Key Takeaways

- A hot wallet is a Bitcoin wallet connected to the internet, designed for fast transactions and daily usage.

- Hot wallets work by storing private keys on internet-connected devices and signing transactions in real time.

- Security risks in crypto wallets mainly come from phishing, malware, and compromised devices.

- A hot wallet should hold only small, operational Bitcoin balances not long-term holdings.

- Using a hot wallet with cold storage creates a safer layered custody strategy.

- Mobile, desktop, and web hot wallets fit different use cases and risk levels.

- Backups, encryption, and address verification are essential for crypto wallet security.

- Businesses use a hot wallet for payments and liquidity, but must enforce limits and approvals.

- Many modern hot wallets support Lightning Network for faster and cheaper Bitcoin payments.

- The future of cryptowallets focuses on stronger key protection, fraud signals, and better UX.

Bitcoin custody isn’t just “where you store coins” it’s how you manage private keys, how quickly you can move funds, and how safely you operate when the internet is full of phishing pages and fake apps. In most real-world setups, people don’t choose only one wallet type. They combine systems: a hot wallet for speed and convenience, and cold storage for long-term safety.

In 2026, the most common mistake we still see is not understanding the risk boundaries of a hot wallet. A wallet is excellent for daily BTC use, but it requires disciplined security habits. If your wallet is always online, you must assume attackers can reach it. The goal isn’t “perfect security” (that doesn’t exist), it’s building layers of protection so a single failure doesn’t become a total loss.

This guide follows a practical path: basic definitions first, then “how it works,” then risk and protection, then best Cryptocurrency wallet selection logic, and finally advanced topics like Lightning integration and compliance realities for Bitcoin wallet usage.

2) What Are Hot Wallets in Bitcoin?

A hot wallet is a Bitcoin wallet that remains connected to the internet (directly or indirectly) so you can create, sign, and broadcast transactions quickly. That connectivity is the main advantage and also the main risk. In a typical hot wallet, private keys are stored on an internet-connected device (phone, desktop, or browser environment) or protected through a modern approach like secure enclaves or multi-party computation.[1]

Statement (practical reality): A wallet is designed for usability and speed. If you treat a wallet like a long-term vault, you increase risk unnecessarily. Use wallet for active funds, not “all funds.”

| Hot Wallet Characteristic | What It Means | Why It Matters |

|---|---|---|

| Online connectivity | Wallet environment can access the network | Fast transfers, but larger attack surface |

| Fast transaction workflow | Quick signing + broadcasting | Useful for trading, payments, daily operations |

| Key management varies | Keys may be local, enclave-protected, or shared across parties | Security depends on architecture and user habits |

| Best for active funds | Spending and frequent transfers | Limits exposure—only keep what you need in a hot wallet |

3) Why Hot Wallets Are Important in the Bitcoin Ecosystem

Bitcoin is permissionless anyone can transact at any time. That freedom creates a practical need: a cryptocurrency wallet that is always ready. A wallet fills the “ready-to-use” role for everyday BTC activity. If you accept payments, run an exchange-like flow, operate a marketplace, or simply send Bitcoin frequently, wallet is the operational layer.

From an engineering viewpoint, a hot wallet often acts as a product feature: it enables onboarding, deposits, withdrawals, and real-time experiences. From a user viewpoint, a hot wallet is the “I can send BTC now” tool. That’s why most mature setups use two tiers: wallet for liquidity and a cold layer for reserves.

- Payments: fast sending and receiving using a hot wallet

- Trading: move funds quickly between platforms and wallets

- Operational liquidity: businesses keep limited working BTC in wallet

- Lightning readiness: modern flows often connect wallet to L2 tools

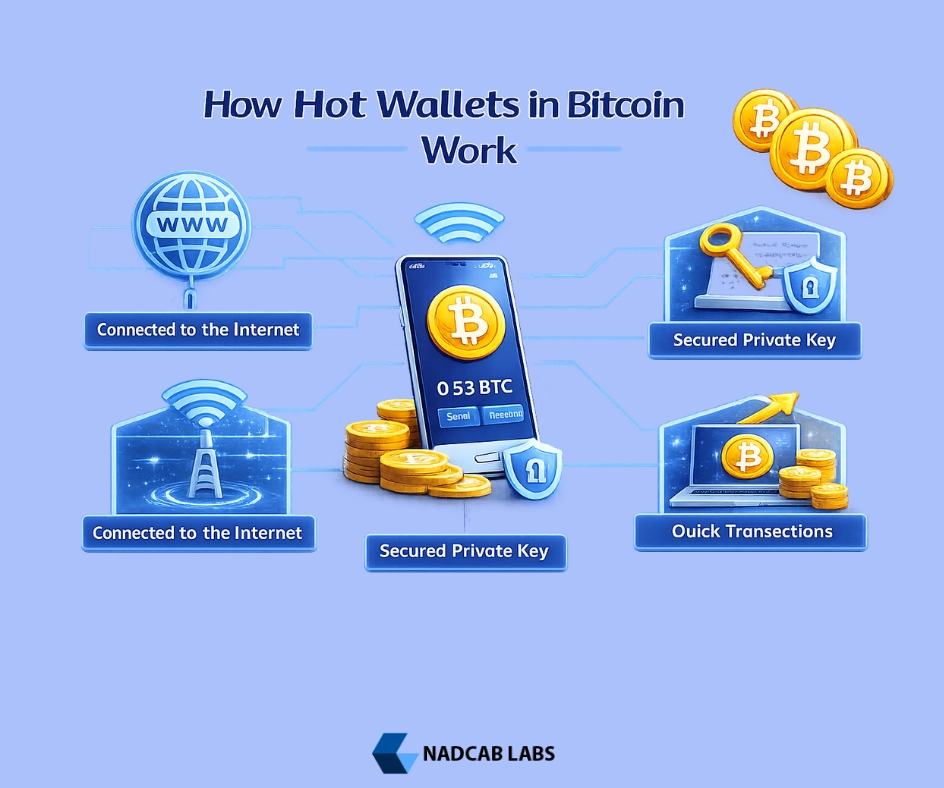

4) How Hot Wallets in Bitcoin Work (Step-by-Step Flow)

At a high level, a hot wallet performs three core jobs: it creates a transaction, it signs the transaction using private keys, and it broadcasts the signed transaction to the Bitcoin network. The user experience looks simple (“send”), but the security depends on what happens behind the scenes.

A) Internet connection

A hot wallet is connected to the internet so it can query balances, fetch UTXOs, estimate fees, and broadcast transactions. Some wallets connect to their own node, others rely on third-party infrastructure. From a privacy and reliability perspective, running your own node is stronger; from a convenience perspective, third-party access is simpler.

B) Private key handling

In a traditional hot wallet, private keys live on the device (encrypted). In more advanced designs, key material is protected by secure enclaves or split across parties so no single device can leak a full key. This is where “security architecture” really starts: how keys are generated, stored, and accessed.

C) Transaction signing

A Bitcoin transaction must be signed before it’s valid. The hot wallet uses the private key to produce a signature proving ownership. After signing, the crypto wallet broadcasts the transaction. If a malicious app can trick you into signing the wrong transaction or steal the signing capability the funds can be moved.

| Step | What the Hot Wallet Does | Security Checkpoint |

|---|---|---|

| 1) Build | Select UTXOs, set outputs, set fee | Verify recipient address + amount |

| 2) Sign | Sign inputs with private key access | Protect keys, prevent unauthorized signing |

| 3) Broadcast | Send signed TX to node/network | Use trusted node endpoints, avoid MITM risk |

| 4) Track | Watch confirmations, update balance | Confirm TXID and final settlement |

5) Types of Hot Wallets in Bitcoin

The term hot wallet covers multiple formats. The difference is not just “where it runs,” but how it protects keys, how it connects to the network, and what tradeoffs it makes between speed, privacy, and security. The wallet types are –

Mobile hot wallets

A mobile wallet is the most common choice for daily BTC use. It’s always with you, supports quick scanning, and can combine biometrics with local encryption. The risk is the phone itself: malware, compromised apps, or SIM swap attacks can lead to account takeovers especially if recovery is tied to phone numbers.

Desktop hot wallets

A desktop hot wallet offers more control and can be paired with node setups for better privacy. It’s also targeted by malware. In our experience, desktop environments demand strong hygiene: OS updates, anti-malware discipline, avoiding cracked software, and careful browser behavior.

Web-based Bitcoin wallets

Web-based options can feel effortless, but the security depends heavily on the provider and the environment. A browser is a noisy place. If you use a web wallet, treat it like a convenience layer keep small balances, enable strong authentication, and avoid using it on shared devices.

| Type | Strength | Primary Risk | Best Use Case |

|---|---|---|---|

| Mobile hot wallet | Convenient, fast payments | Phone compromise, SIM swap, phishing | Daily BTC spending |

| Desktop hot wallet | More control, node-friendly | Malware, unsafe downloads | Power users, operations |

| Web hot wallet | Fast access anywhere | Browser attacks, provider risk | Small balances, temporary use |

6) Hot Wallets vs Cold Wallets in Bitcoin (Detailed Comparison)

The simplest way to understand the role of a hot wallet is to compare it to cold storage. A wallet is built for activity; cold storage is built for preservation. Many people try to pick one “best wallet,” but the real best practice is a layered setup: use wallet for active BTC and cold storage for savings.

| Factor | Hot Wallet | Cold Storage | What We Recommend |

|---|---|---|---|

| Connectivity | Online | Offline | Keep online only what you need |

| Speed | Fast | Slower | Use a hot wallet for daily operations |

| Security baseline | Depends on device + habits | Stronger by design | Layer: wallet + cold reserve |

| Best for | Spending, trading, quick transfers | Long-term holding | Split funds by purpose |

7) Key Features of a Secure Bitcoin Hot Wallet

Not every hot wallet is equal. In our delivery work, we evaluate a wallet through a “security + usability + recovery” lens. A wallet that’s secure but impossible to recover is not practical. A wallet that’s convenient but weak on key protection is risky. The best wallet balances all three.

Private key control

A strong hot wallet is explicit about how keys are generated and where they live. For self-custody, you should be able to back up your recovery phrase safely and avoid hidden custodial dependencies. If the “wallet” is actually an account system, understand what that means for your control.

Backup & recovery

Recovery is where most users fail not because they are careless, but because the process isn’t explained clearly. A good wallet provides a simple recovery path, warns about seed phrase safety, and supports safe backups. For teams and businesses, multi-person recovery is often required.

Encryption

A hot wallet should encrypt sensitive data at rest and reduce exposure during signing. This includes OS-level key storage, secure hardware usage, and protection against screen scraping and clipboard hijacking where possible.

Multi-device access

Multi-device can be helpful but risky. The safest wallet approach for multi-device is one that doesn’t copy raw keys everywhere. Modern methods like distributed key approaches can reduce single-device catastrophic loss.

| Feature | What to Look For | Why It Matters |

|---|---|---|

| Clear custody model | Self-custody vs account-based clarity | Defines who can move funds |

| Strong recovery | Seed phrase guidance, secure backup flow | Prevents permanent loss |

| Device security support | PIN/biometrics, lockouts, secure storage | Reduces casual theft risk |

| Transparent updates | Timely patches and security notes | Wallet security changes over time |

8) Security Architecture Behind Hot Wallets in Bitcoin

When we audit or design a hot wallet system, we break architecture into layers: key generation, key storage, signing permissions, transaction policy controls, network access, monitoring, and recovery. A well-designed wallet assumes that some layer will fail and prepares for it.

Layer 1: Key generation and storage

The heart of a hot wallet is the signing key. Basic wallets store keys on-device (encrypted). Stronger models reduce exposure using hardware-backed storage or distributed key methods. The goal is to prevent a simple device compromise from becoming total fund loss.

Layer 2: Signing policies and limits

Advanced hot wallet setups enforce policies: daily withdrawal caps, address allow lists, time delays for large transfers, and multi-approval for business transactions. These controls are extremely effective because they reduce the impact of a single stolen credential.

Layer 3: Network and privacy controls

Many hot wallet privacy leaks happen via the network layer. Using your own node, isolating API keys, and avoiding untrusted endpoints can reduce data exposure. For businesses, separating public-facing services from signing services is a major best practice.

Hot wallet security lifecycle (real-world operational model)

A hot wallet isn’t “set and forget.” Security is a lifecycle. Below is the operational lifecycle we recommend for product teams and serious users who rely on a wallet.

| Phase | What You Do | Outcome |

|---|---|---|

| Setup | Install from trusted source, secure device, create backups | Safe foundation for hot wallet use |

| Operate | Use small balances, verify addresses, avoid risky networks | Reduced exposure |

| Monitor | Alerts, anomaly checks, withdrawal limits for teams | Early detection |

| Patch | Update wallet + OS, rotate secrets if needed | Lower exploit risk |

| Review | Audit permissions, clean devices, refresh backups | Long-term stability for wallet operations |

9) Are Hot Wallets in Bitcoin Safe? (Realistic Risk Analysis)

A hot wallet can be safe enough for its purpose if you set correct boundaries and follow security best practices. The realistic way to think about safety is: what is your threat model, and what is your exposure? If you keep a small operational balance, the downside is limited. If you keep a large life savings balance, wallet becomes a high-risk choice.[2]

Safety also depends on whether your wallet is self-custodial wallet or account-based. With self-custody, you control keys and recovery. With account-based wallets, you rely on provider security, recovery processes, and access controls. Both can work, but you must understand the responsibility shift.

Statement (how professionals manage risk): We advise clients to size their wallet like a “checking account,” not a “fixed deposit.” Your wallet should support daily needs, while long-term BTC stays in stronger storage.

10) Common Security Risks in Bitcoin Hot Wallets

Attackers rarely “hack Bitcoin.” They hack people, devices, and weak recovery flows. A hot wallet is exposed to internet-era threats, so your best defense is understanding the most common attack patterns and building habits that reduce your chances of being the target.

Malware

Malware can read your clipboard, overlay screens, steal session tokens, or attempt to extract wallet data. If a device is compromised, your wallet can be compromised especially if you approve transactions without careful verification.

Phishing

Phishing is the #1 real-world cause of wallet loss. Attackers clone wallet sites, create fake “support” chats, and trick users into entering seed phrases. A legitimate wallet will never ask for your recovery phrase during normal use.

SIM swap attacks

SIM swaps target wallets tied to phone numbers for recovery. If your wallet uses SMS-based controls, you must treat it as a weak link. Prefer app-based authentication and strong device locks.

| Threat | How It Hits a Hot Wallet | Practical Defense |

|---|---|---|

| Phishing | Fake apps/sites steal seed phrases or credentials | Never share recovery phrase; verify URLs |

| Malware | Clipboard hijack, screen overlays, data theft | Clean OS, trusted installs, avoid risky downloads |

| SIM swap | Phone number takeover triggers recovery | Avoid SMS controls; lock carrier account |

| Fake support | Scammers ask for seed phrase “to help” | No real support needs your seed phrase |

Example: A common phishing scenario (and how to avoid it)

You search for your crypto wallet name on Google, click an ad, and land on a perfect clone of the site. The page says “Security update required” and asks for your recovery phrase. If you enter it, the attacker imports your wallet and drains funds. The safe behavior is: never type your seed phrase into a web form; only use official sources, and treat the seed phrase like the master key to your Bitcoin.

11) Best Security Practices for Using Hot Wallets in Bitcoin

Security is mostly behavior. The safest hot wallet can still fail if the device is infected or if the user shares the recovery phrase. Below is a practical checklist based on what we implement for production systems and what we advise to high-frequency Bitcoin users.

| Best Practice | Why It Protects Your Hot Wallet | How to Apply It |

|---|---|---|

| Keep small balances | Limits damage if the hot wallet is compromised | Treat it as “spending BTC only” |

| Secure backups | Prevents permanent loss due to device failure | Store recovery phrase offline and private |

| Verify every send | Stops clipboard and address replacement attacks | Check first/last characters of address |

| Update regularly | Reduces known exploit risk in a wallet | Update OS + wallet from official sources |

| Avoid risky networks | Reduces interception and phishing opportunities | Avoid public Wi-Fi; use trusted connectivity |

For businesses using a wallet in production (exchanges, payment apps, lending platforms), we strongly recommend additional controls like withdrawal policies, approval flows, and segregated signing services because consumer-grade habits are not enough at scale.

12) Best Hot Wallets in Bitcoin for 2026

Instead of listing “random top 10 wallets,” we recommend selecting the best wallet based on your usage profile: beginner, trader, business operator, or privacy-focused user. The “best hot wallet” is the one that matches your risk tolerance and workflow. Below is a neutral, criteria-based approach you can use to shortlist options.

| User Type | Best Hot Wallet Profile | Must-Have Security | Why This Works |

|---|---|---|---|

| Beginner | Simple UI, guided recovery, safe defaults | Strong device lock + clear backups | Reduces human mistakes in a hot wallet |

| Trader | Fast sends, fee controls, address book | Transaction verification + limits | Supports high frequency safely |

| Business ops | Policy engine, approvals, monitoring | Allow list + multi-approval | Prevents single-user compromise |

| Privacy-focused | Node-friendly, minimal tracking | Trusted endpoints + transparency | Reduces network-level data leakage |

If you want, share your exact use case (beginner/trader/business), and we can map a “best wallet profile” plus a safe fund-splitting strategy to reduce risk.

13) How to Choose the Best Hot Wallet for Bitcoin

Choosing a wallet is a decision about trust and threat exposure. Our practical selection method uses five checks: custody clarity, recovery clarity, security controls, reputation signals, and operational fit.

Check 1: Custody model

Confirm whether the wallet is self-custodial (you hold keys) or account-based (provider controls access). This changes everything: recovery, control, and risk.

Check 2: Recovery design

A wallet must have a recovery process that is safe and understandable. If recovery is confusing, users take shortcuts that attackers exploit.

Check 3: Security controls

Look for device locks, signing prompts, address verification helpers, and sensible limits. The best wallet helps you avoid mistakes.

Check 4: Reputation signals

Prefer transparent security notes, active updates, and a long track record. Wallet trust is earned over time.

Check 5: Operational fit

The best hot wallet for a trader is not the same as for a business. Match features to your workflow: fees, batching, approvals, or Lightning support.

If you’re building a product, treat your wallet choice like infrastructure. You must plan key management, monitoring, incident response, and user recovery—because production wallet risk is operational, not theoretical.

14) Hot Wallets in Bitcoin for Trading, Payments & Daily Use

A hot wallet becomes most valuable when speed matters. Here are realistic patterns where a hot wallet is the correct tool provided you keep balances reasonable and follow security hygiene.

- Trading: move BTC quickly between venues; use a hot wallet for immediate liquidity

- Payments: receive BTC and send refunds using a wallet with clear address verification

- Daily transfers: family payments, services, subscriptions, frequent sends

- Business operations: keep limited operational BTC in wallet with strict policies

Example: A safe daily-use setup

Keep two layers: (1) wallet for daily BTC with a small balance you can afford to lose, and (2) a reserve wallet for longer-term holding. Refill the hot wallet weekly or as needed. This simple behavior drastically reduces the blast radius of attacks.

15) Hot Wallets in Bitcoin for Beginners vs Advanced Users

The same hot wallet features can be “safe” for one user and “dangerous” for another. Beginners benefit from safer defaults and guided recovery. Advanced users often want deeper control, node connectivity, and custom fee handling in a wallet.

| Area | Beginner Needs | Advanced Needs |

|---|---|---|

| UI | Guided, simple | Detailed controls |

| Fees | Auto fee suggestions | Manual fee + advanced options |

| Security | Clear recovery warnings | Node usage + policy controls |

| Best fit | Small balance hot wallet for daily use | Operational hot wallet with layered setup |

16) Role of Hot Wallets in DeFi, Lightning Network & Web3

While Bitcoin is its own network, modern user expectations include faster payments and smoother experiences. That’s why a crypto wallet in 2026 often connects to Layer-2 solutions like the Lightning Network for quick, low-fee transfers. From a product standpoint, Lightning-ready flows often use a wallet for on-chain liquidity and an L2 component for instant payments.

In broader Web3 wallet contexts, wallet concepts like identity, account abstraction, and risk scoring influence expectations even if Bitcoin remains UTXO-based. A well-designed wallet experience borrows the best UX patterns while keeping Bitcoin security fundamentals intact: protect keys, verify sends, and keep exposure limited.

Statement (product strategy): If you’re building consumer-facing payment flows, wallet that supports fast send/receive plus a layered Lightning path can dramatically improve user retention provided security policies are enforced.

17) Regulatory & Compliance Considerations for Bitcoin Hot Wallets

Compliance requirements depend on jurisdiction and whether you’re an individual user or a business. For individuals using a hot wallet, the main practical focus is safe custody and accurate record-keeping for taxes. For businesses, compliance can include KYC/AML obligations, transaction monitoring, and security controls aligned with operational risk management.

If your product includes a wallet layer, you should plan for: audit trails, access controls, incident response processes, and clear user communication. In our 8+ years of delivery, we’ve learned that compliance and security overlap good access control and logging reduce both fraud and regulatory risk.

| Scenario | What Matters | Hot Wallet Impact |

|---|---|---|

| Individual user | Custody safety + records | Use hot wallet for daily activity; store proofs |

| Merchant | Payment tracking + dispute handling | wallet supports refunds and settlement speed |

| Platform/business | Security controls + audit trails | Policy-based wallet operations reduce risk |

18) Future of Hot Wallets in Bitcoin (2026–2030 Trends)

The future of the hot wallet is about reducing single points of failure while improving UX. We expect wider adoption of distributed key approaches, better fraud detection, stronger policy controls, and smoother Lightning integrations. Importantly, users will demand both speed and trust which means wallet builders must make security visible without making the experience difficult.

| Trend | What It Means | Impact on Hot Wallet Security |

|---|---|---|

| Distributed keys | No single device holds full signing power | Lower “one hack drains all” risk |

| Policy-based signing | Limits, allow lists, approvals | Reduces fraud and insider risk |

| Lightning-first UX | Instant payments, low fees | Requires strong liquidity and monitoring |

| Fraud signals | Risk scoring and anomaly detection | Prevents suspicious sends from a hot wallet |

For organizations, the best future-ready approach is to treat the wallet as a controlled signing service not just a UI. That shift improves resilience and helps maintain user trust at scale.

19) When You Should NOT Use a Hot Wallet for Bitcoin

A hot wallet is not the right tool for every situation. If your goal is long-term holding, if you’re storing a large portion of your net worth, or if you can’t commit to basic security habits, then a wallet becomes unnecessary risk.

- You’re holding BTC long-term and rarely transact

- You want maximum protection from internet threats

- You cannot secure backups or maintain device hygiene

- You’re a business without policies, limits, and monitoring

In these cases, use a crypto wallet only as a small liquidity layer, not as the main storage solution.

20) Final Thoughts: Are Hot Wallets in Bitcoin Right for You?

A hot wallet is the best choice when you need speed and convenience daily transfers, payments, or active trading. The key is to use the crypto wallet with a purpose-based balance and strong habits. The moment your crypto wallet turns into a “store everything forever” vault, you increase risk.

| Your Goal | Recommended Setup | Why |

|---|---|---|

| Daily usage | Small-balance wallet + secure backup | Fast access with limited exposure |

| Trading | hot wallet for liquidity + reserve storage | Speed without risking all funds |

| Long-term holding | Reserve storage + minimal crypto wallet only if needed | Prioritizes safety over convenience |

Agency note (8+ years of delivery insight)

In real projects, the winning approach is always layered: crypto wallet for day-to-day activity, strong recovery and verification habits, and a separate storage approach for reserves. This design reduces panic, reduces losses, and makes Bitcoin usage sustainable for both individuals and businesses.

Need a secure hot wallet strategy for your product?

If you’re building a Bitcoin product that includes a hot wallet layer (deposits, withdrawals, merchant payments, or Lightning flows), the architecture and policies matter as much as the UI. A production-grade wallet requires key management design, policy enforcement, monitoring, and incident readiness not just screens.

Frequently Asked Questions

A hot wallet is a Bitcoin wallet that stays connected to the internet, allowing users to send, receive, and manage BTC instantly. Hot wallets are commonly used for daily transactions and active trading due to their speed and convenience.

A Bitcoin hot wallet works by storing private keys on an internet-connected device and using them to sign transactions. Once signed, the transaction is broadcast to the Bitcoin network for confirmation.

It can be safe when used correctly, but it is not meant for storing large amounts long term. Security depends on device protection, strong passwords, backups, and user behavior.

It include phishing attacks, malware, fake wallet apps, and SIM swap attacks. Because hot wallets are online, they have a higher attack surface than cold wallets.

It is connected to the internet and designed for fast transactions, while a cold wallet remains offline and is used for long-term Bitcoin storage. Most users combine both for better security.

The best hot wallet type depends on usage. Mobile wallets are best for daily payments, desktop wallets offer more control, and web wallets are convenient but should only hold small balances.

You should only keep the amount of Bitcoin in a wallet that you need for daily use or short-term activity. Treat a hot wallet like a checking account, not long-term savings.

Yes, businesses often use a wallet for payments, withdrawals, and operational liquidity. However, business hot wallets should include transaction limits, approvals, and monitoring controls.

Many modern wallets support or integrate with the Lightning Network, enabling faster and cheaper Bitcoin transactions while still using a hot wallet for on-chain liquidity.

Best practices for a wallet include keeping small balances, securing recovery phrases offline, updating software regularly, verifying transaction addresses, and avoiding public Wi-Fi networks.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.