Key Takeaways

- Understand Each Fundraising Model: ICOs are self-managed, IDOs use decentralized exchanges, and IEOs rely on centralized exchanges for added trust and security.

- Prepare a Comprehensive Project Plan: Include a whitepaper, tokenomics, roadmap, and a clear use-case to attract serious investors.

- Leverage Presales: Early token sales increase visibility, credibility, and community engagement.

- Choose the Right Platforms: Selecting reliable platforms ensures global reach and investor confidence.

- Engage and Communicate: Active community engagement through social media and regular updates fosters loyalty and long-term support.

- Prioritize Security and Compliance: Use KYC/AML processes, secure wallets, and verified smart contracts to protect investors and build trust.

- Strategic Execution: By navigating ICOs, IDOs, and IEOs effectively, your project can raise capital, build a loyal investor base, and establish a strong presence in the competitive crypto ecosystem.

The world of crypto fundraising has grown rapidly in recent years, offering innovative ways for blockchain projects to raise capital. Methods like ICO, IDO, and IEO give startups, developers, and even nonprofits a chance to access global investors while leveraging blockchain’s transparency and efficiency. In this guide, we’ll explore each fundraising model, how it works, its benefits and risks, and how to participate safely.

Understanding Crypto Fundraising

Crypto fundraising is a modern method for projects and organizations to secure capital by offering digital tokens to a global audience, leveraging blockchain technology for transparency and efficiency. Unlike traditional methods, it often bypasses intermediaries but involves unique types, strategies, and regulatory considerations. This approach allows startups, nonprofits, and blockchain innovators to tap into a worldwide pool of investors, reducing geographic barriers and enabling faster capital acquisition.

Beyond raising funds, crypto fundraising also fosters community engagement. Token holders often gain access to project governance, early platform usage, or other benefits that incentivize participation and long-term loyalty. The digital nature of tokens ensures secure, traceable transactions on the blockchain, while smart contracts automate processes like token distribution and liquidity provisioning.

However, with these advantages come challenges. Regulatory uncertainty, varying global laws, and the risk of scams require both projects and investors to exercise caution. Effective crypto fundraising, whether through ICO, IDO, and IEO, demands a careful balance between innovation, transparency, and compliance, ensuring projects not only raise capital but also build trust and sustainable ecosystems.

What is an ICO (Initial Coin Offering)?

An Initial Coin Offering (ICO)[1] is a blockchain-based crowdfunding method and a widely used form of crypto fundraising. In an ICO, startups sell newly created digital tokens to raise capital, functioning similarly to a stock IPO but with much less regulation. Investors exchange cryptocurrency or fiat money for these tokens, which can provide utility, access to services, or potential future value within the project. Companies use ICO solutions to fund new coins, applications, or platforms, bypassing traditional financial systems. While investors gain early access to potentially high-growth projects, they also face significant risks due to the lack of oversight and regulatory protections.

How the ICO Works:

- Project Conception & White Paper: The company designs a new blockchain project, detailing its objectives, technology, team, funding requirements, and token specifics in a comprehensive white paper.

- Token Creation (Tokenomics): A unique digital token is created, outlining its role—such as granting access to services or voting rights—and its supply limits.

- Promotion: The project launches a marketing campaign, often online, to generate interest and attract investors by emphasizing the token’s potential future value.

- Token Offering: Tokens are sold to investors—publicly or privately—in exchange for established cryptocurrencies (like BTC or ETH) or, in some cases, fiat currency.

- Funding & Development: Raised funds are used to develop the project, while investors hold tokens, anticipating that their value will grow as the project succeeds.

- Trading & Use: Once live, tokens can be utilized within the project’s ecosystem or traded on cryptocurrency exchanges.

What is an IDO (Initial DEX Offering)?

An IDO (Initial DEX Offering) is a crypto fundraising method in which a new project launches its tokens directly on a Decentralized Exchange (DEX). Using smart contracts, token sales are automated and permissionless, giving investors direct access and immediate liquidity. Unlike older models such as ICO, which often required central approval, IDOs offer a more transparent and fair way for projects to raise capital from the community. Participants benefit from instant trading and lower barriers to entry, making it an efficient method for both projects and investors.

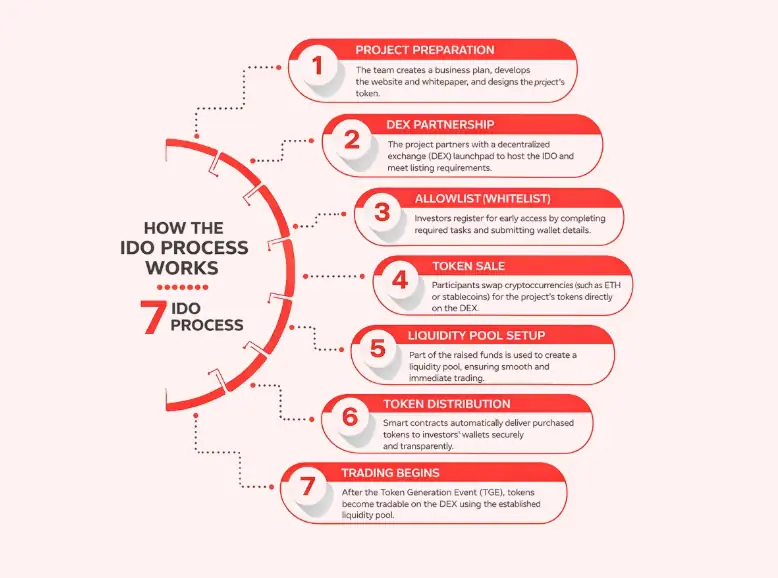

How the IDO Works:

- Project Preparation: The team develops a business plan, prepares marketing materials (website, whitepaper), and creates the project’s token.

- DEX Partnership: The project partners with a decentralized exchange (DEX) launchpad to host the IDO, ensuring it meets listing requirements.

- Allowlist (Whitelist): Interested investors join an allowlist by completing required steps, such as marketing tasks or submitting wallet details, to gain early access.

- Token Sale: During the IDO, investors swap cryptocurrencies (e.g., ETH or stablecoins) for the project’s new tokens directly on the DEX.

- Liquidity Pool Setup: A portion of the raised funds is allocated to create a liquidity pool (e.g., Project Token/ETH), ensuring immediate trading depth.

- Token Distribution: Smart contracts automatically send the purchased tokens to investors’ wallets.

- Trading Begins: After the Token Generation Event (TGE), investors can trade their tokens on the DEX, leveraging the established liquidity pool.

What is an IEO (Initial Exchange Offering)?

An Initial Exchange Offering (IEO)[2] is a crypto fundraising method in which a new project sells its tokens through a trusted cryptocurrency exchange. The exchange manages the entire process, including vetting the IEO project, IEO marketing, technical setup, and Know Your Customer (KYC) checks, providing a safer and more reliable environment for investors. By leveraging the exchange’s reputation and existing user base, IEO offer greater security and trust compared to older fundraising methods like ICO, giving investors early access to new tokens in a regulated setting.

How the IEO Works:

- Project Vetting: The startup approaches an exchange (like Binance Launchpad, KuCoin Spotlight), which performs strict due diligence, checking the team, whitepaper, tech, and legal compliance to filter out scams.

- Partnership: If approved, the project pays the exchange a fee or a percentage of tokens; the exchange gains new users and potentially listing fees.

- Marketing & KYC: The exchange promotes the IEO to its large user base, handles Know Your Customer (KYC) & Anti-Money Laundering (AML) checks, and manages the entire sale process.

- Token Sale: Users buy the new tokens directly from the exchange’s platform using their existing exchange accounts (e.g., with BTC or ETH).

- Immediate Listing: Once the sale concludes, the tokens are instantly listed on the exchange, providing instant liquidity and trading for investors.

Key Differences Between ICO, IDO, and IEO You Must Know

ICO, IDO, and IEO are distinct methods for crypto fundraising, where cryptocurrency projects raise capital by selling tokens, primarily differing in where the sale occurs, the level of centralized oversight, and inherent investor protection.

| Feature | ICO (Initial Coin Offering) | IEO (Initial Exchange Offering) | IDO (Initial DEX Offering) |

|---|---|---|---|

| Platform | Conducted by the project itself on its own website or smart contract | Hosted on a centralized exchange (CEX) | Launched on a decentralized exchange (DEX) or launchpad |

| Management | Entirely managed by the project team | Managed by the exchange (vetting, tech setup) | Automated via smart contracts on the DEX |

| Vetting / Security | Minimal; no formal third-party review | Exchange conducts due diligence and compliance checks | Varies; reliant on launchpad standards and smart contract audits |

| Liquidity | Not guaranteed after the sale; depends on later exchange listings | Usually, immediate listing on the hosting exchange | Immediate liquidity via DEX liquidity pools |

| Investor Access | Open to anyone with crypto (no central gatekeeping) | Limited to exchange users (KYC/AML required) | Open to anyone with a compatible crypto wallet; may require staking |

| Cost to Project | Lower setup cost but heavy marketing burden | Higher fees and revenue share with the exchange | Lower than IEOs but requires liquidity provisioning |

| Regulatory Risk | High; often operates in legal grey areas | Lower; exchange enforces compliance | Moderate; decentralization complicates enforcement |

| Trust & Protection | Low trust; high scam potential historically | Higher trust due to vetting and exchange reporting | Medium: smart contract risks but less centralized control |

How to Participate Safely in ICO, IDO, and IEO

Participating in ICO, IDO, and IEO in crypto fundraising involves significant risk. The primary safety measures revolve around thorough research (due diligence), using reputable platforms, and implementing strong personal security practices. Never invest more than you can afford to lose.

Core Safety Practices for All Offerings:

-

Conduct Rigorous Due Diligence

This is the most critical defense against scams and poorly managed projects. Thorough research helps you separate legitimate opportunities from risky or fraudulent ones:

- Scrutinize the Whitepaper: Carefully read the project’s vision document. It should clearly explain the problem being solved, the technology, roadmap, token utility, and long-term goals. Be cautious if the whitepaper is vague, overly technical without clarity, or makes unrealistic promises.

- Verify the Team: Investigate the backgrounds of the founders, developers, and advisors. Check professional profiles on LinkedIn, past projects, achievements, and blockchain experience. Projects with anonymous teams or unverifiable credentials carry significantly higher risk.

- Analyze Tokenomics: Understand how the token supply is structured, how tokens are distributed, and the vesting schedules for founders and early investors. Consider whether the token has real utility within the platform. Be wary of projects where a few insiders hold a large share, as this can lead to price manipulation or sudden dumps.

- Assess Community Sentiment: Join social media channels like Telegram, Discord, or X and observe community activity. Engaged discussions about technology, partnerships, and project updates indicate a healthy project. Communities focused solely on price speculation, hype, or pump-and-dump schemes are red flags.

- Check for Audits: Ensure smart contracts have been reviewed by reputable third-party security firms (e.g., CertiK, SlowMist). Read audit reports to understand whether critical vulnerabilities or issues were found, and whether they have been addressed.

-

Manage Risk and Security

Protecting your assets and managing exposure is as important as choosing the right project:

- Diversify Investments: Avoid putting all your funds into a single project. Spreading investments across multiple tokens or projects helps reduce the impact of a single failure or scam.

- Use Secure Wallets: Long-term token storage should be in secure, hardware wallets like Ledger or Trezor. Avoid keeping large amounts of crypto on exchanges due to hacking risks.

- Never Share Private Keys or Seed Phrases: These are the keys to your crypto assets. Store them securely offline, never digitized or shared with anyone, even if they claim to be support staff.

- Beware of Unrealistic Promises: Be skeptical of any project guaranteeing high, quick, or guaranteed returns. Legitimate investments carry risk, and promises of certain profits are almost always scams.

- Stay Informed: The crypto market evolves rapidly. Follow project updates, market news, and regulatory changes in your jurisdiction. Being informed allows you to react to risks, opportunities, and security alerts promptly.

- Watch for Red Flags: Look out for excessive marketing hype, aggressive referral programs, or pressure tactics to invest quickly. Scammers often use fear-of-missing-out (FOMO) to manipulate investors.

- Understand Your Risk Tolerance: Only invest what you can afford to lose. Crypto markets are highly volatile, and even legitimate projects can experience sudden price drops.

Specific Participation Steps and Safety Considerations

| Offering | ICO | IDO | IEO |

|---|---|---|---|

| Platform | Project’s own website | Decentralized Exchange (DEX) Launchpad | Centralized Exchange (CEX) Launchpad |

| Key Safety Feature(s) | Self-managed, highly unregulated, and relies heavily on investor due diligence. | Immediate liquidity, no central intermediary, but prone to smart contract risks and potential for scams if the launchpad lacks proper vetting. | Exchange conducts initial due diligence, adding a layer of trust and security; it generally requires KYC/AML. |

| Participation Steps | 1. Register on the project’s official website. 2. Pass any required KYC/AML checks. 3. Transfer the required cryptocurrency (e.g., ETH, BTC) to the specified address. 4. Receive tokens in your wallet after the sale. |

1. Choose a reputable DEX launchpad (e.g., Polkastarter, Seedify). 2. Complete KYC verification (if required by the platform). 3. Connect a compatible crypto wallet (e.g., MetaMask) with sufficient funds and gas fees. 4. Acquire and stake the launchpad’s native token (often required for an allocation). 5. Register for the project’s whitelist. 6. Participate in the token sale during the specified time and claim tokens after the IDO concludes. |

1. Create and verify an account on the hosting exchange (e.g., Binance, KuCoin). 2. Complete the required KYC and AML procedures. 3. Fund your exchange wallet with the required cryptocurrency. 4. Participate in the token sale directly through the exchange’s platform during the event. 5. Tokens are typically listed for trading immediately after the IEO. |

By understanding these mechanisms in ICO, IDO, and IEO and prioritizing security and research, you can navigate the fundraising platforms more safely.

Why Presales Matter in ICO, IDO, and IEO Fundraising

Presales are a crucial step for any crypto project because they allow investors to access tokens at an early stage, often at lower prices, creating momentum and attracting more participants. As the source explains, submitting a presale helps your project gain visibility and reach potential backers before it officially hits the market.[3]

Whether you are launching an ICO, IDO, and IEO, listing your presale on a trusted platform ensures your project “appears in search results and listing platforms, helping you reach more investors.” This early exposure builds credibility, increases awareness, and attracts early supporters who can become long-term backers.

Additionally, presales help projects stand out in a crowded crypto market by offering transparency and engaging investors with clear project details. The platform source emphasizes the importance of providing accurate information, such as token name, symbol, total supply, and roadmap, since clear and accurate details attract more investors.

In short, presales are not just about raising funds—they are a strategic move to increase trust, visibility, and investor confidence, giving your ICO, IDO, and IEO a stronger foundation for a successful launch.

How to Submit an ICO, IDO, and IEO Presale Successfully

Submitting a presale is a critical step to make your crypto project visible to early investors and build momentum before the official token launch. Here’s a step-by-step guide to ensure your presale submission is successful:

1. Prepare Your Project Details

Gather essential information such as token name, symbol, total supply, website link, and a brief description. As OpenPR highlights, “Clear and accurate details attract more investors.”

2. Choose the Right Platform

Select a reliable listing platform that supports ICO, IDO, and IEO submissions. Ensure it is well-known among crypto enthusiasts to maximize visibility and trust.

3. Complete the Submission Form

Fill in all required fields with precise information, including social media links and contact details. Transparency is key to building credibility with potential investors.

4. Verify Your Project

Some platforms may require verification, such as KYC for founders or basic legal documentation for the project. Verification increases investor confidence and enhances the project’s legitimacy.

5. Submit and Wait for Approval

After submitting your presale, the platform will review the project. Once approved, your token will appear on the listing platform, reaching a global audience of potential investors.

6. Engage and Promote

Even after submission, actively engage with your community through social media, forums, and updates. Offering attractive presale terms like discounts or bonus tokens can motivate early investors.

By following these steps, your ICO, IDO, and IEO presale can attract early supporters, build trust, and set a strong foundation for a successful token launch. As the source concludes, Submitting your presale is a smart move for any crypto project looking to grow… it helps you attract investors and gain credibility.

Start Your Crypto Fundraising Journey with ICO, IDO, and IEO

Starting your crypto fundraising journey with ICO, IDO, and IEO allows your project to access a global investor base, raise capital efficiently, and build a strong community around your blockchain initiative. Each fundraising method offers unique advantages: ICOs provide flexibility and direct project management, IDOs offer instant liquidity through decentralized exchanges, and IEOs deliver higher trust by leveraging established centralized exchanges.

To begin, focus on creating a detailed project plan, including a transparent whitepaper, clear tokenomics, and a roadmap that highlights milestones and long-term goals. Submitting a presale is a crucial step to gain early visibility, attract initial supporters, and build momentum before the official token launch. Engaging your community, promoting your project on reputable platforms, and ensuring security and compliance will significantly increase investor confidence and the success of your fundraising campaign.

Crypto fundraising is more than just raising money—it’s about building a lasting ecosystem, engaging a global community, and demonstrating the potential of your project in a competitive market. By choosing the right fundraising model, preparing meticulously, and prioritizing transparency and security, your project can stand out in the crowded crypto space. Remember, success comes not only from innovative ideas but also from trust, clarity, and strategic execution.

Frequently Asked Questions:

Crypto fundraising is the process by which blockchain projects raise capital by issuing and selling digital tokens to investors. Funds are used for development, operations, or promotion. Common methods include ICO, IDO, and IEO.

ICO (Initial Coin Offering): Tokens sold directly by the project.

IEO (Initial Exchange Offering): Tokens sold through a crypto exchange.

IDO (Initial DEX Offering): Tokens launched and sold via a decentralized exchange.

No. An IPO is a regulated public stock sale giving a company ownership. ICOs are unregulated token sales, usually giving investors utility tokens rather than ownership.

An IEO is a token sale hosted on an exchange, where the exchange handles KYC/AML compliance, token distribution, and often immediate trading.

ICOs are independently conducted by projects, while IEOs are exchange-managed, providing added security, credibility, and investor access.

The 1% rule suggests that no more than 1% of your total portfolio should be invested in a single cryptocurrency, helping limit potential losses.

In an ICO, IDO, and IEO, investors buy tokens by sending cryptocurrencies like ETH or BNB, or sometimes fiat, to a project’s wallet or the hosting exchange, in return receiving the new tokens that can be used or traded.

KYC (Know Your Customer) and AML (Anti-Money Laundering) are identity verification processes to prevent fraud, money laundering, or other illegal activities during token sales.

Token prices can fluctuate sharply post-launch. While profits are possible, careful analysis of project fundamentals is essential before trading.

Common scams include fake ICOs, phishing websites, rug pulls, Ponzi schemes, impersonation of legitimate projects, and fraudulent exchanges. Conduct thorough research and use trusted platforms.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.