Key Takeaways

- 1

Custodial DeFi means a third party company holds and manages your crypto private keys on your behalf. - 2

Non custodial DeFi gives you full ownership and control of your private keys and digital assets. - 3

The core difference between custodial and non custodial wallets is who is responsible for securing the private key. - 4

Self custody crypto meaning refers to personally holding and safeguarding your own digital assets without relying on any intermediary. - 5

Custodial crypto platforms are typically easier for beginners because the platform handles security, recovery, and wallet management. - 6

Non custodial DeFi wallets offer more privacy, freedom, and resistance to censorship but require more personal responsibility. - 7

The risk with custodial platforms is that if the company is hacked or goes bankrupt, your funds may be lost. - 8

CeDeFi platforms blend centralized convenience with decentralized financial tools, creating a hybrid approach. - 9

Businesses and startups must carefully evaluate crypto custody risks before choosing an infrastructure model for their platform. - 10

The future of crypto custody is moving toward flexible, user friendly solutions that combine the strengths of both models.

If you have ever wondered who actually controls the cryptocurrency in your wallet, you are already asking one of the most important questions in the world of decentralized finance. The debate around Custodial vs Non Custodial DeFi is at the very heart of how people store, manage, and interact with digital assets. Whether you are a complete beginner or someone exploring blockchain for your business, understanding this concept is essential before making any financial move in the crypto space.

In simple terms, the word “custody” in crypto means who holds the keys to your funds. Think of it like a bank locker. In one model, the bank holds the key for you and manages your locker. In the other, only you have the key, and nobody else can open it. Both approaches come with unique benefits and risks, and your choice between the two can shape your entire crypto experience.

This guide will walk you through everything you need to know about custodial and non custodial DeFi, including how each model works, the pros and cons, security considerations, and which one might be the right fit for you or your business. Let us dive in.

What is Custodial DeFi?

To understand what is custodial DeFi, think about how traditional banking works. When you deposit money in a bank, you trust that institution to keep your funds safe. You do not personally guard the vault or manage the security systems. Instead, the bank does it for you. Custodial DeFi works in a very similar way.

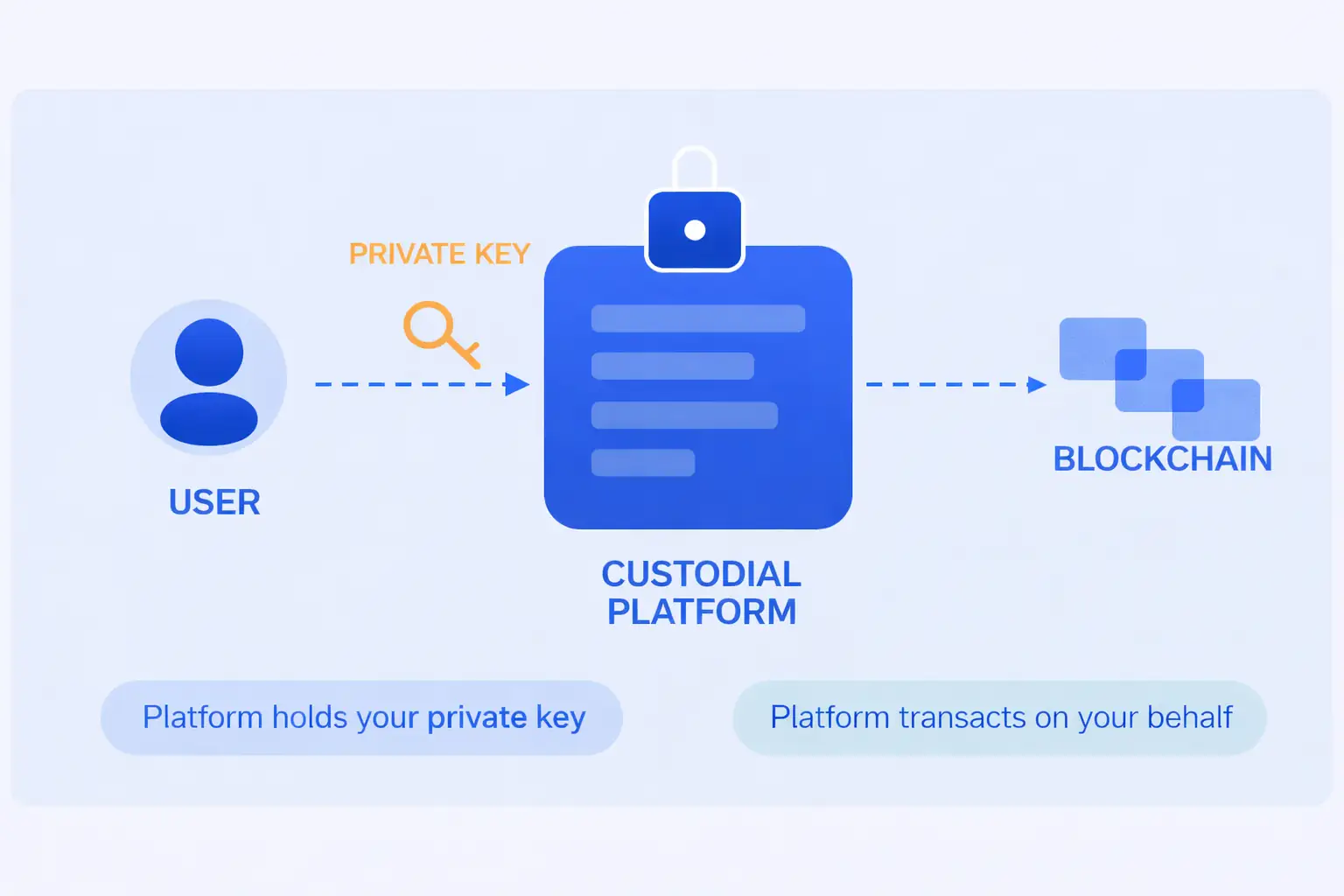

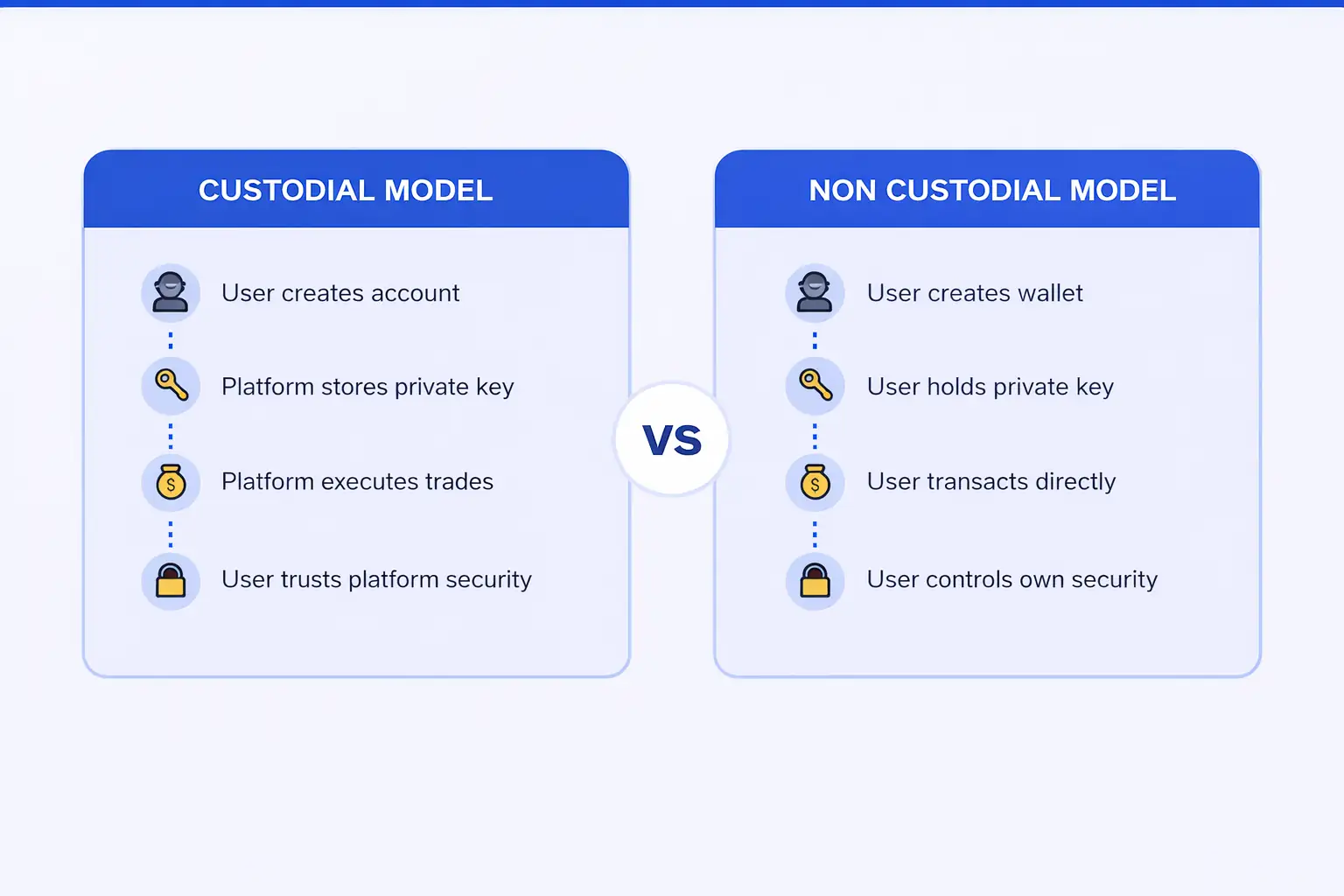

In the custodial model, a centralized company or platform holds your cryptocurrency private keys. This means you do not directly control access to your funds. Instead, you rely on the platform to manage transactions, protect your wallet, and provide features like password recovery if you forget your login details.

Popular examples of custodial crypto platforms include major exchanges where you create an account, deposit crypto, and trade using the platform’s interface. The experience feels smooth and familiar, much like using a mobile banking app or a digital payment service.

Custodial DeFi is often the first entry point for people who are new to cryptocurrency because it removes the complexity of managing private keys and seed phrases. However, the trade off is that you must trust the platform entirely with the safety of your assets.

What is Non Custodial DeFi?

Now let us look at the other side. What is non custodial DeFi? In this model, you are the only person who holds the private keys to your wallet. No company, no intermediary, and no third party has access to your funds. You are fully in charge.

Imagine having a personal safe at home instead of a bank locker. You hold the combination, you decide when to open it, and if you lose the code, nobody else can help you get inside. That is exactly how non custodial DeFi wallets work. The power and the responsibility both rest entirely with you.

Non custodial platforms allow users to interact directly with decentralized protocols. You connect your wallet to a decentralized application (dApp), approve transactions, and everything happens on the blockchain without any middleman holding your assets. This is the foundation of true decentralized finance.

The concept of self custody crypto meaning is rooted in this philosophy: you and only you are the guardian of your wealth. Well known non custodial DeFi wallets include tools like MetaMask, Trust Wallet, and Phantom, which allow users to store, send, and interact with DeFi protocols while maintaining full private key ownership.

Why Does Custody Matter in Crypto and Blockchain?

In the world of blockchain, there is a well known saying: “Not your keys, not your coins.” This phrase captures the essence of why private key ownership is such a critical topic.

Unlike traditional banking, where governments and regulatory bodies can insure deposits or step in during crises, the crypto world operates differently. If a custodial platform gets hacked, freezes withdrawals, or shuts down, users can potentially lose everything they stored on that platform. History has shown multiple instances where centralized exchanges faced security breaches, leaving millions of dollars in user funds at risk.

On the other hand, with non custodial solutions, the responsibility falls on the individual. If you lose your seed phrase or private key, there is no customer support team to help you recover your assets. The trade off between convenience and control is what makes the discussion of centralized vs decentralized custody so important.

For businesses and startups building products in the blockchain space, deciding between custodial and non custodial infrastructure has implications for user experience, regulatory compliance, security budgets, and overall trust. This is why working with experienced blockchain solution providers like Nadcab Labs can be invaluable when making such foundational decisions.

How Custodial Platforms Work: Step by Step

Understanding how custodial crypto platforms function will help you see why they are so popular among beginners. Here is a straightforward breakdown of the process:

Account Creation

You sign up on a centralized platform by providing your email, phone number, and identity documents (KYC verification). This is similar to opening a bank account online.

Wallet Assignment

The platform generates a wallet address for you. However, the private key linked to that wallet is stored and managed by the platform, not by you.

Depositing Funds

You transfer cryptocurrency into your platform wallet or purchase crypto directly using fiat currency through the platform’s interface.

Trading and Transacting

You can trade, swap, stake, or earn interest on your crypto using the platform’s built in tools. Every action is facilitated by the platform on your behalf.

Withdrawal

When you want to move funds out, you request a withdrawal. The platform processes this by using the private key it holds to authorize the transaction on the blockchain.

Throughout this entire flow, the platform acts as an intermediary. It is similar to how a stockbroker handles your stock trades. You give instructions, and the broker executes them using the assets held in your brokerage account.

How Non Custodial DeFi Works: Step by Step

The non custodial model puts you in the driver’s seat. Here is how it works from start to finish:

Wallet Creation

You download a non custodial wallet app such as MetaMask or Trust Wallet. The app generates a unique private key and a seed phrase (a series of 12 or 24 words) that only you can see.

Securing Your Keys

You write down and safely store your seed phrase offline. This phrase is the master access code to your wallet. If you lose it, no one can recover your funds.

Funding Your Wallet

You receive crypto from another wallet or purchase it through a third party service and transfer it to your wallet address.

Connecting to DeFi Protocols

You visit a decentralized application (dApp) website and connect your wallet. The dApp interacts directly with smart contracts on the blockchain.

Approving Transactions

Every transaction requires your manual approval through your wallet. You sign each transaction with your private key, and it is recorded directly on the blockchain without any intermediary.

In this model, there is no account, no password reset option, and no customer support. The blockchain itself is your platform, and your private key is your identity. This is the purest form of financial self sovereignty, and it is the reason why many advocates prefer non custodial DeFi wallets over centralized alternatives.

Key Differences Between Custodial vs Non Custodial DeFi

The difference between custodial and non custodial wallets becomes clearer when you compare them across several important factors. The table below provides a quick reference:

| Feature | Custodial DeFi | Non Custodial DeFi |

|---|---|---|

| Private Key Ownership | Held by the platform | Held by the user |

| User Control | Limited; platform controlled | Full; user controlled |

| Ease of Use | Beginner friendly, simple interface | Requires technical understanding |

| Account Recovery | Password reset and support available | No recovery if seed phrase is lost |

| Privacy | Requires KYC and identity verification | Can be used anonymously |

| Security Risk | Vulnerable to platform hacks | Vulnerable to user error |

| Regulatory Compliance | Typically regulated and licensed | Operates outside traditional regulation |

| Transaction Speed | Can be faster via off chain systems | Depends on blockchain network speed |

| Trust Requirement | Must trust the custodian | Trustless; relies on code and blockchain |

| Best For | Beginners and casual users | Experienced users and privacy focused individuals |

Benefits of Custodial DeFi

There are several reasons why custodial platforms remain popular, especially among newcomers to the crypto ecosystem:

For someone comparing this to everyday life, using a custodial platform is like storing valuables in a bank’s safety deposit box. You trust the bank’s security, and in return, you get convenience and peace of mind.

Risks of Custodial DeFi

Despite the convenience, custodial DeFi comes with significant crypto custody risks that every user should understand:

These risks are not theoretical. Several major custodial platforms have experienced security incidents or financial collapses in recent years, reminding the crypto community that trusting a third party always comes with a degree of uncertainty.

Benefits of Non Custodial DeFi

The non custodial approach is built on the core principles of blockchain: decentralization, transparency, and individual sovereignty. Here are the main advantages:

For individuals in regions with unstable banking systems or strict capital controls, non custodial DeFi offers a lifeline. It provides financial inclusion without requiring permission from any central authority. As noted by Ethereum.org, DeFi creates an open financial system that is accessible to everyone.

Risks of Non Custodial DeFi

While the freedom of non custodial DeFi is empowering, it also demands a high level of personal responsibility:

These risks highlight why education is so important before entering the non custodial DeFi space. Taking the time to learn about wallet security, seed phrase storage, and smart contract basics can significantly reduce the likelihood of costly mistakes.

Security Comparison and Responsibility Differences

Security in the crypto world works very differently from traditional finance. In custodial DeFi, the platform bears the primary responsibility for protecting user funds. This includes investing in server security, cold storage solutions, insurance policies, and fraud detection systems. However, this centralized model creates a single point of failure. If the platform’s security is compromised, all users are affected.

In non custodial DeFi, security is distributed. Each user is responsible for their own wallet. This means no single breach can compromise everyone at once, but it also means each individual must practice strong security habits. These include storing seed phrases offline, using hardware wallets for large holdings, verifying website URLs before connecting wallets, and never sharing private keys with anyone.

The choice between the two models often comes down to a fundamental question: do you prefer to trust a professional institution to protect your assets, or do you prefer to take full control and accept the responsibility that comes with it? Neither answer is wrong; it depends on your knowledge, comfort level, and the amount of crypto you are managing.

Regulatory and Compliance Differences

Regulation is one of the biggest areas of contrast between custodial and non custodial DeFi. Custodial platforms, because they hold user funds and collect personal data, are subject to financial regulations in most jurisdictions. They must comply with anti money laundering (AML) laws, know your customer (KYC) requirements, and may need to obtain specific licenses to operate.

For users, this means greater legal protection in theory. If a regulated platform fails, there may be legal recourse. For businesses, building on a custodial model means navigating a complex web of compliance requirements, but it also opens doors to institutional clients and partnerships that require regulatory clarity.

Non custodial DeFi protocols, on the other hand, operate on the open blockchain and typically do not require user identification. This makes them more accessible but also creates challenges for regulators who are working to prevent illicit activities. According to the World Economic Forum, the regulation of DeFi remains one of the most actively debated topics in global financial policy.

As the regulatory landscape continues to evolve, platforms and businesses will need to stay informed and adapt their strategies accordingly.

Which is Better for Beginners?

If you are just getting started with cryptocurrency, the honest answer is that custodial platforms offer a gentler learning curve. The familiar interface, password recovery options, and customer support make it easier to build confidence without the fear of losing everything due to a small mistake.

However, beginners should treat custodial platforms as a starting point, not a permanent solution. As your knowledge grows, transitioning to non custodial wallets and DeFi protocols can give you greater freedom, better privacy, and a deeper understanding of how blockchain technology actually works.

Beginner Strategy: Keep a small amount on a custodial platform for easy trading and learning, while gradually moving the majority of your holdings into a secure non custodial wallet as you become more comfortable with key management and DeFi interactions.

The Role of CeDeFi and Hybrid Models

The crypto industry has recognized that many users want the best of both worlds. This has given rise to CeDeFi platforms, which combine the convenience and compliance of centralized finance with the openness and innovation of decentralized protocols.

CeDeFi platforms typically allow users to access DeFi services like lending, staking, and yield farming through a centralized interface. The platform may handle custody and compliance while connecting to decentralized liquidity pools behind the scenes. This hybrid model reduces the technical barriers for everyday users while still leveraging the power of blockchain based financial tools.

For businesses and startups, the CeDeFi approach can be especially attractive. It allows them to offer innovative financial products to their customers while maintaining regulatory compliance and providing a user friendly experience. This is an area where blockchain development firms like Nadcab Labs have deep expertise, helping companies design and build platforms that bridge the gap between centralized reliability and decentralized innovation.

Business and Startup Relevance

For business founders and startup teams exploring blockchain, the custodial vs non custodial decision is not just a user preference; it is a core architectural choice that affects every aspect of the product.

If you are building a crypto exchange, a digital banking app, or a tokenized asset platform, you need to decide how custody will work for your users. Choosing a custodial model means investing in security infrastructure, compliance frameworks, and insurance. Choosing a non custodial model means focusing on smart contract development, wallet integration, and user education.

Many successful projects in the defi and Web3 space adopt a hybrid approach, offering custodial services for onboarding new users while providing non custodial options for advanced users who prefer full control. This strategy maximizes user acquisition while respecting the principles of decentralization.

Regardless of which model you choose, partnering with a knowledgeable blockchain development company can save time, reduce risk, and accelerate your time to market. Teams like Nadcab Labs bring real world experience in building both custodial and non custodial solutions across a wide range of industries.

Future Trends in Crypto Custody

The crypto custody landscape is evolving rapidly. Several trends are shaping the future of how individuals and institutions will manage digital assets:

The industry is clearly moving toward solutions that do not force users to choose between security and convenience. The future of Custodial vs Non Custodial DeFi will likely be defined by flexible, intelligent systems that adapt to each user’s needs.

Conclusion

Understanding Custodial vs Non Custodial DeFi is one of the most important steps in your blockchain journey. At its core, the question is simple: do you want someone else to hold the keys to your crypto, or do you want to hold them yourself? Each model comes with its own set of benefits, risks, and responsibilities.

Custodial DeFi offers ease of use, customer support, and a familiar experience that mirrors traditional finance. Non custodial DeFi provides full ownership, privacy, and alignment with the foundational values of decentralization. And for those who want a middle ground, CeDeFi and hybrid models offer a blend of both approaches.

For beginners, the best approach is to start learning, start small, and gradually increase your comfort with self custody as your understanding grows. For businesses and startups, the choice of custody model will define the architecture, security posture, and compliance strategy of your entire platform.

No matter where you are on your crypto journey, the most important thing is to make informed decisions. Educate yourself, understand the risks, and choose the model that aligns with your goals. And when you are ready to build, trusted blockchain partners like Nadcab Labs can help you navigate the path with confidence.

Frequently Asked Questions

Yes, you can. The process involves creating a new non custodial wallet, securely saving your seed phrase, and then withdrawing your crypto from the custodial platform to your new wallet address. Always double check the wallet address and send a small test amount first before transferring larger holdings.

MetaMask is a non custodial wallet. When you set it up, the app generates a private key and a seed phrase that only you can access. MetaMask does not store your keys on any server, which means you have full control and full responsibility for your funds.

Ask yourself one simple question: were you given a seed phrase or private key when you created the wallet? If yes, it is likely non custodial. If you signed up with an email and password and never received a seed phrase, your wallet is almost certainly custodial, and the platform holds your keys.

Absolutely. Many experienced crypto users maintain both types simultaneously. They may keep funds on a custodial exchange for active trading and convenience, while storing the majority of their long term holdings in a non custodial hardware or software wallet for maximum security.

Hardware wallets are a specific type of non custodial wallet. They store your private keys on a physical device that stays offline, making them one of the most secure options for long term storage. Popular examples include Ledger and Trezor. All hardware wallets are non custodial, but not all non custodial wallets are hardware based; many are software apps on your phone or browser.

Most non custodial wallets are free to download and use. However, you will still need to pay blockchain network fees (often called gas fees) whenever you send a transaction or interact with a smart contract. These fees go to the network validators, not to the wallet provider. Some wallets may also include a small swap fee if you use their built in token exchange feature.

Yes, you can. Many DeFi protocols allow you to lend, stake, or provide liquidity directly from your non custodial wallet. You connect your wallet to a dApp, approve the transaction, and your assets begin earning yield while remaining under your control through smart contracts. This is one of the key advantages of decentralized finance.

In most countries, using a non custodial wallet is completely legal. However, regulations vary by jurisdiction. Some countries have introduced rules around reporting crypto holdings or transactions for tax purposes, regardless of which wallet type you use. It is always wise to check your local laws and consult a financial advisor if you are unsure about compliance obligations.

Yes, businesses can receive crypto payments directly into a non custodial wallet. This eliminates payment processor fees and gives the business instant access to funds. However, for proper record keeping and tax compliance, most businesses choose to use specialized crypto payment gateways that can integrate with non custodial wallets while also generating invoices and tracking transactions automatically.

The safest approach is to write your seed phrase on paper or engrave it on a metal plate and store it in a secure physical location such as a fireproof safe or a bank vault. Never store your seed phrase digitally in screenshots, notes apps, cloud storage, or emails. Some users split their seed phrase across multiple secure locations for added protection. The golden rule is: if it is connected to the internet, it is not safe enough for your seed phrase.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.