Key Takeaways

- The global NFT market was valued at approximately 48.68 billion dollars in 2024, with projections pointing toward 701.15 billion dollars by 2033, growing at a CAGR of 34.5 percent, showing strong recovery and expanding real-world utility.[1]

- NFT marketplace development costs range from 30,000 to 150,000 dollars, depending on features, with basic platforms costing 30,000 to 50,000 dollars and advanced platforms with custom smart contracts and multi-chain support reaching 150,000 dollars or more.[2]

- OpenSea remains the most recognized NFT marketplace with over 80 million NFTs hosted across multiple blockchains, though competitors like Blur and Magic Eden have captured significant market share since 2023.[3]

- Ethereum powers approximately 62 percent of all NFT transactions globally, though alternatives like Solana, Polygon, and Binance Smart Chain have gained traction through lower fees and faster processing times.[4]

- Gaming NFTs represent a massive market valued at approximately 4.8 billion dollars in 2024, with projections suggesting growth to 44.1 billion dollars by 2034 at a CAGR of 24.8 percent.[5]

- Over 100 million dollars worth of NFTs were publicly reported as stolen through scams between July 2021 and July 2022, with scammers averaging around 300,000 dollars per incident, according to blockchain analysis firm Elliptic.[6]

The world of non-fungible tokens has grown far beyond simple digital art collections. Today, there are different types of platforms that serve different purposes within the NFT ecosystem. If you are a creator, investor, or entrepreneur looking to enter this space, understanding the differences between an NFT marketplace, an NFT platform, and an NFT launchpad is important before making any decision.

Each of these serves a unique role. Some are built for buying and selling. Others are designed for building and creating. And some exist purely to help new projects get off the ground. In this blog, we will break down each one in simple language, compare them side by side, and help you understand which one fits your needs best.

What Is an NFT Marketplace

An NFT marketplace is a digital platform where people can buy, sell, and trade non-fungible tokens. Think of it like an online store, but instead of physical products, you are buying and selling unique digital assets like artwork, music, game items, domain names, and virtual land. The marketplace connects creators who want to sell their NFTs with buyers who want to own them, making it one of the most practical NFT marketplace solutions for creators, collectors, and businesses entering the Web3 space.

When someone creates an NFT, they can list it on a marketplace with a fixed price or put it up for auction. Buyers then browse through available listings and make purchases using cryptocurrency. The marketplace handles the transaction, ensures the NFT is transferred to the new owner, and records everything on the blockchain permanently.

Smart contracts play a big role in how NFT marketplaces work. These are self-executing programs stored on the blockchain that automatically handle the transfer of cryptocurrency from buyer to seller, deliver the NFT to the buyer, distribute royalties to the original creator, and record everything on the blockchain without needing any middleman.

1. Popular Examples of NFT Marketplaces

OpenSea is probably the most well-known NFT marketplace in the world. It was founded in 2017 and quickly became the go-to destination for NFT trading. The platform hosts over 80 million NFTs across multiple blockchains and has supported billions of dollars in trading volume over the years. OpenSea allows anyone to create and list NFTs without needing approval, making it an open marketplace model.

Blur emerged in late 2022 with a different approach. Instead of targeting casual collectors, Blur focuses on professional NFT traders who want advanced tools, analytics, and zero seller fees. This strategy worked well, and Blur captured a significant portion of Ethereum NFT trading volume within its first year of operation.

Magic Eden started as a Solana-focused NFT marketplace but has since expanded to support Bitcoin Ordinals and other blockchains. By mid 2024, Magic Eden had overtaken both OpenSea and Blur in monthly trading volume at certain points, showing how quickly the competitive landscape can shift.

2. How NFT Marketplaces Make Money

Most NFT marketplaces generate revenue through transaction fees. When a sale happens, the marketplace takes a small percentage, usually between 2-5 percent. Some platforms also charge listing fees, minting fees, or offer premium features for a subscription. Royalties are another important element. Original creators can set a royalty percentage so they earn money every time their NFT is resold on the secondary market.

Recommended Reading:

NFT Marketplace Development Guide Architecture, Cost, Security & Compliance Explained

What Is an NFT Platform

An NFT platform is a broader term that covers a wider range of services compared to a marketplace. While a marketplace is mainly for buying and selling, an NFT platform provides the tools and infrastructure for creating, managing, and building around NFTs. It is like the difference between a shopping mall (marketplace) and the entire city infrastructure that supports it (platform).

An NFT platform can include marketplace features, but it also offers development tools, APIs, SDKs, smart contract templates, blockchain integration layers, and sometimes even its own blockchain network. Developers and businesses use NFT platforms to build their own custom applications, games, or marketplaces on top of the existing infrastructure.

1. Key Features of an NFT Platform

NFT platforms provide minting tools that allow creators to turn their digital content into NFTs without writing any code. They offer wallet integration so users can connect their crypto wallets and manage their assets. Many platforms also include analytics dashboards, collection management tools, and community features that help creators build an audience around their work.

For developers, NFT platforms offer APIs and SDKs that make it easy to integrate NFT functionality into existing applications. This means a gaming company, for example, can use an NFT platform to add token-based ownership of in-game items without building everything from scratch.

2. Popular Examples of NFT Platforms

Rarible stands out as both a marketplace and a platform. It operates the Rarible Protocol, which is an open-source infrastructure that developers can use to build their own NFT applications. The protocol supports multiple blockchains, including Ethereum, Solana, and Polygon, giving developers flexibility in choosing where to deploy their projects.

Rarible also introduced something interesting with its RARI governance token. Holders of RARI tokens can vote on platform upgrades, propose changes to fee structures, participate in curation, and help moderate the community. This was actually the first governance token launched in the NFT space, and it represents a shift toward community-driven marketplace management where users have a direct say in how the platform evolves.

Metaplex is another good example. Built specifically for the Solana blockchain, Metaplex provides the tools and standards that most Solana NFT projects use to create and manage their collections. It handles everything from minting to metadata management, making it easier for creators to launch without deep technical knowledge.

3. Who Should Use an NFT Platform

NFT platforms are ideal for businesses that want to integrate NFT technology into their existing products or services. If you are a game developer wanting to add NFT-based items, a brand looking to create loyalty tokens, or a startup building a new application around digital ownership, an NFT platform gives you the building blocks you need without starting from zero.

What Is an NFT Launchpad

An NFT launchpad is a specialized platform designed to help new NFT projects get started. It acts as a launch pad (as the name suggests) that gives creators and project teams a place to introduce their NFT collections to the public for the first time. Think of it like a crowdfunding platform, but specifically built for NFTs.

When a new NFT project wants to sell its collection, it can partner with a launchpad to handle the initial minting process. The launchpad promotes the project to its existing community, handles the technical side of the mint, and provides a level of trust and credibility that a brand-new project might not have on its own.

1. How NFT Launchpads Work

The process typically starts with the launchpad reviewing and vetting the project. Not every project gets accepted. Most reputable launchpads have a screening process where they look at the team behind the project, the quality of the artwork or utility, the community engagement, and the overall business plan. This vetting helps protect early buyers from scams and low-quality projects.

Once a project is approved, the launchpad sets up the minting event. This is the moment when the NFTs become available for purchase for the first time. The launchpad handles the smart contract deployment, manages the minting interface, and often promotes the launch through its marketing channels and community.

2. Popular Examples of NFT Launchpads

Magic Eden Launchpad is one of the most well-known in the Solana ecosystem. It has helped hundreds of NFT projects launch their collections to a large and engaged audience. Getting listed on Magic Eden’s launchpad is considered a significant achievement for any Solana-based NFT project because of the visibility it provides.

Binance NFT Launchpad leverages the massive user base of the Binance exchange to give projects exposure to millions of potential buyers. Because Binance already has a trusted reputation in the crypto world, projects that launch through their NFT launchpad benefit from that trust.

Seedify focuses specifically on gaming and metaverse NFT projects. It uses a tier system based on its SFUND token, where investors who hold more tokens get earlier or better access to new project launches. This model helps build a dedicated community of gaming NFT enthusiasts.

3. Why Launchpads Matter for New Projects

For new creators, launching an NFT collection without any existing audience is extremely difficult. A launchpad solves this problem by giving the project immediate access to an established community of NFT buyers and collectors. The launchpad’s marketing support, technical infrastructure, and reputation all help increase the chances of a successful launch.

Launchpads also provide a layer of safety for buyers. Since projects go through a vetting process, buyers can feel more confident that they are not investing in a scam. This does not guarantee success, but it does reduce the risk compared to buying from completely unknown sources.

Recommended Reading:

NFT Marketplace vs NFT Platform Comparison

Understanding the difference between an NFT marketplace and an NFT platform is one of the most common points of confusion in the Web3 space. While they share some overlapping features, their core purposes are quite different.

An NFT marketplace is designed primarily for end users. It provides a storefront where people can list, browse, buy, and sell NFTs. The focus is on the trading experience, including search filters, auction systems, collection pages, and wallet connectivity. The goal is to make it as easy as possible for creators to sell and for collectors to buy.

An NFT platform, on the other hand, is built more for developers and businesses. It provides the underlying infrastructure and tools that others can use to build their own NFT applications. While a platform might include a marketplace component, it also offers APIs, SDKs, protocol-level integrations, and development frameworks that go far beyond simple buying and selling.

To put it simply, every NFT marketplace is technically built on top of an NFT platform, but not every NFT platform includes a marketplace. The NFT marketplace vs NFT platform comparison really comes down to whether you need a place to trade (marketplace) or the tools to build something custom (platform).

NFT Marketplace vs NFT Launchpad Differences

The NFT marketplace vs NFT launchpad comparison is a bit more straightforward. A marketplace is where NFTs are traded after they have been created. A launchpad is where NFTs are introduced for the very first time.

Think of it in terms of the product lifecycle. The launchpad handles the “birth” of an NFT collection. It manages the initial minting event, promotes the project, and connects creators with early buyers. Once the NFTs have been minted and distributed, the marketplace takes over. Buyers who want to resell their NFTs list them on a marketplace, and new buyers come in to purchase them on the secondary market.

Some platforms combine both functions. Magic Eden, for example, operates both a launchpad for new project mints and a marketplace for secondary trading. But the two features serve fundamentally different purposes and target different stages of the NFT lifecycle.

The NFT marketplace vs launchpad differences also extend to how they make money. Marketplaces earn from ongoing trading fees on every transaction. Launchpads typically earn from the initial mint, taking a percentage of the total mint revenue or charging a flat fee for the launch service. Some launchpads also earn through their native token economies.

NFT Platform vs NFT Launchpad

When comparing an NFT platform vs NFT launchpad, the difference lies in scope and purpose. An NFT platform provides the infrastructure and tools for building NFT-related applications. A launchpad focuses specifically on helping new projects launch their NFT collections to the public.

A platform is like the entire toolkit. It gives you smart contract templates, minting APIs, metadata management, storage solutions, and integration tools. You can use a platform to build a marketplace, a game, a membership system, or anything else that involves NFTs.

A launchpad is more focused. It is designed for one specific use case, which is getting new projects in front of buyers for the first time. The launchpad handles the initial sale, provides marketing exposure, and creates a structured process for early access and minting.

Both can exist independently, and both can work together. A project might use an NFT platform to build its smart contracts and then use a launchpad to handle the initial public sale. After the sale, the NFTs would then be traded on a marketplace. Each piece fits into a different part of the puzzle.

NFT Marketplace vs NFT Platform vs NFT Launchpad at a Glance

| Feature | NFT Marketplace | NFT Platform | NFT Launchpad |

|---|---|---|---|

| Primary Purpose | Buying, selling, and trading NFTs | Building and creating NFT applications | Launching new NFT projects |

| Target Users | Buyers, sellers, collectors | Developers, businesses, builders | New project creators, early investors |

| Revenue Model | Transaction fees on trades | API usage fees, subscriptions | Mint commission, token sales |

| Vetting Process | Usually open to all | Varies by platform | Strict project screening |

| Marketing Support | Limited | Minimal | Strong promotional support |

| Examples | OpenSea, Blur, Magic Eden | Rarible Protocol, Metaplex | Binance NFT, Seedify, Magic Eden Launchpad |

| Stage in NFT Lifecycle | Secondary trading | Development and infrastructure | Initial launch and minting |

The Role of Blockchain Technology in NFT Ecosystems

No matter which type of NFT solution you are looking at, whether it is a marketplace, platform, or launchpad, blockchain technology is the foundation that everything is built on. The blockchain provides a decentralized ledger that records ownership, verifies authenticity, and enables trustless transactions.

Ethereum remains the dominant blockchain for NFTs, powering approximately 62 percent of all NFT transactions globally. Its token standards, particularly ERC 721 for unique one-of-one assets and ERC 1155 for semi-fungible tokens, have become the industry standard that most NFT applications follow.

However, Ethereum is not the only option. Solana has gained popularity because of its fast transaction speeds and lower fees. Polygon offers Ethereum compatibility with significantly reduced costs, making it attractive for gaming NFTs and high-volume use cases. Major brands like Starbucks and Nike have chosen Polygon for their NFT initiatives. Flow, developed by Dapper Labs, powers NBA Top Shot and other sports collectible platforms with a programming model designed specifically for digital assets.

The choice of blockchain affects the entire user experience. Ethereum offers the largest collector base and the highest security, but gas fees can be expensive during peak network usage. Solana provides speed and low costs but has a smaller ecosystem. Each blockchain involves trade-offs that project teams need to consider based on their specific goals and target audience.

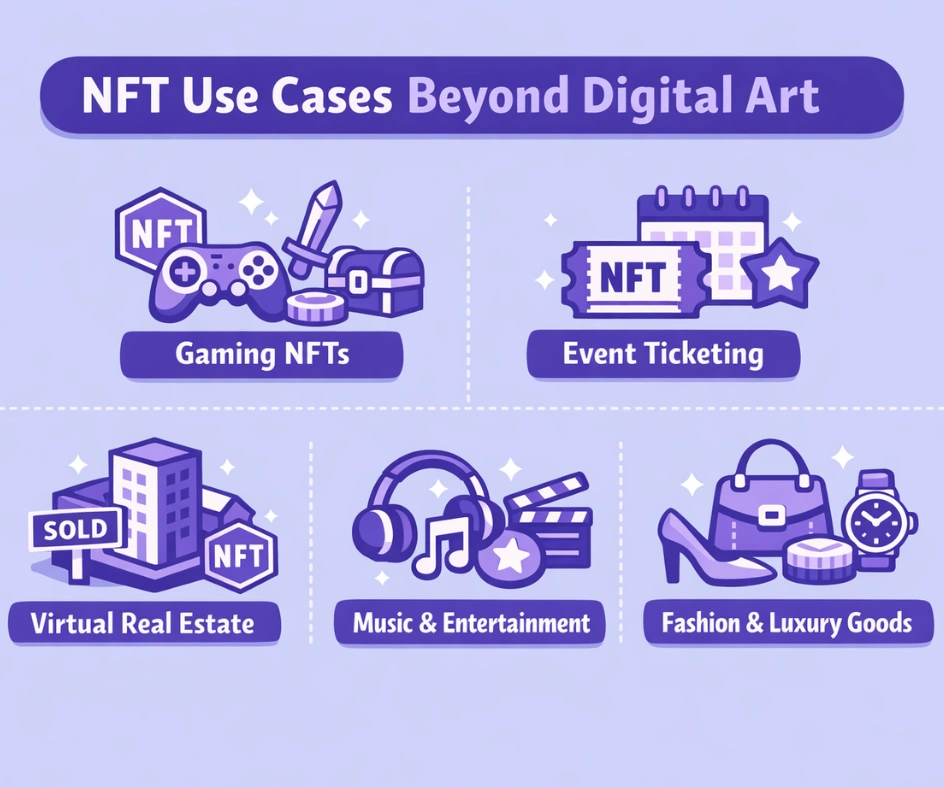

NFT Use Cases Beyond Digital Art

While digital art collections like Bored Ape Yacht Club and CryptoPunks brought NFTs into mainstream awareness, the technology has expanded into many other areas. Understanding these use cases helps explain why different types of NFT infrastructure, from marketplaces to launchpads, continue to grow.

1. Gaming NFTs

The gaming NFT sector was valued at approximately 4.8 billion dollars in 2024, with projections suggesting growth to 44.1 billion dollars by 2034. Gaming NFTs allow players to truly own their in-game items, characters, and virtual land. These assets can be traded on NFT marketplaces, giving players the ability to earn real value from their gaming activity. Play-to-earn models, where players earn NFTs or tokens through gameplay, have attracted millions of users worldwide.

2. Event Ticketing

NFT-based ticketing is growing fast. Event ticketing NFTs now represent 5.3 percent of ticket sales across major US venues. NFT tickets cannot be counterfeited because each one is recorded on the blockchain with a unique identifier. They can also include additional benefits like backstage access, exclusive merchandise, or post-event digital collectibles. This creates more value for both event organizers and attendees.

3. Virtual Real Estate

Platforms like Decentraland and The Sandbox allow users to buy, develop, and monetize virtual land represented as NFTs. Real estate NFTs grew by 32 percent year over year, surpassing 1.4 billion dollars in market size. Virtual land owners can build experiences, host events, or rent their properties to other users, creating a digital economy that mirrors aspects of the physical real estate market.

4. Music and Entertainment

Musicians are using NFTs to sell their music directly to fans without going through traditional record labels or streaming services. NFTs can include royalty rights, allowing fans to earn a share of the revenue every time the song is streamed. Music NFTs generated over 520 million dollars in revenue in 2025, showing that this use case has real financial weight behind it.

5. Fashion and Luxury Goods

Fashion NFTs, driven by digital wearables and brand partnerships, reached a valuation of approximately 890 million dollars. Brands like Adidas and Gucci have released NFT collections tied to physical products, creating a “phygital” experience where digital and physical ownership are linked together. Phygital NFTs saw a 60 percent rise in transaction volume, led largely by luxury brands.

Recommended Reading:

Role of Smart Contracts in NFT Marketplaces A Deep Foundational Guide Introduction

Security Challenges in the NFT Space

Security is one of the biggest concerns across all types of NFT infrastructure, whether you are running a marketplace, building on a platform, or launching through a launchpad. The decentralized nature of blockchain technology provides some built-in security, but the applications and interfaces built on top of it can still be vulnerable.

According to a report by blockchain analysis firm Elliptic, over 100 million dollars worth of NFTs were publicly reported as stolen through scams between July 2021 and July 2022. The average scam netted the perpetrators around 300,000 dollars. These numbers highlight why security should be a top priority for anyone building or using NFT infrastructure.

The most common attack methods include phishing scams, where fake websites or messages trick users into connecting their wallets to malicious smart contracts. Social media compromises accounted for 23 percent of all NFTs stolen during that period, with hackers targeting Discord servers and Twitter accounts of popular NFT projects to post fake links.

For marketplace operators, implementing strong security measures is not optional. This includes regular smart contract audits by independent firms, multi-factor authentication for user accounts, monitoring systems that detect suspicious activity, and clear policies for handling stolen NFTs. Launchpads also need strong security because a compromised mint event can result in massive losses for early buyers.

NFT Marketplace Development Cost Breakdown

| Development Component | Cost Range | Key Considerations |

|---|---|---|

| Basic Platform Features | $30,000 – $50,000 | User authentication, NFT minting, buying/selling functionality, basic wallet integration |

| Advanced Platform Features | $100,000 – $150,000+ | Custom smart contracts, multi-chain support, advanced analytics, decentralized storage, royalty management |

| UI/UX Design | $5,000 – $20,000 | Simple interface vs. custom-branded design with detailed elements |

| Blockchain Integration | $10,000 – $20,000 | Ethereum most common, alternatives like Solana or BSC may vary |

| Smart Contract Development | Included in platform costs | Token standards (ERC-721, ERC-1155), security audits, testing |

| Security Implementation | $5,000 – $15,000 | Encryption, multi-factor authentication, and regular security audits |

| Ongoing Maintenance | $1,000 – $5,000/month | Server hosting, updates, customer support, security monitoring |

The cost of building an NFT marketplace depends heavily on what features you want to include and which blockchain you choose to build on. A basic marketplace with core functionality like user registration, wallet integration, NFT minting, and simple buying and selling can be built for around 30,000 to 50,000 dollars.

If you want advanced features like custom smart contracts, multi-chain support, sophisticated analytics, decentralized storage integration, and complex royalty management systems, the cost can climb to 100,000 to 150,000 dollars or more. These advanced features are typically needed for marketplaces that want to compete with established players or serve niche markets with specific requirements.

Ongoing maintenance is also a high cost that many people overlook. Running a live marketplace requires server hosting, regular software updates, customer support, and continuous security monitoring. These costs can run from 1,000 to 5,000 dollars per month, depending on the scale of the platform and the level of support needed.

How to Choose Between a Marketplace, Platform, and Launchpad

Choosing the right type of NFT infrastructure depends entirely on your goals. Here is a simple way to think about it.

1. Choose an NFT Marketplace

Suppose you want to create a space where people can buy and sell NFTs. If your primary business model revolves around facilitating trades and earning from transaction fees, a marketplace is what you need. This is the right choice for businesses that want to connect creators with collectors and take a cut of every sale.

2. Choose an NFT Platform

If you want to build custom NFT applications or integrate NFT functionality into an existing product. If you are a developer, a gaming company, or a brand that wants to use NFTs as part of a larger strategy, you need the tools and infrastructure that a platform provides. This gives you the most flexibility but also requires more technical knowledge.

3. Choose an NFT Launchpad

If you are launching a new NFT collection and need help reaching buyers. If you have a new project and want to maximize your initial mint, a launchpad gives you access to an existing community, marketing support, and the credibility that comes from being vetted and approved. This is especially important for new creators who do not yet have a following.

4. Consider a Combined Approach

Many successful projects use all three. They use a platform to build their smart contracts and infrastructure, a launchpad to handle the initial collection launch, and then list their NFTs on a marketplace for secondary trading. This combined approach covers every stage of the NFT lifecycle and maximizes the project’s reach.

The Growing NFT Market and What It Means for Builders

The NFT market has matured significantly since the hype driven days of 2021. While the speculative frenzy has cooled down, the underlying technology and its applications have only gotten stronger. The global NFT market was valued at approximately 48.68 billion dollars in 2024, with projections pointing toward 701.15 billion dollars by 2033 at a compound annual growth rate of 34.5 percent.

This growth is not coming from speculation alone. Real-world applications in gaming, ticketing, music, fashion, and enterprise use cases are driving sustained adoption. The number of active NFT marketplaces grew to 112 in 2025, and NFT-related job postings increased by 48 percent in a single year. These numbers show that the NFT infrastructure is expanding, creating opportunities for builders at every level.

North America continues to dominate the NFT market, with the United States accounting for approximately 41 percent of global NFT transaction volume. Asia Pacific is also growing rapidly, with countries like South Korea, Japan, and India showing increasing interest in blockchain gaming and digital collectibles.

NFT users have grown from just 0.15 million in 2018 to 11.64 million in 2025, with millennials leading adoption at 23 percent compared to just 2 percent among baby boomers. This demographic data suggests that as younger generations gain more purchasing power, the demand for NFT infrastructure will continue to rise.

NFT Marketplace Solutions Built for Real World Use Cases

The following projects show how NFT marketplace and platform architecture are already being applied across trading, community rewards, and decentralized digital asset management. Each implementation showcases the same principles discussed throughout this article, from smart contract automation and community governance to multi-chain support and creator-focused features.

🎨

LooksRare: Community First NFT Marketplace

Built a community-centered NFT marketplace that redistributes 100 percent of protocol fees back to active traders, collectors, and creators. The platform features reduced trading fees, bulk buying and listing tools, flexible pricing options including fixed USD and floor-based pricing, and ETH-based payment processing within a fully decentralized framework.

Launch Your NFT Marketplace Platform Today:

We bring deep blockchain expertise to NFT marketplace development. Our specialized team handles everything from smart contract creation to multi-chain integration, ensuring your platform is built for growth, safety, and user experience. Whether you need a curated art marketplace or a gaming NFT platform, we deliver solutions that work.

Conclusion

The NFT ecosystem has three main types of infrastructure that each serve a different purpose. An NFT marketplace is where people buy, sell, and trade digital assets on the secondary market. An NFT platform provides the underlying tools and infrastructure that developers and businesses use to build custom NFT applications. An NFT launchpad helps new projects introduce their NFT collections to the public for the first time through structured minting events.

Understanding the NFT marketplace vs NFT platform comparison helps you decide whether you need a trading venue or a development toolkit. Knowing the NFT marketplace vs NFT launchpad differences helps you understand the lifecycle of an NFT from initial creation to ongoing trading. And the NFT platform vs NFT launchpad distinction clarifies whether you need building tools or launch services.

The NFT market continues to grow, with the global market projected to reach over 700 billion dollars by 2033. Real-world applications in gaming, ticketing, music, fashion, and enterprise use cases are driving this growth beyond the earlier speculative hype. Whether you are a creator looking to launch your first collection, a business wanting to integrate NFTs into your products, or an entrepreneur building the next big marketplace, understanding these three types of NFT infrastructure is the first step toward making smart decisions in this space.

The right choice depends on your goals, your budget, and your target audience. Many successful projects use a combination of all three, leveraging platforms for development, launchpads for initial launches, and marketplaces for ongoing trading. Whatever path you choose, the growing NFT ecosystem offers plenty of opportunities for those who understand how its different parts work together.

Frequently Asked Questions

An NFT marketplace is a digital platform where users can buy, sell, and trade non-fungible tokens. It connects creators who mint digital assets with collectors and buyers who want to own them, handling transactions through blockchain smart contracts.

An NFT launchpad is a specialized platform that helps new NFT projects introduce their collections to the public through initial minting events. It provides marketing support, technical infrastructure, and a built-in community of early buyers.

An NFT platform provides development tools, APIs, and infrastructure for building NFT applications. A marketplace focuses specifically on the trading experience for buying and selling NFTs. A platform is for builders while a marketplace is for traders.

Ethereum remains the most popular choice, handling about 62 percent of NFT transactions. However, Solana offers faster speeds and lower fees, while Polygon provides Ethereum compatibility at reduced costs. The best choice depends on your project needs.

A basic NFT marketplace with core features costs between 30,000 and 50,000 dollars. Advanced marketplaces with custom smart contracts, multi-chain support, and complex features can cost 100,000 to 150,000 dollars or more, plus ongoing maintenance fees.

Yes, some platforms combine marketplace, platform, and launchpad features. Magic Eden, for example, operates both a launchpad for new mints and a marketplace for secondary trading while providing developer tools for builders.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.