Key Takeaways

- DEX staking rewards offer a reliable path to passive income from DeFi by allowing token holders to earn returns simply by locking their assets in protocol contracts.

- High APY staking in DEX opportunities range from conservative 5-15% on established platforms to 100%+ on newer protocols, with risk typically correlating with reward levels.

- Understanding how DEX staking works is essential for maximizing returns while managing risks effectively through smart contract interactions and non-custodial mechanisms.

- Liquidity pool staking rewards combine trading fee earnings with token incentives, offering potentially higher returns than single-token staking but with added complexity.

- The choice between yield farming vs staking depends on your risk tolerance, available time for management, and whether you prefer simplicity or maximum yield potential.

- Best DEX staking platforms share common characteristics including audited smart contracts, transparent operations, sustainable tokenomics, and proven security track records.

- Crypto staking on DEX requires understanding both the technical mechanics and economic incentives to build strategies that generate consistent returns over time.

- Diversifying staking tokens across multiple platforms and pool types reduces concentration risk while maintaining attractive aggregate yield potential.

The decentralized finance ecosystem has unlocked unprecedented opportunities for cryptocurrency holders to generate returns on their assets without relying on traditional financial intermediaries. Among these opportunities, staking on decentralized exchanges stands out as one of the most accessible and potentially rewarding approaches for both newcomers and experienced DeFi participants. Whether you seek conservative yield on established tokens or are willing to explore higher-risk opportunities for enhanced returns, understanding the mechanics and strategies behind DEX staking rewards empowers you to make informed decisions that align with your financial goals.

Understanding Staking Rewards in DEX

Before diving into specific strategies to earn staking rewards in DEX, establishing a solid foundation of what staking means within the decentralized exchange context is essential. Unlike traditional proof-of-stake blockchain staking that secures network consensus, DEX staking encompasses various mechanisms through which users lock tokens to earn rewards while supporting platform functionality. This broader definition includes governance staking, liquidity provision, and protocol-specific incentive programs that collectively create the earning opportunities discussed throughout this guide.

The rewards generated through decentralized exchange staking derive from multiple sources depending on the specific program and platform design. Trading fees collected from swap transactions, newly minted protocol tokens distributed according to emission schedules, and revenue sharing from various platform services all contribute to the yield that stakers receive. Understanding these reward sources helps evaluate the sustainability and reliability of different staking opportunities.

What Are Staking Rewards in Decentralized Exchanges

Staking rewards in decentralized exchanges represent the compensation users receive for contributing their tokens to protocol operations. When you stake tokens on a DEX, you typically lock them in smart contracts that enable various platform functions, from providing trading liquidity to participating in governance decisions. In exchange for this contribution and the opportunity cost of locking your assets, the protocol distributes rewards proportional to your stake.

The nature of these rewards varies across platforms and staking types. Some programs distribute the platform’s native governance token, giving stakers ownership and voting rights alongside financial returns. Others share actual trading revenue in the form of fee tokens like ETH or stablecoins, providing more predictable value. Many programs combine both approaches, offering base fee rewards plus bonus token incentives that can significantly boost overall APY. Exploring how fee structures impact trading costs and rewards provides deeper insight into these mechanics.

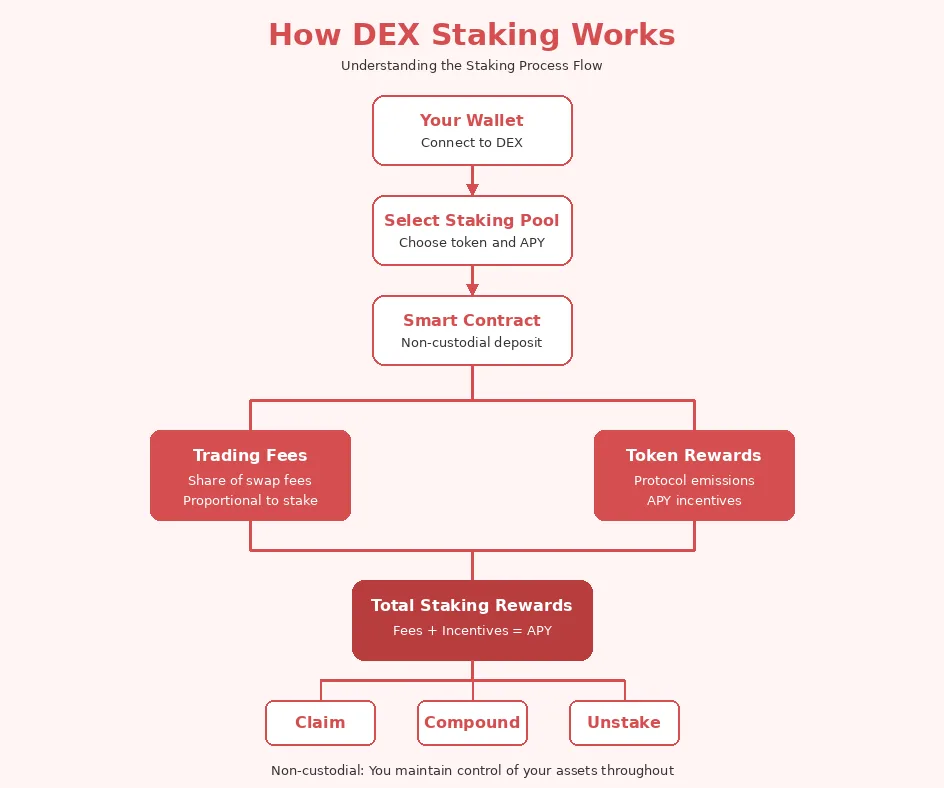

How DEX Staking Works on Blockchain

How DEX staking works on blockchain involves interactions between users and smart contracts that automate the entire staking lifecycle. When you initiate a stake, you send a transaction that transfers your tokens from your wallet to the staking contract, which records your deposit and begins tracking your proportional share of rewards. The blockchain’s immutable ledger ensures transparent accounting that anyone can verify independently.

The technical implementation varies between protocols, but the core principle remains consistent: smart contracts replace trusted intermediaries in managing staked assets and distributing rewards. This trustless architecture means you maintain control through your private keys even while tokens are staked, and reward calculations execute automatically according to predefined rules that cannot be arbitrarily changed.

Role of Smart Contract Based Staking

Smart contract based staking eliminates the need for trusted third parties in the staking process, replacing human discretion with deterministic code execution. The contract contains all the rules governing deposits, withdrawals, reward calculations, and distributions, executing exactly as programmed regardless of external pressures. This automation provides efficiency and fairness that traditional financial intermediaries cannot match.

The transparency of smart contracts allows users to verify exactly how their rewards are calculated before committing funds. Unlike opaque bank interest rates, every parameter affecting your staking returns is publicly visible in the contract code. This radical transparency enables informed decision-making and community oversight that helps identify potential issues before they cause harm.

Non-Custodial Staking Mechanism

Non-custodial staking mechanisms ensure you maintain ultimate control over your staked assets even while they are locked in protocol contracts. Unlike centralized exchange staking where the platform holds your private keys, DEX staking keeps you in control through wallet-based interactions. You can withdraw your stake at any time by signing a transaction with your private key, with no counterparty able to freeze or confiscate your funds.

This self-custody model carries both empowerment and responsibility. While you are protected from platform insolvency or mismanagement risks that affect centralized services, you also bear full responsibility for securing your private keys and understanding the contracts you interact with. The tradeoff between convenience and control defines the fundamental difference between centralized and decentralized staking options.

| Staking Type | Typical APY | Risk Level | Complexity |

|---|---|---|---|

| Single Token Staking | 5% – 30% | Low-Medium | Simple |

| LP Token Staking | 15% – 100% | Medium-High | Moderate |

| Governance Staking | 10% – 40% | Medium | Moderate |

| Boosted/Locked Staking | 20% – 150% | Medium-High | Complex |

Industry Insight: The most sustainable staking rewards typically come from protocols where rewards are funded by actual revenue generation rather than pure token inflation. Fee-sharing models tend to provide more reliable long-term returns than emission-dependent programs.

Best Ways to Earn Staking Rewards in DEX

Multiple pathways exist to earn staking rewards in DEX environments, each offering distinct risk-reward profiles suited to different investor preferences and circumstances. The best approach for any individual depends on factors including available capital, risk tolerance, time horizon, and desired level of active management. Understanding the full range of options enables informed selection of strategies that align with your specific goals.

The following sections explore the primary methods for generating staking income on decentralized exchanges, from straightforward single-token staking through more complex liquidity provision strategies. Each approach has merit in appropriate contexts, and many successful DeFi participants combine multiple methods to build diversified income portfolios.

Token Staking on Decentralized Exchanges

Staking tokens on decentralized exchanges represents the most straightforward path to earning passive rewards in DeFi. This approach involves depositing a single token type into a staking contract and receiving rewards over time based on your proportional contribution to the staking pool. The simplicity makes it ideal for beginners while still offering attractive returns that exceed traditional savings rates by substantial margins.

Most major DEX platforms offer native token staking programs where holding and staking their governance token earns you a share of protocol revenue and additional token rewards. For example, staking SUSHI on SushiSwap or CAKE on PancakeSwap provides exposure to platform growth while generating ongoing yield. These programs align incentives between token holders and protocol success, creating value for committed community members.

High APY Staking Opportunities

High APY staking in DEX platforms can deliver returns ranging from 50% to several hundred percent annually, though such opportunities require careful evaluation of sustainability and risk factors. These elevated yields typically appear in newly launched protocols seeking to bootstrap liquidity, in pools for volatile or emerging tokens, or in complex staking mechanisms requiring longer lock periods.

Pursuing high APY opportunities demands understanding why such returns exist and whether they can persist. Token inflation funding unsustainable emission rates, low liquidity creating artificial scarcity, or promotional periods with temporary bonus rewards all create high short-term APY that may not continue. Sustainable high yields typically require some combination of genuine utility demand, fee revenue sharing, reasonable tokenomics, and well-designed loyalty reward mechanisms that incentivize long-term participation rather than short-term speculation.

Long-Term vs Short-Term Staking Strategies

Long-term staking strategies focus on established protocols with proven track records, prioritizing security and sustainability over maximum yield. This approach suits investors seeking reliable passive income without constant monitoring or frequent position changes. Lock-up bonuses often reward long-term commitment with enhanced APY, creating additional incentive for patient capital.

Short-term staking strategies capitalize on promotional rates, new protocol launches, and market inefficiencies that create temporarily elevated yields. This more active approach requires regular monitoring, willingness to move capital between opportunities, and acceptance of higher risk in exchange for potentially higher returns. Many successful DeFi participants blend both approaches, maintaining stable long-term positions while allocating a portion of capital to short-term opportunities.

Liquidity Pool Staking Rewards

Liquidity pool staking rewards extend beyond simple token staking by combining trading fee earnings with additional incentive token distributions. When you provide liquidity to a DEX trading pair and stake the resulting LP tokens, you earn rewards from multiple sources: your share of swap fees generated by traders, plus bonus tokens distributed to incentivize liquidity provision. This layered reward structure often generates higher total yields than single-token staking. Understanding how farming mechanisms boost yield potential reveals the full opportunity set.

The enhanced returns from LP staking come with additional complexity and risk, most notably impermanent loss that can occur when token prices in your pair diverge significantly. Successfully navigating LP staking requires understanding these risks and selecting pairs where potential rewards adequately compensate for the additional exposure you accept.

How Liquidity Pools Generate Passive Income

Liquidity pools generate passive income through the trading fees collected every time someone swaps tokens through the pool. Most DEX platforms charge between 0.1% and 1% per trade, with a portion of these fees distributed to liquidity providers proportional to their share of the pool. High-volume pools can generate substantial fee income even at relatively low percentage rates.

Beyond trading fees, many protocols add token incentives to attract liquidity to specific pools deemed strategically important. These DEX liquidity mining programs distribute governance or utility tokens to LP stakers, significantly boosting total APY. The combination of organic fee generation plus incentive rewards creates compelling passive income opportunities for liquidity providers willing to accept the associated risks.

Risks and Returns in DEX Liquidity Mining

DEX liquidity mining offers attractive returns but carries risks beyond those of simple staking. Impermanent loss occurs when the price ratio between tokens in your liquidity position changes, causing your holdings to be worth less than if you had simply held the tokens separately. This risk increases with volatility and price divergence, meaning stable pairs offer lower risk while volatile pairs present higher potential for both gains and losses.

Additional risks include smart contract vulnerabilities specific to liquidity pool implementations, the value trajectory of reward tokens received, and the potential for liquidity to migrate away from pools as incentive programs end. Successful liquidity miners evaluate total risk-adjusted returns rather than focusing solely on headline APY figures.

Yield Farming vs Staking in DeFi

The comparison between yield farming vs staking in DeFi represents a fundamental strategic choice for passive income seekers. While the terms are sometimes used interchangeably, they describe distinct approaches with different characteristics. Understanding these differences helps select the approach best suited to your circumstances and goals.

Pure staking involves locking a single token to earn rewards, with returns typically coming from protocol emissions or fee sharing. Yield farming extends this by deploying capital across multiple protocols and strategies, often involving liquidity provision, leverage, or complex position management. The choice between them involves tradeoffs between simplicity and potential returns, risk and management requirements.

Key Differences Between Yield Farming and DEX Staking

Key differences between yield farming and DEX staking span multiple dimensions including complexity, risk profile, and required engagement. Single-token staking typically involves one deposit transaction and passive reward accumulation, while yield farming may require managing multiple positions, harvesting and redeploying rewards, and monitoring changing market conditions.

Risk profiles also differ significantly. Staking a single token exposes you primarily to price risk of that token and smart contract risk of the staking contract. Yield farming adds impermanent loss exposure, multiple contract risks across various protocols, and potential for compounding losses if market conditions move adversely. Higher complexity does not automatically mean higher risk-adjusted returns, making careful strategy selection essential.

| Characteristic | DEX Staking | Yield Farming |

|---|---|---|

| Complexity | Simple, single deposit | Complex, multiple positions |

| Risk Level | Lower, single contract | Higher, multiple contracts |

| Potential APY | 5% – 50% typical | 20% – 200%+ possible |

| Impermanent Loss | Not applicable | Yes, can be significant |

| Management Needed | Minimal, mostly passive | Active optimization helps |

| Best For | Beginners, passive income | Experienced DeFi users |

Choosing the Right Strategy for Passive Income

Choosing the right strategy for passive income from DeFi depends on honest assessment of your available time, risk tolerance, and desired level of engagement. If you prefer a set-it-and-forget-it approach with predictable returns, single-token staking on established protocols offers the best fit. If you enjoy optimizing returns and can dedicate time to monitoring and adjusting positions, yield farming may deliver superior results.

Many investors find that a blended approach works best, maintaining core staking positions for stability while allocating a smaller portion to more active yield farming strategies. This diversification captures some upside from higher-yield opportunities while limiting overall portfolio risk. The key is matching your strategy to your actual behavior patterns rather than aspirational ones.

DEX Staking Lifecycle: Step-by-Step Process

| Step | Action | Description | Result |

|---|---|---|---|

| 1 | Research Platforms | Evaluate security, APY, and reputation | Shortlist of trusted platforms |

| 2 | Connect Wallet | Link your crypto wallet to DEX | Platform access enabled |

| 3 | Select Staking Pool | Choose pool matching your tokens | Target opportunity identified |

| 4 | Approve Contract | Grant permission to stake tokens | Contract authorized |

| 5 | Deposit Tokens | Stake desired amount in contract | Staking position created |

| 6 | Earn Rewards | Accumulate rewards over time | Growing claimable balance |

| 7 | Claim or Compound | Harvest rewards, optionally restake | Realized returns |

How to Maximize Staking Rewards in DEX

Maximizing staking rewards requires strategic thinking beyond simply choosing the highest advertised APY. True optimization considers factors including reward sustainability, compound frequency, gas efficiency, and tax implications alongside raw yield figures. The difference between average and excellent staking returns often comes from attention to these secondary factors rather than chasing headline rates.

The following sections detail specific strategies and considerations for extracting maximum value from your staking activities while maintaining appropriate risk management. These principles apply across platforms and market conditions, providing a framework for consistent performance improvement.

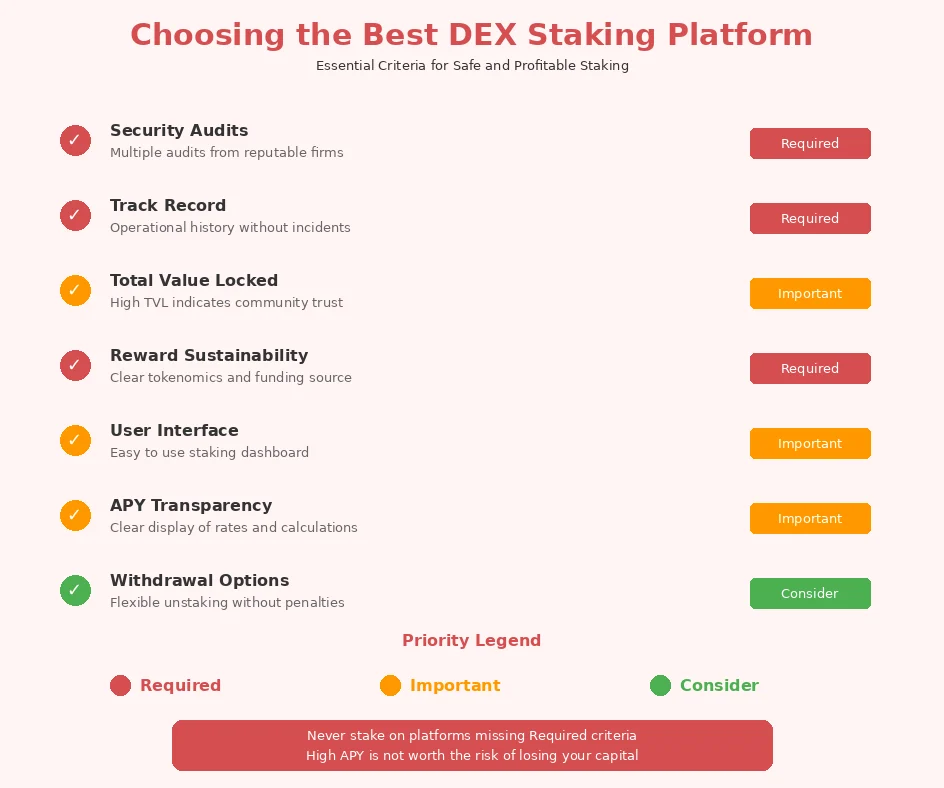

Selecting the Best DEX Staking Platforms

Selecting the best DEX staking platforms requires evaluating multiple dimensions beyond simple APY comparison. Security track record, smart contract audit history, total value locked indicating community trust, and the sustainability of reward mechanisms all factor into platform quality assessment. A platform offering 100% APY with questionable security represents worse expected value than one offering 20% with proven reliability.

User experience considerations also matter for practical staking success. Intuitive interfaces, clear reward tracking, reasonable gas efficiency, and responsive support resources all contribute to a platform being practically usable for your staking needs. The best platform technically means nothing if you cannot effectively interact with it. Building effective automated trading platforms demands attention to all these factors.

Factors Affecting Staking Rewards and APY

Multiple factors affecting staking rewards and APY determine the actual returns you receive from any staking position. Token emission rates set by protocol governance determine how many reward tokens are distributed, while total staked value determines your proportional share. When more users stake, your percentage of the pool decreases even if absolute emission remains constant.

External factors including reward token price volatility, gas costs for claiming and compounding, and market conditions affecting the tokens you stake all impact real returns. A position showing 50% APY in nominal token terms may deliver very different dollar returns depending on price movements. Comprehensive return analysis considers all these factors for accurate performance assessment.

Secure and Reliable DEX Staking Solutions

Secure and reliable DEX staking solutions share common characteristics that help identify trustworthy opportunities. Multiple independent smart contract audits from reputable firms, substantial total value locked demonstrating community confidence, transparent team identity and communication, and long operational history without security incidents all indicate platform reliability.

Beyond platform-level security, individual staking solutions within platforms may carry different risk profiles. Newer pools, complex vault strategies, or pools involving less established tokens carry higher risk than simple staking of major assets in established programs. Matching security requirements to each specific opportunity within your portfolio enables appropriate risk allocation.

Platform Selection Criteria for DEX Staking

Evaluate potential staking platforms against these essential criteria:

- Security Audits: Multiple reputable audit reports with no critical findings unaddressed

- Total Value Locked: Sufficient TVL indicating community trust and liquidity depth

- Reward Sustainability: Clear tokenomics showing how rewards are funded long-term

- User Experience: Intuitive interface with clear staking instructions and reward tracking

- Track Record: Operational history without security incidents or controversial governance

- Community Activity: Active development, regular communication, and engaged user base

Low-Risk Staking Strategies in DeFi

Low-risk staking strategies prioritize capital preservation and consistent returns over maximum yield potential. This approach suits investors who cannot afford significant losses or prefer peace of mind over aggressive growth. While returns may be more modest, the probability of achieving projected yields increases substantially with conservative positioning.

Conservative strategies focus on staking established tokens with proven demand and utility, using well-audited protocols with long track records, and avoiding complex or leveraged positions that amplify both upside and downside potential. The goal is steady, predictable income rather than outsized gains that might reverse quickly.

Diversifying Staking Tokens

Diversifying staking tokens across multiple assets reduces concentration risk and provides exposure to different protocol ecosystems. Rather than staking everything in a single token, spreading capital across several staking opportunities means that poor performance or security issues with any single position have limited portfolio impact.

Effective diversification considers correlation between holdings alongside simple position count. Staking multiple tokens that all move together during market stress provides less protection than holding uncorrelated or negatively correlated assets. Including stablecoins, major cryptocurrencies, and various governance tokens creates more robust diversification than concentrating only on similar asset types.

Managing Volatility in Crypto Staking

Managing volatility in crypto staking involves strategies that reduce the impact of price swings on your overall staking portfolio value. Including stablecoin staking positions provides anchor points that do not fluctuate with crypto market conditions, while staking through multiple entry points over time averages your cost basis and reduces timing risk.

Regular reward harvesting and conversion to stable assets locks in gains regardless of subsequent price movements, though this approach sacrifices potential upside if reward tokens appreciate. The right volatility management approach depends on your conviction about future price directions and your need for predictable portfolio values.

Is DEX Staking Safe for Beginners

DEX staking can be appropriately safe for beginners who approach it with proper education and caution, though it requires understanding risks that do not exist in traditional finance. The permissionless nature of DeFi means no customer service department will recover funds lost to mistakes or exploits, placing full responsibility on individual users. This autonomy brings both freedom and obligation.

Beginning safely involves starting with small amounts you can afford to lose entirely while learning, using only well-established platforms with proven security, and building knowledge gradually before expanding position sizes. Many experienced DeFi users recommend treating initial investments as educational expenses, expecting that mistakes will happen and planning accordingly.

Understanding Smart Contract Risks

Smart contract risks represent the possibility that bugs, vulnerabilities, or design flaws in the code governing your staking position could result in fund loss. Even audited contracts have been exploited, as audits reduce but do not eliminate risk. The immutable nature of blockchain means that once funds are lost to an exploit, recovery is typically impossible.

Minimizing smart contract risk involves favoring protocols with extensive audit histories, long operational track records, bug bounty programs that incentivize responsible disclosure, and appropriate governance mechanisms for responding to discovered issues. Newer contracts and more complex functionality generally carry higher risk than simple, battle-tested implementations.

Importance of Secure Staking in DEX

Secure staking in DEX protects not just your immediate staked funds but your entire financial relationship with the DeFi ecosystem. Security breaches can compromise connected wallets, approved contracts, and future interactions beyond the immediate loss. Taking security seriously from the beginning establishes habits that protect your expanding DeFi activity over time.

Understanding the interconnected nature of DeFi security helps appreciate why platform choice matters so significantly. A compromised staking contract might expose approvals you have granted to other protocols, creating cascading vulnerabilities. Security-first thinking evaluates these systemic risks alongside direct staking considerations.

Audited Smart Contracts

Audited smart contracts have undergone independent professional review to identify potential vulnerabilities before they can be exploited. Quality audits involve line-by-line code examination, automated testing tools, economic attack modeling, and comprehensive documentation of findings. Multiple audits from different firms provide stronger assurance than a single review.

Interpreting audit results requires understanding that audits are point-in-time assessments that may not cover subsequent code changes, and that even thorough audits cannot guarantee security. However, the absence of audits for any DeFi protocol should raise immediate red flags, as serious projects prioritize professional security review before handling user funds.

Platform Reputation and Transparency

Platform reputation develops over time through consistent delivery on promises, transparent communication during challenges, and responsible handling of any security incidents. Protocols that have navigated difficulties while protecting user interests build credibility that new projects cannot match. This track record provides evidence beyond technical claims.

Transparency about operations, tokenomics, team identity, and governance decisions enables community oversight that catches potential issues early. Protocols that operate opaquely or resist scrutiny may have legitimate privacy reasons but also deny users important information for evaluating trustworthiness. The balance between privacy and transparency should lean toward openness for projects asking users to trust them with funds.

Security Reminder: Never stake more than you can afford to lose entirely. Smart contract exploits, platform failures, and market crashes can result in complete loss of staked funds. Diversify across platforms, maintain appropriate position sizes, and always verify contract addresses before interacting.

Passive Income Opportunities Through DEX Staking

Passive income from DeFi staking attracts many participants who want their cryptocurrency holdings to generate returns without active trading or constant management. Unlike active investment strategies requiring frequent decisions and market timing, properly structured staking positions can generate income with minimal ongoing attention once established.

The passive income potential varies significantly based on staking choices, from conservative single-digit yields on stable positions to more aggressive double-digit returns requiring periodic optimization. Finding the right balance between passivity and returns depends on individual circumstances and preferences.

How to Earn Passive Income with DeFi Staking

Earning passive income with DeFi staking begins with selecting positions designed for minimal maintenance. Auto-compounding vaults that automatically reinvest rewards eliminate the need for manual claiming and restaking. Longer lock periods often provide boosted yields while also removing the temptation to constantly adjust positions.

True passivity requires accepting that you may miss some optimization opportunities in exchange for reduced management burden. The trader constantly moving between opportunities may achieve higher nominal returns but also invests significant time and incurs transaction costs. Evaluating returns on a time-adjusted basis often favors simpler approaches.

On-Chain Staking Rewards Explained

On-chain staking rewards are distributed and recorded directly on the blockchain, creating a transparent and verifiable record of all earnings. Unlike off-chain systems where you must trust provider accounting, on-chain rewards can be independently verified by anyone examining the relevant smart contracts and transactions.

The on-chain nature of DeFi staking rewards means they accumulate in real-time according to protocol rules, with no human intermediary able to delay, withhold, or modify distributions. This trustless automation represents a fundamental improvement over traditional financial systems where counterparty discretion creates uncertainty.

Future of Staking Rewards in Decentralized Exchanges

The future of staking rewards in decentralized exchanges points toward increasing sophistication, accessibility, and integration with broader financial systems. As the DeFi ecosystem matures, staking mechanisms are evolving to offer better risk-adjusted returns, more user-friendly interfaces, and innovative reward structures that align incentives more effectively. Building crypto exchanges for future needs requires understanding these emerging trends.

Technological advances including layer 2 scaling, cross-chain interoperability, and improved smart contract capabilities will enable staking products impossible with current infrastructure. These innovations promise to reduce costs, increase efficiency, and expand the range of staking opportunities available to users across all experience levels.

Emerging DeFi Staking Opportunities

Emerging DeFi staking opportunities include liquid staking derivatives that provide yield while maintaining asset liquidity, real-world asset tokenization creating new staking collateral options, and protocol-owned liquidity models that change the traditional relationship between users and platforms. These innovations expand the staking landscape beyond current limitations.

Cross-chain staking enabling single positions that earn across multiple blockchains, AI-optimized yield strategies that automatically adjust positions, and institutional-grade staking products meeting regulatory compliance requirements all represent frontier developments likely to shape future opportunities. Early awareness of these trends positions participants to benefit as they mature. Understanding how automated trading platforms evolve provides context for these changes.

Automated Yield Strategies and Innovation

Automated yield strategies represent the cutting edge of DeFi staking, using smart contracts to continuously optimize positions without human intervention. Protocols like Yearn Finance pioneered this approach, automatically moving capital between opportunities to maximize risk-adjusted returns. These systems democratize sophisticated strategies previously available only to professionals.

Ongoing innovation in automated strategies includes more sophisticated risk management, cross-protocol optimization, and personalized vaults tailored to individual risk preferences. As these systems become more capable and accessible, the distinction between active and passive staking strategies may blur, with automation handling complex optimization while users enjoy simplified interfaces.

Choosing the Right DEX Staking Solution

Choosing the right DEX staking solution requires matching platform capabilities to your specific needs, goals, and constraints. The ideal solution for an experienced DeFi power user differs substantially from what serves a beginning investor best. Honest self-assessment of your knowledge level, risk tolerance, and available time for management guides selection toward appropriate options.

Beyond individual suitability, practical considerations including supported tokens, blockchain compatibility, fee structures, and user interface quality all affect which platforms work best for your situation. Taking time for thorough evaluation before committing capital pays dividends in avoided frustration and optimized returns.

Features of Reliable DEX Staking Platforms

Reliable DEX staking platforms share common features that distinguish them from riskier alternatives. Comprehensive security practices including multiple audits, bug bounties, and transparent incident response plans demonstrate commitment to protecting user funds. Clear documentation explaining exactly how staking works enables informed participation.

Operational features including real-time reward tracking, efficient claim mechanisms, reasonable fee structures, and responsive user support all contribute to platform quality. The combination of strong security foundation with excellent user experience characterizes the best DEX staking platforms across the ecosystem.

Custom Staking and DeFi Staking Solutions

Custom staking solutions allow advanced users or organizations to configure staking strategies tailored to specific requirements. Some platforms offer customizable parameters including lock durations, reward distribution preferences, and risk management settings that standard products do not accommodate. These solutions serve users whose needs exceed one-size-fits-all offerings.

DeFi staking solutions for institutional participants may include additional compliance features, reporting capabilities, and governance structures appropriate for professional fund management. As institutional adoption of DeFi grows, purpose-built staking products meeting enterprise requirements will become increasingly important to the ecosystem.

Build a High-Yield DEX Staking Platform

We create custom staking and liquidity reward models that drive growth and user engagement.

Final Thoughts on Earning Staking Rewards in DEX

Earning staking rewards in DEX represents one of the most accessible pathways to generating passive income from cryptocurrency holdings. Whether you pursue conservative single-token staking for steady returns or venture into more complex liquidity provision strategies for enhanced yields, the opportunities available through decentralized exchanges far exceed what traditional finance offers for comparable risk levels.

Success in DEX staking combines technical understanding of how these systems work with strategic thinking about risk management and return optimization. The knowledge gained through careful study and measured experimentation compounds over time, enabling increasingly sophisticated participation in the DeFi ecosystem.

As decentralized finance continues evolving, staking opportunities will expand and mature alongside the broader ecosystem. Participants who build foundational knowledge and establish healthy practices today position themselves advantageously for future developments. The journey from beginning staker to confident DeFi participant requires patience and continuous learning, but the potential rewards justify the investment.

Frequently Asked Questions

Staking rewards in decentralized exchanges are the earnings you receive for locking your cryptocurrency tokens in a DEX protocol to support various platform functions such as governance, liquidity provision, or network security. These rewards typically come from trading fees generated by the platform, protocol token emissions, or a combination of both sources. The amount you earn depends on factors including the staking duration, total tokens staked in the pool, and the specific reward distribution mechanism used by the DEX.

To earn staking rewards in DEX platforms, you need to connect your cryptocurrency wallet to the platform, select a staking pool or program that matches your tokens and goals, and deposit your assets into the staking contract. Your rewards begin accumulating immediately based on your share of the total staked amount and the current APY offered by the pool. Most platforms allow you to claim rewards periodically or automatically compound them to maximize returns over time.

Staking typically involves locking a single token to earn rewards through governance participation or protocol support, while yield farming requires providing liquidity with token pairs and involves more active management of positions. Yield farming generally offers higher potential returns but carries additional risks like impermanent loss that do not apply to single-token staking. Staking tends to be simpler and more predictable, making it better suited for passive income seekers, while yield farming rewards those who actively optimize their strategies.

The DEX platforms offering highest staking APY vary over time and depend on market conditions, but established platforms like Curve Finance, SushiSwap, and PancakeSwap consistently offer competitive rates ranging from 10% to 100%+ APY depending on the specific pool and token. Newer platforms may offer higher promotional rates to attract liquidity, though these often come with increased risk and may not be sustainable long-term. Always research platform security, audit history, and reward token sustainability before chasing high APY figures.

DEX staking can be relatively safe for beginners when approached with proper caution and education about the risks involved. Starting with well-established platforms that have undergone multiple security audits, using small amounts initially, and sticking to straightforward single-token staking programs helps minimize risk while learning. Beginners should understand smart contract risks, the volatility of reward tokens, and the importance of securely managing their wallet private keys before committing significant capital.

DEX staking rewards are calculated based on your proportional share of the total staking pool multiplied by the reward emissions distributed during each period. If you stake 1% of the total pool and the daily emission is 1000 tokens, you would receive approximately 10 tokens per day before compounding effects. APY calculations annualize these returns and may assume regular compounding, which is why actual returns can differ from displayed rates depending on how frequently you claim and restake rewards.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.