Key Takeaways

- Real estate tokenization regulations treat tokenized property interests as securities in virtually all major jurisdictions including USA, UK, UAE, and Canada, triggering comprehensive regulatory frameworks covering registration, disclosure, transfer restrictions, and ongoing compliance obligations that platforms must satisfy before launching offerings.

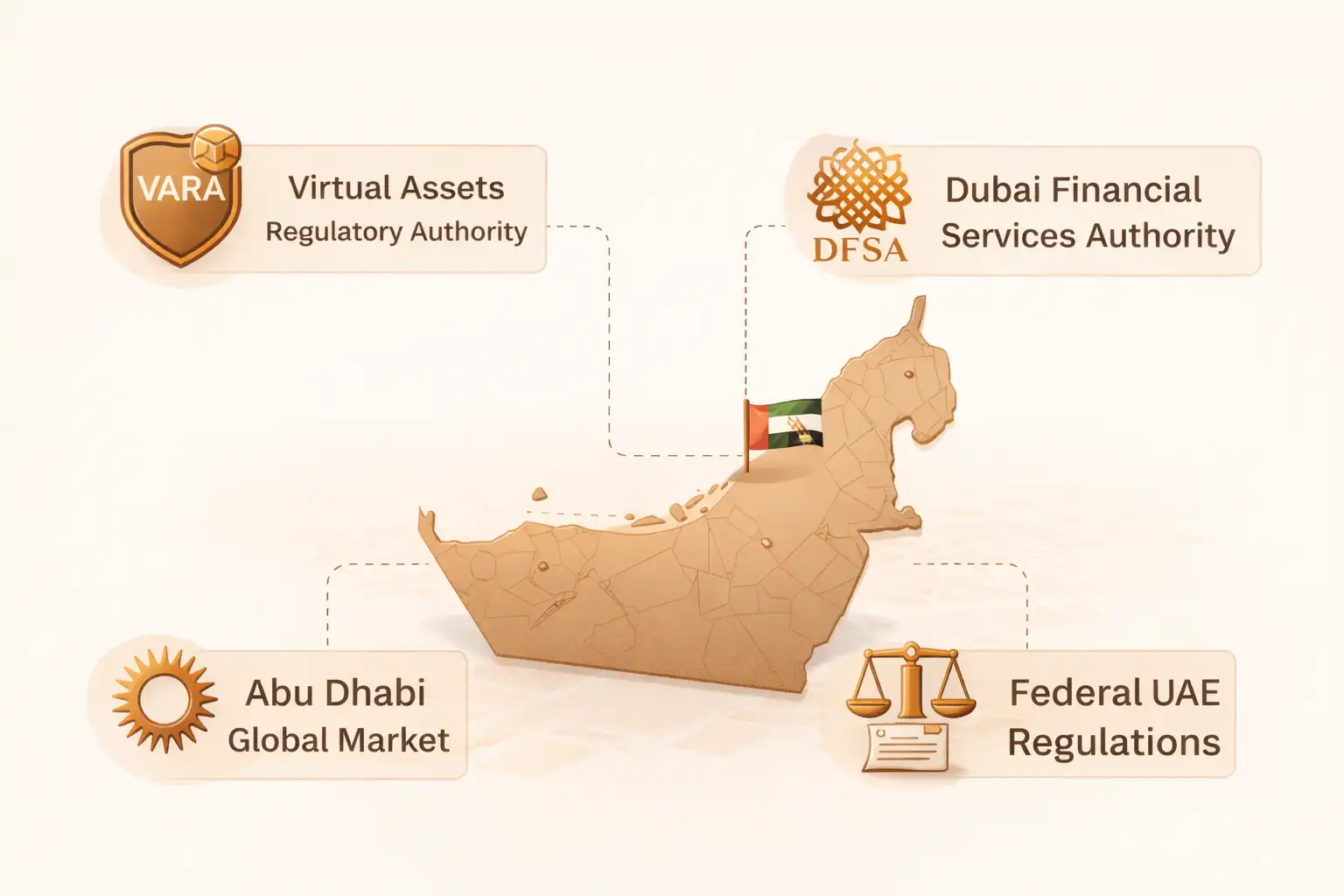

- Securities law compliance represents the foundational regulatory requirement with US SEC applying Regulation D for private placements, Regulation A+ for mini-public offerings, UK FCA requiring prospectus approval, UAE VARA and DFSA implementing digital asset security frameworks, and Canadian provinces enforcing National Instrument requirements.

- KYC and AML obligations for tokenization platforms match or exceed traditional financial services requirements mandating customer identification, beneficial ownership verification, sanctions screening, suspicious activity monitoring, and comprehensive record-keeping with violations resulting in criminal prosecution and substantial civil penalties.

- Cross-border tokenization creates jurisdictional complexity requiring compliance with securities laws in all countries where tokens are offered or traded with limited safe harbors like US Regulation S for offshore transactions, making geographic restrictions and multi-jurisdictional compliance essential for international platforms.

- Smart contracts implementing transfer restrictions, KYC verification, and distribution automation must be legally enforceable while maintaining regulatory compliance requiring careful design balancing code automation with legal requirements, comprehensive testing, and legal review confirming smart contract terms satisfy applicable securities and contract laws.

- Licensing requirements for tokenization platforms vary significantly by jurisdiction and business model with secondary trading platforms typically requiring broker-dealer or Alternative Trading System registration, custodial services needing qualified custodian status, and issuers potentially requiring investment adviser registration depending on services offered.

- Taxation of tokenized real estate follows traditional property tax principles in most jurisdictions with token holders subject to capital gains tax on appreciation, income tax on distributions, and property-level taxes flowing through ownership structures, though specific treatment varies and requires professional tax advice.

- Regulatory non-compliance creates existential platform risks beyond financial penalties including forced shutdown orders, investor rescission rights requiring buybacks at original prices, criminal prosecution of executives, permanent industry bars, and cascading investor lawsuits that can destroy platform value regardless of underlying property quality.

- Emerging regulatory frameworks in UAE and other progressive jurisdictions provide clearer pathways for compliant tokenization while maintaining investor protections, demonstrating regulatory evolution toward accommodating digital securities within established legal frameworks rather than creating entirely new regulatory categories.

- Global regulatory harmonization remains limited despite international coordination efforts requiring platforms to implement highest common standards across all operating jurisdictions, maintain flexible compliance systems adapting to regulatory changes, and engage proactively with regulators establishing enforcement precedents shaping industry development.

Introduction to Real Estate Tokenization Regulations

Real estate tokenization regulations represent the complex intersection of traditional property law, securities regulation, digital asset frameworks, anti-money laundering requirements, and cross-border legal considerations that collectively govern how property ownership interests can be digitized, offered to investors, and traded on blockchain infrastructure. Understanding this regulatory landscape is essential for platforms launching tokenization offerings, investors evaluating compliance risks, and jurisdictions developing frameworks balancing innovation with investor protection.

The regulatory treatment of tokenized real estate has evolved significantly since early experimental implementations in 2017-2018 when legal uncertainty dominated and many platforms operated without clear regulatory authorization. Today, regulators across the USA, UK, UAE, and Canada have established that tokenized property interests constitute securities subject to comprehensive regulatory oversight, ending debates about whether blockchain technology creates novel asset categories exempt from traditional securities laws. This regulatory clarity, while imposing compliance burdens, provides legal certainty enabling institutional participation and mainstream adoption.

Our experience structuring 150+ compliant tokenization implementations across multiple jurisdictions reveals that successful regulatory navigation requires understanding both letter and spirit of applicable laws, engaging proactively with regulators establishing enforcement precedents, implementing robust compliance programs exceeding minimum requirements, and maintaining operational flexibility adapting to regulatory evolution. Platforms viewing compliance as checkbox exercise rather than core operational requirement inevitably face enforcement actions destroying value for all stakeholders.

Core Regulatory Domains Governing Real Estate Tokenization Regulations

Securities Regulation

Registration requirements, disclosure obligations, exemption qualifications, transfer restrictions, ongoing reporting, anti-fraud provisions, and broker-dealer regulations governing how tokenized property interests are offered, sold, and traded as investment securities.

Anti-Money Laundering

Customer identification, beneficial ownership verification, sanctions screening, transaction monitoring, suspicious activity reporting, and record retention requirements preventing tokenization platforms from facilitating money laundering, terrorist financing, or sanctions evasion.

Property Law

Real estate ownership structures, title recording, lien priorities, foreclosure procedures, landlord-tenant regulations, zoning compliance, and property tax obligations that continue applying to underlying properties regardless of tokenized ownership representation.

Data Protection

GDPR in EU/UK, PIPEDA in Canada, state privacy laws in USA, and UAE data protection regulations governing collection, processing, storage, and deletion of investor personal information collected through KYC procedures and platform operations.

Tax Law

Capital gains taxation, income tax on distributions, depreciation pass-through, transfer taxes, withholding obligations, international tax treaties, and reporting requirements affecting token holders, issuers, and underlying property entities across multiple jurisdictions.

Cross-Border Regulation

Jurisdictional conflicts, extraterritorial enforcement, international cooperation agreements, cross-border offering restrictions, foreign investment regulations, and currency controls affecting platforms operating across USA, UK, UAE, Canada, and other markets simultaneously.

The regulatory complexity of real estate tokenization regulations stems from its hybrid nature combining traditional property ownership with digital securities infrastructure and blockchain technology. Each regulatory domain brings established requirements developed over decades for traditional markets that must be interpreted and applied to novel tokenization structures. This interpretation process involves regulatory guidance, no-action letters, enforcement actions, and court decisions gradually establishing how existing laws apply to digitized property ownership.

Regulatory approaches vary significantly across jurisdictions, with some like UAE actively creating progressive frameworks specifically designed for digital securities, while others like USA apply existing securities laws developed in 1930s to modern blockchain implementations. These divergent approaches create compliance challenges for international platforms that must satisfy the strictest applicable requirements across all operating jurisdictions rather than selecting most permissive regulatory environments.

Regulatory Philosophy: Real estate tokenization regulations should be understood not as obstacles to innovation but as investor protection frameworks ensuring market integrity, preventing fraud, and maintaining public confidence in property markets. Successful platforms embrace compliance as competitive advantage demonstrating professionalism, protecting investors, and building trust with institutional participants requiring regulatory certainty. The platforms that thrive long-term are those viewing regulatory compliance as core value proposition rather than burdensome cost, investing appropriately in legal counsel, compliance systems, and ongoing regulatory engagement establishing industry best practices.

This comprehensive regulatory guide examines each major regulatory domain affecting real estate tokenization regulations, analyzes specific requirements in USA, UK, UAE, and Canada, provides practical compliance strategies based on our operational experience, and explores emerging regulatory developments shaping the future of digitized property ownership. Understanding these regulations is essential for anyone involved in tokenization, from platforms seeking to launch compliant offerings to investors evaluating regulatory risks in their investment decisions.

Why Regulatory Clarity Matters in Real Estate Tokenization Regulations

Regulatory clarity represents the foundational prerequisite for mainstream real estate tokenization regulations adoption, with clear legal frameworks enabling institutional investment, reducing compliance costs, preventing enforcement actions, and facilitating secondary market development that realizes tokenization’s liquidity promise. Conversely, regulatory uncertainty creates existential platform risks where business models potentially violate laws, compliance investments prove insufficient, investor protection remains unclear, and enforcement actions can instantly destroy years of development effort and billions in investor capital.

The transformation from regulatory uncertainty in 2017-2018 to increasing clarity today has enabled exponential growth in compliant tokenization implementations. Early platforms operated in legal gray areas, hoping regulators would create novel frameworks exempting blockchain-based securities from traditional regulation. This hope proved misguided as regulators consistently affirmed that tokenization doesn’t change fundamental legal character of investment securities, requiring comprehensive compliance with existing laws regardless of underlying technology.

Regulatory clarity benefits all market participants through multiple mechanisms. For platforms, clear regulations enable confident investment in compliance systems knowing requirements won’t retroactively change, support fundraising from institutional investors requiring regulatory certainty, facilitate partnerships with banks and traditional financial institutions, and reduce legal risk enabling long-term business planning. For investors, regulatory frameworks provide legal protections including disclosure requirements, anti-fraud provisions, and enforcement mechanisms addressing misconduct.

| Stakeholder | Benefits of Regulatory Clarity | Risks of Regulatory Uncertainty |

|---|---|---|

| Tokenization Platforms | Confident compliance investment, reduced legal risk, institutional partnerships, long-term business planning, clear operational boundaries | Enforcement actions, wasted compliance investment, inability to attract capital, partnership failures, business model invalidity |

| Investors | Legal protections, disclosure requirements, anti-fraud provisions, enforcement mechanisms, clear tax treatment, exit rights | Investment loss through enforcement, unclear legal rights, inadequate disclosures, fraud vulnerability, tax ambiguity |

| Institutional Participants | Fiduciary compliance certainty, risk management clarity, audit trail requirements, regulatory approval for participation | Participation prohibition, fiduciary breach risks, audit failures, regulatory scrutiny, reputational damage |

| Regulators | Market oversight capability, investor protection enforcement, fraud prevention, market integrity maintenance, tax collection | Regulatory arbitrage, enforcement challenges, investor harm, market integrity threats, tax evasion facilitation |

| Property Owners/Sellers | Access to tokenization liquidity, clear exit strategies, regulatory compliance confidence, broader investor base | Tokenization unavailability, legal liability, transaction invalidity, limited buyer pool, regulatory complications |

The economic impact of regulatory clarity extends beyond individual platform success to enable entire ecosystem development. Secondary markets for tokenized real estate require regulatory frameworks governing trading venues, custody arrangements, and transfer restrictions. Institutional custody providers need clear rules about fiduciary obligations and liability. Traditional financial institutions considering tokenization partnerships require regulatory certainty before allocating resources. Insurance companies offering coverage for tokenization risks need predictable legal frameworks for underwriting decisions.

Historical examples from cryptocurrency markets demonstrate regulatory uncertainty’s destructive impact. The 2017 ICO boom saw hundreds of projects raise billions in capital through token offerings operating without clear regulatory authorization. Subsequently, SEC enforcement actions determined most ICOs constituted unregistered securities offerings, resulting in forced refunds, civil penalties, and criminal prosecutions that destroyed many projects and harmed investors. Real estate tokenization regulations learns from this history by proactively seeking regulatory compliance rather than hoping for regulatory exemptions.

Case Study: Regulatory Clarity Enabling Institutional Adoption

In 2021, a US-based real estate tokenization regulations completed comprehensive SEC-registered offering under Regulation A+, becoming one of first platforms achieving full securities registration rather than relying on private placement exemptions. The 18-month registration process required extensive legal work, financial audits, compliance system implementation, and ongoing reporting obligations costing over $2 million.

However, this regulatory compliance enabled partnerships with major institutional investors, pension funds, and insurance companies that cannot invest in exempt offerings. The platform subsequently raised $500 million from institutional investors requiring registered securities, demonstrating how regulatory compliance costs represent investments rather than expenses. Institutional capital flow enabled platform scaling, professional management implementation, and secondary market development benefiting all investors.

This case illustrates how regulatory clarity, while imposing compliance costs, creates competitive advantages for compliant platforms through institutional access, investor confidence, and long-term sustainability. Platforms attempting regulatory arbitrage through minimal compliance face existential risks from enforcement actions and miss institutional capital opportunities available only to fully compliant offerings.

Regulatory engagement represents another dimension where clarity matters significantly. Proactive dialogue with regulators establishing enforcement precedents, participating in regulatory comment periods on proposed rules, and collaborating with industry associations developing best practices all contribute to clearer regulatory frameworks. Our experience demonstrates that regulators welcome constructive engagement from platforms genuinely seeking compliance guidance rather than viewing regulators as obstacles to circumvent.

The path forward requires continued regulatory evolution balancing innovation accommodation with investor protection. Progressive jurisdictions like UAE demonstrate how clear digital asset frameworks specifically designed for tokenization can attract international business while maintaining robust investor safeguards. Other jurisdictions can learn from these models, adapting principles to their legal traditions and policy priorities while providing clarity enabling compliant market development.

Legal Definition of Tokenized Real Estate Assets

The legal definition of tokenized real estate assets determines which regulatory frameworks apply, what rights token holders possess, and how courts will interpret disputes involving digitized property ownership. Across USA, UK, UAE, and Canada, legal systems consistently define tokenized real estate as digital representations of ownership interests in real property or property-holding entities, where the token serves as evidence of ownership rather than constituting property itself. This distinction proves critical for regulatory classification and legal enforceability.

In legal terminology, tokenized real estate assets represent hybrid instruments combining characteristics of traditional securities with blockchain-based digital assets. The underlying legal structure typically involves a special purpose vehicle (SPV) or trust owning physical property, with tokens representing fractional ownership interests, profit participation rights, or debt obligations secured by property. Token holders’ rights derive from governing legal documents including operating agreements, trust deeds, or subscription agreements rather than from blockchain code alone, though smart contracts may automate rights enforcement.

Courts and regulators across jurisdictions have rejected arguments that blockchain technology creates novel legal categories exempt from traditional property and securities law. Instead, legal analysis focuses on economic substance over technological form, examining what rights tokens convey and how those rights function economically. This substance-over-form approach ensures investors receive consistent legal protections regardless of whether ownership interests are represented through paper certificates, electronic book entries, or blockchain tokens.

Components of Legal Definition for Tokenized Real Estate

Underlying Asset

Physical real property or property-holding legal entity constituting the tangible asset that token ownership represents. This may be direct property ownership through trust structures or indirect ownership through corporate entities, limited partnerships, or other vehicles. Legal definition must clearly identify the specific property and ownership structure creating token holders’ interests.

Ownership Rights Bundle

Specific rights tokens convey including voting rights in property decisions, profit distribution rights, liquidation preference, transfer restrictions, governance participation, and information access. Legal documents must enumerate these rights explicitly as smart contract code alone provides insufficient legal specification. Rights bundle determines whether tokens constitute equity securities, debt instruments, or hybrid structures affecting regulatory treatment.

Digital Representation

Blockchain token serving as digital certificate evidencing ownership rights, enabling transfers, and potentially automating certain rights exercise through smart contracts. Legal definition must clarify that token represents ownership interest rather than constituting the interest itself, similar to how stock certificates evidence corporate ownership without being the ownership. This distinction matters for property law and bankruptcy considerations.

Governing Legal Framework

Jurisdiction whose laws govern token holder rights, dispute resolution, and legal interpretation. Most tokenization structures specify governing law in offering documents, typically choosing jurisdictions where property is located or where issuing entity is organized. Choice of law provisions must be valid under conflict of laws principles and enforceable in relevant jurisdictions where disputes might arise.

Transfer Mechanisms

Procedures for token transfer including blockchain transactions, registry updates, compliance verification, and legal effectiveness timing. Legal definition must address whether blockchain transfer alone suffices for legal ownership transfer or whether additional formalities like registry amendments or issuer notifications are required. Transfer mechanism design affects liquidity, regulatory compliance, and practical enforceability.

Regulatory implications of legal definitions vary across jurisdictions but share common principles. In the USA, SEC applies functional analysis under Howey Test examining whether token holders invest money in common enterprise with expectation of profits from others’ efforts. This analysis typically concludes tokenized real estate constitutes securities regardless of whether called “tokens,” “coins,” or other terminology. UK FCA applies similar functional analysis under Financial Services and Markets Act frameworks determining whether instruments constitute specified investments requiring regulation.

UAE regulatory authorities in DFSA and VARA have adopted explicit definitions for security tokens and investment tokens that clearly encompass tokenized real estate. These definitions provide greater clarity than jurisdictions relying solely on functional analysis of decades-old statutes, though ultimate regulatory treatment remains substantially similar. Canadian provincial securities regulators apply investment contract analysis reaching conclusions consistent with US and UK approaches despite different legal frameworks.

| Legal Element | Proper Definition | Common Misconception | Legal Impact |

|---|---|---|---|

| Token Nature | Evidence of ownership interest in property or entity | Token itself is the property or confers independent value | Determines bankruptcy treatment, attachment points for liens, and property law application |

| Rights Source | Legal documents (operating agreements, trust deeds) define rights | Smart contract code alone defines legally enforceable rights | Determines court interpretation in disputes and enforceability of automated terms |

| Transfer Effect | Blockchain transfer plus issuer registry update effects legal ownership change | Blockchain transaction alone completes legal transfer | Affects perfection of security interests, priority disputes, and legal ownership determination |

| Regulatory Status | Security subject to comprehensive securities regulation | Novel digital asset exempt from traditional securities laws | Determines registration requirements, disclosure obligations, and enforcement risk |

| Jurisdictional Scope | Subject to laws of all jurisdictions where offered, sold, or held | Only governed by blockchain protocol rules or single jurisdiction choice | Creates multi-jurisdictional compliance obligations and extraterritorial enforcement exposure |

Practical implications of legal definitions require careful documentation and structure. Tokenization platforms must draft comprehensive legal agreements clearly defining token holder rights, property ownership structures, governance mechanisms, and dispute resolution procedures. These documents must withstand legal scrutiny in multiple jurisdictions, satisfy regulatory requirements, and remain enforceable through traditional legal processes if smart contract failures or disputes arise. Technology alone cannot substitute for proper legal documentation establishing rights and obligations.

Definitional Principle: Legal definitions for tokenized real estate must prioritize substance over form, clearly articulating economic rights, legal relationships, and regulatory status rather than focusing on technological implementation details. Courts and regulators will analyze tokenization structures based on their economic function and investor protections regardless of terminology or blockchain sophistication. Platforms must ensure legal documentation comprehensively defines all material aspects of token holder relationships with underlying properties and issuing entities, recognizing that smart contract code provides automation and efficiency but cannot substitute for proper legal framework establishing enforceable rights and obligations across all relevant jurisdictions.

How Securities Laws Apply to Tokenized Real Estate

Securities laws represent the primary regulatory framework governing real estate tokenization regulations across USA, UK, UAE, and Canada, with regulatory authorities consistently determining that tokens representing property ownership interests constitute investment securities subject to comprehensive registration, disclosure, anti-fraud, and ongoing compliance requirements. Understanding how securities laws apply to tokenized real estate is essential for platforms structuring compliant offerings and investors evaluating legal protections available through regulatory frameworks.

The application of securities laws to tokenized real estate stems from functional analysis of economic substance rather than technological form. US Supreme Court’s Howey Test, established in 1946 and applied consistently to novel investment vehicles including tokenized assets, defines investment contracts as securities when they involve investment of money in common enterprise with expectation of profits derived primarily from efforts of others. Tokenized real estate clearly satisfies all Howey elements: investors contribute capital, properties operate as common enterprise pooling investor funds, and expected returns derive from property management, appreciation, and rental income generated through others’ efforts.

Once tokenized real estate qualifies as securities, comprehensive regulatory frameworks apply including registration requirements mandating SEC (USA), FCA (UK), VARA/DFSA (UAE), or provincial securities commission (Canada) approval before offering tokens to investors. Exemptions from registration exist through private placement rules, mini-public offering frameworks, and offshore safe harbors, but each exemption imposes specific conditions and limitations that platforms must satisfy. No exemption eliminates anti-fraud provisions, requiring truthful disclosures and prohibiting material misrepresentations regardless of offering structure.

Core Securities Law Requirements for Tokenized Real Estate

Registration or Exemption

Securities offerings must either register with regulatory authorities providing comprehensive disclosures reviewed for completeness and accuracy, or qualify for specific exemptions limiting offering scope, investor types, or resale restrictions. US Regulation D private placements, Regulation A+ mini-IPOs, Regulation S offshore offerings, and Regulation CF crowdfunding each provide different pathways with distinct requirements, limitations, and compliance obligations.

Disclosure Obligations

Issuers must provide investors with material information necessary for informed investment decisions including property details, financial projections, management backgrounds, fee structures, conflicts of interest, risk factors, and use of proceeds. Disclosure standards vary by exemption but always require truthful, complete information with liability for material omissions or misrepresentations. Ongoing disclosure updates investors about material developments affecting investments.

Anti-Fraud Provisions

Securities Act Section 17(a) in USA, similar provisions in other jurisdictions, prohibit fraudulent statements, material omissions, and manipulative practices in connection with securities offers and sales. These anti-fraud rules apply regardless of registration status or exemption qualification, creating liability for misleading marketing, inflated valuations, undisclosed conflicts, or other deceptive practices. Violations support regulatory enforcement and private investor lawsuits seeking damages.

Transfer Restrictions

Most securities exemptions impose transfer restrictions preventing immediate resale, requiring holding periods from 6-12 months, limiting transfers to qualified purchasers, or mandating issuer approval. Smart contracts must implement these restrictions programmatically, preventing non-compliant transfers while enabling legitimate secondary trading once restrictions lapse. Violations of transfer restrictions can void exemptions retroactively, converting offerings into illegal unregistered public offerings.

Broker-Dealer Requirements

Entities facilitating securities transactions typically must register as broker-dealers or operate as registered alternative trading systems, requiring comprehensive licensing, capital requirements, operational standards, and ongoing supervision. Tokenization platforms enabling secondary trading generally need broker-dealer registration or must partner with registered entities. Exemptions exist for issuers selling own securities and certain limited activities, but most platforms providing liquidity require registration.

Ongoing Reporting

Registered securities and certain exempt offerings require ongoing financial reporting, material event disclosures, and updated risk factor descriptions keeping investors informed about investment performance and developments. Reporting frequency and detail depend on offering type, with fully registered offerings requiring quarterly and annual reports similar to public companies, while exempt offerings may have reduced reporting obligations but still must provide material information to investors.

Specific securities law exemptions commonly used for tokenized real estate vary significantly in their requirements and limitations. US Regulation D Rule 506(b) permits offerings to unlimited accredited investors plus up to 35 sophisticated non-accredited investors without general solicitation, imposing no dollar limit but requiring Form D filing and transfer restrictions. Rule 506(c) allows general solicitation but requires all investors be accredited with reasonable verification, attracting platforms seeking wider marketing. Regulation A+ enables offerings up to $75 million annually with lighter disclosure than full registration, permitting general solicitation and non-accredited investors, but requiring SEC qualification and ongoing reporting.

Get Help With Tokenization Rules!

We help platforms follow real estate tokenization regulations in USA, UK, UAE, and Canada. 8+ years experience. Make compliance simple and stress-free today.

UK financial promotion rules govern marketing of tokenized real estate, restricting communications to certified sophisticated investors, high net worth individuals, or investment professionals unless prospectus approval obtained. FCA authorization requirements apply to platforms facilitating securities trading, custody, or providing investment advice. UAE VARA regulations require platforms to obtain virtual asset service provider licenses covering different activities, while DFSA in Dubai International Financial Centre applies comprehensive financial services regulation including prospectus requirements for public offerings.

Securities Law Compliance Lifecycle

Structure Analysis

Analyze proposed tokenization structure under securities laws, apply Howey Test and jurisdictional equivalents, determine security status, identify applicable exemptions or registration requirements

Offering Preparation

Prepare offering documents meeting disclosure requirements, engage legal counsel for review, obtain financial audits if required, draft marketing materials complying with solicitation rules, implement investor qualification procedures

Regulatory Filing

File required forms with securities regulators (Form D, Regulation A offering statement, registration statement), respond to regulator comments, obtain qualifications or exemption confirmations, maintain filing records

Token Issuance

Conduct offering in compliance with exemption limitations, verify investor qualifications, provide required disclosures, accept investments, issue tokens with transfer restrictions properly implemented in smart contracts

Ongoing Compliance

Provide ongoing disclosures and reports, monitor secondary trading compliance, update investors on material developments, maintain transfer restrictions, respond to regulator inquiries, adapt to regulatory changes

Enforcement consequences for securities law violations demonstrate why compliance represents non-negotiable requirement. SEC enforcement actions against non-compliant tokenization platforms have resulted in millions in civil penalties, disgorgement of profits, cease and desist orders, and requirements to offer rescission to all investors enabling them to demand return of investment at original price plus interest. Criminal prosecution for willful violations can result in imprisonment. Beyond regulatory enforcement, securities law violations create private rights of action enabling investors to sue platforms and executives personally for damages.

Securities Law Reality: No technological innovation, including blockchain and tokenization, exempts investment securities from comprehensive securities regulation. Regulators globally have consistently affirmed that securities laws apply to tokenized real estate based on economic substance rather than technological form. Platforms must abandon hopes for regulatory exemptions based on blockchain novelty and instead embrace securities law compliance as foundational operating requirement. The path to sustainable tokenization success runs through full regulatory compliance, not around it through claimed technological exceptionalism. Investors should demand comprehensive evidence of securities law compliance before participating in tokenized real estate offerings, recognizing that non-compliant platforms face existential enforcement risks threatening total investment loss.

Asset Classification: Security Tokens vs Utility Tokens in Real Estate

The classification of tokens as securities versus utilities represents critical regulatory determination affecting which laws apply, what compliance obligations exist, and whether offerings require registration or qualify for lighter regulatory treatment. In real estate tokenization regulations context, this classification question has been decisively resolved in favor of security token classification across all major jurisdictions, with utility token arguments consistently rejected by regulators and courts when tokens represent property ownership interests or investment returns.

Security tokens represent investment securities in digital form, conveying ownership rights, profit participation, debt obligations, or other financial interests in underlying assets or enterprises. Tokenized real estate clearly falls within security token category as tokens provide investors with property ownership interests, rental income distributions, appreciation participation, and governance rights in property decisions. These characteristics satisfy securities law tests across USA, UK, UAE, and Canada regardless of whether platforms label tokens as securities, investments, or use alternative terminology attempting regulatory avoidance.

Utility tokens theoretically provide access to products, services, or networks without conveying investment returns or ownership interests. Pure utility tokens escaping securities classification might include tokens redeemable for specific property usage rights, prepaid rent tokens, or access tokens for property-related services. However, even tokens with utility features constitute securities when they also convey investment characteristics, with courts applying multi-factor analysis examining economic reality rather than token labels or intended future utility.

| Characteristic | Security Token | Utility Token | Real Estate Application |

|---|---|---|---|

| Primary Purpose | Investment return, ownership rights, profit participation | Access to services, consumptive use, network participation | Tokenized real estate serves investment purpose conveying property ownership and income rights |

| Value Source | Underlying asset performance, property appreciation, rental income | Utility value for service access, consumptive use value | Property token value derives from property performance rather than consumptive utility |

| Rights Conveyed | Ownership, voting, distributions, liquidation preference | Service access, network usage, consumptive benefits | Property tokens convey ownership and financial rights characteristic of securities |

| Regulatory Status | Subject to comprehensive securities regulation | Consumer protection, potentially lighter regulation if non-security | Property tokenization clearly subject to securities laws across all jurisdictions |

| Transfer Restrictions | Securities law transfer restrictions, holding periods, qualified purchaser limits | Freely transferable generally, limited only by platform terms | Property tokens face securities transfer restrictions requiring programmatic enforcement |

| Disclosure Requirements | Comprehensive securities disclosures, financial statements, risk factors | Product/service descriptions, terms of use, consumer disclosures | Property tokenization requires securities-level comprehensive disclosures |

| Secondary Markets | Broker-dealer or ATS registration required for trading platforms | General marketplace regulation, consumer protection standards | Property token secondary trading requires securities exchange licensing |

Historical attempts to classify investment tokens as utilities to avoid securities regulation have universally failed when challenged by regulators. SEC enforcement actions against ICO issuers in 2018-2020 established that tokens sold as investments with expectation of profits constitute securities regardless of purported future utility. Even tokens with genuine utility features face securities classification when investment characteristics predominate, with courts applying substance-over-form analysis examining economic reality rather than marketing claims.

For real estate specifically, utility token classification proves particularly implausible as property ownership interests clearly constitute investment securities under centuries of legal precedent. Attempts to recharacterize property tokens as utility tokens through creative structuring like “platform access tokens” or “governance tokens” that coincidentally provide property returns fail securities law analysis. Regulators and courts examine economic substance, recognizing that calling investment securities by alternative names doesn’t change their fundamental character or applicable legal requirements.[1]

Classification Test: Howey Analysis for Real Estate Tokens

Element 1: Investment of Money

Token purchasers invest capital (cryptocurrency, fiat currency) to acquire property tokens. This element is clearly satisfied in all real estate tokenization regulations structures where investors contribute funds expecting returns.

Element 2: Common Enterprise

Investor funds pool into property acquisitions with proportional interests and shared outcomes. All token holders’ returns depend on same underlying property performance, establishing horizontal commonality satisfying common enterprise requirement.

Element 3: Expectation of Profits

Investors purchase tokens expecting rental income distributions, property appreciation, and investment returns. Marketing materials, offering documents, and economic structure all demonstrate profit expectation rather than consumptive use or utility value.

Element 4: Efforts of Others

Returns derive from platform operators’, property managers’, and service providers’ efforts in property management, tenant relations, maintenance, refinancing, and eventual disposition. Token holders remain passive investors rather than active property operators, satisfying efforts of others requirement.

Practical implications of security token classification require comprehensive securities law compliance including registration or exemption qualification, disclosure document preparation, transfer restriction implementation, anti-fraud rule adherence, and ongoing reporting. Platforms cannot avoid these requirements through utility token labeling or creative structuring attempting securities law circumvention. Regulatory enforcement against non-compliant platforms demonstrates that claimed utility status provides no protection when economic substance reveals investment securities.

Classification Warning: Real estate tokenization regulations platforms should abandon utility token classification strategies as they provide no regulatory protection and create false compliance confidence potentially resulting in catastrophic enforcement actions. Every credible legal analysis concludes tokenized property interests constitute securities requiring full regulatory compliance. Platforms claiming utility token status for property ownership interests demonstrate either profound legal misunderstanding or intentional investor deception. Investors should immediately reject platforms asserting utility token classification for real estate tokens, recognizing such claims as red flags indicating likely regulatory non-compliance and elevated investment risk. The question of security versus utility classification for real estate tokenization regulations has been definitively resolved in favor of security status across all major jurisdictions.

Ownership Rights and Investor Protection in Tokenized Properties

Ownership rights in tokenized real estate require careful legal structuring to ensure token holders possess enforceable claims to underlying properties, receive appropriate investor protections, and maintain rights equivalent to traditional property investors despite digital representation. The legal architecture connecting blockchain tokens to physical property ownership determines whether tokenization provides genuine ownership or merely creates speculative digital assets disconnected from property interests investors believe they’re purchasing.

Proper tokenization structures typically employ special purpose vehicles (SPVs), trusts, or other legal entities owning physical properties, with tokens representing fractional ownership interests, membership units, beneficial interests, or debt obligations of these entities. This layered structure ensures tokens convey legally enforceable rights under established property and corporate law frameworks rather than relying solely on blockchain technology for ownership claims. Legal documentation including operating agreements, trust deeds, and subscription agreements defines specific rights tokens convey and mechanisms for exercising those rights.

Investor protections in tokenized real estate derive from multiple sources including securities laws requiring comprehensive disclosures and prohibiting fraud, corporate or trust law establishing fiduciary duties of managers toward token holders, property law governing underlying real estate interests, and contract law enforcing token holder agreement terms. These overlapping legal protections provide multiple enforcement mechanisms when platforms breach obligations, managers engage in self-dealing, or disputes arise over property decisions or distributions.

Essential Ownership Rights in Tokenized Real Estate

Economic Rights: Income and Appreciation

Token holders must possess enforceable rights to proportional shares of rental income, property appreciation, and disposition proceeds. Legal documentation should specify distribution calculations, payment timing, expense deductions, reserve requirements, and priority structures. Smart contracts may automate distributions but cannot substitute for legally documented economic rights enforceable through courts if automation fails or disputes arise over proper distribution amounts.

Governance Rights: Voting and Participation

Major property decisions including sales, refinancing, significant capital expenditures, manager replacement, and structural changes should require token holder approval through voting mechanisms. Governance structures must balance operational efficiency against investor protection, typically granting day-to-day management authority to professional operators while reserving fundamental decisions for token holder votes. Voting procedures should accommodate blockchain-based voting while maintaining legal enforceability and preventing manipulation.

Information Rights: Transparency and Disclosure

Token holders need access to property financial statements, operational reports, management decisions, and material developments affecting investments. Information rights should include periodic reporting (quarterly, annually), major event notifications, inspection rights for financial records, and access to property information enabling informed voting and investment decisions. Blockchain transparency supplements but doesn’t replace required formal disclosures meeting securities law standards.

Transfer Rights: Liquidity and Exit Options

While securities law transfer restrictions limit immediate resale, token structures should provide eventual liquidity through secondary markets, issuer redemption rights, or property disposition. Transfer mechanisms must balance investor liquidity interests against regulatory compliance, platform operational requirements, and avoiding unlimited transferability creating regulatory complications. Smart contract implementation of transfer restrictions should include exception procedures for estate planning, divorce settlements, or legitimate business needs.

Protection Rights: Anti-Dilution and Priority

Token holders should possess protections against dilution through additional token issuance, priority in liquidation scenarios, anti-self-dealing provisions preventing manager conflicts of interest, and legal recourse through dispute resolution procedures. These protections prevent platforms from extracting value through subsequent offerings, ensure fair treatment in bankruptcy or property sales, and provide enforcement mechanisms when breaches occur.

Fiduciary duties represent critical investor protection mechanism in tokenized real estate, with platform operators, property managers, and controlling token holders owing duties of care and loyalty to minority investors. Duty of care requires reasonable business judgment and informed decision-making in property management. Duty of loyalty prohibits self-dealing, requires disclosure of conflicts of interest, and mandates fair dealing in related-party transactions. These fiduciary obligations exist under corporate law, trust law, or partnership law depending on entity structure, providing legal basis for challenging manager misconduct.

Securities law protections supplement entity-level fiduciary duties through anti-fraud provisions, disclosure requirements, and enforcement mechanisms. Securities Act Section 17(a) and Rule 10b-5 prohibit fraudulent statements and material omissions in connection with securities transactions, creating liability for platforms making false claims, inflating valuations, or concealing material information. These anti-fraud rules apply regardless of exemption status, providing baseline investor protection even in private placements with sophisticated investors.

| Protection Mechanism | Legal Source | Rights Provided | Enforcement Method |

|---|---|---|---|

| Securities Regulation | Securities Act, Exchange Act, jurisdictional equivalents | Disclosure requirements, anti-fraud protections, transfer restrictions, regulatory oversight | SEC enforcement, private lawsuits under Rule 10b-5, rescission rights |

| Fiduciary Duties | Corporate law, trust law, partnership law | Duty of care in management, duty of loyalty prohibiting self-dealing, fair dealing requirements | Derivative actions, breach of fiduciary duty lawsuits, injunctive relief |

| Contract Rights | Subscription agreements, operating agreements, token holder agreements | Specific contractual promises, distribution rights, governance procedures, dispute resolution | Breach of contract lawsuits, specific performance, arbitration per agreement terms |

| Property Law | Real property statutes, landlord-tenant law, foreclosure law | Ownership interests in underlying property, priority in liens, foreclosure protections | Property law actions, quiet title suits, foreclosure defense |

| Consumer Protection | Consumer protection statutes, unfair practices laws | Protection against deceptive practices, unfair contract terms, adequate disclosures | State attorney general enforcement, consumer protection lawsuits, FTC actions |

Bankruptcy and insolvency protections require special attention in tokenized real estate structures. If platform operators become insolvent, token holders should possess direct claims to underlying properties rather than being treated as unsecured creditors of bankrupt entities. Proper structuring isolates property assets in bankruptcy-remote SPVs owned by token holders, preventing platform creditors from reaching properties. Trust structures provide additional protection as trust assets remain separate from trustee’s personal assets and creditors cannot reach trust property for non-trust debts.

Dispute resolution mechanisms should provide efficient, cost-effective procedures for addressing conflicts between token holders, between holders and managers, or involving property operations. Arbitration clauses in token holder agreements can mandate binding arbitration for disputes, potentially reducing litigation costs and providing faster resolution than court proceedings. However, arbitration clauses cannot waive securities law protections or preclude regulatory enforcement, with courts invalidating arbitration provisions attempting to eliminate statutory investor protections.

Model Ownership Rights Framework

Tier 1: Fundamental Rights

- Proportional economic interests

- Vote on major decisions (sale, refinancing)

- Fiduciary duty protections

- Anti-fraud protections

- Bankruptcy-remote asset ownership

Tier 2: Governance Rights

- Manager replacement voting

- Amendment approval for major terms

- Conflict transaction approval

- Budget and reserve approvals

- Professional service provider selection

Tier 3: Information Rights

- Quarterly financial statements

- Annual audited financials

- Material event notifications

- Management reports and analysis

- Inspection rights for records

Tier 4: Transfer Rights

- Secondary market trading (post-restriction)

- Estate planning transfers

- Gift and family transfers

- Redemption rights in certain events

- Tag-along rights in control sales

Practical enforcement of ownership rights requires clear procedures, accessible mechanisms, and realistic costs. Token holder agreements should specify how rights are exercised including voting procedures, information request processes, dispute resolution steps, and enforcement actions. Blockchain-based governance can facilitate voting and information distribution but must integrate with traditional legal enforcement mechanisms when automation fails or disputes require judicial resolution. Platforms should maintain accessible customer service, clear communication channels, and responsive management addressing token holder concerns proactively.

Ownership Rights Principle: Tokenization technology should enhance rather than diminish investor protections compared to traditional real estate investment structures. Token holders must possess legally enforceable ownership rights equivalent to traditional investors including economic interests, governance participation, information access, and legal recourse when rights are violated. Smart contracts automate certain rights exercise but cannot substitute for comprehensive legal documentation establishing enforceable claims to underlying properties through established property, securities, and corporate law frameworks. Investors should thoroughly review token holder agreements, operating agreements, and legal opinions confirming ownership rights before investing, demanding clarity on enforcement mechanisms and practical procedures for exercising rights throughout investment lifecycle.

Role of Smart Contracts Under Real Estate Tokenization Regulations

Smart contracts play dual roles in regulated tokenized real estate serving as both technical infrastructure automating operational processes and as legal instruments potentially creating enforceable obligations between parties. Understanding how regulations treat smart contracts, what legal requirements they must satisfy, and how they interact with traditional legal documentation is essential for compliant platform design and effective investor protection implementation.

From regulatory perspective, smart contracts in tokenized real estate primarily serve compliance enforcement functions implementing transfer restrictions required by securities exemptions, automating KYC verification before token transfers, enforcing holding periods preventing premature resale, calculating and distributing income in accordance with legal obligations, and executing governance decisions according to token holder votes. These compliance functions make smart contracts valuable regulatory tools when properly designed and implemented, though their use doesn’t reduce overall compliance obligations.

Legal enforceability of smart contracts varies across jurisdictions with most legal systems recognizing smart contracts as enforceable agreements when they satisfy traditional contract formation requirements including offer, acceptance, consideration, capacity, and lawful purpose. However, smart contract code alone often proves insufficient for legal enforceability, requiring accompanying written agreements explaining contract terms, parties’ intentions, and legal interpretations of code execution. This dual documentation approach using both smart contracts and traditional legal agreements provides technical automation benefits while maintaining judicial enforceability.

Regulatory Functions of Smart Contracts in Tokenized Real Estate

Transfer Restriction Enforcement

Smart contracts programmatically implement securities law transfer restrictions including holding period requirements, accredited investor verification, volume limitations, and qualified purchaser restrictions. Code checks compliance conditions before allowing transfers, preventing regulatory violations through automated enforcement. Platforms must design exception mechanisms for legitimate transfers requiring manual review like estate settlements.

KYC and AML Compliance

Smart contracts can verify token transfer participants completed KYC procedures, check against sanctions lists, enforce transaction monitoring limits, and prevent transfers to prohibited jurisdictions. Integration with off-chain KYC databases through oracles enables automated compliance while maintaining privacy for sensitive personal information not stored on public blockchains.

Distribution Automation

Rental income and proceeds distributions can automate through smart contracts calculating proportional shares, withholding taxes as required, implementing waterfall priorities, and executing payments to all token holders simultaneously. Automation reduces administrative costs, eliminates distribution errors, and provides transparent auditable records. However, calculations must match legal distribution formulas specified in operating agreements.

Governance Implementation

Voting on property decisions, manager elections, and major transactions can occur through blockchain-based governance with smart contracts tallying votes, implementing vote thresholds, enforcing quorum requirements, and executing approved decisions automatically. Transparent on-chain governance provides audit trails and prevents vote manipulation, though must accommodate off-chain voter participation for accessibility.

Regulatory Reporting

Smart contracts generate data for regulatory reports including transaction logs, token holder registries, distribution records, and governance activities. Blockchain transparency enables regulators accessing records directly, reducing reporting burdens while enhancing oversight. Platforms must ensure smart contract data meets regulatory reporting format and content requirements.

Emergency Controls

Pause functions enable platforms halting token transfers during security incidents, regulatory investigations, or technical failures. Circuit breakers limit transaction sizes or velocities preventing exploitation. Emergency controls must balance security needs against investor rights, implementing appropriate governance and time limitations preventing abuse of emergency powers.

Regulatory challenges with smart contracts include immutability creating difficulties fixing bugs or adapting to regulatory changes, code complexity making legal review challenging for regulators and judges, oracle dependencies introducing off-chain trust assumptions, and upgrade mechanisms potentially creating centralization concerns. Platforms must address these challenges through comprehensive testing, formal verification where possible, transparent upgrade governance, and clear documentation explaining smart contract functionality to non-technical regulators and investors.

Legal framework integration requires smart contracts complement rather than replace traditional legal documentation. Token holder agreements should explicitly incorporate smart contract terms, specify which provisions automate through code versus require manual execution, establish code interpretation rules for ambiguities, and provide dispute resolution procedures when smart contract execution produces unintended outcomes. This approach ensures smart contracts enhance operational efficiency while maintaining legal enforceability through traditional judicial systems when necessary.

| Smart Contract Element | Regulatory Requirement | Implementation Approach |

|---|---|---|

| Transfer Restrictions | Securities exemptions require holding periods, investor qualification checks, volume limits | Whitelist approved addresses, check timestamps against holding requirements, verify accreditation status through oracle, enforce percentage ownership caps |

| KYC Verification | AML laws require customer identification, sanctions screening, ongoing monitoring | Integration with off-chain KYC database through oracle, address whitelisting after verification complete, blocking transfers to unverified addresses |

| Distribution Calculations | Operating agreements specify distribution formulas, priorities, reserve requirements | On-chain calculation implementing legal formulas, proportional allocation based on token balances, waterfall priorities for different token classes |

| Governance Voting | Corporate/trust law requires proper voting procedures, quorums, vote thresholds | Proposal submission mechanisms, voting period enforcement, quorum calculations, super-majority requirements for major decisions, vote delegation options |

| Upgrade Mechanisms | Platforms need ability to fix bugs, adapt to regulatory changes, add features | Proxy patterns enabling logic updates, time-locked upgrades with notice periods, multi-signature approval requirements, governance votes for major upgrades |

Auditing and testing requirements for regulatory smart contracts exceed typical software quality assurance given their role in compliance enforcement and potential financial impact of failures. Multiple independent security audits should review code for vulnerabilities, formal verification should prove critical functions behave correctly, comprehensive test coverage should verify compliance logic under all scenarios, and bug bounty programs should incentivize ongoing security review. Regulatory comfort with smart contract implementations depends on demonstrating rigorous quality assurance processes.

Jurisdictional differences in smart contract legal treatment create challenges for international platforms. USA generally recognizes smart contracts as enforceable under Uniform Electronic Transactions Act and state equivalents, though contract interpretation disputes apply traditional principles. UK law reform recognizes smart contracts can create legally binding obligations when parties intend legal relations. UAE has enacted specific smart contract legislation providing legal recognition. However, enforcement mechanisms, interpretation standards, and regulatory acceptance vary requiring platforms to structure smart contracts considering all relevant jurisdictions.

Smart Contract Regulatory Principle: Smart contracts provide powerful tools for automating regulatory compliance in tokenized real estate but cannot substitute for comprehensive legal frameworks, proper documentation, and traditional enforcement mechanisms. Platforms must design smart contracts as compliance tools supplementing rather than replacing legal obligations, ensuring code implements regulatory requirements accurately while maintaining flexibility for manual intervention when circumstances require human judgment. The most effective regulatory approach combines smart contract automation of routine compliance functions with traditional legal documentation establishing enforceable rights, dispute resolution procedures, and interpretive guidance enabling courts to adjudicate conflicts when automation fails or produces unintended results. Regulatory acceptance of smart contracts depends on demonstrating they enhance rather than undermine investor protections and regulatory oversight.

KYC and AML Requirements for Tokenized Real Estate Platforms

Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements represent critical regulatory obligations for tokenized real estate platforms, with comprehensive customer identification, beneficial ownership verification, sanctions screening, and transaction monitoring mandated across USA, UK, UAE, and Canada to prevent platforms from facilitating money laundering, terrorist financing, sanctions evasion, or other illicit financial activities. Real estate’s historical association with money laundering intensifies regulatory scrutiny of tokenization platforms, requiring institutional-grade compliance programs meeting or exceeding traditional financial services standards.

KYC procedures verify investor identities through government-issued identification documents, validate addresses through utility bills or bank statements, confirm dates of birth and nationalities, and establish individuals’ identities with sufficient certainty to prevent identity fraud or synthetic identity schemes. Enhanced due diligence applies to politically exposed persons, high-risk jurisdictions, and large transactions, requiring additional documentation and increased scrutiny. Beneficial ownership identification pierces through corporate structures, trusts, and nominee arrangements identifying natural persons ultimately controlling or benefiting from investments.

AML obligations extend beyond initial identity verification to ongoing monitoring of customer transactions, screening against sanctions lists maintained by OFAC (USA), UN, EU, and national authorities, analyzing transaction patterns for suspicious activities potentially indicating money laundering or terrorist financing, filing Suspicious Activity Reports (SARs) or Suspicious Transaction Reports (STRs) when required thresholds met, and maintaining comprehensive records for 5-7 years supporting regulatory examinations and investigations.

Comprehensive KYC/AML Framework for Tokenization Platforms

Customer Identification Program (CIP)

Collect identifying information including full legal name, date of birth, residential address, identification number (SSN, passport, national ID), and nationality. Verify information through government-issued photo identification, independent database checks, or documentary verification. For corporate investors, obtain formation documents, identification of authorized representatives, and beneficial ownership information. Document verification procedures and maintain records of identification documents and verification steps performed.

Beneficial Ownership Identification

For legal entity investors, identify natural persons owning 25% or more equity interests, exercising control through other means, or holding senior officer positions. Pierce through nominee shareholders, trusts, or complex corporate structures identifying ultimate beneficial owners. FinCEN (USA) beneficial ownership requirements effective 2024 mandate collection of beneficial ownership information for most corporate entities. Maintain certified beneficial ownership documentation updated when ownership changes occur.

Sanctions Screening

Screen all customers against OFAC Specially Designated Nationals (SDN) list, UN sanctions lists, EU sanctions, and relevant national lists before account opening and periodically thereafter. Check names, addresses, dates of birth, and identification numbers against sanctions databases. Implement automated screening systems with appropriate fuzzy matching to catch close name matches while minimizing false positives. Block transactions involving sanctioned parties and file required reports with authorities.

Enhanced Due Diligence (EDD)

Apply heightened scrutiny to politically exposed persons (PEPs) including government officials, their family members, and close associates. Screen for PEP status using commercial databases, obtain senior management approval for PEP accounts, understand source of wealth and purpose of relationship, and conduct ongoing enhanced monitoring. EDD also applies to customers from high-risk jurisdictions, unusual transaction patterns, or transactions involving significant funds without clear legitimate business purpose.

Transaction Monitoring

Monitor customer transactions for patterns indicating potential money laundering including rapid movement of funds, structuring transactions below reporting thresholds, transactions inconsistent with stated business purpose, involvement of high-risk jurisdictions, or other suspicious patterns. Implement automated transaction monitoring systems with rules calibrated to platform risk profile. Investigate alerts, document investigation findings, and escalate to compliance officers when suspicious activity identified.

Suspicious Activity Reporting

File Suspicious Activity Reports (SARs) with FinCEN in USA, Suspicious Transaction Reports with relevant authorities in other jurisdictions when transactions involve known or suspected criminal activity, appear designed to evade BSA requirements, lack apparent lawful purpose, or involve use of platform to facilitate criminal activity. SAR filing thresholds vary by jurisdiction but generally apply to transactions over $5,000-$10,000 involving suspicious activity. Maintain confidentiality of SAR filings prohibited from disclosure to subjects.

Regulatory frameworks governing KYC/AML vary across jurisdictions though share common principles. USA Bank Secrecy Act and implementing FinCEN regulations require comprehensive AML programs for financial institutions including tokenization platforms facilitating securities transactions. UK Money Laundering Regulations and FCA guidance impose similar requirements. UAE Federal Decree-Law No. 20 of 2018 on Anti-Money Laundering and Combating the Financing of Terrorism establishes comprehensive framework, with VARA implementing specific requirements for virtual asset service providers. Canadian FINTRAC regulations under Proceeds of Crime (Money Laundering) and Terrorist Financing Act establish reporting requirements and compliance obligations.

Technology solutions for KYC/AML compliance include specialized service providers like Jumio, Onfido, Sumsub, and Chainalysis offering identity verification, document authentication, sanctions screening, and blockchain transaction monitoring. These solutions combine AI-powered document verification, biometric liveness detection, database cross-referencing, and ongoing monitoring reducing manual review burdens while improving accuracy. However, platforms retain ultimate responsibility for KYC/AML compliance regardless of third-party reliance, requiring vendor due diligence and performance monitoring.

| Jurisdiction | Primary Regulatory Authority | Key AML Requirements | Penalties for Non-Compliance |

|---|---|---|---|

| USA | FinCEN, SEC (for securities), State regulators | Written AML program, CIP procedures, ongoing monitoring, SAR filing, CTR filing for cash transactions over $10K, recordkeeping 5 years | Civil penalties up to $1M per violation, criminal prosecution up to 10 years imprisonment, license revocation |

| UK | FCA, NCA (National Crime Agency), HMRC | Risk assessment, customer due diligence, enhanced DD for high-risk, ongoing monitoring, STR filing, record retention 5 years | Unlimited fines for firms, up to 14 years imprisonment for individuals, FCA enforcement actions, license suspension/revocation |

| UAE | CBUAE (Central Bank), VARA, DFSA, Financial Intelligence Unit | AML compliance program, customer identification, beneficial ownership, STR filing, risk-based approach, screening against UN/national lists | Fines up to AED 5 million, imprisonment up to 10 years, license revocation, asset freezing |

| Canada | FINTRAC, Provincial securities regulators | Compliance program, customer identification, beneficial ownership determination, STR filing for amounts $10K+, record retention 5 years, ongoing monitoring | Administrative monetary penalties up to $100K per violation, criminal prosecution for willful violations, provincial securities sanctions |

Privacy considerations create tension with KYC requirements as platforms must collect sensitive personal information while complying with data protection laws like GDPR, PIPEDA, and state privacy statutes. Best practices include collecting minimum necessary information, implementing strong data security, providing privacy notices explaining data usage, enabling data subject access rights, limiting data retention to regulatory minimums, and using encryption and access controls protecting stored information. Zero-knowledge proof technologies may eventually enable privacy-preserving KYC though current implementations remain experimental.

Ongoing compliance program maintenance requires dedicated resources including compliance officer appointment, regular risk assessments updating program for evolving threats, employee training ensuring staff understand AML obligations, independent testing validating program effectiveness, and responding promptly to regulatory inquiries or examination findings. Platforms should budget appropriately for compliance, typically allocating 5-15% of operational budgets to KYC/AML functions depending on transaction volumes, customer base complexity, and jurisdictional scope.

KYC/AML Compliance Warning: Real estate tokenization regulations platforms cannot treat KYC/AML requirements as optional or implement minimal checkbox compliance given severe enforcement consequences including criminal prosecution, multi-million dollar penalties, and license revocation. Real estate’s historical association with money laundering creates heightened regulatory scrutiny requiring platforms to demonstrate institutional-grade compliance programs equivalent to banks and securities firms. Platforms must invest appropriately in KYC technology, compliance personnel, and ongoing program maintenance, recognizing that inadequate AML controls create existential regulatory risks. Investors should verify platform KYC/AML compliance through independent assessment, demanding evidence of comprehensive procedures, technology solutions, compliance staffing, and clean regulatory examination history before entrusting platforms with investments.

Cross-Border Challenges in Real Estate Tokenization Regulations

Cross-border real estate tokenization regulations presents complex regulatory challenges as platforms operating internationally must navigate conflicting legal requirements, jurisdictional enforcement, transfer restrictions, tax obligations, and regulatory coordination across USA, UK, UAE, Canada, and other markets simultaneously. The inherently borderless nature of blockchain technology conflicts with territorial regulatory frameworks, creating compliance complexity requiring sophisticated legal structuring and operational controls preventing regulatory violations in any operating jurisdiction.

Jurisdictional scope issues arise from questions about which country’s laws apply to token offerings, secondary trading, and investor protections. Most jurisdictions assert regulatory authority over offerings targeting their residents regardless of platform location, creating potential concurrent jurisdiction where offerings must comply with multiple regulatory frameworks simultaneously. US securities laws apply to offers to US persons regardless of where platforms operate. UK financial promotion rules restrict marketing to UK residents. UAE VARA regulations govern virtual asset activities within UAE. Canadian provinces regulate offerings to their residents.

Regulatory arbitrage temptations lead some platforms to structure operations in permissive jurisdictions hoping to avoid stricter regulatory oversight in major markets. However, regulators increasingly coordinate internationally, share information through memoranda of understanding, and exercise long-arm jurisdiction over foreign platforms serving their residents. Attempting regulatory arbitrage creates significant enforcement risk as regulators demonstrate willingness to pursue foreign platforms, freeze assets, block platforms from their markets, and coordinate with international law enforcement for serious violations.

Key Cross-Border Regulatory Challenges

Concurrent Jurisdiction and Conflicting Laws

When platforms offer tokens to investors across multiple countries, each jurisdiction may assert regulatory authority creating concurrent jurisdiction where compliance requires satisfying all applicable frameworks simultaneously. Conflicts arise when jurisdictions impose contradictory requirements such as disclosure standards that conflict between jurisdictions, transfer restriction differences, or taxation approaches creating double taxation. Platforms must identify all jurisdictions with potential regulatory authority, analyze requirements in each, and structure offerings satisfying strictest applicable standards while documenting compliance rationale for each jurisdiction.

Extraterritorial Enforcement and Long-Arm Jurisdiction

Regulators increasingly exercise extraterritorial enforcement authority over foreign platforms serving their residents. SEC regularly pursues foreign cryptocurrency platforms offering securities to US persons without proper registration. UK FCA takes action against overseas platforms conducting regulated activities with UK customers. These enforcement actions include cease and desist orders, asset freezes, platform blocking, and coordination with foreign authorities for criminal prosecution. Platforms cannot assume foreign location provides immunity from enforcement by jurisdictions where investors are located.

Transfer Restrictions and Resale Limitations

Securities exemptions often restrict resales to qualified purchasers, impose holding periods, or limit transfers to specific jurisdictions. Cross-border secondary trading must navigate these restrictions across multiple jurisdictions where tokens might trade. US Regulation S provides safe harbor for offshore offerings excluding US persons but requires implementation of procedures preventing flowback to US markets during restricted periods. Platforms must implement smart contract controls preventing prohibited cross-border transfers while enabling legitimate international secondary trading post-restriction periods.

Tax Withholding and Reporting Obligations

Cross-border real estate investments trigger complex tax obligations including withholding requirements on distributions to foreign investors, transfer pricing considerations for related-party transactions, permanent establishment risks creating unexpected tax nexus, and reporting obligations in multiple jurisdictions. US FIRPTA imposes withholding on foreign investment in US real property. Tax treaties between countries may reduce withholding rates but require proper documentation. Platforms must implement systems tracking investor tax residence, applying appropriate withholding, and providing required tax documentation across jurisdictions.

Data Localization and Privacy Requirements

Some jurisdictions require personal data storage within national borders or restrict international data transfers. EU GDPR limits transfers to countries without adequate data protection unless appropriate safeguards implemented. China and Russia maintain strict data localization requirements. Blockchain’s distributed nature conflicts with data localization mandates as transaction data propagates across global node networks. Platforms must structure KYC data storage complying with localization requirements, implement appropriate transfer mechanisms like Standard Contractual Clauses, and minimize personal data recorded on public blockchains.

Practical strategies for managing cross-border regulatory complexity include geographic restrictions limiting offerings to jurisdictions where platforms obtain proper authorization, staged international expansion entering markets sequentially after establishing compliance infrastructure, partnership models working with local regulated entities in target jurisdictions, and regulatory technology solutions automating jurisdiction-specific compliance requirements. Platforms should prioritize quality over quantity, operating compliantly in fewer jurisdictions rather than attempting global reach without adequate compliance resources.