Key Takeaways

- Chainlink dominates the oracle market with approximately 67% to 70% market share and has enabled over $26 trillion in cumulative transaction value as of October 2025, making it the most widely adopted oracles in DEXs and DeFi protocols.[1]

- Price oracle manipulation attacks ranked as the second most damaging attack vector in 2024, accounting for $52 million in losses across 37 separate incidents, highlighting the critical importance of proper oracle implementation.[2]

- DeFi Total Value Locked reached a record $237 billion in Q3 2025, with Ethereum commanding approximately 49% of the total share, demonstrating the massive scale of assets dependent on oracle infrastructure.[3]

- Pyth Network processed $149.1 billion in Total Transaction Value during Q1 2025 and expanded to support over 100 blockchains, making it a major competitor to Chainlink, particularly for high-frequency derivatives trading on platforms like perpetual DEXs.[4]

- Chainlink’s Cross Chain Interoperability Protocol (CCIP) has expanded to over 60 blockchains as of mid 2025, enabling protocols to transfer data and assets across multiple networks through a single integration.[5]

- The crypto industry lost more than $3.1 billion in the first half of 2025 alone due to hacks and fraud, already exceeding the total losses of $2.85 billion for all of 2024, with oracle vulnerabilities contributing significantly to these exploits.

- Uniswap v3’s TWAP (Time Weighted Average Price) oracle calculates the geometric mean of relative prices over a specified period, making manipulation significantly more expensive by requiring attackers to control prices across multiple blocks.[6]

- Perpetual DEX market share grew from 2.7% in 2023 to 26% by 2025, with platforms like Hyperliquid handling over 70% of all perpetual DEX trading volume and relying heavily on oracles like Chainlink for pricing and liquidation mechanisms.[7]

- DEXs processed $360 billion in trades between November 1 and November 26, 2025, surpassing June’s full-month total of $332 billion, demonstrating the growing volume of transactions dependent on oracle price feeds.[8]

- Chainlink Data Streams throughput surged by 777% in Q1 2025, with a single low-latency Decentralized Oracle Network now capable of supporting up to 700 assets in parallel, reducing operating costs by over 50% since the beginning of 2025.[9]

Introduction: Why Oracles Matter for Decentralized Exchanges

Decentralized exchanges have transformed how cryptocurrency traders buy, sell, and swap digital assets. Unlike centralized platforms where a company controls order matching and custody, DEXs operate through smart contracts that execute trades automatically on the blockchain. But these smart contracts face a fundamental limitation: they cannot access information from outside their native blockchain environment. This is where blockchain oracles become essential.

Think of an oracle as a bridge between the isolated world of a blockchain and the vast universe of external data. When a DEX needs to know the current price of Ethereum compared to USDC, it cannot simply check a price aggregator website. The smart contract requires that information be delivered in a format it can process and verify. Oracles solve this problem by fetching external data, validating it, and transmitting it to the blockchain, where smart contracts can use it for critical functions like executing trades, calculating collateral values, and triggering liquidations.

The stakes could not be higher. With DeFi protocols collectively managing hundreds of billions of dollars in locked value, the accuracy and integrity of oracle data directly impact the financial security of millions of users. A single corrupted price feed can cascade into catastrophic losses, as attackers have repeatedly demonstrated through sophisticated oracle manipulation schemes. Understanding how to properly implement and use oracles in decentralized exchanges has therefore become one of the most important technical and operational challenges in the cryptocurrency industry.

This comprehensive guide explores the best practices for Oracle integration in DEXs, examining everything from fundamental concepts to advanced cross-chain solutions and future trends that will shape the next generation of decentralized trading platforms.

Understanding the Oracle Problem in Decentralized Exchanges

Blockchains are designed as deterministic systems where the same input always produces the same output across all network nodes. This consistency is what makes decentralized consensus possible, but it also creates what cryptographers call the “oracle problem.” Smart contracts operating on Ethereum, Solana, or any other blockchain network cannot natively access price data from Binance, stock quotes from the NYSE, or weather information from any external source. They exist in computational isolation, processing only the data already recorded on their chain.

For a decentralized exchange, this isolation creates immediate practical challenges. When a user wants to swap 1 ETH for an equivalent value in stablecoins, the smart contract must somehow know the current market rate. When a lending protocol built on top of a DEX needs to determine if a loan is undercollateralized and should be liquidated, it requires accurate price information updated in real time. Without oracles providing this crucial external data, the entire DeFi ecosystem would be unable to function.

The challenge extends beyond simply fetching data. The oracle itself must be trustworthy, resistant to manipulation, and available at all times. If a DEX relies on a single oracle node controlled by one entity, that entity could manipulate prices for profit, or the service could go offline, freezing all trading activity. This has led to the development of decentralized oracle networks (DONs) that aggregate data from multiple independent sources, apply cryptographic verification, and use economic incentives to ensure honest behavior.

Modern oracle solutions address these challenges through various mechanisms, including multiple independent data providers, staking requirements that penalize dishonest reporting, and cryptographic proofs that verify data authenticity. The goal is to create an oracle system that maintains the decentralization and trustlessness that make blockchain technology valuable in the first place, while still connecting smart contracts to the real-world information they need.

Types of Oracles Used in Decentralized Exchanges

Not all oracles work the same way, and different DEX use cases demand different oracle architectures. Understanding these distinctions helps protocol developers and traders make informed decisions about which solutions best fit their needs.

Centralized Oracles

Centralized oracles rely on a single entity to provide data to smart contracts. While they can be fast and simple to implement, they introduce a single point of failure that contradicts the decentralized ethos of blockchain technology. If the oracle operator is compromised or acts maliciously, the entire system depending on that data becomes vulnerable. Most serious DEX projects have moved away from purely centralized approaches, though some protocols still use them for less critical functions or as one input among several.

Decentralized Oracle Networks

Decentralized oracle networks distribute the responsibility of data provision across multiple independent nodes. Chainlink pioneered this approach, creating a system where multiple oracle operators fetch data from different sources, aggregate their findings through consensus mechanisms, and deliver verified results to requesting smart contracts. This architecture eliminates single points of failure and makes manipulation significantly more expensive since an attacker would need to compromise multiple independent parties simultaneously.

On Chain Oracles (DEX Native)

Some protocols use price data derived directly from on-chain trading activity. Uniswap, for example, provides built-in oracle functionality that tracks the cumulative price of assets in its liquidity pools over time. These on-chain oracles benefit from being completely decentralized and requiring no external dependencies, but they face unique manipulation risks since an attacker can directly influence the underlying trading data through large swaps or flash loans.

Push vs Pull Oracle Models

In push oracle systems, data providers continuously update prices on the chain at regular intervals, regardless of whether anyone needs the data at that moment. This approach ensures fresh data is always available but incurs gas costs for every update. Pull oracle systems, by contrast, only update on chain prices when a user or protocol requests them, significantly reducing costs but potentially introducing latency. Many modern solutions, like Pyth Network, have adopted pull models that offer efficient, on-demand price updates.

You May Also Like:

Off-Chain Trading in DEXs- Faster Execution and Lower Gas Costs

Leading Oracle Solutions for DEX Integration

The oracle market has consolidated around several major providers, each with distinct strengths and architectural approaches that make them suitable for different applications within decentralized exchanges.

Chainlink: The Industry Standard

Chainlink has established itself as the dominant force in blockchain oracles, commanding approximately 67% to 70% of the total oracle market share by value secured. The network’s decentralized architecture relies on independent node operators who stake LINK tokens as collateral, creating economic incentives for accurate data reporting. Major DeFi protocols, including Aave, GMX, Lido, and Synthetix, depend on Chainlink price feeds to power their core functions.

Chainlink’s strength lies in its comprehensive approach to the oracle problem. The system aggregates data from multiple premium providers, processes it through independent nodes that reach consensus off-chain, and delivers cryptographically verified results to smart contracts. This layered decentralization at the data source, node operator, and network levels creates multiple barriers against manipulation or single points of failure.

The platform has expanded well beyond simple price feeds. Chainlink now offers Data Streams for low-latency market data, Proof of Reserve for verifying asset backing, Automation for triggering smart contract functions, and the Cross-Chain Interoperability Protocol for connecting different blockchain networks. For DEXs seeking comprehensive infrastructure, this ecosystem approach provides solutions for nearly every data and connectivity challenge.

Pyth Network: Speed for Derivatives

Pyth Network has emerged as a major competitor to Chainlink, particularly in the perpetual futures and derivatives space, where latency matters enormously. The network sources data directly from first-party publishers, including major trading firms, exchanges, and market makers like Jane Street and Cboe Global Markets. This first-party data model reduces the risk of manipulation that can occur when relying on aggregated third-party sources.

The platform’s pull oracle architecture enables updates as fast as one millisecond through Pyth Lazer, now called Pyth Pro, making it attractive for high-frequency trading applications. Perpetual DEXs like Drift Protocol, Hyperliquid, and Jupiter rely on Pyth for the rapid price updates needed to manage leveraged positions and liquidations effectively.

Pyth’s expansion to over 100 supported blockchains demonstrates the growing demand for cross-chain oracle infrastructure. The network processed $149.1 billion in Total Transaction Value during Q1 2025, highlighting its significant role in the DeFi ecosystem despite being newer than Chainlink.

Band Protocol and Other Alternatives

Band Protocol takes a community-curated approach to oracle data, allowing dApp operators to participate in managing and curating data feeds. The network uses a delegated proof of stake model and focuses on cross-chain compatibility, particularly within the Cosmos ecosystem through the Inter Blockchain Communication protocol.

Other Oracle providers have carved out specific niches. RedStone offers gas-efficient cross-chain data feeds with particular strength in real-world asset pricing. DIA provides fully open source oracle feeds with community governance. Tellor uses a tip-based system where users can request specific data queries and reporters compete to provide answers. Each of these alternatives may be appropriate for specific use cases or protocols seeking to diversify their oracle dependencies.

Comparison of Major Oracle Providers for DEX Integration

| Oracle Provider | Market Position and Reach | Best Use Cases for DEXs |

|---|---|---|

| Chainlink | 67% to 70% market share, $100+ billion value secured, 2,400+ integrations | Lending protocols, spot DEXs, cross-chain bridges, institutional applications |

| Pyth Network | 100+ blockchains, 127+ data providers, $149B Q1 2025 TTV | Perpetual DEXs, derivatives, high-frequency trading, Solana ecosystem |

| Band Protocol | Cosmos IBC focused, community-curated feeds, delegated PoS model | Cosmos ecosystem DEXs, cross-chain applications, and customizable data needs |

| RedStone | 110+ pull chains, zero mispricing incidents, modular architecture | Real-world assets, proof of reserves, low latency applications |

| Uniswap TWAP | Native to Uniswap v2/v3 pools, fully on-chain, no external dependencies | DEXs needing manipulation-resistant averages, protocols requiring on-chain verification |

| Chronicle Protocol | $7+ billion TVS, primary oracle for Sky (MakerDAO) | Stablecoin protocols, lending platforms, CDP based systems |

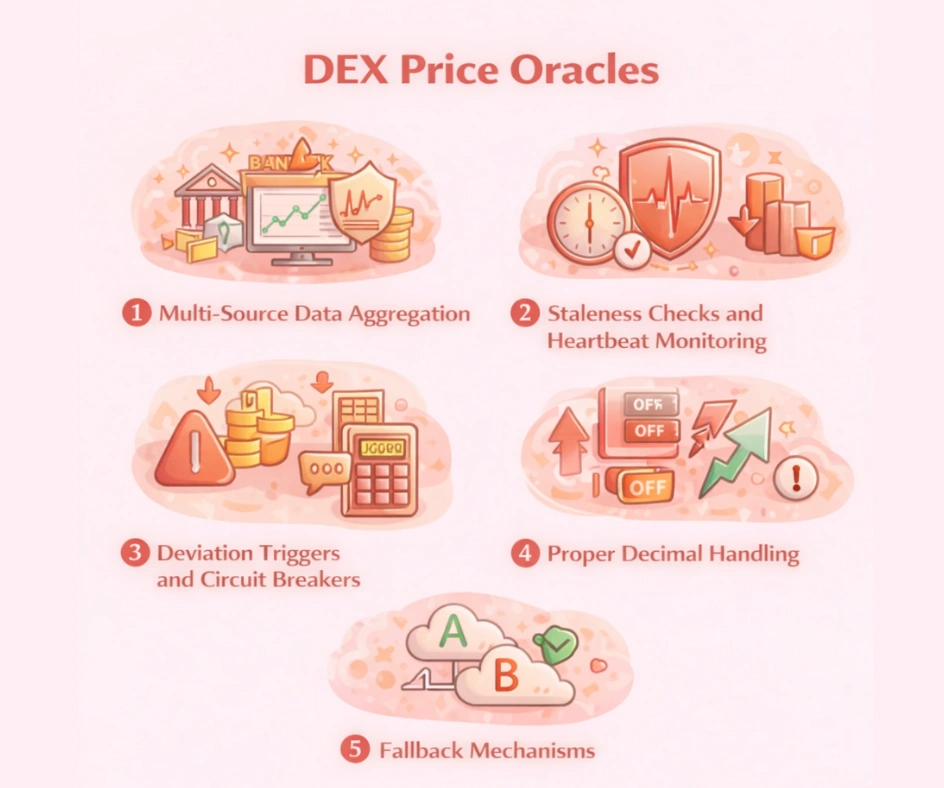

DEX Price Oracles: Implementation Best Practices

Implementing price oracles correctly can mean the difference between a protocol that operates safely for years and one that suffers catastrophic losses from its first exploit. The following practices represent lessons learned from both successful implementations and costly failures.

Multi-Source Data Aggregation

Never rely on a single data source for critical price information. Sophisticated oracle implementations aggregate prices from multiple centralized exchanges, decentralized exchanges, and data providers before calculating a weighted median or mean. This aggregation approach ensures that manipulation of any single venue cannot significantly impact the final price delivered to your smart contract. Chainlink’s approach of using multiple premium data providers who themselves aggregate from numerous sources creates multiple layers of protection against inaccurate data.

Staleness Checks and Heartbeat Monitoring

Price data that was accurate an hour ago may be dangerously wrong in volatile cryptocurrency markets. Every oracle integration should include staleness checks that verify the recency of price updates before using them in calculations. Most production implementations reject price data older than a defined threshold, typically measured in minutes rather than hours. Chainlink feeds include heartbeat parameters that specify how frequently updates should occur, allowing consuming protocols to set appropriate staleness thresholds.

Deviation Triggers and Circuit Breakers

Price feeds should update not only on regular intervals but also when prices move significantly. A deviation trigger ensures that large price movements are captured immediately rather than waiting for the next scheduled update. Additionally, protocols should implement circuit breakers that pause operations if prices move outside expected ranges, preventing cascading failures during extreme market conditions or oracle malfunctions. The 2022 Mango Markets exploit demonstrated how the absence of such safeguards can allow attackers to profit from artificially inflated prices.

Proper Decimal Handling

Cryptocurrency tokens use different decimal representations, and oracle feeds may return prices with varying precision. Incorrect decimal handling has caused significant losses in DeFi protocols. Always verify the decimal places expected by your oracle feed and ensure your smart contract performs appropriate scaling. Many vulnerabilities have occurred simply because developers assumed 18 decimals when the actual feed used 8, resulting in calculations that were off by factors of millions or billions.

Fallback Mechanisms

What happens when your primary oracle goes offline or returns invalid data? Production deployments should include fallback mechanisms that can switch to secondary oracle sources or pause trading gracefully rather than executing trades based on stale or missing prices. Some protocols implement a hierarchy of oracle sources, automatically falling back to the next option if the primary feed fails validation checks.

Time Weighted Average Price Oracles in DEXs

Time Weighted Average Price oracles represent a specialized approach to the oracle problem that has become particularly important for on-chain price references. Introduced in Uniswap v2 and refined in v3, TWAP oracles calculate average prices over specified time intervals, making them significantly more resistant to short term manipulation compared to spot price feeds.

How TWAP Works

The fundamental principle behind TWAP is straightforward. Rather than using the current instantaneous price, which could be artificially manipulated for a single block, TWAP calculates the average price weighted by how long each price level persisted. If ETH trades at $3,000 for 23 hours and $3,200 for 1 hour, the 24-hour TWAP would be approximately $3,008, heavily weighted toward the price that persisted longer.

Uniswap implements this by storing a cumulative price variable that continuously increases over time. Smart contracts can read this cumulative value at two different timestamps and calculate the average price over the intervening period through simple arithmetic. The elegance of this design is that it requires minimal storage (just the cumulative value) and allows any time window to be calculated without storing historical price data.

Manipulation Resistance

The key security benefit of TWAP comes from the cost of manipulation. To significantly move a 30-minute TWAP, an attacker would need to maintain an artificially elevated or depressed price for a substantial portion of that window. This requires either controlling multiple consecutive blocks (expensive or impossible on proof of stake chains) or accepting continuous losses to arbitrageurs who profit from restoring the price to market equilibrium.

For a 1-hour TWAP on a liquid Uniswap pool, moving the price by 5% would cost approximately equal to the arbitrage losses incurred by maintaining that price displacement for every block during the hour. On major trading pairs with deep liquidity, this cost can reach millions of dollars, making manipulation economically infeasible for most attackers.

Tradeoffs and Limitations

TWAP oracles are not without disadvantages. The averaging inherently introduces latency; during rapidly moving markets, TWAP prices may significantly lag spot prices, potentially causing issues for applications that need current market rates. Longer averaging windows increase manipulation resistance but also increase this lag. Additionally, TWAP is only available for assets that trade on chain with sufficient liquidity, limiting its applicability for tokens that primarily trade on centralized exchanges or have low trading volumes.

The transition to proof-of-stake consensus on Ethereum also changed the security assumptions for TWAP oracles. With known block proposers, sophisticated attackers could potentially arrange to control consecutive blocks, though the practical cost remains substantial. Protocols relying on TWAP should ensure adequate liquidity in the underlying pools and consider using longer averaging windows for critical functions.

You May Also Like:

Oracle Manipulation Attacks and How DEXs Can Prevent Them

Understanding how attackers exploit Oracle vulnerabilities is essential for designing robust defenses. The history of DeFi is littered with costly examples of oracle manipulation, and the techniques continue to evolve as attackers become more sophisticated.

Flash Loan-Based Attacks

Flash loans allow anyone to borrow massive amounts of capital without collateral, provided the loan is repaid within the same transaction. Attackers have repeatedly used this capability to manipulate prices on low liquidity DEX pools, then exploit protocols that reference those manipulated prices.

The typical attack pattern works as follows: the attacker borrows millions in a flash loan, uses those funds to execute large swaps that move the price on a targeted pool, triggers a vulnerable protocol that reads the now manipulated price for critical calculations like collateral valuation, profits from the artificially favorable terms, and finally repays the flash loan. Because everything occurs in a single atomic transaction, the attacker needs no starting capital and faces no risk if any step fails.

The Polter Finance exploit in November 2024 demonstrated this pattern clearly. The attacker used flash loans to deplete liquidity from SpookySwap pools, artificially inflating the price of the BOO token, then borrowed against that inflated collateral value on Polter Finance. The protocol’s reliance on a single DEX pool for price data made the manipulation straightforward.

Multi-Block Manipulation

Some attacks require control over multiple consecutive blocks to manipulate TWAP oracles or bypass time delay protections. In proof-of-stake systems, block proposers are known in advance, creating opportunities for proposers to coordinate or for wealthy attackers to stake enough to increase their chances of proposing consecutive blocks.

The KiloEx exploit in April 2025 showed how even supposedly protected Oracle systems can be vulnerable. The attacker manipulated the platform’s price oracle across multiple blockchain networks, including Base, BNB Chain, and Taiko, extracting approximately $7 million by creating positions at artificially favorable prices before the manipulation was detected.

Defense Strategies

Effective protection against Oracle manipulation requires multiple complementary approaches:

Use decentralized oracle networks: Protocols like Chainlink aggregate data from multiple independent sources, making manipulation exponentially more difficult. An attacker would need to compromise multiple exchanges, data providers, and oracle nodes simultaneously.

Implement TWAP with appropriate windows: For on-chain oracle references, using TWAP over longer time periods (30 minutes to 1 hour) dramatically increases manipulation costs compared to spot price references.

Set minimum liquidity thresholds: Only accept price data from DEX pools meeting minimum liquidity requirements. Thin markets are cheap to manipulate and should not be trusted for critical protocol decisions.

Add time delays for significant actions: Introducing time delays between price observation and action execution allows arbitrageurs to correct manipulated prices before they can be exploited. This is particularly important for large collateral liquidations or significant borrowing events.

Implement price deviation limits: Reject price data that deviates too dramatically from recent historical values or from multiple independent sources. Extreme price movements should trigger additional verification rather than automatic execution.

Conduct regular security audits: Oracle integration vulnerabilities often hide in unexpected places. Professional security audits that specifically examine Oracle usage patterns can identify weaknesses before attackers do.

Cross-Chain Oracle Solutions for Multi-Net DEXs

As the blockchain ecosystem has fragmented across dozens of competing networks, cross-chain functionality has become essential for DEXs seeking to serve users wherever they prefer to trade. Cross-chain oracle solutions enable protocols to access data from multiple blockchains and facilitate asset transfers and messaging across network boundaries.

The Interoperability Challenge

Each blockchain operates as an isolated system with its own consensus rules, transaction formats, and finality guarantees. For a DEX operating across Ethereum, Solana, and BNB Chain to maintain consistent pricing and enable cross-chain swaps, it needs infrastructure that can trustlessly verify state on each network and relay that information to the others. Traditional bridges have attempted this through various mechanisms, but many have suffered catastrophic hacks due to security vulnerabilities in their verification processes.

Oracles designed for cross-chain operation address these challenges by providing verified, attested data that protocols on any supported chain can consume. Rather than each protocol building its own cross-chain verification system, they can rely on oracle networks that specialize in this complex infrastructure.

Chainlink CCIP

Chainlink’s Cross Chain Interoperability Protocol has emerged as a leading solution for cross-chain communication, expanding to over 60 blockchains, including Solana, through its v1.6 upgrade. CCIP enables both token transfers and arbitrary message passing across chains, all secured by Chainlink’s decentralized oracle network infrastructure.

For DEXs, CCIP enables several important capabilities. Protocols can offer native cross-chain swaps where users swap tokens on one chain for tokens on another without relying on wrapped representations. Cross-margined trading platforms can maintain consistent collateral values across deployments on multiple networks. Governance decisions made on one chain can automatically propagate to protocol instances on other chains.

The protocol includes built-in risk management features, including rate limiting, configurable security parameters, and a separate Risk Management Network that monitors for anomalies. Major protocols, including Lido (with $33+ billion TVL) have adopted CCIP for cross-chain infrastructure, demonstrating institutional confidence in its security model.

Multi-Chain Oracle Deployment

Both Chainlink and Pyth maintain oracle deployments across numerous blockchain networks, allowing DEXs to access consistent price feeds regardless of which chain they deploy on. This multi-chain presence simplifies development since protocols can use familiar oracle interfaces, whether they’re building on Ethereum Layer 2s, Solana, or alternative Layer 1s.

Pyth’s expansion to over 100 supported blockchains demonstrates the demand for oracle infrastructure that follows developers wherever they choose to build. For emerging chains seeking to attract DeFi protocols, oracle support has become a prerequisite since DEXs cannot function without price data, and developers will not build on chains that lack oracle infrastructure.

Key Features of Cross-Chain Oracle Solutions for DEXs

| Feature | Description | Benefits for DEXs |

|---|---|---|

| Native Asset Transfers | Transfer actual tokens across chains without wrapping or synthetic representations | Eliminates wrapped token risks, provides better user experience, and reduces smart contract complexity |

| Arbitrary Message Passing | Send any data between chains, not just tokens, enabling cross-chain smart contract calls | Enables cross-chain governance, unified liquidity management, and coordinated protocol upgrades |

| Programmable Token Transfers | Combine token transfers with custom logic execution on the destination chain | Enables complex DeFi operations like cross-chain swaps with automatic staking or lending |

| Decentralized Verification | Multiple independent nodes verify cross-chain messages and reach consensus | Eliminates single points of failure, increases trust minimization, and protects against malicious operators |

| Rate Limiting and Security Controls | Configurable limits on transfer volumes and frequencies to prevent exploits | Limits damage from potential vulnerabilities, provides time for incident response |

| Consistent Price Feeds | Same oracle data available across all supported chains | Enables consistent pricing across multi-chain deployments, simplifies arbitrage and market making |

Oracles for Perpetual DEXs and Derivatives Trading

Perpetual decentralized exchanges have emerged as one of the fastest-growing segments in DeFi, with market share growing from 2.7% in 2023 to 26% by 2025. These platforms enable leveraged trading on cryptocurrency pairs through perpetual futures contracts that never expire, and they place extraordinary demands on oracle infrastructure for accurate pricing, timely liquidations, and funding rate calculations.

The Unique Requirements of Derivatives

Unlike spot DEXs, where slight price inaccuracies might cost traders a small amount of slippage, perpetual exchanges use prices for critical functions where errors can cause catastrophic losses. A leveraged position at 10x can be liquidated by a 10% adverse price movement; if oracle prices are manipulated or delayed during volatile markets, traders may be unfairly liquidated, or protocols may be unable to close underwater positions before losses exceed collateral.

Funding rates, which balance long and short positions by transferring payments between traders, must be calculated based on the difference between perpetual contract prices and spot oracle prices. Inaccurate oracle data leads to incorrect funding payments, potentially creating systematic advantages for one side of the market that sophisticated traders will exploit.

Low Latency Data Streams

The need for rapid price updates has driven perpetual DEXs toward oracle solutions optimized for speed. Chainlink Data Streams provides pull-based price data specifically designed for derivatives markets, enabling sub-second updates when protocols request fresh prices. GMX, one of the largest perpetual DEXs, has processed over $64 billion in transaction volume powered by Chainlink Data Streams since adopting the solution.

Pyth Network’s focus on millisecond-level updates through Pyth Pro has made it particularly popular among Solana-based perpetual platforms. The network’s first-party data sourcing from major trading firms provides prices derived directly from where institutional trading occurs, reducing the risk of delayed or manipulated feeds.

Hybrid Oracle Architectures

Many sophisticated perpetual DEXs combine multiple oracle approaches for different functions. A platform might use Chainlink price feeds as the authoritative source for liquidations (prioritizing security) while using faster on-chain TWAP references for displaying estimated prices to traders (prioritizing responsiveness). This hybrid approach allows protocols to optimize for the specific requirements of each use case rather than accepting compromises inherent in any single solution.

Risk engines on these platforms typically incorporate multiple price checks before executing significant actions. A liquidation might require confirmation from both off-chain oracle sources and on-chain TWAP, with discrepancies triggering delays or manual review rather than automatic execution. These safety mechanisms add latency but protect against the flash crashes and manipulation events that have devastated less cautious protocols.

You May Also Like:

Understanding Gas Token Economics in Decentralized Exchanges

The Role of Oracles in Liquidity Management

Beyond price feeds, oracles support numerous functions critical to how decentralized exchanges manage and deploy liquidity. Understanding these broader applications helps protocol designers leverage Oracle infrastructure for maximum effect.

Automated Market Maker Optimization

Concentrated liquidity AMMs like Uniswap v3 allow liquidity providers to specify price ranges where their capital will be active. Oracle data can power automated strategies that rebalance these positions as market prices move, keeping liquidity concentrated around current trading ranges where it generates fees most efficiently. Without external price data, such strategies would need to rely entirely on chain information, limiting their ability to anticipate market movements.

Dynamic Fee Adjustments

Some DEXs implement dynamic fees that adjust based on market conditions, charging higher fees during periods of high volatility when liquidity providers face greater impermanent loss risk. Oracles can provide the volatility data needed to make these adjustments automatically, ensuring that fees appropriately compensate for risk without requiring manual parameter updates.

Risk Assessment for Liquidity Provision

Advanced DeFi platforms are beginning to use oracle data for real-time risk assessment. A lending protocol integrated with a DEX might adjust borrowing limits or collateral requirements based on oracle-provided volatility metrics, liquidity depth data, or correlation analysis between assets. This data-driven risk management represents a significant evolution from static parameters set at protocol launch.

Proof of Reserves

For DEXs that hold significant user funds or issue synthetic assets, proof of reserves oracles provide independent verification that backing assets actually exist. Chainlink’s Proof of Reserve product enables automated auditing of reserves across both on-chain wallets and traditional custodians, with attestations delivered to smart contracts that can enforce backing requirements or trigger alerts when reserves fall below acceptable levels.

Future of Oracle Integration in DEXs

The oracle landscape continues to evolve rapidly as protocols compete to provide faster, more accurate, and more versatile data services. Several emerging trends will shape how DEXs integrate and use oracle infrastructure in the coming years.

AI and Intent-Based Systems

Artificial intelligence is beginning to intersect with Oracle infrastructure in meaningful ways. AI agents that execute trades or manage portfolios on behalf of users need trustworthy data sources to make decisions. Oracle networks are exploring how to provide data optimized for AI consumption, including more complex composite feeds, predictive analytics, and real-time risk scores.

Intent-based trading systems, where users specify desired outcomes rather than specific transactions, require oracles that can verify whether intents have been satisfied. An intent to swap at the best available price across multiple chains requires cross-chain price data to evaluate fulfillment. Oracle networks are developing capabilities to support these more complex verification requirements.

Real World Asset Integration

The tokenization of real-world assets, including stocks, bonds, commodities, and real estate, is creating demand for oracle data beyond cryptocurrency prices. DEXs seeking to offer trading in tokenized equities need reliable equity price feeds. Lending protocols accepting tokenized real estate as collateral need property valuations. Oracle networks are expanding their data coverage accordingly, with Pyth now offering over 750 equity feeds and Chainlink integrating with traditional financial data providers, including S&P Global and FTSE Russell.

Enhanced Privacy Features

Privacy has become an increasingly important consideration in DeFi. Oracle solutions are beginning to offer capabilities that enable computations on private data, allowing protocols to verify conditions without exposing the underlying information. Chainlink’s DECO technology enables users to prove claims about their data from websites and databases without revealing the data itself, opening possibilities for privacy-preserving oracle applications in trading and compliance contexts.

Institutional Grade Infrastructure

As traditional financial institutions enter DeFi, they bring requirements for enterprise-grade infrastructure, compliance capabilities, and service level guarantees. Oracle providers are responding with institutionally focused products. Chainlink’s work with SWIFT, DTCC, and major banks demonstrates how oracle infrastructure is evolving to meet institutional standards while maintaining the decentralized properties that make it valuable.

Oracle Extractable Value (OEV) Solutions

Maximum Extractable Value has become a significant concern in DeFi, with substantial value captured by miners, validators, and searchers through transaction ordering. A subset of this value derives from oracle updates, particularly around liquidations. Chainlink’s Smart Value Recapture solution enables protocols to reclaim this oracle extractable value rather than losing it to external parties, creating new revenue streams that can fund protocol development or benefit users directly.

Build Your DEX with Enterprise Grade Oracle Integration

Whether you need a new decentralized exchange with comprehensive oracle infrastructure, integration of Chainlink or Pyth feeds into existing protocols, custom TWAP implementations, or cross-chain trading capabilities, our experienced blockchain development team delivers sophisticated DeFi solutions tailored to your specific requirements. We combine deep expertise in smart contract development with a thorough understanding of oracle security patterns to build trading platforms you can trust.

Conclusion

Oracles have evolved from a technical necessity into a foundational layer of the decentralized exchange ecosystem. The billions of dollars flowing through DEXs every day depend on oracle infrastructure that is fast enough to support trading, accurate enough to prevent manipulation, and resilient enough to operate through the volatility and adversarial conditions inherent in cryptocurrency markets.

The best practices for Oracle integration in DEXs combine multiple approaches. Decentralized oracle networks like Chainlink and Pyth provide the independent, aggregated data feeds that critical functions require. On-chain TWAP oracles offer manipulation-resistant references for applications that can tolerate latency. Multi-source aggregation, staleness checks, and circuit breakers protect against the various failure modes and attack vectors that threaten oracle-dependent systems.

Cross-chain oracle solutions have become essential as the DeFi ecosystem fragments across numerous blockchain networks. Protocols like Chainlink CCIP enable DEXs to offer unified experiences regardless of which chain users prefer, while maintaining the security properties that make decentralized infrastructure valuable in the first place.

Looking forward, Oracle infrastructure will continue to evolve alongside the trading platforms it supports. Integration with AI systems, support for real-world asset data, enhanced privacy features, and new value capture mechanisms will expand what oracles can do. For DEX developers and operators, staying current with these developments and implementing oracle best practices is not optional but essential to building platforms that can compete and survive in the demanding DeFi environment.

The protocols that will succeed are those that treat Oracle integration as a core competency rather than an afterthought. Security audits focused specifically on Oracle usage, careful selection of appropriate Oracle solutions for each use case, and robust fallback mechanisms distinguish professional implementations from those that await exploitation. As DEXs handle ever larger volumes and serve ever more sophisticated traders, the importance of getting oracles right only increases.

Frequently Asked Questions

An oracle in a DEX is a service that provides external data to smart contracts that cannot access information outside their native blockchain. Most commonly, oracles provide price feeds that DEXs use to determine exchange rates, calculate collateral values, trigger liquidations, and execute various trading functions. Without oracles, DEXs would be unable to know current market prices or verify any real-world information needed for their operations.

Smart contracts on blockchains like Ethereum are deterministic systems that can only process data recorded on their chain. They cannot make API calls to external servers, check prices on Binance, or access any off-chain database. This is by design, as allowing arbitrary external data access would compromise the consensus mechanism. Oracles bridge this gap by fetching external data, verifying it, and delivering it to the blockchain in a format smart contracts can use.

The primary risks include oracle manipulation, where attackers corrupt price data to exploit protocols, oracle failure, where data feeds go offline or become stale, and centralization risk, where reliance on a few data sources creates single points of failure. Price oracle manipulation was the second most damaging attack vector in 2024, causing $52 million in losses. Proper implementation using decentralized oracle networks, multiple data sources, and robust validation checks mitigates these risks.

Chainlink is the largest oracle provider with approximately 67% to 70% market share, offering comprehensive infrastructure including price feeds, cross-chain messaging, and proof of reserves. Pyth Network focuses on low-latency price data sourced directly from first-party publishers like major trading firms and exchanges. Pyth is particularly popular for perpetual DEXs and derivatives where speed matters most, while Chainlink dominates in lending protocols and applications requiring the highest security guarantees.

Time Weighted Average Price oracles calculate average prices over specified time intervals rather than using instantaneous spot prices. This makes manipulation expensive because an attacker must maintain artificial prices for the entire averaging period, continuously losing money to arbitrageurs. For example, manipulating a 30-minute TWAP on a liquid Uniswap pool would require sustaining losses to arbitrage for the full half hour, potentially costing millions of dollars for significant price movements.

Key considerations include choosing oracle providers with strong track records and appropriate security for your use case, implementing multiple data sources rather than relying on single points of failure, adding staleness checks that reject outdated price data, including deviation limits and circuit breakers for abnormal price movements, designing fallback mechanisms for when primary feeds fail, and conducting security audits specifically examining oracle integration. The choice between different oracle solutions should match your specific requirements for speed, cost, security, and supported chains.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.