper often fails in practice, while imperfect but usable security succeeds. Choose the method matching your technical expertise, risk tolerance, and actual usage patterns rather than chasing theoretical perfection.

Frequently Asked Questions

A bitcoin paper wallet is an offline cold storage method that holds a public address and private key on paper or durable material, allowing users to store Bitcoin without internet exposure.

Bitcoin paper wallets are safe only if created correctly offline and stored securely. Most risks come from human error, poor key generation, or physical loss rather than blockchain vulnerabilities.

A paper wallet cannot be hacked remotely because it is offline. However, malware during creation or physical theft of the private key can result in loss of funds.

If you lose all copies of your paper wallet and the private key, the Bitcoin is permanently inaccessible. There is no recovery option or password reset mechanism.

No. A bitcoin paper wallet should be treated as single-use. Once the private key is exposed to an online device, the wallet is no longer secure and should never be reused.

Sweeping transfers all funds to a new wallet address and is safer. Importing adds the private key to a software wallet, increasing exposure to malware and security risks.

Paper wallets offer offline security but lack recovery options and usability. Hardware wallets provide strong security with better user experience and are recommended for most users in 2026.

Yes, but it’s risky without proper backups, secure storage, and technical expertise. For large holdings, hardware wallets or multisig solutions are generally safer.

No. Taking photos creates digital copies that can be stolen via phone hacks, cloud backups, or malware. Private keys should never be stored digitally.

Yes, but only for specific use cases like long-term cold storage, gifting small amounts of BTC, or educational purposes. They are no longer the best default option.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.