Key Takeaways

- Synthetic asset trading enables global market exposure without owning underlying assets, transforming how investors access stocks, commodities, and forex.

- Price oracles serve as critical infrastructure components, aggregating real-world data from multiple sources to maintain accurate synthetic asset valuations.

- Over-collateralization ratios between 150% and 500% protect protocols against volatility while ensuring synthetic holders can redeem their positions.

- Smart contracts automate minting, burning, and liquidation processes, eliminating intermediaries and reducing counterparty risk in Synthetic asset trading operations.

- Capital efficiency gains from synthetic instruments allow traders to achieve leveraged exposure with optimized collateral utilization across DeFi protocols.

- Interoperability standards enable synthetic assets to flow seamlessly across multiple DeFi protocols, enhancing liquidity and composability in ecosystems.

- Security architecture must address oracle manipulation, flash loan attacks, and smart contract vulnerabilities through multi-layered defense mechanisms.

- Regulatory frameworks in USA, UK, UAE, and Canada are evolving to address synthetic asset classification, requiring proactive compliance strategies.

- Real-world use cases span tokenized equities, commodity derivatives, forex exposure, and yield-bearing synthetic positions for institutional and retail traders.

- Future infrastructure evolution includes cross-chain synthetic liquidity pools, AI-powered risk management, and institutional-grade Synthetic asset trading interfaces.

Understanding Synthetic Asset Trading in DeFi Ecosystems

Synthetic asset trading represents one of the most transformative innovations in decentralized finance, enabling users to gain price exposure to virtually any asset class without holding the underlying asset. Through blockchain-based protocols integrated with Decentralized Exchange infrastructure, traders can access stocks, commodities, currencies, and indices that were previously restricted by geographic or regulatory barriers. This technology democratizes financial markets for users across the USA, UK, UAE, and Canada.

The fundamental premise of synthetic asset trading relies on creating tokenized representations that mirror real-world price movements through oracle-fed smart contracts. Unlike traditional derivatives that require counterparty agreements, DeFi synthetics operate autonomously through code, eliminating intermediary risk and enabling 24/7 Synthetic asset trading. Our agency has spent over eight years building and optimizing these systems for institutional and retail clients globally.

The infrastructure supporting synthetic asset trading has matured significantly, with protocols now managing billions in total value locked. These systems require sophisticated collateral management, precise oracle integrations, and robust liquidation mechanisms to maintain stability. Understanding this infrastructure is essential for anyone building or participating in modern DeFi ecosystems.

Core Components of a Synthetic asset trading Infrastructure

A comprehensive Synthetic asset trading infrastructure requires multiple interconnected systems working in harmony.

Price Feed Layer

- Decentralized oracle networks

- Multi-source data aggregation

- Manipulation-resistant pricing

- Sub-second update frequency

Collateral Engine

- Multi-asset collateral support

- Dynamic ratio calculations

- Risk isolation mechanisms

- Automated rebalancing

Liquidation System

- Incentivized liquidator bots

- Partial liquidation support

- Bad debt socialization

- MEV protection layers

Role of Smart Contracts in Synthetic Asset Creation

Smart contracts serve as the autonomous engines that power synthetic asset creation, management, and redemption. These self-executing programs encode the rules governing collateral deposits, synthetic minting ratios, and liquidation thresholds. By removing human intermediaries, smart contracts ensure consistent rule enforcement regardless of market conditions or user identity.

The architecture of synthetic asset smart contracts typically includes factory contracts for deploying new synthetic tokens, vault contracts for managing individual positions, and controller contracts for coordinating system-wide parameters. Each component must be meticulously audited and tested, as vulnerabilities can result in complete loss of user funds. Leading protocols undergo multiple security audits before mainnet deployment.

Gas optimization in synthetic asset contracts directly impacts user experience and protocol competitiveness. Efficient storage patterns, optimized function calls, and batch processing capabilities reduce transaction costs for users across Ethereum, Polygon, Arbitrum, and other EVM-compatible networks popular among traders in the USA, UK, and UAE.

Collateral Design and Risk Isolation in Synthetic asset trading

Collateral design determines how synthetic protocols absorb market volatility and protect against insolvency. Different collateral types carry varying risk profiles that must be carefully managed through appropriate ratios and isolation mechanisms. Understanding these dynamics is crucial for protocol architects and users alike.

| Collateral Type | Min Ratio | Risk Level | Use Case |

|---|---|---|---|

| Stablecoins (USDC, DAI) | 110% | Low | Conservative positions, low volatility exposure |

| ETH / WETH | 150% | Medium | Standard synthetic minting, balanced risk |

| BTC (Wrapped) | 150% | Medium | Cross-chain exposure, BTC holders |

| Governance Tokens | 200% | Medium-High | Protocol-aligned incentives, staking |

| LP Tokens | 250% | High | Advanced users, yield stacking strategies |

Minting, Burning, and Settlement Mechanisms Explained

The minting process begins when users deposit collateral into protocol vaults, enabling them to create synthetic tokens up to their collateralization ratio limits. Smart contracts verify collateral value through oracle feeds, calculate available minting capacity, and issue synthetic tokens to the user’s wallet. This process occurs atomically, ensuring no partial state changes can corrupt the system.

Burning synthetic assets reverses this process, destroying tokens to release underlying collateral. Users must maintain minimum collateralization ratios to avoid liquidation. Settlement mechanisms handle edge cases where synthetic assets must be redeemed against protocol reserves, particularly during extreme market conditions or protocol shutdown scenarios.

Advanced protocols implement debt pools where all synthetic positions share collective risk and reward. This model, pioneered by protocols serving users in the USA, UK, and Canada, enables greater capital efficiency but requires sophisticated risk management to prevent concentration issues.

Liquidity Models Supporting Synthetic Asset Markets

Liquidity provision in synthetic asset markets differs fundamentally from traditional AMM models. Instead of requiring liquidity providers to supply both assets in a Synthetic asset trading pair, synthetic protocols often use debt-based liquidity where the protocol itself serves as counterparty to all trades. This model eliminates impermanent loss for stakers but concentrates risk within the protocol treasury.

Virtual AMM models create synthetic liquidity through algorithmic pricing curves without requiring actual asset pools. Traders interact with smart contracts that calculate prices based on open interest and funding rates. This approach enables infinite liquidity at the cost of potential price deviation from external markets during high-volume periods.

Hybrid models combine pool-based liquidity with algorithmic backstops, offering traders better execution while managing protocol risk. These sophisticated systems require careful parameter tuning and ongoing monitoring to maintain optimal performance across varying market conditions.[1]

On-Chain vs Off-Chain Execution in Synthetic asset trading

Execution architecture significantly impacts Synthetic asset trading experience, costs, and security guarantees. Understanding the tradeoffs between on-chain and off-chain approaches helps protocol designers optimize for their target user base.

| Aspect | On-Chain Execution | Off-Chain Execution |

|---|---|---|

| Settlement Finality | Immediate on-chain confirmation | Periodic batch settlement |

| Transaction Costs | Higher (gas fees per trade) | Lower (batched settlements) |

| Latency | Block confirmation time | Near-instant matching |

| Censorship Resistance | Maximum decentralization | Operator dependency |

| Throughput | Limited by block space | High-frequency capable |

Leverage, Margin, and Liquidation Infrastructure

Leverage amplifies both gains and losses in synthetic asset trading, requiring sophisticated margin and liquidation systems. Protocols must calculate real-time margin requirements based on position size, asset volatility, and market conditions. Maintenance margin thresholds trigger liquidations before positions can accumulate bad debt that threatens protocol solvency.

Liquidation infrastructure includes keeper networks that monitor positions and execute liquidations when thresholds are breached. Incentive structures must balance attracting sufficient keeper participation while minimizing extraction from liquidated users. Partial liquidation mechanisms allow users to retain portions of positions rather than losing everything.

Insurance funds and backstop mechanisms provide additional protection layers when liquidations fail to cover position losses. These reserves accumulate from Synthetic asset trading fees and protocol revenue, serving as last-resort protection for synthetic asset holders across global markets including Dubai, Toronto, and London financial centers.

Security Architecture for Synthetic Asset Protocols

Comprehensive security requires multiple defensive layers protecting against diverse attack vectors.

Layer 1: Smart contract audits from multiple reputable firms with ongoing bug bounty programs.

Layer 2: Oracle manipulation protection through TWAP, multi-source aggregation, and deviation bounds.

Layer 3: Flash loan attack prevention through transaction boundaries and price delay mechanisms.

Layer 4: Access control with timelocks on critical parameter changes and multi-sig governance.

Layer 5: Circuit breakers that pause trading during extreme volatility or detected anomalies.

Layer 6: Insurance funds and protocol reserves as backstops against unexpected loss events.

Managing Oracle Failure and Extreme Market Volatility

Oracle failures represent existential risks for synthetic asset protocols, as incorrect price data can trigger massive incorrect liquidations or enable arbitrage exploits. Robust protocols implement multiple fallback mechanisms including secondary oracle sources, staleness checks, and deviation bounds that flag suspicious price movements for manual review.

Extreme market volatility tests protocol resilience beyond normal operating parameters. Flash crashes can cascade through synthetic markets as liquidations trigger further price movements. Protocols must model extreme scenarios and maintain sufficient liquidity buffers to absorb rapid deleveraging events without accumulating bad debt.

Emergency governance mechanisms allow protocol teams to pause operations during crisis events. However, these capabilities must be carefully constrained to prevent abuse while remaining accessible when genuinely needed. Transparent escalation procedures build user trust in protocol crisis management capabilities.

Scalability Challenges in Synthetic asset trading Platforms

Scalability constraints limit synthetic asset trading throughput on congested networks. High gas costs during peak demand periods make small trades economically unfeasible, pushing retail users toward centralized alternatives. Layer 2 solutions and alternative Layer 1 networks offer partial relief but introduce additional complexity and bridge risks.

State bloat accumulates as synthetic protocols track growing numbers of positions and historical data. Efficient data structures and pruning mechanisms help manage on-chain storage requirements. Some protocols move historical data off-chain while maintaining cryptographic proofs for verification when needed.

Cross-chain synthetic assets multiply scalability challenges by requiring coordination across multiple networks. Bridge latency, fragmented liquidity, and inconsistent finality guarantees complicate unified trading experiences. Emerging solutions like intent-based architectures and chain abstraction layers promise to simplify cross-chain synthetic trading for users globally.

Interoperability of Synthetic Assets Across DeFi Protocols

Interoperability enables synthetic assets to flow seamlessly between lending protocols, AMMs, yield aggregators, and other DeFi applications. Composability multiplies the utility of synthetic tokens, allowing users to earn yield on synthetic positions or use them as collateral for additional borrowing. This interconnectedness creates powerful financial strategies unavailable in traditional markets.

Standardization efforts including token standards and messaging protocols facilitate cross-protocol integration. However, each integration point introduces potential vulnerabilities that attackers may exploit. Protocols must carefully vet integration partners and implement appropriate safeguards against composability-based attacks.

Cross-chain interoperability extends synthetic asset reach beyond single network boundaries. Users in the USA might mint synthetics on Ethereum, bridge to Arbitrum for lower-cost trading, and use proceeds on Polygon for yield farming. This multi-chain approach maximizes capital efficiency but requires robust bridge security and consistent asset valuation across networks.

Synthetic Asset Trading Integration Testing Lifecycle

1. Unit Testing

Test individual smart contract functions in isolation to verify minting, burning, and collateral logic works correctly.

2. Oracle Integration Testing

Verify price feed connections function properly and handle edge cases like stale data or extreme deviations.

3. Liquidation Simulation

Simulate various market scenarios to ensure liquidation mechanisms trigger correctly and protect protocol solvency.

4. Multi-Contract Integration

Validate interactions between vault, controller, and token contracts function as designed under various conditions.

5. End-to-End Testing

Complete user workflow validation from frontend through smart contracts to ensure seamless trading experience.

6. Security Audit

Professional third-party review of all contract code to identify vulnerabilities before mainnet deployment.

7. Testnet Deployment

Deploy to public testnet for community testing and final validation in production-like environment.

8. Mainnet Launch

Production deployment with monitoring, incident response plans, and gradual TVL cap increases.

Capital Efficiency Gains Enabled by Synthetic Instruments

Synthetic asset trading dramatically improves capital efficiency compared to traditional financial instruments. Traders gain leveraged exposure to diverse asset classes without the capital requirements of physical ownership. A trader in Dubai can gain exposure to US equities, European commodities, and Asian forex markets simultaneously from a single collateral pool.

Cross-margin capabilities allow traders to use unrealized profits from winning positions to margin additional trades. This recursive capital utilization amplifies returns during favorable market conditions while requiring careful risk management during downturns. Sophisticated position management interfaces help traders optimize their capital deployment.

Yield stacking strategies combine synthetic positions with DeFi yield opportunities. Traders mint synthetics against yield-bearing collateral, earning returns on both the underlying collateral and the synthetic position. These compounding strategies drive significant institutional interest in synthetic asset trading infrastructure.

Regulatory Considerations for Synthetic Asset Infrastructure

Regulatory frameworks across major jurisdictions are actively evolving to address synthetic asset classification and oversight requirements. Protocols must navigate complex compliance landscapes while maintaining decentralization principles.

| Jurisdiction | Regulator | Classification | Key Requirements |

|---|---|---|---|

| USA | SEC / CFTC | Securities / Derivatives | Registration, accredited investor restrictions |

| UK | FCA | Specified Investments | MiFID compliance, retail restrictions |

| UAE | VARA / SCA | Virtual Assets | Licensing, custody requirements |

| Canada | CSA / Provincial | Crypto Assets | Platform registration, AML compliance |

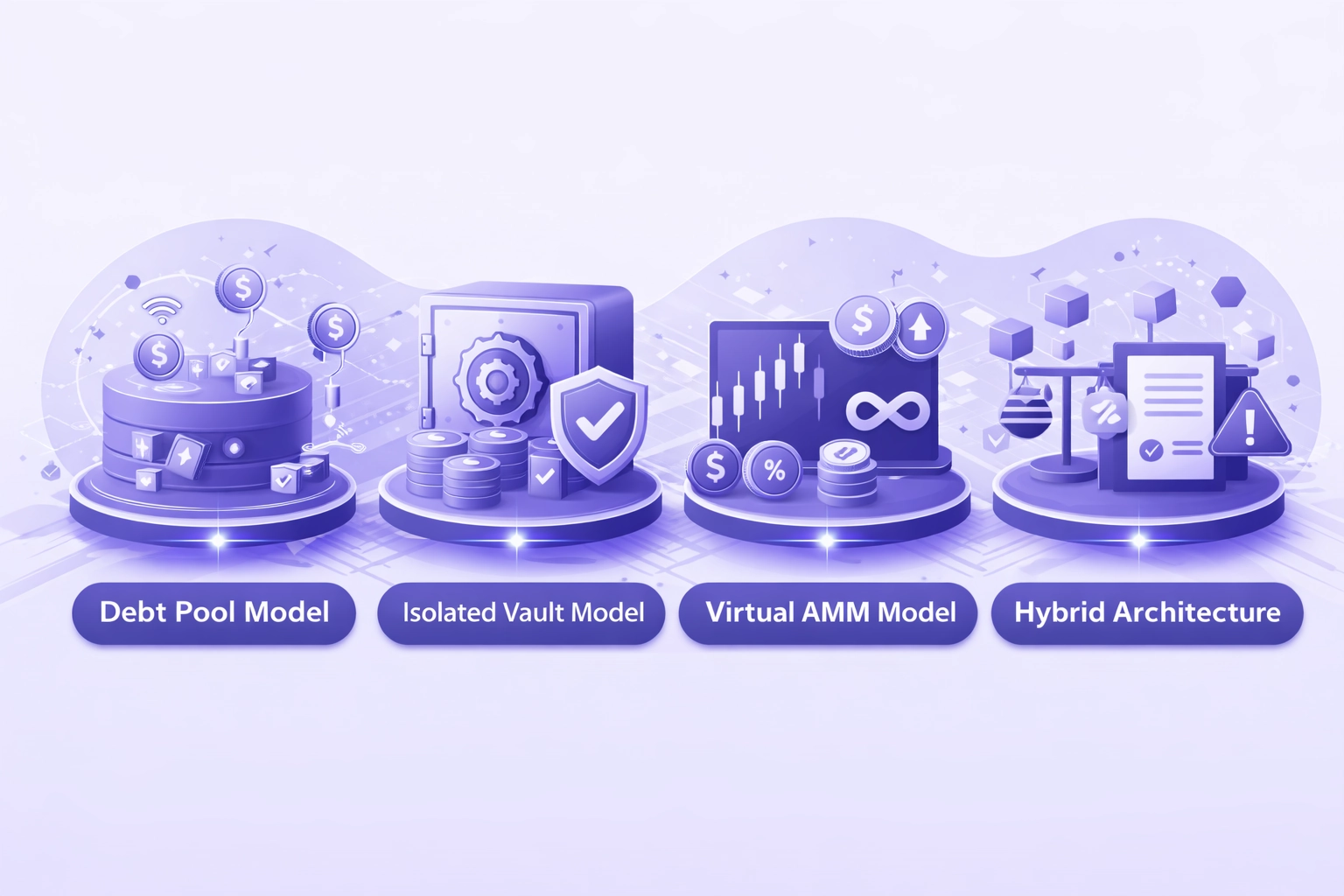

Synthetic Protocol Model Selection Criteria

Choosing the right synthetic protocol architecture requires evaluating multiple factors based on target use cases.

Debt Pool Model

Best for protocols prioritizing unlimited liquidity and infinite asset creation. Requires sophisticated risk management for shared debt exposure.

Isolated Vault Model

Ideal for risk-averse deployments where position isolation prevents cascading liquidations. Lower capital efficiency but stronger safety guarantees.

Virtual AMM Model

Optimal for perpetual-style trading with funding rate mechanisms. Enables high leverage without traditional liquidity provider requirements.

Hybrid Architecture

Combines multiple models for flexibility. Best for platforms serving diverse user segments with varying risk appetites and trading styles.

Use Cases Driving Adoption of Synthetic Asset Trading

Tokenized equity exposure allows global users to trade synthetic versions of US stocks without brokerage accounts or geographic restrictions. Traders in Dubai can speculate on Tesla or Apple price movements through decentralized protocols operating 24/7. This democratization of equity access drives significant user adoption in emerging markets.

Commodity synthetics provide exposure to gold, oil, and agricultural products without physical storage or futures contract complexity. DeFi users hedge inflation risk or speculate on commodity cycles through simple token transactions. These instruments bring commodity market access to retail users who previously faced prohibitive barriers.

Forex synthetic pairs enable currency exposure beyond traditional crypto trading pairs. Stablecoin users gain exposure to EUR, GBP, or JPY movements without leaving the DeFi ecosystem. Institutional treasuries use these instruments for currency hedging while maintaining crypto-native settlement infrastructure.

Synthetic Protocol Compliance Checklist

Legal Structure

- Entity jurisdiction selection

- Token classification analysis

- Terms of service documentation

AML/KYC Requirements

- Identity verification tiers

- Transaction monitoring

- Sanctions screening

Risk Disclosures

- Smart contract risks

- Market volatility warnings

- Liquidation risk explanations

Operational Controls

- Audit trail maintenance

- Incident response procedures

- Governance documentation

Future Evolution of Synthetic Trading as DeFi Core Infrastructure

Emerging trends shaping the next generation of synthetic asset trading infrastructure.

Trend 1: Cross-chain synthetic liquidity pools enabling unified trading across multiple networks simultaneously.

Trend 2: AI-powered risk management systems providing real-time position monitoring and automated hedging.

Trend 3: Institutional-grade trading interfaces with advanced order types and portfolio management tools.

Trend 4: Zero-knowledge proof integration for privacy-preserving synthetic trading without sacrificing compliance.

Trend 5: Real-world asset tokenization bridges connecting synthetic protocols with traditional financial infrastructure.

Trend 6: Intent-based trading architectures abstracting complexity for improved user experience and MEV protection.

Trend 7: Modular protocol architectures enabling customizable risk parameters and collateral configurations.

Trend 8: Regulatory-compliant synthetic asset wrappers enabling institutional participation in DeFi markets.

Build Your Synthetic Asset Trading Infrastructure with Experts!

Partner with our team of blockchain specialists to create secure, scalable synthetic asset protocols tailored for global DeFi markets.

Frequently Asked Questions

Synthetic asset trading in DeFi enables users to gain exposure to real-world assets like stocks, commodities, and currencies without holding the underlying asset. These synthetic instruments are created through smart contracts using collateral and price oracles to track asset values. Traders in USA, UK, UAE, and Canada use synthetic assets to access global markets 24/7 without traditional brokerage accounts or geographic restrictions.

Synthetic assets maintain price accuracy through decentralized oracle networks that continuously feed real-time market data to smart contracts. Protocols like Chainlink aggregate prices from multiple sources to prevent manipulation. The collateralization mechanism ensures each synthetic asset is backed by sufficient value, while arbitrage incentives encourage traders to correct any price deviations, keeping synthetics aligned with their underlying reference assets.

Synthetic asset trading typically requires overcollateralization ranging from 150% to 750% depending on the protocol and asset volatility. Common collateral types include stablecoins like USDC and DAI, native tokens like ETH, and protocol-specific tokens. Higher collateral ratios provide greater safety margins against liquidation during market volatility, protecting both individual positions and overall protocol solvency across DeFi ecosystems.

Synthetic asset trading carries risks including smart contract vulnerabilities, oracle manipulation, liquidation during high volatility, and regulatory uncertainty. Protocol failures can result in complete loss of collateral. Users must monitor collateralization ratios continuously and understand that synthetic assets depend entirely on the underlying protocol’s security and economic design rather than traditional asset custody.

Synthetic asset trading operates on decentralized blockchain infrastructure without intermediaries, enabling permissionless access and transparent execution. Unlike traditional derivatives requiring brokers, clearing houses, and regulatory compliance, DeFi synthetics execute through auditable smart contracts. Settlement occurs instantly on-chain rather than through multi-day processes, though regulatory frameworks in USA, UK, and other jurisdictions continue evolving around these instruments.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.