The emergence of Automated Market Maker pools has fundamentally transformed how cryptocurrency trading operates in decentralized environments. Unlike traditional exchanges that rely on order books matching buyers with sellers, AMM pools in DEXs create entirely new paradigms for liquidity provision and price discovery. This revolutionary approach has enabled billions of dollars in daily trading volume across decentralized platforms, democratizing market making and creating opportunities for participants worldwide to contribute liquidity and earn returns.

Understanding how Automated Market Maker pools function is essential for anyone participating in decentralized finance, whether as a trader executing swaps, a liquidity provider seeking yield, or a protocol designer building the next generation of DEX infrastructure. The mechanics underlying AMM liquidity pools involve sophisticated mathematical models, economic incentives, and smart contract architecture that together create self-sustaining trading ecosystems. This comprehensive guide explores every aspect of AMM-based DEXs, from fundamental mechanisms to emerging trends shaping the future of decentralized trading.

Key Takeaways

- AMM pools in DEXs utilize algorithmic pricing mechanisms, primarily the constant product formula (x × y = k), to enable automated token swaps without order books, with prices determined by the ratio of tokens in the pool rather than by matching buy and sell orders.

- Liquidity providers deposit token pairs into pools and earn proportional shares of trading fees (typically 0.25% to 1% per swap) plus potential liquidity mining rewards, though they face impermanent loss risk when token prices diverge from their initial deposit ratios.

- The DEX AMM mechanism executes trades by traders adding one token to the pool and receiving another in return, with the constant product formula automatically adjusting prices to maintain mathematical equilibrium and prevent pool depletion.

- Smart contracts govern all AMM pool operations including token swaps, fee distribution, liquidity addition and removal, with security depending entirely on code quality, making audited protocols with proven track records significantly safer than new or unverified implementations.

- Impermanent loss represents the primary risk for liquidity providers, occurring when the price ratio of pooled tokens changes relative to the initial deposit, with losses becoming permanent upon withdrawal and potentially exceeding earned trading fees during high volatility periods.

- Price slippage in AMM-based DEXs increases with trade size relative to pool depth, as large orders significantly alter token ratios and push prices along the pricing curve, with deeper pools offering better execution for large trades.

- Different AMM pool models serve distinct purposes: constant product pools offer simplicity and reliability, concentrated liquidity models improve capital efficiency for active managers, and hybrid AMMs combine multiple mechanisms to optimize specific use cases like stablecoin trading.

- Next-generation AMM innovations include dynamic pricing that adjusts to market conditions, concentrated liquidity positions for improved capital efficiency, multi-asset pools beyond simple pairs, and oracle integration for external price reference to reduce arbitrage opportunities.

- Governance tokens allow AMM pool stakeholders to vote on protocol decisions including fee structures, supported assets, treasury management, and protocol upgrades, creating decentralized oversight of pool parameters and long-term development direction.

- The future of AMM pools focuses on solving current limitations through Layer 2 scaling for reduced gas costs, cross-chain liquidity aggregation, improved capital efficiency models, better impermanent loss mitigation strategies, and integration with advanced DeFi primitives for enhanced functionality.

AMM Pools in DEXs – An Overview

The concept of AMM pools in DEXs emerged from the need to solve a fundamental problem in decentralized trading: how to provide continuous liquidity without centralized market makers or complex order book infrastructure. Traditional centralized exchanges rely on professional market makers who maintain buy and sell orders across price levels, providing liquidity in exchange for spreads and fees. This model doesn’t translate well to blockchain environments where every order placement and cancellation would require expensive transactions and create significant latency.

Automated Market Maker pools revolutionized this challenge by replacing the order book entirely with liquidity pools managed by mathematical formulas. Instead of matching individual buyers with sellers, traders simply swap tokens against pooled reserves, with prices determined algorithmically based on the pool’s token composition. This innovation enabled permissionless liquidity provision where anyone could contribute assets to pools and earn fees, democratizing market making and creating the foundation for the explosive growth of decentralized finance.

What Are AMM Pools in Decentralized Exchanges

AMM pools in decentralized exchanges are smart contract-based reserves containing two or more tokens that facilitate automated trading through predefined mathematical formulas. Each pool represents a trading pair, such as ETH/USDC or BTC/DAI, with the pool maintaining specific ratios of these tokens. When someone wants to trade, they deposit one token into the pool and receive the other token in return, with the exchange rate calculated by the pool’s pricing formula. The pool’s smart contract handles all the logic for price calculation, token transfers, and fee distribution without requiring human intervention.

The beauty of this system lies in its simplicity and automation. Unlike order book exchanges where liquidity can be fragmented across different price levels or withdrawn when market makers cancel orders, AMM liquidity pools provide constant, guaranteed liquidity up to the pool’s total reserves. This ensures trades can always execute, though the price may not always be favorable for very large orders relative to pool size. The permissionless nature means anyone can create new pools for any token pair, contributing to the remarkable diversity of trading opportunities available across decentralized exchanges.

Role of Automated Market Maker Pools in DEXs

Automated Market Maker pools serve as the liquidity backbone of decentralized exchanges, enabling core trading functionality while simultaneously creating opportunities for passive income generation through liquidity provision. The role extends beyond simple token swapping to encompass price discovery, market efficiency, and the foundation for more complex DeFi protocols. Many lending platforms, derivatives markets, and synthetic asset protocols build on top of AMM pool infrastructure, using pool prices as reference points or leveraging pool liquidity for various financial operations.

From an ecosystem perspective, AMM pools reduce dependence on centralized intermediaries and create more resilient trading infrastructure. The distributed nature of liquidity provision means no single entity controls market making or can manipulate prices through traditional means. This aligns with the broader ethos of decentralization and self-custody that defines cryptocurrency’s value proposition. The success of AMM-based platforms has proven that automated, algorithmic systems can effectively replace traditional market-making infrastructure, at least for certain asset classes and trading scenarios. Organizations seeking to build exchange infrastructure increasingly adopt AMM architectures for their reliability and user appeal.

Why AMM-Based DEXs Depend on Liquidity Pools

The fundamental dependence of AMM-based DEXs on liquidity pools stems from the technical and economic constraints of blockchain environments. Recording every order placement and modification on-chain would be prohibitively expensive and slow, making traditional order book models impractical for most blockchain networks. AMM pools solve this by consolidating liquidity into single contracts that only require on-chain transactions when actual trades occur, dramatically reducing the number of blockchain interactions needed to maintain active markets.

Economically, liquidity pools create sustainable incentive structures that attract capital without requiring professional market makers or complex infrastructure. The combination of trading fees and liquidity mining rewards provides clear, transparent returns for liquidity providers, while the permissionless nature enables anyone to participate regardless of technical expertise or capital requirements. This democratization of market making has unlocked billions in liquidity that would never have flowed to traditional market-making operations, creating deeper, more resilient markets across thousands of token pairs.

AMM pools transform liquidity provision from an exclusive professional activity into a permissionless opportunity accessible to all participants willing to accept associated risks.

How AMM Pools Work in DEXs

Understanding the operational mechanics of how AMM pools work in DEXs requires examining both the mathematical foundations and the practical implementation through smart contracts. At the core lies the pricing mechanism that determines exchange rates, the process by which trades execute against pool reserves, and the smart contract architecture that enforces these rules trustlessly. Each component plays a critical role in ensuring pools function efficiently, fairly, and securely without centralized oversight or intervention.

The genius of the AMM design is that it creates self-balancing markets through pure mathematics. When demand for one token increases, causing traders to buy it from the pool, the pricing formula automatically makes that token more expensive and the other token cheaper. This price adjustment encourages arbitrageurs to rebalance the pool by selling the expensive token back to the pool, bringing prices in line with broader market rates. This continuous arbitrage process keeps AMM pool prices roughly aligned with external markets while generating trading fees for liquidity providers.

AMM Pricing Mechanism Explained

The pricing mechanism in AMM pools represents the mathematical heart of automated trading. Rather than prices being set by the highest bidder and lowest seller as in order books, prices emerge from the pool’s token composition and the formula governing their relationship. The most widely adopted approach, pioneered by Uniswap, uses the constant product formula, though alternative mechanisms exist for specific use cases like stablecoin trading or multi-asset pools.

These pricing mechanisms ensure several critical properties. First, they guarantee that trades can always execute up to the pool’s total reserves, providing unlimited price depth. Second, they automatically adjust prices based on supply and demand without external inputs. Third, they prevent the pool from being completely drained of either token through exponentially increasing prices as reserves deplete. These mathematical guarantees create predictable, manipulable trading environments that function reliably without human oversight or external price feeds.

Constant Product AMM Model (x × y = k)

The constant product formula (x × y = k) forms the foundation of most AMM liquidity pools, where x represents the quantity of Token A, y represents the quantity of Token B, and k is a constant that remains unchanged by trading activity. This elegant mathematical relationship means that as you remove one token from the pool, you must add the other in quantities that maintain the product. If a pool contains 100 ETH (x) and 200,000 USDC (y), then k equals 20,000,000. Any trade must preserve this constant, automatically determining exchange rates.

When a trader wants to buy 10 ETH from this pool, they must add enough USDC to maintain k = 20,000,000. After removing 10 ETH, x becomes 90, so y must equal 20,000,000 ÷ 90 = 222,222 USDC. The trader therefore adds 22,222 USDC to receive 10 ETH, resulting in an effective price of 2,222 USDC per ETH. This price is higher than the pre-trade rate of 2,000 USDC per ETH, reflecting the price impact of removing tokens from the pool. The larger the trade relative to pool size, the more pronounced this price impact becomes, creating the characteristic slippage curve of AMM pools.

Price Discovery in AMM Liquidity Pools

Price discovery in AMM liquidity pools operates through a different mechanism than traditional exchanges. Rather than price being determined by the intersection of supply and demand orders, AMM prices reflect the current token ratio in the pool. If external markets value one token differently than the pool’s ratio suggests, arbitrageurs profit by trading with the pool to bring its ratio (and thus its price) in line with external markets. This arbitrage mechanism effectively imports price discovery from external sources while the AMM itself simply maintains its mathematical invariants.

This indirect price discovery mechanism has both advantages and disadvantages. On the positive side, it’s simple, automated, and doesn’t require external price feeds or oracles. The downside is that AMM pools are always slightly behind external market prices, as arbitrageurs must execute trades to correct discrepancies. This lag creates opportunities for arbitrage but also means liquidity providers effectively subsidize this arbitrage through impermanent loss. Understanding this dynamic is crucial for anyone providing liquidity or executing large trades against AMM pools.

How Trades Are Executed in AMM-Based DEXs

Trade execution in AMM-based DEXs follows a streamlined process coordinated entirely through smart contracts. When a trader wants to swap tokens, they interact with the DEX interface which communicates with the relevant pool’s smart contract. The trader specifies the input amount or desired output amount, along with slippage tolerance parameters that define acceptable price ranges. The smart contract calculates the exchange rate based on current pool reserves, executes the token transfers if parameters are met, and updates pool state accordingly.

The entire process occurs atomically within a single blockchain transaction, meaning either all steps complete successfully or the entire transaction reverts with no state changes. This atomicity prevents scenarios where tokens are taken from the trader without providing the swapped tokens in return. The smart contract also deducts trading fees (typically 0.3% for Uniswap-style pools) and distributes them to liquidity providers. This seamless, trustless execution without intermediaries represents one of the key innovations making decentralized trading viable. Learning DEX architecture fundamentals reveals how these systems achieve such reliable operation.

Swap Process Using AMM Pools

The swap process begins when a trader selects tokens to exchange and specifies either the input amount they want to trade or the output amount they wish to receive. The DEX interface queries the pool’s smart contract to calculate the exchange rate and expected output amount (or required input amount), displaying this to the trader along with estimated fees and price impact. The trader must approve the DEX contract to spend their input tokens if not previously approved, which requires a separate transaction.

Once approved, the trader submits the swap transaction with specified slippage tolerance. The smart contract verifies that current pool conditions still satisfy the slippage parameters (as pool state may have changed since the quote was generated), executes the token transfers, calculates and distributes fees, and updates the pool’s token reserves. The entire process completes in one transaction, typically taking anywhere from seconds to minutes depending on blockchain congestion and gas prices. Failed transactions usually result from price movements exceeding slippage tolerance or insufficient gas fees.

Role of Smart Contracts in AMM Pools

Smart contracts serve as the autonomous operational core of AMM pools, encoding all the logic for price calculation, trade execution, liquidity management, and fee distribution. These self-executing programs run on blockchain networks, enforcing pool rules without requiring trust in any centralized party. The code is publicly visible, auditable, and immutable once deployed, creating transparency about exactly how the pool operates. This transparency and determinism distinguish AMM-based systems from traditional exchanges where internal operations remain opaque.

The smart contract architecture typically separates concerns across multiple contracts: core pool contracts managing reserves and trades, factory contracts for creating new pools, router contracts for multi-hop swaps across pools, and peripheral contracts for additional functionality like limit orders or aggregation. This modular design enables upgradability and feature expansion while maintaining security through isolated, focused contract logic. However, it also introduces complexity that must be carefully managed to prevent vulnerabilities or unexpected interactions between contracts.

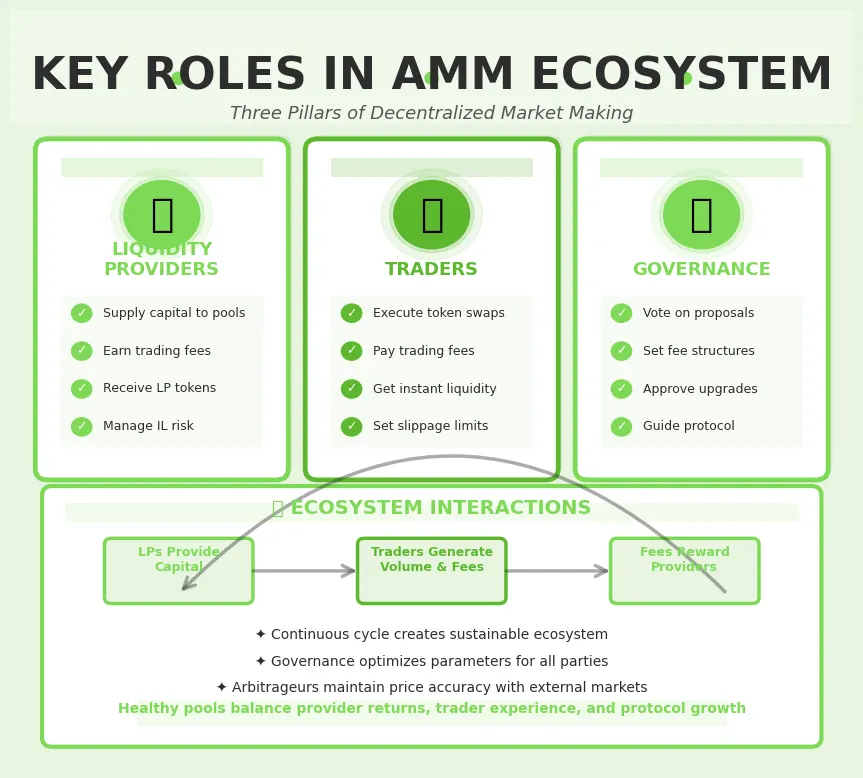

Key Roles in AMM Pools

The AMM pool ecosystem functions through the interactions of several key participant types, each playing distinct roles with different incentives and risk profiles. Understanding these roles and their relationships helps clarify how AMM-based DEXs maintain operations, generate value, and evolve over time. The primary actors include liquidity providers who supply capital, traders who use pools to exchange tokens, and governance participants who guide protocol evolution. Each role contributes essential functions that enable the overall system to operate efficiently.

The relationship between these roles creates interesting economic dynamics. Liquidity providers earn fees paid by traders, but face risks from impermanent loss that can exceed those earnings. Traders benefit from instant liquidity but pay fees and slippage costs. Governance token holders can influence protocol parameters but must carefully balance the interests of various stakeholders. These interdependencies create feedback loops where protocol success depends on maintaining attractive conditions for all participants simultaneously.

| Role | Primary Function | Incentives | Primary Risks |

|---|---|---|---|

| Liquidity Providers | Supply capital to pools | Trading fees, liquidity rewards | Impermanent loss, smart contract risk |

| Traders | Execute token swaps | Instant liquidity, no KYC | Price slippage, MEV exploitation |

| Arbitrageurs | Balance pool prices | Profit from price discrepancies | Competition, gas costs |

| Governance Participants | Vote on protocol changes | Protocol success, token value | Governance attacks, misaligned incentives |

| Protocol Developers | Build and maintain infrastructure | Grants, token allocations | Security vulnerabilities, competition |

Liquidity Providers in AMM Pools

Liquidity providers form the foundation of AMM pool operations by depositing token pairs that create the reserves against which all trades execute. Without sufficient liquidity, pools cannot facilitate meaningful trading volume or offer competitive pricing. Providers range from individual retail participants depositing modest amounts to institutional players and DAOs managing multi-million dollar positions. The diversity of liquidity sources contributes to market resilience and decentralization, ensuring no single entity controls critical trading infrastructure.

The economics of liquidity provision require careful analysis. Returns come from trading fees proportional to pool share and trading volume, plus potential liquidity mining rewards distributed by protocols. However, these returns must exceed impermanent loss to generate net profits. Successful providers carefully select pools based on expected volume, fee rates, token volatility, and available incentives, often diversifying across multiple pools to balance risk and return. The rise of professional liquidity management services and yield optimization vaults reflects the increasing sophistication of liquidity provision strategies.

How Liquidity Providers Add Assets to DEX AMM Pools

Adding liquidity to AMM pools requires depositing both tokens in the pair at the current pool ratio. If a pool contains ETH and USDC at a 1:2000 ratio, you must deposit these tokens in the same proportion. The pool’s smart contract calculates the equivalent values and mints LP tokens representing your share of the total pool. These LP tokens are fungible, tradeable assets that prove ownership of a pool percentage and entitle holders to proportional shares of trading fees and eventual withdrawal of underlying assets.

The process typically involves several steps: approving both tokens for spending by the pool contract (two separate transactions if not previously approved), executing the liquidity deposit transaction, and receiving LP tokens in return. The deposit transaction must specify either the amount of one token (with the other calculated proportionally) or amounts of both tokens with slippage tolerance for ratio changes. Many platforms offer “zap” features that automatically swap assets to achieve correct ratios, simplifying the process but introducing additional costs. Understanding pool mechanics thoroughly helps providers optimize their strategies.

Incentives and Rewards for AMM Liquidity Providers

Liquidity provider incentives come in multiple forms. Primary among these are trading fees, with most AMM pools charging 0.25% to 1% per swap and distributing these fees to liquidity providers proportionally. High-volume pools can generate substantial fee income, though competition has driven down fees on major trading pairs. The fees accrue continuously to the pool, automatically increasing the value of LP tokens. When providers eventually withdraw liquidity, they receive their proportional share of both tokens plus accumulated fees.

Beyond trading fees, many protocols implement liquidity mining programs that reward providers with governance tokens or other incentives. These programs typically target specific pools to bootstrap liquidity for new trading pairs or maintain depth in strategic markets. Liquidity mining can dramatically boost returns, sometimes offering triple-digit APYs, though these rates typically decline as more liquidity enters the pool. Some protocols also offer boosted rewards for locking liquidity for defined periods or for holding governance tokens, creating additional yield optimization strategies for sophisticated providers.

Traders in AMM-Based DEXs

Traders represent the demand side of the AMM ecosystem, using pools to exchange tokens for various purposes including speculation, portfolio rebalancing, entering or exiting positions, and accessing tokens not available on centralized exchanges. The trader experience on AMM-based DEXs differs significantly from centralized exchanges, with instant execution against pools rather than waiting for order matching, but also facing unique considerations around slippage, gas fees, and MEV (Maximal Extractable Value) exploitation.

Different trader types approach AMM pools with varying strategies. Retail traders appreciate the permissionless access and ability to trade long-tail assets not listed on major exchanges. Professional traders and funds use AMM pools for arbitrage opportunities, portfolio rebalancing, and accessing DeFi yield strategies. Market makers even provide liquidity to capture the spread between AMM prices and external markets. The diversity of trader types and motivations creates the continuous trading activity that generates fees for liquidity providers and maintains market efficiency.

How Traders Interact With AMM Liquidity Pools

Trader interaction with AMM liquidity pools typically occurs through web interfaces or mobile apps that abstract away the underlying smart contract complexity. The trader selects tokens to swap, specifies an amount, and reviews the quoted exchange rate including fees and estimated price impact. Most interfaces allow adjusting slippage tolerance, which defines how much the execution price can deviate from the quote before the transaction fails. Too tight tolerance causes frequent failures, while too loose tolerance risks unfavorable execution.

Advanced traders often interact directly with smart contracts or use specialized tools for better execution. They may split large orders across multiple pools to reduce slippage, use aggregators that automatically route trades through optimal paths across multiple DEXs, or time transactions to avoid MEV exploitation. Some implement limit order functionality through third-party protocols that execute swaps when pools reach target prices. These sophisticated approaches can significantly improve execution quality but require deeper technical understanding and often higher gas costs from additional complexity.

Governance Role in AMM Pools

Governance in AMM protocols determines critical parameters that affect all participants. Token holders vote on proposals covering fee structures, supported tokens, treasury management, protocol upgrades, liquidity mining allocations, and partnership decisions. This decentralized governance model aims to align protocol evolution with community interests rather than centralizing control with developers or venture capital backers. Effective governance balances competing interests while adapting protocols to market conditions and competitive pressures.

However, governance introduces its own challenges. Low participation rates can allow small groups to control decisions. Token distributions concentrated among early investors or developers create power imbalances. Technical complexity of proposals makes informed voting difficult for many holders. Some protocols implement safeguards like time delays, multi-signature requirements, or guardian systems to prevent malicious governance attacks while maintaining decentralization. The evolution of DeFi governance remains an active area of experimentation and improvement.

AMM Pool Governance and Protocol Decisions

Protocol governance encompasses both routine operational decisions and major strategic directions. Routine decisions might include adjusting fee tiers for specific pools, approving new token listings, or allocating liquidity mining rewards. Strategic decisions involve protocol upgrades like implementing concentrated liquidity, expanding to new blockchain networks, establishing treasury diversification strategies, or forming partnerships with other protocols. The governance process typically involves proposal submission, community discussion, voting periods, and execution through timelock contracts.

Different protocols implement varying governance models. Some use fully on-chain governance where votes directly execute code changes. Others employ off-chain voting platforms like Snapshot for sentiment measurement with multisignature wallets executing decisions. Hybrid approaches combine both methods for different decision types. The governance token distribution model critically affects power dynamics, with some protocols reserving significant allocations for teams and investors while others distribute more broadly to users. These structural choices profoundly impact protocol evolution and community alignment.

Effective AMM pool governance requires balancing multiple stakeholder interests while maintaining protocol security, competitiveness, and long-term sustainability.

Risks Associated With AMM Pools in DEXs

Participation in AMM pools, whether as liquidity provider or trader, involves multiple risk categories that participants must understand and manage. These risks range from well-documented phenomena like impermanent loss to more subtle threats including smart contract vulnerabilities, economic exploits, and market manipulation. The permissionless and automated nature of AMM pools, while enabling innovation, also creates new attack surfaces and edge cases not present in traditional financial systems.

Risk management in the AMM context requires technical knowledge, economic understanding, and continuous monitoring. Unlike centralized exchanges with customer support and potential recourse for errors, AMM transactions are irreversible and autonomous. A misplaced decimal, incorrect smart contract interaction, or misunderstanding of pool mechanics can result in permanent loss. This unforgiving nature demands careful education, thorough due diligence, and conservative position sizing, especially for newer participants still learning the ecosystem.

| Risk Type | Description | Affected Parties | Mitigation Strategies |

|---|---|---|---|

| Impermanent Loss | Loss from price divergence vs holding | Liquidity Providers | Choose correlated pairs, calculate breakeven fee income |

| Smart Contract Risk | Bugs or exploits in pool code | All Participants | Use audited protocols, diversify across platforms |

| Price Slippage | Price impact from large trades | Traders | Split orders, use deep pools, set slippage limits |

| Liquidity Risk | Insufficient pool depth for trades | Traders, Liquidity Providers | Verify TVL, avoid low-volume pairs |

| Rug Pull Risk | Malicious token contract drain | Liquidity Providers, Traders | Verify contracts, avoid unaudited tokens |

| MEV Exploitation | Front-running, sandwich attacks | Traders | Use private mempools, limit order size |

Impermanent Loss in AMM Pools

Impermanent loss represents the most significant and least understood risk facing liquidity providers in AMM pools. This phenomenon occurs because pool algorithms automatically rebalance holdings as prices change, effectively forcing providers to sell appreciating assets and buy depreciating ones. If you provide liquidity to an ETH/USDC pool and ETH doubles in price, the pool rebalances by selling some ETH for USDC to maintain the constant product relationship. When you withdraw, you have less ETH and more USDC than if you’d simply held the original amounts.

The mathematics of impermanent loss are deterministic and calculable. For a 2x price change in one token, impermanent loss equals about 5.7%. For a 4x change, it reaches approximately 20%. For extreme price movements of 10x or more, impermanent loss can exceed 40% of the position value. These losses are “impermanent” only in that they reverse if prices return to original ratios; if you withdraw at different ratios, the loss becomes permanent. Whether impermanent loss is offset by trading fees depends on pool volume, fee percentage, and the magnitude and duration of price divergence. Resources covering impermanent loss mechanics help providers understand this critical concept.

How Impermanent Loss Occurs in Liquidity Pools

Impermanent loss emerges from the interaction between AMM pricing mechanisms and external market forces. Consider a pool with 10 ETH and 20,000 USDC (implying 2,000 USDC per ETH). If external markets move ETH to 2,500 USDC, arbitrageurs profit by buying cheap ETH from the pool until the pool price matches external markets. The pool ends up with less ETH (now more valuable) and more USDC (stable value). The total dollar value of the position is less than if you’d held the original 10 ETH and 20,000 USDC.

This mechanism is inherent to the constant product formula and cannot be eliminated without fundamentally changing how AMM pools operate. The loss increases with greater price volatility and divergence between token pairs. Correlated assets like stablecoin pairs or wrapped versions of the same asset experience minimal impermanent loss, making them attractive for conservative liquidity providers. Conversely, volatile pairs with uncorrelated price movements carry the highest impermanent loss risk, requiring correspondingly higher fee income or rewards to justify the exposure.

Liquidity Risk in DEX AMM Pools

Liquidity risk in AMM pools manifests when insufficient reserves exist to support desired trading activity at reasonable prices. Shallow pools, those with low total value locked (TVL), experience dramatic price impacts from moderate-sized trades. A $10,000 trade in a $100,000 pool moves prices significantly more than the same trade in a $10 million pool. This creates challenges for both traders seeking efficient execution and liquidity providers facing potential losses from extreme price movements caused by individual transactions.

Low liquidity also amplifies manipulation risks. Malicious actors can more easily manipulate prices in shallow pools to trigger liquidations in lending protocols, exploit oracle vulnerabilities, or set up profitable MEV attacks. The cyclical nature of liquidity exacerbates these issues: as liquidity withdraws due to poor conditions, remaining participants face worse prices and higher risks, potentially triggering further withdrawals. Successful pools must attract and maintain sufficient liquidity to support healthy trading activity, creating better experiences that reinforce liquidity provision.

Low Liquidity and Its Impact on Trades

Low liquidity directly translates to poor trading experiences through elevated slippage, wide spreads, and vulnerability to price manipulation. Traders attempting to execute meaningful size in shallow pools pay premium prices due to the constant product formula’s exponential price impact curve. This makes low-liquidity pools suitable only for very small trades or participants who have no alternative venues. The poor execution quality discourages trading activity, which reduces fee generation, which discourages liquidity provision, creating a negative feedback loop.

The impact extends beyond individual trades to affect overall market efficiency. Insufficient liquidity prevents effective arbitrage, allowing pool prices to diverge significantly from external markets. This misalignment reduces the pool’s utility as a trading venue and can cause cascading problems if other protocols rely on the pool for price information. Bootstrapping sufficient liquidity represents one of the greatest challenges for new AMM pools, with most successful launches involving substantial initial liquidity provision, generous mining rewards, or strategic partnerships to seed initial depth.

Smart Contract Risks in AMMs

Smart contract risks encompass vulnerabilities, bugs, or exploitable logic in the code governing AMM pools. Despite extensive testing and auditing, complex smart contract systems inevitably contain edge cases or unforeseen interactions that attackers can exploit. History provides numerous examples: flash loan attacks draining pools, reentrancy exploits allowing unauthorized withdrawals, oracle manipulation enabling mispriced trades, and economic exploits leveraging unexpected behavior. A single vulnerability can drain entire pools, resulting in total loss for liquidity providers.

The immutable nature of deployed smart contracts means bugs cannot be quickly patched like traditional software. While some protocols implement upgradeable contracts with administrative privileges, this centralization introduces governance risks and potential for admin key compromise. The tension between security through immutability and flexibility through upgradeability remains an unsolved challenge. Most established protocols choose battle-tested, audited, immutable contracts, accepting limited flexibility in exchange for proven security and true decentralization.

Vulnerabilities in AMM Pool Smart Contracts

Common vulnerability categories in AMM smart contracts include reentrancy attacks where malicious contracts call back into the pool during execution, integer overflow/underflow in mathematical calculations, front-running of transactions for profit, oracle manipulation to feed incorrect prices, and flash loan exploits that leverage temporary capital to manipulate markets. Newer attack vectors emerge regularly as hackers discover novel exploits in increasingly complex protocol interactions and composability.

Mitigating smart contract risk requires multiple layers of defense. Professional security audits from reputable firms provide initial verification, though audits cannot guarantee absolute security. Bug bounty programs incentivize white-hat hackers to discover and responsibly disclose vulnerabilities. Gradual rollouts with initially low TVL limits exposure if problems emerge. Time-tested protocols with significant value secured over extended periods demonstrate resilience through Lindy effect. Users should strongly prefer established protocols with proven security track records over newer, unaudited alternatives regardless of superficially attractive incentives.

Price Slippage in AMM Pools

Price slippage in AMM pools is the predictable consequence of the constant product formula and finite pool depth. Unlike order books where you can see exact available liquidity at each price level, AMM pools calculate execution prices dynamically based on trade size and current reserves. Larger trades consume more of the pool’s reserves, moving further along the pricing curve and receiving progressively worse rates on each marginal unit. This mathematical certainty means slippage is always present for meaningful trade sizes, though its magnitude depends on pool depth.

Traders can partially mitigate slippage through various strategies. Splitting large orders into smaller chunks executed over time reduces per-trade impact but increases overall gas costs and time exposure. Using aggregators that route trades across multiple pools can offer better net prices by distributing impact. Timing trades during high liquidity periods when pools are deepest minimizes slippage. However, these optimizations have limits; extremely large trades relative to available liquidity will always face substantial slippage in AMM systems, making order book exchanges more suitable for institutional-sized orders.

Effect of Large Trades on AMM Pricing

Large trades create outsized price impacts due to the exponential nature of the constant product curve. Consider a pool with 1,000 ETH and 2,000,000 USDC (k = 2 billion). A 50 ETH purchase requires adding enough USDC to maintain k = 2 billion. After removing 50 ETH, 950 ETH remains, so USDC must equal 2,105,263, requiring the trader to add 105,263 USDC. The average price of 2,105 USDC per ETH is 5.25% higher than the pre-trade rate of 2,000 USDC per ETH, demonstrating significant slippage on a trade representing just 5% of pool depth.

This mathematical relationship explains why deep liquidity is crucial for attracting large traders and maintaining market efficiency. Pools with millions or tens of millions in TVL can accommodate substantial trades with acceptable slippage, while shallow pools with hundreds of thousands or less struggle to support anything beyond retail-sized orders. The capital efficiency improvements of concentrated liquidity models partially address this limitation by focusing liquidity where trades actually occur, allowing smaller total capital to provide better execution than traditional full-range pools.

Understanding and accepting AMM-specific risks is essential for participation; these risks cannot be eliminated but can be managed through education, diversification, and conservative position sizing.

Types of AMM Pool Models Used in DEXs

The diversity of AMM pool models reflects attempts to optimize for different use cases, trading characteristics, and user needs. While the constant product model dominates general-purpose DEXs, specialized models offer advantages for specific scenarios. Stablecoin trading benefits from curves optimized for minimal slippage between similar-priced assets. Multi-asset portfolios use weighted pools that maintain arbitrary token ratios. Concentrated liquidity enables capital efficiency for active liquidity managers. Understanding the strengths and weaknesses of each model helps users select appropriate platforms for their needs.

The evolution of AMM models continues as protocols experiment with innovations addressing known limitations. Dynamic fees that adjust based on volatility, oracles integration for better price reference, and hybrid approaches combining multiple mechanisms all represent attempts to improve on early AMM designs. However, increased complexity introduces new risks and edge cases, requiring careful consideration of tradeoffs between sophistication and reliability. The most successful models balance innovation with battle-tested security and user comprehension.

Constant Product AMM Pools

Constant product AMM pools, implementing the x × y = k formula, remain the most widely deployed model due to their simplicity, reliability, and proven security. Popularized by Uniswap, this approach provides robust liquidity across all price ranges, automatically prevents complete pool depletion, and operates without external dependencies like oracles. The mathematical elegance of the constant product formula makes behavior predictable and verifiable, reducing unexpected edge cases that could be exploited. These properties make constant product pools the default choice for general-purpose trading pairs.

However, the model’s simplicity comes with limitations. Capital inefficiency is the primary drawback: liquidity is distributed across the entire price curve from zero to infinity, but most trading occurs in narrow ranges around current market prices. This means significant capital sits idle, earning no fees while still facing impermanent loss risk. For highly volatile or uncorrelated pairs, constant product pools work reasonably well, but more specialized models can offer better performance for specific use cases. Despite these limitations, constant product pools will likely remain foundational infrastructure due to their proven track record and straightforward operation.

Concentrated Liquidity AMMs

Concentrated liquidity models, pioneered by Uniswap V3, allow liquidity providers to specify custom price ranges where their capital is active. Instead of spreading liquidity from zero to infinity, providers concentrate funds in ranges where they expect most trading to occur. A provider might add liquidity to an ETH/USDC pool only between $2,000 and $3,000, earning fees on all trades within this range. If prices move outside the range, the position becomes inactive (providing no liquidity and earning no fees) until prices return.

This approach dramatically improves capital efficiency. A position providing liquidity across a 10% price range can earn fees equivalent to several times more capital in a traditional full-range position. However, concentrated liquidity requires active management and increases impermanent loss risk for positions that experience prices outside their ranges. Sophisticated providers use multiple positions across different ranges, dynamically adjusting as markets move. Less experienced participants may prefer simpler full-range positions or delegate to professional liquidity managers. The capital efficiency benefits make concentrated liquidity increasingly popular despite added complexity. Understanding trading optimization strategies helps users navigate these advanced models.

Hybrid AMM Models in DEXs

Hybrid AMM models combine elements from different approaches to optimize for specific use cases. Curve Finance’s StableSwap combines constant product and constant sum formulas, creating a hybrid curve optimized for stablecoin trading with minimal slippage. Balancer allows weighted multi-asset pools where tokens maintain arbitrary ratios (not just 50/50), enabling index-like functionality. Some protocols integrate oracles to anchor prices or implement dynamic parameters that respond to market conditions. These hybrid approaches trade simplicity for targeted optimization.

The effectiveness of hybrid models depends on correct implementation and parameter tuning. A poorly designed hybrid can inherit the disadvantages of multiple approaches without capturing their benefits. Complexity increases attack surface and makes behavior harder to predict, potentially creating exploitable edge cases. However, when well-executed, hybrid models provide substantially better performance for their target use cases. Stablecoin pools on Curve regularly offer lower slippage than constant product alternatives. Multi-asset pools on Balancer enable creative treasury management and index products impossible with simple pair-based pools.

Evolution and Trends in AMM Pools

The AMM landscape continues evolving rapidly as protocols iterate on early designs, address known limitations, and experiment with novel approaches. Key trends include improving capital efficiency through various mechanisms, reducing impermanent loss through better price reference or hedging, expanding beyond simple token pairs to complex multi-asset strategies, and integrating with broader DeFi ecosystems for enhanced functionality. These innovations aim to make AMM pools more competitive with traditional market-making while preserving the permissionless, trustless properties that define decentralized exchanges.

The competitive dynamics driving AMM evolution create rapid iteration and experimentation. Protocols that solve key limitations attract liquidity from incumbents, incentivizing continuous improvement across the sector. However, not all innovations prove successful; many experimental approaches fail to gain traction due to complexity, insufficient benefits, or unforeseen issues. The protocols that endure typically balance innovation with conservative approach to security, user experience, and economic sustainability. Understanding these evolutionary trends helps participants anticipate future developments and position themselves advantageously.

Next-Generation AMM Models

Next-generation AMM models explore radical departures from constant product foundations. Dynamic AMMs adjust parameters like fees or curves based on market conditions, volatility, or liquidity depth. Some protocols implement oracle-guided pricing that references external market rates, reducing arbitrage losses for liquidity providers. Proactive market making uses off-chain systems to suggest price adjustments or liquidity rebalancing. Virtual reserves and dynamic k values enable more sophisticated pricing without requiring active management from providers.

These advanced models promise better capital efficiency, reduced impermanent loss, and improved trading experiences. However, they introduce dependencies on oracles, increase smart contract complexity, and create new potential failure modes. Some approaches sacrifice full decentralization for improved functionality, accepting this tradeoff as necessary for mainstream competitiveness. Others maintain pure on-chain operation while innovating within those constraints. The diversity of approaches reflects ongoing experimentation as the industry searches for optimal balances between various design goals.

Dynamic AMM Pools and Adaptive Pricing

Dynamic AMM pools adjust their parameters automatically in response to market conditions. Fee structures might increase during high volatility to compensate liquidity providers for elevated risk, then decrease during stable periods to attract traders. Liquidity curves could adapt based on recent trading patterns, concentrating around current prices while maintaining full-range coverage. Some protocols implement dynamic k values that effectively resize pools based on demand, improving capital efficiency during high activity while maintaining security during low usage.

The challenge with dynamic systems lies in parameter selection and update frequency. Too frequent updates create gaming opportunities where participants manipulate conditions to trigger favorable parameters. Too infrequent updates fail to respond quickly enough to meaningful changes. The algorithms governing parameter adjustments must be carefully designed to be robust against manipulation while effectively serving their intended purpose. Despite these challenges, dynamic AMMs represent promising directions for addressing limitations of static models, with several protocols successfully deploying these innovations.

AMM Innovation Trends in DEXs

Current innovation trends focus on several key areas. Cross-chain liquidity aggregation enables seamless trading across multiple blockchain networks, with protocols working to unify fragmented liquidity. Layer 2 scaling solutions dramatically reduce gas costs, making AMM pools accessible to smaller traders previously priced out by high fees. Concentrated liquidity continues spreading from Uniswap V3 to other platforms as providers embrace improved capital efficiency. Integration with lending protocols creates new strategies like leveraged liquidity provision or collateralized positions.

Other trends include permissioned pools with restricted access for compliance, NFT-backed liquidity positions creating new financial primitives, and sophisticated automation for retail users through vault strategies and professional management services. The boundaries between different DeFi categories blur as protocols integrate AMM functionality with lending, derivatives, yield optimization, and asset management. This composability represents both opportunity for innovation and risk from complex interactions. The ecosystem’s future likely involves further integration and specialization rather than convergence toward single dominant designs. Exploring advanced DeFi mechanisms reveals how AMM innovation enables new financial instruments.

Efficiency Improvements in Decentralized Liquidity Pools

Efficiency improvements target both capital utilization and operational costs. Capital efficiency advances include concentrated liquidity, just-in-time liquidity where positions are created and removed dynamically around trades, and virtual balances that simulate larger pools than actual reserves. Gas optimizations reduce transaction costs through more efficient smart contract code, batch operations, and layer 2 deployment. Protocol optimizations include better fee structures, improved price oracles, and reduced fragmentation through liquidity aggregation.

These improvements compound to create significantly better experiences than early AMM implementations. Trades execute with lower slippage, providers earn better returns per unit of capital, and reduced costs make DeFi accessible to broader user bases. However, efficiency gains often involve tradeoffs in complexity, security assumptions, or decentralization. The most successful innovations achieve efficiency improvements while maintaining core properties of trustlessness, permissionlessness, and security that define valuable DeFi infrastructure.

Future of AMM Pools in Decentralized Exchanges

The future trajectory of AMM pools points toward increasing sophistication, broader adoption, and deeper integration into global financial infrastructure. As blockchain technology matures and regulatory frameworks clarify, AMM-based trading will likely capture growing market share from centralized alternatives. Improvements in user experience, capital efficiency, and risk management will make these systems accessible to mainstream users beyond crypto natives. The permissionless innovation enabled by AMM pools continues driving experimentation that pushes boundaries of what decentralized finance can accomplish.

Long-term success requires solving current limitations around scalability, capital efficiency, and user protection while preserving the decentralization and permissionlessness that define DeFi’s value proposition. The protocols that achieve this balance will establish themselves as foundational infrastructure for the next generation of financial systems. Whether traditional finance gradually adopts AMM principles or decentralized systems eventually subsume traditional infrastructure remains uncertain, but the innovation catalyzed by AMM pools has permanently influenced how we think about liquidity, market making, and exchange design.

Scalability and Capital Efficiency in AMM Pools

Scalability challenges constrain AMM pool adoption as blockchain throughput limits transaction capacity and high gas fees price out smaller participants. Layer 2 solutions like Optimistic Rollups and ZK-Rollups offer dramatic improvements, enabling orders of magnitude more transactions at fraction-of-penny costs. Alternative layer 1 blockchains with higher throughput also compete for AMM deployment. The multi-chain future likely involves liquidity fragmented across numerous networks, with cross-chain bridges and aggregators attempting to unify this fragmentation.

Capital efficiency remains the frontier where the greatest improvements await. Current models still waste significant capital providing liquidity at price ranges where trades never occur. Future innovations may enable just-in-time liquidity provision, algorithmic market making that dynamically adjusts positions, or hybrid approaches combining on-chain settlement with off-chain optimization. These advances could enable AMM pools to match or exceed the capital efficiency of professional market makers while maintaining decentralization benefits. Success in scalability and efficiency will determine whether AMM-based exchanges remain niche tools for crypto natives or evolve into mainstream financial infrastructure.

Build High-Performance AMM Pools for Your DEX

Build secure and scalable AMM pools for your DEX with expert smart contracts and optimized liquidity models designed for efficient decentralized trading.

Launch Your Exchange Now

Long-Term Role of AMM Pools in DEX Liquidity

The long-term role of AMM pools extends beyond simple token trading to potentially encompass broad categories of financial operations. AMM principles could apply to derivatives markets, enabling decentralized options and perpetuals. Real-world asset tokenization might use AMM-style mechanisms for trading stocks, bonds, or commodities. Algorithmic stablecoins often incorporate AMM-like pricing mechanisms. The fundamental insight that mathematical formulas can replace intermediaries in market making appears broadly applicable across financial domains.

However, AMMs will likely coexist with order book exchanges and hybrid models rather than completely replacing alternatives. Different use cases favor different approaches: AMMs excel for long-tail assets and permissionless markets, while order books better serve professional traders and large orders. Hybrid systems combining strengths of multiple approaches may dominate, using AMM pools for certain functions while incorporating order book features for others. The diversity of trading needs ensures multiple models will persist, with AMM pools occupying crucial niches in the broader ecosystem of decentralized trading infrastructure.

Frequently Asked Questions

AMM pools in DEXs are smart contract-based liquidity reserves that enable automated trading without traditional order books. These pools contain pairs of tokens deposited by liquidity providers and use mathematical formulas, most commonly the constant product formula (x × y = k), to determine exchange rates. When traders want to swap tokens, they interact directly with these pools rather than matching with other traders, with prices adjusting automatically based on the ratio of tokens in the pool after each trade.

Automated Market Maker pools work by maintaining predetermined ratios of token pairs through algorithmic pricing mechanisms. When a trader swaps one token for another, they add their token to the pool and receive the other token in return, with the pool automatically recalculating prices based on the new token ratios. The constant product formula ensures that the product of the quantities of both tokens remains constant, meaning that as one token is bought from the pool, its price increases while the other token’s price decreases. This self-balancing mechanism enables continuous liquidity and 24/7 trading without intermediaries.

Impermanent loss occurs when the price ratio of tokens in an AMM pool changes compared to when you deposited them, resulting in lower value compared to simply holding the tokens separately. This loss is “impermanent” because it can reverse if prices return to their original ratio, though it becomes permanent when you withdraw your liquidity. The phenomenon happens because AMM pools automatically rebalance token ratios as traders make swaps, meaning liquidity providers effectively sell appreciating assets and buy depreciating ones. While trading fees can offset impermanent loss, significant price divergence can result in substantial losses for liquidity providers.

Liquidity providers earn returns through trading fees charged on every swap executed in the pool, typically ranging from 0.25% to 1% per transaction, distributed proportionally based on each provider’s share of the total pool. Many AMM-based DEXs also offer additional incentives through liquidity mining programs that reward providers with governance tokens or other rewards. The total return depends on trading volume, fee percentage, the provider’s pool share, and must be weighed against potential impermanent loss. High-volume pools with stable token pairs generally offer more predictable returns, while newer or volatile pairs may offer higher rewards but carry increased risk.

The constant product formula (x × y = k) is the mathematical foundation for most AMM pools, where x and y represent the quantities of two tokens in the pool and k is a constant. This formula ensures that the product of token quantities remains unchanged after trades, automatically adjusting prices based on supply and demand. When someone buys Token X from the pool, they add Token Y, increasing y and decreasing x, which makes Token X more expensive for the next trader. This elegant mechanism provides continuous liquidity, prevents pool depletion, and creates a predictable pricing curve without requiring external price oracles or order matching.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.