Token burning has emerged as one of the most powerful mechanisms shaping the economics of decentralized exchanges. By permanently removing tokens from circulation, DEX platforms create deflationary pressure that can increase scarcity and potentially enhance token value over time. Recent events highlight this trend, with Uniswap’s governance recently approving a historic proposal to burn 100 million UNI tokens worth approximately $590 million, marking one of the largest single token removals in DeFi history.[1] This comprehensive guide explores how token burn mechanisms work on DEX platforms, their benefits, implementation strategies, and their growing importance in decentralized finance.

Key Takeaways

- Supply Reduction: Token burns permanently remove tokens from circulation, creating scarcity and potential value appreciation.

- Smart Contract Automation: Modern DEX platforms use automated burn mechanisms through smart contracts for consistency and transparency.

- Fee-Based Burns: Many protocols redirect a portion of trading fees to purchase and burn tokens, linking platform activity to deflation.

- Governance Integration: Token burns often require community approval through governance votes, ensuring decentralized decision-making.

- Value Accrual: Burns transform governance tokens into value-accruing assets by connecting token supply to platform performance.

- Market Confidence: Transparent burn mechanisms build trust and attract long-term investors seeking deflationary assets.

- Economic Sustainability: Well-designed burn models balance deflationary pressure with liquidity needs for healthy trading environments.

What Is Token Burn and How Does It Work?

Token burn refers to the process of permanently removing cryptocurrency tokens from circulation by sending them to an inaccessible address. This burn address has no private key, meaning tokens sent there can never be recovered or spent. The process creates verifiable, on-chain proof of token destruction, providing transparency that traditional financial systems cannot match.

In DEX development, token burn mechanisms are typically implemented through smart contracts that execute burns automatically based on predefined conditions. These conditions might include time intervals, trading volume thresholds, or fee accumulation targets. The automation ensures consistency and removes human intervention from the process, which is essential for maintaining trust in decentralized systems.

The fundamental economics behind token burning follow supply and demand principles. When tokens are burned, the total supply decreases while demand remains constant or increases, creating upward pressure on token value. This deflationary model contrasts with inflationary token systems where new tokens are continuously minted. Token development teams carefully design burn mechanisms to balance deflation with the need for sufficient circulating supply to support healthy trading activity.

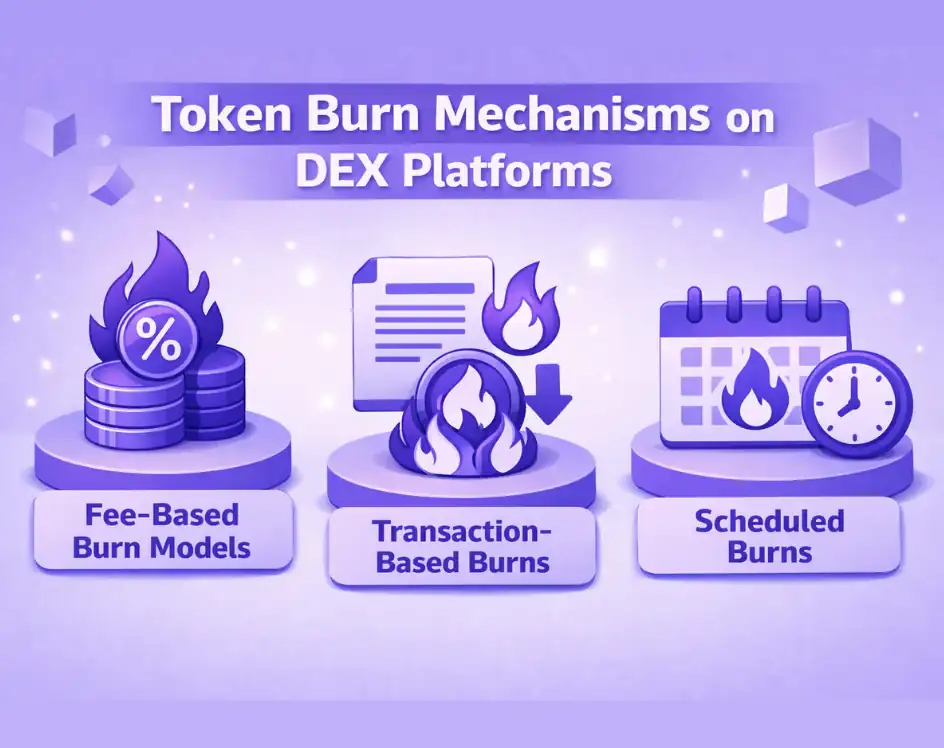

Token Burn Mechanisms on DEX Platforms

Decentralized exchanges employ various burn mechanisms depending on their tokenomics design and platform objectives. Understanding these different approaches helps traders and developers make informed decisions about participating in or building deflationary token ecosystems.

Fee-Based Burn Models

The most common approach involves redirecting a portion of trading fees to fund token burns. When users execute trades on the DEX, a percentage of the fees collected goes into a protocol-controlled pool. These accumulated fees are then used to purchase tokens from the open market, which are subsequently burned. This creates a direct link between platform usage and token deflation. Uniswap’s recently activated fee switch could translate into roughly $130 million annually flowing into their burn mechanism based on current trading volumes.[2]

Transaction-Based Burns

Some platforms implement burns directly on each transaction. A small percentage of every token transfer is automatically burned, creating continuous deflation as trading activity increases. This model is popular in crypto token development for meme tokens and community-driven projects. The mechanism operates seamlessly without requiring separate buyback operations, though it can affect liquidity if burn percentages are set too high.

Scheduled Burns

Periodic scheduled burns remove tokens at regular intervals regardless of trading activity. These burns might occur quarterly, monthly, or at other predetermined intervals. The Osmosis DEX recently implemented an automated burn mechanism that has removed over 8 million OSMO tokens from circulation, with the burn rate outpacing emissions by approximately eight times.

Benefits of Token Burns for DEX Users

Token burn mechanisms provide substantial benefits for users participating in decentralized exchange ecosystems. These advantages extend beyond simple price appreciation to include broader improvements in platform sustainability and user engagement.

Value Appreciation Potential

The primary benefit for token holders is the potential for value appreciation as supply decreases. With fewer tokens in circulation, each remaining token represents a larger share of the total ecosystem. This scarcity effect can drive price increases when combined with steady or growing demand. The development of well-designed burn mechanisms helps create sustainable value accrual rather than relying solely on speculation.

Economic Alignment

Burns create alignment between platform success and token holder interests. When trading activity generates burns, token holders directly benefit from increased platform usage. This alignment encourages community members to promote and support the platform, knowing their participation contributes to the deflationary pressure benefiting their holdings. Different governance tokens in Web3 ecosystems leverage this alignment to build engaged communities.

Transparency and Trust

On-chain burns provide verifiable proof of token destruction. Unlike traditional company buybacks where shares might be reissued later, burned tokens are permanently removed. This transparency builds trust among investors who can independently verify burn transactions on the blockchain. Crypto token development best practices emphasize this transparency as essential for long-term project credibility.

| Burn Mechanism | How It Works | Advantages | Considerations |

|---|---|---|---|

| Fee-Based | Trading fees fund buyback and burn | Links platform usage to deflation | Depends on trading volume |

| Transaction-Based | Percentage of each transfer burned | Continuous automatic deflation | Can reduce liquidity if too high |

| Scheduled | Burns at regular intervals | Predictable supply reduction | Not tied to platform performance |

| Governance-Triggered | Community votes approve burns | Democratic, community-driven | Slower implementation process |

Implementing Token Burns on DEX Platforms

Successful token burn implementation requires careful planning and technical expertise. For platforms considering adding burn mechanisms, several key factors must be addressed to ensure the system operates effectively and securely.

Smart Contract Architecture

The burn mechanism must be implemented through audited smart contracts that handle the process securely. These contracts define the burn conditions, manage fee collection, execute buybacks when applicable, and perform the actual token destruction. Development teams should prioritize security audits to prevent vulnerabilities that could be exploited. Working with experienced crypto token solution providers ensures proper implementation of these complex mechanisms.

Governance Integration

Many DEX platforms integrate burns with their governance systems, requiring community approval for significant burn events or parameter changes. This approach maintains decentralization while allowing the community to adjust burn rates based on market conditions. The Hyperliquid community recently passed a governance vote to burn 11% of circulating HYPE supply, with 85% voting in favor, demonstrating how decentralized decision-making shapes burn policies.

Economic Modeling

Before implementing burns, platforms must model the long-term economic effects. This includes projecting supply reduction over time, assessing impact on liquidity, and ensuring the burn rate supports sustainable growth. Blockchain development expertise is essential for creating models that balance aggressive deflation with practical liquidity requirements.

Challenges and Considerations

While token burns offer significant benefits, DEX platforms must navigate several challenges to implement them effectively. Understanding these considerations helps projects avoid common pitfalls and design sustainable burn mechanisms.

Liquidity Impact

Aggressive burns can reduce circulating supply to levels that harm trading efficiency. If insufficient tokens remain, traders may face increased slippage and reduced market depth. Token development strategies must balance deflationary pressure with maintaining adequate liquidity for smooth exchange operations.

Market Manipulation Risks

Large scheduled burns can create opportunities for market manipulation if timing is predictable. Traders might accumulate tokens before known burn events, then sell immediately after. Development teams address this by using randomized intervals, gradual burns, or fee-based mechanisms where burn timing depends on unpredictable trading activity.

Regulatory Considerations

Token burns that return value to holders may attract regulatory scrutiny in some jurisdictions. Platforms must consider how their burn mechanisms might be classified by regulators and design systems that comply with applicable laws. The legal landscape for deflationary tokens continues evolving, making ongoing compliance monitoring essential for Token Development projects.

Token Burns and Cross-Chain Assets

As DEX platforms expand across multiple blockchains, implementing consistent burn mechanisms across chains presents unique challenges. Wrapped token systems add complexity since burns must be coordinated between native tokens and their wrapped representations on other chains.

Cross-chain burn implementation requires careful synchronization to maintain accurate total supply tracking across all networks. Blockchain development teams must design systems that communicate burn events across chains while preventing discrepancies. For comprehensive understanding of token types, explore our coin and token solution guide.

Planning a Token Burn Mechanism for Your DEX?

Professional teams provide comprehensive token development services to design and implement effective deflationary mechanisms for your decentralized exchange.

Future of Token Burns in DeFi

Token burn mechanisms continue evolving as DeFi matures and platforms experiment with new economic models. Several trends are shaping the future of deflationary tokenomics on decentralized exchanges.

The integration of burns with governance systems is becoming standard practice, giving communities direct control over deflationary policies. Platforms are also developing more sophisticated models that adjust burn rates dynamically based on market conditions and trading volume. As institutional interest in DeFi grows, transparent burn mechanisms will become increasingly important for attracting sophisticated investors. The blockchain development trend toward linking platform revenue directly to token burns, as demonstrated by Uniswap’s fee switch activation, represents a maturation of DeFi economic models.

Conclusion

Token burn mechanisms have become essential components of DEX platform economics, providing transparent methods for reducing token supply and aligning platform success with token holder interests. From fee-based buybacks to governance-triggered treasury burns, these mechanisms offer various approaches to creating sustainable deflationary pressure.

The recent wave of major platforms implementing burn mechanisms demonstrates growing recognition of their value in mature DeFi ecosystems. As trading volumes increase and platforms generate substantial revenue, burns provide a mechanism for returning value to token holders while maintaining decentralization principles.

For projects looking to implement effective burn mechanisms, working with experienced Token Development teams ensures proper design, security auditing, and integration with existing platform infrastructure. Professional Crypto Development Company expertise helps navigate the technical complexities of building sustainable deflationary tokenomics that support long-term growth while delivering value to community members.

Frequently Asked Questions

Token burning on a DEX is the permanent removal of tokens from circulation by sending them to an inaccessible address. This reduces total supply and creates deflationary pressure on the token’s economics.

Token burns reduce supply while demand remains constant or grows, potentially increasing the value of remaining tokens. However, price impact depends on market conditions, burn volume, and overall demand for the token.

No, burned tokens are permanently destroyed. They are sent to addresses with no private keys, making recovery impossible. This permanence provides confidence that supply reduction is genuine and irreversible.

A fee switch redirects a portion of trading fees from liquidity providers to a protocol-controlled mechanism that uses those fees to buy back and burn tokens, creating ongoing deflation tied to platform usage.

Burn frequency varies by platform. Some burn continuously with each transaction, others burn quarterly or monthly, and some burn based on accumulated fees reaching certain thresholds.

No, burn mechanisms are optional design choices. Some DEX tokens are inflationary with continuous minting, while others have fixed supplies without burns. Each model has different economic implications.

Burns themselves cannot be reversed since destroyed tokens are permanently gone. However, governance can vote to change or disable future burn mechanisms, affecting ongoing deflation rates.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.