Key Takeaways

- Gas tokens in DEX platforms enable traders to store cheap gas and redeem it during high-fee periods, historically providing 30-50% savings on complex transactions.

- Gas token economics work through Ethereum’s gas refund mechanism, where clearing storage during token burns triggers refunds that subsidize transaction costs.

- CHI token and GST2 token represent the most widely adopted gas tokens, with CHI optimized for DEX aggregator integration and GST2 serving general-purpose applications.

- The EIP-3529 update significantly reduced gas refund rates, diminishing traditional gas token effectiveness while driving innovation in alternative gas fee optimization in DEX approaches.

- Decentralized exchange gas fees comprise both protocol trading fees and network gas costs, making optimization crucial for cost-effective trading during high congestion periods.

- Modern gas saving strategies in DeFi include Layer 2 adoption, transaction timing optimization, batching, and selecting efficient protocols rather than relying solely on gas tokens.

- DEX transaction fees impact trading profitability significantly, particularly for active traders executing frequent or complex multi-hop transactions across liquidity sources.

- Future gas optimization will increasingly leverage cross-chain routing, account abstraction, and protocol-level efficiency improvements rather than traditional gas token mechanisms.

Transaction costs represent one of the most significant friction points in decentralized exchange trading, with gas fees sometimes exceeding the value of smaller trades during network congestion. Understanding gas token economics provides traders with powerful tools for managing these costs while participating in DeFi markets. This comprehensive guide explores how gas tokens function, their economic principles, and practical strategies for optimizing transaction expenses across decentralized trading platforms.

Introduction to Gas Tokens in DEX

Gas tokens emerged as an innovative solution to the volatile and often expensive nature of Ethereum gas fees that impact every decentralized exchange transaction. These specialized tokens exploit blockchain mechanics to effectively arbitrage gas prices across time, allowing users to benefit from price differentials between low and high congestion periods. For active DEX traders, understanding gas tokens in DEX platforms can mean the difference between profitable and loss-making trading strategies.

Building crypto exchanges today requires careful consideration of gas economics that directly impact user experience and platform competitiveness. The integration of gas optimization mechanisms has become a differentiating feature for leading DEX platforms seeking to attract cost-conscious traders.

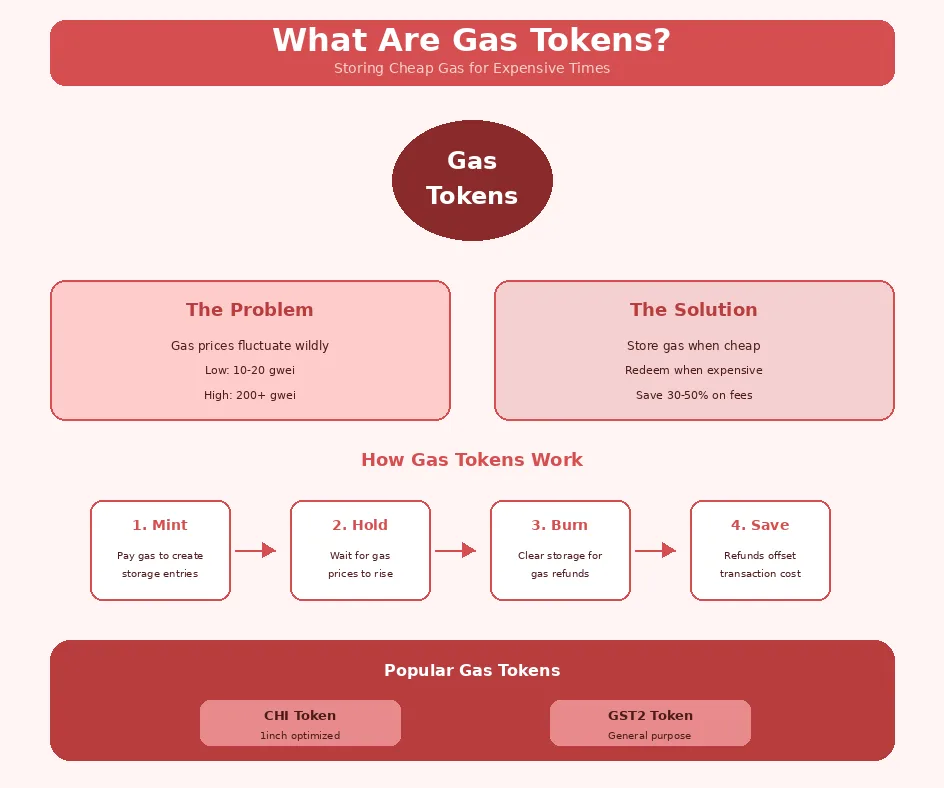

What Are Gas Tokens?

Gas tokens are ERC-20 tokens designed to store gas value when network fees are low and release that value when fees are high. They function by exploiting Ethereum’s gas refund mechanism, which provides partial refunds for certain operations that free up blockchain storage. When you mint gas tokens, you pay gas to create storage entries. When you burn them during a transaction, clearing that storage triggers refunds that effectively subsidize your transaction costs.

The concept originated from recognizing that Ethereum gas prices fluctuate significantly based on network demand. During quiet periods, gas might cost 10-20 gwei, while during peak demand, prices can spike to 200+ gwei. Gas tokens enable users to capture this differential, essentially buying low and selling high with gas as the commodity. Understanding how decentralized exchange mechanisms process transactions helps appreciate why gas optimization matters for trading efficiency.

Importance of Gas Tokens in Decentralized Exchanges

The importance of gas tokens in decentralized exchanges stems from the direct relationship between transaction costs and trading profitability. Unlike centralized exchanges where trading fees are the primary cost, DEX users must also pay gas fees that can vary dramatically. During high volatility periods when trading activity increases, gas prices often spike precisely when traders most want to execute transactions, creating a cost surge at the worst possible time.

For arbitrage traders, market makers, and active speculators, gas costs can determine whether strategies remain profitable. A swap that costs $5 in gas during quiet periods might cost $50 or more during peak times. Gas tokens historically provided a mechanism to smooth these costs, enabling more consistent transaction economics regardless of network conditions. This predictability supported more sophisticated trading strategies that would otherwise be disrupted by unpredictable gas expenses.

Economic Insight: Gas tokens represent one of the earliest examples of financial engineering in DeFi, demonstrating how blockchain mechanics can be leveraged to create new economic instruments. Their evolution informs ongoing innovations in transaction cost management.

Gas Token Economics Explained

Gas token economics describes the financial principles governing how gas tokens create and capture value through the arbitrage of gas prices across time. Understanding these economics requires examining both the technical mechanisms that enable gas storage and the market dynamics that create profit opportunities. The interplay between blockchain gas pricing and token mechanics creates a unique economic model specific to Ethereum and compatible networks.

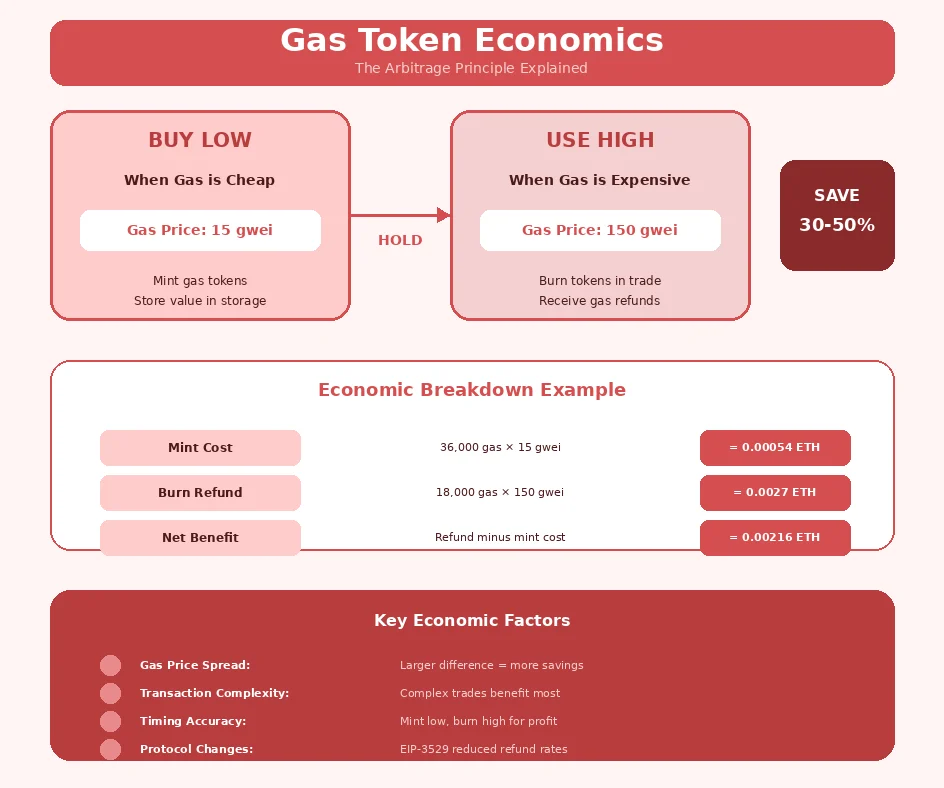

How Gas Token Economics Work

Gas token economics work through a simple arbitrage principle: buy gas when cheap, use it when expensive. The mechanism relies on Ethereum’s storage gas refund, which returns a portion of gas costs when storage is cleared. Minting gas tokens creates storage entries that lock in gas value at current prices. Burning tokens during future transactions clears that storage, triggering refunds that offset transaction costs.

The economic value created depends on the spread between minting and burning gas prices. If you mint tokens at 20 gwei and burn them when gas costs 100 gwei, you effectively access gas at below-market rates. However, the economics also include the gas cost of minting itself, storage rent considerations, and the opportunity cost of capital locked in gas tokens. Successful gas token usage requires careful timing and understanding of these factors.

Economic Model of Gas Tokens in Ethereum

The economic model of Ethereum gas tokens centers on the storage refund mechanism that originally provided up to 50% gas refunds for operations that freed storage. This generous refund created substantial arbitrage opportunities that gas tokens exploited. By converting cheap gas into storage and later converting that storage back into refunds, users could effectively transport gas value through time.

The model’s sustainability depended on continued gas price volatility and the persistence of significant refund rates. Network upgrades, particularly EIP-3529, modified this model by capping refunds at 20% of total transaction gas, significantly reducing potential savings. This change represented Ethereum’s response to gas token mechanics that, while beneficial for individual users, created network-level inefficiencies through excessive storage manipulation.

Examples of Gas Tokens: CHI and GST2

CHI token, created by 1inch, represents the most optimized gas token specifically designed for DEX aggregator transactions. Its contract was optimized for the 1inch routing contracts, providing slightly better efficiency than general-purpose alternatives. CHI gained widespread adoption due to 1inch’s popularity and the token’s integration into their interface, making gas savings accessible without technical knowledge.

GST2 token (GasToken version 2) serves as a general-purpose gas token applicable to any Ethereum transaction. It improved upon the original GST1 by using a more gas-efficient storage mechanism. While less optimized than CHI for specific use cases, GST2’s broader applicability made it valuable for various DeFi interactions beyond DEX trading. Both tokens demonstrated the practical application of gas token economics in reducing transaction costs.

Gas Token Comparison: CHI vs GST2

| Feature | CHI Token | GST2 Token |

|---|---|---|

| Creator | 1inch Network | GasToken Project |

| Primary Use | DEX aggregator optimization | General-purpose gas saving |

| Mint Cost | ~36,000 gas per token | ~41,000 gas per token |

| Burn Refund | ~18,000 gas per token | ~15,000 gas per token |

| Integration | 1inch native support | Manual integration |

| Current Status | Reduced effectiveness post-EIP-3529 | Reduced effectiveness post-EIP-3529 |

Managing Transaction Fees in DEX

Managing transaction fees effectively determines trading profitability for active DEX participants. The total cost of a DEX transaction includes protocol trading fees, network gas costs, and potential slippage. While protocol fees are typically predictable, gas costs fluctuate significantly based on network conditions. Developing strategies for DEX transaction fees management enables traders to maintain profitability across varying market conditions.

Decentralized Exchange Gas Fees Overview

Decentralized exchange gas fees comprise the computational cost of executing swap transactions on blockchain networks. Unlike simple token transfers, DEX transactions involve complex smart contract interactions including liquidity pool queries, price calculations, token approvals, and balance updates. A typical Uniswap V3 swap might consume 150,000-200,000 gas, while complex aggregated routes through multiple pools can exceed 500,000 gas.

The gas fee calculation multiplies gas consumed by the current gas price (in gwei) and converts to ETH. At 50 gwei, a 200,000 gas transaction costs 0.01 ETH; at 200 gwei, the same transaction costs 0.04 ETH. This variability creates challenges for trading strategies and makes gas optimization essential for frequent traders. Exploring how modern DEX platforms optimize transaction efficiency reveals the infrastructure supporting cost-effective trading.

Gas Fee Optimization in DEX

Gas fee optimization in DEX involves multiple approaches targeting different aspects of transaction costs. Protocol-level optimizations include efficient smart contract design that minimizes computational steps and storage operations. User-level optimizations include timing transactions for low-gas periods, selecting efficient trading routes, and using gas tokens or alternative networks when beneficial.

DEX aggregators like 1inch incorporate gas optimization into their routing algorithms, considering not just price but total transaction cost including gas. This holistic approach sometimes routes trades through seemingly suboptimal paths that actually deliver better net value after gas costs. Advanced traders combine multiple optimization techniques to minimize total trading expenses across their activity.

Gas Saving Strategies in DeFi

Gas saving strategies in DeFi extend beyond gas tokens to encompass timing, technology, and technique optimizations. Timing strategies involve monitoring gas prices and executing transactions during predictably low-cost periods, typically weekends and early morning hours in major trading regions. Technology strategies include using Layer 2 networks where gas costs are 90%+ lower than Ethereum mainnet.

Technique strategies include batching multiple operations into single transactions, using limit orders that execute when conditions including gas prices meet criteria, and selecting protocols with gas-efficient implementations. Token approval optimization, setting exact allowances rather than unlimited approvals, and revoking unused approvals also contribute to overall gas savings across DeFi activities.

Gas Token Usage Lifecycle

| Stage | Action | Gas Cost | Optimal Timing |

|---|---|---|---|

| 1 | Monitor Gas Prices | None | Continuous |

| 2 | Mint Gas Tokens | ~36,000 gas/token | Low gas periods (10-20 gwei) |

| 3 | Hold Tokens | None (storage rent) | Wait for high gas |

| 4 | Execute DEX Trade | Variable (150,000+) | When trading needed |

| 5 | Burn Tokens in Trade | Refund ~18,000/token | High gas periods (100+ gwei) |

| 6 | Calculate Net Savings | Savings realized | Post-transaction |

Gas Optimization Strategy Selection Criteria

When selecting gas optimization approaches, evaluate these factors:

- Trading Frequency: Active traders benefit most from comprehensive optimization strategies

- Transaction Size: Larger trades justify more complex optimization efforts

- Time Sensitivity: Urgent trades may not allow waiting for optimal gas prices

- Technical Capability: Some strategies require smart contract interaction knowledge

- Network Options: Layer 2 availability may offer better optimization than gas tokens

- Capital Efficiency: Consider opportunity cost of capital locked in gas tokens

Use Cases and Impact of Gas Tokens

Gas tokens have found diverse applications across the DeFi ecosystem, from individual trader cost optimization to protocol-level integration for improved user economics. Their impact extends beyond direct gas savings to influence how developers and traders think about transaction cost management. Understanding these use cases illuminates both the historical importance and ongoing relevance of gas optimization concepts.

Reducing Fees in DEX Trading

Reducing fees in DEX trading through gas tokens was most impactful for high-frequency traders and arbitrageurs whose profitability depends on minimizing transaction costs. A trader executing 50 transactions daily could save thousands of dollars monthly by strategically using gas tokens during high-fee periods. The savings enabled trading strategies that would otherwise be unprofitable after gas costs.

DEX aggregators integrated gas token burning directly into their routing contracts, making savings automatic for users holding tokens. This seamless integration democratized access to gas savings, allowing casual users to benefit without understanding the underlying mechanics. The fee reduction contributed to DEX adoption by making decentralized trading more cost-competitive with centralized alternatives. Learning about yield optimization strategies in decentralized exchanges complements gas optimization knowledge.

Influence of Gas Tokens on Decentralized Trading

The influence of gas tokens on decentralized trading extended beyond direct fee savings to shape protocol design and user behavior. Protocols began optimizing contracts for gas efficiency, recognizing that lower transaction costs attracted more users and volume. The competitive pressure created by gas-optimized alternatives pushed the entire ecosystem toward more efficient implementations.

User behavior adapted to incorporate gas awareness into trading decisions. Traders learned to time transactions, monitor gas prices, and factor gas costs into profitability calculations. This education improved overall DeFi literacy while establishing gas optimization as a standard consideration for decentralized trading. The cultural shift toward cost-consciousness persists even as specific gas token mechanisms have evolved.

Benefits for Traders and Developers

For traders, gas tokens provided tangible cost reductions that improved trading economics. The ability to lock in cheap gas and deploy it strategically gave active traders competitive advantages over those paying market rates. Arbitrageurs particularly benefited, as their strategies require executing transactions quickly regardless of current gas prices, making stored cheap gas especially valuable.

Developers benefited from gas token concepts informing more efficient smart contract design. Understanding which operations consume gas and which receive refunds guided optimization efforts that benefit all users. The gas token ecosystem also created opportunities for tooling development, including gas price monitoring, minting automation, and integration services that supported the broader DeFi infrastructure.

Gas Optimization Methods Comparison

| Method | Savings Potential | Complexity | Current Viability |

|---|---|---|---|

| Gas Tokens (CHI/GST2) | 10-20% (post-EIP-3529) | Medium | Reduced |

| Layer 2 Networks | 90-99% | Low | High |

| Timing Optimization | 30-70% | Low | High |

| Transaction Batching | 20-40% | Medium | High |

| DEX Aggregator Routing | 10-30% | Low | High |

Important Notice: Gas token economics have changed significantly following Ethereum protocol updates. The EIP-3529 upgrade reduced gas refund rates, diminishing traditional gas token effectiveness. Always verify current economics before investing in gas token strategies, and consider modern alternatives like Layer 2 networks.

Future of Gas Token Economics in DEX

The future of gas token economics in DEX will likely see traditional gas tokens fade while the underlying principles inform new optimization approaches. Protocol-level gas efficiency, Layer 2 scaling, and cross-chain routing will increasingly handle cost optimization that gas tokens previously addressed. Understanding how next-generation exchange platforms approach transaction efficiency reveals the direction of gas optimization evolution.

Trends in Gas Fee Management

Current trends in gas fee management emphasize infrastructure solutions over user-side optimization. Layer 2 networks like Arbitrum, Optimism, and zkSync provide 90%+ fee reduction through scaling technology, making gas token arbitrage unnecessary. Account abstraction enables gas payment in any token, removing the need to hold ETH specifically for gas. These infrastructure improvements address gas costs at their source rather than working around them.

Cross-chain routing increasingly considers gas costs across networks, automatically directing trades to the most cost-effective execution venue. Smart contract optimization continues advancing, with new EVM features enabling more efficient implementations. These trends suggest gas fee concerns will diminish as the ecosystem matures, though optimization will remain valuable for mainnet transactions.

Build Your Own DEX with Optimized Gas Management

Partner with us to develop a secure, efficient decentralized exchange. Reduce gas fees, enhance trading performance, and deliver a seamless DeFi experience.

Potential Innovations in Gas Tokens

Potential innovations in gas-related tokenomics include gas futures markets where users could hedge against gas price volatility, subscription models providing predictable transaction costs, and protocol-native gas subsidies funded by trading fees. While traditional gas token mechanisms face obsolescence, the concept of managing gas exposure through financial instruments may evolve in new forms.

Cross-chain gas abstraction could enable unified gas management across multiple networks, allowing users to maintain gas reserves that work regardless of which chain they transact on. Integration with account abstraction might enable automatic gas optimization without user intervention, making cost efficiency a background feature rather than an active strategy. Exploring how decentralized exchange protocols continue innovating reveals ongoing developments in this space.

Future Outlook: While traditional gas tokens are declining in relevance, the principles they established inform ongoing innovation in transaction cost management. The DeFi ecosystem continues developing solutions that make trading more accessible and cost-effective for all participants.

Gas token economics represent a fascinating chapter in DeFi innovation, demonstrating how creative financial engineering can address blockchain limitations. While specific gas token mechanisms have been curtailed by protocol changes, the principles they established continue influencing how the ecosystem approaches transaction costs. Modern traders benefit from Layer 2 networks, efficient protocols, and timing optimization rather than gas tokens, but understanding this history provides context for ongoing innovation in decentralized exchange cost management.

The evolution from gas tokens to infrastructure-level solutions reflects DeFi’s maturation from workarounds to fundamental improvements. As the ecosystem continues developing, transaction costs will likely become increasingly predictable and manageable, making decentralized trading accessible to broader audiences. For current participants, combining timing awareness, Layer 2 adoption, and efficient protocol selection provides the most effective approach to gas fee optimization in today’s environment.

Frequently Asked Questions

Gas tokens are specialized tokens that allow users to store gas when network fees are low and redeem that stored gas when fees are high, effectively reducing transaction costs. These tokens work by exploiting Ethereum’s gas refund mechanism, where certain operations like clearing storage receive partial gas refunds. Popular examples include CHI token and GST2 token, which traders use to optimize their decentralized exchange gas fees during volatile network conditions.

Gas tokens save money by allowing users to mint tokens when gas prices are cheap and burn them during expensive periods to receive gas refunds. When you execute a DEX trade during high gas periods, burning gas tokens triggers storage clearing operations that provide refunds, effectively subsidizing your transaction. The savings can reach 40-50% on complex transactions, making gas tokens valuable tools for active traders.

Gas tokens have become less effective after the EIP-3529 update in the London hard fork, which significantly reduced gas refunds for storage clearing operations. While traditional gas tokens like GST2 offer diminished benefits, the concept of gas optimization remains important through alternative strategies including Layer 2 solutions, transaction batching, and timing optimization. Modern DeFi platforms increasingly incorporate native gas fee optimization in DEX rather than relying on external gas tokens.

CHI token was created by 1inch specifically for their aggregator protocol, offering optimized gas savings for their routing contracts with slightly better efficiency than GST2. GST2 token is the second generation of GasToken, providing general-purpose gas savings across any Ethereum transaction but requiring more gas to mint and burn. Both tokens work on the same principle of storing and releasing gas, but CHI was designed for DEX aggregator integration while GST2 serves broader use cases.

Savings from gas tokens historically ranged from 30-50% on complex transactions when gas prices were high, though current savings are significantly reduced after protocol updates. The actual savings depend on the difference between gas prices when you minted tokens versus when you burn them, plus the complexity of your transaction. For simple swaps, savings were modest, while complex multi-hop trades through DEX aggregators showed the greatest benefits from gas token economics.

Effective gas saving strategies in DeFi include trading during low-activity periods when gas prices drop, using Layer 2 networks like Arbitrum or Optimism for dramatically reduced fees, batching multiple transactions together, and selecting efficient DEX protocols. Transaction simulation tools help estimate costs before execution, while gas price trackers identify optimal timing windows. Many traders also use limit orders that execute when gas prices fall below thresholds.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.