The decentralized application landscape has transformed dramatically, and understanding dApp development cost has become essential for businesses planning their Web3 journey in 2026. Whether you are a startup founder in the USA exploring DeFi opportunities, an enterprise in the UK considering blockchain integration, or an investor in the UAE evaluating tokenization projects, accurate cost estimation determines project success. With over 8 years of experience delivering blockchain solutions across North America, Europe, and the Middle East, our team has witnessed firsthand how proper budget planning separates successful launches from failed ventures. This comprehensive guide breaks down every aspect of decentralized application pricing, from initial planning through post-launch maintenance, helping you make informed decisions about your decentralized applications and Web3 initiatives.

Key Takeaways

- The average dApp development cost in 2026 ranges from $25,000 for MVPs to $750,000+ for complex multi-chain enterprise solutions.

- Smart contract creation alone accounts for 25-40% of total project expenses, with security audits adding $5,000 to $100,000 depending on complexity.

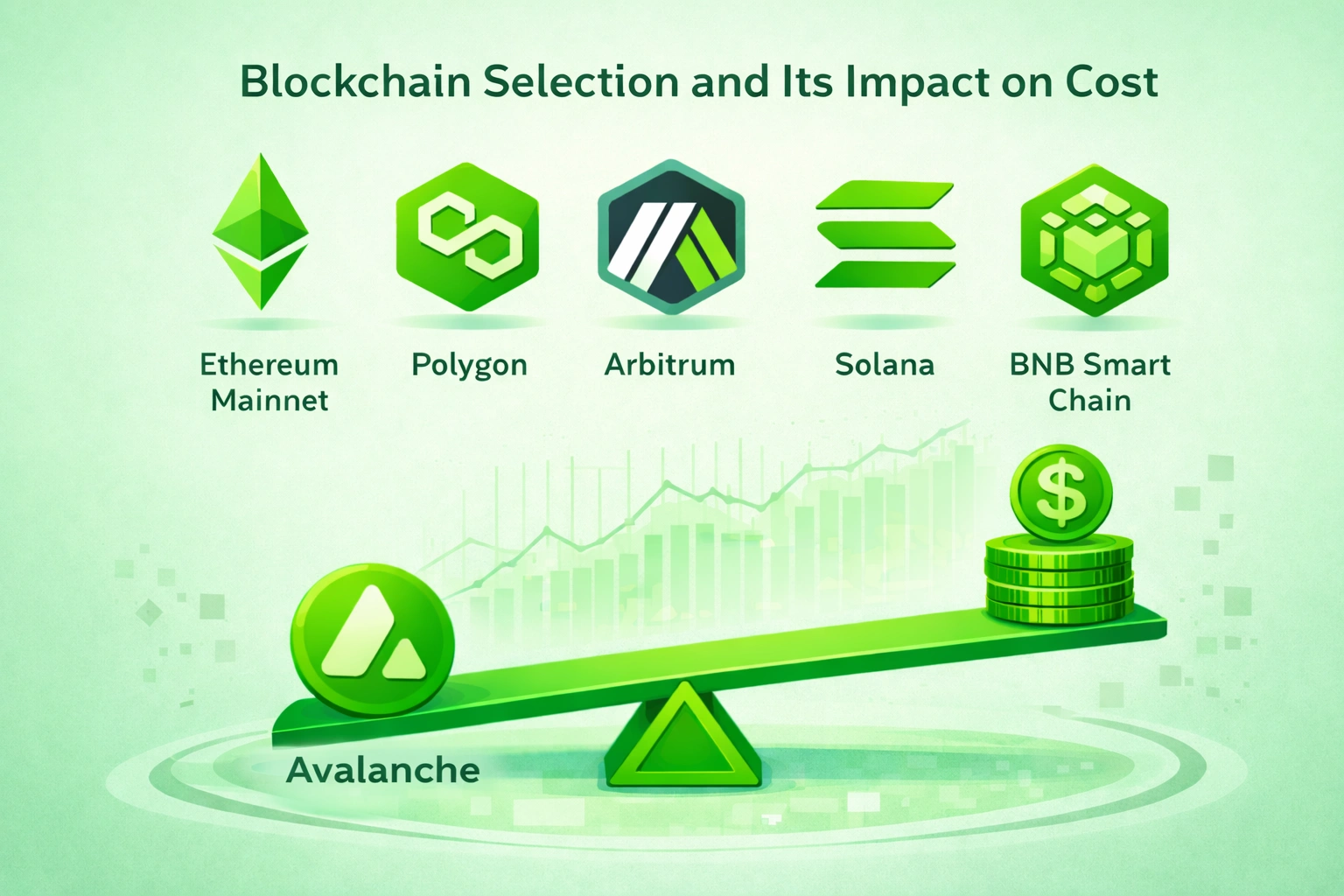

- Blockchain platform selection significantly impacts costs, with Ethereum mainnet deployments costing 3-5x more than Layer-2 or alternative chains.

- Hiring rates vary globally, with North American developers charging $150-200/hour while Eastern European teams offer comparable quality at $70-140/hour.

- Hidden costs including gas fees, oracle services, legal compliance, and ongoing maintenance can add 30-50% to initial budget estimates.

- UI/UX design for decentralized applications typically costs $40,000 to $120,000, crucial for mainstream user adoption and retention rates.

- Post-launch maintenance and scaling expenses average 15-25% of initial project costs annually for infrastructure and security updates.

- The global dApp market is projected to exceed $42 billion by 2026, making strategic investment in quality solutions increasingly valuable.

- Modular architecture and code reuse strategies can reduce custom dApp development cost by 20-35% without compromising functionality.

- Comprehensive security audits and bug bounty programs are non-negotiable investments that protect against exploits costing billions industry-wide.

What Is a dApp? A Quick Overview

A decentralized application, commonly known as a dApp, operates on blockchain networks rather than centralized servers, eliminating single points of failure and control. Unlike traditional applications where data resides on company-owned infrastructure, dApps utilize distributed ledger technology to ensure transparency, immutability, and user ownership of data. The backend logic executes through smart contracts deployed across nodes worldwide, making the system resistant to censorship and manipulation. Users interact with dApps through cryptographic wallets that provide secure authentication without requiring personal information stored in corporate databases. This architectural approach has revolutionized industries from finance and gaming to supply chain management and healthcare. DeFi protocols, NFT marketplaces, DAOs, and blockchain games represent the most prominent dApp categories driving adoption in 2026. Understanding this fundamental structure helps businesses appreciate why blockchain app development cost differs significantly from traditional software projects, as the decentralized nature demands specialized expertise and rigorous security practices.

Why Understanding dApp Development Cost Matters?

Accurate budget estimation separates successful blockchain projects from those that fail midway through execution. Many businesses entering the Web3 space underestimate how much does it cost to build a dApp, leading to incomplete products, compromised security, or abandoned initiatives. The cryptocurrency industry has witnessed billions lost to exploits stemming from inadequate security investments during the creation phase. Furthermore, the specialized talent required for blockchain projects commands premium rates, and unexpected expenses can quickly derail funding rounds. For organizations in the USA, UK, Canada, and UAE competing in the global digital economy, strategic budget allocation ensures competitive advantage without unnecessary overspending. Understanding cost structures also empowers better vendor negotiations, realistic timeline planning, and appropriate milestone-based payment schedules. Our experience across hundreds of projects reveals that clients who invest time in comprehensive cost analysis achieve 40% better ROI compared to those who rush into production without proper financial planning.

Average dApp Development Cost

The dApp development cost in 2026 varies substantially based on project scope, complexity, and regional factors. Industry data indicates that basic dApps start around $25,000 while enterprise-grade solutions can exceed $750,000. The following table provides comprehensive pricing ranges across different project scales and geographic markets.

| Project Type | Cost Range (USD) | Timeline | Team Size |

|---|---|---|---|

| Basic MVP dApp | $25,000 – $50,000 | 2-3 months | 3-4 people |

| Standard dApp | $50,000 – $150,000 | 4-6 months | 5-7 people |

| Advanced DeFi Platform | $150,000 – $350,000 | 6-9 months | 8-12 people |

| Enterprise Multi-Chain Solution | $350,000 – $750,000+ | 9-18 months | 15-25 people |

dApp Development Cost Breakdown by Project Type

DeFi Applications

- Lending/Borrowing: $100K – $300K

- DEX Platforms: $150K – $400K

- Yield Aggregators: $80K – $200K

- Staking Protocols: $50K – $150K

NFT Platforms

- NFT Marketplace: $80K – $250K

- Generative Art: $40K – $100K

- Gaming NFTs: $120K – $350K

- Royalty Systems: $60K – $150K

Enterprise Solutions

- Supply Chain: $200K – $500K

- Healthcare Records: $250K – $600K

- Identity Management: $150K – $400K

- Asset Tokenization: $180K – $450K

How dApp Complexity Affects Development Cost?

Project complexity stands as the most significant determinant of decentralized application development cost. A simple token with basic website functionality can be completed rapidly at minimal expense. However, adding features like staking, lending, voting mechanisms, or cross-chain capabilities exponentially increases scope and budget requirements. Complex systems demand extensive safety checks, additional testing cycles, and specialized expertise that basic projects do not require. The number of smart contracts, their interdependencies, and the sophistication of business logic directly correlate with engineering hours needed. Furthermore, regulatory compliance requirements in jurisdictions like the USA, UK, and UAE add layers of complexity that impact both timeline and expenses. Organizations must carefully evaluate feature prioritization, identifying which capabilities are essential for launch versus those that can be implemented in subsequent phases to optimize initial investment while maintaining competitive functionality.[1]

Feature-Based Cost Breakdown in dApp Development

Every feature integrated into your decentralized application carries specific cost implications. Understanding these granular expenses enables precise budgeting and informed feature prioritization. The following breakdown reflects current market rates across major service regions including the USA, UK, Canada, and UAE.

| Feature Category | Cost Range | Time Estimate |

|---|---|---|

| Wallet Integration (MetaMask, WalletConnect) | $5,000 – $15,000 | 1-2 weeks |

| Token Creation (ERC-20/BEP-20) | $3,000 – $10,000 | 1 week |

| NFT Minting & Marketplace | $25,000 – $80,000 | 4-8 weeks |

| Staking Mechanism | $15,000 – $50,000 | 2-4 weeks |

| Lending/Borrowing Protocol | $50,000 – $150,000 | 6-10 weeks |

| Cross-Chain Bridge | $80,000 – $200,000 | 8-14 weeks |

| DAO Governance System | $30,000 – $100,000 | 4-8 weeks |

| Oracle Integration (Chainlink) | $10,000 – $40,000 | 2-4 weeks |

Smart Contract Pricing Explained

Smart contracts form the backbone of every decentralized application, executing business logic automatically without intermediary intervention. The cost to build a dApp heavily depends on smart contract complexity, with this component typically representing 25-40% of total project expenses. Simple token contracts may cost $3,000 to $10,000, while sophisticated DeFi protocols with multiple interconnected contracts can exceed $150,000. Solidity remains the dominant language for Ethereum-compatible chains, while Rust powers Solana and Near ecosystems. The immutable nature of deployed contracts demands meticulous coding practices, comprehensive testing, and thorough auditing. Any vulnerability in smart contract code can result in catastrophic financial losses, as demonstrated by numerous exploits that have drained billions from protocols. Experienced Solidity engineers command rates of $100 to $250 per hour in North American markets, with comparable Eastern European talent available at $70 to $140 hourly. Organizations seeking to hire dApp developers must prioritize proven expertise over cost savings, as smart contract security directly protects user funds and protocol reputation.

Blockchain Selection and Its Impact on Cost

Choosing the right blockchain platform significantly influences both initial Web3 dApp development cost and ongoing operational expenses. Each network offers distinct tradeoffs between security, speed, transaction fees, and ecosystem maturity. Ethereum mainnet provides unmatched security and liquidity but carries higher deployment and gas costs. Layer-2 solutions like Arbitrum, Optimism, and Polygon offer Ethereum compatibility at fraction of the cost. Alternative Layer-1 chains including Solana, BNB Smart Chain, and Avalanche present cost-effective options with robust ecosystems.

| Blockchain | Deployment Cost | Avg Gas/Tx | Best For |

|---|---|---|---|

| Ethereum Mainnet | $500 – $5,000 | $1 – $50 | High-value DeFi |

| Polygon | $1 – $50 | < $0.01 | Gaming, NFTs |

| Arbitrum | $10 – $100 | $0.01 – $0.10 | DeFi protocols |

| Solana | $1 – $20 | < $0.001 | High-speed apps |

| BNB Smart Chain | $5 – $100 | $0.05 – $0.30 | Cost-effective DeFi |

| Avalanche | $10 – $200 | $0.02 – $0.50 | Enterprise apps |

UI/UX Design Costs for Decentralized Applications

User interface and experience design represents a critical investment often underestimated in blockchain projects. Modern users expect seamless wallet connections, clear transaction descriptions, intuitive navigation, and mobile-optimized interfaces regardless of the underlying technology. Great product design for Web3 applications costs between $40,000 and $120,000, encompassing research, wireframing, prototyping, visual design, and usability testing. The unique challenges of blockchain UX include explaining gas fees, managing transaction confirmations, handling wallet states, and presenting complex financial data accessibly. Projects targeting mainstream adoption in markets like the USA, UK, and Canada cannot afford clunky interfaces that alienate non-crypto-native users. Investment in professional UI/UX directly correlates with user retention, platform adoption, and ultimately protocol success. Cutting corners on design often proves costly when user acquisition campaigns fail to convert visitors into active participants due to confusing interfaces.

Security, Audits, and Compliance Costs

Basic Security Audit: $5,000 – $15,000 for simple smart contracts with limited functionality and single-chain deployment.

Comprehensive Audit: $25,000 – $100,000 for complex DeFi protocols requiring multiple auditor reviews and formal verification.

Bug Bounty Programs: $10,000 – $500,000+ in reserves depending on protocol TVL and risk exposure levels.

Legal Compliance: $20,000 – $100,000 for regulatory assessment, token classification, and jurisdiction-specific requirements.

KYC/AML Integration: $15,000 – $50,000 for identity verification systems meeting USA, UK, UAE, and Canada regulations.

Penetration Testing: $10,000 – $30,000 for application-level security assessment beyond smart contract auditing.

dApp Development Timeline: From Planning to Launch

Phase 1: Discovery & Planning

Define project scope, technical requirements, tokenomics design, and blockchain platform selection. Duration: 2-4 weeks.

Phase 2: Architecture Design

Create system architecture, smart contract specifications, database schemas, and API documentation. Duration: 2-3 weeks.

Phase 3: Smart Contract Creation

Write, test, and optimize smart contract code with comprehensive unit and integration testing. Duration: 4-10 weeks.

Phase 4: Frontend & Backend Build

Build user interfaces, wallet integrations, backend services, and API connections. Duration: 6-12 weeks.

Phase 5: Security Auditing

Conduct comprehensive security audits, penetration testing, and vulnerability assessments. Duration: 3-6 weeks.

Phase 6: Testnet Deployment

Deploy to test networks, conduct beta testing with selected users, and gather feedback. Duration: 2-4 weeks.

Phase 7: Mainnet Launch

Execute production deployment, initialize liquidity, and activate monitoring systems. Duration: 1-2 weeks.

Phase 8: Post-Launch Support

Provide ongoing maintenance, feature updates, community support, and scaling optimization. Duration: Ongoing.

Team Structure & Developer Rates Affecting Cost

The team composition directly impacts dApp development cost and project quality. A typical mid-complexity project requires blockchain engineers, frontend specialists, backend programmers, UI/UX designers, QA testers, and project managers. Senior blockchain engineers command premium rates due to specialized skill requirements. Geographic location significantly influences hourly rates, with substantial variations between North American, European, and Asian markets.

| Role | USA/UK Rate | Eastern Europe | Asia |

|---|---|---|---|

| Senior Blockchain Engineer | $150 – $250/hr | $70 – $140/hr | $40 – $80/hr |

| Solidity/Rust Developer | $120 – $200/hr | $60 – $120/hr | $35 – $70/hr |

| Frontend Developer (React/Web3) | $80 – $150/hr | $40 – $80/hr | $25 – $50/hr |

| UI/UX Designer | $70 – $130/hr | $35 – $70/hr | $20 – $45/hr |

| Security Auditor | $200 – $400/hr | $100 – $200/hr | $60 – $120/hr |

| Project Manager | $80 – $150/hr | $40 – $80/hr | $25 – $50/hr |

Hidden Costs in dApp Development You Should Know

Infrastructure Costs

- RPC Node Services: $500 – $5,000/month

- IPFS/Decentralized Storage: $100 – $1,000/month

- Cloud Hosting: $200 – $2,000/month

- Monitoring Tools: $100 – $500/month

Operational Costs

- Gas Fee Reserves: $1,000 – $50,000

- Oracle Subscriptions: $500 – $5,000/month

- Legal Consulting: $10,000 – $100,000

- Insurance Premiums: $5,000 – $50,000/year

Growth & Marketing

- Community Management: $3,000 – $15,000/month

- Marketing Campaigns: $10,000 – $100,000

- Exchange Listings: $10,000 – $500,000

- Documentation: $5,000 – $20,000

Post-Launch Maintenance and Scaling Costs

Web3 infrastructure is living technology requiring continuous attention. Post-launch maintenance typically costs 15-25% of initial project investment annually. This includes security monitoring, smart contract upgrades through proxy patterns, infrastructure scaling, user support, and feature enhancements based on community feedback. Protocols managing significant Total Value Locked must maintain robust incident response capabilities and regular security re-audits. Scaling costs increase as user bases grow, with RPC node expenses, database requirements, and support team needs expanding accordingly. Organizations in competitive markets like the USA, UK, and UAE must budget for continuous improvement to maintain market position against emerging competitors. Neglecting post-launch investment often results in security vulnerabilities, poor user experience, and eventual protocol abandonment.

Proven Strategies to Optimize dApp Development Costs

Strategy 1: Start with MVP approach focusing on core functionality before adding advanced features to validate market fit early.

Strategy 2: Leverage proven open-source libraries and audited code bases to reduce custom smart contract creation expenses.

Strategy 3: Choose Layer-2 solutions or cost-effective blockchains for initial deployment with migration plans for scaling.

Strategy 4: Partner with experienced agencies offering fixed-price contracts to avoid budget overruns from scope creep.

Strategy 5: Implement modular architecture enabling component reuse across future products and reducing redundant engineering work.

Strategy 6: Use gas optimization techniques in smart contracts to reduce long-term operational costs for high-volume applications.

Strategy 7: Conduct thorough requirements gathering upfront to minimize costly mid-project specification changes and rework.

Strategy 8: Engage security auditors early in the process rather than post-completion to catch issues when fixes are less expensive.

Compliance & Governance Checklist

| Compliance Area | Requirements | Estimated Cost |

|---|---|---|

| Token Classification (USA) | Howey Test analysis, SEC compliance review | $15,000 – $50,000 |

| FCA Registration (UK) | Crypto asset registration, promotional rules | $20,000 – $75,000 |

| VARA Licensing (UAE) | Virtual asset service provider licensing | $30,000 – $100,000 |

| CSA Compliance (Canada) | Securities law assessment, prospectus exemptions | $20,000 – $60,000 |

| KYC/AML Implementation | Identity verification, transaction monitoring | $15,000 – $50,000 |

| GDPR/Data Privacy | Privacy policies, data handling procedures | $10,000 – $30,000 |

Is Building a dApp Worth the Cost Today?

The strategic value of investing in decentralized application creation depends on multiple factors including market opportunity, competitive landscape, and long-term business objectives. The global dApp market, valued at $30.6 billion in 2024, is projected to exceed $42 billion by 2026, representing substantial growth potential. Over 560 million people globally now interact with crypto and Web3 tools, indicating mainstream adoption rather than niche experimentation. DeFi protocols reached $237 billion in total value locked, with institutional capital increasingly driving growth.

For organizations in the USA, UK, UAE, and Canada, the question is not whether blockchain technology will transform industries but whether to participate as leaders or followers. Early movers in tokenization, decentralized finance, and Web3 infrastructure are establishing competitive advantages that late entrants will struggle to overcome. However, success requires adequate investment in security, user experience, and compliance. Underfunded projects face higher failure rates due to security vulnerabilities, poor market fit, or regulatory challenges. When properly budgeted and executed, dApps deliver unique value propositions including transparency, user ownership, reduced intermediary costs, and global accessibility that traditional applications cannot match.

Final Words

Understanding dApp development cost empowers organizations to make strategic decisions about their Web3 initiatives. From basic MVPs at $25,000 to enterprise-grade solutions exceeding $750,000, the investment spectrum accommodates diverse business needs and objectives. Critical factors including project complexity, blockchain selection, team composition, security requirements, and regulatory compliance collectively determine final budgets. Hidden costs from infrastructure, operations, and marketing often add 30-50% to initial estimates, making comprehensive planning essential.

With over 8 years of experience delivering blockchain solutions across the USA, UK, UAE, and Canada, our team has guided hundreds of clients through successful launches. We understand that every dollar invested must generate tangible value, and our approach prioritizes security, scalability, and user experience without unnecessary expenditure. The window for experimental Web3 is closing, as 2026 marks the transition to operational accountability where dApps must compete directly with traditional applications on utility and user experience. Organizations ready to hire dApp developers and invest strategically will capture market share in what promises to be a transformative decade for decentralized technology.

Ready to Build Your Vision Into a Secure, Scalable dApp?

Get accurate cost estimates, timeline projections, and expert guidance from our blockchain specialists with 8+ years of proven delivery.

Frequently Asked Questions

The cost to build a dApp in 2026 typically ranges from $25,000 for a basic minimum viable product to over $500,000 for enterprise-grade multi-chain applications. Several factors influence this pricing, including blockchain platform selection, smart contract complexity, UI/UX requirements, and security audit needs. Businesses in the USA, UK, and UAE often invest between $75,000 and $200,000 for mid-level decentralized applications with standard features like wallet integration and token functionality.

The primary factors affecting decentralized application pricing include project complexity, blockchain network selection, feature requirements, team location, and security compliance needs. Smart contract logic complexity can alone account for 30-40% of the total budget. Additional integrations like oracle services, cross-chain bridges, and advanced tokenomics significantly increase costs. Projects requiring regulatory compliance in regions like Canada or the UAE face additional expenses for legal audits.

Building a blockchain app is generally more expensive than traditional application creation due to specialized skill requirements, security audit necessities, and infrastructure costs. While traditional apps may cost $20,000 to $150,000, comparable blockchain applications often start at $50,000 and can exceed $300,000. However, blockchain apps offer long-term benefits including reduced intermediary costs, enhanced security, and decentralized trust that can offset initial investment over time.

Creating a decentralized application typically takes between 3 to 12 months depending on complexity and scope. A basic dApp with simple smart contracts and minimal features can be completed in 3-4 months. Medium-complexity projects with DeFi functionality or NFT integration require 5-8 months. Enterprise-level applications with multi-chain support, advanced security, and regulatory compliance often need 9-12 months or longer for proper completion and testing.

The most cost-effective blockchains for building dApps in 2026 include Polygon, BNB Smart Chain, and Solana, offering lower gas fees and faster transaction speeds compared to Ethereum mainnet. Polygon offers gas costs under $0.01 per transaction while maintaining Ethereum compatibility. BNB Smart Chain provides affordable deployment with strong ecosystem support. However, choosing the cheapest option may not always align with project goals, as factors like security, user base, and liquidity should also guide blockchain selection.

Security audits are often not included by default and are billed separately. Professional smart contract audits typically cost between $10,000 and $50,000+, depending on code size and risk level. For dApps handling financial assets, audits are non-negotiable. Skipping audits may lower upfront costs but can result in severe losses due to exploits or vulnerabilities.

Hidden costs in dApp development include gas fees, third-party API usage, audit rechecks, legal compliance, infrastructure hosting, and post-launch maintenance. Marketing, community management, and future upgrades are often overlooked. Planning for these expenses early helps avoid budget overruns and ensures smoother scaling after launch.

Yes, dApp development costs can be reduced by building an MVP first, prioritizing essential features, using pre-built frameworks, and choosing cost-efficient blockchains. Agile development and outsourcing to experienced teams can also lower expenses. However, cutting corners on security or architecture may lead to higher costs later, so optimization should never compromise quality.

Post-launch maintenance for a dApp generally costs around 15–30% of the initial development budget per year, depending on complexity and usage. This ongoing cost includes regular bug fixes, performance optimization, security patches, smart contract upgrades, and compatibility updates with blockchain network changes. As user adoption grows, additional costs may arise for scalability improvements, infrastructure upgrades, and feature enhancements. Continuous maintenance is essential to ensure long-term stability, security, and user trust.

Building a dApp is worth the cost when it addresses a real-world problem and is backed by a clear, sustainable business model. dApps provide key advantages such as transparency, decentralization, global accessibility, and reduced reliance on intermediaries. While upfront development and security costs can be high, long-term benefits like automation, community-driven governance, and new monetization opportunities often outweigh the investment. Strategic planning, proper execution, and scalability-focused development are crucial to achieving strong returns.

Reviewed & Edited By

Aman Vaths

Founder of Nadcab Labs

Aman Vaths is the Founder & CTO of Nadcab Labs, a global digital engineering company delivering enterprise-grade solutions across AI, Web3, Blockchain, Big Data, Cloud, Cybersecurity, and Modern Application Development. With deep technical leadership and product innovation experience, Aman has positioned Nadcab Labs as one of the most advanced engineering companies driving the next era of intelligent, secure, and scalable software systems. Under his leadership, Nadcab Labs has built 2,000+ global projects across sectors including fintech, banking, healthcare, real estate, logistics, gaming, manufacturing, and next-generation DePIN networks. Aman’s strength lies in architecting high-performance systems, end-to-end platform engineering, and designing enterprise solutions that operate at global scale.