Key Takeaways

- Gas on the Ethereum blockchain is measured in gwei, where 1 gwei equals 0.000000001 ETH, and a simple ETH transfer typically requires 21,000 gas units to complete.

[1] - After EIP-1559, the total transaction fee on Ethereum is split into a base fee that is burned by the protocol and a priority fee (tip) that goes to validators, replacing the old first-price auction system.

[2] - The base fee on Ethereum adjusts automatically, increasing by up to 12.5% when a block is 100% full and decreasing by up to 12.5% when a block is empty, helping keep fee changes predictable.

[3] - Average gas prices on Ethereum dropped from around 72 gwei in early 2024 to about 2.7 gwei by March 2025, representing a 96% decrease driven by Layer 2 adoption and the Dencun upgrade

- Solana transactions cost around $0.00025 per transaction on average, making it one of the cheapest blockchain networks for gas fees compared to Ethereum’s average of $0.44 as of mid 2025.

[4] - Complex smart contract operations like token swaps on decentralized exchanges require 100,000 to 200,000 gas units on Ethereum, while ERC-20 token transfers use about 45,000 to 65,000 gas units.

[5] - Layer 2 solutions such as Arbitrum, Optimism, and Polygon offer 90 to 99% cost reductions on gas fees compared to the Ethereum mainnet while keeping the same security guarantees.

If you have ever sent cryptocurrency, swapped tokens on a decentralized exchange, or tried minting an NFT, you have probably noticed something called a “gas fee” attached to your transaction. This fee is what keeps blockchains running. It pays the people who process your transaction and keeps the network safe from spam. But for many users, understanding how to estimate gas for blockchain transactions can feel confusing at first.

Gas is basically the fuel that powers every action on a blockchain. Just like you need petrol to drive a car from one place to another, you need gas to move data or value on a blockchain network. The tricky part is that gas fees are not fixed. They change depending on how busy the network is, how complex your transaction is, and which blockchain you are using. A simple transfer of Ethereum might cost just a few cents, while deploying a full smart contract could cost several dollars or more. That is why many businesses and developers now look for blockchain solutions that can optimize transaction execution, reduce unnecessary costs, and improve overall network efficiency.

In this blog, we will walk through everything you need to know about gas estimation in blockchain. You will learn what gas actually is, how gas fee calculation works on Ethereum and other chains, what tools you can use to check gas costs before you send a transaction, and practical tips for saving money on every blockchain interaction you make. Whether you are a beginner just learning about crypto or a developer building on the blockchain, this guide will help you understand gas fees in a way that is simple and easy to follow.

What Is Gas in Blockchain?

In the world of blockchain, gas refers to the unit that measures how much computational work is needed to carry out a specific operation. Every time you interact with a blockchain, whether that is sending coins, calling a smart contract, or approving a token for trading, the network has to do some work. Gas is how that work is measured and paid for.

Think of it this way. When you go to a restaurant, the bill depends on what you ordered. A glass of water costs nothing, but a full-course meal costs quite a bit. Similarly, a simple ETH transfer is like ordering water; it does not need much gas. But a complex DeFi swap or an NFT mint is like a full-course meal; it uses a lot more gas because the network has to do more calculations.

On Ethereum, gas is measured in units called gwei. One gwei is equal to 0.000000001 ETH. That is one billionth of a single Ether. The total fee you pay depends on two things: how many gas units your transaction uses and how much each unit costs at that moment. This is the basic formula behind every gas fee calculation on the Ethereum network.

1. Why Gas Exists on Blockchains

Gas fees serve a very important purpose beyond just paying validators. They protect the network from being flooded with useless or harmful transactions. If there were no cost to send transactions, anyone could spam the network with millions of fake requests, making it impossible for real users to get their transactions through. By attaching a small cost to every action, the blockchain makes sure people only send transactions that actually matter to them. Gas fees also create a natural way to prioritize transactions. When the network is busy, users who need faster processing can choose to pay a higher fee, while users who are not in a rush can wait for cheaper times.

2. Gas on Ethereum vs Other Blockchains

While Ethereum is the most well-known blockchain that uses the gas system, it is not the only one. BNB Smart Chain, Polygon, Avalanche, and many other EVM-compatible chains also use a similar gas model. However, each chain has its own fee structure and pricing. Some chains like Solana use a different system entirely, with fixed base fees and optional priority fees measured in compute units rather than gas. The concept remains the same, though: every blockchain needs a way to measure and pay for the work it does.

Recommended Reading:

How Gas Fees Work on Ethereum

Ethereum is the blockchain where the concept of gas was born, and it remains the most important network for understanding how gas fees work. When Ethereum first launched, gas fees were calculated using a simple auction model. Users would set a gas price, and the miners would pick the transactions with the highest bids. This often led to unpredictable and sometimes extremely high fees, especially during busy periods like popular NFT drops or DeFi farming events.

Everything changed in August 2021 when Ethereum implemented EIP-1559 as part of the London Hard Fork. This upgrade completely redesigned how transaction fees are handled. Instead of a single gas price, the system now uses three values: a base fee, a priority fee (also called a tip), and a max fee. Understanding these three parts is essential for anyone who wants to learn how to estimate gas fees properly.

1. The Base Fee

The base fee is set automatically by the Ethereum protocol itself. No one chooses it. It goes up or down depending on how full the previous block was. If the block is more than 50% full, the base fee increases for the next block. If it was less than 50% full, the base fee decreases. The maximum it can change by is 12.5% per block. This system makes fee changes much more predictable compared to the old auction model. The important thing to know is that the base fee gets burned, which means it is permanently removed from circulation and does not go to validators.

2. The Priority Fee (Tip)

The priority fee is an optional amount that you can add on top of the base fee. This tip goes directly to the validators who process your transaction. During normal times, even a very small tip of 1 to 2 gwei is usually enough to get your transaction included in the next block. But during periods of high demand, you might need to offer a larger tip to make sure validators pick your transaction over others.

3. The Max Fee

The max fee is the absolute highest amount you are willing to pay per unit of gas. You set this to protect yourself in case the base fee suddenly jumps while your transaction is waiting. If the base fee plus your tip is less than the max fee you set, the difference gets refunded to you. A good practice is to set your max fee at about double the current base fee plus your tip. This ensures your transaction stays valid even if there are several blocks in a row that are completely full.

4. The Gas Limit

The gas limit is the maximum number of gas units you are willing to spend on a transaction. For a simple ETH transfer, this is always 21,000 units. For more complex operations like smart contract calls, the gas limit can be much higher. If your transaction runs out of gas before it finishes, it fails, and you still lose the gas that was already used. That is why setting the right gas limit and gas price is so important.

The Gas Fee Calculation Formula

Now that you understand the parts that make up a gas fee, let us look at the actual formula. The gas fee calculation on Ethereum after EIP-1559 works like this:

Total Fee = Gas Units Used × (Base Fee + Priority Fee)

Let us work through a real example. Say you want to send 1 ETH to another wallet. This is a basic transfer that requires 21,000 gas units. If the current base fee is 10 gwei and you set a priority fee of 2 gwei, then your total cost would be:

21,000 × (10 + 2) = 252,000 gwei = 0.000252 ETH

If ETH is trading at around $2,500, that works out to roughly $0.63 for the entire transaction. That is pretty affordable for a direct wallet-to-wallet transfer.

But what if you are doing something more complex? A token swap on a decentralized exchange might use 150,000 gas units. Using the same base fee and tip:

150,000 × (10 + 2) = 1,800,000 gwei = 0.0018 ETH

At $2,500 per ETH, that comes to about $4.50. As you can see, the complexity of the transaction plays a huge role in the final cost. This is why transaction gas cost varies so much from one type of action to another.

Gas Usage by Transaction Type on Ethereum

| Transaction Type | Typical Gas Units | Approximate Cost (at 10 Gwei Base Fee) |

|---|---|---|

| Simple ETH Transfer | 21,000 | $0.05 to $0.20 |

| ERC-20 Token Transfer | 45,000 to 65,000 | $0.20 to $0.50 |

| Token Swap on DEX | 100,000 to 200,000 | $0.50 to $2.00 |

| NFT Minting | 100,000+ | $1.00 to $5.00 |

| Smart Contract Deployment | 300,000 to 1,000,000+ | $5.00 to $50.00+ |

| NFT Sale Transaction | 600,000+ | $3.00 to $15.00+ |

| Cross-Chain Bridge Transfer | 100,000 to 350,000 | $1.00 to $10.00 |

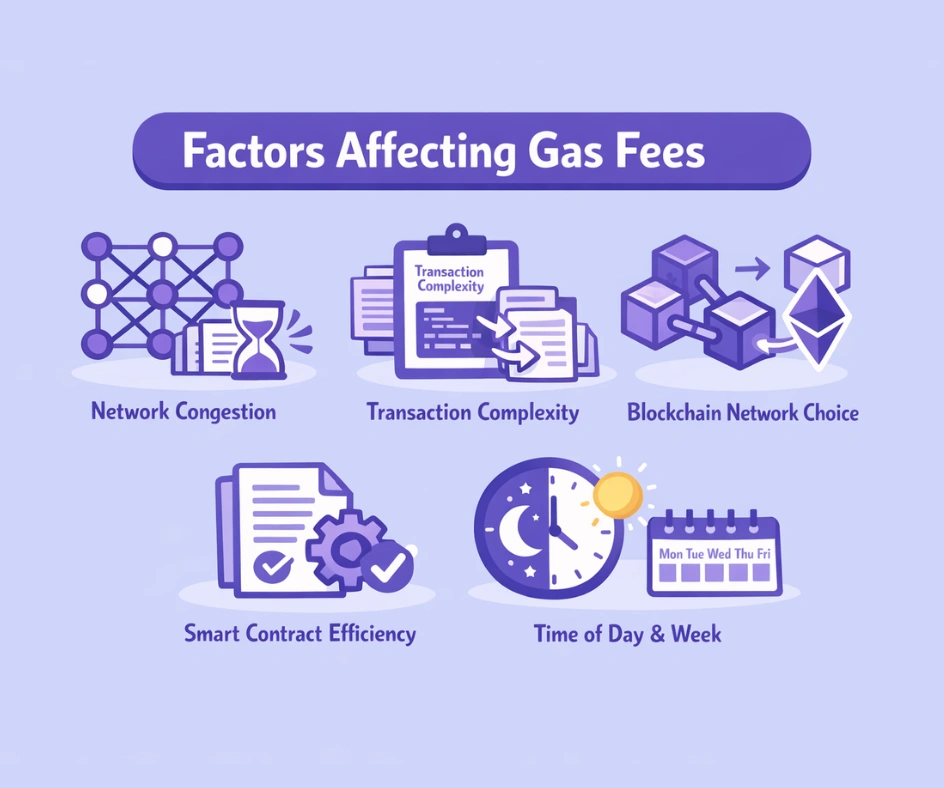

What Factors Affect Gas Fees?

Understanding how gas fees work also means knowing what causes them to go up or down. Several factors directly influence the cost of a blockchain transaction, and being aware of these can help you time your transactions better and avoid paying more than necessary.

1. Network Congestion

This is the biggest factor. When lots of people are trying to use the blockchain at the same time, the demand for block space goes up. Since each block can only hold a limited number of transactions, users start competing by offering higher fees. During the 2021 NFT boom, for example, minting or trading on Ethereum could cost over $100 in gas alone. On quiet days, the same actions might cost less than a dollar.

2. Transaction Complexity

The more complex your transaction is, the more gas it needs. A basic ETH transfer is the simplest action you can do, requiring just 21,000 gas units. But when you interact with a smart contract, the contract has to run code, read and write data to the blockchain, and sometimes interact with other contracts too. All of this adds up. A DeFi lending operation or a multi-step swap can use hundreds of thousands of gas units.

3. Blockchain Network Choice

Different blockchains have very different fee structures. Ethereum tends to have higher fees because of its popularity and limited throughput. Chains like Solana, Polygon, and BNB Smart Chain were designed to handle more transactions at lower costs. Choosing the right network for your needs can make a massive difference in how much you pay.

4. Smart Contract Efficiency

The way a smart contract is written directly affects how much gas it uses. Well-optimized code uses fewer storage operations, packs variables efficiently, and avoids unnecessary computations. Poorly written contracts waste gas on every interaction. This is why smart contract development teams focus heavily on gas optimization during the coding and testing phases.

5. Time of Day and Week

Gas prices tend to follow patterns. Weekday afternoons (in US time zones) are often the busiest times on Ethereum because that is when trading activity peaks. Weekends and late-night hours usually see lower fees. By timing your transactions during quieter periods, you can save a noticeable amount on every interaction.

Tools to Estimate Gas for Blockchain Transactions

You do not have to guess how much gas your transaction will cost. There are several tools and platforms built specifically to help you get a blockchain gas fee estimate before you submit anything. Using these tools is one of the smartest things you can do as a crypto user or developer.

1. Etherscan Gas Tracker

Etherscan’s gas tracker is one of the most popular and widely used tools for monitoring Ethereum gas prices in real time. It shows you the current low, average, and high gas prices in gwei. It also provides the estimated cost for common actions like ETH transfers, ERC-20 transfers, and Uniswap swaps. On top of that, it includes charts showing gas price trends over the last 1,000 blocks, which can help you identify patterns and find the cheapest times to transact.

2. Blocknative Gas Estimator

Blocknative takes a different approach. Their gas estimator is powered by deep analysis of pending transactions in the Ethereum mempool (the waiting area for unconfirmed transactions). It gives you gas price recommendations categorized as “Slow,” “Standard,” and “Fast,” along with how long each option is likely to take for confirmation. They also offer a Chrome browser extension that makes it easy to check gas prices without leaving your current tab.

3. Cryptoneur Gas Fee Calculator

The Cryptoneur gas calculator for crypto lets you input the details of your transaction and see the estimated cost in your local currency. It supports multiple EVM-compatible networks, including Ethereum mainnet, Arbitrum, and Polygon. This is especially useful for people who want to compare the cost of the same transaction across different networks before deciding where to execute it.

4. The eth_estimateGas API Call

For developers building applications on the blockchain, the eth_estimateGas function is a built-in API call that most Ethereum nodes support. You send it the details of your planned transaction, and it returns the number of gas units that the transaction would need. This is what wallets like MetaMask use behind the scenes to suggest gas limits for your transactions. Etherscan also offers this as an API endpoint, making it easy to integrate into any application.

5. Wallet Built-in Estimators

Modern crypto wallets like MetaMask, Trust Wallet, and Coinbase Wallet have built-in Ethereum gas estimation features. When you start a transaction, the wallet automatically checks the current network conditions and suggests appropriate gas settings. Most wallets also let you switch between slow, standard, and fast options, giving you control over how much you want to pay and how long you are willing to wait.

Recommended Reading:

Gas Estimation on Different Blockchain Networks

While Ethereum gets most of the attention when it comes to gas fees, every blockchain has its own approach to pricing transactions. If you are trying to estimate gas for blockchain transactions across different networks, it helps to understand how each one handles fees differently.

1. Ethereum

Ethereum uses the EIP-1559 model we discussed earlier. Gas prices fluctuate based on network demand, with the base fee adjusting automatically. As of mid 2025, average gas prices on Ethereum hover around 2 to 5 gwei on most days, making simple transfers cost well under $1. However, during peak activity, fees can still spike significantly. Ethereum processed about $2.48 billion in total fees during 2024, showing just how much activity flows through this network.

2. BNB Smart Chain (BSC)

BNB Smart Chain uses a similar gas model to Ethereum but with much lower fees. The average transaction fee on BSC is about $0.12, making it roughly 3 to 4 times cheaper than Ethereum for most operations. BSC achieves this through its Proof of Staked Authority (PoSA) consensus mechanism, which uses a smaller set of 21 validators. This makes it faster and cheaper, though some argue it comes at the cost of being more centralized than Ethereum.

3. Solana

Solana takes a completely different approach to transaction fees. Instead of gas units, Solana uses compute units, but the result for users is extremely low costs. The average transaction on Solana costs around $0.00025, which is less than one tenth of a cent. Solana achieves this through its unique Proof of History (PoH) mechanism combined with parallel transaction processing, which allows it to handle thousands of transactions per second without driving up fees.

4. Polygon

Polygon operates as a Layer 2 scaling solution for Ethereum. It processes transactions on its own chain and then posts compressed data back to Ethereum for security. This design allows Polygon to offer gas fees as low as $0.001 to $0.01 per transaction. For users who want Ethereum compatibility without the high fees, Polygon has become one of the most popular choices.

5. Arbitrum and Optimism

These are optimistic rollup solutions that batch many transactions together before posting them to the Ethereum mainnet. Arbitrum’s average transaction fee is around $0.0088, while Optimism typically charges under $0.50. Both offer full Ethereum compatibility, meaning you can use the same wallets, tools, and smart contracts as on Ethereum but at a fraction of the cost.

Gas Fee Comparison Across Major Blockchain Networks

| Blockchain Network | Average Transaction Fee (USD) | Fee Model and Notes |

|---|---|---|

| Ethereum | $0.44 | EIP-1559 with base fee plus priority fee; base fee is burned |

| BNB Smart Chain | $0.05 to $0.20 | PoSA consensus with 21 validators; fees paid in BNB |

| Solana | $0.00025 | Proof of History with parallel processing; fees paid in SOL |

| Polygon | $0.001 to $0.01 | Layer 2 sidechain for Ethereum; fees paid in POL |

| Avalanche | $0.01 to $0.10 | Subnet architecture with customizable fee settings; fees in AVAX |

| Arbitrum | $0.0088 | Optimistic rollup Layer 2; batches transactions to the Ethereum mainnet |

| Optimism | Under $0.50 | Optimistic rollup with broad DeFi adoption; fees in ETH |

How EIP-1559 Changed Ethereum Gas Estimation

Before EIP-1559, Ethereum gas estimation was a guessing game. You had to pick a gas price that you thought would be high enough to get your transaction included in a block, but not so high that you would overpay. If you guessed too low, your transaction could get stuck for hours or even days. If you guessed too high, you wasted money.

EIP-1559 fixed this problem in a really clever way. By introducing the automatic base fee that adjusts with each block, the network essentially tells you the minimum price you need to pay. Wallets can now read this base fee directly from the blockchain and suggest appropriate settings automatically. Most users no longer need to manually adjust gas prices at all.

The upgrade also introduced something called variable block sizes. Before EIP-1559, every Ethereum block had a fixed gas limit. After the upgrade, blocks can temporarily expand to handle up to twice the target size. This means that during short bursts of high demand, more transactions can fit into a single block, which helps prevent sudden fee spikes. The target is to keep blocks at about 50% capacity on average, with the base fee adjusting to maintain this balance.

Another big benefit of EIP-1559 is the fee-burning mechanism. Because the base fee is permanently removed from circulation, every transaction on Ethereum actually reduces the total supply of ETH. During periods of high activity, the amount of ETH being burned can even exceed the amount being created through staking rewards, making ETH temporarily deflationary. This has important implications for the long-term economics of the Ethereum network.

How Layer 2 Solutions Reduce Gas Costs

One of the biggest changes in the blockchain world over the past couple of years has been the rise of Layer 2 solutions. These are separate networks that sit on top of Ethereum and handle transactions off the main chain, dramatically reducing gas costs while still benefiting from Ethereum’s security.

There are two main types of Layer 2 solutions that you should know about: optimistic rollups and zero-knowledge (ZK) rollups. Both work by batching many transactions together and then submitting a compressed summary to the Ethereum mainnet.

1. Optimistic Rollups

Networks like Arbitrum and Optimism use optimistic rollups. They assume all transactions are valid by default and only run full verification if someone challenges a transaction. This approach is simpler and supports existing Ethereum smart contracts with minimal changes. Arbitrum currently offers fees of around $0.05 to $0.30 per transaction, which is a massive reduction compared to the Ethereum mainnet.

2. Zero-Knowledge Rollups

ZK rollups like zkSync Era and Polygon zkEVM use mathematical proofs to verify transaction batches. They are more complex to build but offer faster finality because the proof confirms everything is valid without waiting for a challenge period. zkSync typically charges under $0.10 per transaction, making it one of the cheapest ways to interact with Ethereum-compatible applications.

3. Impact of the Dencun Upgrade

The Dencun upgrade, which went live on Ethereum in March 2024, made Layer 2 solutions even cheaper. It introduced “blob” transactions through EIP-4844, which gave rollups a much cheaper way to post their data to the Ethereum mainnet. This single upgrade reduced Layer 2 data posting costs by 50 to 90%, and its effects were felt immediately across all major rollup networks.

Practical Tips to Reduce Your Gas Fees

Now that you understand how gas estimation in blockchain works, here are some practical steps you can take to spend less on every transaction.

1. Time Your Transactions

Use a gas tracker to monitor prices throughout the day. On Ethereum, late night and early morning hours (in US time zones) often have the lowest fees. Weekends are also typically cheaper than weekdays. If your transaction is not urgent, waiting a few hours can sometimes save you 20 to 30% on gas costs.

2. Use Layer 2 Networks

For most everyday activities like token swaps, lending, or sending stablecoins, Layer 2 networks offer the same functionality as the Ethereum mainnet at a tiny fraction of the cost. Most major DeFi protocols now have deployments on Arbitrum, Optimism, Base, and Polygon. Making the switch is one of the most effective ways to cut your gas spending.

3. Set Appropriate Gas Limits

Do not set your gas limit higher than necessary. While unused gas is refunded, failed transactions due to too low a limit still cost you the gas that was used before the failure. Most wallets do a good job of estimating the right gas limit, but you can also check historical transactions for the same contract on a block explorer to see how much gas similar transactions actually used.

4. Batch Transactions When Possible

If you need to perform multiple operations, look for ways to combine them into a single transaction. Some DeFi protocols and wallet interfaces support batching, which lets you approve and swap tokens in one go instead of two separate transactions. This can cut your total gas costs nearly in half for multi-step operations.

5. Consider Alternative Blockchains

If you are sending stablecoins or doing simple transfers, consider using a chain with lower fees. Solana, BNB Smart Chain, and Polygon all support major tokens like USDT and USDC, and the fees are negligible compared to Ethereum. Just make sure the receiving party has a wallet on the same network you are sending from.

Recommended Reading:

Gas Optimization for Smart Contract Developers

If you are a developer building smart contracts, gas optimization is something you need to think about from the very first line of code. Every unnecessary computation, every extra storage operation, and every poorly structured function costs your users more gas. Here are some key strategies that experienced developers use.

1. Minimize Storage Operations

Writing data to the blockchain (storage) is by far the most expensive operation in terms of gas. Every time you use the SSTORE opcode, it costs a significant amount of gas. Developers should reduce the number of storage writes wherever possible. Use memory or calldata for temporary values, and only write to storage when absolutely needed.

2. Pack Variables Efficiently

Solidity stores variables in 32-byte slots. If you declare two uint128 variables next to each other, they can share a single storage slot, saving gas. But if you put a uint256 between them, each needs its own slot. Smart ordering of variables in your contract can reduce storage costs without changing any functionality.

3. Use Events Instead of Storage for Read-Only Data

If you need to record data that only needs to be read off-chain (like transaction history or activity logs), use events instead of storage variables. Events are recorded in transaction logs and cost much less gas than writing to contract storage. Off-chain applications can still read this data using filters and event listeners.

4. Prefer Mappings Over Arrays

When you need to store a collection of items indexed by a key, use mappings instead of arrays. Mappings have constant time (O(1)) access cost regardless of size, while arrays can get increasingly expensive to iterate through as they grow. For most use cases in smart contracts, mappings provide better gas efficiency.

5. Use Fixed-Size Types Where Possible

Fixed-size byte arrays (like bytes32) are generally cheaper than dynamic types (like string or bytes). If you know the maximum size of your data ahead of time, using a fixed-size type can save gas on both storage and computation.

6. Test Gas Usage Thoroughly

Use development tools like Hardhat and Foundry that provide gas reports for every function call. Track gas usage across different test scenarios and look for functions that consume unexpectedly high amounts. Gas profiling should be a standard part of your testing pipeline, not an afterthought.

The Future of Gas Fees in Blockchain

The blockchain world is not standing still when it comes to gas fees. Several upcoming upgrades and trends are expected to make transactions even cheaper and more efficient in the coming months and beyond.

Ethereum has a clear roadmap for continued improvements. The Pectra upgrade is focused on further enhancing network efficiency and validator operations. Beyond that, proposals to increase the gas limit from 36 million to 150 million (through the Fusaka upgrade) could dramatically increase the network’s capacity and lower fees even further. The long term vision includes full danksharding, which would multiply Ethereum’s data availability many times over, making Layer 2 solutions cheaper than they already are.

On other networks, innovation continues at a rapid pace. Solana is exploring state compression techniques to make NFT storage even cheaper. BNB Smart Chain continues to optimize its validator operations. New Layer 1 blockchains like Sui and Aptos are experimenting with novel approaches to transaction processing that could push fees even lower.

Account abstraction is another trend worth watching. With account abstraction, users can pay gas fees using any token, not just the native token of the chain they are on. Some implementations even allow third parties (like dApp developers) to sponsor gas fees for their users, creating a “gasless” experience. This does not eliminate gas fees from the network’s perspective, but it removes the friction for end users who just want to use an application without worrying about holding the right native token.

Blockchain Solutions in the Real World

The following projects show how blockchain architecture is already being applied across DeFi platforms, blockchain explorers, and high-throughput networks. Each project uses the same gas optimization, smart contract efficiency, and transaction processing principles discussed throughout this article, from gas-efficient contract design and validator operations to Layer 2 scaling and cross-chain development.

🔗

Hubble Protocol: Gas Optimized DeFi Lending Platform

Built a high-performance DeFi borrowing platform with advanced smart contracts and gas-optimized processes. The platform enables users to borrow against cryptocurrency assets with low transaction fees, efficient algorithms, and a backend infrastructure designed to handle thousands of transactions while minimizing gas costs for every user interaction.

🔍

MerkleChain Explorer: Real-Time Blockchain Analytics

Developed a full-featured blockchain explorer for Future Smart Chain that provides real-time tracking of transactions, blocks, gas prices, and smart contracts. The explorer handles high transaction volumes with a sharding architecture, giving users immediate access to gas usage data, transaction costs, and network activity statistics.

Build Gas-Efficient Blockchain Solutions Today:

Our blockchain development team specializes in smart contract optimization, gas-efficient architecture, and multi-chain integration. From DeFi protocols to custom token development, we deliver solutions that minimize transaction costs for your users while keeping performance and security at the highest level. Whether you need a gas-optimized smart contract or a complete blockchain platform, we build solutions that work.

Conclusion

Understanding how to estimate gas for blockchain transactions is one of the most practical skills you can develop as a crypto user or blockchain developer. Gas fees are not just a random cost that gets added to your transactions. They are a carefully designed system that keeps blockchains running, rewards the people who validate transactions, and protects the network from abuse. Once you understand how this system works, you can make smarter decisions about when to transact, which network to use, and how much to pay.

The key to saving on gas is knowledge. Know the formula: total fee equals gas units multiplied by the sum of the base fee and priority fee. Know what affects gas prices: network congestion, transaction complexity, and the blockchain you are using. Know the tools: Etherscan Gas Tracker, Blocknative, Cryptoneur, and the built-in estimators in your wallet. And know the strategies: time your transactions, use Layer 2 networks, batch operations, and consider alternative blockchains for simple transfers.

For developers, writing gas-efficient smart contracts is not just about saving money. It is about creating a better experience for every user who interacts with your code. Every unnecessary storage operation, every poorly packed variable, and every unoptimized function translates directly into higher costs for your users. The best blockchain projects are the ones that take gas optimization seriously from the design phase all the way through deployment and testing.

The good news is that blockchain gas fees are on a clear downward trend. Ethereum’s upgrades from EIP-1559 to the Dencun upgrade have already cut fees dramatically. Layer 2 solutions are making blockchain more accessible to millions of new users. And the next wave of improvements, from increased gas limits to full danksharding, promise to make things even better. Whether you are building the next great DeFi protocol or simply trying to send some tokens to a friend, the future of blockchain transactions is looking more affordable every day.

Frequently Asked Questions

Gas is a unit that measures the amount of computational work needed to process a transaction or run a smart contract on a blockchain network like Ethereum. Users pay gas fees in the network’s native cryptocurrency to compensate validators for the resources they use to verify and confirm transactions. The more complex the operation, the more gas it requires.

After the EIP-1559 upgrade, Ethereum gas fees are calculated by multiplying the number of gas units used by the sum of the base fee and the priority fee. The base fee is set automatically by the network based on how full the previous block was. The priority fee is an optional tip you add to incentivize validators to include your transaction faster.

Gas fees fluctuate because they are driven by supply and demand. When many users are trying to use the blockchain at the same time, the demand for limited block space increases and fees go up. When the network is quiet and blocks are mostly empty, fees drop. Time of day, day of the week, and special events like popular NFT launches all affect how busy the network is.

Among major blockchains, Solana consistently offers some of the lowest transaction fees at around $0.00025 per transaction. Polygon, Arbitrum, and other Layer 2 networks also offer very low fees, typically under $0.01 for simple transactions. The best choice depends on what you need to do, as different chains support different tokens and applications.

You cannot completely avoid gas fees because they are a fundamental part of how blockchain networks operate. However, some applications offer “gasless” experiences where the dApp developer pays the gas fee on your behalf using account abstraction or meta-transactions. The gas still gets paid to the network, but the end user does not have to pay it directly.

If your gas limit is lower than what the transaction actually needs to complete, the transaction will fail with an “out of gas” error. The important thing to know is that you still lose the gas that was already consumed before the failure. This is why it is important to use proper gas estimation tools and not set your gas limit below the recommended amount.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.