Key Takeaways

- Liquidation penalties in DeFi platforms typically range from 5% to 15% of the collateral value, serving as both a deterrent and an incentive mechanism for liquidators.

- DAOs in the DeFi Space utilize smart contracts to automate the entire liquidation process, ensuring transparency and removing human bias from protocol operations.

- Maintaining a health factor above 1.5 significantly reduces your liquidation risk and provides an adequate buffer during market volatility.

- Different collateral types carry varying liquidation thresholds, with stablecoins offering higher loan-to-value ratios compared to volatile altcoins.

- Liquidation auctions in protocols like MakerDAO allow third parties to purchase collateral at discounted rates, creating a competitive market for debt settlement.

- Protocol governance through DAOs enables community members to vote on liquidation penalty rates, ensuring democratic decision-making in the ecosystem.

- Automated monitoring tools and position management services can help borrowers avoid liquidation through timely alerts and automatic collateral adjustments.

- Market volatility directly impacts liquidation frequency, with rapid price drops triggering cascading liquidations across interconnected DeFi protocols.

- Understanding the difference between partial and full liquidation helps borrowers structure their positions for optimal risk management.

- Nadcab Labs brings over 8 years of expertise in building secure DeFi infrastructure that minimizes liquidation risks while maximizing capital efficiency.

Introduction: The Role of Liquidation in DeFi

Decentralized Finance has revolutionized how individuals interact with financial services by eliminating intermediaries and enabling permissionless access to lending, borrowing, and trading. At the heart of this ecosystem lies a critical mechanism that maintains system integrity and protects lenders from default risk: liquidation. Within DAOs in the DeFi Space, liquidation serves as the ultimate safeguard that ensures borrowed assets are always backed by sufficient collateral, creating a trustless environment where smart contracts enforce financial agreements without human intervention.

The concept of liquidation in decentralized lending protocols mirrors traditional finance margin calls but operates with unprecedented speed and transparency. When a borrower’s collateral value falls below the required threshold, automated systems immediately trigger the liquidation process, selling the collateral to repay outstanding debt. This mechanism is fundamental to maintaining solvency across lending platforms and protecting depositors who provide liquidity to these protocols.

Understanding liquidation penalties is essential for anyone participating in DeFi lending markets, whether as a borrower seeking leverage or a lender providing capital. These penalties represent the cost of allowing your position to reach the liquidation threshold and serve multiple purposes within the ecosystem, from incentivizing liquidators to maintaining protocol health during market turbulence.

What Are Liquidation Penalties?

Liquidation penalties represent an additional fee charged to borrowers when their collateralized positions are forcibly closed due to insufficient collateral value. This penalty is typically expressed as a percentage of the total collateral being liquidated and ranges from 5% to 15%, depending on the protocol and asset type. When a liquidation event occurs, the borrower loses not only their collateral but also pays this additional fee, which compensates the liquidator for executing the transaction and covers any slippage or gas costs associated with the process.

In the context of DAOs in DeFi Space, liquidation penalties are programmatically defined within smart contracts and cannot be negotiated or waived. This immutability ensures fair and consistent treatment of all participants while removing the possibility of preferential treatment that might exist in traditional lending relationships. The penalty structure is publicly visible on the blockchain, allowing borrowers to calculate potential losses before opening positions.

Example Statement: If a borrower has $10,000 worth of ETH collateral and faces liquidation with a 10% penalty, the liquidator would acquire the ETH at a 10% discount ($9,000), using the proceeds to repay the debt while the $1,000 difference serves as their profit for executing the liquidation.

Why DeFi Platforms Charge Liquidation Penalties

The primary rationale behind liquidation penalties extends far beyond simple punishment for borrowers who fail to maintain adequate collateral. These penalties create economic incentives that keep the entire lending ecosystem functioning smoothly. Without liquidation penalties, there would be no motivation for third parties to monitor positions and execute liquidations, potentially leaving protocols exposed to bad debt during rapid market downturns.

Liquidation penalties serve multiple interconnected purposes within DeFi protocols. First, they incentivize a competitive market of liquidators who constantly monitor positions across various platforms, ready to act when collateral ratios fall below safe thresholds. Second, they discourage borrowers from operating at dangerously high leverage levels, promoting more sustainable borrowing practices. Third, they provide a buffer that accounts for price slippage, oracle delays, and transaction costs that occur during the liquidation process.

The penalty structure also reflects the risk profile of different assets within DAOs in the DeFi Space. More volatile assets typically carry higher liquidation penalties because they present greater risks during the liquidation process. If prices continue falling while a liquidation is being executed, higher penalties ensure the protocol remains protected even in adverse conditions.

How Liquidation Protects Lenders

Lenders who deposit assets into DeFi protocols face the inherent risk of borrower default. Unlike traditional banking, where collateral enforcement can take months and involve legal proceedings, decentralized protocols provide instantaneous protection through automated liquidation mechanisms. The moment a borrower’s position becomes undercollateralized, smart contracts enable immediate asset recovery, ensuring lenders can always withdraw their deposits plus accrued interest.

The overcollateralization requirement, combined with liquidation thresholds, creates multiple layers of protection for lenders. Most protocols require borrowers to deposit collateral worth 150% to 200% of their loan value, providing a significant cushion before liquidation becomes necessary. This excess collateral absorbs price volatility and ensures that even after liquidation penalties are paid, sufficient value remains to cover the outstanding debt completely.

Lender Protection Parameters

Overcollateralization

150% to 200%

Liquidation Threshold

80% to 85%

Safety Buffer

15% to 20%

Impact on Borrowers During Liquidation

For borrowers, liquidation represents a significant financial event that can result in substantial losses beyond the initial debt obligation. When liquidation occurs, borrowers not only lose their collateral but also forfeit the liquidation penalty, which can represent thousands of dollars on large positions. The psychological and financial impact of liquidation often catches inexperienced DeFi users off guard, particularly during periods of extreme market volatility when multiple liquidations can cascade across the ecosystem.

The timing of liquidation can dramatically affect the outcome for borrowers. In rapidly declining markets, the actual liquidation price may be worse than anticipated due to oracle latency and execution delays. This means borrowers might receive even less remaining collateral than their health factor calculations suggested. Understanding these dynamics is crucial for anyone utilizing leverage within DAOs in the DeFi Space.

Partial liquidation, available on many modern protocols, offers some relief by closing only a portion of the underwater position. This approach allows borrowers to retain some collateral while bringing their health factor back above the safe threshold. However, partial liquidation still incurs the full penalty percentage on the liquidated portion, and multiple partial liquidations can occur in sequence during extended downturns.

Types of Collateral Used in DeFi Loans

The DeFi ecosystem accepts a diverse range of digital assets as collateral, each carrying different risk parameters and liquidation characteristics. Understanding how various collateral types affect your borrowing capacity and liquidation risk is fundamental to successful position management. Protocols typically categorize collateral into tiers based on liquidity, volatility, and market capitalization, with each tier receiving different loan-to-value ratios and liquidation thresholds.

| Collateral Type | Examples | LTV Ratio | Liquidation Threshold | Risk Level |

|---|---|---|---|---|

| Stablecoins | USDC, USDT, DAI | 75% to 85% | 88% to 90% | Low |

| Major Cryptocurrencies | ETH, BTC, wBTC | 70% to 80% | 82% to 86% | Medium |

| Liquid Staking Tokens | stETH, rETH, cbETH | 65% to 75% | 78% to 82% | Medium |

| DeFi Governance Tokens | UNI, AAVE, COMP | 55% to 65% | 70% to 75% | High |

| Volatile Altcoins | Various Mid Caps | 40% to 55% | 60% to 70% | Very High |

LP tokens from decentralized exchanges and yield farming protocols represent a newer category of collateral that some platforms now accept. These tokens carry additional complexity because their value depends on the underlying assets and the constant product formula used by automated market makers. This complexity translates to higher liquidation penalties and lower loan-to-value ratios compared to standard cryptocurrency collateral.

How Collateral Value Affects Liquidation Risk

The relationship between collateral value and liquidation risk follows a dynamic equation that every DeFi borrower must understand. As collateral value fluctuates with market conditions, the health factor of a position changes proportionally. A position that appears safe with a 200% collateralization ratio can quickly approach liquidation if the underlying collateral experiences a 40% or 50% price decline, scenarios that occur regularly in cryptocurrency markets.

Price correlation between collateral and borrowed assets introduces another layer of complexity. When a borrower uses ETH as collateral to borrow stablecoins, they face directional exposure to ETH price movements. However, when borrowing one volatile asset against another, such as using ETH to borrow wrapped Bitcoin, the liquidation risk depends on the relative price movement between the two assets rather than absolute changes.

Health Factor Formula

Health Factor = (Collateral Value × Liquidation Threshold) ÷ Total Debt

When Health Factor drops below 1.0, liquidation becomes possible. Maintaining HF above 1.5 is recommended for safety.

Trigger Points: When Liquidation Happens

Liquidation events are triggered when specific on-chain conditions are met, as determined by protocol smart contracts and oracle price feeds. The primary trigger occurs when a position’s health factor falls below the minimum threshold, typically 1.0, indicating that the collateral value has declined to the point where it no longer adequately secures the borrowed amount. This calculation happens continuously as oracles update price information.

Oracle infrastructure plays a critical role in determining liquidation triggers within DAOs in the DeFi Space. Most protocols rely on decentralized oracle networks like Chainlink to provide tamper-resistant price data. These oracles aggregate prices from multiple exchanges and apply time-weighted averaging to prevent manipulation. However, during extreme volatility, oracle updates may lag behind actual market prices, creating opportunities for either late liquidations or premature triggers.

Some protocols implement grace periods or buffer zones before executing liquidations. These mechanisms provide borrowers with additional time to add collateral or repay debt before their positions are closed. However, such features can increase protocol risk during rapid market declines, which is why most major lending platforms opt for immediate liquidation once thresholds are breached.

Liquidation Penalty Rates Across Popular DeFi Platforms

Different DeFi protocols have adopted varying approaches to liquidation penalties based on their risk models, target user bases, and governance decisions. Understanding these differences helps borrowers choose platforms that align with their risk tolerance and investment strategies. The following comparison highlights how major protocols structure their liquidation mechanisms.

| Platform | Penalty Rate | Liquidation Type | Close Factor | Network |

|---|---|---|---|---|

| Aave V3 | 5% to 10% | Partial | 50% | Multi Chain |

| Compound V3 | 8% | Partial | 50% | Ethereum, Base |

| MakerDAO | 13% | Auction | 100% | Ethereum |

| Liquity | 10% | Full | 100% | Ethereum |

| Venus Protocol | 10% | Partial | 50% | BNB Chain |

| Spark Protocol | 5% | Partial | 50% | Ethereum |

The close factor determines what percentage of the underwater position can be liquidated in a single transaction. A 50% close factor means liquidators can only close half of the position at once, potentially requiring multiple liquidation events if prices continue declining. This design reduces the severity of individual liquidation events but may extend the total time a position remains at risk.

Automatic vs. Manual Liquidation Processes

DeFi protocols employ two primary approaches to executing liquidations: fully automated systems driven by liquidator bots and manual processes where human operators monitor and execute liquidation transactions. Most modern lending platforms rely heavily on automated liquidators, which run sophisticated algorithms to identify profitable liquidation opportunities across multiple protocols simultaneously.

Automatic Liquidation

✓ Executes within seconds of threshold breach

✓ Competitive gas bidding for priority

✓ Runs 24/7 without human intervention

✓ Uses flash loans for capital efficiency

Most DeFi protocols use this approach

Manual Liquidation

✓ Human judgment in edge cases

✓ Can negotiate with borrowers

✓ Flexible timing considerations

✓ Dispute resolution possible

Rare in pure DeFi, common in CeDeFi

Flash loan liquidations have revolutionized how liquidators operate within DAOs in the DeFi Space. By borrowing the necessary capital to repay a borrower’s debt, executing the liquidation to receive discounted collateral, selling the collateral, and repaying the flash loan all within a single atomic transaction, liquidators can profit without committing any of their own capital. This democratizes liquidation opportunities and increases competition among liquidators.

Market Volatility and Its Effect on Liquidation

Cryptocurrency markets are notorious for extreme volatility, with daily price swings of 10% or more occurring regularly across major assets. This volatility directly impacts liquidation frequency and severity in DeFi lending protocols. During market downturns, cascading liquidations can amplify selling pressure as liquidated collateral floods exchanges, pushing prices lower and triggering additional liquidations in a self-reinforcing cycle.

Historical data from major market crashes demonstrates the scale of liquidation cascades. During the May 2021 market correction, over $8 billion in positions were liquidated across DeFi protocols within 24 hours. More recently, significant liquidation events have occurred during various market stress periods, highlighting the systemic risks inherent in leveraged DeFi positions.

Thesis Statement: The interconnected nature of DeFi protocols means that liquidations on one platform can trigger a domino effect across the ecosystem, as borrowed assets from one protocol may serve as collateral on another, creating complex webs of dependencies that amplify market stress.

Strategies Borrowers Can Use to Avoid Liquidation

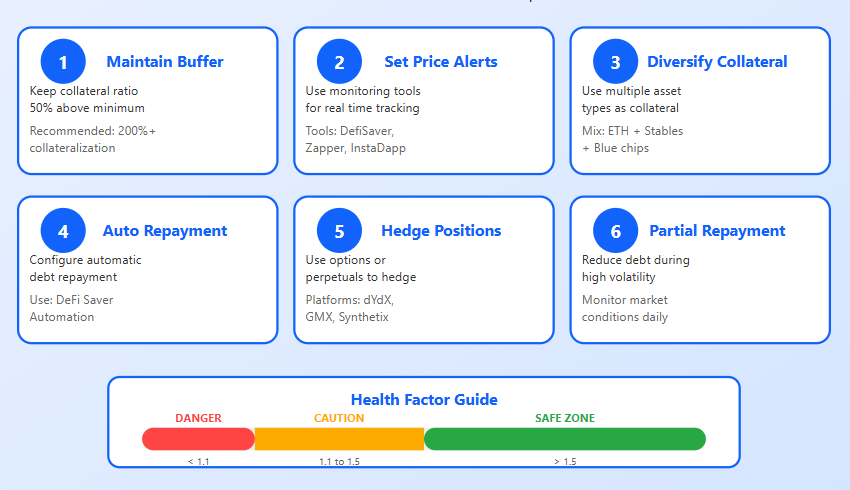

Proactive position management is the most effective defense against liquidation losses. Successful DeFi borrowers employ multiple strategies simultaneously to protect their positions during market turbulence. These approaches range from conservative collateralization to sophisticated automated tools that adjust positions in response to market conditions.

Essential Liquidation Prevention Strategies

1. Maintain Conservative Collateral Ratios: Keep your collateralization at least 200% or higher, providing a substantial buffer against price volatility.

2. Set Up Price Alerts: Configure notifications on platforms like DefiSaver or Zapper to alert you when collateral prices approach dangerous levels.

3. Use Automation Services: Platforms like DeFi Saver offer automated position management that can add collateral or repay debt before liquidation thresholds are reached.

4. Diversify Collateral Types: Spreading collateral across multiple assets reduces single-point-of-failure risk and can provide more stable health factors.

5. Monitor Market Conditions: Stay informed about upcoming events that could impact cryptocurrency prices, such as regulatory announcements or major protocol upgrades.

6. Keep Emergency Funds Ready: Maintain liquid assets outside your positions that can be quickly deployed to add collateral during emergencies.

Understanding leverage dynamics is crucial for avoiding liquidation. Many borrowers fail to account for compound effects where borrowed assets are used in additional yield strategies. Each layer of leverage multiplies both potential returns and liquidation risk, creating complex exposure profiles that can unwind rapidly during market stress.

How Liquidation Penalties Maintain Protocol Stability

Protocol stability in DeFi lending depends on maintaining solvency at all times, ensuring that total collateral value always exceeds total debt obligations across the system. Liquidation penalties contribute to this stability by creating economic incentives that align individual behavior with collective protocol health. The penalty structure ensures rapid response to underwater positions while generating revenue that can be directed toward protocol reserves or insurance funds.

Many protocols direct a portion of liquidation penalty proceeds to safety modules or reserve pools that serve as backstops during extreme market events. These reserves can be deployed to cover bad debt that arises when liquidations fail to fully recover outstanding loans, a scenario that can occur during flash crashes when prices drop faster than liquidators can execute transactions.

The deterrent effect of liquidation penalties encourages more responsible borrowing behavior across the ecosystem. Knowing that liquidation comes with significant additional costs, borrowers tend to maintain larger safety margins than they otherwise might, collectively reducing systemic risk within DAOs in DeFi Space.

Risks and Limitations of Liquidation Penalties

Despite their importance in maintaining protocol stability, liquidation penalties are not without drawbacks and limitations. High penalty rates can create perverse incentives during market stress, potentially accelerating liquidation cascades as borrowers rush to close positions before liquidation rather than riding out temporary volatility. This behavior can amplify market downturns and create additional selling pressure at the worst possible times.

Oracle manipulation remains a persistent risk in the liquidation process. Sophisticated attackers may attempt to temporarily manipulate price feeds to trigger artificial liquidations, profiting from the resulting discounted collateral purchases. While most protocols implement safeguards against such attacks, including time-weighted price feeds and multiple oracle sources, determined attackers have occasionally succeeded in exploiting these systems.

The fairness of liquidation penalties has also been questioned. Small borrowers often pay the same percentage penalty as large institutional positions, meaning the absolute cost can be disproportionately burdensome for retail users. Some community members advocate for tiered penalty structures that could provide some protection for smaller positions while maintaining strong incentives for large borrowers.

Liquidation Auctions: How Collateral Is Sold

Several major DeFi protocols, most notably MakerDAO, utilize auction mechanisms to sell liquidated collateral rather than instant liquidation at fixed discount rates. These auctions aim to achieve fair market prices for collateral while ensuring complete debt recovery. The auction process creates opportunities for participants beyond dedicated liquidation bots, democratizing access to discounted collateral acquisition.

MakerDAO’s Collateral Auction mechanism operates in two phases. The first phase is a forward auction where participants bid increasing amounts of DAI to acquire the collateral, with the auction continuing until the debt is fully covered. If the auction generates excess DAI beyond the debt amount, a second reverse auction phase begins where participants compete to accept decreasing amounts of collateral for their winning bid, returning excess collateral to the borrower.

MakerDAO Auction Timeline

Phase 1

Forward Auction

Bid DAI for collateral

Phase 2

Reverse Auction

Reduce collateral claim

Settlement

Final Transfer

Collateral distributed

The Role of Governance in Setting Penalty Rates

Decentralized governance lies at the heart of how DAOs in the DeFi Space determine and adjust liquidation penalty rates. Token holders in protocols like Aave, Compound, and MakerDAO have direct voting power over critical parameters, including liquidation thresholds, penalty percentages, and close factors. This democratic approach ensures that the community has ultimate control over the risk parameters that affect all participants.

Governance proposals related to liquidation parameters typically undergo extensive community discussion before reaching formal votes. These discussions weigh competing interests between lenders who benefit from higher penalties that incentivize faster liquidations and borrowers who prefer lower penalties that reduce their downside risk. Finding the optimal balance requires careful consideration of market conditions, competitive landscape, and protocol-specific factors.

Risk teams within major DeFi protocols conduct ongoing analysis of liquidation data to inform governance decisions. These teams examine historical liquidation efficiency, bad debt incidents, and comparative analysis with competing protocols. Their recommendations carry significant weight in governance discussions, though final decisions rest with token holders through the voting process.

Case Studies: Notable DeFi Liquidations

Examining historical liquidation events provides valuable lessons for understanding how these mechanisms function during real market stress. Major liquidation events have shaped protocol design decisions and community understanding of DeFi risks. These case studies illustrate both the effectiveness of liquidation systems and their potential failure modes.

Case Study: Black Thursday (March 2020)

During the COVID 19 market crash, ETH prices dropped over 40% in 24 hours, triggering massive liquidations across DeFi protocols. MakerDAO’s auction system faced unprecedented stress, with some collateral being sold for zero DAI due to network congestion preventing bidders from participating.

Key Lessons: The event led to significant protocol upgrades, including faster oracle updates, improved auction mechanics, and the introduction of emergency shutdown capabilities.

Total liquidations exceeded $4 million in bad debt for MakerDAO alone.

Case Study: Cascade Liquidations (May 2021)

A coordinated sell-off triggered by negative news sentiment caused Bitcoin to drop from $58,000 to $30,000 within weeks. The cascading liquidations across DeFi reached $8 billion in a single day, demonstrating the interconnected nature of leveraged positions.

Key Lessons: Protocols responded by adjusting collateral requirements for volatile assets and implementing better risk monitoring tools for users.

This event highlighted the importance of conservative position management in volatile markets.

These historical events underscore the importance of robust liquidation mechanisms and the ongoing need for protocol improvement. Each major liquidation event has driven innovation in DeFi protocol design, from improved oracle infrastructure to more sophisticated auction mechanisms and better user interfaces for position monitoring.

Build Secure DeFi Solutions with Nadcab Labs

Partner with industry experts to create robust liquidation mechanisms, smart contracts, and DeFi protocols that protect users while maximizing capital efficiency.

Conclusion: Balancing Risk, Reward, and Protocol Safety

Liquidation penalties represent a fundamental mechanism that enables the entire DeFi lending ecosystem to function without traditional intermediaries or credit assessments. By creating economic incentives that align individual behavior with collective protocol health, these penalties ensure that lending platforms remain solvent even during extreme market conditions. Understanding how liquidation works, what triggers it, and how to avoid it is essential knowledge for anyone participating in DAOs in the DeFi Space as either a borrower or lender.

The evolution of liquidation mechanisms continues as protocols learn from past events and implement improvements. From auction-based systems that maximize collateral recovery to partial liquidation approaches that reduce borrower impact, innovation in this space reflects the broader maturation of decentralized finance. As the ecosystem grows, we can expect further refinements that balance the competing needs of system stability, user protection, and capital efficiency.

For borrowers, the key takeaway is clear: conservative position management and active monitoring are your best defenses against liquidation losses. Maintain adequate collateral buffers, use available tools for position tracking, and stay informed about market conditions that could impact your positions. For protocol designers and governance participants, the challenge lies in calibrating liquidation parameters that protect the system while remaining competitive and user-friendly.

Nadcab Labs has been at the forefront of blockchain and DeFi innovation for over 8 years, delivering enterprise-grade solutions that prioritize security, efficiency, and user experience. Our team of expert developers and DeFi specialists understands the intricate balance required in designing liquidation mechanisms that protect all stakeholders while maintaining system performance. Whether you are building a new lending protocol, optimizing existing smart contracts, or seeking to implement robust risk management frameworks, Nadcab Labs brings the technical expertise and industry experience necessary to succeed in the competitive DeFi landscape. Our track record includes successful implementations across multiple blockchain networks, and our commitment to security has helped clients avoid common pitfalls that plague less experienced teams. Trust Nadcab Labs to be your partner in building the future of decentralized finance.

Frequently Asked Questions

Once liquidation completes, you cannot recover the liquidated collateral. However, any excess collateral remaining after the debt is repaid and penalties are deducted is returned to your wallet automatically. Always monitor your positions closely to avoid reaching liquidation thresholds.

Most DeFi platforms do not send direct notifications before liquidation since they operate autonomously on smart contracts. Users must rely on third party monitoring tools, mobile apps, or manual checks to track their collateral health factor. Some advanced platforms offer integration with notification services.

Your borrowed funds remain yours after liquidation. The liquidation process only affects your collateral which is sold to repay the debt. If you moved borrowed assets to another wallet or used them for other investments, those funds are not affected by the liquidation event.

No, liquidation penalties cannot exceed your total collateral value. However, in extreme market crashes, the combined effect of falling collateral prices and liquidation penalties can result in losing your entire collateral position while still having outstanding debt in rare cases.

Tax treatment of liquidation penalties varies by jurisdiction. In many countries, liquidation events are treated as taxable disposals of assets. Consult with a tax professional familiar with cryptocurrency regulations in your region to understand your specific obligations and potential deductions.

Liquidation bots earn profits by purchasing liquidated collateral at a discount, typically equal to the liquidation penalty percentage. They compete to execute liquidations first by paying higher gas fees. This competitive market ensures rapid liquidations that protect protocol solvency.

Most DeFi platforms have fixed liquidation thresholds set by protocol governance. However, you can effectively adjust your risk level by borrowing less than the maximum allowed amount or adding more collateral to increase your buffer against liquidation.

Partial liquidation allows liquidators to repay only a portion of your debt, typically 50%, while full liquidation closes your entire position. Many modern DeFi protocols prefer partial liquidation as it minimizes user losses while still protecting protocol health.

No, stablecoins do not eliminate liquidation risk. While stablecoins are more stable than volatile cryptocurrencies, they can still depeg from their target value during market stress. Additionally, borrowed assets can appreciate relative to your stablecoin collateral.

Liquidations typically execute within seconds to minutes after the trigger threshold is reached. Liquidation bots constantly monitor blockchain data and compete to execute profitable liquidations. During network congestion, delays may occur, but most liquidations complete within one block confirmation.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.