Flash swaps in DEX represent one of the most powerful innovations in decentralized finance, enabling traders to borrow assets without collateral and execute complex strategies within a single transaction block. This revolutionary capability has transformed how sophisticated traders approach decentralized exchange arbitrage, liquidations, and capital efficiency optimization. With over $200 million in daily flash swap volume across major protocols, understanding how flash swaps work has become essential knowledge for DeFi participants seeking to maximize their trading edge. This comprehensive guide explores flash swap strategies, technical implementation, security considerations, and practical applications that can enhance your DeFi trading toolkit.

Key Takeaways

- Zero Collateral Required: Flash swaps allow borrowing any amount of tokens without upfront capital, repaying within the same transaction.

- Atomic Execution: All operations complete in a single transaction block, eliminating counterparty risk through automatic reversal if conditions fail.

- Arbitrage Powerhouse: Enable instant exploitation of price discrepancies across DEXs without capital requirements.

- Smart Contract Integration: Require custom Solidity contracts implementing callback functions to handle borrowed assets.

- Fee Structure: Typically charge 0.3% on borrowed amounts, factored into profitability calculations.

- MEV Opportunities: Create profitable scenarios through maximal extractable value strategies when properly implemented.

- Risk Considerations: Smart contract vulnerabilities, gas costs, and execution failures require careful management.

What Are Flash Swaps in DEX?

Flash swaps in DEX platforms are advanced DeFi mechanisms that allow users to borrow tokens directly from a liquidity pool without providing collateral upfront, as long as the borrowed amount plus fees is returned within the same blockchain transaction. This makes flash swaps fundamentally different from traditional lending, where users must first lock collateral before accessing liquidity.[1]

The concept was popularized by the Flash swaps Uniswap implementation, which introduced an optimistic execution model. In this model, the protocol temporarily allows users to withdraw tokens first and settle the payment later within the same transaction block. If the user fails to repay the borrowed tokens along with the required fees before the transaction ends, the entire transaction automatically reverts. In simple terms, it is treated as if the swap never happened.

The security of flash swaps relies on transaction atomicity in blockchain networks. Atomicity ensures that every operation within a transaction must either complete fully or fail entirely. Flash swaps take advantage of this property by allowing short-lived access to liquidity, knowing that the blockchain will enforce repayment. Even though the user is briefly undercollateralized during execution, the protocol remains secure because any unpaid transaction is instantly rolled back.

How Flash Swaps Work: Technical Deep Dive?

The mechanics of decentralized exchange flash swaps involve a specific sequence of operations coordinated through smart contract callbacks. Understanding this flow is essential for implementing effective flash swap strategies.

Flash Swap Execution Flow

Step 1: Initiate Flash Swap

Your smart contract calls the liquidity pool’s swap function, specifying the amount of tokens to receive and providing callback data. The request signals that you want to receive tokens before providing payment.

Step 2: Receive Tokens

The pool immediately transfers the requested tokens to your contract before any payment is made. At this point, you have borrowed assets without providing anything in return.

Step 3: Execute Your Strategy

Your callback function executes whatever logic you need, whether arbitrage, liquidation, collateral swaps, or other operations using the borrowed tokens. This is where value creation happens.

Step 4: Repay the Pool

Before the callback completes, you must return either the borrowed tokens plus fees or the equivalent value in the paired token. The pool accepts either form of repayment.

Step 5: Verification

The pool verifies that adequate repayment was received. If not, the entire transaction reverts, returning everything to the original state as if nothing happened.

Flash Swaps vs Flash Loans

Understanding flash swaps vs flash loans clarifies when to use each tool for optimal results:

| Feature | Flash Swaps | Flash Loans |

|---|---|---|

| Source | DEX liquidity pools (Uniswap) | Lending protocols (Aave, dYdX) |

| Repayment Options | Same token or paired token | Same token only |

| Typical Fee | 0.3% (Uniswap V2) | 0.09% (Aave V3) |

| Best Use Case | DEX arbitrage, token swaps | Collateral swaps, liquidations |

| Flexibility | Can repay in different token | Must repay exact borrowed token |

Flash swaps offer unique flexibility through their ability to repay in either token of the pair, making them particularly suited for DEX arbitrage strategies where you may end up with different tokens than you started with.

Flash Swap Strategies for Profitable Trading

Effective flash swaps trading strategy implementation requires understanding the various applications and their profit potential. Here are the most powerful strategies used by sophisticated DeFi traders.

1. Arbitrage Using Flash Swaps

Arbitrage using flash swaps is the most common and profitable application. When price discrepancies exist between different DEXs or liquidity pools in DEX platforms, flash swaps enable instant exploitation without capital requirements.

Flash swaps for arbitrage work as follows:

- Identify a token trading at $100 on Uniswap and $102 on SushiSwap

- Initiate flash swap to borrow 100 tokens from Uniswap

- Sell borrowed tokens on SushiSwap for $10,200

- Use proceeds to repay Uniswap (100 tokens × $100 + 0.3% fee = $10,030)

- Keep the $170 profit minus gas costs

This on-chain arbitrage happens atomically, ensuring you either profit or pay nothing but gas. The strategy requires careful calculation to ensure profits exceed fees and gas costs.

2. Triangular Arbitrage

Advanced DEX arbitrage strategies involve triangular routes where price inefficiencies exist across three or more trading pairs. For example:

- Flash swap ETH from ETH/USDC pool

- Trade ETH → LINK on another pool

- Trade LINK → USDC on a third pool

- Repay original ETH flash swap with USDC equivalent

- Profit from the price inefficiency across the triangle

These complex strategies require sophisticated automated arbitrage in DEX systems that can calculate optimal routes and execute faster than competitors.

3. Liquidation Execution

Flash swaps power efficient liquidation bots on lending protocols. When a borrower becomes undercollateralized, the sequence works as follows:

- Flash swap the debt token needed for liquidation

- Execute liquidation on the lending protocol

- Receive discounted collateral as liquidation reward

- Sell collateral to repay the flash swap

- Keep the liquidation bonus as profit

This strategy enables anyone to perform liquidations without holding the debt token inventory, democratizing access to DeFi trading strategies previously limited to well-capitalized actors.

4. Collateral Swap Strategy

Users can swap their collateral on lending platforms without closing positions:

- Flash swap new collateral token

- Deposit new collateral into lending position

- Withdraw original collateral

- Swap original collateral to repay flash swap

This enables seamless portfolio rebalancing while maintaining borrowing positions, avoiding the need to close and reopen loans.

5. Self-Liquidation Protection

When approaching liquidation threshold, users can protect themselves:

- Flash swap the debt token

- Repay part of your loan to improve health factor

- Withdraw freed collateral

- Sell collateral to repay flash swap

This avoids paying liquidation penalties to third parties by self-managing position health.

Flash Swaps Solidity: Smart Contract Implementation

Implementing flash swaps Solidity contracts requires understanding the callback interface and proper security measures. Here is a foundational implementation for flash swap smart contracts.

Uniswap V2 Flash Swap Contract

The Uniswap V2 flash swap implementation requires the following contract structure:

// SPDX-License-Identifier: MIT

pragma solidity ^0.8.19;

import "@uniswap/v2-core/contracts/interfaces/IUniswapV2Pair.sol";

import "@uniswap/v2-core/contracts/interfaces/IUniswapV2Factory.sol";

import "@openzeppelin/contracts/token/ERC20/IERC20.sol";

contract FlashSwapArbitrage {

address private constant FACTORY = 0x5C69bEe701ef814a2B6a3EDD4B1652CB9cc5aA6f;

address private constant WETH = 0xC02aaA39b223FE8D0A0e5C4F27eAD9083C756Cc2;

address public owner;

constructor() {

owner = msg.sender;

}

modifier onlyOwner() {

require(msg.sender == owner, "Not authorized");

_;

}

function startFlashSwap(

address token0,

address token1,

uint256 amount0,

uint256 amount1

) external onlyOwner {

address pair = IUniswapV2Factory(FACTORY).getPair(token0, token1);

require(pair != address(0), "Pair does not exist");

bytes memory data = abi.encode(token0, token1, amount0, amount1);

IUniswapV2Pair(pair).swap(

amount0,

amount1,

address(this),

data // Non-empty data triggers flash swap

);

}

function uniswapV2Call(

address sender,

uint256 amount0,

uint256 amount1,

bytes calldata data

) external {

// Verify callback is from legitimate pair

address token0 = IUniswapV2Pair(msg.sender).token0();

address token1 = IUniswapV2Pair(msg.sender).token1();

address pair = IUniswapV2Factory(FACTORY).getPair(token0, token1);

require(msg.sender == pair, "Invalid caller");

require(sender == address(this), "Invalid sender");

// Decode callback data

(address tokenBorrow, address tokenPay,

uint256 borrowAmount, uint256 payAmount) =

abi.decode(data, (address, address, uint256, uint256));

// ========================================

// Execute your arbitrage logic here

// Example: Trade on another DEX for profit

// ========================================

// Calculate repayment amount (borrowed + 0.3% fee)

uint256 amountRequired = (borrowAmount * 1000) / 997 + 1;

// Repay the flash swap

IERC20(tokenPay).transfer(pair, amountRequired);

}

function withdrawTokens(address token) external onlyOwner {

uint256 balance = IERC20(token).balanceOf(address(this));

IERC20(token).transfer(owner, balance);

}

receive() external payable {}

}Key Implementation Points

Callback Function: The uniswapV2Call function is automatically invoked by the pair contract when flash swap data is provided. This is where your strategy logic executes.

Verification: Always verify the caller is the legitimate pair contract by checking against the factory. This prevents malicious contracts from calling your callback.

Fee Calculation: Uniswap V2 charges a 0.3% fee, meaning you must repay 100.3% of borrowed amount. The formula (amount * 1000) / 997 calculates this correctly.

Flash Swaps Smart Contract Security

Flash swaps smart contract security is paramount given the high-value transactions involved. Vulnerabilities can result in complete fund loss. Here are essential security considerations.

Critical Security Measures

1. Callback Verification

Always verify that callback functions are called by legitimate liquidity pools. Attackers can create malicious contracts that impersonate pools:

// Proper callback verification

function uniswapV2Call(...) external {

address token0 = IUniswapV2Pair(msg.sender).token0();

address token1 = IUniswapV2Pair(msg.sender).token1();

address pair = IUniswapV2Factory(FACTORY).getPair(token0, token1);

require(msg.sender == pair, "Unauthorized callback");

require(sender == address(this), "Invalid initiator");

}2. Reentrancy Protection

Use reentrancy guards on all external functions to prevent attack vectors where malicious tokens trigger unexpected callback execution.

3. Access Controls

Restrict flash swap initiation to authorized addresses to prevent griefing attacks where attackers trigger unprofitable trades that waste your gas.

4. Profit Validation

Implement minimum profit thresholds to ensure transactions are only executed when profitable after fees and gas costs are considered.

Common Vulnerabilities to Avoid

| Vulnerability | Risk | Mitigation |

|---|---|---|

| Unchecked Callback Origin | Fund theft | Verify pair address via factory |

| Missing Profit Check | Unprofitable trades | Minimum profit threshold |

| Reentrancy | State manipulation | ReentrancyGuard modifier |

| Hardcoded Addresses | Cross-chain failures | Configurable parameters |

| Integer Overflow | Calculation errors | Solidity 0.8+ or SafeMath |

Gas Optimization for Flash Swaps

Gas optimization for flash swaps directly impacts profitability. High gas costs can eliminate profit margins entirely, making optimization essential for successful strategies.

Optimization Techniques

Minimize Storage Operations: Storage reads and writes are expensive operations. Use memory variables where possible and batch storage updates to reduce gas consumption.

Efficient Token Transfers: Use direct transfer calls rather than transferFrom when possible. Approve maximum amounts once rather than per-transaction to save approval gas.

Calldata Optimization: Pack callback data efficiently to reduce calldata costs. Use tight encoding for parameters and avoid unnecessary data.

Assembly Operations: For critical paths, consider inline assembly for operations like address calculations and simple arithmetic that can be optimized beyond Solidity’s compiler output.

| Operation | Standard Gas | Optimized Gas | Savings |

|---|---|---|---|

| Storage Write | 20,000 | 5,000 (memory) | 75% |

| Token Transfer | ~65,000 | ~50,000 | 23% |

| Pair Calculation | ~3,000 | ~800 (assembly) | 73% |

| Data Encoding | ~2,500 | ~1,200 (packed) | 52% |

MEV Opportunities Using Flash Swaps

MEV opportunities using flash swaps represent advanced profit extraction strategies that sophisticated traders employ. Maximal Extractable Value (MEV) includes arbitrage, liquidations, and sandwich attacks that flash swaps can enable.

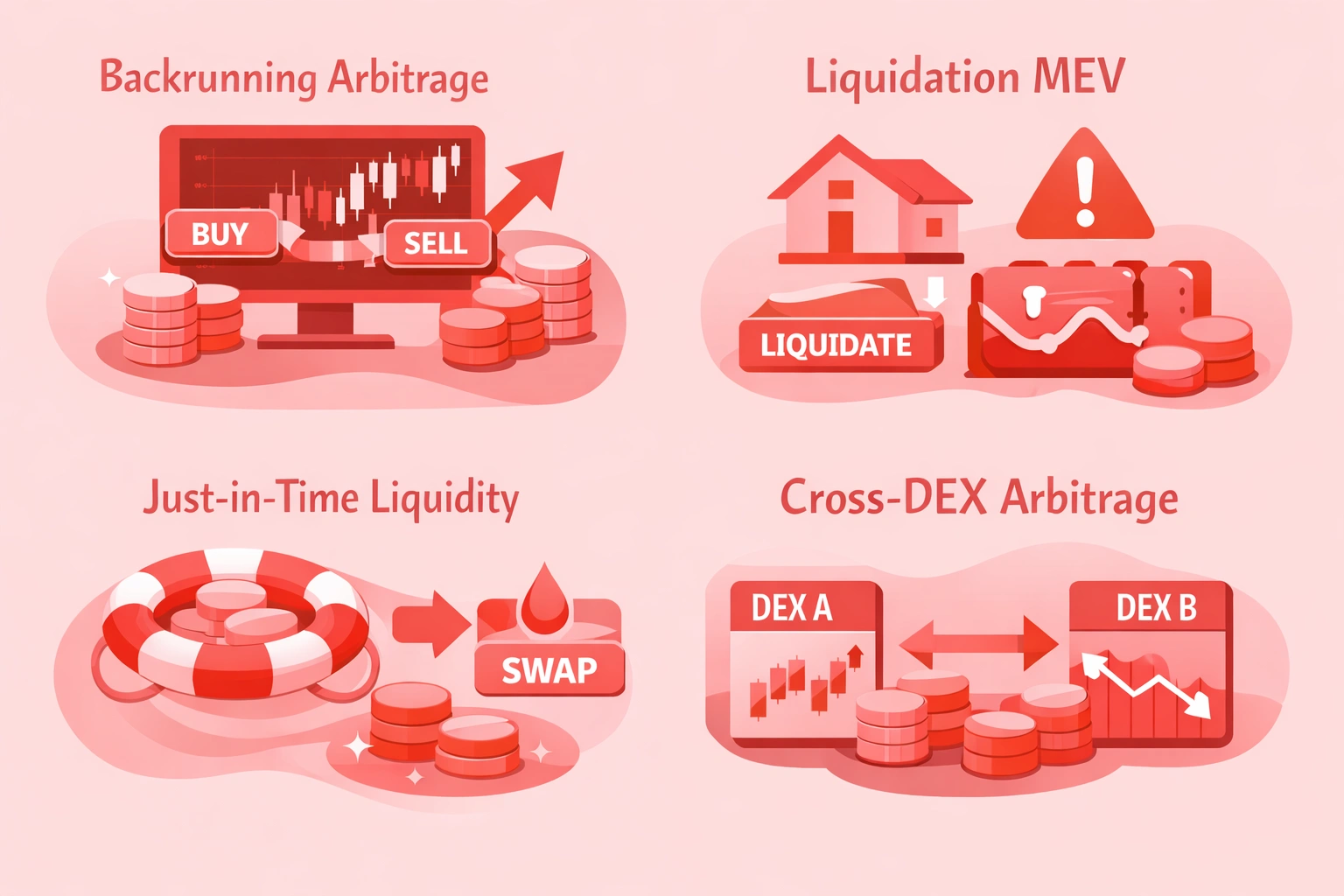

Types of MEV with Flash Swaps

Backrunning Arbitrage: Monitor the mempool for large trades that will move prices significantly. Position flash swap arbitrage transactions immediately after to capture the price impact created by the original trade.

Liquidation MEV: Race to liquidate undercollateralized positions using flash swaps to provide the debt token instantly. The liquidation bonus often exceeds flash swap fees, creating profitable opportunities.

Just-in-Time Liquidity: Provide concentrated liquidity just before large swaps execute, capture the trading fees generated, then withdraw immediately after the swap completes.

Cross-DEX Arbitrage: Simultaneously exploit price differences across multiple automated market maker (AMM) platforms, using flash swaps to provide the capital needed for the initial leg.

These strategies require sophisticated infrastructure including private mempools, Flashbots integration, and high-performance computing to compete effectively against other MEV searchers.

Automated Market Maker Integration

Flash swaps integrate deeply with automated market maker (AMM) mechanics. Understanding how AMMs price assets helps identify profitable flash swap opportunities and optimize execution.

AMM Price Impact Calculation

AMMs use the constant product formula: x × y = k. When you borrow tokens through a flash swap, you temporarily reduce one side of the pool, affecting prices. Your repayment must account for this price impact plus the protocol fee.

Liquidity pools in DEX platforms determine the available borrowing capacity and price impact of flash swaps. Deeper pools allow larger borrows with less slippage, while shallow pools may not support profitable arbitrage due to excessive price impact.

Multi-Pool Routing Strategies

Advanced strategies route through multiple liquidity pools in DEX platforms to optimize execution:

- Split large trades across multiple pools to reduce aggregate price impact

- Route through intermediate tokens when direct pools lack sufficient liquidity

- Combine flash swaps from multiple sources for larger position sizes

- Consider pool fee tiers when calculating optimal routing paths

Risks and Limitations of Flash Swaps

While powerful, flash swaps carry significant risks that traders must understand and actively manage to avoid losses.

Technical Risks

Smart Contract Bugs: Errors in your flash swap contract can result in failed transactions (wasting gas) or worse, fund loss if exploitable vulnerabilities exist in your logic.

Oracle Manipulation: Some strategies rely on price oracles that can be manipulated within the same transaction, leading to unprofitable or exploited trades.

Transaction Failures: Network congestion, gas price spikes, or execution delays can cause profitable opportunities to become losses by the time execution completes.

Economic Risks

Competition: Flash swap arbitrage is highly competitive. Multiple bots racing for the same opportunity results in gas wars where only one succeeds while others pay gas for failed transactions.

Fee Changes: Protocol fee changes can affect profitability calculations, turning previously profitable strategies into consistent losses overnight.

Market Conditions: Low volatility periods reduce arbitrage opportunities significantly, while extreme volatility may increase execution risk and price movement during transaction confirmation.

Building an Automated Flash Swap System

Successful automated arbitrage in DEX using flash swaps requires comprehensive infrastructure beyond just smart contracts.

Essential System Components

Price Monitoring: Real-time tracking of prices across multiple DEXs to identify arbitrage opportunities the instant they appear. This requires WebSocket connections to multiple data sources.

Profit Calculator: Automated calculation of potential profit after accounting for flash swap fees, gas costs, slippage, and price impact. Only profitable opportunities should trigger execution.

Execution Engine: Fast transaction submission with dynamic gas pricing to ensure timely execution. Integration with Flashbots or private mempools prevents front-running.

Risk Management: Automated checks for minimum profit thresholds, maximum gas limits, position sizing rules, and circuit breakers for abnormal market conditions.

Monitoring Dashboard: Real-time visibility into system performance, successful trades, failed attempts, profit/loss tracking, and alerting for issues requiring attention.

Future of Flash Swaps in DeFi

The evolution of flash swaps DeFi continues with emerging innovations that expand capabilities and create new applications.

Cross-Chain Flash Swaps: New protocols are developing mechanisms for flash swaps across different blockchains, enabling cross-chain arbitrage opportunities previously impossible.

Intent-Based Systems: Emerging architectures where users express desired outcomes and specialized solvers compete to fulfill them using flash swaps and other techniques.

Aggregated Flash Liquidity: Protocols that combine flash swap liquidity from multiple sources for larger, more efficient operations that individual pools cannot support alone.

MEV Protection Integration: New designs that protect regular users from MEV extraction while still allowing beneficial arbitrage that improves market efficiency.

As DeFi matures, decentralized exchange flash swaps will continue evolving, offering new opportunities for sophisticated traders who master their implementation and application.

Conclusion

Flash swaps in DEX platforms represent a paradigm shift in how traders can access capital and execute complex strategies. The ability to borrow any amount without collateral, execute sophisticated arbitrage, and repay within a single transaction enables trading approaches that were previously impossible in both traditional and early decentralized finance.

Success with flash swap strategies requires deep understanding of smart contract development, flash swaps smart contract security best practices, and the competitive landscape of MEV extraction. While the technical barriers are significant, the potential rewards justify the investment in building robust, secure systems.

Whether pursuing arbitrage using flash swaps, liquidation opportunities, or innovative DeFi trading strategies, the principles remain consistent: verify security rigorously, calculate profitability precisely accounting for all costs, optimize gas consumption aggressively, and manage risk carefully with proper position sizing and circuit breakers. As the DeFi ecosystem expands, flash swaps will continue providing sophisticated traders with powerful tools for capital-efficient execution.

Build Advanced Flash Swap Strategies on DEXs

From arbitrage and collateral swaps to liquidations, we help you integrate flash swaps into high-performance DeFi protocols with security-first smart contracts.

Frequently Asked Questions

Flash swaps are a DeFi mechanism allowing users to borrow tokens from liquidity pools without collateral, provided repayment occurs within the same transaction block. If repayment fails, the entire transaction reverts automatically. This enables arbitrage, liquidations, and complex trading strategies without requiring upfront capital, making sophisticated DeFi trading accessible.

Flash swaps require no collateral and must be repaid within the same transaction, while traditional loans require collateral and have extended repayment periods. Flash swaps offer flexibility to repay in either token of the trading pair, whereas flash loans must return the exact borrowed token. Both provide instant liquidity for different use cases.

Flash swap fees vary by protocol. Uniswap V2 charges 0.3% on borrowed amounts, while Uniswap V3 fees range from 0.05% to 1% depending on the pool tier. These fees must be factored into profitability calculations alongside gas costs. Successful arbitrage requires profit margins exceeding total fees for viable execution.

Flash swaps are inherently safe since failed transactions automatically revert with no fund loss beyond gas costs. However, smart contract bugs can create exploitable vulnerabilities. Proper security measures include callback verification, access controls, reentrancy guards, and thorough testing. Using audited contracts significantly reduces risk.

Flash swap implementation requires Solidity proficiency for smart contracts, understanding of EVM mechanics, and familiarity with DeFi protocols like Uniswap. Backend development skills in Python or JavaScript help build monitoring and execution systems. Knowledge of gas optimization and security best practices is essential for profitable operations.

Flash swap arbitrage is highly competitive, making consistent profits challenging for beginners. Established bots with optimized infrastructure dominate most opportunities. Beginners should start by learning smart contract development, understanding AMM mechanics, and practicing on testnets before deploying capital. Initial success often comes from niche opportunities.

MEV (Maximal Extractable Value) refers to profit extracted by reordering, inserting, or censoring transactions within blocks. Flash swaps enable MEV through arbitrage backrunning, liquidation racing, and sophisticated trading strategies. Traders use private mempools and Flashbots to capture MEV opportunities while minimizing competition from other searchers.

Major DEXs supporting flash swaps include Uniswap V2 and V3, SushiSwap, PancakeSwap, and Balancer. Each implements slightly different interfaces and fee structures. Uniswap V2 uses uniswapV2Call callback while V3 uses uniswapV3FlashCallback. Understanding platform-specific implementations enables cross-protocol flash swap strategies.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.