The fundraising landscape is undergoing a fundamental transformation as Web3 startups increasingly move away from traditional venture capital models in favor of token-based fundraising. Crypto fundraising reached over $25 billion in 2025, shattering analyst expectations and demonstrating the growing appetite for decentralized capital formation. This shift is driven by the desire for global reach, enhanced community engagement, and decentralized control that aligns with the core principles of blockchain technology. Understanding how Web3 startups secure funds by bypassing VCs has become essential for founders seeking faster, more flexible paths to capital.

Key Takeaways

- Token Fundraising Growth: IDOs now account for over 66% of new token sales, becoming the dominant model.

- Global Accessibility: Token sales enable participation from investors worldwide without geographic restrictions.

- Community Alignment: Token holders become stakeholders with vested interest in project success.

- Faster Capital Formation: Token launches can mobilize capital in weeks rather than months-long VC processes.

- Retained Control: Founders maintain governance without surrendering equity or board seats.

- Immediate Liquidity: Tokens can be traded on exchanges shortly after launch.

- DAO Governance: Decentralized organizations enable community-driven funding decisions.

Why Web3 Startups Skip Venture Capital

For decades, venture capital has been the go-to option for startup funding, but it often comes with significant trade-offs that conflict with Web3 principles. Traditional VC funding models involve centralized decision-making processes, equity dilution, loss of control over company direction, and intense pressure to scale at unsustainable rates. These conditions frequently clash with the values of Web3 founders who are building on principles of decentralization, transparency, and community ownership.

The statistics paint a stark picture of traditional fundraising limitations. Fewer than 0.05% of all startups secure venture capital funding, meaning roughly 1 in 2,000 startups. Those who do land VC backing often give up 20-30% equity in Series A rounds. Additionally, traditional VC funding is geographically concentrated, limiting access for startups outside major financial hubs. For teams building web3 platform solution projects, these barriers can be especially problematic.

Instead of following the traditional VC path, many blockchain startup funding efforts now turn to tokenized fundraising, which allows founders to raise capital without giving up control or compromising their decentralized mission. This approach offers retained ownership and governance, faster access to global capital pools, and community engagement from the earliest stages.

The Rise of Token-Based Fundraising

Tokenization lies at the core of the Web3 fundraising revolution, offering a transformative alternative to traditional equity-based methods. Rather than issuing company shares, startups issue blockchain-based tokens that represent value, utility, access, or governance rights within their ecosystem. These tokens can be held, traded, or used by supporters, allowing projects to generate early-stage liquidity while building active communities.

Web3 startups raised $9.6 billion in venture funding during Q2 2025 alone, making it the second-largest quarter on record. Private token sales raised $410 million across just 15 deals, marking their strongest showing since 2021. This data reveals a maturing market where investors put more money into fewer, higher-quality projects with strong fundamentals.

Community-driven token launches saw the most substantial revival of the ICO model since 2017-18. Platforms like Echo, Kaito Launchpad, and Legion facilitated project fundraises that prioritized community ownership over institutional concentration. This surge reflected growing skepticism among developers toward traditional VC structures, which were criticized for concentrating token allocations among insiders.

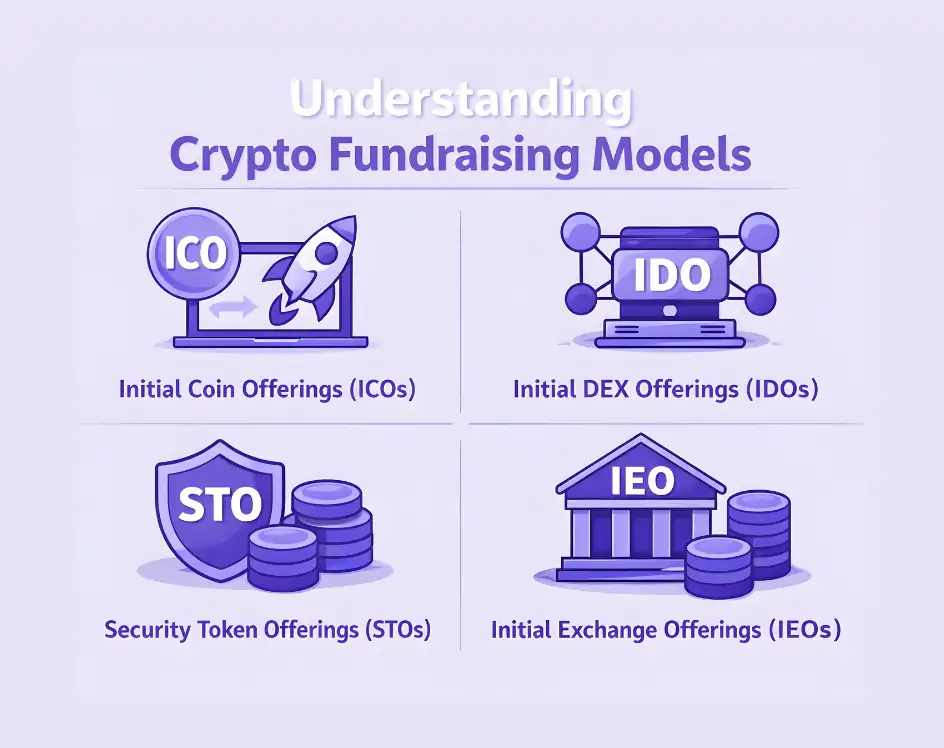

Understanding Crypto Fundraising Models

The methods for launching tokens have evolved significantly to address regulatory concerns, investor protection, and market dynamics. Understanding these options helps founders choose the right approach for their specific needs.

Initial Coin Offerings (ICOs)

ICO fundraising pioneered token-based capital formation, allowing projects to raise funds directly from the public. While they enabled rapid capital accumulation, the lack of regulation in early years led to challenges. Today, ICOs have matured with better infrastructure and compliance frameworks, making them viable again for serious projects.

Initial DEX Offerings (IDOs)

IDO token launch represents the latest evolution in decentralized fundraising, leveraging decentralized exchanges for token launches. IDOs have become the dominant model, accounting for over 66% of new token sales. They offer immediate liquidity, lower costs, greater accessibility, and alignment with Web3’s decentralized ethos. However, the decentralized nature means less oversight, requiring investors to conduct thorough due diligence.

Security Token Offerings (STOs)

STO crypto fundraising emerged to bring regulatory compliance to token sales. Security tokens represent ownership stakes, revenue shares, or profit rights and are subject to securities oversight. STOs offer greater investor protection and are gaining traction for real-world asset tokenization, though they involve more complex legal processes.

Initial Exchange Offerings (IEOs)

IEO crypto fundraising is conducted through cryptocurrency exchanges, which vet projects and handle the sale process. This adds credibility through exchange due diligence and KYC/AML checks, though projects may face listing fees and reduced control over the fundraising process.

| Model | Key Features | Best For |

|---|---|---|

| ICO | Direct public sale, broad participation, flexible structure | Projects with strong community following |

| IDO | Decentralized launch, instant liquidity, low costs | DeFi protocols and community-first projects |

| STO | Regulatory compliant, asset-backed, investor protection | Real-world asset tokenization |

| IEO | Exchange vetting, built-in audience, credibility | Projects seeking institutional credibility |

Token Types in Web3 Fundraising

Successful startups carefully design their tokenomics to balance utility, incentives, and long-term growth. Understanding different token types is crucial for structuring effective fundraising campaigns.

Utility Tokens

Utility tokens provide users with access to platform features, products, or services. These tokens are common in DeFi platforms, blockchain games, and NFT ecosystems where they enable staking, purchases, or exclusive content access. They play a crucial role in building active user participation. Understanding decentralized storage and other infrastructure helps design effective utility token models.

Governance Tokens

Governance tokens give holders the ability to vote on key decisions within decentralized protocols. These decisions may include protocol upgrades, fee structures, or fund allocation from community treasuries. By distributing governance rights among users, projects foster community-driven processes central to many DAOs.

Security Tokens

Security tokens represent ownership stakes, revenue shares, or profit rights and are subject to regulatory oversight similar to traditional securities. They can distribute dividends, profit shares, or voting rights, appealing to investors seeking compliant opportunities within the blockchain space.

How DAOs Power Web3 Capital Formation

Decentralized Autonomous Organizations have emerged as vital components of tokenized fundraising, transforming how startups manage and distribute capital. DAO fundraising enables token holders to participate in governance by voting on proposals, allocating funds, and supporting project growth. This creates self-governing, community-driven funding models where power and decision-making are decentralized.

Several DAO-based funding models are gaining popularity. These include grants and bounties from community treasuries, launchpad DAOs that incubate early-stage Web3 ideas, and investment DAOs pooling capital for specific sectors like DeFi or infrastructure. Programs like Gitcoin grants, Ethereum grants, and Solana grants provide non-dilutive funding for builders.

By integrating DAO structures, startups go beyond just raising capital, actively involving their communities in governance, direction, and long-term success. Proper setup of a web3 application infrastructure supports effective DAO implementation.

Ready to Launch Your Token?

Expert teams provide comprehensive token launch services including tokenomics consulting, smart contract creation, and regulatory guidance for successful Web3 fundraising.

Benefits of Token-Based Fundraising

Token-based fundraising unlocks advantages that are difficult to match with traditional VC models, especially for founders building global, decentralized products.

Global and inclusive participation allows anyone with an internet connection to invest, democratizing opportunities that were previously limited to elite investors. Token sales break down geographic and financial barriers, creating borderless communities with skin in the game. Faster time to market is another significant advantage, with projects able to launch funding rounds within weeks using solid whitepapers, communities, and smart contracts rather than months-long VC pitch processes.

Community building and network effects emerge naturally as token holders become evangelists with vested interest in project success. This alignment fosters viral growth that’s difficult to replicate with passive VC investors. Immediate liquidity through exchange listings allows faster reinvestment and reward mechanisms. Understanding crypto wallet in Web3 functionality supports smooth token distribution and holder management.

Challenges and Risk Considerations

Despite its benefits, token fundraising presents challenges that founders must navigate carefully.

Crypto fundraising risks include market volatility that can impact project treasuries and investor confidence, requiring careful planning to manage unpredictable price swings. Regulatory uncertainty remains significant as global regulations continue evolving. Web3 regulatory compliance requires attention to token classification, KYC/AML requirements, and securities laws across jurisdictions.

Security token compliance and blockchain security risks demand robust smart contract auditing and secure infrastructure. Projects must also avoid the trap of overhyped expectations, focusing instead on realistic goals, transparency, and steady execution to build long-term credibility.

The Future of Web3 Fundraising

Token fundraising is rapidly becoming a foundational model for startups rather than a passing trend. Industry leaders predict that token-based fundraising will become the default path for startups as companies launch onchain early to access internet capital markets. The emergence of cross-border compliant launchpads makes it easier for founders to tap into global Web3 capital pools.

The future is likely hybrid, combining traditional VC backing with community token sales for optimal results. Top-tier projects will continue pairing token sales with venture backing, recognizing that capital is only one part of building a successful company. As the model matures, token-based fundraising will reshape how early-stage ventures raise capital and grow.

Conclusion

Token-based fundraising has emerged as a transformative alternative to traditional venture capital, enabling Web3 startups to raise funds, engage communities, and scale without giving up control. The convergence of blockchain technology, community governance, and global accessibility has created new pathways for capital formation that align with decentralized principles.

As the landscape continues evolving, startups looking to embrace this model benefit from expert guidance on tokenomics, smart contract creation, regulatory compliance, and community building. Whether through ICOs, IDOs, STOs, or DAO-based funding, the opportunities for Web3 startups to secure funds by bypassing VCs have never been greater.

Frequently Asked Questions

Crypto fundraising involves issuing blockchain-based tokens to raise capital. Startups create tokens representing utility, governance, or ownership rights, then sell them to investors through various launch mechanisms like ICOs, IDOs, STOs, or IEOs, with proceeds funding project growth.

ICOs are direct public sales run by projects themselves. IEOs are conducted through centralized exchanges that vet projects. IDOs launch on decentralized exchanges, offering immediate liquidity and greater accessibility without centralized gatekeepers.

Benefits include global accessibility, faster capital formation, community alignment, retained founder control, immediate liquidity, and lower barriers to investor participation compared to traditional venture capital.

Risks include market volatility affecting token values, regulatory uncertainty across jurisdictions, smart contract vulnerabilities, and challenges building sustainable tokenomics that maintain long-term value.

DAOs enable community-driven capital allocation through transparent voting mechanisms. Members can propose and approve funding decisions, creating democratic investment processes that align with decentralized principles.

The best method depends on project needs. IDOs suit community-first DeFi projects seeking decentralization. STOs work for real-world asset tokenization requiring compliance. IEOs provide credibility through exchange partnerships.

Yes, many Web3 startups successfully raise capital through token sales, DAO grants, community crowdfunding, and launchpad partnerships without traditional VC involvement, maintaining greater control over their projects.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.