Key Takeaways

- A multi-currency wallet allows you to store, manage, and transact with multiple cryptocurrencies from a single interface, eliminating the need for separate wallets.

- Security features like private key encryption, seed phrase backup, and two-factor authentication are essential for protecting your digital assets.

- Hot wallets offer convenience for daily transactions, while cold wallets provide maximum security for long-term storage.

- Cross-chain compatibility and DeFi integration are transforming multi-currency wallets into comprehensive asset management platforms.

- Proper setup, regular backups, and following security best practices are critical to safely managing your cryptocurrency portfolio.

The cryptocurrency landscape has evolved dramatically over the past decade, and 2026 represents a pivotal moment in digital asset management. With over 25,000 different cryptocurrencies in circulation and the explosive growth of Web3, NFTs, and decentralized finance (DeFi), managing multiple digital assets has become increasingly complex. This is where a multi-currency wallet becomes not just convenient, but essential.

Drawing from our eight years of experience in blockchain technology and digital asset management, we’ve witnessed the transformation of crypto wallets from simple storage solutions to sophisticated financial management tools. The modern multi-currency wallet serves as your gateway to the decentralized economy, offering security, convenience, and comprehensive control over your digital portfolio in one unified platform.

Whether you’re a cryptocurrency newcomer exploring your first Bitcoin purchase, an NFT collector managing digital art across multiple blockchains, or a DeFi enthusiast juggling various tokens and yield farming strategies, understanding how to effectively use a multi-currency wallet is crucial. This guide will take you from the fundamentals to advanced strategies, ensuring you have the knowledge to manage your digital assets securely and efficiently.

What Is a Multi-Currency Wallet and How Does It Work?

A multi-currency wallet is a digital application or hardware device that enables users to store, manage, send, and receive multiple types of cryptocurrencies within a single interface. Unlike traditional single currency wallets that support only one blockchain (such as a Bitcoin-only wallet), a multi-crypto wallet provides unified access to various digital assets across different blockchain networks.

Think of it as the cryptocurrency equivalent of a traditional bank account that holds multiple currencies except you maintain complete control over your assets without intermediaries. In our years of consulting with both individual investors and institutional clients, we’ve observed that the shift from single-currency to multi-currency solutions represents one of the most significant improvements in user experience within the crypto space.[1]

Single-Currency Wallet vs Multi-Currency Wallet

Single-Currency Wallet: Supports only one cryptocurrency (e.g., Bitcoin Core wallet only stores Bitcoin). Users need separate wallets for each cryptocurrency they own.

Multi-Currency Wallet: Supports multiple cryptocurrencies across various blockchains (e.g., Bitcoin, Ethereum, Cardano, Solana) all in one application. Users manage their entire portfolio from a single dashboard.

Popular examples of multi-currency wallets in 2026 include Trust Wallet, MetaMask (which has expanded beyond Ethereum), Ledger hardware wallets, Exodus, and Atomic Wallet. Each offers different features, supported currencies, and security models, but all share the common goal of simplifying cryptocurrency management through consolidation.

How Multi-Currency Wallets Work

Understanding the technical foundation of how multi-currency wallets work is essential for using them securely. At their core, these wallets don’t actually “store” your cryptocurrencies instead, they manage the cryptographic keys that prove your ownership of assets recorded on various blockchains.

Private Keys, Public Addresses, and Seed Phrases

Every cryptocurrency wallet operates on public-private key cryptography. Your private key is a secret alphanumeric code that proves ownership and allows you to sign transactions. The corresponding public address is derived from your private key and serves as your receiving address similar to an email address that others can use to send you funds.

The seed phrase (also called a recovery phrase or mnemonic phrase) is typically a 12 to 24-word sequence that serves as a master backup for your cryptocurrency wallet. This phrase can regenerate all your private keys and restore access to your funds if you lose your device. In our security audits, we’ve found that improper seed phrase management is the leading cause of fund loss making this knowledge critical.

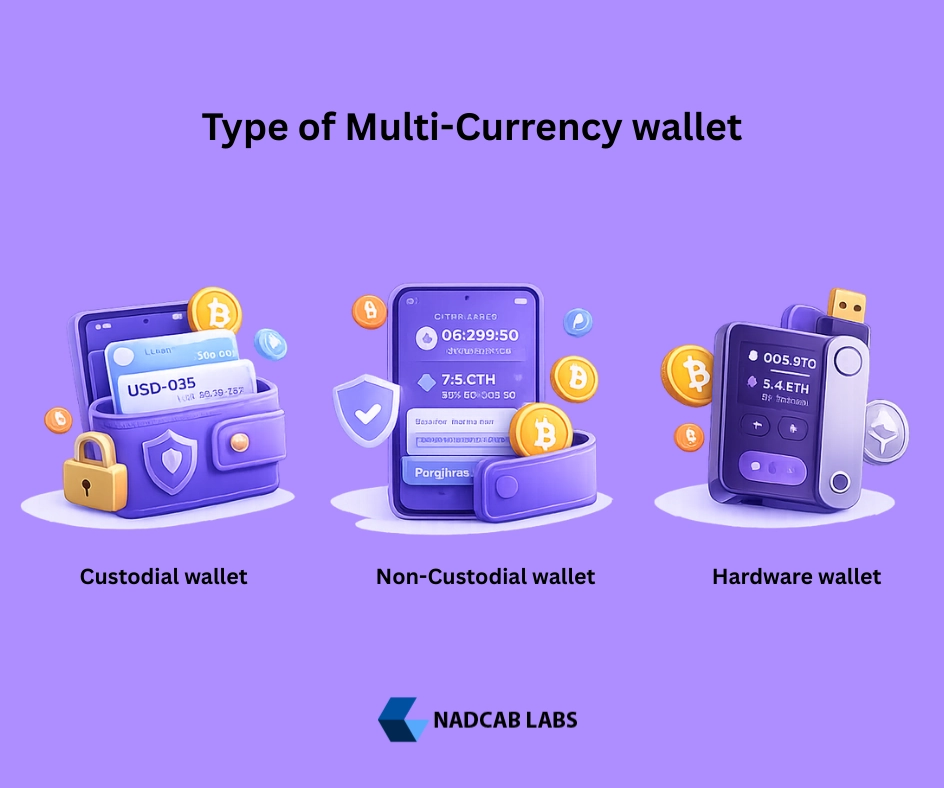

Types of Multi-Currency Wallets

| Wallet Type | Description | Security Level | Best For |

|---|---|---|---|

| Hot Wallets | Connected to the internet (mobile apps, web wallets, desktop software) | Medium | Daily transactions, active trading |

| Cold Wallets | Offline storage (hardware devices, paper wallets) | High | Long-term storage, large holdings |

| Hybrid Solutions | Combination of hot and cold storage features | High | Balanced security and convenience |

Hot wallets is a wallet type and it offer immediate access and convenience, making them ideal for frequent transactions and interacting with DeFi protocols. However, their internet connection creates potential vulnerability to hacking attempts. Cold wallets, particularly hardware devices like Ledger or Trezor, keep your private keys completely offline, providing maximum security against online threats though at the cost of less convenient access.[2]

Key Features of a Multi-Currency Wallet

Through our extensive experience evaluating wallet solutions for clients managing portfolios ranging from a few hundred to millions of dollars, we’ve identified several critical features that distinguish exceptional multi-currency wallets from mediocre ones.

Security Features

Security forms the foundation of any reliable multi-currency wallet. Essential security features include:

- Two-Factor Authentication (2FA): Adds an extra verification layer beyond your password, typically through an authenticator app or SMS code.

- End-to-End Encryption: Ensures your private keys and transaction data remain encrypted both in transit and at rest.

- Biometric Protection: Fingerprint or facial recognition for mobile wallet access.

- Backup and Recovery Options: Secure seed phrase backup mechanisms and recovery procedures.

- Transaction Signing Verification: Clear display of transaction details before confirmation to prevent address spoofing attacks.

Cross-Chain Compatibility

Advanced crypto wallets support not just multiple cryptocurrencies, but multiple blockchain networks. This means you can manage Bitcoin, Ethereum-based tokens, Binance Smart Chain assets, Solana tokens, and more from a single interface. Advanced wallets in 2026 now support over 100 different blockchain networks, making true cross-chain portfolio management a reality.

User Interface and Experience

A clean, intuitive interface dramatically improves the user experience. The best multi-currency wallets feature dashboard views showing your entire portfolio at a glance, easy-to-navigate transaction histories, simple send/receive functions, and built-in tools for tracking portfolio performance. We’ve observed that user interface quality directly correlates with user error rates poorly designed wallets lead to costly mistakes.

Platform Availability

| Platform | Advantages | Considerations |

|---|---|---|

| Mobile Wallets | Convenience, QR code scanning, on-the-go access | Device security, smaller screen for verification |

| Desktop Wallets | Larger interface, more features, better for complex transactions | Computer security, less portable |

| Hardware Wallets | Maximum security, offline storage, immune to malware | Initial cost, less convenient for frequent transactions |

| Web Wallets | Access from any device, no installation required | Dependent on third-party service, potential phishing risks |

Benefits of Using a Multi-Currency Wallet for Crypto Management

The advantages of consolidating your digital assets into a multi-currency wallet extend far beyond simple convenience. Based on our client feedback and industry analysis, here are the most significant benefits:

Unified Asset Management

Imagine juggling five different banking apps to manage five different currencies frustrating and inefficient. The same applies to cryptocurrency management. A multi-currency wallet consolidates your Bitcoin, Ethereum, various altcoins, and tokens into one dashboard. You can view your total portfolio value, track individual asset performance, and make informed decisions without switching between multiple applications.

Streamlined Portfolio Management

Advanced multi-currency wallets now include portfolio analytics, price alerts, and performance tracking. Instead of manually calculating your holdings across different wallets, you get automated reports showing asset allocation, profit/loss statements, and historical performance charts. This feature has proven invaluable for our clients during tax season, providing clear transaction histories for reporting purposes.

Efficient Cross-Chain Transactions

Modern wallets increasingly support atomic swaps and cross-chain bridges, enabling you to exchange one cryptocurrency for another directly within the wallet interface. For example, you can swap Bitcoin for Ethereum or convert Ethereum to Polygon tokens without using a centralized exchange saving time, reducing fees, and maintaining privacy.

Enhanced Security Through Centralized Management

Contrary to initial assumptions, using one secure multi-currency wallet often provides better security than managing multiple wallets. You only need to secure one seed phrase, implement security measures once, and monitor one application for updates and potential vulnerabilities. This reduces the attack surface and simplifies security maintenance—critical factors we emphasize in our security consulting work.

Real-World Example: Portfolio Consolidation

One of our clients, a DeFi investor, initially managed 8 different wallets across various platforms, holding 15 different cryptocurrencies. After transitioning to a comprehensive multi-currency wallet, they reported:

- 67% reduction in time spent on portfolio management

- Elimination of 3 instances where they nearly sent funds to wrong addresses due to wallet confusion

- Improved tax reporting accuracy with unified transaction history

- Better investment decision-making with complete portfolio visibility

Step-by-Step Guide to Setting Up a Multi-Currency Wallet

Setting up a multi-currency wallet correctly from the start prevents security issues and ensures smooth operation. Follow this comprehensive guide based on best practices we’ve refined over eight years of implementation experience.

Step 1: Choose the Right Wallet for Your Needs

Consider these factors when selecting your wallet:

- Supported Cryptocurrencies: Ensure the wallet supports all the digital assets you own or plan to acquire.

- Security Features: Prioritize wallets with robust security measures, especially if managing significant holdings.

- User Experience: Choose an interface that matches your technical comfort level.

- Platform Compatibility: Select based on whether you need mobile, desktop, or hardware wallet functionality.

- Reputation and Reviews: Research the wallet’s track record, security audits, and user feedback.

Step 2: Download from Official Sources Only

This critical step cannot be overstated. Always download wallet software exclusively from official websites or verified app stores. Phishing websites distributing fake wallet apps represent one of the most common attack vectors. We recommend:

- Bookmark the official wallet website after verifying its authenticity

- Double-check URLs for subtle misspellings or domain variations

- Verify app store listings match official developer names

- Check SSL certificates and security indicators

Step 3: Create Your Account and Secure Your Seed Phrase

During wallet creation, you’ll generate a seed phrase—typically 12 or 24 words. This is the most critical security element of your entire setup:

⚠️ Critical Security Warning: Never store your seed phrase digitally (no screenshots, cloud storage, or emails). Write it on paper and store it in a secure physical location. Anyone with access to your seed phrase has complete control over your funds. This cannot be recovered if lost and cannot be changed—it’s permanent.

Best practices for seed phrase storage:

- Write the phrase on durable paper or metal backup solutions

- Create multiple copies stored in different secure locations

- Consider using a safe deposit box for long-term storage

- Never share the phrase with anyone, including wallet support teams

- Verify you’ve written it correctly by testing the recovery process

Step 4: Enable Additional Security Features

After basic setup, activate all available security features:

- Enable two-factor authentication (2FA) using an authenticator app

- Set up biometric authentication if using a mobile wallet

- Create a strong, unique password different from your other accounts

- Configure transaction confirmation notifications

- Set up address whitelisting if available for frequently used addresses

Step 5: Add Your Cryptocurrencies

Most multi-currency wallets automatically support popular cryptocurrencies. To add assets:

- Navigate to the “Add Asset” or “Manage Tokens” section

- Search for the cryptocurrency you want to add

- Enable the asset to generate a receiving address

- For custom tokens, you may need to manually enter the contract address

- Verify you’re on the correct blockchain network (e.g., ERC-20 for Ethereum tokens)

Step 6: Conduct Your First Transaction

Start with a small test transaction to familiarize yourself with the process:

- Receiving: Copy your wallet address for the specific cryptocurrency, send a small amount from an exchange or another wallet, and wait for blockchain confirmation

- Sending: Enter the recipient’s address (double-check every character), specify the amount, review transaction fees, and confirm the transaction details before signing

Pro Tip: The Test Transaction Strategy

When sending cryptocurrency for the first time to a new address especially large amounts always send a small test transaction first. Verify it arrives correctly before sending the full amount. This simple practice has saved our clients from costly mistakes involving wrong addresses or incorrect networks. The small additional transaction fee is insignificant compared to the potential loss of sending thousands of dollars to the wrong destination.

Advanced Features and Tips

As you become comfortable with basic operations, exploring advanced features of your multi-currency wallet unlocks additional functionality and opportunities within the cryptocurrency ecosystem.

Cross-Chain Swaps and DeFi Integration

Modern multi-currency wallets increasingly integrate decentralized exchange (DEX) functionality, allowing you to swap tokens directly within the wallet interface. These swaps use automated market makers (AMMs) and liquidity pools rather than traditional order books, providing:

- Non-custodial trading you maintain control of your assets throughout the swap

- Access to thousands of token pairs unavailable on centralized exchanges

- Competitive rates through aggregation of multiple DEX sources

- Privacy benefits with no KYC requirements

Advanced wallets also provide direct access to DeFi protocols for lending, borrowing, and liquidity provision. You can connect your wallet to platforms like Aave, Compound, or Uniswap to participate in yield farming and other DeFi strategies without leaving your wallet ecosystem.

NFT Storage and Management

The NFT market has matured significantly, and multi-currency wallets now serve as comprehensive NFT galleries. Leading wallets display your NFT wallet collections with rich metadata, images, and provenance information. You can view, transfer, and in some cases, even list NFTs for sale directly from your wallet interface. This integration transforms your wallet from a simple currency holder into a complete digital asset manager.

Multi-Signature Wallets for Enhanced Security

For businesses, organizations, or individuals managing significant assets, multi-signature (multisig) wallets provide an additional security layer. A multisig wallet requires multiple private key signatures to authorize transactions for example, 2 out of 3 designated parties must approve before funds can move. This prevents single points of failure and provides accountability in organizational settings.

| Multisig Configuration | Description | Use Case |

|---|---|---|

| 2-of-2 | Both parties must approve every transaction | Joint accounts, business partnerships |

| 2-of-3 | Any two of three keyholders can approve | Personal backup, small business treasuries |

| 3-of-5 | Three of five keyholders must approve | Organizations, DAOs, larger businesses |

Staking and Yield Generation

Many wallets now integrate staking functionality, allowing you to earn passive income on supported cryptocurrencies. Instead of transferring assets to an exchange for staking, you can stake directly from your wallet while maintaining custody. Common staking options include:

- Proof-of-Stake Networks: Ethereum, Cardano, Polkadot, and others offer staking rewards for network validation

- Liquid Staking: Receive derivative tokens representing your staked assets, maintaining liquidity while earning rewards

- Delegated Staking: Delegate your tokens to validators without running your own node infrastructure

Advanced Security Practices

Based on our security auditing experience, implement these advanced protection measures:

- Hardware Security Module Integration: Connect your software wallet to a hardware wallet for transaction signing while maintaining user interface convenience

- Time-Lock Functions: Set up transaction delays requiring a waiting period before large transfers execute, providing time to detect and prevent unauthorized transactions

- Address Book Management: Maintain a verified address book with labels and notes, reducing the risk of typos or clipboard malware attacks

- Regular Security Audits: Periodically review authorized dApp connections, revoke unused permissions, and update security settings

- Separate Hot and Cold Storage: Use a multi-wallet strategy with hot wallets for active trading and cold storage for long-term holdings

Common Mistakes to Avoid

In our years of consulting and technical support, we’ve identified recurring mistakes that lead to fund loss or security compromises. Learning from these errors can save you significant financial and emotional distress.

Mistake #1: Improper Seed Phrase Management

The most catastrophic mistake involves seed phrase mismanagement. Common errors include:

- Storing seed phrases in email, cloud storage, or password managers

- Taking digital photos of seed phrases

- Sharing seed phrases with “customer support” (legitimate support NEVER asks for this)

- Storing seed phrases and wallet access on the same device

- Losing the only copy without backup

Solution: Write seed phrases on durable material, store physically in multiple secure locations, and never share them with anyone under any circumstances.

Mistake #2: Using Unverified or Counterfeit Wallets

Phishing attacks using fake wallet applications have resulted in millions in losses. Attackers create convincing copies of popular wallets, distribute them through fake websites or unofficial app stores, and steal credentials or seed phrases from unsuspecting users.

Solution: Only download wallets from official sources, verify URLs carefully, check app developer credentials, and research wallet authenticity before installation.

Mistake #3: Neglecting Software Updates

Outdated wallet software may contain known vulnerabilities that attackers can exploit. We’ve seen cases where users ignored update notifications for months, only to fall victim to exploits that had already been patched in newer versions.

Solution: Enable automatic updates when possible, regularly check for new versions, and apply security patches promptly while verifying update authenticity.

Mistake #4: Failing to Verify Transaction Details

Clipboard malware can change copied wallet addresses, and user error can result in sending funds to wrong addresses or on wrong networks. Blockchain transactions are irreversible once sent, funds cannot be recovered without the recipient’s cooperation.

Solution: Always verify the complete recipient address character by character, confirm the correct network, double-check amounts, and start with small test transactions for new recipients.

Mistake #5: Granting Unlimited Token Approvals

When interacting with DeFi protocols, you often approve smart contracts to spend your tokens. Many users unknowingly approve unlimited spending allowances, creating ongoing security risks if those contracts are compromised.

Solution: Use tools like Revoke.cash to review and limit token approvals, only approve the minimum necessary amount, and regularly audit authorized contracts.

Case Study: The $2 Million Typo

A client once contacted us after accidentally sending $2 million in Bitcoin wallet to an address with one character different from the intended recipient. The transaction was irreversible, and despite our attempts to contact the recipient through blockchain analysis, the funds were never recovered. This painful lesson underscores the absolute necessity of address verification and test transactions practices this client now follows religiously.

Top Multi-Currency Wallets in 2026

Based on our comprehensive evaluation criteria including security audits, user feedback, feature sets, and long-term reliability, here’s our analysis of leading multi-currency wallet options in 2026:

| Wallet | Type | Supported Assets | Key Features | Best For |

|---|---|---|---|---|

| Ledger Nano X | Hardware | 5,500+ coins | Bluetooth, mobile app, staking support | Security-focused users, large holdings |

| Trust Wallet | Mobile | 4.5M+ tokens | DEX integration, NFT support, staking | Mobile-first users, DeFi enthusiasts |

| Exodus | Desktop/Mobile | 260+ assets | Beautiful UI, built-in exchange, portfolio tracker | Beginners, design-conscious users |

| MetaMask | Browser/Mobile | EVM chains + more | Web3 integration, DApp browser, swaps | DeFi users, NFT collectors, developers |

| Trezor Model T | Hardware | 1,800+ coins | Touchscreen, open-source, Shamir backup | Security purists, open-source advocates |

Detailed Wallet Analysis

Ledger Nano X

Pros: Industry-leading security with Secure Element chip, supports the most cryptocurrencies, Bluetooth connectivity for mobile use, regular firmware updates, established reputation since 2014.

Cons: Higher initial cost ($149), requires physical device for transactions, past data breach exposed customer information (though funds remained secure).

Price: $149 one-time purchase

Trust Wallet

Pros: Free, user-friendly interface, extensive token support across 100+ blockchains, integrated DEX and staking, strong NFT features, backed by Binance.

Cons: Hot wallet security limitations, occasional network congestion issues, customer support can be slow.

Price: Free

Exodus

Pros: Exceptional user interface, excellent for beginners, built-in exchange functionality, comprehensive portfolio tracking, 24/7 customer support.

Cons: Closed-source code, fewer supported assets than competitors, exchange fees can be higher than market rates.

Price: Free (fees on exchanges)

When selecting the best multi-currency wallet for your needs, consider your technical expertise, the value of assets you’ll manage, your trading frequency, and specific features you require. Many experienced users employ a multi-wallet strategy using hardware wallets for long-term storage and mobile wallets for active trading.

Future of Multi-Currency Wallets

The cryptocurrency wallet landscape continues to evolve rapidly. Based on current development trends and our industry insights, here are the transformative changes we anticipate for multi-currency wallet technology:

Social Recovery and Account Abstraction

The next generation of wallets will implement social recovery mechanisms, allowing users to designate trusted contacts who can help restore wallet access if seed phrases are lost. Account abstraction technology will enable customizable security rules, such as spending limits, transaction whitelisting, and automated security responses—making self-custody more user-friendly without compromising security.

AI-Powered Portfolio Management

Artificial intelligence integration is becoming standard in premium wallets. AI features include automated tax optimization, predictive analytics for portfolio rebalancing, fraud detection, transaction pattern analysis, and personalized investment suggestions based on your risk profile and goals. These intelligent assistants will help users make informed decisions while maintaining full control over their assets.

Universal Identity and Credential Management

Wallets are evolving into comprehensive digital identity platforms. Beyond managing cryptocurrencies, future wallets will store and manage verifiable credentials, educational certificates, health records, and other digital identities. This transformation positions multi-currency wallets as central hubs for all digital interactions in Web3 wallet ecosystems.

Enhanced Interoperability

Cross-chain bridges and protocols are making blockchain interoperability seamless. Future wallets will abstract away the complexity of different blockchains, allowing users to interact with any blockchain as easily as switching tabs in a browser. Assets will move freely between networks based on optimal fees and transaction speeds, all managed automatically by wallet intelligence.

Integration with Traditional Finance

The boundary between cryptocurrency and traditional finance continues to blur. Advanced multi-currency wallets now feature integrated fiat on-ramps/off-ramps, virtual and physical debit cards funded by crypto holdings, direct bill payment functionality, and even mortgage and loan services collateralized by digital assets. This convergence creates truly unified financial management platforms.

Industry Perspective: The All-in-One Digital Asset Manager

We’re witnessing the transformation of multi-currency wallets from simple storage solutions to comprehensive digital asset management platforms. The wallet of 2030 will likely manage cryptocurrencies, NFTs, tokenized real-world assets, digital identities, social connections, and traditional financial products—all secured by advanced cryptography and personalized through AI. This evolution represents the maturation of the cryptocurrency industry and its integration into mainstream financial infrastructure.

Conclusion

The multi-currency wallet has evolved from a convenience feature to an essential tool for anyone participating in the cryptocurrency ecosystem. As digital assets become increasingly integrated into global finance, the ability to securely manage multiple cryptocurrencies from a unified platform provides significant advantages in security, efficiency, and investment strategy.

Throughout this guide, we’ve explored the fundamentals of multi-currency wallets from basic concepts and security principles to advanced features like DeFi integration and multi-signature setups. We’ve emphasized that successful cryptocurrency management requires not just the right tools, but also proper understanding, security practices, and ongoing education.

The key lessons from our eight years of experience in this field can be distilled into several core principles:

- Security is paramount: Protect your seed phrase, use hardware wallets for significant holdings, and implement all available security features.

- Start simple and grow: Begin with basic wallet functions before exploring advanced features. Master the fundamentals before engaging in complex DeFi strategies.

- Verify everything: Double-check addresses, confirm network selections, and test with small amounts before large transactions.

- Stay informed: The cryptocurrency space evolves rapidly. Keep your wallet software updated and stay aware of emerging security threats.

- Use appropriate tools: Match your wallet choice to your needs hardware wallets for storage, mobile wallets for convenience, and hybrid solutions for balanced approaches.

As you embark on your cryptocurrency journey or optimize your existing setup, remember that the best multi-currency wallet is one that matches your specific needs, technical comfort level, and security requirements. Take time to research options, start with small amounts to gain confidence, and gradually expand your capabilities as your understanding grows.

The future of digital asset management is bright, with continuous innovation making cryptocurrency more accessible and secure. By following the principles and practices outlined in this guide, you’re well-equipped to navigate this exciting landscape safely and effectively.

Ready to Start Managing Your Digital Assets Securely?

Choose a reputable multi-currency wallet today and take control of your cryptocurrency portfolio with confidence. Remember to start small, prioritize security, and never stop learning.

Your journey to financial sovereignty begins with a single step—make it a secure one.

About the Author: This comprehensive guide was developed by our team of blockchain security experts and cryptocurrency consultants with over eight years of combined experience in digital asset management, security auditing, and cryptocurrency implementation. We’ve worked with thousands of clients ranging from individual investors to institutional funds, helping them navigate the complexities of cryptocurrency storage and management securely.

Frequently Asked Questions

A multi-currency wallet is a crypto wallet that allows users to store, send, receive, and manage multiple cryptocurrencies across different blockchains from a single interface.

Yes, a multi-currency wallet is safe when it uses strong security features like private key encryption, seed phrase backups, two-factor authentication, and hardware wallet integration.

A multi-currency wallet works by managing multiple private keys that control assets on different blockchains, allowing users to access and transact with various cryptocurrencies from one application.

The best multi-currency wallet in 2026 depends on your needs. Ledger and Trezor are best for security, Trust Wallet and MetaMask are ideal for DeFi and NFTs, while Exodus is popular for beginners.

Yes, a multi-currency wallet can store Bitcoin, Ethereum, and many other cryptocurrencies together, as long as it supports the respective blockchain networks.

A single-currency wallet supports only one cryptocurrency, while a multi-currency wallet supports multiple cryptocurrencies across various blockchains in a single wallet interface.

Most modern multi-currency wallets are non-custodial, meaning users control their private keys. However, some custodial wallets exist where a third party manages the keys.

Yes, many multi-currency wallets support DeFi applications and NFT storage, allowing users to interact with decentralized apps and manage NFTs directly from the wallet.

If you lose your seed phrase, you permanently lose access to your funds. Multi-currency wallets cannot recover lost seed phrases, which is why secure backup is critical.

Most multi-currency wallets are free to download and use. However, transaction fees, swap fees, and optional hardware wallet costs may apply.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.