Key Takeaways

- Locked funds in liquidity pools prevent rug pulls by making it technically impossible for project creators to drain pool funds during the lock period, protecting traders and investors.

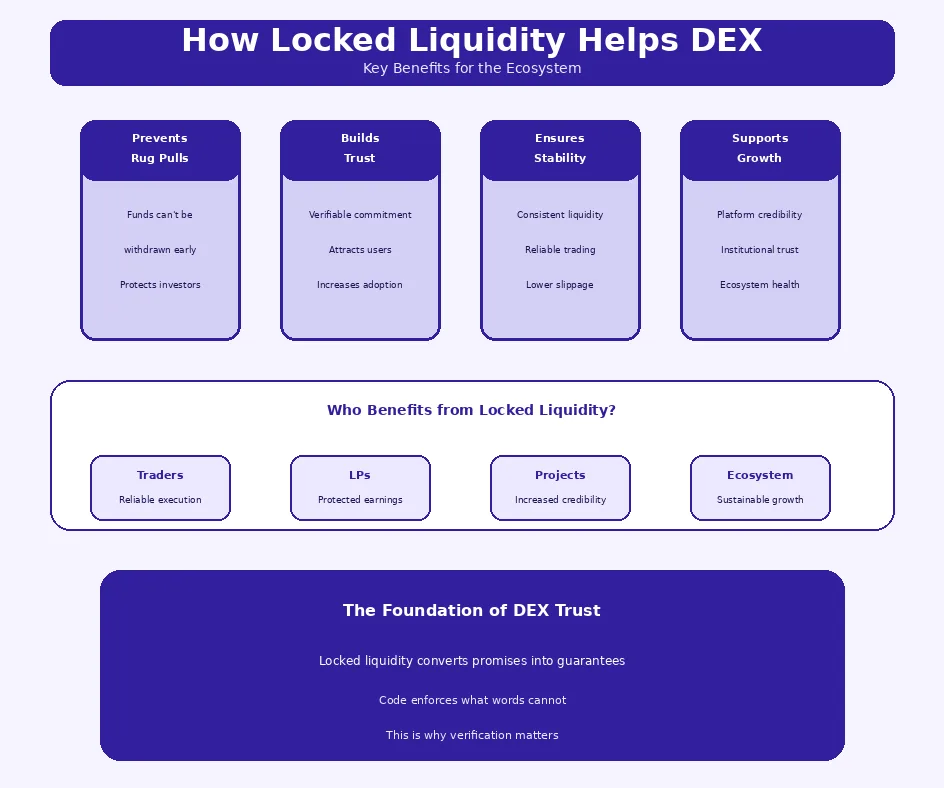

- How locked liquidity helps DEXs extends to building user confidence, ensuring consistent trading availability, and attracting both retail and institutional participation.

- Liquidity pools in decentralized exchanges require locked mechanisms to provide the stability that enables smooth token swaps with minimal slippage.

- The importance of locked funds in DeFi includes protecting liquidity providers from manipulation, reducing counterparty risk, and establishing project credibility.

- DEX liquidity pool security depends on audited smart contracts enforcing locks, with reputable locking services like Unicrypt and Team Finance providing verification.

- The role of liquidity pools in DEX platforms is amplified when funds are locked, as this guarantees trading infrastructure availability for the committed duration.

- Benefits of locked liquidity for DEXs include enhanced platform credibility, improved trading experience, and sustainable ecosystem growth through retained liquidity.

- Liquidity providers continue earning fees during lock periods while enjoying protection from sudden liquidity removal events that could affect their positions.

The decentralized finance ecosystem has transformed how people trade digital assets, with liquidity pools forming the backbone of modern DEX operations. However, the security and stability of these pools depend significantly on whether funds are locked or freely withdrawable. Understanding how locked funds in liquidity pools help DEX platforms reveals why this mechanism has become essential for building trust and ensuring sustainable DeFi trading environments.

Understanding Locked Funds in Liquidity Pools

Understanding locked funds in liquidity pools begins with grasping how liquidity enables decentralized trading. Unlike traditional exchanges with order books, DEX platforms rely on pools of token pairs that facilitate automated trading. The security and reliability of these pools directly impact user experience and platform credibility.

What Are Liquidity Pools in Decentralized Exchanges?

Liquidity pools in decentralized exchanges are smart contract-based reserves containing pairs of tokens that enable automated trading. Rather than matching buyers with sellers, DEX platforms use these pools to execute trades algorithmically. Users swap tokens against the pool, with prices determined by mathematical formulas based on pool balances.

Anyone can contribute to liquidity pools by depositing equal values of both tokens in a pair, becoming a liquidity provider (LP). In return, LPs receive pool tokens representing their share and earn fees from trades executed against their liquidity. Understanding how automated market makers function in DEX trading provides essential context for liquidity pool mechanics.

Role of Liquidity Pools in DEX Platforms

The role of liquidity pools in DEX platforms is fundamental to enabling permissionless trading without traditional market makers. Pools provide the liquidity necessary for users to swap tokens at any time, regardless of whether a counterparty wants the opposite trade. This constant availability distinguishes DEX from peer-to-peer exchanges requiring order matching.

Pool depth directly affects trading quality. Deeper pools with more locked liquidity in DEX platforms support larger trades with less price impact. Shallow pools result in high slippage, discouraging users and reducing trading activity. Building crypto exchanges with effective liquidity mechanics requires careful attention to pool design and security.

How Automated Market Makers (AMMs) Use Liquidity Pools

Automated Market Makers use liquidity pools through mathematical formulas that determine prices based on pool composition. The constant product formula (x * y = k) used by many AMMs ensures that trades adjust prices automatically as pool ratios change. This algorithmic pricing eliminates the need for order books while providing continuous trading capability.

AMMs incentivize liquidity provision through trading fees distributed to pool participants. When traders swap tokens, a small percentage goes to LPs proportional to their pool share. This fee structure creates economic incentives for maintaining pool depth, though locked liquidity adds security guarantees beyond pure economic motivation.

What Does Locked Liquidity Mean in DeFi?

Locked liquidity in DeFi means that funds deposited in liquidity pools cannot be withdrawn for a specified period, enforced by smart contracts. The lock applies to LP tokens that represent pool positions, preventing anyone, including project creators, from removing liquidity until the lock expires. This mechanism provides security guarantees that unlocked liquidity cannot offer.

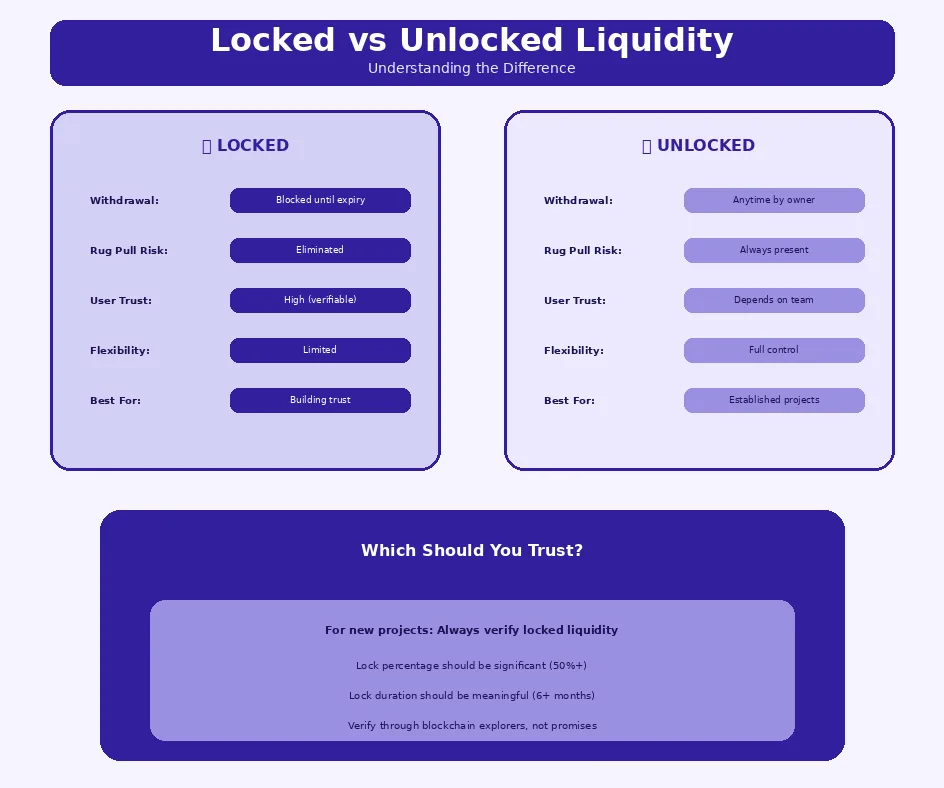

Difference Between Locked Liquidity and Unlocked Liquidity

The difference between locked liquidity and unlocked liquidity centers on withdrawal capability and security implications. Unlocked liquidity can be removed anytime by the provider, offering flexibility but creating risk that liquidity might disappear suddenly. Locked liquidity guarantees availability for the committed duration, building trust but limiting provider flexibility.

From a user perspective, locked liquidity signals project commitment and reduces rug pull risk. Unlocked liquidity, while not inherently problematic, requires greater trust in provider intentions. Most serious DeFi projects lock at least initial liquidity to demonstrate commitment, with ongoing liquidity potentially remaining flexible.

How Smart Contracts Lock Funds in DeFi Liquidity Pools

Smart contracts lock funds in DeFi liquidity pools by holding LP tokens and refusing withdrawal transactions until predefined conditions are met. When liquidity is locked, the LP tokens that would normally allow withdrawal are transferred to a locking contract with a timestamp-based release mechanism. No private key or administrator can override this lock before expiration.

Locking services like Unicrypt, Team Finance, and PinkLock provide standardized, audited contracts for this purpose. Project creators deposit LP tokens into these contracts, specifying lock duration and beneficiary addresses. The contracts then enforce the lock automatically, with verification available through blockchain explorers.

Security Principle: Locked liquidity represents a commitment mechanism that converts trust from social promises to cryptographic guarantees. When code enforces locks, users need not trust project teams’ intentions, only the verified smart contract logic.

How Locked Funds in Liquidity Pools Help DEXs

How locked liquidity helps DEXs spans multiple dimensions from trust building to operational stability. These benefits compound to create environments where users can trade confidently and liquidity providers can participate with reduced risk. The mechanism has become so fundamental that projects without locked liquidity face significant credibility challenges.

Improving Trust in Decentralized Exchange Platforms

Improving trust in decentralized exchange platforms through locked liquidity addresses one of DeFi’s primary adoption barriers: fear of losing funds to malicious actors. When projects publicly lock liquidity through verifiable smart contracts, users can independently confirm that funds cannot be stolen, dramatically reducing perceived risk.

How Locked Liquidity Prevents Rug Pulls in DeFi

Locked liquidity prevents rug pulls by eliminating the technical capability to remove funds. In a typical rug pull, project creators provide initial liquidity to enable trading, attract investors, then withdraw all liquidity leaving tokens worthless. With locked liquidity, this withdrawal is impossible until the lock expires, giving users time to evaluate projects while protecting their investments.

The prevention mechanism is absolute during the lock period. Even if project developers change intentions, become compromised, or face legal pressure, the smart contract maintains the lock. This immutability provides stronger guarantees than any promise or legal agreement could offer.

Building User Confidence Through Locked Liquidity

Building user confidence through locked liquidity creates positive network effects for DEX platforms. When users trust that liquidity will remain available, they trade more actively and recommend platforms to others. This confidence translates directly into higher trading volumes, deeper liquidity, and stronger platform economics.

Locked vs Unlocked Liquidity Comparison

| Aspect | Locked Liquidity | Unlocked Liquidity |

|---|---|---|

| Withdrawal | Blocked until expiry | Anytime by owner |

| Rug Pull Risk | Eliminated during lock | Always present |

| User Trust | High (verifiable) | Depends on provider |

| Flexibility | Limited during lock | Full flexibility |

| Best For | New projects, trust building | Established protocols |

Enhancing DEX Liquidity Pool Security

Enhancing DEX liquidity pool security through locking mechanisms protects all ecosystem participants. While the primary focus often falls on preventing malicious withdrawal, security benefits extend to protecting against various manipulation tactics and ensuring predictable pool behavior.

Protecting Liquidity Providers (LPs) Funds

Protecting liquidity providers’ funds involves ensuring their contributed assets remain available and earning fees as intended. When core project liquidity is locked, LPs can participate confidently knowing that even if project teams change, the fundamental trading infrastructure remains intact. This protection encourages broader LP participation.

Reducing Liquidity Manipulation Risks

Reducing liquidity manipulation risks through locks prevents tactics like liquidity removal during price peaks or coordinated draining during market events. Locked funds create stable pool conditions that resist manipulation attempts, ensuring fair trading conditions for all participants. Understanding how DEX platforms structure liquidity incentives reveals additional protection mechanisms.

Increasing Stability in DEX Trading

Increasing stability in DEX trading through locked liquidity ensures consistent trading conditions regardless of external pressures. When users know that liquidity cannot suddenly disappear, they can plan trades, execute strategies, and participate confidently in DeFi ecosystems.

Impact of Locked Liquidity on Price Stability

The impact of locked liquidity on price stability manifests through guaranteed pool depth that supports trading without excessive slippage. When large portions of liquidity are locked, traders can execute reasonable positions knowing the pool will absorb their trades. This predictability reduces volatility caused by liquidity uncertainty.

How Locked Funds Support Smooth Token Swaps

Locked funds support smooth token swaps by maintaining consistent pool ratios that AMM algorithms depend on for accurate pricing. Without locked liquidity, sudden withdrawals could dramatically alter pool composition, causing price spikes and failed transactions. Locks ensure the mathematical models underlying swaps remain valid.

Liquidity Locking Lifecycle

| Phase | Stage | Actions | Outcome |

|---|---|---|---|

| 1 | Pool Creation | Deposit token pairs to DEX | LP tokens received |

| 2 | Lock Initiation | Transfer LP to locking contract | Lock activated |

| 3 | Active Lock Period | Fees accumulate, no withdrawal | Protected liquidity |

| 4 | Lock Expiration | Timestamp reached | Withdrawal enabled |

| 5 | Post-Lock Decision | Withdraw or relock | Continued security or exit |

Benefits of Locked Liquidity for Liquidity Providers and Traders

Benefits of locked liquidity for DEXs extend to all participants in the ecosystem. While the mechanism primarily protects against malicious actors, the resulting stability and trust create advantages for both liquidity providers seeking yields and traders seeking reliable execution.

Advantages for Liquidity Providers (LPs)

Advantages for liquidity providers include protection from ecosystem-level risks while maintaining full earning potential. LPs continue accumulating trading fees during lock periods, with the added security that project-level liquidity remains intact regardless of team actions.

Long-Term Yield Opportunities in DeFi Liquidity Pools

Long-term yield opportunities in DeFi liquidity pools benefit from locked liquidity environments. When core liquidity is locked, pools maintain depth that supports consistent trading volumes, generating reliable fee income for LPs. This stability enables long-term yield strategies without concerns about sudden liquidity removal affecting returns.

Reduced Risk Through Locked Funds

Reduced risk through locked funds protects LP investments from common DeFi attack vectors. While impermanent loss remains inherent to AMM participation, the additional risks of liquidity removal, pool manipulation, and rug pulls decrease substantially in locked environments. This risk reduction encourages broader participation.

Benefits for Traders on DEX Platforms

Benefits for traders on DEX platforms with locked liquidity include reliable execution, reduced slippage, and confidence in platform stability. These advantages make DeFi trading more comparable to centralized exchange experiences in terms of reliability, while maintaining decentralization benefits.

Lower Slippage Due to Locked Liquidity

Lower slippage due to locked liquidity results from guaranteed pool depth that absorbs trades without excessive price impact. Traders can execute with confidence knowing that quoted prices will closely match execution prices. This predictability enables more precise trading strategies. Understanding how DEX aggregators improve trading experience reveals additional approaches to optimizing execution.

Reliable Trading Experience in Decentralized Exchanges

Reliable trading experience in decentralized exchanges depends on consistent liquidity availability. Locked mechanisms ensure that pools remain functional regardless of market conditions or project team decisions. This reliability makes DEX platforms viable for serious trading activities beyond speculative token purchases.

Evaluating Locked Liquidity Projects

When assessing projects with locked liquidity, consider these factors:

- Lock Duration: Longer locks indicate stronger commitment

- Lock Percentage: What portion of total liquidity is locked

- Locking Service: Reputation and audit status of the platform

- Verification: Independently verify locks through explorers

- Lock Ownership: Who can withdraw when lock expires

- Renewal Plans: Project commitment to continuing locks

Role of Locked Liquidity in DeFi Ecosystem Growth

The role of locked liquidity in DeFi ecosystem growth extends beyond individual project security to systemic trust building. As more projects adopt locking practices, the overall ecosystem becomes safer, encouraging broader participation and capital inflows that benefit all participants.

Supporting Sustainable DeFi Liquidity Mechanisms

Supporting sustainable DeFi liquidity mechanisms through locking creates foundations for long-term ecosystem health. Locked liquidity demonstrates that DeFi can offer security comparable to traditional finance while maintaining decentralization benefits, addressing key concerns that limit mainstream adoption.

Encouraging Long-Term Participation in DeFi

Encouraging long-term participation in DeFi requires environments where users feel confident committing capital for extended periods. Locked liquidity creates this confidence by ensuring that ecosystem infrastructure remains stable regardless of individual actor decisions. This stability encourages the long-term thinking essential for sustainable growth.

Strengthening the Overall DEX Ecosystem

Strengthening the overall DEX ecosystem through widespread locking practices creates positive externalities for all participants. As locked liquidity becomes standard, the reputation of DeFi improves, attracting new users and capital. Understanding decentralized exchanges implement security mechanisms reveals the technical foundations supporting this growth.

Locked Liquidity and DEX Platform Credibility

Locked liquidity and DEX platform credibility are closely linked in user perception. Platforms and projects that prioritize liquidity locking signal commitment to user protection, differentiating themselves from less serious or potentially malicious alternatives.

How Locked Funds Improve Project Transparency

Locked funds improve project transparency by creating verifiable commitments visible on-chain. Unlike promises or legal agreements, locked liquidity can be independently verified by anyone with blockchain access. This transparency builds trust through verification rather than requiring faith in project teams.

Institutional Trust in DEX Liquidity Models

Institutional trust in DEX liquidity models increases when locked mechanisms provide security guarantees familiar from traditional finance. While institutions understand and accept market risks, they require protection against counterparty and operational risks. Locked liquidity addresses these concerns, enabling institutional DeFi participation.

Important Notice: While locked liquidity significantly reduces certain risks, it does not eliminate all DeFi dangers. Smart contract vulnerabilities, market volatility, and impermanent loss remain present. Always conduct thorough research, verify locks independently, and never invest more than you can afford to lose.

Security and Risk Considerations of Locked Funds

Security and risk considerations of locked funds require balanced understanding. While locking provides significant benefits, the mechanism introduces its own considerations that users should understand before participating in locked liquidity environments.

Common Risks Associated With Liquidity Pool Locking

Common risks associated with liquidity pool locking include both technical and operational factors. Understanding these risks enables informed decisions about participating in locked liquidity pools and evaluating project security practices.

Smart Contract Vulnerabilities in DeFi Liquidity Pools

Smart contract vulnerabilities in DeFi liquidity pools can affect both the pool itself and the locking mechanism. Bugs in locking contracts could potentially enable unauthorized withdrawals or prevent legitimate ones. Using audited locking services with established track records minimizes but does not eliminate these risks.

Liquidity Lock Duration and Exit Limitations

Liquidity lock duration creates exit limitations that users must accept before committing. If market conditions change dramatically or project fundamentals deteriorate during the lock period, withdrawal remains impossible until expiration. This inflexibility represents a trade-off for the security benefits locking provides.

Best Practices for Secure Liquidity Locking

Best practices for secure liquidity locking help projects and users maximize benefits while minimizing risks. Following established guidelines ensures that locking mechanisms provide intended protections without introducing unnecessary vulnerabilities.

Audited Smart Contracts for Locked Liquidity

Audited smart contracts for locked liquidity provide essential security assurance. Reputable locking services undergo multiple audits from recognized security firms, with findings publicly available. Users should verify audit status before using any locking service, prioritizing platforms with comprehensive, recent audit reports.

Choosing Trusted Liquidity Locking Mechanisms

Choosing trusted liquidity locking mechanisms involves evaluating track record, audit history, and community reputation. Established services like Unicrypt, Team Finance, and PinkLock have locked billions of dollars without security incidents. New or unproven services should be approached with caution regardless of promised features.

Locking Service Evaluation Factors

| Factor | What to Look For | Red Flags |

|---|---|---|

| Audit Status | Multiple audits, reputable firms | No audits, unknown auditors |

| Track Record | Years of operation, no incidents | New, unproven service |

| TVL History | Consistent, high-value locks | Little usage, low values |

| Verification | Easy on-chain verification | Difficult to verify locks |

Future of Locked Liquidity in Decentralized Exchanges

The future of locked liquidity in decentralized exchanges involves continued innovation in security mechanisms, broader adoption, and integration with emerging DeFi primitives. As the ecosystem matures, locked liquidity practices will likely become more sophisticated and widespread.

Innovations in DeFi Liquidity Pool Security

Innovations in DeFi liquidity pool security continue advancing the capabilities and safety of locking mechanisms. New approaches address limitations of current systems while expanding functionality for diverse use cases. Exploring professional exchange platforms implement advanced security reveals emerging best practices.

Advanced AMM Models and Locked Funds

Advanced AMM models and locked funds are increasingly integrated in next-generation DEX designs. Concentrated liquidity, dynamic fee structures, and protocol-owned liquidity all interact with locking mechanisms in novel ways. These innovations improve capital efficiency while maintaining security guarantees.

Cross-Chain Liquidity Locking Trends

Cross-chain liquidity locking trends address the multi-chain reality of modern DeFi. As projects deploy across multiple networks, locking mechanisms must evolve to provide consistent security guarantees regardless of which chain holds liquidity. Standardized cross-chain locking protocols are emerging to address these needs.

Build a Secure DEX With Locked Liquidity Solutions

We develop secure DEX platforms with locked liquidity and audited smart contracts to ensure trust, stability, and smooth trading.

Launch Your Exchange Now

How Locked Liquidity Will Shape Next-Gen DEX Platforms

How locked liquidity will shape next-generation DEX platforms depends on evolving user expectations and technological capabilities. The mechanism has become a baseline expectation, with future innovations building upon rather than replacing core locking concepts.

Increased Adoption of Secure DeFi Trading

Increased adoption of secure DeFi trading will accelerate as locked liquidity becomes standard across the ecosystem. As users learn to expect and verify locks, projects without proper locking will face increasing scrutiny and reduced participation. This self-reinforcing adoption cycle drives ecosystem-wide security improvements.

Long-Term Impact on Decentralized Finance

The long-term impact on decentralized finance includes establishing trust standards that enable mainstream adoption. Locked liquidity mechanisms demonstrate that DeFi can offer security guarantees without sacrificing decentralization, addressing key concerns that limit institutional and retail participation in the current ecosystem.

Frequently Asked Questions

Locked liquidity in DeFi refers to funds deposited in liquidity pools that cannot be withdrawn by anyone, including project creators, for a predetermined period. Smart contracts enforce this lock, ensuring liquidity remains available for trading. This mechanism protects traders and investors from rug pulls where developers might otherwise drain pool funds.

Locked funds help decentralized exchanges by ensuring consistent liquidity for trading pairs, building user trust, and preventing sudden liquidity removal that could crash token prices. This stability attracts more traders and liquidity providers, creating positive network effects. DEX platforms with locked liquidity typically demonstrate higher credibility and user adoption.

Locked liquidity is secured in smart contracts that prevent withdrawal for specific timeframes, while unlocked liquidity can be removed anytime by the provider. Locked liquidity provides security guarantees to users, whereas unlocked liquidity offers flexibility but carries higher risk of sudden removal. Most serious DeFi projects lock at least a portion of their liquidity.

Locked liquidity prevents rug pulls by making it technically impossible for project creators to drain pool funds during the lock period. Even if developers wanted to remove liquidity, the smart contract refuses the transaction until the lock expires. This mechanism eliminates the primary vector for rug pull scams in DeFi.

Risks of locked liquidity pools include smart contract vulnerabilities that could be exploited, inability to withdraw during market crashes, impermanent loss during the lock period, and potential loss if the locking protocol fails. Users should verify audit status, choose reputable locking services, and understand lock durations before committing funds.

Optimal liquidity lock duration depends on project goals and user expectations. New projects typically lock for 6 months to 2 years to build trust. Established platforms may use shorter locks or rolling mechanisms. Longer locks provide more security assurance but limit flexibility. Most DeFi investors consider minimum 6-month locks as credible commitments.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.