The evolution of decentralized exchange infrastructure has fundamentally transformed how digital assets are traded across global markets. Among the most significant innovations driving this transformation is the emergence of dynamic fee models in DEX platforms, which represent a paradigm shift from traditional fixed-rate structures. As an agency with over eight years of experience building sophisticated DeFi solutions for clients across the USA, UK, UAE, and Canada, we have witnessed firsthand how these adaptive pricing mechanisms create more sustainable and efficient trading ecosystems.

Dynamic fee models in DEX platforms automatically adjust transaction costs based on real-time market conditions, liquidity availability, and volatility metrics. This intelligent approach ensures that liquidity providers receive fair compensation for the risks they assume while traders benefit from optimized pricing that reflects actual market dynamics. The implementation of such models requires careful consideration of smart contract architecture, oracle integration, and governance frameworks.

Key Takeaways

- Dynamic fee models in DEX platforms adjust trading costs automatically based on liquidity depth, volatility levels, and trading volume metrics.

- Fixed fee structures create inefficiencies during volatile markets, failing to compensate liquidity providers adequately for impermanent loss risks.

- Smart contract implementation of dynamic fees requires gas-efficient algorithms that balance calculation complexity with transaction cost optimization.

- Oracle-driven fee adjustments provide external data reliability but introduce dependency risks requiring robust fallback mechanisms and data validation.

- AMM architecture choice directly impacts fee model design, with concentrated liquidity models offering granular fee tier customization options.

- Volatility-based fee logic protects liquidity providers during market turbulence while maintaining competitive rates during stable trading periods.

- Governance controls enable parameter tuning for fee models while multi-signature requirements prevent malicious manipulation of fee calculations.

- Testing dynamic fee behavior through simulation environments and testnet deployments identifies edge cases before mainnet implementation.

- Risk management frameworks must address flash loan attacks, oracle manipulation, and sandwich attacks targeting dynamic fee mechanisms.

- Future DEX fee models will incorporate machine learning predictions, cross-chain data aggregation, and real-time sentiment analysis capabilities.

What Are Dynamic Fee Models in DEX?

Dynamic fee models in DEX represent algorithmic pricing mechanisms that automatically calculate and adjust transaction fees based on prevailing market conditions. Unlike traditional exchanges with fixed percentage fees, these sophisticated systems evaluate multiple parameters including pool liquidity ratios, recent trading volume, price volatility indices, and market depth to determine optimal fee rates for each transaction. This approach creates a responsive ecosystem where fees accurately reflect the true cost of providing liquidity under varying market circumstances.

The core philosophy behind DEX dynamic fees centers on aligning incentives between traders and liquidity providers. When markets experience heightened volatility, liquidity providers face increased impermanent loss exposure, and dynamic models compensate them through elevated fees. Conversely, stable market conditions with deep liquidity warrant lower fees, attracting more trading activity and improving overall market efficiency. This self-balancing mechanism has proven particularly valuable for institutional traders in the UK and USA who require predictable execution costs.

Implementing dynamic fee logic for AMM-based DEX requires careful consideration of computational efficiency, as complex calculations must execute within blockchain gas constraints. Modern DEX protocol fee logic employs optimized mathematical formulas that minimize on-chain computation while maintaining accuracy. These calculations typically leverage fixed-point arithmetic libraries and pre-computed lookup tables to achieve gas-efficient fee determination without sacrificing precision in the final fee calculation.

Why Fixed Fee Structures Fall Short in Modern DEXs?

Fixed fee structures, while simple to implement and understand, create fundamental inefficiencies that undermine the sustainability of decentralized exchange ecosystems. During periods of extreme market volatility, static fees fail to adequately compensate liquidity providers for the substantial impermanent loss risks they bear. This inadequate compensation leads to liquidity withdrawal precisely when markets need it most, exacerbating price slippage and reducing execution quality for traders attempting to navigate volatile conditions.

The one-size-fits-all approach of fixed DEX fee structures also creates competitive disadvantages across different trading pair categories. Stablecoin pairs with minimal price deviation require different fee economics than highly volatile altcoin pairs. A 0.3% fee that seems reasonable for volatile assets becomes prohibitively expensive for stablecoin swaps where arbitrageurs operate on thin margins. This mismatch drives volume to competitors offering more appropriate fee tiers, fragmenting liquidity across multiple venues.

Market makers and professional traders operating across UAE, Canada, and other jurisdictions have increasingly demanded more sophisticated DEX pricing models that reflect true market risk. Fixed fees ignore the temporal dimension of trading costs, charging identical rates regardless of whether a trade occurs during calm markets or amid significant price discovery events. This temporal blindness reduces capital efficiency and creates arbitrage opportunities that extract value from liquidity pools without proportionate compensation.

Core Design Principles Behind Dynamic Fee Models

Market Responsiveness

- Real-time volatility tracking

- Volume-weighted adjustments

- Liquidity depth monitoring

- Price impact calculations

Capital Efficiency

- Optimized LP returns

- Reduced impermanent loss

- Competitive trader rates

- Sustainable yield generation

Security First Design

- Manipulation resistance

- Oracle redundancy

- Bounded fee ranges

- Governance safeguards

The foundational principles guiding dynamic fee model architecture prioritize adaptability, fairness, and computational efficiency. Designing dynamic fee models for decentralized exchanges requires balancing multiple competing objectives while maintaining system integrity under adversarial conditions. Successful implementations establish clear mathematical relationships between market inputs and fee outputs, ensuring predictable behavior that participants can understand and trust.

Role of Liquidity Depth in Dynamic Fee Adjustment

Liquidity depth serves as a primary input variable for dynamic fee calculations, directly influencing the cost structure for different trade sizes. Deep liquidity pools can absorb large orders with minimal price impact, justifying lower fee rates that encourage volume concentration. Conversely, shallow pools require higher fees to compensate liquidity providers for the disproportionate price impact their capital absorbs when processing significant orders.

The relationship between liquidity depth and dynamic trading fees DEX platforms implement follows sophisticated mathematical models. Many protocols employ tiered fee structures where the effective rate increases as trade size relative to pool depth grows. This approach protects liquidity providers from large trades that would otherwise extract disproportionate value while maintaining competitive rates for typical retail transaction sizes common among traders in markets like Canada and the UK.

Concentrated liquidity models have introduced additional complexity to depth-based fee calculations. When liquidity providers can specify price ranges for their capital, effective depth varies significantly across the price curve. Dynamic fee models must account for this heterogeneous distribution, calculating fees based on the liquidity available at the specific price points a trade will traverse rather than relying on aggregate pool metrics that may misrepresent actual execution conditions.

Volatility-Based Fee Logic in DEX Platforms

Volatility represents perhaps the most critical factor in dynamic fee model design, as it directly correlates with the impermanent loss risk liquidity providers face. During periods of significant price movement, the divergence between pool token ratios and external market prices accelerates, creating losses for LPs that fixed fees cannot adequately offset. Volatility-based fee adjustments dynamically increase rates during turbulent markets, providing the additional compensation necessary to maintain liquidity provider participation.

Implementing volatility measurement within smart contracts presents unique challenges given blockchain computational constraints. Common approaches include tracking recent price variance through exponential moving averages, monitoring the frequency of arbitrage transactions that indicate price misalignment, and incorporating external volatility indices from oracle providers. Each methodology offers different trade-offs between accuracy, gas efficiency, and manipulation resistance that protocol designers must carefully evaluate.

The calibration of volatility sensitivity parameters requires extensive backtesting against historical market data. Overly aggressive fee increases during volatile periods may drive traders to competing venues, while insufficient adjustments leave liquidity providers inadequately compensated. Our experience building DEX solutions for clients across the USA and UAE has demonstrated that optimal calibration varies significantly based on asset pair characteristics, target user demographics, and competitive market positioning.

Trading volume and demand patterns provide essential signals for dynamic fee optimization algorithms. High volume periods indicate strong market interest and typically justify lower per-transaction fees that capture market share, while low volume periods may warrant fee increases to maintain minimum revenue thresholds for liquidity providers. The interplay between volume signals and fee adjustments creates feedback loops that protocol designers must carefully model to prevent unintended oscillations or instability.

AMM Architectures and Their Impact on Fee Design

The underlying AMM architecture fundamentally shapes the possibilities and constraints for dynamic fee implementation. Constant product market makers following the x*y=k formula exhibit predictable price impact curves that simplify fee calculations but limit customization options. These traditional designs typically support only uniform fee rates across all price levels, restricting the granularity of dynamic adjustments available to protocol designers seeking more sophisticated decentralized exchange fee models.

Concentrated liquidity architectures revolutionized fee model possibilities by allowing liquidity providers to specify discrete price ranges and associated fee tiers. This innovation enables market-driven fee discovery where LPs compete for trading volume by offering different fee and price range combinations. The resulting ecosystem naturally gravitates toward efficient fee structures as providers optimize their capital deployment across various fee tiers based on observed trading patterns and competitive dynamics.

Hybrid AMM designs combining multiple bonding curves or incorporating order book elements introduce additional complexity to fee calculations. These architectures may require different fee logic for different execution paths, necessitating careful consideration of how dynamic adjustments apply across heterogeneous liquidity sources. Our work with institutional clients in the UK and Canada has highlighted the importance of clear fee transparency regardless of underlying architectural complexity.

Smart Contract Logic for Implementing Dynamic Fees

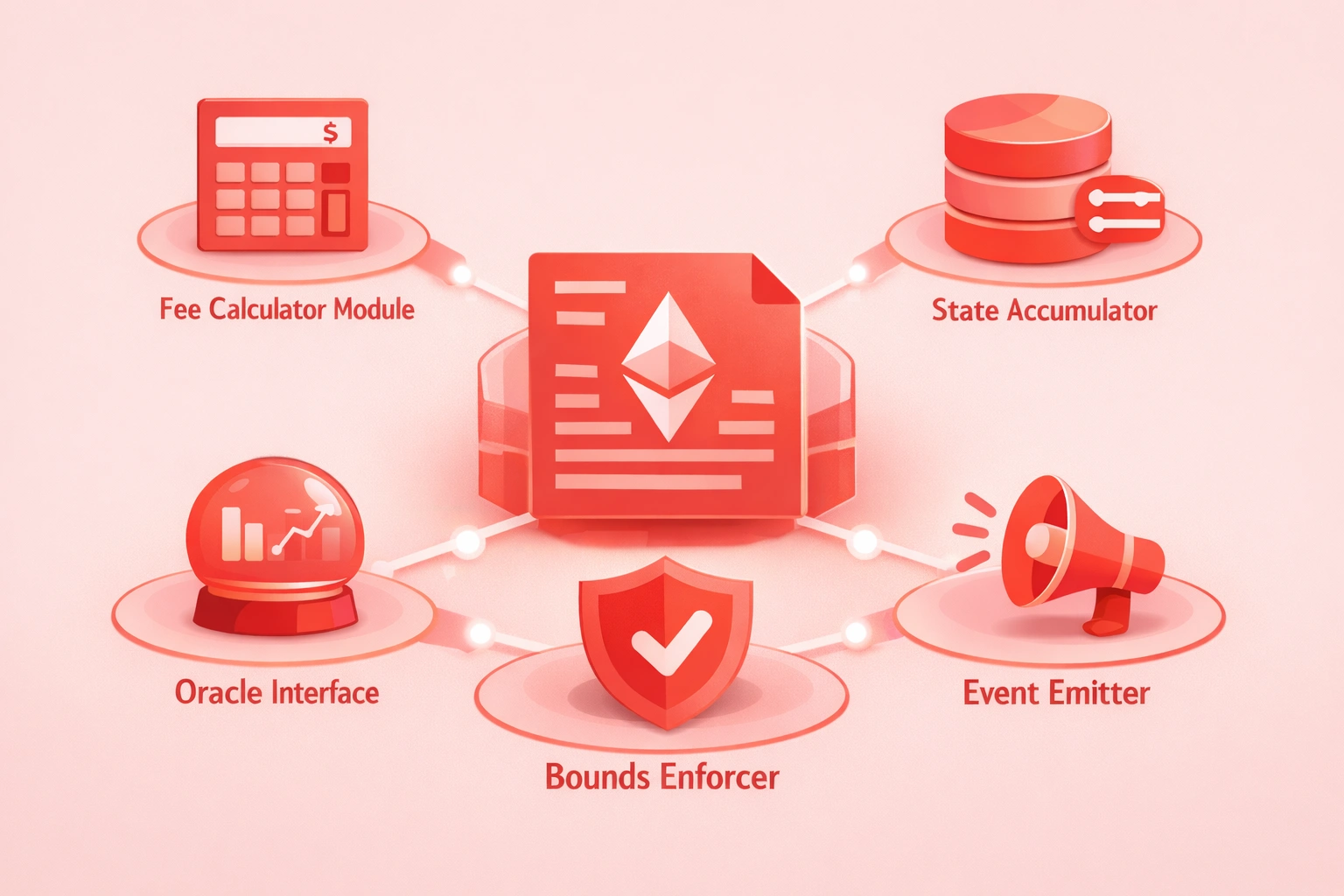

| Component | Function | Gas Consideration |

|---|---|---|

| Fee Calculator Module | Processes market inputs and computes current fee rate | Medium complexity, optimize with lookup tables |

| State Accumulator | Tracks rolling averages and historical metrics | Storage intensive, use packed structs |

| Oracle Interface | Fetches external price and volatility data | External calls add latency and cost |

| Bounds Enforcer | Ensures fees remain within governance limits | Minimal overhead with simple comparisons |

| Event Emitter | Logs fee changes for transparency and analytics | Indexed events for efficient querying |

Smart contract implementation of dynamic fees requires modular architecture separating fee calculation logic from core swap functionality. This separation enables upgradeable fee models through proxy patterns while maintaining immutable swap mechanics that users trust. The fee calculator module receives trade parameters and current market state, returning the applicable fee rate for integration into the swap execution flow.

Fixed-point arithmetic libraries provide the precision necessary for accurate fee calculations without floating-point support. Libraries like PRBMath or ABDKMath64x64 offer gas-efficient implementations of mathematical operations essential for volatility calculations, exponential smoothing, and other advanced fee logic components. Choosing appropriate precision levels balances accuracy against computational overhead throughout the fee determination pipeline.

On-Chain vs Off-Chain Inputs in Dynamic Fee Models

The choice between on-chain and off-chain data sources for dynamic fee calculations involves fundamental trade-offs between decentralization, latency, and data richness. Pure on-chain implementations derive all inputs from blockchain state, ensuring censorship resistance and eliminating external dependencies. However, on-chain data sources limit fee models to information available within the execution context, potentially missing important external market signals that would improve fee accuracy.[1]

Off-chain inputs accessed through oracle networks dramatically expand the data available for fee calculations. External volatility indices, cross-exchange price comparisons, and aggregated market depth information enable more sophisticated fee models impossible with on-chain data alone. DEX platforms serving institutional traders in the USA and UAE increasingly incorporate these enriched data feeds to provide execution quality competitive with centralized alternatives.

Hybrid architectures combining on-chain primary calculations with off-chain supplementary data offer balanced solutions. The core fee logic executes entirely on-chain using pool state and recent transaction history, while oracle-provided data adjusts parameters within bounded ranges. This approach maintains functionality during oracle outages while benefiting from enriched data when available, providing robust operation across varying network conditions.

Oracle-Driven Fee Adjustments and Data Reliability

Chainlink Integration: Industry-standard price feeds with decentralized node networks providing tamper-resistant data for fee calculations.

TWAP Oracles: Time-weighted average prices from on-chain sources reduce manipulation risk through temporal aggregation mechanisms.

Fallback Systems: Multiple oracle sources with automatic failover ensure continuous operation during individual provider outages.

Staleness Checks: Timestamp validation prevents stale data from influencing fee calculations during oracle latency events.

Deviation Thresholds: Anomaly detection identifies suspicious price movements that could indicate oracle manipulation attempts.

Bounded Updates: Rate limiting on oracle-driven changes prevents sudden fee spikes that could harm user experience.

Oracle reliability directly impacts the trustworthiness of dynamic fee models that depend on external data. Protocols must implement comprehensive validation logic that detects and responds appropriately to oracle failures, manipulation attempts, and data quality issues. The challenges in implementing dynamic fees in DEX include managing oracle dependencies without creating single points of failure that could compromise system integrity.

Gas Efficiency Considerations in Dynamic Fee Implementation

Gas efficiency represents a critical constraint in dynamic fee implementation, as complex calculations directly increase transaction costs for users. Every additional storage read, mathematical operation, and external call adds to the gas burden that traders must bear. Protocol designers must carefully optimize fee calculation logic to minimize computational overhead while maintaining sufficient sophistication to achieve meaningful dynamic adjustment.

Lazy evaluation patterns defer expensive calculations until absolutely necessary, reducing average gas consumption across transactions. Rather than computing comprehensive market state on every swap, protocols can cache intermediate values and update them incrementally. Time-based checkpointing systems amortize complex calculations across multiple transactions, spreading the computational burden while maintaining reasonably current fee estimates.

Layer 2 deployment dramatically expands the complexity ceiling for dynamic fee models by reducing per-operation costs. Protocols operating on Arbitrum, Optimism, or other scaling solutions can implement more sophisticated fee algorithms that would be prohibitively expensive on Ethereum mainnet. This cost reduction enables advanced features like real-time volatility tracking, multi-factor fee models, and granular parameter tuning that enhance user experience for traders across global markets.

Risk Management and Exploit Prevention in Fee Logic

Flash Loan Protection

- Time-weighted calculations resist single-block manipulation

- Multi-block averaging prevents instant parameter shifts

- Snapshot mechanisms capture pre-transaction state

Sandwich Attack Mitigation

- Fee adjustments account for MEV extraction risks

- Slippage-aware fee calculations protect traders

- Dynamic spreads respond to mempool activity

Oracle Manipulation Defense

- Multi-source price validation

- Deviation circuit breakers

- Gradual parameter adjustment limits

Security considerations permeate every aspect of dynamic fee model design, as the adaptive nature of these systems creates potential attack surfaces absent in fixed-fee implementations. Adversaries may attempt to manipulate the inputs driving fee calculations, artificially triggering favorable rate adjustments before executing large trades. Comprehensive threat modeling during the design phase identifies these vectors and informs countermeasure implementation.

Testing and Simulating Dynamic Fee Behavior Before Deployment

Unit Testing

Test individual fee calculation functions in isolation to verify mathematical correctness across edge cases and boundary conditions.

Integration Testing

Verify fee modules interact correctly with swap logic, oracle interfaces, and governance controls under realistic conditions.

Historical Backtesting

Replay historical market data through fee models to evaluate performance during past volatility events and market conditions.

Testnet Deployment

Deploy complete systems on test networks to observe real-world behavior with actual transaction flows and network conditions.

Rigorous testing protocols must precede any mainnet deployment of dynamic fee systems. The adaptive nature of these models creates emergent behaviors that may not be apparent from component-level analysis alone. Comprehensive simulation environments that replicate realistic market conditions, including extreme volatility scenarios and coordinated manipulation attempts, provide essential validation before exposing real user funds to untested fee logic.

Governance Controls and Parameter Tuning for Fee Models

| Parameter | Governance Control | Tuning Consideration |

|---|---|---|

| Base Fee Rate | DAO vote with timelock | Balance LP returns vs trader competitiveness |

| Volatility Sensitivity | Multi-sig adjustment | Asset-specific calibration required |

| Fee Bounds (Min/Max) | Immutable or governance-controlled | Prevent extreme fee manipulation |

| Update Frequency | Protocol-defined with governance override | Balance responsiveness vs stability |

| Oracle Sources | Whitelist managed by governance | Security and reliability requirements |

Effective governance frameworks balance the need for parameter flexibility with security requirements that prevent malicious manipulation. Timelocks on sensitive parameter changes provide community members opportunity to review and respond to proposed modifications. Multi-signature requirements for emergency actions ensure that no single actor can unilaterally alter fee behavior in ways that could harm users or extract value from the protocol.

Model Selection Criteria for Dynamic Fee Implementation

Step 1: Asset Analysis

Evaluate the volatility profile, liquidity characteristics, and trading patterns of target asset pairs. Stablecoin pairs require different fee models than volatile altcoin combinations, with each category demanding tailored sensitivity parameters.

Step 2: Infrastructure Assessment

Determine available oracle infrastructure, gas budget constraints, and AMM architecture compatibility. Layer 2 deployments enable more complex models than mainnet implementations where gas costs limit calculation complexity.

Step 3: Competitive Positioning

Analyze competing DEX fee structures in target markets including USA, UK, UAE, and Canada. Position dynamic fees to offer competitive advantages during stable periods while maintaining adequate LP compensation during volatility.

Authoritative Industry Standards for Dynamic Fee Implementation

Standard 1: Implement bounded fee ranges with immutable minimum and maximum limits to prevent extreme manipulation.

Standard 2: Use time-weighted calculations spanning multiple blocks to resist single-transaction manipulation attempts.

Standard 3: Require comprehensive security audits from reputable firms before mainnet deployment of fee logic.

Standard 4: Implement oracle fallback mechanisms ensuring continued operation during external data provider outages.

Standard 5: Document all fee calculation logic transparently, enabling users to verify and predict fee behavior.

Standard 6: Establish governance timelocks preventing immediate parameter changes that could harm unsuspecting users.

Standard 7: Conduct historical backtesting against extreme market events including black swan scenarios before launch.

Standard 8: Monitor deployed fee systems continuously with automated alerts for anomalous behavior patterns.

Future Trends in Dynamic Fee Models for Decentralized Exchanges

The evolution of dynamic fee models continues accelerating as DeFi protocols compete to offer superior execution quality and liquidity provider returns. Machine learning integration represents a frontier area where predictive algorithms could anticipate market conditions rather than merely reacting to them. These systems might analyze historical patterns, cross-chain activity, and even social sentiment to proactively adjust fees before volatility materializes.

Cross-chain fee coordination emerges as protocols expand across multiple networks. Future dynamic fee models may incorporate liquidity conditions and trading activity from other chains, enabling global optimization rather than chain-specific adjustments. This holistic approach could dramatically improve capital efficiency for liquidity providers operating across multiple networks while providing traders with more consistent execution regardless of their chosen chain.

Intent-based trading systems present new paradigms for fee model design. Rather than charging fees at execution time, future protocols might implement subscription models, volume-based tier systems, or retroactive fee adjustments based on realized execution quality. These innovations could fundamentally reshape how dynamic fee models in DEX platforms balance the interests of traders, liquidity providers, and protocol sustainability in markets spanning the USA, UK, UAE, and Canada.

Compliance and Governance Checklist

| Requirement | Status | Priority |

|---|---|---|

| Fee calculation logic audit completed | ☐ | Critical |

| Oracle fallback mechanisms implemented | ☐ | Critical |

| Governance timelock configured | ☐ | High |

| Fee bounds documented and immutable | ☐ | High |

| Historical backtesting completed | ☐ | High |

| Testnet deployment validated | ☐ | High |

| Monitoring and alerting configured | ☐ | Medium |

Conclusion

Dynamic fee models represent a fundamental advancement in decentralized exchange design, addressing the limitations of static fee structures that have constrained DEX competitiveness and sustainability. The transition from fixed to adaptive pricing requires careful consideration of smart contract architecture, oracle integration, governance frameworks, and security measures. Protocols that successfully implement these sophisticated systems create more efficient markets that better serve traders while providing sustainable returns for liquidity providers.

Our eight years of experience building DeFi solutions across the USA, UK, UAE, and Canada have demonstrated that dynamic fee implementation success depends on thorough understanding of market dynamics, rigorous testing protocols, and ongoing optimization based on real-world performance data. The best dynamic fee models for DEX platforms balance complexity with gas efficiency, responsiveness with stability, and flexibility with security.

As decentralized finance continues maturing, dynamic fee models will become increasingly sophisticated, incorporating machine learning predictions, cross-chain coordination, and novel economic mechanisms. Protocols that invest in robust dynamic fee infrastructure today position themselves for leadership in the evolving DeFi landscape, offering superior execution quality that attracts both retail and institutional participants seeking alternatives to centralized exchange dominance.

Ready to Implement Dynamic Fee Models in Your DEX?

Partner with our expert team to design and build sophisticated dynamic fee systems that optimize liquidity provider returns and trader experience.

Frequently Asked Questions

Dynamic fee models in decentralized exchanges automatically adjust trading fees based on real-time market conditions such as liquidity depth, trading volume, and price volatility. Unlike static fee structures, these models use algorithmic calculations embedded in smart contracts to determine optimal fee rates for each transaction. When market volatility increases, fees rise to compensate liquidity providers for impermanent loss risks. Conversely, during stable periods with high liquidity, fees decrease to attract more trading activity, creating a self-balancing ecosystem that benefits both traders and liquidity providers.

Dynamic trading fees in DEX platforms offer multiple advantages over fixed fee structures. They optimize revenue for liquidity providers during volatile market conditions while remaining competitive during stable periods. This adaptive approach reduces impermanent loss exposure, attracts more liquidity providers, and creates fairer pricing for traders based on actual market risk. Additionally, dynamic fees improve capital efficiency by incentivizing liquidity during high-demand periods, ultimately leading to better price execution and reduced slippage for users across major markets including the USA, UK, and UAE.

Dynamic fee adjustments in decentralized exchanges rely on multiple data inputs including on-chain metrics like pool liquidity depth, recent trading volume, and price impact calculations. Off-chain data from oracles provides external price feeds and volatility indices. Smart contracts process these inputs through predefined algorithms to calculate appropriate fee tiers. Some advanced DEX fee structures also incorporate time-weighted average prices, historical volatility measurements, and cross-pool arbitrage indicators to ensure fee calculations accurately reflect current market conditions and risks.

Automated Market Maker architectures significantly influence how dynamic fee models operate within DEX platforms. Constant product AMMs like Uniswap require different fee logic compared to concentrated liquidity models or hybrid designs. The bonding curve mechanics determine how price impact scales with trade size, directly affecting fee optimization strategies. Concentrated liquidity AMMs allow granular fee tier selection, while virtual AMM designs offer more flexibility in implementing volatility-based fee adjustments. Understanding these architectural differences is crucial when designing dynamic fee logic for AMM-based DEX systems.

Implementing dynamic fees in DEX platforms presents several technical and operational challenges. Gas efficiency becomes critical as complex fee calculations increase transaction costs on networks like Ethereum. Oracle dependency introduces potential manipulation vectors and latency issues. Smart contract complexity raises audit requirements and potential vulnerability surfaces. Additionally, balancing user experience with dynamic pricing requires careful parameter tuning to avoid fee unpredictability that could deter traders. Governance mechanisms must enable parameter adjustments while preventing exploitation by malicious actors.

DEX protocols implement multiple safeguards to prevent fee manipulation in dynamic models. Time-weighted calculations prevent flash loan attacks that could artificially influence fee parameters. Rate limiting mechanisms restrict rapid parameter changes, while multi-signature governance controls require consensus for significant adjustments. Circuit breakers automatically pause fee adjustments during extreme market conditions. Additionally, protocols employ maximum and minimum fee bounds to prevent exploitation, and many conduct formal verification of fee calculation logic to mathematically prove correctness and resistance to known attack vectors.

The best dynamic fee models for DEX platforms combine multiple market signals with gas-efficient implementation. Uniswap V3’s concentrated liquidity fee tiers offer manual selection, while Curve’s dynamic fees adjust based on pool imbalance. Balancer V2 implements dynamic swap fees responding to volatility. Newer protocols like Maverick use dynamic distribution AMMs with adaptive fees. The optimal choice depends on specific use cases, with volatility-based models suiting high-risk pairs and volume-based models working better for stablecoin pools. Leading platforms in Canada, UK, and USA increasingly adopt hybrid approaches.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.