NFT marketplaces have evolved from experimental platforms into structured digital ecosystems supporting creators, brands, enterprises, and communities. Today, launching a successful NFT marketplace requires more than smart contracts it requires architectural clarity, regulatory awareness, security discipline, and long-term scalability planning. This guide is written for founders, product leaders, and enterprises evaluating NFT marketplace development as a serious digital business, not a short-term trend.

Key Takeaways

- NFT marketplaces are long-term digital platforms that require strong architecture, security, and regulatory planning to remain sustainable.

- A successful NFT marketplace is built on blockchain ownership, application-level business logic, and reliable storage for NFT metadata and assets.

- The NFT market is shifting from speculative trading toward utility-driven and industry-specific marketplace models.

- System design choices such as custodial models, data storage, and blockchain selection directly affect scalability, compliance, and user trust.

- The technology stack must balance performance, cost efficiency, and future scalability through modular and multi-chain infrastructure.

- AI enhances NFT marketplaces by improving asset discovery, pricing insights, and fraud detection without replacing blockchain ownership logic.

- Security measures such as smart contract audits and secure wallet interactions are essential to protect users and marketplace credibility.

- NFT marketplaces must be designed with regulatory flexibility to adapt to changing laws around IP rights, KYC/AML, and taxation.

- A structured, audit-ready development process is critical for building, launching, and maintaining an NFT marketplace.

- Development cost and ROI depend on long-term adoption, liquidity, and user engagement rather than short-term market hype.

Understanding NFT Marketplaces The Core Foundation

An NFT marketplace is a digital platform that allows users to mint, buy, sell, and trade non-fungible tokens (NFTs) while ensuring transparent ownership through blockchain technology.

At a structural level, every NFT marketplace consists of:

- Blockchain layer (ownership, transactions)

- Application layer (business logic, user experience)

- Storage layer (NFT metadata and assets)

Unlike traditional platforms, NFT marketplaces replace institutional trust with verifiable code and cryptographic ownership.

NFT Marketplace Development Services focus on building these layers with security-first architecture.

Market Landscape & Industry Trends

The NFT marketplace landscape is rapidly evolving beyond short-term speculation into utility-driven, infrastructure-focused ecosystems. What began as experimental digital collectibles has matured into a foundational layer for ownership, access, and value exchange across multiple industries.

Today, NFT adoption is expanding across gaming economies, digital media rights, brand engagement, loyalty programs, real-world asset tokenization, and enterprise use cases. This shift signals a broader transformation where NFTs are no longer viewed as hype-driven assets, but as core components of long-term digital platforms.

Key Trends Shaping the NFT Marketplace Ecosystem

Multi-Chain NFT Platforms

Marketplaces are increasingly adopting multi-chain architectures to improve scalability, reduce transaction costs, and enable broader user access across ecosystems such as Ethereum, Solana, Polygon, and BNB Chain.

Enterprise-Grade NFT Adoption

Enterprises are leveraging NFTs for intellectual property management, digital identity, licensing, ticketing, and supply-chain traceability, driving demand for robust, secure, and customizable marketplace solutions.

Compliance-Aware Marketplace Design

With growing regulatory oversight, modern NFT platforms are integrating KYC/AML frameworks, copyright protection, and jurisdiction-specific compliance features to support institutional participation.

AI-Powered Discovery & Fraud Prevention

Artificial intelligence is playing a key role in enhancing NFT discovery, improving personalized recommendations, detecting wash trading, identifying fake collections, and mitigating marketplace fraud.

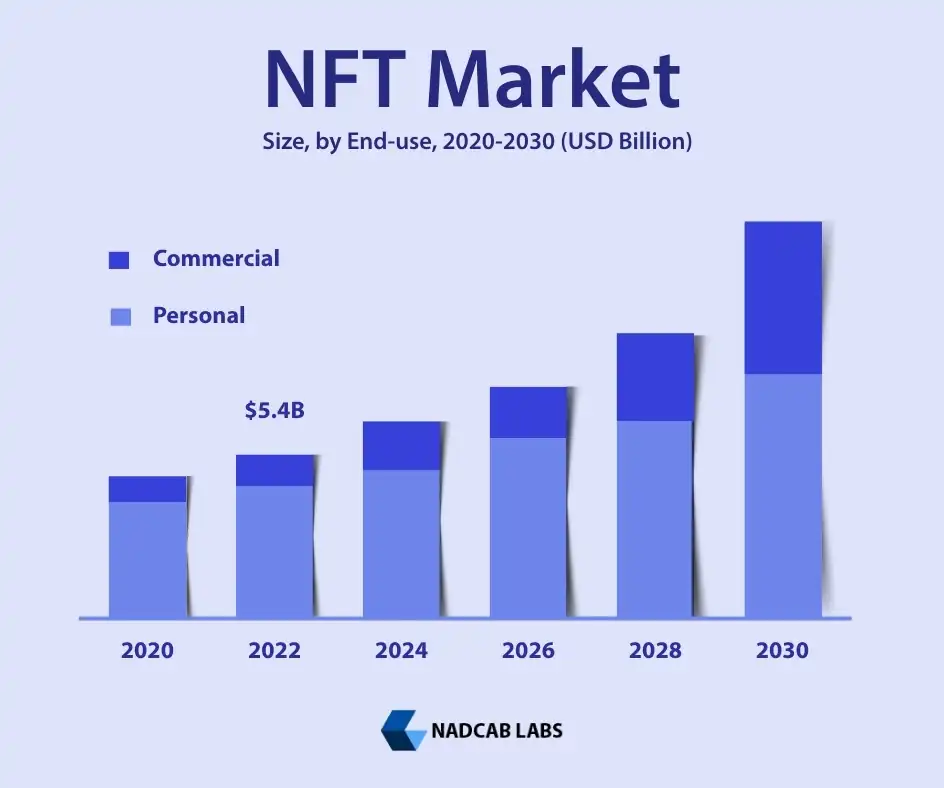

Industry Validation & Market Outlook

-

-

- NFT Marketplaces Market Size & Growth Forecast — Global NFT marketplace revenue is projected to expand significantly, with increasing adoption across collectibles, gaming, and utility use cases, reflecting robust market momentum and diversification beyond speculation.[1]

-

-

-

- NFT Platform Market Growth Trends — The broader NFT platform market is expected to grow substantially through 2035, driven by digital art, gaming assets, and interoperability across blockchain networks.[2]

-

Architecture & System Design of NFT Marketplaces

A high-performance NFT marketplace is built on a scalable, modular, and upgrade-friendly architecture that supports long-term growth, security, and evolving user demands. As NFT platforms move toward enterprise and mass adoption, architectural design plays a critical role in ensuring performance, compliance, and user trust.

Modern NFT marketplace architecture combines on-chain blockchain logic with off-chain infrastructure to balance decentralization, cost efficiency, and seamless user experience.

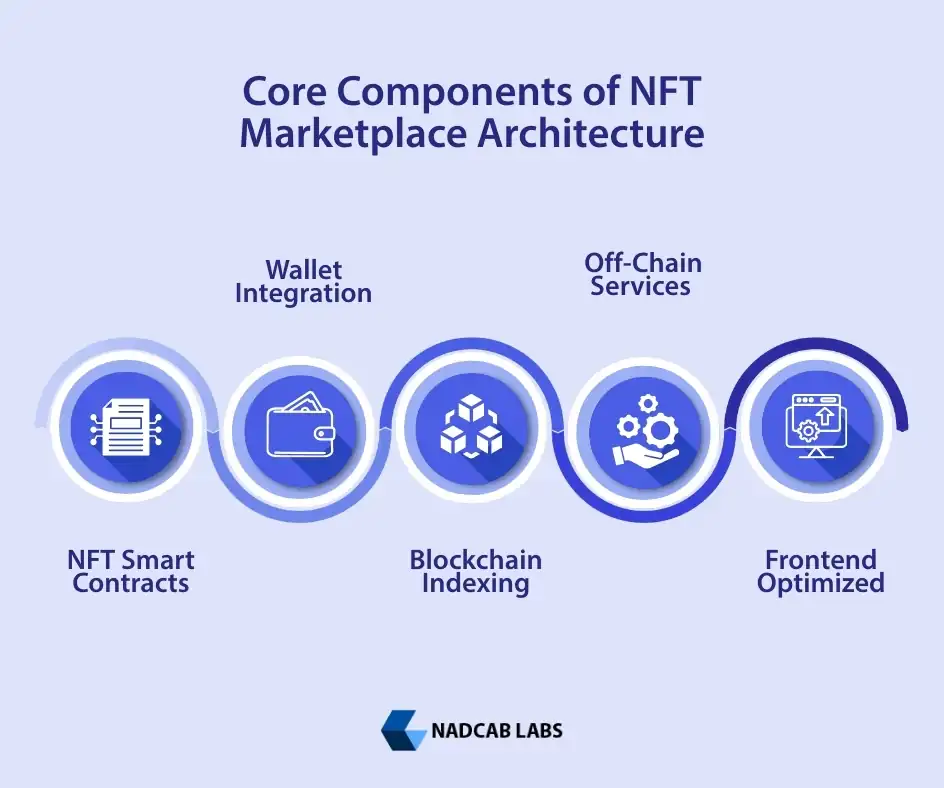

Core Components of NFT Marketplace Architecture

Smart Contracts for NFT Operations

Smart contracts form the backbone of any NFT marketplace, managing minting, ownership transfers, royalty distribution, listings, and auctions. Well-audited contracts ensure transparency, immutability, and trustless execution while supporting standards such as ERC-721 and ERC-1155.

Wallet Integration & User Authentication

Secure wallet integration enables users to connect, authenticate, and transact without intermediaries. Support for popular wallets (MetaMask, WalletConnect, Phantom, Trust Wallet) enhances accessibility while enabling non-custodial NFT ownership.

Blockchain Indexing & Search Services

Indexing layers aggregate on-chain data and transform it into searchable, real-time marketplace insights. These services power advanced NFT search, filtering, activity feeds, and analytics, ensuring fast performance despite blockchain limitations.

Off-Chain Services for Scalability & Performance

To reduce latency and gas costs, NFT marketplaces rely on off-chain components such as metadata storage, caching layers, content delivery networks (CDNs), and event processing services—while preserving on-chain ownership verification.

Frontend Optimized for Web3 User Experience

A Web3-native frontend ensures intuitive navigation, wallet interactions, transaction transparency, and real-time feedback. Responsive UI design is essential for improving NFT discovery, conversion rates, and user retention.

Key Architectural Decisions That Shape NFT Platforms

Custodial vs Non-Custodial Marketplace Models

Choosing between custodial and non-custodial architectures affects asset control, compliance readiness, and user trust. Non-custodial models prioritize decentralization, while custodial solutions can simplify onboarding for mainstream users.

On-Chain vs Off-Chain NFT Metadata

Metadata storage strategy directly impacts decentralization, performance, and cost. On-chain metadata ensures immutability, while off-chain storage (IPFS, Arweave) improves scalability and flexibility.

Security, Compliance & Upgradeability

Upgrade-friendly contract patterns, access controls, and compliance-aware design (KYC, royalty enforcement, copyright protection) are essential for enterprise-grade NFT marketplace development.

By leveraging modular NFT marketplace architecture, integrating secure smart contracts, and balancing on-chain and off-chain infrastructure, modern NFT platforms can deliver scalable, compliant, and user-centric digital marketplaces.

As NFT adoption expands across gaming, media, and enterprise use cases, well-designed system architecture becomes the foundation for long-term marketplace sustainability and trust.

Technology Stack & Infrastructure Considerations

Choosing the right technology stack for NFT marketplace development is critical to achieving scalability, security, and long-term performance. A modern NFT platform requires a carefully balanced infrastructure that supports decentralized ownership while delivering enterprise-grade reliability and user experience. Successful NFT marketplaces typically combine blockchain networks, standardized token protocols, decentralized storage, scalable backend services, and Web3-optimized frontend frameworks.

Common Technology Stack Used in NFT Marketplace Development

Blockchain Networks

Built an NFT marketplaces high-performance blockchains that support smart contracts, low transaction costs, and developer ecosystems:

- Ethereum – Industry standard for NFTs with strong security and liquidity

- Polygon – Layer-2 scalability for lower gas fees and faster transactions

- Solana – High-throughput blockchain for real-time NFT trading

NFT Token Standards

Standardized NFT protocols ensure interoperability and marketplace compatibility:

- ERC-721 – Ideal for unique, one-of-one digital assets

- ERC-1155 – Supports semi-fungible NFTs and batch minting for gaming and metaverse use cases

Decentralized Storage Solutions

NFT metadata and digital assets are stored using decentralized file systems to preserve immutability and availability:

- IPFS – Distributed storage for NFT images, metadata, and files

Arweave – Permanent data storage for long-term NFT preservation

Frontend Frameworks for Web3 UX

User interfaces are built with performance-focused frameworks that support wallet connectivity and real-time interactions:

-

- React.js – Component-based UI for scalable NFT platforms

- Next.js – Server-side rendering and SEO-friendly Web3 applications

Backend & Middleware Services

Backend systems handle indexing, APIs, notifications, and off-chain processing:

- Node.js – Real-time APIs and blockchain event handling

Python – Analytics, automation, and AI-powered marketplace intelligence

AI in NFT Marketplaces: Practical Use Cases

Artificial intelligence is emerging as a powerful intelligence layer within NFT marketplaces, enhancing efficiency without compromising decentralization or ownership transparency.

How AI Enhances NFT Marketplace Performance

AI-Powered NFT Discovery & Recommendations

Machine learning models analyze user behavior, trading history, and preferences to surface relevant NFT collections, improving engagement and conversion rates.

Fraud Detection & Abnormal Trading Analysis

AI algorithms identify suspicious activity such as wash trading, price manipulation, and fake collections—strengthening marketplace trust and compliance.

NFT Price Trend & Liquidity Analysis

Predictive analytics assess historical pricing, demand signals, and liquidity patterns to help users and platforms make data-driven decisions.

Strategic Value of AI in Web3 Marketplaces

By integrating AI with blockchain infrastructure, NFT marketplaces can deliver smarter insights, safer trading environments, and personalized experiences—all while preserving decentralized asset ownership and on-chain verification.

Security Risks & Failure Points in NFT Marketplaces

Security failures remain the primary reason NFT marketplaces lose user trust and long-term credibility. As digital assets represent real economic value, even minor vulnerabilities can lead to financial loss, reputational damage, and regulatory scrutiny.

Major Security Risk Areas in NFT Marketplaces

Smart Contract Vulnerabilities

Poorly written or unaudited smart contracts expose marketplaces to reentrancy attacks, integer overflows, access-control flaws, and royalty bypass exploits. Since smart contracts are immutable once deployed, security-first development and formal audits are critical.

Fake NFT Collections & Wash Trading

Fraudulent collections and artificial trading volume undermine marketplace integrity. Without proper verification and behavioral analysis, users can easily fall victim to scams or manipulated price signals.

Phishing Attacks via Malicious Wallet Prompts

Attackers often exploit wallet approvals and fake signatures to drain user assets. NFT marketplaces must implement transaction clarity, warning systems, and safe-approval standards to reduce social-engineering risks.

NFT Metadata Tampering & Asset Integrity Risks

If metadata is hosted insecurely or altered off-chain, NFTs may lose authenticity or value. Inadequate storage strategies weaken trust in digital ownership and permanence.

Security Best Practices for NFT Marketplace Development

Industry leaders emphasize proactive prevention over reactive recovery. Best-in-class NFT platforms adopt:

- Regular smart contract audits and penetration testing

- Real-time transaction monitoring and anomaly detection

- Verified creator programs and collection authenticity checks

- Secure wallet interactions with clear signing transparency

- Decentralized and tamper-resistant metadata storage

Legal Compliance & Regulatory Considerations for NFT Marketplaces

As NFT marketplaces transition from experimental platforms to commercial and enterprise-grade digital marketplaces, legal compliance has become a critical success factor. Regulatory oversight is increasing globally, and non-compliant platforms risk penalties, delisting, or loss of user trust.

Key Legal & Regulatory Areas NFT Marketplaces Must Address

Intellectual Property (IP) Ownership & Rights Management

NFTs do not automatically transfer copyright or usage rights. Marketplaces must clearly define IP ownership, licensing terms, and creator rights to prevent disputes and unauthorized content distribution.

KYC / AML Compliance Requirements

Depending on jurisdiction, NFT marketplaces may be required to implement Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures—especially when supporting high-value transactions or fiat on-ramps.

Consumer Protection & Marketplace Transparency

NFT platforms must comply with consumer protection laws related to fair pricing, disclosures, refunds, and dispute resolution. Transparent terms of service and transaction clarity are essential for legal defensibility.

Cross-Border Taxation & Reporting Obligations

NFT transactions often occur across jurisdictions, triggering complex tax implications such as VAT, GST, capital gains, and withholding requirements. Marketplaces must support accurate transaction records and tax reporting.

Designing Compliance-Ready NFT Marketplace Architecture

Because NFT regulations vary by country and continue to evolve, platforms should avoid rigid legal assumptions. Instead, best practices include:

Modular compliance layers that can be enabled per region Flexible KYC workflows based on transaction thresholds Clear IP and licensing metadata standards Jurisdiction-aware tax and reporting integrations

Execution & Development Lifecycle of NFT Marketplaces

A successful NFT marketplace follows a structured development lifecycle to ensure scalability, security, and smooth user experience.

Typical stages include:

- Business & Technical Discovery – defining use cases, architecture, and compliance needs

- UX/UI Design – creating intuitive Web3 user flows and wallet interactions

- Smart Contract Development – implementing minting, royalties, and trading logic

- Backend & Frontend Integration – connecting blockchain, APIs, and user interfaces

- Security Audits & QA – validating contracts, performance, and platform integrity

- Launch, Monitoring & Upgrades – deploying, tracking activity, and evolving features

Cost, Pricing & ROI Perspective for NFT Marketplaces

The cost of NFT marketplace development varies based on multiple technical and strategic factors, including:

- Feature complexity and marketplace functionality

- Blockchain selection (Ethereum, Polygon, Solana, etc.)

- Security audits and compliance requirements

- Level of customization and scalability needs

Common NFT Marketplace Revenue Models

NFT marketplaces generate ROI through flexible monetization strategies such as:

- Transaction commissions on trades and auctions

- Minting and listing fees for creators and brands

- Premium features (analytics, promotions, verified listings)

- Subscription-based access for power users or enterprises

A well-designed pricing and monetization strategy ensures faster break-even, sustainable revenue, and long-term marketplace growth.

cIndustry Use Cases & Applications of NFT Marketplaces

Vertical-focused NFT marketplace development enables platforms to better serve creators, enterprises, and users while unlocking sustainable revenue opportunities.

Key Industry Use Cases for NFT Marketplaces

Art & Digital Collectibles

NFT marketplaces for art focus on creator royalties, authenticity verification, scarcity mechanics, and auction-based pricing models. UX emphasizes discovery, provenance, and artist branding.

Gaming & Metaverse Assets

Gaming NFT marketplaces support in-game items, characters, skins, and land assets. These platforms require high-performance infrastructure, batch minting (ERC-1155), and seamless wallet integration to support real-time trading.

Music, Media & Intellectual Property Rights

NFT marketplaces in the music and media sector enable fractional ownership, licensing, royalty distribution, and fan engagement. Smart contracts automate payouts while ensuring IP protection and transparent usage rights.

Real Estate & Asset Tokenization

Real estate NFT marketplaces tokenize property ownership, leases, or revenue rights. These platforms demand strict compliance, identity verification, and integration with legal documentation and off-chain data.

Enterprise Digital Assets & Corporate Use Cases

Enterprises use NFT marketplaces for certificates, digital credentials, loyalty programs, supply-chain tracking, and internal asset management. These solutions prioritize security, compliance, and permissioned access.

Key Factors to Evaluate When Choosing an NFT Marketplace Development Company

Proven Blockchain & Web3 Experience

Look for a partner with hands-on experience in blockchain development, smart contracts, and NFT marketplace platforms across multiple networks such as Ethereum, Polygon, and Solana.

Strong Security & Audit Capabilities

Security expertise is non-negotiable. A reliable NFT marketplace development firm prioritizes secure smart contract development, audit readiness, and ongoing risk monitoring.

Custom Architecture & Scalability Expertise

Every NFT marketplace has unique requirements. Your partner should design custom, modular architecture that supports multi-chain expansion, performance optimization, and future upgrades.

Long-Term Support & Platform Evolution

NFT marketplaces require continuous improvement. Choose a partner offering post-launch support, monitoring, feature upgrades, and scalability planning to ensure long-term ROI.

FAQ NFT Marketplace Development Architecture , Cost and Guide

An NFT marketplace is a digital platform where users can create (mint), buy, sell, and trade non-fungible tokens using blockchain technology. These platforms manage NFT listings, wallet interactions, ownership verification, and transaction execution in a transparent and verifiable manner.

An NFT marketplace operates using smart contracts deployed on a blockchain to handle minting, ownership transfer, royalties, and transactions. The platform also includes a frontend interface, backend services for indexing and performance, wallet integrations, and decentralized or cloud-based storage for NFT metadata.

The best blockchain depends on business requirements. Ethereum is widely adopted and secure, Polygon offers lower transaction fees, and Solana provides high throughput. Many modern NFT marketplaces support multi-chain architecture to balance cost, scalability, and user reach.

NFT marketplace development costs vary based on features, blockchain selection, customization level, security audits, and compliance requirements. Basic platforms typically cost less than fully customized, enterprise-grade NFT marketplaces with advanced features and multi-chain support.

Common risks include smart contract vulnerabilities, fake NFT listings, wash trading, phishing attacks, and metadata manipulation. These risks can be mitigated through smart contract audits, secure wallet integrations, transaction monitoring, and continuous security testing.

NFT marketplace regulations vary by jurisdiction. Legal considerations may include intellectual property rights, KYC/AML requirements, taxation, and consumer protection laws. Platforms operating globally must design their systems with compliance flexibility to adapt to changing regulations.

Yes, AI is commonly used as a supporting layer in NFT marketplaces for NFT discovery, recommendation systems, price trend analysis, and fraud detection. AI enhances user experience and operational efficiency without replacing blockchain-based ownership mechanisms.

NFT marketplaces typically generate revenue through transaction commissions, minting or listing fees, premium features, subscriptions, and secondary sale royalties. The choice of revenue model depends on the target audience and marketplace use case.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.